Key Insights

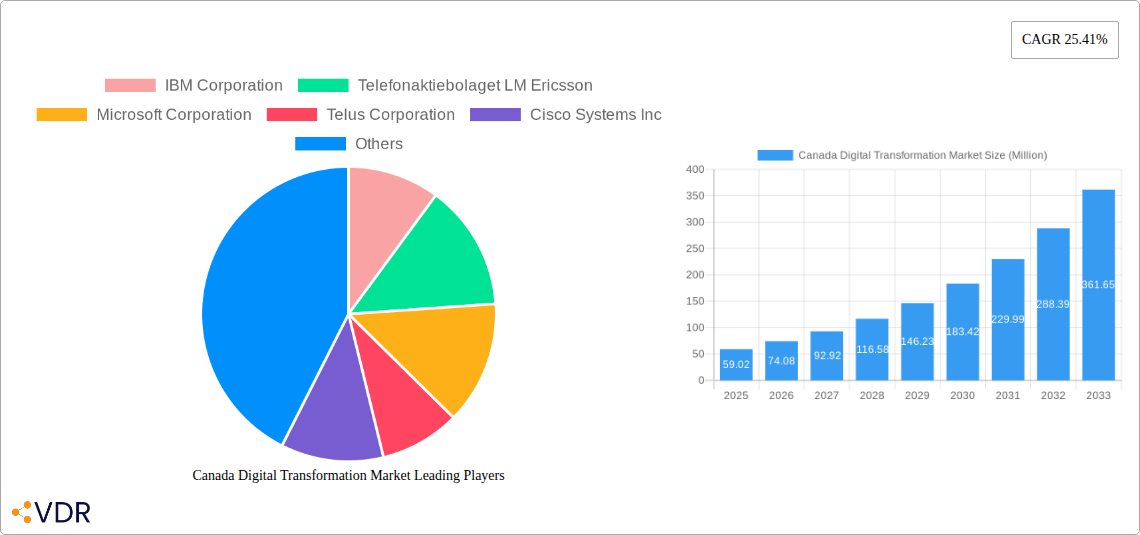

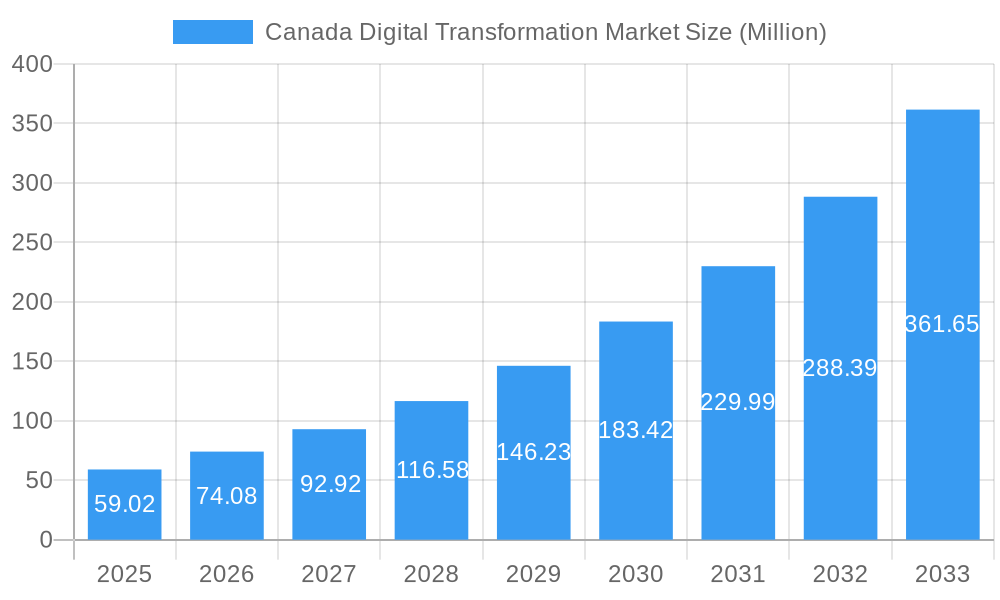

The Canadian digital transformation market is poised for explosive growth, projected to reach an estimated \$59.02 million in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 25.41% expected to persist through 2033. This robust expansion is fueled by a confluence of compelling drivers, primarily the accelerating adoption of advanced technologies across all end-user industries. Key among these are the pervasive integration of Extended Reality (XR), the Internet of Things (IoT) for enhanced data collection and operational efficiency, and the increasing deployment of Industrial Robotics to automate complex manufacturing processes. Furthermore, the strategic implementation of Blockchain technology for secure and transparent transactions, the rise of Additive Manufacturing/3D Printing for rapid prototyping and custom production, and the critical need for advanced Cybersecurity solutions to protect sensitive data are all significant contributors to this upward trajectory. Cloud and Edge Computing infrastructure underpins these advancements, enabling seamless data processing and accessibility. The market is further diversified by the growing importance of niche solutions like digital twins, mobility, and enhanced connectivity, all contributing to a dynamic and evolving digital landscape.

Canada Digital Transformation Market Market Size (In Million)

The Canadian market's digital transformation journey is being shaped by significant trends, including a strong emphasis on leveraging AI and Machine Learning for data-driven decision-making and predictive analytics within sectors like Manufacturing, Oil, Gas, and Utilities, and Healthcare. The Retail & E-commerce sector is rapidly adopting digital solutions for personalized customer experiences and streamlined supply chains, while Transportation and Logistics are benefiting from IoT and AI for optimized route planning and fleet management. The BFSI sector is actively engaged in digital modernization to enhance customer service and security, and Telecom & IT providers are at the forefront of enabling this transformation through robust infrastructure. Government and Public Sector entities are also increasingly investing in digital initiatives to improve service delivery and operational efficiency. While opportunities abound, potential restraints such as the high initial investment cost for certain advanced technologies and the ongoing need for skilled talent to manage and implement these complex solutions could present challenges. However, the overwhelming commitment to innovation and the clear benefits of digital adoption are expected to propel the market forward, making Canada a significant player in the global digital transformation arena.

Canada Digital Transformation Market Company Market Share

Canada Digital Transformation Market: Accelerating Innovation and Economic Growth (2019–2033)

This comprehensive report offers an in-depth analysis of the Canada Digital Transformation Market, providing critical insights into its current state and future trajectory from 2019 to 2033. With the base year and estimated year set as 2025, and a detailed forecast period of 2025–2033, this report is indispensable for businesses, investors, and policymakers seeking to capitalize on the rapid evolution of digital technologies across Canada. The historical period of 2019–2024 provides a foundational understanding of past trends. This report delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, emerging opportunities, and the pivotal role of key players in shaping Canada's digital future. Valued in Millions for all quantitative data.

Canada Digital Transformation Market Market Dynamics & Structure

The Canada Digital Transformation Market is characterized by a dynamic interplay of market concentration, rapid technological innovation, and evolving regulatory landscapes. While major technology titans like Microsoft Corporation, Google LLC (Alphabet Inc ), and IBM Corporation hold significant sway, a vibrant ecosystem of specialized firms such as Next Big Technology (NBT) and Magneto IT Solution fosters healthy competition and drives innovation across niche segments. The increasing adoption of advanced technologies like IoT, Cybersecurity, and Cloud Edge Computing is a primary driver, supported by government initiatives aimed at fostering a digitally advanced economy. Cisco Systems Inc and Telus Corporation are at the forefront of bolstering network infrastructure, a crucial enabler for widespread digital adoption. Competitive product substitutes are emerging rapidly, particularly in areas like Extended Reality (XR) and Blockchain, pushing incumbents to continuously innovate. End-user demographics are shifting towards digitally savvy consumers and businesses demanding seamless, data-driven experiences. Merger and acquisition (M&A) trends are on the rise as larger players seek to integrate specialized capabilities and expand their market reach, further consolidating the market in key areas. Barriers to innovation include the need for significant upfront investment in new technologies and the challenge of upskilling the workforce to meet the demands of the digital economy.

- Market Concentration: Dominated by a few large technology providers, with growing influence from specialized solution providers.

- Technological Innovation Drivers: Driven by advancements in AI, IoT, cloud computing, and data analytics.

- Regulatory Frameworks: Evolving government policies are supportive of digital adoption and data privacy.

- Competitive Product Substitutes: Rapid emergence of innovative solutions across various digital transformation segments.

- End-User Demographics: Increasing demand for personalized, efficient, and digitally integrated services.

- M&A Trends: Active M&A landscape indicating strategic consolidation and capability acquisition.

- Innovation Barriers: High capital expenditure for new technologies and the need for digital skills development.

Canada Digital Transformation Market Growth Trends & Insights

The Canada Digital Transformation Market is experiencing robust growth, fueled by a multifaceted surge in the adoption of digital technologies across all sectors. Market size evolution is characterized by a consistent upward trajectory, with projections indicating a substantial expansion over the forecast period. The CAGR for the Canada Digital Transformation Market is estimated at XX% for the period 2025–2033. This growth is underpinned by increasing market penetration of solutions related to Cloud Edge Computing and Cybersecurity, as businesses recognize their critical importance in securing operations and enabling scalability. Technological disruptions, particularly in the realm of Artificial Intelligence (AI) and Machine Learning (ML), are profoundly reshaping industries, driving demand for sophisticated analytical tools and automated processes. Consumer behavior shifts are equally influential, with an escalating preference for online channels, personalized digital experiences, and on-demand services, compelling businesses to accelerate their digital initiatives. The pervasive adoption of the IoT is creating new avenues for data collection and operational efficiency, further stimulating market expansion. The integration of Blockchain technology is also gaining traction, promising enhanced security and transparency in transactions. The market’s expansion is also evident in the growing investment in digital infrastructure and the development of new digital products and services. The increasing interconnectedness of businesses and consumers alike necessitates a continuous evolution of digital strategies, thereby creating a self-reinforcing cycle of growth within the market. The adoption of Extended Reality (XR), though nascent in some sectors, holds significant promise for transforming customer engagement and employee training. This dynamic environment, driven by both technological advancements and evolving user expectations, positions the Canadian digital transformation landscape for sustained and significant growth.

Dominant Regions, Countries, or Segments in Canada Digital Transformation Market

The Telecom and IT sector stands out as a dominant end-user industry driving the Canada Digital Transformation Market. This dominance is a direct consequence of the sector's intrinsic reliance on advanced digital infrastructure, constant innovation in service delivery, and the imperative to provide seamless connectivity to an increasingly digitalized populace. Within this sector, Cloud Edge Computing and Cybersecurity solutions are witnessing unprecedented demand as telecommunication companies and IT service providers strive to enhance network resilience, manage vast amounts of data closer to the source, and protect critical digital assets from escalating cyber threats. The market share within this segment is considerable, estimated at XX% of the total Canada Digital Transformation Market.

Key Drivers in the Telecom and IT Sector:

- Infrastructure Modernization: Continuous investment in 5G networks, fiber optics, and cloud-native architectures.

- Data Explosion: The exponential growth of data generated by connected devices and digital services necessitates robust data management and processing capabilities.

- Cybersecurity Imperatives: The escalating sophistication of cyberattacks mandates advanced security solutions to protect sensitive data and critical infrastructure.

- Digital Service Innovation: The need to offer innovative digital services, from streaming to IoT solutions, to a competitive market.

- Government Support: Policies promoting digital infrastructure development and innovation within the tech sector.

The Analytics (Key Grow) segment within the broader Type classification is also a significant growth engine, closely tied to the needs of the dominant Telecom and IT sector. The ability to extract actionable insights from vast datasets is paramount for optimizing network performance, understanding customer behavior, and developing new revenue streams. This involves advanced Use Case Analysis to identify and implement effective digital strategies. The market share for Analytics is estimated at XX% for the forecast period.

Dominance Factors:

- High Adoption Rates: Telecom and IT are early adopters of transformative digital technologies.

- Interdependence: The growth of other sectors is heavily reliant on the robust digital infrastructure provided by Telecom and IT.

- Investment Capacity: These sectors possess the financial capacity for significant investment in digital transformation initiatives.

- Talent Pool: Concentration of skilled IT professionals in major urban centers facilitates digital transformation projects.

Regions like Ontario and British Columbia are leading the charge in digital transformation adoption, driven by their strong presence of technology companies, financial services, and a skilled workforce. These regions benefit from robust economic policies supporting innovation and digital infrastructure development, further solidifying their position as hubs for digital transformation in Canada. The synergy between government initiatives, private sector investment, and a conducive business environment propels these regions and the Telecom and IT sector to the forefront of Canada's digital revolution.

Canada Digital Transformation Market Product Landscape

The Canada Digital Transformation Market product landscape is characterized by a proliferation of innovative solutions designed to address the evolving needs of businesses and consumers. From advanced Cybersecurity platforms offering multi-layered threat protection to sophisticated IoT solutions enabling real-time data collection and automation, the market is brimming with cutting-edge offerings. Cloud Edge Computing solutions are gaining prominence, providing businesses with enhanced agility and reduced latency for data processing. Furthermore, the integration of Blockchain technology is fostering trust and transparency in transactions, while Extended Reality (XR) applications are beginning to revolutionize areas like remote collaboration and virtual training. The performance metrics of these products are consistently improving, with a focus on scalability, efficiency, and enhanced user experience. Unique selling propositions often revolve around the seamless integration of multiple digital technologies, the ability to derive actionable insights from data, and robust security features. Technological advancements are driven by continuous research and development in areas such as AI-powered analytics, hyper-automation, and decentralized ledger technologies.

Key Drivers, Barriers & Challenges in Canada Digital Transformation Market

Key Drivers:

The Canada Digital Transformation Market is propelled by several key drivers, including the relentless pursuit of operational efficiency and enhanced customer experiences. Government initiatives promoting digital adoption, such as grants and tax incentives, play a crucial role. The escalating demand for data-driven decision-making fuels the adoption of advanced analytics and AI solutions. Furthermore, the increasing prevalence of remote work and digital-first consumer behaviors necessitates robust digital infrastructure and cloud-based services. Technological advancements in areas like IoT, 5G, and cybersecurity are creating new possibilities for innovation.

Barriers & Challenges:

Despite the strong growth momentum, the market faces significant barriers and challenges. The substantial upfront investment required for implementing new digital technologies can be a deterrent for small and medium-sized enterprises (SMEs). A persistent shortage of skilled digital talent, particularly in specialized fields like AI and cybersecurity, poses a critical bottleneck. Regulatory hurdles related to data privacy and security, while essential, can also slow down implementation timelines. Furthermore, the complexity of integrating legacy systems with new digital solutions presents a significant technical challenge, impacting operational continuity and increasing implementation costs. Competitive pressures are intense, requiring continuous innovation and adaptation.

Emerging Opportunities in Canada Digital Transformation Market

Emerging opportunities in the Canada Digital Transformation Market are abundant, particularly in the realm of sustainable digital solutions and the expansion of the digital economy into previously underserved sectors. The growing focus on Environmental, Social, and Governance (ESG) principles is creating demand for digital technologies that enhance energy efficiency and reduce carbon footprints. Furthermore, the increasing maturity of Additive Manufacturing/3D Printing presents opportunities for localized production and supply chain resilience. The "Internet of Everything" (IoE) paradigm, encompassing smart cities and connected homes, offers vast potential for IoT and Cloud Edge Computing applications. The application of Blockchain in supply chain management and digital identity verification is another promising avenue. The rise of the "gig economy" and the demand for flexible work arrangements also create opportunities for digital platforms and collaboration tools.

Growth Accelerators in the Canada Digital Transformation Market Industry

Several catalysts are accelerating growth within the Canada Digital Transformation Market. Significant advancements in Artificial Intelligence (AI) and Machine Learning (ML) are enabling more sophisticated automation and predictive analytics, driving adoption across various industries. Strategic partnerships between technology providers, cloud service providers, and end-user industries are fostering collaborative innovation and enabling the development of tailored digital solutions. Government investment in digital infrastructure, including broadband expansion and cybersecurity initiatives, is creating a more fertile ground for digital transformation. The increasing focus on data analytics to derive business value is also a significant growth accelerator, pushing companies to invest in solutions that can process and interpret large volumes of data. Market expansion strategies, including the development of new digital services and the penetration into new market segments, are further fueling growth.

Key Players Shaping the Canada Digital Transformation Market Market

- IBM Corporation

- Telefonaktiebolaget LM Ericsson

- Microsoft Corporation

- Telus Corporation

- Cisco Systems Inc

- Cloudoft

- Next Big Technology (NBT)

- Accenture PLC

- Oracle Corporation

- Google LLC (Alphabet Inc )

- Magneto IT Solution

Notable Milestones in Canada Digital Transformation Market Sector

- July 2024: GetWireless announced an expansion of its operations into the Canadian market. The company is set to distribute its full range of IoT products and services to an extended network of resale partners and network operators in Canada.

- June 2024: Kyndryl, an IT infrastructure services provider, announced an extended partnership with the National Bank of Canada to accelerate its digital transformation and cloud migration. The partnership aims to streamline workloads and operations, reduce technical debt, and drive innovation across the organization.

In-Depth Canada Digital Transformation Market Market Outlook

The Canada Digital Transformation Market is poised for continued expansion, driven by a confluence of technological innovation and strategic investments. Growth accelerators such as the increasing adoption of AI, the expansion of IoT networks, and the robust demand for enhanced cybersecurity solutions will underpin future market performance. Strategic partnerships and collaborations will be instrumental in driving the development of integrated digital ecosystems, fostering innovation, and accelerating market penetration. Government support for digital initiatives and infrastructure development will continue to create a conducive environment for growth. The market's future potential lies in its ability to leverage digital technologies to address complex societal and economic challenges, from climate change mitigation to improving healthcare delivery. Strategic opportunities include the development of specialized digital solutions for niche industries and the exploitation of emerging technologies like quantum computing and advanced AI.

Canada Digital Transformation Market Segmentation

-

1. Type

-

1.1. Analytic

- 1.1.1. Current

- 1.1.2. Key Grow

- 1.1.3. Use Case Analysis

- 1.1.4. Market Outlook

- 1.2. Extended Reality (XR)

- 1.3. IoT

- 1.4. Industrial Robotics

- 1.5. Blockchain

- 1.6. Additive Manufacturing/3D Printing

- 1.7. Cybersecurity

- 1.8. Cloud Edge Computing

-

1.9. Others (digital twin, mobility and connectivity)

- 1.9.1. Market B

-

1.1. Analytic

-

2. End-user Industry

- 2.1. Manufacturing

- 2.2. Oil, Gas, and Utilities

- 2.3. Retail & e-commerce

- 2.4. Transportation and Logistics

- 2.5. Healthcare

- 2.6. BFSI

- 2.7. Telecom and IT

- 2.8. Government and Public Sector

- 2.9. Other En

Canada Digital Transformation Market Segmentation By Geography

- 1. Canada

Canada Digital Transformation Market Regional Market Share

Geographic Coverage of Canada Digital Transformation Market

Canada Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Adoption of Big Data Analytics and Other Technologies in the Country; The Rapid Proliferation of Mobile Devices and Apps

- 3.3. Market Restrains

- 3.3.1. Increase in the Adoption of Big Data Analytics and Other Technologies in the Country; The Rapid Proliferation of Mobile Devices and Apps

- 3.4. Market Trends

- 3.4.1. Cybersecurity is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Digital Transformation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytic

- 5.1.1.1. Current

- 5.1.1.2. Key Grow

- 5.1.1.3. Use Case Analysis

- 5.1.1.4. Market Outlook

- 5.1.2. Extended Reality (XR)

- 5.1.3. IoT

- 5.1.4. Industrial Robotics

- 5.1.5. Blockchain

- 5.1.6. Additive Manufacturing/3D Printing

- 5.1.7. Cybersecurity

- 5.1.8. Cloud Edge Computing

- 5.1.9. Others (digital twin, mobility and connectivity)

- 5.1.9.1. Market B

- 5.1.1. Analytic

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Manufacturing

- 5.2.2. Oil, Gas, and Utilities

- 5.2.3. Retail & e-commerce

- 5.2.4. Transportation and Logistics

- 5.2.5. Healthcare

- 5.2.6. BFSI

- 5.2.7. Telecom and IT

- 5.2.8. Government and Public Sector

- 5.2.9. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telefonaktiebolaget LM Ericsson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telus Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cloudoft

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Next Big Technology (NBT)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accenture PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Google LLC (Alphabet Inc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Magneto IT Solution

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Canada Digital Transformation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Digital Transformation Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Digital Transformation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Digital Transformation Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Canada Digital Transformation Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Canada Digital Transformation Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Canada Digital Transformation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Canada Digital Transformation Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Canada Digital Transformation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Canada Digital Transformation Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Canada Digital Transformation Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Canada Digital Transformation Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Canada Digital Transformation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Canada Digital Transformation Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Digital Transformation Market?

The projected CAGR is approximately 25.41%.

2. Which companies are prominent players in the Canada Digital Transformation Market?

Key companies in the market include IBM Corporation, Telefonaktiebolaget LM Ericsson, Microsoft Corporation, Telus Corporation, Cisco Systems Inc, Cloudoft, Next Big Technology (NBT), Accenture PLC, Oracle Corporation, Google LLC (Alphabet Inc ), Magneto IT Solution.

3. What are the main segments of the Canada Digital Transformation Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Adoption of Big Data Analytics and Other Technologies in the Country; The Rapid Proliferation of Mobile Devices and Apps.

6. What are the notable trends driving market growth?

Cybersecurity is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Increase in the Adoption of Big Data Analytics and Other Technologies in the Country; The Rapid Proliferation of Mobile Devices and Apps.

8. Can you provide examples of recent developments in the market?

July 2024: GetWireless announced an expansion of its operations into the Canadian market. The company is set to distribute its full range of IoT products and services to an extended network of resale partners and network operators in Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Canada Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence