Key Insights

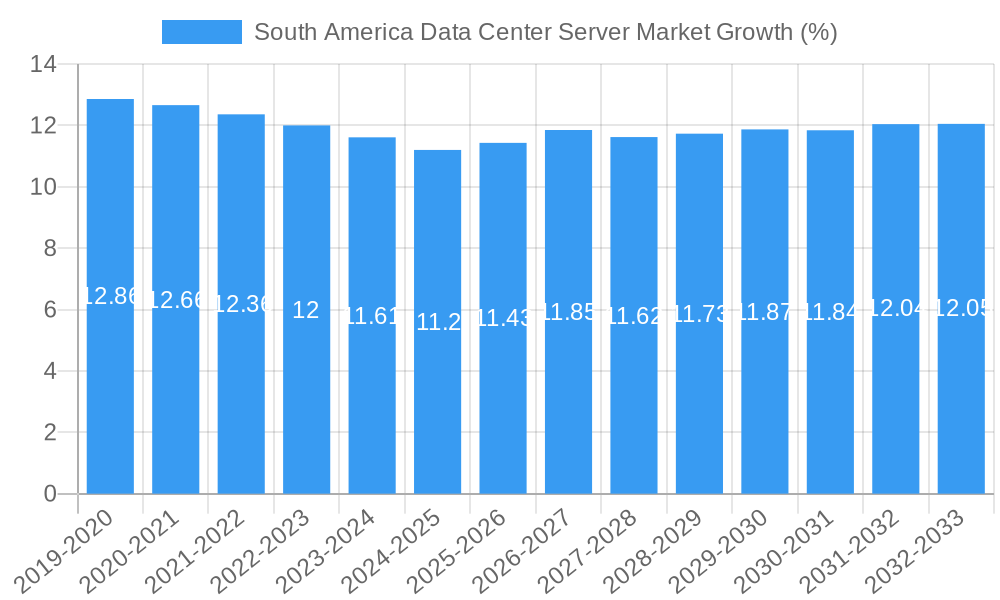

The South America Data Center Server Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.60% over the study period, indicating a robust and dynamic expansion. This impressive growth is primarily fueled by escalating digital transformation initiatives across key industries, including IT & Telecommunication, BFSI, and Government sectors. The increasing adoption of cloud computing services, the surge in data generation from various applications, and the growing demand for high-performance computing solutions are significant drivers propelling the market forward. Furthermore, the continuous need for robust IT infrastructure to support e-commerce, online gaming, and streaming services contributes to this upward trajectory. The market is also witnessing a significant push towards modernizing existing data center facilities and building new ones to accommodate the ever-increasing data storage and processing demands. This sustained investment in digital infrastructure is a cornerstone of economic development and technological advancement within the region.

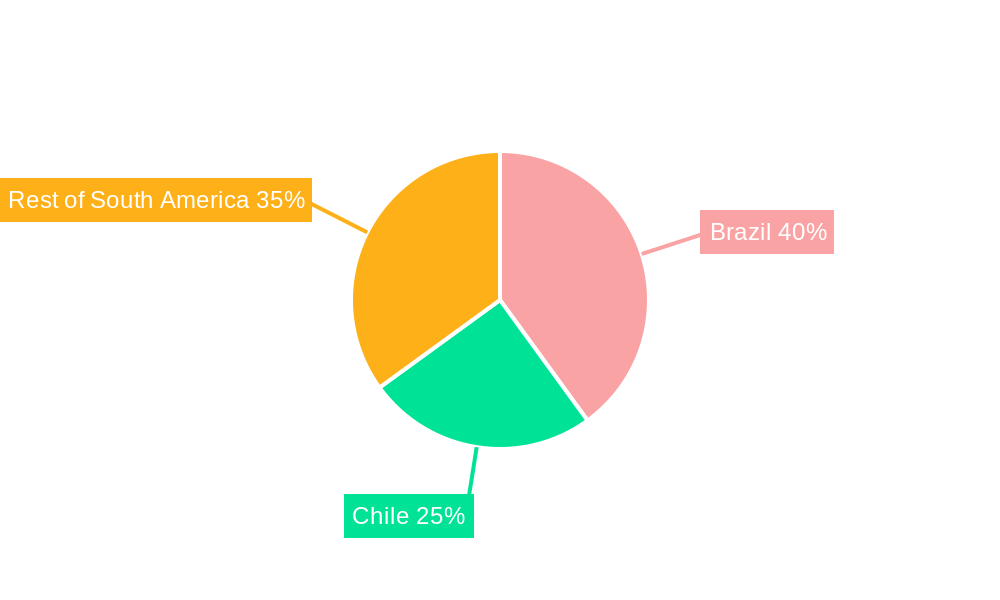

The competitive landscape is characterized by the presence of major global players such as Lenovo Group Limited, International Business Machines (IBM) Corporation, Hewlett Packard Enterprise, and Dell Inc., alongside emerging regional and international contenders. These companies are actively engaged in product innovation, focusing on developing energy-efficient, high-density, and scalable server solutions to meet the diverse needs of end-users. The market is segmented by Form Factor into Blade Servers, Rack Servers, and Tower Servers, with Rack and Blade servers likely to dominate due to their efficiency and scalability in data center environments. Geographically, Brazil is expected to lead the market due to its large economy and significant investments in technology infrastructure. Chile and the rest of South America are also anticipated to experience considerable growth as digital adoption accelerates. Restraints such as the high initial investment costs for data center infrastructure and the need for skilled IT professionals may pose challenges, but the overarching growth drivers are expected to outweigh these limitations, ensuring a positive market outlook.

This report provides an in-depth analysis of the South America Data Center Server Market, offering strategic insights into its growth trajectory, key trends, and competitive landscape. Leveraging extensive research and data, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The study period spans from 2019 to 2033, with a base year of 2025, an estimated year also of 2025, and a forecast period from 2025 to 2033. The historical period covered is 2019–2024.

South America Data Center Server Market Market Dynamics & Structure

The South America Data Center Server Market is characterized by a moderately concentrated market structure, with key players like Lenovo Group Limited, International Business Machines (IBM) Corporation, Inspur Group, Hewlett Packard Enterprise, Cisco Systems Inc, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, and Huawei Technologies Co Ltd holding significant market shares. Technological innovation is a primary driver, fueled by the increasing demand for high-performance computing (HPC), artificial intelligence (AI), and cloud services across various industries. Regulatory frameworks are evolving, with governments in countries like Brazil and Chile implementing policies to encourage digital transformation and data localization, influencing server procurement and deployment strategies.

Competitive product substitutes, such as cloud-based Infrastructure-as-a-Service (IaaS) solutions, present a constant challenge, pushing server manufacturers to offer more specialized and cost-effective on-premises solutions. End-user demographics are shifting, with a growing reliance on data analytics and digital services across IT & Telecommunication, BFSI, Government, and Media & Entertainment sectors.

- Market Concentration: Dominated by a few global tech giants, with emerging local players gaining traction in specific niches.

- Technological Innovation Drivers: AI/ML, IoT, 5G deployment, and edge computing are key catalysts for server technology advancements.

- Regulatory Frameworks: Data privacy laws and government initiatives promoting digitalization are shaping market demand.

- Competitive Product Substitutes: Cloud IaaS and PaaS offerings provide alternatives for businesses seeking scalability and flexibility.

- End-User Demographics: Growing adoption by enterprises for data-intensive applications and digital services.

- M&A Trends: Limited, but potential for strategic acquisitions to gain market access or acquire specialized technologies.

South America Data Center Server Market Growth Trends & Insights

The South America Data Center Server Market is experiencing robust growth, driven by the accelerating digital transformation initiatives across the region. The market size is projected to expand significantly, fueled by an increasing adoption rate of advanced server technologies and an insatiable demand for data processing power. This growth is underpinned by key trends such as the widespread deployment of cloud infrastructure, the burgeoning adoption of AI and machine learning workloads, and the continuous expansion of 5G networks, which necessitate powerful and efficient server solutions.

Consumer behavior shifts are also playing a pivotal role, with businesses across sectors like BFSI, IT & Telecommunication, and Government increasingly recognizing the strategic importance of robust data center infrastructure for operational efficiency, innovation, and competitive advantage. The CAGR for the South America Data Center Server Market is estimated to be a healthy XX% during the forecast period, reflecting this sustained expansion. Market penetration is steadily increasing, particularly in the enterprise segment, as organizations migrate from legacy systems to modern, high-performance servers capable of handling complex analytical tasks and real-time data processing.

Technological disruptions, including advancements in server architecture such as GPU-accelerated computing and the increasing adoption of ARM-based processors for power efficiency, are reshaping the market landscape. These innovations enable higher processing speeds, reduced latency, and improved energy efficiency, making them attractive to data-intensive applications like AI, big data analytics, and HPC. Furthermore, the growing reliance on digital services and e-commerce across South America is driving the need for scalable and reliable data center infrastructure, further stimulating the demand for advanced servers. The focus on edge computing for localized data processing and reduced network load also presents a significant growth avenue, requiring specialized server solutions designed for distributed environments.

Dominant Regions, Countries, or Segments in South America Data Center Server Market

The South America Data Center Server Market is primarily driven by Brazil, emerging as the dominant country due to its large economy, significant investments in digital infrastructure, and a substantial IT & Telecommunication sector. Brazil's robust ecosystem for cloud computing and its proactive government initiatives to foster technological development position it as a key growth engine. The country's extensive population and widespread internet penetration further amplify the demand for data center services and, consequently, server hardware.

Within the Form Factor segment, Rack Servers are anticipated to maintain their dominance, largely due to their versatility, scalability, and cost-effectiveness for a wide range of data center applications. However, Blade Servers are experiencing a significant surge in demand, particularly from hyperscale data centers and enterprises with high-density computing needs for AI, HPC, and cloud workloads, as evidenced by recent industry developments.

The End-User segment of IT & Telecommunication is a major contributor to market growth, driven by the relentless expansion of data traffic, the rollout of 5G, and the increasing adoption of cloud services by telecom operators. The BFSI sector is also a critical driver, with financial institutions investing heavily in modernizing their infrastructure to support digital banking, online trading platforms, and advanced fraud detection systems, all of which require powerful server solutions. The Government sector, propelled by smart city initiatives, e-governance projects, and national security concerns, represents another significant growth avenue.

- Dominant Country: Brazil leads due to its economic size, digital transformation initiatives, and robust IT & Telecommunication sector.

- Leading Form Factor: Rack Servers continue to be the most adopted, offering a balance of performance, cost, and scalability.

- Fastest Growing Form Factor: Blade Servers are gaining significant traction for high-density computing in AI and HPC environments.

- Key End-User: IT & Telecommunication sector leads demand, followed by BFSI and Government due to digitalization trends.

- Geographic Influence: While Brazil is dominant, Chile and other emerging economies in the "Rest of South America" are showing promising growth potential, influenced by increasing foreign investment and digital infrastructure development.

South America Data Center Server Market Product Landscape

The product landscape of the South America Data Center Server Market is defined by continuous innovation focused on enhancing performance, efficiency, and specialized capabilities. Manufacturers are increasingly offering servers optimized for specific workloads like AI, HPC, and big data analytics, featuring advanced processors, high-speed memory, and accelerated computing capabilities through GPUs. Product developments are geared towards greater density and modularity, enabling data center operators to optimize space utilization and power consumption. Unique selling propositions often revolve around energy efficiency, enhanced security features, and integrated management solutions that simplify deployment and maintenance.

Key Drivers, Barriers & Challenges in South America Data Center Server Market

Key Drivers: The primary forces propelling the South America Data Center Server Market include the escalating demand for cloud computing services, the rapid adoption of AI and machine learning technologies, and the continuous expansion of telecommunication networks, especially 5G. Government initiatives promoting digital transformation and e-governance are also significant drivers. Furthermore, the increasing volume of data generated by businesses and consumers necessitates more powerful server infrastructure.

Barriers & Challenges: Supply chain disruptions, particularly for critical components like semiconductors, pose a significant challenge. Regulatory hurdles related to data localization and privacy can impact deployment strategies. Intense competitive pressure among global and regional vendors, coupled with price sensitivity in certain markets, can restrain profit margins. The high initial investment cost for advanced server infrastructure can also be a barrier for small and medium-sized enterprises.

Emerging Opportunities in South America Data Center Server Market

Emerging opportunities in the South America Data Center Server Market lie in the growing demand for edge computing solutions, driven by the proliferation of IoT devices and the need for real-time data processing closer to the source. The increasing adoption of hyperconverged infrastructure (HCI) presents another significant opportunity for vendors offering integrated server and storage solutions. Furthermore, the untapped potential in sectors like healthcare and education for digitalizing services and leveraging data analytics offers substantial growth avenues. The development of localized manufacturing and support services can also unlock new market segments.

Growth Accelerators in the South America Data Center Server Market Industry

Catalysts driving long-term growth in the South America Data Center Server Market include technological breakthroughs in server architecture, such as advancements in liquid cooling for high-density computing and the development of more energy-efficient processors. Strategic partnerships between server manufacturers, cloud service providers, and telecommunication companies are crucial for expanding market reach and developing integrated solutions. Market expansion strategies focused on underserved regions and industries, coupled with tailored product offerings for specific local requirements, will also accelerate growth.

Key Players Shaping the South America Data Center Server Market Market

- Lenovo Group Limited

- International Business Machines (IBM) Corporation

- Inspur Group

- Hewlett Packard Enterprise

- Cisco Systems Inc

- Fujitsu Limited

- Dell Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

Notable Milestones in South America Data Center Server Market Sector

- January 2023: Supermicro announced the launch of its new server and storage portfolio with more than 15 families of performance-optimized systems focusing on cloud computing, AI, and HPC, as well as enterprise, media, and 5G/telco/edge workloads. SuperBlade would deliver the computational performance of a whole server rack in a considerably smaller physical footprint by using shared, redundant components, including cooling, networking, power, and chassis management. These blade server systems are geared for AI, Data Analytics, HPC, Cloud, and Enterprise applications and feature GPU-enabled blades.

- September 2022: Lenovo Group Ltd. introduced dozens of new servers, storage systems, and Hyperconverged Infrastructure appliances, as well as a cloud-based hardware management service. Intel Corp. Sapphire Rapids server processors would be incorporated into some of the new systems it is rolling out. The processors, which are scheduled to launch in the market next year, use a ten-nanometer Intel 7 manufacturing process.

In-Depth South America Data Center Server Market Market Outlook

The future market potential for the South America Data Center Server Market is exceptionally strong, propelled by the sustained digital transformation across the continent. Strategic opportunities abound in catering to the escalating demand for AI, IoT, and edge computing, requiring highly specialized and performant server solutions. The continuous evolution of cloud infrastructure will also drive demand for scalable and efficient server hardware. Companies focusing on providing advanced analytics capabilities, enhanced cybersecurity features, and eco-friendly server solutions are poised to capture significant market share. The increasing adoption of hybrid cloud models will further necessitate robust on-premises server deployments, creating a balanced growth environment.

South America Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

-

3. Geography

- 3.1. Brazil

- 3.2. Chile

- 3.3. Rest of South America

South America Data Center Server Market Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Rest of South America

South America Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud Technologies; Large-scale commercialization of 5G networks

- 3.3. Market Restrains

- 3.3.1. Rising CapEx for data center construction; Cybersecurity Threats

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment Holds The Major Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Chile

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Brazil South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 6.1.1. Blade Server

- 6.1.2. Rack Server

- 6.1.3. Tower Server

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. IT & Telecommunication

- 6.2.2. BFSI

- 6.2.3. Government

- 6.2.4. Media & Entertainment

- 6.2.5. Other End-User

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Chile

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 7. Chile South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 7.1.1. Blade Server

- 7.1.2. Rack Server

- 7.1.3. Tower Server

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. IT & Telecommunication

- 7.2.2. BFSI

- 7.2.3. Government

- 7.2.4. Media & Entertainment

- 7.2.5. Other End-User

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Chile

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 8. Rest of South America South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 8.1.1. Blade Server

- 8.1.2. Rack Server

- 8.1.3. Tower Server

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. IT & Telecommunication

- 8.2.2. BFSI

- 8.2.3. Government

- 8.2.4. Media & Entertainment

- 8.2.5. Other End-User

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Chile

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 9. Brazil South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Lenovo Group Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 International Business Machines (IBM) Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Inspur Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hewlett Packard Enterprise

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cisco Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fujitsu Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dell Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kingston Technology Company Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Huawei Technologies Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Lenovo Group Limited

List of Figures

- Figure 1: South America Data Center Server Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Data Center Server Market Share (%) by Company 2024

List of Tables

- Table 1: South America Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 3: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 11: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 15: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 19: South America Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: South America Data Center Server Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Data Center Server Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the South America Data Center Server Market?

Key companies in the market include Lenovo Group Limited, International Business Machines (IBM) Corporation, Inspur Group, Hewlett Packard Enterprise, Cisco Systems Inc, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd.

3. What are the main segments of the South America Data Center Server Market?

The market segments include Form Factor, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud Technologies; Large-scale commercialization of 5G networks.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment Holds The Major Share..

7. Are there any restraints impacting market growth?

Rising CapEx for data center construction; Cybersecurity Threats.

8. Can you provide examples of recent developments in the market?

January 2023: Supermicro announced the launch of its new server and storage portfolio with more than 15 families of performance-optimized systems focusing on cloud computing, AI, and HPC, as well as enterprise, media, and 5G/telco/edge workloads. SuperBlade would deliver the computational performance of a whole server rack in a considerably smaller physical footprint by using shared, redundant components, including cooling, networking, power, and chassis management. These blade server systems are geared for AI, Data Analytics, HPC, Cloud, and Enterprise applications and feature GPU-enabled blades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Data Center Server Market?

To stay informed about further developments, trends, and reports in the South America Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence