Key Insights

The global Gas Sensor, Detector, and Analyzer market is poised for robust expansion, projected to reach a substantial USD 4.67 billion. This growth trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 5.60%, indicating a sustained and significant demand for these critical technologies. The market's dynamism is fueled by several key drivers. Increasing stringent environmental regulations worldwide are compelling industries to adopt advanced gas monitoring solutions to comply with emission standards and ensure workplace safety. The escalating need for enhanced safety protocols in hazardous environments, including oil and gas, mining, and chemical processing, further propels the demand for reliable gas detection systems. Furthermore, the growing adoption of smart technologies and the Internet of Things (IoT) is creating opportunities for connected gas sensors and analyzers, enabling real-time data collection and remote monitoring, thereby boosting operational efficiency and safety compliance.

Gas Sensor, Detector and Analyzer Market Market Size (In Million)

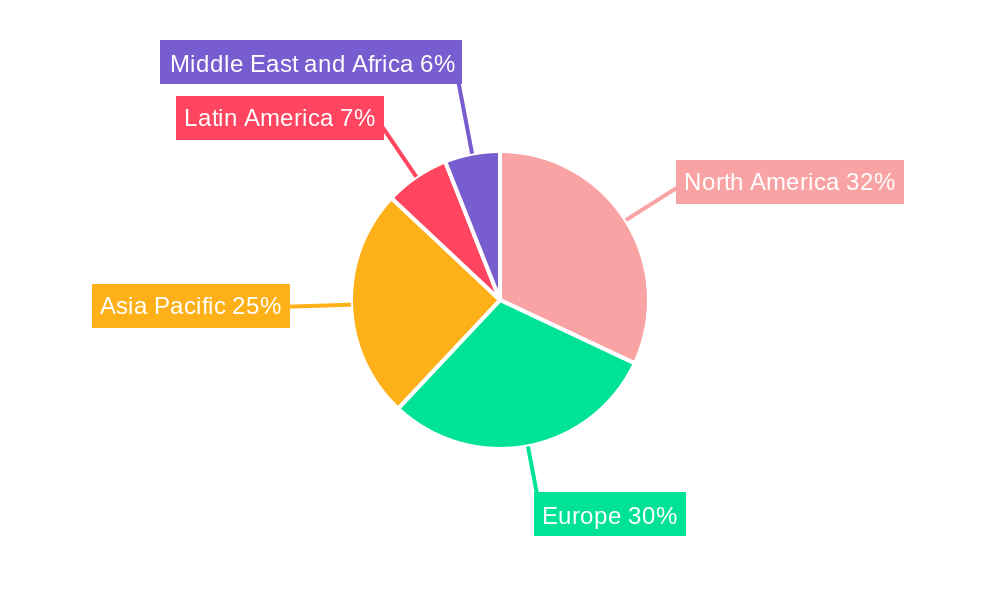

The market segmentation reveals distinct areas of focus and opportunity. Within the 'Type' segment, Sensors are expected to dominate due to their widespread application in various detection and analysis devices. Detectors and Analyzers, while perhaps smaller in individual market share, play crucial roles in providing comprehensive gas management solutions. The 'End-Use' segment highlights the industrial sector as a primary consumer, driven by the inherent risks and regulatory demands of manufacturing and processing. Environmental monitoring represents another significant area, reflecting a global commitment to air quality and pollution control. Safety applications, spanning personal safety devices for workers and emergency response systems, are also critical growth enablers. Research and Development activities are also contributing, fostering innovation in sensor technology and analytical capabilities. Geographically, North America and Europe are anticipated to lead the market, owing to their well-established industrial bases, strict regulatory frameworks, and early adoption of advanced technologies. The Asia Pacific region, however, is expected to witness the fastest growth, driven by rapid industrialization, increasing environmental concerns, and a burgeoning awareness of safety standards.

Gas Sensor, Detector and Analyzer Market Company Market Share

This in-depth report provides a detailed analysis of the global Gas Sensor, Detector, and Analyzer Market, offering critical insights into market dynamics, growth trends, regional dominance, product innovations, and future opportunities. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study is an essential resource for industry professionals seeking to understand and navigate this rapidly evolving sector.

The report meticulously examines the parent market for gas detection and analysis solutions, with a granular focus on its key child markets: Gas Sensors, Gas Detectors, and Gas Analyzers. We present all market values in Million Units for clarity and direct comparability.

Gas Sensor, Detector and Analyzer Market Market Dynamics & Structure

The Gas Sensor, Detector, and Analyzer Market is characterized by a moderate level of market concentration, with key players like Honeywell Analytics Inc., MSA Safety Incorporated, and Siemens AG holding significant shares. However, a growing number of innovative smaller companies are emerging, driving intense competition through rapid technological advancements. Technological innovation is primarily fueled by the increasing demand for miniaturization, enhanced sensitivity, improved accuracy, and the integration of IoT capabilities for remote monitoring and data analytics. Stringent regulatory frameworks, particularly concerning industrial safety, environmental protection, and public health, are a major driver, mandating the widespread adoption of gas detection and analysis equipment. Competitive product substitutes, though limited in highly specialized applications, exist in broader categories, necessitating continuous product development and cost-effectiveness. End-user demographics are shifting towards industries with higher safety and compliance requirements, such as oil & gas, chemical processing, and manufacturing, alongside a growing emphasis on environmental monitoring and research & development applications. Mergers and acquisitions (M&A) are a notable trend, as larger companies seek to expand their product portfolios, gain access to new technologies, and consolidate market presence. For instance, the acquisition of key sensor manufacturers by larger automation and safety solution providers is a recurring strategy. Innovation barriers include the high cost of research and development, the need for specialized expertise in sensor technology and materials science, and long product development cycles.

Gas Sensor, Detector and Analyzer Market Growth Trends & Insights

The global Gas Sensor, Detector, and Analyzer Market is poised for robust expansion, driven by escalating concerns for industrial safety, stringent environmental regulations, and advancements in smart monitoring technologies. The market size is projected to witness significant growth, evolving from xx Million Units in 2024 to an estimated xx Million Units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Adoption rates are accelerating across various end-use industries, with industrial applications currently dominating the market, followed by environmental monitoring and safety sectors. Technological disruptions, such as the development of highly sensitive and selective electrochemical, catalytic, and optical sensors, are revolutionizing performance and enabling new applications. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in analyzers is enhancing predictive maintenance capabilities and real-time data interpretation. Consumer behavior shifts are marked by an increasing demand for connected devices, user-friendly interfaces, and comprehensive data management solutions that offer greater situational awareness and proactive risk mitigation. The growing awareness of the health impacts of air pollution and the need for accurate emissions monitoring are also significant contributors to market penetration. Furthermore, the increasing adoption of portable and wearable gas detection devices for personal safety in hazardous environments is a key trend influencing market growth. The continuous innovation in sensor materials and fabrication techniques is leading to more cost-effective and durable solutions, further expanding the market's reach into previously untapped segments.

Dominant Regions, Countries, or Segments in Gas Sensor, Detector and Analyzer Market

North America currently stands as a dominant region in the Gas Sensor, Detector, and Analyzer Market, driven by its advanced industrial infrastructure, stringent safety regulations, and substantial investments in environmental monitoring. The United States, in particular, leads the market due to the presence of major players like Honeywell Analytics Inc. and MSA Safety Incorporated, and a robust oil & gas and chemical processing industry that mandates comprehensive gas detection solutions. Stringent environmental protection agencies like the EPA enforce strict emission standards, propelling the demand for advanced gas analyzers. Economic policies supporting industrial growth and technological innovation further bolster the market.

Within the Type segment, Gas Sensors are expected to exhibit the highest growth potential, owing to their fundamental role in various detection and analysis devices and the continuous innovation in miniaturization and sensitivity. However, Gas Detectors are currently the largest segment by market share due to their widespread deployment in industrial safety applications.

In terms of End-Use, the Industrial segment remains the largest and most significant driver of market growth. This is attributed to the inherent risks associated with chemical manufacturing, oil and gas exploration and production, mining, and power generation, all of which necessitate continuous monitoring of hazardous gases. The growing adoption of Industry 4.0 principles, emphasizing automation and enhanced safety protocols, further fuels demand.

Other regions like Europe, with its strong focus on environmental regulations and a mature industrial base, and Asia-Pacific, experiencing rapid industrialization and increasing investments in safety infrastructure, are also significant growth markets. Key drivers in these regions include government initiatives for pollution control, increasing awareness of workplace safety, and the expansion of manufacturing hubs.

Gas Sensor, Detector and Analyzer Market Product Landscape

The product landscape of the Gas Sensor, Detector, and Analyzer Market is characterized by a constant stream of innovations aimed at enhancing performance, reliability, and user experience. Key advancements include the development of miniaturized, low-power sensors for portable devices, such as photo-ionization detectors (PIDs) for volatile organic compounds (VOCs) and electrochemical sensors for toxic gases like carbon monoxide and hydrogen sulfide. Smart analyzers are increasingly incorporating advanced algorithms for data processing, predictive analytics, and remote diagnostics, exemplified by Servomex Group Ltd's recent photometric gas analysis solution designed for applications like ethylene production and carbon capture. Unique selling propositions often revolve around superior detection limits, faster response times, broader temperature and humidity tolerance, and seamless integration with existing safety and control systems. Technological advancements are also focused on extending sensor lifespan and reducing calibration requirements, thereby lowering the total cost of ownership for end-users.

Key Drivers, Barriers & Challenges in Gas Sensor, Detector and Analyzer Market

Key Drivers:

- Stringent Safety Regulations: Mandates for industrial safety and environmental emissions control are primary growth drivers.

- Technological Advancements: Miniaturization, increased sensitivity, IoT integration, and AI-powered analytics are creating new market opportunities.

- Growing Industrialization: Expansion of industries like oil & gas, chemicals, and manufacturing in developing economies.

- Environmental Awareness: Rising concerns about air quality and greenhouse gas emissions.

- Smart City Initiatives: Demand for environmental monitoring in urban areas.

Key Barriers & Challenges:

- High R&D Costs: Developing new sensor technologies and sophisticated analyzers requires significant investment.

- Calibration and Maintenance: Regular calibration and maintenance of devices can be costly and time-consuming for end-users.

- Sensor Drift and Fouling: Environmental factors and contaminants can affect sensor accuracy and lifespan.

- Market Fragmentation: A large number of small players can lead to intense price competition.

- Skilled Workforce Shortage: Lack of trained personnel for installation, operation, and maintenance of advanced systems.

Emerging Opportunities in Gas Sensor, Detector and Analyzer Market

Emerging opportunities in the Gas Sensor, Detector, and Analyzer Market lie in the expansion of smart city infrastructure, which requires pervasive environmental monitoring networks for air quality management. The burgeoning demand for healthcare and medical applications, such as continuous CO2 monitoring in critical care settings, presents a significant untapped market. Furthermore, the increasing adoption of renewable energy sources, like solar and wind farms, necessitates specialized gas detection for associated equipment and potential hydrogen leaks. The development of highly specific biosensors for detecting biological warfare agents or industrial contaminants is another promising area. The growing trend of remote and automated monitoring solutions, fueled by advancements in wireless communication and cloud computing, offers substantial growth potential for service-based business models.

Growth Accelerators in the Gas Sensor, Detector and Analyzer Market Industry

Long-term growth in the Gas Sensor, Detector, and Analyzer Market will be significantly accelerated by breakthroughs in novel sensing materials, such as graphene-based sensors and advanced nanomaterials, promising enhanced sensitivity and selectivity. Strategic partnerships between sensor manufacturers, IoT platform providers, and data analytics companies will foster the development of integrated, intelligent monitoring systems. Market expansion strategies will focus on penetrating emerging economies with tailored solutions addressing their specific industrial and environmental challenges. The increasing focus on predictive maintenance, driven by the insights gained from real-time gas monitoring data, will also act as a major growth accelerator, encouraging proactive safety measures and reducing operational downtime. The development of self-calibrating and low-maintenance sensor technologies will further drive adoption by reducing the operational burden on end-users.

Key Players Shaping the Gas Sensor, Detector and Analyzer Market Market

- NGK Spark Plugs USA Inc

- Draegerwerk AG & Co KGaA

- Testo SE & Co KGaA

- Afriso-Euro-Index GmbH

- Horiba Ltd

- Figaro Engineering Inc

- MSA Safety Incorporated

- Servomex Group Limited (Spectris PLC)

- Honeywell Analytics Inc

- Bacharach Inc

- Delphi Technologies (BorgWarner Inc)

- GfG Gas Detection UK Ltd

- Detector Electronics Corporation

- Alphasense Limited

- Siemens AG

- Trolex Ltd

- Senseir AB

- Eaton Corporation PLC

- SGX Sensortech Limited (Amphenol Limited)

- California Analytical Instruments

- MKS Instruments Inc

- RKI Instruments Inc

- Robert Bosch GmbH

- Control Instruments Corporation

- Crowncon Detection Instruments Limited

- Yokogawa Electric Corporation

- Thermofisher Scientific Inc

- General Electric Company

- Industrial Scientific Corporation

- Teledyne API

- Denso Corporation

- Membrapor AG

- Emerson Electric Company

Notable Milestones in Gas Sensor, Detector and Analyzer Market Sector

- September 2022: Industrial Scientific Corporation introduced a new Photo-Ionization Detector sensor for the Ventis Pro5 Multi-gas monitor, making it the most compact, versatile, and connected five-gas personal monitor that allows users to detect VOCs while improving situational awareness reliably.

- June 2022: Servomex Group Ltd unveiled a new analyzer to deliver the most advanced photometric gas analysis solution. Designed around an easier-to-use digital platform, the latest analyzer is a rugged and reliable product ready to handle a wide range of industrial applications, including ethylene production, carbon capture, ethylene dichloride production, and the direct reduction iron process.

In-Depth Gas Sensor, Detector and Analyzer Market Market Outlook

The future outlook for the Gas Sensor, Detector, and Analyzer Market is exceptionally promising, driven by an unabating demand for enhanced safety, environmental stewardship, and operational efficiency across industries. Growth accelerators such as the continuous miniaturization and increased intelligence of sensors, coupled with the proliferation of the Internet of Things (IoT) in industrial settings, will fuel the development of comprehensive, real-time monitoring solutions. Strategic alliances and acquisitions are anticipated to consolidate the market, fostering innovation and expanding geographical reach. Emerging applications in healthcare, smart cities, and renewable energy present significant untapped potential. The market will witness a paradigm shift towards predictive analytics and AI-driven insights, enabling proactive risk management and optimized resource allocation. Continuous investment in research and development, particularly in novel sensing materials and advanced data processing capabilities, will be crucial for maintaining a competitive edge and unlocking new avenues for growth.

Gas Sensor, Detector and Analyzer Market Segmentation

-

1. Type

- 1.1. Sensor

- 1.2. Detector

- 1.3. Analyzer

-

2. End-Use

- 2.1. Industrial

- 2.2. Environmental Monitoring

- 2.3. Safety

- 2.4. Research & Development

Gas Sensor, Detector and Analyzer Market Segmentation By Geography

-

1. North America

- 1.1. Europe

- 1.2. Asia Pacific

- 1.3. Latin America

- 1.4. Middle East and Africa

-

2. North America

- 2.1. Europe

- 2.2. Asia Pacific

- 2.3. Latin America

- 2.4. Middle East and Africa

-

3. North America

- 3.1. Europe

- 3.2. Asia Pacific

- 3.3. Latin America

- 3.4. Middle East and Africa

Gas Sensor, Detector and Analyzer Market Regional Market Share

Geographic Coverage of Gas Sensor, Detector and Analyzer Market

Gas Sensor, Detector and Analyzer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Safety Awareness Regarding Occupational Hazards; Proliferation of Handheld Devices

- 3.3. Market Restrains

- 3.3.1. High Costs and Lack of Product Differentiation

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sensor

- 5.1.2. Detector

- 5.1.3. Analyzer

- 5.2. Market Analysis, Insights and Forecast - by End-Use

- 5.2.1. Industrial

- 5.2.2. Environmental Monitoring

- 5.2.3. Safety

- 5.2.4. Research & Development

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. North America

- 5.3.3. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sensor

- 6.1.2. Detector

- 6.1.3. Analyzer

- 6.2. Market Analysis, Insights and Forecast - by End-Use

- 6.2.1. Industrial

- 6.2.2. Environmental Monitoring

- 6.2.3. Safety

- 6.2.4. Research & Development

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sensor

- 7.1.2. Detector

- 7.1.3. Analyzer

- 7.2. Market Analysis, Insights and Forecast - by End-Use

- 7.2.1. Industrial

- 7.2.2. Environmental Monitoring

- 7.2.3. Safety

- 7.2.4. Research & Development

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. North America Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sensor

- 8.1.2. Detector

- 8.1.3. Analyzer

- 8.2. Market Analysis, Insights and Forecast - by End-Use

- 8.2.1. Industrial

- 8.2.2. Environmental Monitoring

- 8.2.3. Safety

- 8.2.4. Research & Development

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 NGK Spark Plugs USA Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Draegerwerk AG & Co KGaA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Testo SE & Co KGaA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Afriso-Euro-Index GmbH

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Horiba Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Figaro Engineering Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 MSA Safety Incorporated

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Servomex Group Limited (Spectris PLC)

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Honeywell Analytics Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Bacharach Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Delphi Technologies (BorgWarner Inc )

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 GfG Gas Detection UK Ltd

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Detector Electronics Corporation

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Alphasense Limited

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 Siemens AG

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 Trolex Ltd

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 Senseir AB

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 Eaton Corporation PLC

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.19 SGX Sensortech Limited (Amphenol Limited)

- 9.2.19.1. Overview

- 9.2.19.2. Products

- 9.2.19.3. SWOT Analysis

- 9.2.19.4. Recent Developments

- 9.2.19.5. Financials (Based on Availability)

- 9.2.20 California Analytical Instruments

- 9.2.20.1. Overview

- 9.2.20.2. Products

- 9.2.20.3. SWOT Analysis

- 9.2.20.4. Recent Developments

- 9.2.20.5. Financials (Based on Availability)

- 9.2.21 MKS Instruments Inc

- 9.2.21.1. Overview

- 9.2.21.2. Products

- 9.2.21.3. SWOT Analysis

- 9.2.21.4. Recent Developments

- 9.2.21.5. Financials (Based on Availability)

- 9.2.22 RKI Instruments Inc

- 9.2.22.1. Overview

- 9.2.22.2. Products

- 9.2.22.3. SWOT Analysis

- 9.2.22.4. Recent Developments

- 9.2.22.5. Financials (Based on Availability)

- 9.2.23 Robert Bosch GmbH

- 9.2.23.1. Overview

- 9.2.23.2. Products

- 9.2.23.3. SWOT Analysis

- 9.2.23.4. Recent Developments

- 9.2.23.5. Financials (Based on Availability)

- 9.2.24 Control Instruments Corporation

- 9.2.24.1. Overview

- 9.2.24.2. Products

- 9.2.24.3. SWOT Analysis

- 9.2.24.4. Recent Developments

- 9.2.24.5. Financials (Based on Availability)

- 9.2.25 Crowncon Detection Instruments Limited

- 9.2.25.1. Overview

- 9.2.25.2. Products

- 9.2.25.3. SWOT Analysis

- 9.2.25.4. Recent Developments

- 9.2.25.5. Financials (Based on Availability)

- 9.2.26 Yokogawa Electric Corporation

- 9.2.26.1. Overview

- 9.2.26.2. Products

- 9.2.26.3. SWOT Analysis

- 9.2.26.4. Recent Developments

- 9.2.26.5. Financials (Based on Availability)

- 9.2.27 Thermofisher Scientific Inc

- 9.2.27.1. Overview

- 9.2.27.2. Products

- 9.2.27.3. SWOT Analysis

- 9.2.27.4. Recent Developments

- 9.2.27.5. Financials (Based on Availability)

- 9.2.28 General Electric Company

- 9.2.28.1. Overview

- 9.2.28.2. Products

- 9.2.28.3. SWOT Analysis

- 9.2.28.4. Recent Developments

- 9.2.28.5. Financials (Based on Availability)

- 9.2.29 Industrial Scientific Corporation

- 9.2.29.1. Overview

- 9.2.29.2. Products

- 9.2.29.3. SWOT Analysis

- 9.2.29.4. Recent Developments

- 9.2.29.5. Financials (Based on Availability)

- 9.2.30 Teledyne API

- 9.2.30.1. Overview

- 9.2.30.2. Products

- 9.2.30.3. SWOT Analysis

- 9.2.30.4. Recent Developments

- 9.2.30.5. Financials (Based on Availability)

- 9.2.31 Denso Corporation

- 9.2.31.1. Overview

- 9.2.31.2. Products

- 9.2.31.3. SWOT Analysis

- 9.2.31.4. Recent Developments

- 9.2.31.5. Financials (Based on Availability)

- 9.2.32 Membrapor AG

- 9.2.32.1. Overview

- 9.2.32.2. Products

- 9.2.32.3. SWOT Analysis

- 9.2.32.4. Recent Developments

- 9.2.32.5. Financials (Based on Availability)

- 9.2.33 Emerson Electric Company

- 9.2.33.1. Overview

- 9.2.33.2. Products

- 9.2.33.3. SWOT Analysis

- 9.2.33.4. Recent Developments

- 9.2.33.5. Financials (Based on Availability)

- 9.2.1 NGK Spark Plugs USA Inc

List of Figures

- Figure 1: Global Gas Sensor, Detector and Analyzer Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Gas Sensor, Detector and Analyzer Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by End-Use 2025 & 2033

- Figure 8: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by End-Use 2025 & 2033

- Figure 9: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 10: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by End-Use 2025 & 2033

- Figure 11: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Type 2025 & 2033

- Figure 17: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by End-Use 2025 & 2033

- Figure 20: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by End-Use 2025 & 2033

- Figure 21: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 22: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by End-Use 2025 & 2033

- Figure 23: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Country 2025 & 2033

- Figure 27: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Type 2025 & 2033

- Figure 28: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Type 2025 & 2033

- Figure 31: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by End-Use 2025 & 2033

- Figure 32: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by End-Use 2025 & 2033

- Figure 33: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 34: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by End-Use 2025 & 2033

- Figure 35: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Country 2025 & 2033

- Figure 36: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 4: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2020 & 2033

- Table 5: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 10: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2020 & 2033

- Table 11: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Europe Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Asia Pacific Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Asia Pacific Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Latin America Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Latin America Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Middle East and Africa Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Middle East and Africa Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 24: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2020 & 2033

- Table 25: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 27: Europe Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Europe Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Asia Pacific Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Asia Pacific Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Latin America Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Latin America Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Middle East and Africa Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Middle East and Africa Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 37: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 38: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2020 & 2033

- Table 39: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Europe Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Europe Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Asia Pacific Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Asia Pacific Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Latin America Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Latin America Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Middle East and Africa Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Middle East and Africa Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Sensor, Detector and Analyzer Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Gas Sensor, Detector and Analyzer Market?

Key companies in the market include NGK Spark Plugs USA Inc, Draegerwerk AG & Co KGaA, Testo SE & Co KGaA, Afriso-Euro-Index GmbH, Horiba Ltd, Figaro Engineering Inc, MSA Safety Incorporated, Servomex Group Limited (Spectris PLC), Honeywell Analytics Inc, Bacharach Inc, Delphi Technologies (BorgWarner Inc ), GfG Gas Detection UK Ltd, Detector Electronics Corporation, Alphasense Limited, Siemens AG, Trolex Ltd, Senseir AB, Eaton Corporation PLC, SGX Sensortech Limited (Amphenol Limited), California Analytical Instruments, MKS Instruments Inc, RKI Instruments Inc, Robert Bosch GmbH, Control Instruments Corporation, Crowncon Detection Instruments Limited, Yokogawa Electric Corporation, Thermofisher Scientific Inc, General Electric Company, Industrial Scientific Corporation, Teledyne API, Denso Corporation, Membrapor AG, Emerson Electric Company.

3. What are the main segments of the Gas Sensor, Detector and Analyzer Market?

The market segments include Type , End-Use .

4. Can you provide details about the market size?

The market size is estimated to be USD 4.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Safety Awareness Regarding Occupational Hazards; Proliferation of Handheld Devices.

6. What are the notable trends driving market growth?

Oil and Gas Industry Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Costs and Lack of Product Differentiation.

8. Can you provide examples of recent developments in the market?

September 2022 - Industrial Scientific Corporation introduced a new Photo-Ionization Detector sensor for the Ventis Pro5 Multi-gas monitor, making it the most compact, versatile, and connected five-gas personal monitor that allows users to detect VOCs while improving situational awareness reliably.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Sensor, Detector and Analyzer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Sensor, Detector and Analyzer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Sensor, Detector and Analyzer Market?

To stay informed about further developments, trends, and reports in the Gas Sensor, Detector and Analyzer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence