Key Insights

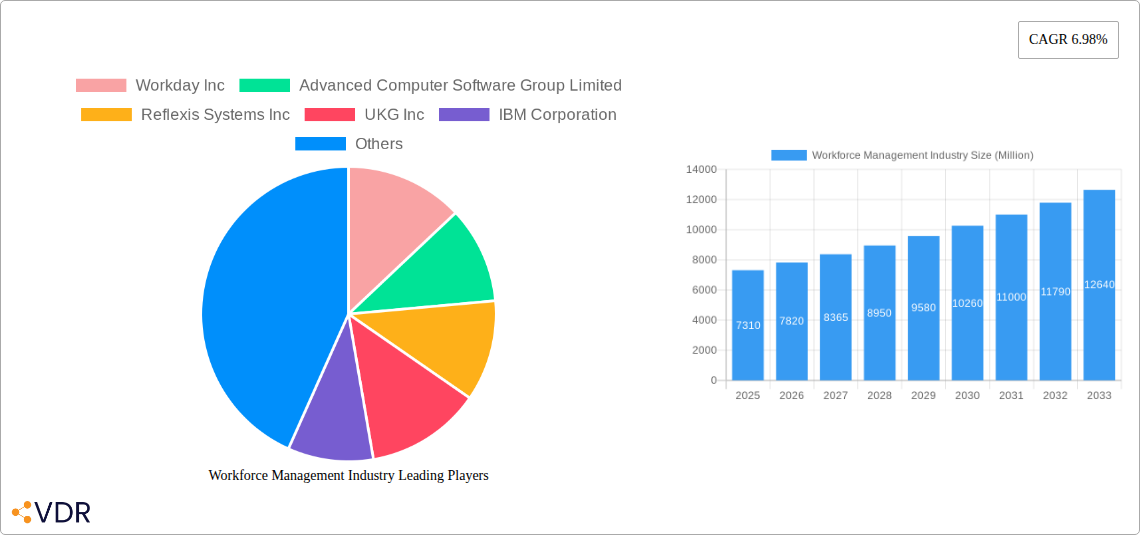

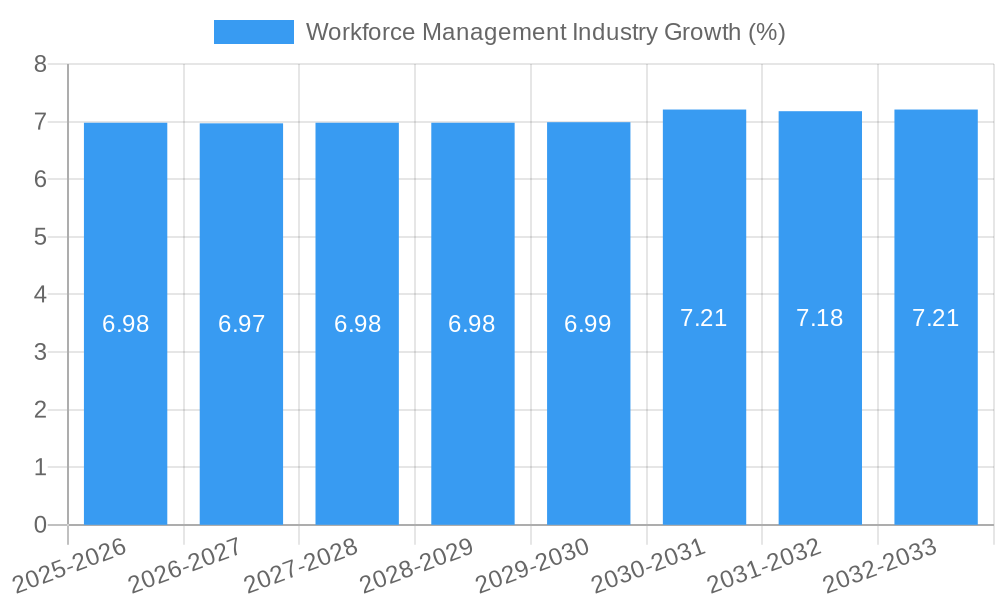

The global Workforce Management (WFM) industry is experiencing robust expansion, projected to reach a substantial market size of approximately $7.31 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.98% anticipated to carry through the forecast period of 2025-2033. This significant growth is primarily fueled by an increasing need for businesses across all sectors to optimize labor costs, enhance employee productivity, and ensure compliance with evolving labor regulations. Key drivers include the growing adoption of cloud-based WFM solutions, which offer scalability and flexibility, alongside the demand for advanced analytics to derive actionable insights from workforce data. The industry is witnessing a paradigm shift towards integrated solutions that encompass not just scheduling and timekeeping but also performance management, absence tracking, and strategic talent planning.

The WFM market is segmented into several critical areas, with Workforce Scheduling and Workforce Analytics leading the charge due to their direct impact on operational efficiency and strategic decision-making. Time and Attendance Management remains a foundational segment, essential for payroll accuracy and compliance. Performance and Goal Management is gaining prominence as organizations focus on aligning individual employee efforts with overarching business objectives. Absence and Leave Management is crucial for maintaining operational continuity and employee well-being. The deployment mode is increasingly leaning towards Cloud solutions, offering cost-effectiveness and ease of implementation, though On-premise solutions still hold a share, particularly in highly regulated industries. Diverse end-user verticals, including BFSI, Consumer Goods and Retail, Healthcare, and Manufacturing, are actively investing in WFM technologies to streamline their operations and manage their large and complex workforces effectively. Major industry players like Workday Inc., UKG Inc., SAP SE, and Oracle Corporation are continuously innovating, driving competition and market penetration.

Unlock Peak Productivity: Comprehensive Workforce Management Industry Report 2024-2033

Dive deep into the dynamic world of Workforce Management (WFM) with our definitive industry report. This exhaustive analysis covers the global WFM market, including parent and child markets, from 2019 to 2033, with a detailed forecast for 2025-2033. Discover how leading companies like Workday Inc, UKG Inc, Oracle Corporation, and SAP SE are shaping the future of employee productivity, scheduling, and engagement. Our report provides unparalleled insights into market size evolution, growth trends, and key strategic initiatives, offering a crucial roadmap for businesses navigating the complexities of modern workforce operations. With a focus on high-traffic keywords such as "workforce scheduling software," "time and attendance systems," "performance management solutions," and "cloud workforce management," this report is optimized for maximum search engine visibility, attracting industry professionals, HR leaders, and strategic decision-makers.

Workforce Management Industry Market Dynamics & Structure

The Workforce Management (WFM) industry exhibits a moderately concentrated market structure, characterized by the presence of several large, established players and a growing number of innovative niche providers. Technological innovation serves as a primary driver, with advancements in AI, machine learning, and cloud computing continuously enhancing WFM capabilities. Companies like Workday Inc and UKG Inc are at the forefront, integrating predictive analytics for better resource allocation and employee engagement. Regulatory frameworks, particularly around labor laws and data privacy (e.g., GDPR, CCPA), significantly influence WFM solution development and deployment. Competitive product substitutes include manual processes, disparate HR systems, and specialized standalone solutions, but the integrated nature of comprehensive WFM platforms offers a distinct advantage. End-user demographics are increasingly diverse, with a growing demand for flexible work arrangements and remote workforce management tools. Mergers and acquisitions (M&A) are a notable trend, with larger players acquiring specialized WFM companies to expand their service offerings and market reach. For instance, Advanced Computer Software Group Limited's acquisition of Mitrefinch Ltd consolidates market presence.

- Market Concentration: Dominated by a few key vendors, but with increasing fragmentation due to specialized solutions.

- Technological Innovation Drivers: AI for predictive scheduling, ML for performance insights, cloud for scalability and accessibility.

- Regulatory Frameworks: Data privacy, labor compliance, and evolving remote work regulations.

- Competitive Product Substitutes: Manual tracking, basic HRIS, standalone scheduling tools.

- End-User Demographics: Growing demand for flexibility, remote work support, and personalized employee experiences.

- M&A Trends: Strategic acquisitions to broaden product portfolios and capture market share.

Workforce Management Industry Growth Trends & Insights

The global Workforce Management (WFM) market is poised for robust expansion, driven by an escalating need for operational efficiency, enhanced employee productivity, and compliance adherence across diverse industries. From a market size of approximately $18,200 million in 2024, the WFM industry is projected to witness a Compound Annual Growth Rate (CAGR) of 9.5% during the forecast period of 2025–2033, reaching an estimated $35,000 million by 2033. This growth is fueled by the increasing adoption of cloud-based WFM solutions, which offer unparalleled scalability, flexibility, and cost-effectiveness. Technological disruptions, particularly the integration of Artificial Intelligence (AI) and Machine Learning (ML), are transforming WFM capabilities. AI-powered predictive analytics are enabling organizations to forecast staffing needs, optimize schedules, and proactively identify potential labor shortages or overstaffing situations. Furthermore, the shift towards hybrid and remote work models has amplified the demand for sophisticated WFM tools that can effectively manage distributed workforces, track attendance, monitor performance, and ensure equitable resource allocation. Consumer behavior shifts, influenced by employee expectations for greater autonomy, flexibility, and personalized work experiences, are also compelling businesses to invest in WFM solutions that foster employee engagement and well-being. The penetration of advanced WFM solutions is rapidly increasing, moving beyond basic time and attendance to encompass comprehensive talent management, performance optimization, and strategic workforce planning. This evolution is critical for organizations seeking to gain a competitive edge, reduce operational costs, and build a resilient and agile workforce capable of adapting to dynamic market conditions.

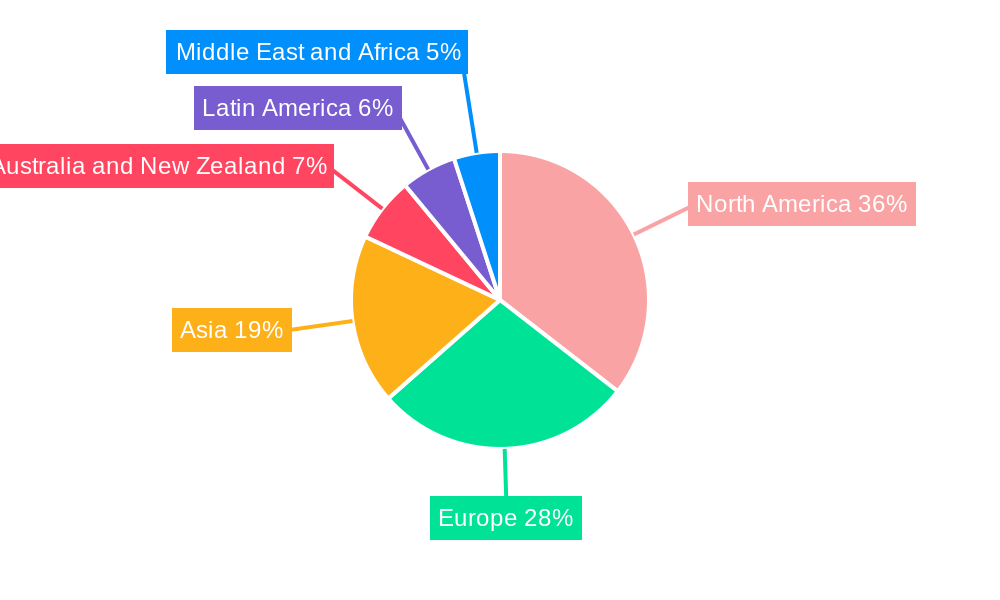

Dominant Regions, Countries, or Segments in Workforce Management Industry

The North American region stands as the dominant force in the global Workforce Management (WFM) industry, driven by a confluence of factors including a highly developed technological infrastructure, a strong emphasis on operational efficiency, and the early adoption of cloud-based solutions. Within North America, the United States emerges as the leading country, accounting for a significant share of the market. Key drivers for this dominance include the presence of numerous large enterprises across various sectors like BFSI, Consumer Goods and Retail, and Healthcare, all actively seeking to optimize their workforce operations. The robust economic policies and a culture of innovation further foster the growth of WFM adoption. In terms of segments, Workforce Scheduling and Workforce Analytics represents the most significant and fastest-growing segment. This segment’s prominence is attributed to the increasing complexity of scheduling in industries with fluctuating demands, such as retail and healthcare, and the growing realization of the strategic value of workforce analytics for informed decision-making. Companies like UKG Inc, Workday Inc, and Oracle Corporation have a strong foothold in this segment, offering advanced solutions that leverage AI and ML for optimized scheduling and predictive insights.

The Cloud deployment mode is also a major contributor to market dominance, outpacing on-premise solutions due to its scalability, flexibility, and lower upfront investment. This shift is particularly evident in the BFSI and Healthcare verticals, where cloud solutions enable seamless integration and access to critical workforce data. The Consumer Goods and Retail vertical further amplifies this trend, with businesses relying heavily on WFM for managing large, often part-time, workforces and responding dynamically to market demands. The healthcare sector, facing critical staffing challenges and stringent compliance requirements, is increasingly investing in WFM for efficient staff allocation and adherence to regulations. While other regions like Europe and Asia Pacific are showing substantial growth, North America's mature market, coupled with its aggressive adoption of advanced WFM technologies, positions it at the forefront of this industry. The continuous demand for enhanced productivity, employee satisfaction, and operational cost reduction will continue to fuel the growth of WFM solutions, particularly in the Workforce Scheduling and Analytics segment and cloud deployment models, further solidifying North America's leadership.

- Dominant Region: North America, with the United States as the leading country.

- Key Growth Drivers in North America: Advanced technological infrastructure, focus on operational efficiency, early cloud adoption.

- Leading Segment: Workforce Scheduling and Workforce Analytics.

- Factors Driving Segment Dominance: Complexity of scheduling, demand for data-driven decision-making, AI/ML integration.

- Dominant Deployment Mode: Cloud.

- Benefits of Cloud Deployment: Scalability, flexibility, cost-effectiveness, accessibility.

- Key Verticals Driving Adoption: BFSI, Consumer Goods and Retail, Healthcare.

- Factors Driving Vertical Adoption: Staffing complexity, compliance needs, fluctuating demands.

Workforce Management Industry Product Landscape

The Workforce Management (WFM) industry is characterized by a rapidly evolving product landscape, driven by innovation and the pursuit of enhanced operational efficiency and employee engagement. Leading vendors are increasingly integrating advanced technologies such as AI, machine learning, and predictive analytics into their solutions. This allows for sophisticated workforce scheduling that optimizes labor costs and ensures adequate staffing levels, alongside robust workforce analytics that provide deep insights into productivity, performance, and labor trends. Key product innovations include intelligent automation of time and attendance tracking, real-time performance monitoring, and dynamic absence and leave management systems designed for compliance and employee convenience. ServiceMax Inc, for example, focuses on field service management, integrating WFM with operational execution, while NICE Ltd offers advanced analytics for contact center optimization. The emphasis is on delivering user-friendly, cloud-based platforms that offer a unified view of the workforce, thereby empowering organizations to make data-driven decisions and foster a more engaged and productive employee base.

Key Drivers, Barriers & Challenges in Workforce Management Industry

Key Drivers:

The Workforce Management (WFM) industry is propelled by several critical drivers. The escalating demand for increased operational efficiency and productivity across all business sectors is a primary catalyst. Furthermore, the growing complexity of labor regulations and compliance requirements necessitates sophisticated WFM solutions. The shift towards hybrid and remote work models has also created a significant demand for tools that can effectively manage distributed teams, track attendance, and monitor performance in a decentralized environment. Technological advancements, including AI and machine learning, are enabling more intelligent scheduling, forecasting, and employee engagement strategies, further accelerating market growth.

Barriers & Challenges:

Despite the strong growth trajectory, the WFM industry faces several challenges. The substantial initial investment required for comprehensive WFM implementations can be a barrier for small and medium-sized enterprises (SMEs). Resistance to change from employees and management, accustomed to traditional methods, can hinder adoption rates. Ensuring data security and privacy within cloud-based WFM solutions is a perpetual concern. Moreover, the market is highly competitive, with numerous vendors offering a wide array of solutions, leading to potential confusion for buyers. Supply chain issues are less directly impactful on software, but the broader economic climate can affect IT spending.

Emerging Opportunities in Workforce Management Industry

The Workforce Management (WFM) industry is ripe with emerging opportunities, particularly in the realm of personalized employee experiences and advanced data analytics. The increasing focus on employee well-being and retention is driving demand for WFM modules that support flexible scheduling, dynamic shift bidding, and proactive feedback mechanisms. The integration of WFM with broader HR tech stacks, including payroll and learning management systems, presents a significant opportunity for creating a seamless employee lifecycle experience. Furthermore, the growing need for real-time insights into workforce performance and engagement in an increasingly volatile economic landscape is spurring innovation in predictive analytics and AI-driven recommendations. Untapped markets in developing economies, where formal WFM adoption is still nascent, offer substantial growth potential.

Growth Accelerators in the Workforce Management Industry Industry

Several catalysts are accelerating growth within the Workforce Management (WFM) industry. The widespread adoption of cloud-native WFM solutions is a major growth accelerator, offering scalability, agility, and enhanced accessibility for businesses of all sizes. Strategic partnerships between WFM providers and other HR technology companies, as exemplified by the Infor and iCIMS partnership, are creating integrated ecosystems that offer more comprehensive solutions. Market expansion strategies, targeting specific industry verticals with tailored WFM functionalities, are also driving growth. For instance, solutions designed for the unique needs of healthcare staffing or retail operations are gaining traction. The ongoing technological breakthroughs, particularly in AI and machine learning for predictive workforce planning and intelligent automation, are fundamentally transforming WFM capabilities and accelerating its adoption.

Key Players Shaping the Workforce Management Industry Market

- Workday Inc

- Advanced Computer Software Group Limited

- Reflexis Systems Inc

- UKG Inc

- IBM Corporation

- tamigo ApS

- ServiceMax Inc

- SISQUAL Workforce Management Lda

- Blue Yonder Group Inc (Panasonic Corporation)

- Infor Group

- NICE Ltd

- Mitrefinch Ltd (Advanced Computer Software Group Limited)

- Atoss Software AG

- Oracle Corporation

- ADP LLC

- WorkForce Software LLC

- Sage Group plc

- SAP SE

- Roubler Australia Pty Ltd

- ActiveOps PLC

Notable Milestones in Workforce Management Industry Sector

- March 2022: ActiveOps and ReturnSafe announced a strategic partnership to combine effective vaccination, testing, and case management capabilities with ActiveOps' hybrid workforce intelligence and planning solutions, addressing the evolving landscape of hybrid working and COVID-19 protocols.

- February 2022: Infor and iCIMS announced a strategic partnership to deliver next-generation talent capabilities in North America, focusing on connecting the end-to-end talent lifecycle for key service industries like healthcare organizations, aiming to transform the talent experience.

In-Depth Workforce Management Industry Market Outlook

The Workforce Management (WFM) industry is on a trajectory of sustained, high-paced growth, driven by an undeniable need for optimized labor utilization, enhanced employee engagement, and stringent regulatory compliance. Future market potential is immense, fueled by the continued digital transformation of businesses worldwide and the imperative to adapt to evolving work models, including the sustained prevalence of hybrid and remote arrangements. Strategic opportunities lie in the further development and integration of AI-powered predictive analytics for proactive workforce planning, enabling organizations to anticipate future needs with unprecedented accuracy. Expansion into underserved markets and the deepening of integrations with other HR and business intelligence platforms will also be key growth accelerators. The industry's ability to deliver tangible ROI through cost savings, productivity gains, and improved employee retention will remain paramount in capturing future market share.

Workforce Management Industry Segmentation

-

1. Type

- 1.1. Workforce Scheduling and Workforce Analytics

- 1.2. Time and Attendance Management

- 1.3. Performance and Goal Management

- 1.4. Absence and Leave Management

- 1.5. Other So

-

2. Deployment Mode

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Consumer Goods and Retail

- 3.3. Automotive

- 3.4. Energy and Utilities

- 3.5. Healthcare

- 3.6. Manufacturing

- 3.7. Other End-user Industries

Workforce Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Workforce Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expanding the Market; Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Implementation and Integration Concerns Hindering the Market

- 3.4. Market Trends

- 3.4.1. Cloud to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Workforce Scheduling and Workforce Analytics

- 5.1.2. Time and Attendance Management

- 5.1.3. Performance and Goal Management

- 5.1.4. Absence and Leave Management

- 5.1.5. Other So

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Consumer Goods and Retail

- 5.3.3. Automotive

- 5.3.4. Energy and Utilities

- 5.3.5. Healthcare

- 5.3.6. Manufacturing

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Workforce Scheduling and Workforce Analytics

- 6.1.2. Time and Attendance Management

- 6.1.3. Performance and Goal Management

- 6.1.4. Absence and Leave Management

- 6.1.5. Other So

- 6.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Consumer Goods and Retail

- 6.3.3. Automotive

- 6.3.4. Energy and Utilities

- 6.3.5. Healthcare

- 6.3.6. Manufacturing

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Workforce Scheduling and Workforce Analytics

- 7.1.2. Time and Attendance Management

- 7.1.3. Performance and Goal Management

- 7.1.4. Absence and Leave Management

- 7.1.5. Other So

- 7.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Consumer Goods and Retail

- 7.3.3. Automotive

- 7.3.4. Energy and Utilities

- 7.3.5. Healthcare

- 7.3.6. Manufacturing

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Workforce Scheduling and Workforce Analytics

- 8.1.2. Time and Attendance Management

- 8.1.3. Performance and Goal Management

- 8.1.4. Absence and Leave Management

- 8.1.5. Other So

- 8.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Consumer Goods and Retail

- 8.3.3. Automotive

- 8.3.4. Energy and Utilities

- 8.3.5. Healthcare

- 8.3.6. Manufacturing

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Workforce Scheduling and Workforce Analytics

- 9.1.2. Time and Attendance Management

- 9.1.3. Performance and Goal Management

- 9.1.4. Absence and Leave Management

- 9.1.5. Other So

- 9.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Consumer Goods and Retail

- 9.3.3. Automotive

- 9.3.4. Energy and Utilities

- 9.3.5. Healthcare

- 9.3.6. Manufacturing

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Workforce Scheduling and Workforce Analytics

- 10.1.2. Time and Attendance Management

- 10.1.3. Performance and Goal Management

- 10.1.4. Absence and Leave Management

- 10.1.5. Other So

- 10.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. BFSI

- 10.3.2. Consumer Goods and Retail

- 10.3.3. Automotive

- 10.3.4. Energy and Utilities

- 10.3.5. Healthcare

- 10.3.6. Manufacturing

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Workforce Scheduling and Workforce Analytics

- 11.1.2. Time and Attendance Management

- 11.1.3. Performance and Goal Management

- 11.1.4. Absence and Leave Management

- 11.1.5. Other So

- 11.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.3.1. BFSI

- 11.3.2. Consumer Goods and Retail

- 11.3.3. Automotive

- 11.3.4. Energy and Utilities

- 11.3.5. Healthcare

- 11.3.6. Manufacturing

- 11.3.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Workforce Management Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Workday Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Advanced Computer Software Group Limited

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Reflexis Systems Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 UKG Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 IBM Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 tamigo ApS

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 ServiceMax Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 SISQUAL Workforce Management Lda

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Blue Yonder Group Inc (Panasonic Corporation)

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Infor Group

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 NICE Ltd

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Mitrefinch Ltd (Advanced Computer Software Group Limited)

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Atoss Software AG

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Oracle Corporation

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 ADP LLC

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.16 WorkForce Software LLC

- 17.2.16.1. Overview

- 17.2.16.2. Products

- 17.2.16.3. SWOT Analysis

- 17.2.16.4. Recent Developments

- 17.2.16.5. Financials (Based on Availability)

- 17.2.17 Sage Group plc

- 17.2.17.1. Overview

- 17.2.17.2. Products

- 17.2.17.3. SWOT Analysis

- 17.2.17.4. Recent Developments

- 17.2.17.5. Financials (Based on Availability)

- 17.2.18 SAP SE

- 17.2.18.1. Overview

- 17.2.18.2. Products

- 17.2.18.3. SWOT Analysis

- 17.2.18.4. Recent Developments

- 17.2.18.5. Financials (Based on Availability)

- 17.2.19 Roubler Australia Pty Ltd

- 17.2.19.1. Overview

- 17.2.19.2. Products

- 17.2.19.3. SWOT Analysis

- 17.2.19.4. Recent Developments

- 17.2.19.5. Financials (Based on Availability)

- 17.2.20 ActiveOps PLC

- 17.2.20.1. Overview

- 17.2.20.2. Products

- 17.2.20.3. SWOT Analysis

- 17.2.20.4. Recent Developments

- 17.2.20.5. Financials (Based on Availability)

- 17.2.1 Workday Inc

List of Figures

- Figure 1: Workforce Management Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Workforce Management Industry Share (%) by Company 2024

List of Tables

- Table 1: Workforce Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Workforce Management Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Workforce Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Workforce Management Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Workforce Management Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 6: Workforce Management Industry Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 7: Workforce Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 8: Workforce Management Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 9: Workforce Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Workforce Management Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Workforce Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Workforce Management Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Workforce Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Workforce Management Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Workforce Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Workforce Management Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: Workforce Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Workforce Management Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Workforce Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Workforce Management Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Workforce Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Workforce Management Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 33: Workforce Management Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 34: Workforce Management Industry Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 35: Workforce Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 36: Workforce Management Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 37: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Workforce Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Workforce Management Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 41: Workforce Management Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 42: Workforce Management Industry Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 43: Workforce Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 44: Workforce Management Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 45: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Workforce Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Workforce Management Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 49: Workforce Management Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 50: Workforce Management Industry Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 51: Workforce Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 52: Workforce Management Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 53: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Workforce Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Workforce Management Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 57: Workforce Management Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 58: Workforce Management Industry Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 59: Workforce Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 60: Workforce Management Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 61: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 63: Workforce Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 64: Workforce Management Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 65: Workforce Management Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 66: Workforce Management Industry Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 67: Workforce Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 68: Workforce Management Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 69: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 71: Workforce Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 72: Workforce Management Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 73: Workforce Management Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 74: Workforce Management Industry Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 75: Workforce Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 76: Workforce Management Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 77: Workforce Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Workforce Management Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Workforce Management Industry?

The projected CAGR is approximately 6.98%.

2. Which companies are prominent players in the Workforce Management Industry?

Key companies in the market include Workday Inc, Advanced Computer Software Group Limited, Reflexis Systems Inc, UKG Inc, IBM Corporation, tamigo ApS, ServiceMax Inc, SISQUAL Workforce Management Lda, Blue Yonder Group Inc (Panasonic Corporation), Infor Group, NICE Ltd, Mitrefinch Ltd (Advanced Computer Software Group Limited), Atoss Software AG, Oracle Corporation, ADP LLC, WorkForce Software LLC, Sage Group plc, SAP SE, Roubler Australia Pty Ltd, ActiveOps PLC.

3. What are the main segments of the Workforce Management Industry?

The market segments include Type, Deployment Mode, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expanding the Market; Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth.

6. What are the notable trends driving market growth?

Cloud to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

Implementation and Integration Concerns Hindering the Market.

8. Can you provide examples of recent developments in the market?

March 2022: ActiveOps and ReturnSafe announced a strategic partnership to combine the effective vaccination, testing, and case management capabilities from ReturnSafe with ActiveOps' hybrid workforce intelligence and planning solutions. The partnership combines the technology and expertise of both companies to handle the ever-changing landscape of hybrid working due to the COVID-19 pandemic and the various protocols, mandates, and policies implemented to protect people from the virus.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Workforce Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Workforce Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Workforce Management Industry?

To stay informed about further developments, trends, and reports in the Workforce Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence