Key Insights

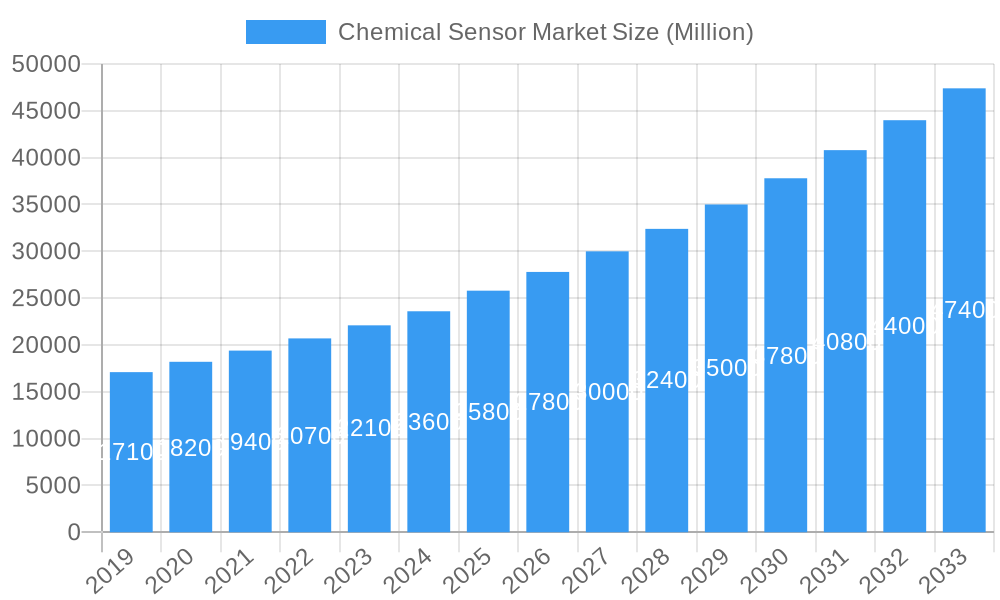

The global chemical sensor market is poised for substantial growth, projected to reach a market size of approximately $25,800 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 7.51% through 2033. This robust expansion is fueled by an increasing demand across diverse end-user applications, including industrial process control, healthcare diagnostics, environmental monitoring, and critical sectors like defense and oil & gas. The industrial segment, in particular, is a significant driver, leveraging chemical sensors for real-time monitoring, automation, and safety compliance. Furthermore, the growing awareness and stringent regulations surrounding environmental protection are propelling the adoption of advanced chemical sensing technologies for detecting pollutants and ensuring air and water quality. Innovations in sensor technology, leading to enhanced accuracy, miniaturization, and cost-effectiveness, are continuously expanding their application spectrum and market penetration.

Chemical Sensor Market Market Size (In Billion)

The market's trajectory is significantly influenced by key trends such as the integration of advanced materials like nanomaterials and advanced polymers to improve sensor performance, and the increasing adoption of wireless and IoT-enabled chemical sensors for remote monitoring and data analytics. The development of sophisticated electrochemical and optical sensors, offering superior sensitivity and selectivity for a wide range of analytes, is also shaping market dynamics. While the market is characterized by strong growth, potential restraints include the high initial investment costs for advanced sensor systems and the need for skilled personnel for their operation and maintenance. However, the continuous advancements in sensor technology, coupled with the ever-growing need for precise and reliable chemical analysis across multiple industries, are expected to outweigh these challenges, ensuring a dynamic and expanding market landscape. The market is segmented into electrochemical, optical, pellister/catalytic bead, and other types of sensors, serving vital applications in industrial, healthcare, environmental monitoring, defense, oil and gas, and homeland security sectors.

Chemical Sensor Market Company Market Share

Comprehensive Chemical Sensor Market Analysis: Dynamics, Trends, and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Chemical Sensor Market, offering unparalleled insights into its intricate dynamics, pivotal growth trends, and future trajectory. Covering the extensive study period from 2019 to 2033, with a focus on the base year of 2025 and a forecast period extending from 2025 to 2033, this research equips industry professionals, investors, and stakeholders with actionable intelligence. Delve into market segmentation by Product Type (Electrochemical, Optical, Pellister/Catalytic Bead, Other Types) and End-user Application (Industrial, Healthcare, Environmental Monitoring, Defense, Oil and Gas Industry, Homeland Security), understanding the drivers and nuances within each segment. This report is meticulously designed for maximum SEO visibility, integrating high-traffic keywords such as chemical sensors, gas sensors, biosensors, environmental monitoring sensors, industrial safety sensors, and healthcare sensors, to attract a broad spectrum of industry searches. Discover key market players, technological advancements, and emerging opportunities that will shape the future of the chemical sensor landscape.

Chemical Sensor Market Dynamics & Structure

The chemical sensor market is characterized by a moderately concentrated structure, driven by significant technological innovation and evolving regulatory frameworks. Leading companies are investing heavily in R&D to enhance sensor accuracy, miniaturization, and real-time detection capabilities, especially for applications in environmental monitoring and industrial safety. The proliferation of stringent environmental regulations globally acts as a major impetus for the adoption of advanced chemical sensors in industries like oil and gas and manufacturing to ensure compliance and mitigate pollution. Competitive product substitutes, while present, often lag in terms of specificity, sensitivity, or integration capabilities, thus sustaining the demand for sophisticated chemical sensing solutions. End-user demographics are diversifying, with increasing adoption in healthcare for disease diagnostics and in homeland security for threat detection. Mergers and acquisitions (M&A) are becoming a key strategy for market consolidation and technology acquisition, enabling players to expand their product portfolios and geographic reach. For instance, the period saw a consistent volume of M&A deals aimed at acquiring innovative sensor technologies and expanding market share, estimated at approximately 30-40 deals annually across the historical period. Barriers to innovation include the high cost of specialized research and development, the need for rigorous testing and validation for critical applications, and the challenge of developing sensors that can operate reliably in harsh or complex environments.

Chemical Sensor Market Growth Trends & Insights

The chemical sensor market is poised for robust growth, driven by a confluence of technological advancements, escalating demand across diverse end-user applications, and increasing regulatory mandates. The market size is projected to expand from an estimated $35,000 million in 2025 to an anticipated $55,000 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 5.5% during the forecast period. Adoption rates are accelerating, particularly in the healthcare sector for early disease detection and patient monitoring, and in environmental monitoring for tracking air and water quality. Technological disruptions, such as the development of highly sensitive and selective nanomaterial-based sensors and the integration of AI and IoT for predictive maintenance and real-time data analytics, are revolutionizing the market. Consumer behavior is shifting towards greater awareness and demand for safer living and working environments, directly fueling the need for advanced chemical detection systems. Market penetration is deepening, with sensors becoming integral components in smart devices, industrial automation, and critical infrastructure. For example, the increasing adoption of smart home devices with integrated air quality sensors is a testament to evolving consumer preferences for healthier living spaces. The integration of these sensors into wearable devices for continuous health monitoring also represents a significant growth frontier. Furthermore, the growing emphasis on process optimization and efficiency in industries like oil and gas and semiconductor manufacturing necessitates precise and reliable chemical sensing for process control, leading to sustained demand. The development of low-cost, disposable sensors for point-of-care diagnostics is also a key trend influencing market expansion and accessibility.

Dominant Regions, Countries, or Segments in Chemical Sensor Market

The industrial segment within the Chemical Sensor Market is a dominant force driving market growth, accounting for an estimated 30% of the market share in 2025. This dominance is propelled by the critical need for safety, efficiency, and regulatory compliance in a vast array of industrial operations, including chemical manufacturing, oil and gas exploration, pharmaceuticals, and food and beverage production. Within the industrial application, electrochemical sensors are particularly prevalent due to their versatility, sensitivity, and cost-effectiveness in detecting specific gases and vapors, crucial for process control and worker safety. Geographically, North America is a leading region, holding an estimated 28% of the global market share in 2025. This leadership is attributed to advanced industrial infrastructure, stringent environmental and safety regulations, and substantial investments in research and development by key industry players. The United States, in particular, benefits from a strong presence of major chemical and manufacturing companies, driving demand for sophisticated industrial safety sensors and environmental monitoring sensors. Economic policies supporting industrial automation and innovation further bolster the market in this region.

Industrial Segment Dominance:

- Essential for process optimization and quality control in manufacturing.

- Critical for ensuring worker safety through the detection of hazardous gases and chemicals.

- Regulatory compliance in industries like petrochemicals and pharmaceuticals necessitates continuous monitoring.

- Market share estimated at $10,500 million in 2025.

North America's Leading Position:

- Robust industrial base and high adoption of advanced technologies.

- Strict regulatory environment for emissions control and workplace safety.

- Significant presence of R&D centers and key market players.

- Growth potential enhanced by ongoing industrial modernization and digitalization initiatives.

The Oil and Gas Industry, a key sub-segment within industrial applications, exhibits particularly strong growth potential due to the inherent risks and stringent safety protocols associated with exploration, extraction, and refining processes. The demand for sensors to monitor methane leaks, hydrogen sulfide, and other hazardous substances remains consistently high, further cementing the industrial segment's leadership.

Chemical Sensor Market Product Landscape

The chemical sensor market is witnessing a dynamic product landscape driven by relentless innovation. Electrochemical sensors remain a cornerstone, offering high specificity and sensitivity for detecting a wide range of gases and analytes, crucial for industrial safety and environmental monitoring. Optical sensors are gaining significant traction, particularly in specialized applications like healthcare diagnostics and food quality analysis, due to their non-contact measurement capabilities and resistance to electromagnetic interference. Recent advancements include the development of miniaturized and highly integrated sensor arrays, enabling multiplexed detection of multiple chemicals simultaneously. Performance metrics such as sensitivity (detection limits in parts per billion or trillion), selectivity (ability to detect a specific chemical without interference from others), response time, and sensor lifespan are continuously being improved. For instance, new optical sensors are demonstrating unprecedented accuracy in detecting trace amounts of critical airborne pollutants, while novel electrochemical sensors are designed for extended operational life in harsh industrial environments. The integration of these sensors into IoT platforms for remote monitoring and data analysis further enhances their utility and market appeal.

Key Drivers, Barriers & Challenges in Chemical Sensor Market

Key Drivers:

The chemical sensor market is primarily propelled by stringent global regulations mandating environmental protection and workplace safety, leading to increased demand for gas sensors and environmental monitoring sensors. Technological advancements, particularly in nanomaterials and miniaturization, are enabling the development of more sensitive, selective, and cost-effective sensors. The growing adoption of IoT and AI is fostering the development of smart sensors with advanced analytics capabilities. Expanding applications in healthcare for diagnostics and in homeland security for threat detection also act as significant growth accelerators.

- Regulatory Push: Environmental protection agencies and occupational safety administrations worldwide enforce stricter limits on emissions and exposure to hazardous substances.

- Technological Innovation: Miniaturization, increased sensitivity, enhanced selectivity, and development of novel sensing materials.

- Industry 4.0 Integration: The rise of the Industrial Internet of Things (IIoT) demands real-time data from sensors for process optimization and predictive maintenance.

- Emerging Applications: Growth in personalized medicine, point-of-care diagnostics, and advanced security systems.

Barriers & Challenges:

Despite strong growth drivers, the market faces several hurdles. The high cost of research and development for cutting-edge sensor technologies can be a barrier to entry for smaller players. The need for extensive validation and certification for critical applications, especially in healthcare and defense, prolongs product development cycles. Supply chain disruptions for specialized raw materials and components can impact production timelines and costs. Intense competition from established and emerging players also puts pressure on pricing and profit margins. Furthermore, the development of sensors capable of reliable performance in extreme or complex environmental conditions (e.g., high temperatures, corrosive atmospheres) remains a persistent challenge.

- High R&D Costs: Developing advanced sensor technologies requires significant investment.

- Stringent Validation & Certification: Meeting regulatory requirements for critical applications is time-consuming and expensive.

- Supply Chain Volatility: Dependence on specialized raw materials and components can lead to disruptions.

- Competitive Pressures: Price sensitivity and the need for continuous innovation to maintain market share.

- Operational Limitations: Developing sensors for extreme environments is technically challenging.

Emerging Opportunities in Chemical Sensor Market

Emerging opportunities in the chemical sensor market are abundant, driven by the increasing demand for real-time monitoring in novel applications and the continuous advancement of sensor technologies. The healthcare sector presents a significant untapped market with the potential for widespread adoption of biosensors for early disease detection, personalized medicine, and remote patient monitoring, representing a market segment with projected growth exceeding 7% CAGR. The growing focus on sustainability and renewable energy is creating demand for sensors in battery management systems (e.g., for Lithium-Ion Batteries), fuel cell monitoring, and smart grid applications. Furthermore, the development of low-cost, disposable sensors for the Internet of Things (IoT) ecosystem, enabling widespread environmental and industrial monitoring, offers substantial growth potential. The expansion of smart agriculture with sensors for soil health, crop disease detection, and pest management also represents a promising frontier.

Growth Accelerators in the Chemical Sensor Market Industry

Several key catalysts are accelerating the growth of the chemical sensor market. Technological breakthroughs in materials science, such as the development of graphene and other 2D materials, are enabling the creation of highly sensitive and durable sensors. Strategic partnerships between sensor manufacturers and technology integrators, particularly in the IoT and AI space, are facilitating the deployment of advanced sensing solutions across various industries. Market expansion strategies, including focusing on emerging economies with growing industrial bases and increasing environmental awareness, are opening up new revenue streams. The continuous demand for enhanced safety and security measures, particularly in critical infrastructure and public spaces, further fuels the market's expansion. The growing demand for compact, portable, and wireless sensors for on-site analysis and remote monitoring is also a significant growth driver.

Key Players Shaping the Chemical Sensor Market Market

- Honeywell International Inc.

- ABB Ltd

- Smiths Detection Inc.

- Denso Corporation

- Delphi Automotive PLC

- Alpha MOS

- MSA Safety Incorporated

- Halma plc

- Siemens AG

- General Electric Co

- Yokogawa Electric Corporation

- Pepperl+Fuchs Group

- AirTest Technologies Inc

Notable Milestones in Chemical Sensor Market Sector

- August 2022: Smiths Detection Inc., along with Block MEMS, LLC, was selected by the Defense Threat Reduction Agency (DTRA) and the Joint Program Executive Office for Chemical, Biological, Radiological, and Nuclear Defense to develop a proximate chemical agent detector (PCAD). This development is crucial for non-contact detection of solid and liquid threats, enhancing defense and homeland security capabilities.

- January 2021: Honeywell introduced an Optical Caliper Measurement Sensor designed to optimize Lithium Ion Battery (LIB) production. This sensor provides accurate thickness measurement of electrode material, a critical factor for optimal battery performance and safety, highlighting advancements in industrial application sensors.

In-Depth Chemical Sensor Market Market Outlook

The Chemical Sensor Market is set for sustained expansion, driven by a potent combination of technological innovation and an ever-growing demand for precise chemical detection across critical sectors. Future growth is largely underpinned by the increasing integration of smart sensors within the broader IoT ecosystem, enabling advanced data analytics and predictive capabilities. The healthcare sector is a prime example, with the burgeoning demand for biosensors and point-of-care diagnostic tools poised to significantly contribute to market value. Strategic partnerships and collaborations between sensor developers and end-users will continue to be instrumental in tailoring solutions to specific industry needs. Emerging markets, coupled with a global emphasis on environmental sustainability and industrial safety, represent substantial opportunities for market penetration and revenue growth, projecting a dynamic and promising future for the chemical sensor industry.

Chemical Sensor Market Segmentation

-

1. Product Type

- 1.1. Electrochemical

- 1.2. Optical

- 1.3. Pellister/Catalytic Bead

- 1.4. Other Types

-

2. End-user Application

- 2.1. Industrial

- 2.2. Healthcare

- 2.3. Environmental Monitoring

- 2.4. Defense

- 2.5. Oil and Gas Industry

- 2.6. Homeland Security

Chemical Sensor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Chemical Sensor Market Regional Market Share

Geographic Coverage of Chemical Sensor Market

Chemical Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Adoption from Automotive and Healthcare Sector

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. Medical Industry to Hold the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Electrochemical

- 5.1.2. Optical

- 5.1.3. Pellister/Catalytic Bead

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Industrial

- 5.2.2. Healthcare

- 5.2.3. Environmental Monitoring

- 5.2.4. Defense

- 5.2.5. Oil and Gas Industry

- 5.2.6. Homeland Security

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Electrochemical

- 6.1.2. Optical

- 6.1.3. Pellister/Catalytic Bead

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. Industrial

- 6.2.2. Healthcare

- 6.2.3. Environmental Monitoring

- 6.2.4. Defense

- 6.2.5. Oil and Gas Industry

- 6.2.6. Homeland Security

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Electrochemical

- 7.1.2. Optical

- 7.1.3. Pellister/Catalytic Bead

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. Industrial

- 7.2.2. Healthcare

- 7.2.3. Environmental Monitoring

- 7.2.4. Defense

- 7.2.5. Oil and Gas Industry

- 7.2.6. Homeland Security

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Electrochemical

- 8.1.2. Optical

- 8.1.3. Pellister/Catalytic Bead

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. Industrial

- 8.2.2. Healthcare

- 8.2.3. Environmental Monitoring

- 8.2.4. Defense

- 8.2.5. Oil and Gas Industry

- 8.2.6. Homeland Security

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Electrochemical

- 9.1.2. Optical

- 9.1.3. Pellister/Catalytic Bead

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. Industrial

- 9.2.2. Healthcare

- 9.2.3. Environmental Monitoring

- 9.2.4. Defense

- 9.2.5. Oil and Gas Industry

- 9.2.6. Homeland Security

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Electrochemical

- 10.1.2. Optical

- 10.1.3. Pellister/Catalytic Bead

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Application

- 10.2.1. Industrial

- 10.2.2. Healthcare

- 10.2.3. Environmental Monitoring

- 10.2.4. Defense

- 10.2.5. Oil and Gas Industry

- 10.2.6. Homeland Security

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smiths Detection Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Denso Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Delphi Automotive PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alpha MOS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MSA Safety Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halma plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yokogawa Electric Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pepperl+Fuchs Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AirTest Technologies Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Chemical Sensor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 5: North America Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 6: North America Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 11: Europe Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 12: Europe Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 17: Asia Pacific Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 18: Asia Pacific Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Latin America Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Latin America Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 23: Latin America Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 24: Latin America Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 29: Middle East and Africa Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 30: Middle East and Africa Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 3: Global Chemical Sensor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 6: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 9: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 12: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 15: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 18: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chemical Sensor Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the Chemical Sensor Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Smiths Detection Inc, Denso Corporation*List Not Exhaustive, Delphi Automotive PLC, Alpha MOS, MSA Safety Incorporated, Halma plc, Siemens AG, General Electric Co, Yokogawa Electric Corporation, Pepperl+Fuchs Group, AirTest Technologies Inc.

3. What are the main segments of the Chemical Sensor Market?

The market segments include Product Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Adoption from Automotive and Healthcare Sector.

6. What are the notable trends driving market growth?

Medical Industry to Hold the Major Share.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

August 2022: Smiths Detection Inc., a global leader in threat detection and security technology, along with Block MEMS, LLC (Block), has been selected by the Defense Threat Reduction Agency (DTRA) and the Joint Program Executive Office for Chemical, Biological, Radiological, and Nuclear Defense to develop a proximate chemical agent detector (PCAD) capable of non-contact detection of solid and liquid threats. PCAD will provide a stand-off (non-contact) chemical agent detector that will be able to identify and classify solid and liquid hazards on various surfaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chemical Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chemical Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chemical Sensor Market?

To stay informed about further developments, trends, and reports in the Chemical Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence