Key Insights

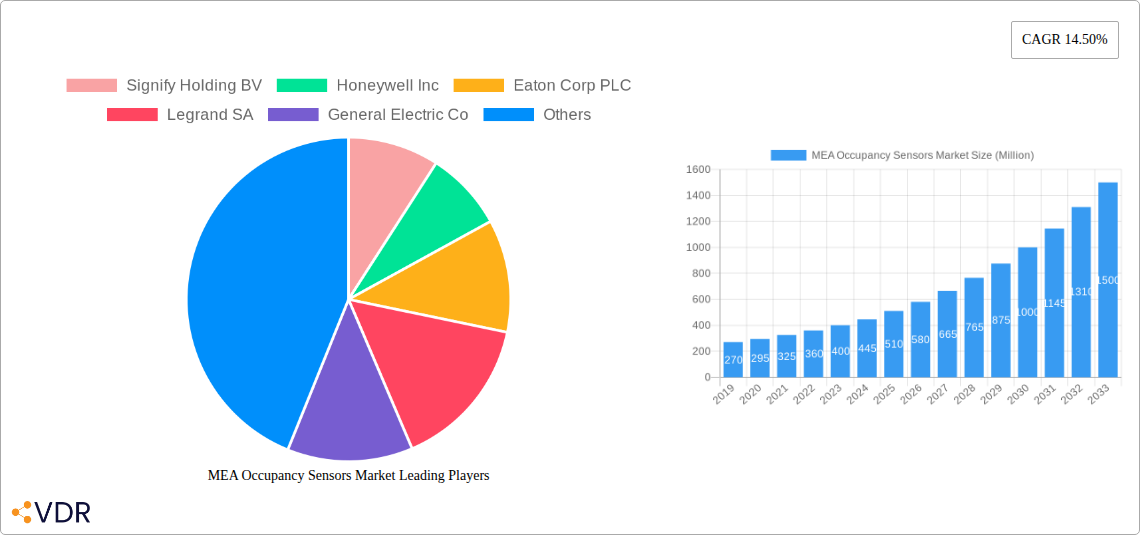

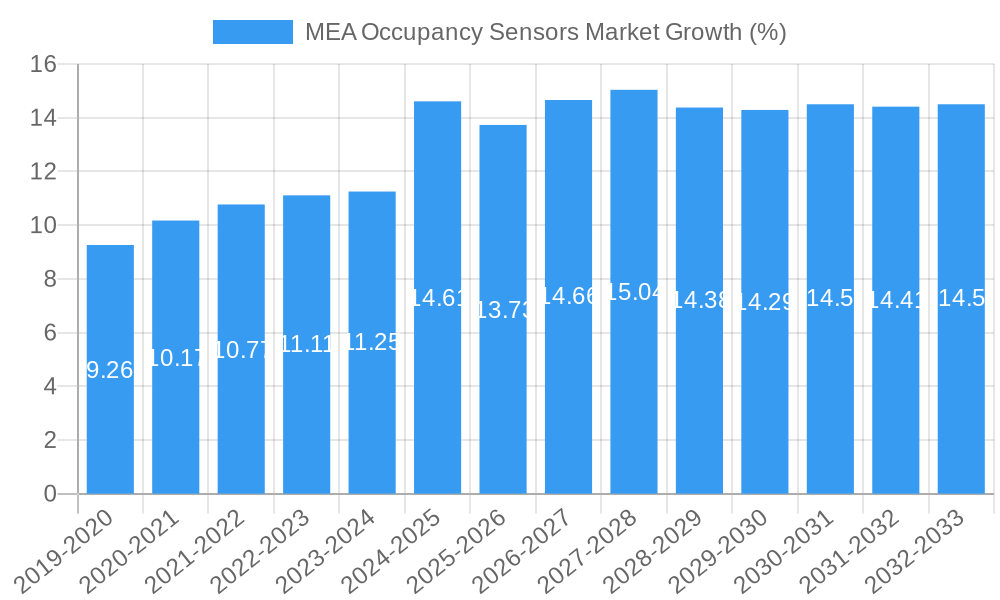

The MEA Occupancy Sensors Market is poised for substantial expansion, projected to reach approximately USD 550 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 14.50% through 2033. This growth is primarily fueled by an increasing emphasis on energy efficiency and sustainability across residential, commercial, and industrial sectors. Escalating energy costs, coupled with government mandates and initiatives promoting smart building technologies and reduced carbon footprints, are significant drivers. The widespread adoption of smart home systems and the increasing integration of IoT devices in buildings further bolster demand. Furthermore, the growing awareness of enhanced security and surveillance capabilities offered by advanced occupancy sensors, particularly in commercial spaces like offices and retail establishments, is contributing to market acceleration.

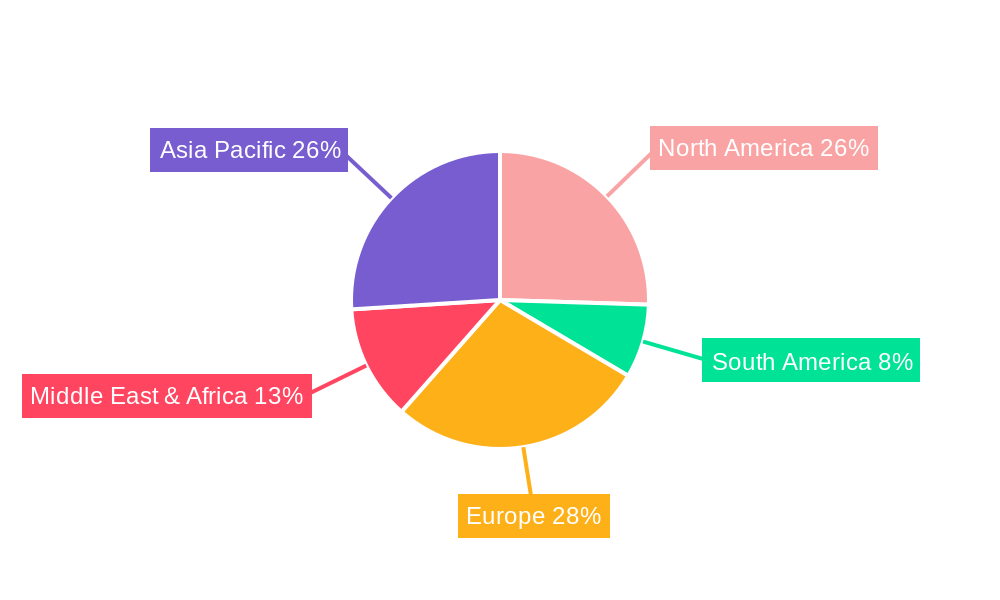

The market segmentation reveals strong potential across various network types and technologies. While wired solutions offer reliability, the increasing demand for flexibility and ease of installation favors wireless technologies. In terms of technology, Ultrasonic and Passive Infrared (PIR) sensors are expected to dominate due to their cost-effectiveness and proven performance, with Microwave technology gaining traction for more advanced applications requiring greater precision. Key applications such as lighting control and HVAC systems are witnessing significant adoption as building owners seek to optimize energy consumption and operational costs. Security and surveillance also represent a growing segment. Geographically, the Asia Pacific region, driven by rapid urbanization and significant investments in smart infrastructure, is expected to be a key growth engine, closely followed by North America and Europe, which already have established smart building ecosystems. The Middle East and Africa region, while starting from a smaller base, presents substantial untapped potential, driven by developing economies and increasing awareness of smart building benefits.

MEA Occupancy Sensors Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the Middle East & Africa (MEA) Occupancy Sensors Market, a critical component of smart building and energy efficiency initiatives. Covering the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this study offers granular insights into market dynamics, growth trends, and the competitive landscape. Discover the evolving demand for wireless occupancy sensors, the dominance of passive infrared technology, the increasing adoption in commercial buildings for lighting control, and the ripple effects of technological advancements. We explore the strategic positioning of key players and the burgeoning opportunities within this dynamic region. The report delves into parent and child market segments, offering a holistic view of market drivers and potential. All quantitative values are presented in Million units.

MEA Occupancy Sensors Market Market Dynamics & Structure

The MEA Occupancy Sensors Market is characterized by a moderate to high level of market concentration, with leading players like Honeywell Inc, Schneider Electric SE, and Johnson Controls Inc. holding significant market shares. The primary driver of technological innovation is the escalating demand for energy efficiency, smart building solutions, and enhanced security. Regulatory frameworks, particularly those promoting green building standards and energy conservation, are increasingly influencing market adoption. Competitive product substitutes, such as manual switches and timers, are gradually being phased out in favor of intelligent occupancy sensing solutions. End-user demographics are shifting towards a greater emphasis on sustainability and operational cost reduction, particularly within the commercial and industrial sectors. Mergers and acquisitions (M&A) activity, while present, is cautiously driven by companies seeking to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by a few key global players, with increasing participation from regional innovators.

- Technological Innovation Drivers: Energy efficiency mandates, smart city initiatives, demand for IoT integration, and advancements in sensor technology.

- Regulatory Frameworks: Government incentives for energy-efficient buildings, building codes promoting occupancy sensing, and sustainability targets.

- Competitive Product Substitutes: Manual controls, timers, and basic motion detectors.

- End-User Demographics: Growing awareness among building owners and facility managers regarding operational cost savings and environmental impact.

- M&A Trends: Strategic acquisitions to gain access to new technologies or expand market presence, with an estimated xx deal volumes observed in the historical period.

MEA Occupancy Sensors Market Growth Trends & Insights

The MEA Occupancy Sensors Market is poised for robust growth, driven by a confluence of factors including rapid urbanization, increasing construction of smart buildings, and a growing imperative for energy conservation across the region. The market size is projected to witness a significant expansion from its historical figures, fueled by the widespread adoption of wireless occupancy sensors, which offer greater flexibility and easier installation compared to their wired counterparts. Technological disruptions, such as the integration of AI and machine learning for more sophisticated occupancy detection and behavioral analysis, are further enhancing the value proposition of these devices. Consumer behavior is shifting towards a greater preference for automated environments that optimize comfort and reduce operational expenditures. The market penetration of occupancy sensors is expected to surge as awareness of their benefits permeates across residential, commercial, and industrial sectors.

The CAGR for the MEA Occupancy Sensors Market is estimated to be xx% during the forecast period, indicative of a dynamic growth trajectory. This growth is underpinned by the increasing demand for intelligent lighting control systems in commercial spaces, where energy savings can be substantial. The integration of occupancy sensors with HVAC systems is also a significant trend, enabling further energy optimization by adjusting temperature and ventilation based on actual occupancy. Security and surveillance applications are also benefiting from advancements in occupancy sensing technology, allowing for more precise monitoring and alert systems. The ongoing development of smart cities and the proliferation of the Internet of Things (IoT) are creating fertile ground for the widespread deployment of occupancy sensors.

Dominant Regions, Countries, or Segments in MEA Occupancy Sensors Market

Within the MEA Occupancy Sensors Market, the Commercial building type segment is emerging as the dominant force, driven by a strong impetus for energy efficiency and operational cost reduction in office buildings, retail spaces, and hospitality venues. Saudi Arabia, the United Arab Emirates (UAE), and South Africa are leading the charge in terms of adoption and market growth. The wireless network type segment is experiencing accelerated growth, outperforming wired solutions due to its ease of installation, scalability, and adaptability in existing infrastructure.

Dominant Building Type: Commercial, with substantial contributions from Residential and growing interest in Industrial applications.

- Key Drivers: High energy consumption in commercial spaces, government mandates for green buildings, and the need for enhanced facility management.

- Market Share: Estimated to hold xx% of the total market in the base year.

- Growth Potential: Significant untapped potential in retrofitting older commercial buildings.

Dominant Network Type: Wireless, rapidly gaining traction over Wired.

- Key Drivers: Flexibility, ease of integration, reduced installation costs, and compatibility with IoT platforms.

- Market Share: Expected to capture over xx% of the market by the forecast period end.

Dominant Technology: Passive Infrared (PIR) sensors continue to lead due to their cost-effectiveness and reliability, though Microwave and Ultrasonic technologies are gaining traction for specific applications.

- Key Drivers: Balance of performance and cost, widespread availability, and proven track record.

Dominant Application: Lighting Control is the primary application, followed closely by HVAC optimization.

- Key Drivers: Direct impact on energy savings and occupant comfort, integration with smart building management systems.

MEA Occupancy Sensors Market Product Landscape

The MEA Occupancy Sensors Market is witnessing continuous product innovation focused on enhanced accuracy, wider detection ranges, and seamless integration capabilities. Manufacturers are developing multi-technology sensors that combine PIR, ultrasonic, and microwave detection to minimize false triggers and maximize performance in diverse environments. The integration of IoT connectivity, enabling remote monitoring, control, and data analytics, is a key differentiator. Products are also evolving to cater to specific applications, such as advanced driver and occupant monitoring systems, exemplified by the Eyeris Technologies, Inc. and Texas Instruments (TI) collaboration.

Key Drivers, Barriers & Challenges in MEA Occupancy Sensors Market

Key Drivers:

- Energy Efficiency Mandates: Growing government focus on reducing energy consumption.

- Smart Building Initiatives: Increasing adoption of IoT and building automation systems.

- Cost Savings: Desire to reduce operational expenditures on lighting and HVAC.

- Technological Advancements: Development of more accurate and integrated sensor solutions.

- Sustainability Awareness: Rising environmental consciousness among businesses and consumers.

Barriers & Challenges:

- Initial Cost: Higher upfront investment compared to traditional systems.

- Lack of Awareness: Limited understanding of the benefits in certain market segments.

- Technical Expertise: Need for skilled personnel for installation and maintenance.

- Interoperability Issues: Challenges in integrating different vendor systems.

- Supply Chain Disruptions: Potential for delays and cost fluctuations in component sourcing.

Emerging Opportunities in MEA Occupancy Sensors Market

Emerging opportunities in the MEA Occupancy Sensors Market lie in the residential sector, particularly in the development of smart homes that prioritize energy efficiency and convenience. The industrial sector presents a significant untapped market, with applications in optimizing energy usage in warehouses, manufacturing facilities, and remote infrastructure. The increasing demand for advanced occupant monitoring systems in automotive and public transportation, as highlighted by the Eyeris and TI partnership, represents a groundbreaking avenue for growth. Furthermore, the development of AI-powered occupancy sensing for predictive maintenance and space utilization analysis offers substantial future potential.

Growth Accelerators in the MEA Occupancy Sensors Market Industry

Growth in the MEA Occupancy Sensors Market is being significantly accelerated by the smart city development agendas across the region, which inherently promote the integration of intelligent technologies. Strategic partnerships between sensor manufacturers and building management system (BMS) providers are fostering greater interoperability and wider system adoption. Government incentives and tax rebates for adopting energy-efficient solutions act as powerful catalysts. The continuous miniaturization and cost reduction of wireless sensor technology are making these solutions more accessible to a broader range of customers.

Key Players Shaping the MEA Occupancy Sensors Market Market

- Signify Holding BV

- Honeywell Inc

- Eaton Corp PLC

- Legrand SA

- General Electric Co

- Dwyer Instruments Inc

- Schneider Electric SE

- Johnson Controls Inc

- Analog Devices Inc

- Texas Instruments Inc

Notable Milestones in MEA Occupancy Sensors Market Sector

- January 2021: Eyeris Technologies, Inc. announced a collaboration with Texas Instruments (TI) on an industry-first in-cabin sensing AI solution at the Consumer Electronics Show (CES) 2021, utilizing TI's JacintoTM TDA4 processors and 2D RGB-IR image sensors. Eyeris DNNs are designed to meet functional safety standards, allow for flexible camera placement, and perform efficiently on low-power edge processors. Eyeris' AI algorithm portfolio for in-cabin sensing includes driver monitoring system (DMS) and occupant monitoring system (OMS) features that meet global NCAP standards.

In-Depth MEA Occupancy Sensors Market Market Outlook

The MEA Occupancy Sensors Market Outlook is highly optimistic, driven by sustained demand for energy efficiency and the proliferation of smart building technologies. Growth accelerators, including government initiatives promoting sustainable infrastructure and the continuous innovation in sensor technology, are creating a robust market environment. Strategic partnerships and the increasing affordability of wireless solutions will further fuel market penetration. The untapped potential in the residential and industrial sectors, coupled with emerging applications in advanced occupant monitoring, positions the MEA Occupancy Sensors Market for significant long-term growth and technological evolution.

MEA Occupancy Sensors Market Segmentation

-

1. Network Type

- 1.1. Wired

- 1.2. Wireless

-

2. Technology

- 2.1. Ultrasonic

- 2.2. Passive Infrared

- 2.3. Microwave

-

3. Application

- 3.1. Lighting Control

- 3.2. HVAC

- 3.3. Security and Surveillance

-

4. Building Type

- 4.1. Residential

- 4.2. Commercial

MEA Occupancy Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Occupancy Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for energy-efficient devices; Demand for Passive Infrared Due to Low Cost and High Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Cryptojacking Threats

- 3.4. Market Trends

- 3.4.1. Residential is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Network Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Ultrasonic

- 5.2.2. Passive Infrared

- 5.2.3. Microwave

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Lighting Control

- 5.3.2. HVAC

- 5.3.3. Security and Surveillance

- 5.4. Market Analysis, Insights and Forecast - by Building Type

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Network Type

- 6. North America MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Network Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Ultrasonic

- 6.2.2. Passive Infrared

- 6.2.3. Microwave

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Lighting Control

- 6.3.2. HVAC

- 6.3.3. Security and Surveillance

- 6.4. Market Analysis, Insights and Forecast - by Building Type

- 6.4.1. Residential

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Network Type

- 7. South America MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Network Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Ultrasonic

- 7.2.2. Passive Infrared

- 7.2.3. Microwave

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Lighting Control

- 7.3.2. HVAC

- 7.3.3. Security and Surveillance

- 7.4. Market Analysis, Insights and Forecast - by Building Type

- 7.4.1. Residential

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Network Type

- 8. Europe MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Network Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Ultrasonic

- 8.2.2. Passive Infrared

- 8.2.3. Microwave

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Lighting Control

- 8.3.2. HVAC

- 8.3.3. Security and Surveillance

- 8.4. Market Analysis, Insights and Forecast - by Building Type

- 8.4.1. Residential

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Network Type

- 9. Middle East & Africa MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Network Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Ultrasonic

- 9.2.2. Passive Infrared

- 9.2.3. Microwave

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Lighting Control

- 9.3.2. HVAC

- 9.3.3. Security and Surveillance

- 9.4. Market Analysis, Insights and Forecast - by Building Type

- 9.4.1. Residential

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Network Type

- 10. Asia Pacific MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Network Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Ultrasonic

- 10.2.2. Passive Infrared

- 10.2.3. Microwave

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Lighting Control

- 10.3.2. HVAC

- 10.3.3. Security and Surveillance

- 10.4. Market Analysis, Insights and Forecast - by Building Type

- 10.4.1. Residential

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Network Type

- 11. North America MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa MEA Occupancy Sensors Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Signify Holding BV

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Honeywell Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Eaton Corp PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Legrand SA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 General Electric Co

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dwyer Instruments Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Schneider Electric SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Johnson Controls Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Analog Devices Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Texas Instruments Inc*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Signify Holding BV

List of Figures

- Figure 1: Global MEA Occupancy Sensors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America MEA Occupancy Sensors Market Revenue (Million), by Network Type 2024 & 2032

- Figure 13: North America MEA Occupancy Sensors Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 14: North America MEA Occupancy Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 15: North America MEA Occupancy Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 16: North America MEA Occupancy Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America MEA Occupancy Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America MEA Occupancy Sensors Market Revenue (Million), by Building Type 2024 & 2032

- Figure 19: North America MEA Occupancy Sensors Market Revenue Share (%), by Building Type 2024 & 2032

- Figure 20: North America MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America MEA Occupancy Sensors Market Revenue (Million), by Network Type 2024 & 2032

- Figure 23: South America MEA Occupancy Sensors Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 24: South America MEA Occupancy Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 25: South America MEA Occupancy Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 26: South America MEA Occupancy Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 27: South America MEA Occupancy Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: South America MEA Occupancy Sensors Market Revenue (Million), by Building Type 2024 & 2032

- Figure 29: South America MEA Occupancy Sensors Market Revenue Share (%), by Building Type 2024 & 2032

- Figure 30: South America MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 31: South America MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Europe MEA Occupancy Sensors Market Revenue (Million), by Network Type 2024 & 2032

- Figure 33: Europe MEA Occupancy Sensors Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 34: Europe MEA Occupancy Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 35: Europe MEA Occupancy Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 36: Europe MEA Occupancy Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Europe MEA Occupancy Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Europe MEA Occupancy Sensors Market Revenue (Million), by Building Type 2024 & 2032

- Figure 39: Europe MEA Occupancy Sensors Market Revenue Share (%), by Building Type 2024 & 2032

- Figure 40: Europe MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Europe MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East & Africa MEA Occupancy Sensors Market Revenue (Million), by Network Type 2024 & 2032

- Figure 43: Middle East & Africa MEA Occupancy Sensors Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 44: Middle East & Africa MEA Occupancy Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 45: Middle East & Africa MEA Occupancy Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 46: Middle East & Africa MEA Occupancy Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East & Africa MEA Occupancy Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East & Africa MEA Occupancy Sensors Market Revenue (Million), by Building Type 2024 & 2032

- Figure 49: Middle East & Africa MEA Occupancy Sensors Market Revenue Share (%), by Building Type 2024 & 2032

- Figure 50: Middle East & Africa MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East & Africa MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Asia Pacific MEA Occupancy Sensors Market Revenue (Million), by Network Type 2024 & 2032

- Figure 53: Asia Pacific MEA Occupancy Sensors Market Revenue Share (%), by Network Type 2024 & 2032

- Figure 54: Asia Pacific MEA Occupancy Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 55: Asia Pacific MEA Occupancy Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 56: Asia Pacific MEA Occupancy Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 57: Asia Pacific MEA Occupancy Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific MEA Occupancy Sensors Market Revenue (Million), by Building Type 2024 & 2032

- Figure 59: Asia Pacific MEA Occupancy Sensors Market Revenue Share (%), by Building Type 2024 & 2032

- Figure 60: Asia Pacific MEA Occupancy Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Asia Pacific MEA Occupancy Sensors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 3: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Building Type 2019 & 2032

- Table 6: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 18: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 19: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Building Type 2019 & 2032

- Table 21: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 26: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 27: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Building Type 2019 & 2032

- Table 29: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Brazil MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Argentina MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 34: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 35: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Building Type 2019 & 2032

- Table 37: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Kingdom MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Germany MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Russia MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Benelux MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Nordics MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 48: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 49: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Building Type 2019 & 2032

- Table 51: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Turkey MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Israel MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: GCC MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: North Africa MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Africa MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Middle East & Africa MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Network Type 2019 & 2032

- Table 59: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 60: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Building Type 2019 & 2032

- Table 62: Global MEA Occupancy Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: China MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: India MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Japan MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: South Korea MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: ASEAN MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Oceania MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Rest of Asia Pacific MEA Occupancy Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Occupancy Sensors Market?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the MEA Occupancy Sensors Market?

Key companies in the market include Signify Holding BV, Honeywell Inc, Eaton Corp PLC, Legrand SA, General Electric Co, Dwyer Instruments Inc, Schneider Electric SE, Johnson Controls Inc, Analog Devices Inc, Texas Instruments Inc*List Not Exhaustive.

3. What are the main segments of the MEA Occupancy Sensors Market?

The market segments include Network Type, Technology, Application, Building Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for energy-efficient devices; Demand for Passive Infrared Due to Low Cost and High Energy Efficiency.

6. What are the notable trends driving market growth?

Residential is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Cryptojacking Threats.

8. Can you provide examples of recent developments in the market?

January 2021 - Eyeris Technologies, Inc. announced a collaboration with Texas Instruments (TI) on an industry-first in-cabin sensing AI solution at the Consumer Electronics Show (CES) 2021, utilizing TI's JacintoTM TDA4 processors and 2D RGB-IR image sensors. Eyeris DNNs are designed to meet functional safety standards, allow for flexible camera placement, and perform efficiently on low-power edge processors. Eyeris' AI algorithm portfolio for in-cabin sensing includes driver monitoring system (DMS) and occupant monitoring system (OMS) features that meet global NCAP standards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Occupancy Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Occupancy Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Occupancy Sensors Market?

To stay informed about further developments, trends, and reports in the MEA Occupancy Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence