Key Insights

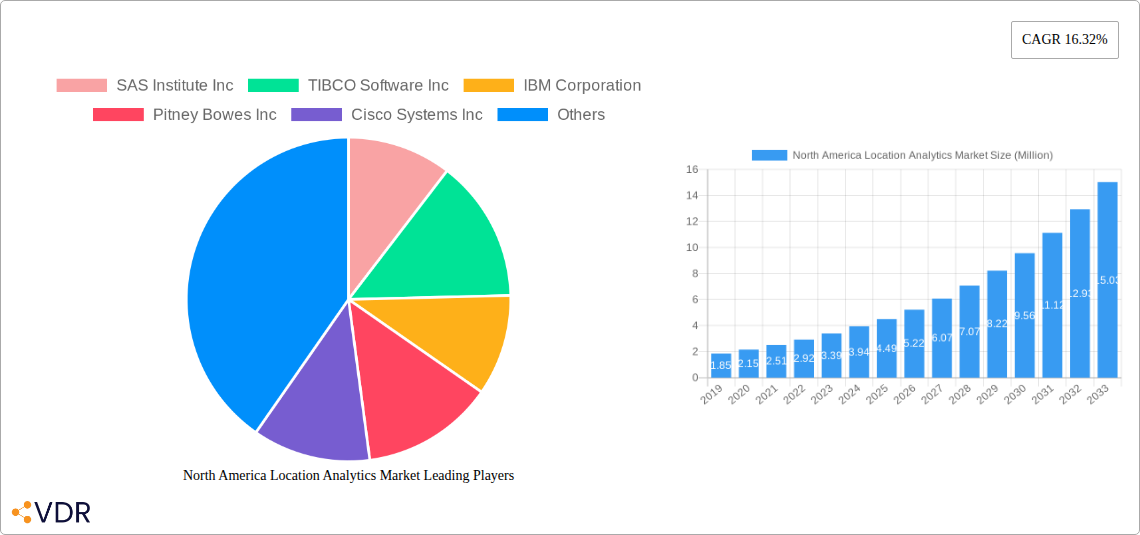

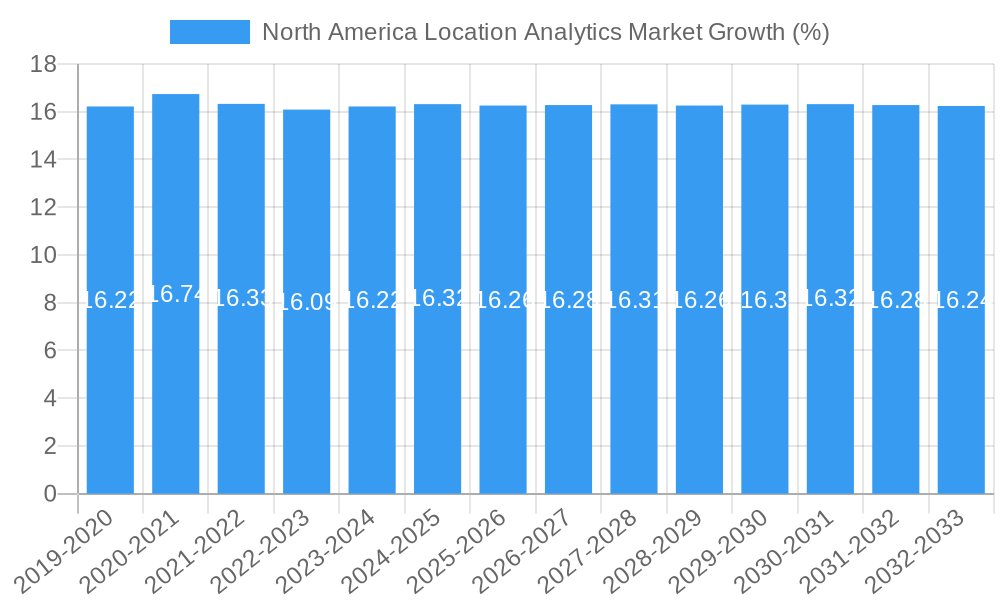

The North American Location Analytics Market is poised for substantial expansion, currently valued at approximately $4.49 million. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 16.32%, indicating a dynamic and rapidly evolving landscape. The surge in demand is primarily propelled by the increasing adoption of location intelligence across diverse industries, including retail, banking, and manufacturing, for applications ranging from sophisticated risk management and supply chain optimization to enhanced sales and marketing strategies. The proliferation of smart devices and the advent of IoT technologies are further fueling this growth, enabling more granular data collection and sophisticated analytical capabilities. Furthermore, the shift towards cloud-based deployment models is democratizing access to advanced location analytics solutions, making them more scalable and cost-effective for businesses of all sizes. The ongoing digital transformation initiatives across North American economies are creating an imperative for organizations to leverage location data for competitive advantage and operational efficiency.

The market's trajectory is further shaped by key trends such as the growing integration of AI and machine learning with location analytics to derive deeper insights and predictive capabilities. Businesses are increasingly utilizing these advanced tools for real-time decision-making, personalized customer experiences, and proactive facility management. While the market experiences strong tailwinds, certain restraints, such as data privacy concerns and the need for skilled personnel to interpret and act upon complex geospatial data, warrant attention. However, proactive measures in data anonymization and the development of user-friendly analytics platforms are mitigating these challenges. The market segmentation reveals a balanced demand for both indoor and outdoor location analytics, with on-premise and cloud deployments catering to varied organizational needs. The broad spectrum of end-user verticals, from energy and power to healthcare and government, underscores the pervasive and transformative impact of location analytics across the North American economic spectrum.

North America Location Analytics Market: Comprehensive Report Overview (2019–2033)

This in-depth report provides a definitive analysis of the North America Location Analytics Market, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025–2033, this study offers unparalleled insights into market dynamics, growth trends, dominant segments, product innovations, key players, and emerging opportunities. Leveraging a robust methodology, this report delivers actionable intelligence for stakeholders navigating this rapidly evolving landscape. The market is segmented by Location (Indoor, Outdoor), Deployment Model (On-premise, Cloud), End-User Vertical (Retail, Banking, Manufacturing, Healthcare, Government, Energy and Power, Other End-User Applications), and Application (Risk Management, Supply Chain Optimization, Sales and Marketing Optimization, Facility Management, Remote Monitoring, Emergency Response Management, Customer Experience Management, Others). All monetary values are presented in Million USD.

North America Location Analytics Market Market Dynamics & Structure

The North America Location Analytics Market is characterized by dynamic forces shaping its structure and growth. Market concentration is moderate, with a few dominant players alongside a growing number of niche providers. Technological innovation is the primary driver, fueled by advancements in IoT, AI, machine learning, and 5G technology, enabling more sophisticated data processing and real-time analytics. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR-like initiatives in Canada and evolving state-level regulations in the US), are increasingly influencing market practices, demanding robust compliance measures. Competitive product substitutes, such as basic GPS tracking or standalone GIS software, are gradually being integrated into comprehensive location analytics solutions, highlighting a trend towards convergence. End-user demographics are shifting towards digitally adept organizations across all verticals seeking to leverage location data for strategic decision-making. Mergers and acquisition (M&A) trends are active, with larger technology firms acquiring specialized location analytics companies to enhance their service offerings and expand market reach.

- Key Market Dynamics:

- Technological Advancements: Proliferation of IoT devices, enhanced sensor accuracy, and improved AI/ML algorithms for predictive analytics.

- Data Privacy Regulations: Growing emphasis on data anonymization, consent management, and secure data handling.

- Demand for Real-time Insights: Businesses across sectors require immediate data to inform operational decisions.

- Integration of Geospatial Data: Increasing reliance on integrating diverse data sources with spatial context for comprehensive analysis.

North America Location Analytics Market Growth Trends & Insights

The North America Location Analytics Market is poised for substantial expansion, driven by escalating demand for data-driven decision-making across diverse industries. The market size is projected to grow significantly, propelled by increasing adoption rates of location-aware technologies and analytical tools. This surge in adoption is directly linked to the recognition of location data's intrinsic value in optimizing operations, enhancing customer experiences, and mitigating risks. Technological disruptions, including the widespread rollout of 5G networks and the proliferation of edge computing, are creating new avenues for real-time, hyper-local data collection and analysis. These advancements are enabling more sophisticated applications, from precision logistics to hyper-personalized marketing campaigns. Consumer behavior shifts are also playing a crucial role, with individuals increasingly expecting location-aware services and personalized interactions, compelling businesses to invest in location analytics to meet these expectations. The market's growth trajectory will be further influenced by the increasing need for predictive maintenance, smart city initiatives, and the optimization of complex supply chains. The compound annual growth rate (CAGR) is anticipated to be robust, reflecting the transformative impact of location analytics on business strategies and operational efficiencies. Market penetration will deepen as organizations across all sizes and sectors recognize the competitive advantage offered by leveraging spatial intelligence. The evolving landscape of data analytics, coupled with a growing comfort level with cloud-based solutions, is democratizing access to powerful location analytics capabilities, further accelerating market growth.

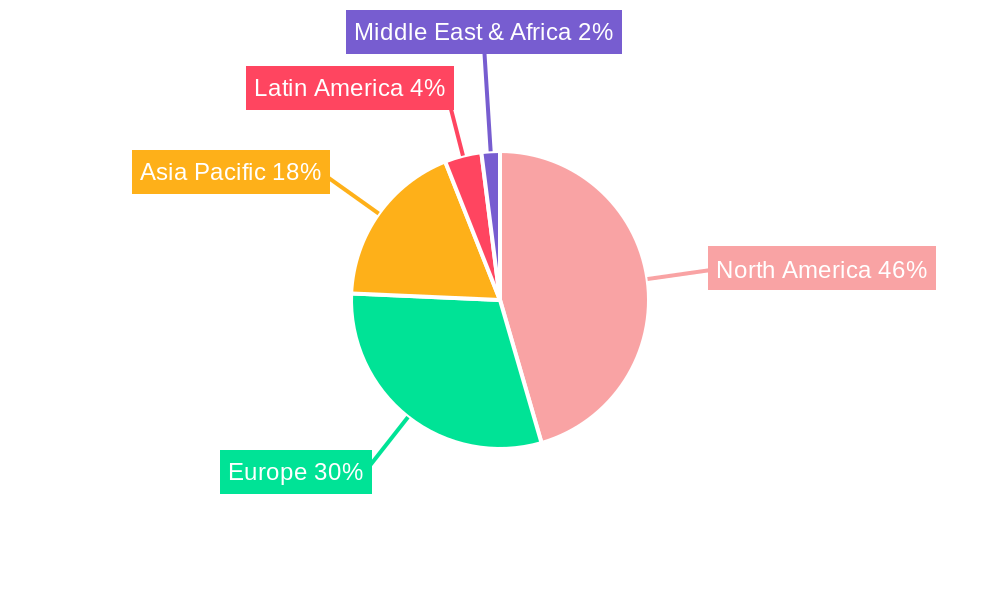

Dominant Regions, Countries, or Segments in North America Location Analytics Market

Within the North America Location Analytics Market, the United States emerges as the dominant country, driven by its advanced technological infrastructure, significant R&D investments, and a mature business ecosystem that readily adopts innovative solutions. This dominance is further amplified by a vast consumer base and a diverse industrial landscape. The Cloud deployment model is the leading segment, owing to its scalability, cost-effectiveness, and ease of implementation, particularly attractive for small and medium-sized enterprises. The Retail and Banking sectors are pivotal end-user verticals, leveraging location analytics for customer footfall analysis, store performance optimization, fraud detection, and personalized marketing. The Supply Chain Optimization application is also a significant growth engine, enabling real-time tracking, route planning, and inventory management, crucial for the vast geographical expanse of North America.

- Dominant Country: United States

- Key Drivers: Strong economic growth, high adoption of advanced technologies, presence of major tech companies, robust venture capital funding for startups.

- Market Share: Holds the largest share due to its sheer market size and early adoption of location intelligence.

- Dominant Deployment Model: Cloud

- Key Drivers: Cost-efficiency, scalability, accessibility, reduced IT overhead, faster deployment cycles.

- Growth Potential: Continues to expand as more organizations migrate from on-premise solutions.

- Dominant End-User Verticals: Retail, Banking

- Key Drivers: Need for customer insights, competitive pressures, personalization strategies, operational efficiency improvements.

- Market Penetration: High as location data is integral to customer engagement and risk management in these sectors.

- Dominant Application: Supply Chain Optimization

- Key Drivers: E-commerce growth, globalized supply chains, demand for real-time visibility, cost reduction imperatives.

- Impact: Essential for managing logistics, improving delivery times, and ensuring resilience in supply networks.

North America Location Analytics Market Product Landscape

The product landscape of the North America Location Analytics Market is characterized by a wave of innovative solutions designed to extract actionable insights from spatial data. Leading companies are introducing advanced platforms that integrate real-time data streams from various sources, including GPS, Wi-Fi, beacons, and IoT sensors. These products offer sophisticated visualization tools, predictive analytics capabilities, and AI-powered algorithms to identify patterns, forecast trends, and optimize operations. Key advancements include enhanced geofencing capabilities for hyper-local targeting, real-time asset tracking with high precision, and predictive modeling for demand forecasting and risk assessment. Performance metrics are continually improving, with faster data processing speeds, greater accuracy in location determination, and more intuitive user interfaces becoming standard. Unique selling propositions often revolve around the ability to seamlessly integrate with existing enterprise systems, provide industry-specific solutions, and ensure robust data security and privacy compliance.

Key Drivers, Barriers & Challenges in North America Location Analytics Market

Key Drivers: The North America Location Analytics Market is propelled by several powerful drivers. The exponential growth of the Internet of Things (IoT) ecosystem, generating massive amounts of location-specific data, is a primary catalyst. Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are enabling deeper analysis and more accurate predictions from this data. Furthermore, the increasing demand for operational efficiency and enhanced customer experiences across industries like retail, logistics, and healthcare is creating a strong pull for location analytics solutions. Government initiatives promoting smart cities and infrastructure development also contribute significantly to market growth.

Barriers & Challenges: Despite its promising outlook, the market faces several barriers and challenges. Data privacy concerns and evolving regulatory landscapes pose significant hurdles, requiring vendors to invest heavily in compliance and security measures. The high cost of initial implementation and the need for specialized expertise can be prohibitive for some small and medium-sized businesses. Data integration complexities, stemming from disparate data sources and legacy systems, often complicate the deployment of comprehensive location analytics solutions. Finally, a shortage of skilled professionals in data science and geospatial analysis can limit the widespread adoption and effective utilization of these technologies.

Emerging Opportunities in North America Location Analytics Market

Emerging opportunities in the North America Location Analytics Market lie in the burgeoning demand for hyper-personalized customer experiences, driven by insights into consumer behavior at a granular spatial level. The expansion of the smart cities initiative presents significant potential for applications in urban planning, traffic management, and public safety. Furthermore, the increasing adoption of autonomous vehicles and drone technology will necessitate advanced real-time location analytics for navigation, monitoring, and operational control. The healthcare sector is also a growing area of opportunity, with location analytics enabling better patient tracking, resource allocation, and public health surveillance. Untapped markets within specific sub-sectors of the energy and power industry, focusing on asset management and predictive maintenance in remote locations, also present promising avenues for growth.

Growth Accelerators in the North America Location Analytics Market Industry

Several catalysts are accelerating the long-term growth of the North America Location Analytics Market. Technological breakthroughs in real-time data processing, including edge computing and advanced AI algorithms, are enhancing the speed and accuracy of location-based insights. Strategic partnerships between location analytics providers, cloud service providers, and enterprise software companies are expanding market reach and integration capabilities. The growing awareness among businesses regarding the competitive advantage derived from spatial intelligence is driving market expansion strategies, with companies investing more heavily in location analytics capabilities. The continuous development of user-friendly platforms and the increasing availability of pre-built analytical models are also democratizing access and fostering wider adoption.

Key Players Shaping the North America Location Analytics Market Market

SAS Institute Inc TIBCO Software Inc IBM Corporation Pitney Bowes Inc Cisco Systems Inc Esri Inc Ericsson Inc Aruba Networks (HPE development LP) SAP SE HERE Global BV

Notable Milestones in North America Location Analytics Market Sector

- May 2023: SAP SE and Google Cloud are expanding their partnership to include a comprehensive open data offering aimed at simplifying the data landscape and unleashing the power of corporate data; it enables customers to create an end-to-end cloud that brings data from all over the enterprise ecosystem using SAP. Datashpere solution collaboration with Google’s data cloud so that businesses can view their entire data estate in real-time.

- February 2023: Esri has announced the Release of a New App to View and Analyze Global Land-Cover Easily Changes. The app is set up on the basis of a unique, online version of its global earth cover map using ESA's Sentinel2 satellite imagery. The app is easy to access and leverages the same geographic information system (GIS) technology behind the land-cover map.

In-Depth North America Location Analytics Market Market Outlook

The outlook for the North America Location Analytics Market remains exceptionally strong, driven by a confluence of technological advancements, evolving business needs, and shifting consumer expectations. Growth accelerators such as enhanced AI/ML capabilities and the widespread adoption of IoT devices will continue to fuel innovation and expand the application of location intelligence across virtually every industry. Strategic partnerships and the development of integrated solutions will further solidify the market's trajectory, making sophisticated location analytics more accessible and impactful. The increasing focus on data-driven decision-making and the pursuit of hyper-personalization will ensure sustained demand for these solutions, positioning the North America Location Analytics Market for significant and continuous growth throughout the forecast period and beyond.

North America Location Analytics Market Segmentation

-

1. Location

- 1.1. Indoor

- 1.2. Outdoor

-

2. Deployment Model

- 2.1. On-premise

- 2.2. Cloud

-

3. End-User Vertical

- 3.1. Retail

- 3.2. Banking

- 3.3. Manufacturing

- 3.4. Healthcare

- 3.5. Government

- 3.6. Energy and Power

- 3.7. Other End-User Applications

-

4. Application

- 4.1. Risk Management

- 4.2. Supply Chain Optimization

- 4.3. Sales and Marketing Optimization

- 4.4. Facility Management

- 4.5. Remote Monitoring

- 4.6. Emergency Response Management

- 4.7. Customer Experience Management

- 4.8. Others

North America Location Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Location Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for geo-based marketing; Increasing use of location analytics market in the retail sector; Increasing Usage of Internet of Things

- 3.3. Market Restrains

- 3.3.1 Lack of Robustness that Enterprises Desire for Their Data Centers

- 3.3.2 Including IT Management Features

- 3.3.3 Such as Availability and Security

- 3.4. Market Trends

- 3.4.1. Retail Sector to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Location Analytics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Retail

- 5.3.2. Banking

- 5.3.3. Manufacturing

- 5.3.4. Healthcare

- 5.3.5. Government

- 5.3.6. Energy and Power

- 5.3.7. Other End-User Applications

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Risk Management

- 5.4.2. Supply Chain Optimization

- 5.4.3. Sales and Marketing Optimization

- 5.4.4. Facility Management

- 5.4.5. Remote Monitoring

- 5.4.6. Emergency Response Management

- 5.4.7. Customer Experience Management

- 5.4.8. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. United States North America Location Analytics Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Location Analytics Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Location Analytics Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Location Analytics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 SAS Institute Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TIBCO Software Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pitney Bowes Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cisco Systems Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Esri Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ericsson Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Aruba Networks (HPE development LP)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SAP SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 HERE Global BV

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 SAS Institute Inc

List of Figures

- Figure 1: North America Location Analytics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Location Analytics Market Share (%) by Company 2024

List of Tables

- Table 1: North America Location Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Location Analytics Market Revenue Million Forecast, by Location 2019 & 2032

- Table 3: North America Location Analytics Market Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 4: North America Location Analytics Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 5: North America Location Analytics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Location Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Location Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Location Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Location Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Location Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Location Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Location Analytics Market Revenue Million Forecast, by Location 2019 & 2032

- Table 13: North America Location Analytics Market Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 14: North America Location Analytics Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 15: North America Location Analytics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: North America Location Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States North America Location Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Location Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Location Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Location Analytics Market?

The projected CAGR is approximately 16.32%.

2. Which companies are prominent players in the North America Location Analytics Market?

Key companies in the market include SAS Institute Inc, TIBCO Software Inc, IBM Corporation, Pitney Bowes Inc, Cisco Systems Inc, Esri Inc, Ericsson Inc , Aruba Networks (HPE development LP), SAP SE, HERE Global BV.

3. What are the main segments of the North America Location Analytics Market?

The market segments include Location, Deployment Model, End-User Vertical, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for geo-based marketing; Increasing use of location analytics market in the retail sector; Increasing Usage of Internet of Things.

6. What are the notable trends driving market growth?

Retail Sector to Witness the Growth.

7. Are there any restraints impacting market growth?

Lack of Robustness that Enterprises Desire for Their Data Centers. Including IT Management Features. Such as Availability and Security.

8. Can you provide examples of recent developments in the market?

May 2023: SAP SE and Google Cloud are expanding their partnership to include a comprehensive open data offering aimed at simplifying the data landscape and unleashing the power of corporate data; it enables customers to create an end-to-end cloud that brings data from all over the enterprise ecosystem using SAP. Datashpere solution collaboration with Google’s data cloud so that businesses can view their entire data estate in real-time

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Location Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Location Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Location Analytics Market?

To stay informed about further developments, trends, and reports in the North America Location Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence