Key Insights

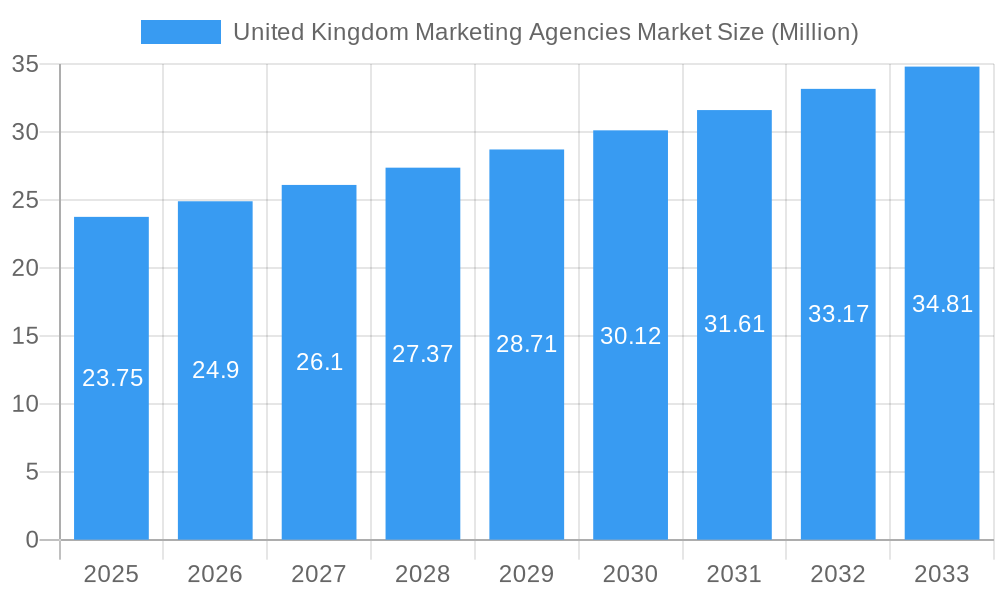

The United Kingdom's marketing agencies market is poised for steady growth, projected to reach a valuation of £23.75 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.82% anticipated throughout the forecast period (2025-2033). This expansion is fueled by a dynamic interplay of evolving consumer behaviors and an increasing demand for sophisticated marketing strategies. Key growth drivers include the ongoing digital transformation across all sectors, necessitating robust digital marketing services, and the persistent need for impactful traditional marketing campaigns to reach diverse demographics. Full-service agencies are expected to thrive as businesses seek integrated solutions that span both online and offline channels, offering a comprehensive approach to brand building and customer engagement. The market's resilience is also supported by the broad application across various enterprise sizes, from large corporations to Small and Mid-sized Enterprises (SMEs), each leveraging marketing expertise to gain a competitive edge.

United Kingdom Marketing Agencies Market Market Size (In Million)

The UK marketing agencies landscape is characterized by significant diversification in service offerings and client engagement models. While digital marketing services, encompassing search engine optimization (SEO), social media marketing, content marketing, and pay-per-click (PPC) advertising, continue to dominate, traditional marketing avenues remain vital for reaching specific audiences. The BFSI, IT & Telecom, and Retail & Consumer Goods sectors are anticipated to be major consumers of these services, investing heavily in customer acquisition and retention strategies. Furthermore, public services and manufacturing and logistics industries are increasingly recognizing the value of strategic marketing to improve public perception and drive business outcomes. Leading agencies such as WPP PLC, Omnicom Media Group, and Publicis Groupe SA are instrumental in shaping these trends, offering a wide array of specialized services and adapting to the evolving needs of their clients. This competitive environment fosters innovation, encouraging agencies to adopt cutting-edge technologies and data-driven approaches to deliver measurable results.

United Kingdom Marketing Agencies Market Company Market Share

Comprehensive Report: United Kingdom Marketing Agencies Market Analysis (2019–2033)

Gain unparalleled insights into the dynamic United Kingdom marketing agencies market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into market size, growth trends, competitive landscape, and future opportunities. This report is essential for industry professionals, investors, and stakeholders seeking to understand the forces shaping digital marketing services, traditional marketing services, and full-service agencies across online and offline modes, catering to large enterprises and SMEs in sectors like BFSI, IT & Telecom, Retail & Consumer Goods, Public Services, Manufacturing, and Logistics.

United Kingdom Marketing Agencies Market Market Dynamics & Structure

The United Kingdom marketing agencies market exhibits a moderately concentrated structure, with a few dominant players alongside a robust ecosystem of specialized and niche agencies. Technological innovation, particularly in areas like Artificial Intelligence (AI) and data analytics, serves as a primary driver, pushing agencies to adopt more sophisticated digital marketing services and personalized campaigns. Regulatory frameworks, such as GDPR, continue to influence data handling practices and advertising standards, impacting traditional marketing services and digital marketing services alike. Competitive product substitutes are emerging, with in-house marketing teams and specialized MarTech platforms offering alternative solutions. End-user demographics are shifting, with an increasing demand for measurable ROI and data-driven strategies from both large enterprises and SMEs. Mergers and acquisitions (M&A) are a significant trend, with major groups consolidating their market share and expanding service offerings. For instance, M&A deal volumes are predicted to reach xx million units in the forecast period, driven by the pursuit of synergies and enhanced capabilities. Innovation barriers include the high cost of advanced technology adoption and the need for continuous upskilling of talent.

United Kingdom Marketing Agencies Market Growth Trends & Insights

The United Kingdom marketing agencies market has witnessed substantial evolution, driven by the pervasive digital transformation and shifting consumer behaviors. The market size has grown from an estimated £xx million in 2019 to £xx million in the base year of 2025, demonstrating a Compound Annual Growth Rate (CAGR) of xx% during the historical period. The adoption rate of digital marketing services is rapidly accelerating, now representing over xx% of total marketing expenditure. Technological disruptions, such as the rise of generative AI and programmatic advertising, are fundamentally reshaping campaign strategies and execution, impacting both online and offline modes of operation. Consumer behavior has shifted towards hyper-personalization, demanding more engaging and relevant content across all touchpoints. The market penetration for integrated marketing solutions, encompassing both digital marketing services and traditional marketing services, is expected to reach xx% by 2033. This growth is further fueled by an increasing reliance on data analytics for campaign optimization and performance measurement. The integration of AI-powered tools is enhancing efficiency, enabling more targeted advertising, and improving customer journey mapping for applications spanning large enterprises and SMEs.

Dominant Regions, Countries, or Segments in United Kingdom Marketing Agencies Market

Within the United Kingdom marketing agencies market, Digital Marketing Services stands out as the most dominant segment, driving substantial growth and innovation. This dominance is intrinsically linked to the widespread adoption of online modes of engagement by consumers and businesses alike. The segment commands an estimated xx% market share in the base year of 2025, with a projected CAGR of xx% during the forecast period.

Key Drivers for Digital Marketing Services Dominance:

- High Internet Penetration and Smartphone Usage: The UK boasts high internet penetration, exceeding xx%, and widespread smartphone adoption, creating a fertile ground for online advertising and digital engagement.

- Measurable ROI and Data Analytics: Digital marketing services offer unparalleled opportunities for tracking, measuring, and analyzing campaign performance, providing clear ROI to clients, particularly appealing to large enterprises and SMEs.

- Evolving Consumer Behavior: Consumers increasingly spend their time online, researching products, engaging with brands, and making purchases, necessitating a strong digital presence for businesses.

- Agility and Adaptability: Digital channels allow for rapid campaign adjustments and A/B testing, enabling agencies to optimize strategies in real-time to meet changing market dynamics.

Dominance Factors and Growth Potential:

- Service Type: Digital Marketing Services: This segment encompasses SEO, SEM, social media marketing, content marketing, email marketing, and programmatic advertising, offering a comprehensive suite of solutions tailored to diverse client needs.

- Mode: Online: The inherent nature of digital marketing makes it primarily an online mode, facilitating global reach and targeted campaigns.

- Application: Large Enterprises and SMEs: Both large enterprises and SMEs are increasingly investing in digital marketing to expand their customer base, enhance brand visibility, and drive sales. SMEs, in particular, benefit from cost-effective digital solutions that can compete with larger players.

- End-User: IT & Telecom and Retail & Consumer Goods: These sectors are at the forefront of digital marketing adoption, leveraging online channels for product launches, customer acquisition, and loyalty programs. BFSI and Public Services are also showing significant growth in their digital marketing expenditures.

The growth potential for digital marketing services remains exceptionally high, driven by emerging technologies like AI-powered personalization, influencer marketing, and immersive experiences in the metaverse. Agencies focusing on these areas are poised for significant expansion.

United Kingdom Marketing Agencies Market Product Landscape

The product landscape of the United Kingdom marketing agencies market is characterized by a surge in technologically advanced and integrated solutions. Agencies are increasingly offering sophisticated digital marketing services such as AI-driven content personalization, predictive analytics for campaign optimization, and programmatic advertising platforms. Traditional marketing services are also being augmented with digital integration, offering omnichannel experiences. Performance metrics for these services are highly quantifiable, focusing on engagement rates, conversion rates, customer acquisition cost (CAC), and return on ad spend (ROAS). Unique selling propositions often lie in agencies' ability to leverage proprietary AI algorithms, deep data analytics capabilities, and award-winning creative strategies that resonate with specific target audiences across various application segments, from large enterprises to SMEs.

Key Drivers, Barriers & Challenges in United Kingdom Marketing Agencies Market

Key Drivers: The United Kingdom marketing agencies market is propelled by the relentless pursuit of digital transformation across all industries. Key drivers include the escalating demand for data-driven marketing strategies, the growing influence of social media and influencer marketing, and the continuous innovation in AI and machine learning that enable hyper-personalization. Government initiatives promoting digital adoption and the increasing sophistication of marketing technology (MarTech) also act as significant catalysts. The need for measurable ROI is paramount, pushing agencies to deliver impactful campaigns.

Barriers & Challenges: Despite robust growth, the market faces several barriers and challenges. The rapid pace of technological change requires continuous investment in talent and technology, creating a barrier for smaller agencies. Data privacy regulations, such as GDPR, necessitate stringent compliance measures, adding complexity. Intense competition from global players and in-house marketing teams poses a constant threat. Furthermore, the increasing cost of digital advertising, particularly in competitive sectors like Retail & Consumer Goods, can limit reach for SMEs. Supply chain issues are less prevalent in this service-based industry, but talent acquisition and retention remain critical challenges.

Emerging Opportunities in United Kingdom Marketing Agencies Market

Emerging opportunities in the United Kingdom marketing agencies market lie in the burgeoning demand for AI-powered marketing solutions, particularly generative AI for content creation and personalization. The growth of influencer marketing and the metaverse presents untapped avenues for brand engagement and experiential marketing. Furthermore, there's a growing need for specialized digital marketing services catering to niche industries and specific customer segments, such as the sustainable products market and the aging population. Agencies that can offer transparent, data-driven strategies with a strong focus on ethical marketing practices will find significant traction.

Growth Accelerators in the United Kingdom Marketing Agencies Market Industry

Several catalysts are accelerating the growth of the United Kingdom marketing agencies market. Technological breakthroughs, especially in AI and machine learning, are enabling more sophisticated and personalized marketing campaigns, enhancing efficiency and effectiveness. Strategic partnerships between marketing agencies and technology providers, like the recent WPP and Google Cloud collaboration, are opening new frontiers in generative AI-driven marketing. Market expansion strategies, including global reach and specialization in high-growth sectors, are also contributing to sustained growth. The increasing reliance on data analytics for informed decision-making further solidifies the market's upward trajectory.

Key Players Shaping the United Kingdom Marketing Agencies Market Market

WPP PLC The Interpublic Group of Companies Inc Omnicom Media Group Publicis Groupe SA Wieden + Kennedy Inc Havas SA Ogilvy Stagwell Group Zenith Media PHD Media

Notable Milestones in United Kingdom Marketing Agencies Market Sector

- April 2024: WPP and Google Cloud announced a pioneering collaboration to propel generative AI-driven marketing to new heights. This partnership is poised to redefine marketing's efficacy and impact by leveraging Google's prowess in data analytics, generative AI technology, and cybersecurity alongside WPP's comprehensive marketing solutions, vast creative reach, and deep brand insights.

- February 2024: IPG made waves by unveiling a strategic collaboration with Adobe. The partnership aims to revolutionize content creation and activation within IPG's global operations. IPG stands out as the inaugural corporation to seamlessly incorporate Adobe GenStudio, a cutting-edge tool leveraging generative AI. This integration empowers brands to accelerate their content ideation, creation, production, and activation.

In-Depth United Kingdom Marketing Agencies Market Market Outlook

The United Kingdom marketing agencies market is poised for continued robust growth, fueled by an ongoing embrace of digital transformation and innovative technologies. The future market potential is immense, driven by the increasing sophistication of AI and machine learning, which will enable hyper-personalized customer experiences and predictive campaign optimization. Strategic opportunities abound in the development of specialized services for emerging sectors and the expansion of global reach. The market's outlook is characterized by a strong emphasis on data-driven insights, measurable outcomes, and agile service delivery, ensuring continued relevance and profitability for agencies adept at navigating this dynamic landscape.

United Kingdom Marketing Agencies Market Segmentation

-

1. Service Type

- 1.1. Digital Marketing Services

- 1.2. Traditional Marketing Services

- 1.3. Full-Service Agencies

-

2. Mode

- 2.1. Online

- 2.2. Offline

-

3. Application

- 3.1. Large Enterprises

- 3.2. Small and Mid-sized Enterprises (SMEs)

-

4. End-User

- 4.1. BFSI

- 4.2. IT & Telecom

- 4.3. Retail & Consumer Goods

- 4.4. Public Services

- 4.5. Manufacturing and Logistics

United Kingdom Marketing Agencies Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Marketing Agencies Market Regional Market Share

Geographic Coverage of United Kingdom Marketing Agencies Market

United Kingdom Marketing Agencies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digital Dominance; Changing Landscape of Marketing

- 3.3. Market Restrains

- 3.3.1. Growing Digital Dominance; Changing Landscape of Marketing

- 3.4. Market Trends

- 3.4.1. Growing Digital Dominance is Fuelling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Marketing Agencies Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Digital Marketing Services

- 5.1.2. Traditional Marketing Services

- 5.1.3. Full-Service Agencies

- 5.2. Market Analysis, Insights and Forecast - by Mode

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Large Enterprises

- 5.3.2. Small and Mid-sized Enterprises (SMEs)

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI

- 5.4.2. IT & Telecom

- 5.4.3. Retail & Consumer Goods

- 5.4.4. Public Services

- 5.4.5. Manufacturing and Logistics

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WPP PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Interpublic Group of Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omnicom Media Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Publicis Groupe SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wieden + Kennedy Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Havas SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ogilvy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stagwell Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zeninth Media

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PHD Media**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 WPP PLC

List of Figures

- Figure 1: United Kingdom Marketing Agencies Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Marketing Agencies Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 3: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 5: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: United Kingdom Marketing Agencies Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: United Kingdom Marketing Agencies Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 9: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 13: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 14: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 15: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Marketing Agencies Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: United Kingdom Marketing Agencies Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 19: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Marketing Agencies Market?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the United Kingdom Marketing Agencies Market?

Key companies in the market include WPP PLC, The Interpublic Group of Companies Inc, Omnicom Media Group, Publicis Groupe SA, Wieden + Kennedy Inc, Havas SA, Ogilvy, Stagwell Group, Zeninth Media, PHD Media**List Not Exhaustive.

3. What are the main segments of the United Kingdom Marketing Agencies Market?

The market segments include Service Type, Mode, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digital Dominance; Changing Landscape of Marketing.

6. What are the notable trends driving market growth?

Growing Digital Dominance is Fuelling the Market.

7. Are there any restraints impacting market growth?

Growing Digital Dominance; Changing Landscape of Marketing.

8. Can you provide examples of recent developments in the market?

April 2024: WPP and Google Cloud announced a pioneering collaboration to propel generative AI-driven marketing to new heights. This partnership is poised to redefine marketing's efficacy and impact by leveraging Google's prowess in data analytics, generative AI technology, and cybersecurity alongside WPP's comprehensive marketing solutions, vast creative reach, and deep brand insights.February 2024: IPG made waves by unveiling a strategic collaboration with Adobe. The partnership aims to revolutionize content creation and activation within IPG's global operations. IPG stands out as the inaugural corporation to seamlessly incorporate Adobe GenStudio, a cutting-edge tool leveraging generative AI. This integration empowers brands to accelerate their content ideation, creation, production, and activation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Marketing Agencies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Marketing Agencies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Marketing Agencies Market?

To stay informed about further developments, trends, and reports in the United Kingdom Marketing Agencies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence