Key Insights

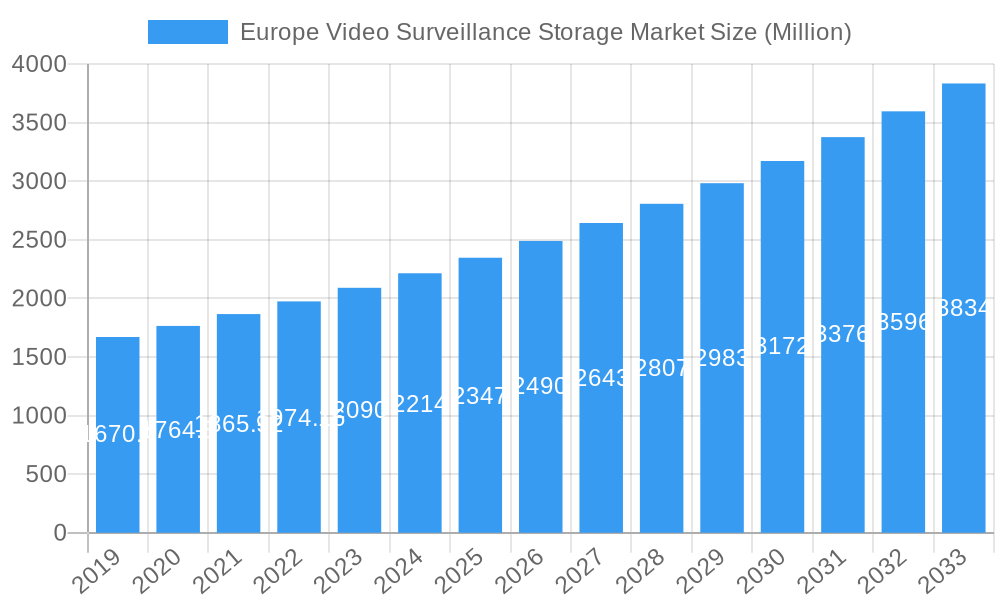

The European video surveillance storage market is poised for significant expansion, projected to reach a valuation of approximately USD 2.37 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.03% expected to continue through 2033. This growth is fueled by a confluence of factors, including the escalating demand for advanced security solutions across various end-user verticals. The increasing adoption of high-definition surveillance cameras necessitates substantial storage capacities, driving the market for both Network Attached Storage (NAS) and Storage Area Network (SAN) solutions. Furthermore, the ongoing digital transformation across industries like BFSI, retail, and government is accelerating the deployment of sophisticated video surveillance systems, thereby boosting the demand for reliable and scalable storage. Emerging trends such as the integration of AI and machine learning for video analytics are also contributing to the market's dynamism, requiring more powerful and efficient storage infrastructure.

Europe Video Surveillance Storage Market Market Size (In Billion)

While the market demonstrates strong growth potential, certain challenges could temper the pace. The substantial initial investment required for advanced storage solutions and the evolving regulatory landscape surrounding data privacy and retention can present hurdles for some organizations. However, the widespread availability of cloud-based storage options is mitigating these concerns, offering flexibility and cost-effectiveness, particularly for small and medium-sized enterprises. The shift towards Solid State Drives (SSDs) for their speed and reliability, alongside the continued dominance of Hard Disk Drives (HDDs) for bulk storage, will shape the storage media segment. Key players are actively innovating, focusing on enhancing storage density, improving data security, and developing integrated solutions that combine surveillance hardware with robust storage capabilities to meet the evolving needs of the European market.

Europe Video Surveillance Storage Market Company Market Share

This in-depth report provides a granular analysis of the Europe Video Surveillance Storage Market, a critical component of the burgeoning security and data management landscape. With the escalating adoption of high-definition cameras and the increasing volume of video data, the demand for robust, scalable, and secure storage solutions is at an all-time high. This study encompasses the entire value chain, from hardware manufacturers to service providers, offering actionable insights for industry stakeholders.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Market Segments Covered:

Key Companies Profiled (List Not Exhaustive): Hangzhou Hikvision Digital Technology Co Ltd, Dell Technologies Inc, Huawei Technologies Co Ltd, Seagate Technology LLC, D-Link, AXIS Communications, Western Digital, Dahua Technology Co Ltd, Rasilient Systems Inc, Vivotek, CP PLUS, Thomas Krenn.

- Product Type: Storage Area Network (SAN), Network Attached Storage (NAS), Direct Attached Storage (DAS), Video Recorders, Services

- Deployment: On-Premises, Cloud

- Storage Media: Solid State Drives (SSDs), Hard Disk Drives (HDDs)

- End-user Vertical: Retail, BFSI, Government and Defense, Home Security, Healthcare, Media & Entertainment, Transportation and Logistics, Education, Others

Europe Video Surveillance Storage Market Dynamics & Structure

The Europe Video Surveillance Storage Market is characterized by a dynamic interplay of technological advancements, evolving regulatory landscapes, and a consolidating competitive environment. Market concentration is influenced by a few dominant players in hardware manufacturing and cloud services, yet a significant number of smaller, specialized firms cater to niche demands. Technological innovation drivers are primarily focused on increasing storage density, enhancing data retrieval speeds, and improving the energy efficiency of storage solutions, especially for surveillance storage solutions and NVR storage. Regulatory frameworks, particularly data privacy laws like GDPR, are shaping data retention policies and driving demand for secure and compliant storage, impacting video surveillance storage devices. Competitive product substitutes include advancements in object storage, edge computing solutions that process data closer to the source, and sophisticated data compression algorithms. End-user demographics reveal a growing demand from sectors like retail for loss prevention and from BFSI for compliance and security, pushing the adoption of enterprise video surveillance storage. Mergers and acquisitions (M&A) trends are consolidating the market, with larger entities acquiring smaller innovators to expand their portfolios and market reach in video analytics storage and surveillance hard drives.

- Market Concentration: Moderate to high, with key players holding significant market share in core hardware and cloud infrastructure.

- Technological Innovation Drivers: Increased storage capacity, faster data access, AI integration for intelligent video analytics, and enhanced cybersecurity for CCTV storage.

- Regulatory Frameworks: Stringent data protection laws (e.g., GDPR) mandate secure storage and data lifecycle management for security camera storage.

- Competitive Product Substitutes: Edge computing for localized processing, advancements in data compression, and alternative data archiving solutions.

- End-User Demographics: Growing demand from smart cities, critical infrastructure, and the proliferation of IoT devices generating vast amounts of video data for surveillance system storage.

- M&A Trends: Consolidation to gain economies of scale and expand technological capabilities in areas like surveillance cloud storage and surveillance data management.

Europe Video Surveillance Storage Market Growth Trends & Insights

The Europe Video Surveillance Storage Market is poised for robust expansion, driven by a confluence of factors including increasing cybersecurity concerns, smart city initiatives, and the pervasive adoption of IoT devices. The market size is projected to witness a significant upward trajectory, fueled by an accelerating adoption rate of advanced video surveillance recording technologies. Technological disruptions, such as the integration of artificial intelligence and machine learning into storage solutions for advanced video analytics and predictive maintenance, are transforming how video data is managed and utilized. Consumer behavior shifts are evident, with end-users demanding more efficient, scalable, and cost-effective storage options, prompting a greater interest in cloud surveillance storage and high-capacity surveillance hard drives. The market penetration of solutions supporting higher resolutions like 4K and 8K video, alongside the expansion of smart retail analytics, are further contributing to this growth. The ongoing digital transformation across various sectors necessitates a reliable and comprehensive surveillance data storage infrastructure.

- Market Size Evolution: Expected to grow significantly due to escalating security needs and data generation from an increasing number of cameras.

- Adoption Rates: Rapid adoption of high-definition cameras and AI-powered analytics is directly correlating with the demand for advanced storage.

- Technological Disruptions: Integration of AI/ML for intelligent video analysis and predictive capabilities within video surveillance storage systems.

- Consumer Behavior Shifts: Growing preference for cloud-based solutions for scalability and remote accessibility, alongside demand for cost-effective surveillance drive solutions.

- Market Penetration: Increasing adoption of solutions supporting higher resolutions (4K, 8K) and edge computing for localized data processing.

- CAGR Projections: The market is anticipated to grow at a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period, indicative of its dynamic expansion.

- Market Penetration Metrics: The penetration of advanced surveillance storage devices is expected to reach xx% by 2033, signifying widespread adoption.

Dominant Regions, Countries, or Segments in Europe Video Surveillance Storage Market

The Europe Video Surveillance Storage Market exhibits varied growth dynamics across its diverse segments and geographical landscape. The Government and Defense vertical stands out as a dominant force, driven by national security imperatives, large-scale infrastructure projects, and the deployment of advanced surveillance systems for public safety and border control, requiring robust government video surveillance storage. Within this vertical, countries with substantial defense budgets and proactive smart city agendas, such as the United Kingdom, Germany, and France, are leading the adoption of sophisticated surveillance storage solutions. The Retail sector also demonstrates strong growth, fueled by the need for loss prevention, customer analytics, and operational efficiency, creating a substantial demand for retail video surveillance storage. The shift towards Cloud deployment is a significant trend across all verticals, offering scalability, cost-effectiveness, and remote accessibility for cloud surveillance storage.

- Dominant End-user Vertical: Government and Defense, driven by national security, smart city initiatives, and critical infrastructure protection.

- Leading Countries: United Kingdom, Germany, and France, due to significant investments in security infrastructure and smart city development.

- Dominant Deployment Model: Cloud deployment is gaining traction due to its scalability, cost-efficiency, and accessibility, impacting demand for cloud video surveillance storage.

- Key Drivers:

- Economic Policies: Government funding for security and smart city projects.

- Infrastructure Development: Expansion of digital infrastructure supporting cloud and network-based storage.

- Security Threats: Rising concerns over public safety and critical infrastructure security.

- Technological Advancements: Availability of high-capacity and AI-enabled storage.

- Market Share: The Government and Defense segment is estimated to hold xx% of the market share in 2025, indicating its significant influence.

- Growth Potential: Emerging opportunities in the Healthcare and Transportation & Logistics sectors, as these industries increasingly adopt video surveillance for safety and operational monitoring.

Europe Video Surveillance Storage Market Product Landscape

The product landscape of the Europe Video Surveillance Storage Market is characterized by continuous innovation aimed at enhancing performance, capacity, and reliability. Key product types include Network Attached Storage (NAS) and Storage Area Network (SAN) solutions offering centralized storage for large deployments, alongside Direct Attached Storage (DAS) for smaller systems. Video recorders, such as Network Video Recorders (NVRs) and Digital Video Recorders (DVRs), remain fundamental, with advancements focusing on increased channel support and higher resolution recording capabilities. Services, including installation, maintenance, and cloud storage management, are becoming increasingly integral to the overall offering, supporting surveillance data management. Solid State Drives (SSDs) are gaining market share due to their superior speed and durability for mission-critical applications, while Hard Disk Drives (HDDs) continue to dominate in terms of cost per terabyte for bulk storage, essential for high-capacity surveillance hard drives. The integration of AI capabilities within storage devices for intelligent video analytics is a significant technological advancement, enhancing the utility of AI video surveillance storage.

Key Drivers, Barriers & Challenges in Europe Video Surveillance Storage Market

Key Drivers:

- Increasing Security Concerns: Rising crime rates and the need for enhanced public safety are major catalysts for video surveillance adoption.

- Smart City Initiatives: Government investments in smart cities worldwide are driving the deployment of extensive surveillance networks.

- Technological Advancements: Development of higher resolution cameras, AI analytics, and more efficient storage technologies.

- IoT Proliferation: The growing number of connected devices generates substantial video data requiring storage.

- Regulatory Mandates: Certain industries are mandated to retain video footage for compliance purposes, driving demand for surveillance storage solutions.

Barriers & Challenges:

- High Initial Investment: The cost of setting up comprehensive video surveillance and storage systems can be a deterrent for some small and medium-sized businesses.

- Data Management Complexity: Handling the sheer volume of video data, including archiving, retrieval, and disposal, poses significant management challenges.

- Cybersecurity Risks: Protecting sensitive video data from unauthorized access and cyber threats is a constant concern, especially for CCTV storage.

- Interoperability Issues: Ensuring seamless integration between different hardware and software components from various vendors can be complex.

- Evolving Regulations: Keeping up with changing data privacy and retention regulations requires continuous adaptation of storage strategies for surveillance data management.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and pricing of essential components like surveillance hard drives and SSDs.

Emerging Opportunities in Europe Video Surveillance Storage Market

Emerging opportunities in the Europe Video Surveillance Storage Market lie in the growing demand for edge computing solutions, which enable data processing closer to the source, reducing latency and bandwidth requirements for edge surveillance storage. The increasing adoption of AI and machine learning for advanced video analytics, such as facial recognition and anomaly detection, is creating a need for specialized AI video surveillance storage optimized for these workloads. The expansion of the Internet of Things (IoT) ecosystem is generating vast amounts of unstructured data, presenting opportunities for integrated IoT surveillance storage solutions. Furthermore, the development of hybrid cloud models, offering the flexibility of cloud storage combined with the security of on-premises solutions, is a significant growth area for hybrid surveillance storage. The increasing focus on sustainability is also driving demand for energy-efficient storage solutions, including those utilizing SSDs for lower power consumption in energy-efficient surveillance storage.

Growth Accelerators in the Europe Video Surveillance Storage Market Industry

Several key catalysts are accelerating the growth of the Europe Video Surveillance Storage Market. The continuous advancement in storage technologies, particularly the increasing density and decreasing cost per terabyte of both HDDs and SSDs, makes larger storage capacities more accessible. The integration of AI and machine learning directly into storage devices and recorders is enabling sophisticated real-time video analytics and intelligent data management, driving the adoption of intelligent surveillance storage. Strategic partnerships between hardware manufacturers, software developers, and cloud providers are fostering the creation of integrated end-to-end solutions, enhancing the overall value proposition for users of integrated surveillance storage. Market expansion strategies by key players, including geographical diversification and targeted product development for specific industry verticals like healthcare and transportation, are further fueling growth in specialized surveillance storage.

Key Players Shaping the Europe Video Surveillance Storage Market Market

- Hangzhou Hikvision Digital Technology Co Ltd

- Dell Technologies Inc

- Huawei Technologies Co Ltd

- Seagate Technology LLC

- D-Link

- AXIS Communications

- Wester Digital

- Dahua Technology Co Ltd

- Rasilient Systems Inc

- Vivotek

- CP PLUS

- Thomas Krenn

Notable Milestones in Europe Video Surveillance Storage Market Sector

- March 2024: ADATA Technology Co. Ltd revealed its plans to present its latest BiCS5 3D(e)TLC storage solutions, high DWPD SSDs, and high-performance/low-power industrial-grade ECC memory modules such as U-DIMM, SO-DIMM, and R-DIMM. These products come with a wide operating temperature range, anti-sulfuration properties, enhanced durability, improved data security measures, moisture-proofing capabilities, and anti-fouling technology, bolstering the availability of robust components for industrial surveillance storage.

- December 2023: Seagate Technology Holdings PLC introduced the latest addition to its product line, the Seagate SkyHawk AI 24 TB hard disk drive (HDD) designed specifically for video and imaging applications (VIA). This new release came after the successful launch of the Seagate Exos X24 24 TB conventional magnetic recording (CMR) hard drive, further catering to the growing demand for mass data storage in the edge security sector, significantly impacting the high-capacity surveillance HDD market.

In-Depth Europe Video Surveillance Storage Market Market Outlook

The future outlook for the Europe Video Surveillance Storage Market is exceptionally promising, propelled by the sustained demand for advanced security solutions and the continuous evolution of data management technologies. Growth accelerators such as the pervasive adoption of AI for intelligent video analytics, the expansion of IoT ecosystems, and the increasing preference for hybrid and cloud-based storage models will continue to shape market dynamics. Strategic opportunities abound for companies offering integrated solutions that address the complex challenges of data security, scalability, and cost-efficiency. The market is expected to witness further innovation in areas like edge computing for localized processing and specialized storage for mission-critical applications, solidifying its role as a cornerstone of modern security infrastructure.

Europe Video Surveillance Storage Market Segmentation

-

1. Product Type

- 1.1. Storage Area Network (SAN)

- 1.2. Network Attached Storage (NAS)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Video Recorders

- 1.5. Services

-

2. Deployment

- 2.1. On-Premises

- 2.2. Cloud

-

3. Storage Media

- 3.1. Solid State Drives (SSDs)

- 3.2. Hard Disk Drives (HDDs)

-

4. End-user Vertical

- 4.1. Retail

- 4.2. BFSI

- 4.3. Government and Defense

- 4.4. Home Security

- 4.5. Healthcare

- 4.6. Media & Entertainment

- 4.7. Transportation and Logistics

- 4.8. Education

- 4.9. Others

Europe Video Surveillance Storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Video Surveillance Storage Market Regional Market Share

Geographic Coverage of Europe Video Surveillance Storage Market

Europe Video Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing

- 3.2.2 Data Analytics

- 3.2.3 and Cloud

- 3.3. Market Restrains

- 3.3.1 The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing

- 3.3.2 Data Analytics

- 3.3.3 and Cloud

- 3.4. Market Trends

- 3.4.1. Solid State Drives (SSDs) Segment is Expected to Grow at a Fast Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Video Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Storage Area Network (SAN)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Video Recorders

- 5.1.5. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premises

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Storage Media

- 5.3.1. Solid State Drives (SSDs)

- 5.3.2. Hard Disk Drives (HDDs)

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Retail

- 5.4.2. BFSI

- 5.4.3. Government and Defense

- 5.4.4. Home Security

- 5.4.5. Healthcare

- 5.4.6. Media & Entertainment

- 5.4.7. Transportation and Logistics

- 5.4.8. Education

- 5.4.9. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Huawei Technologies Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Seagate Technology LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 D-Link

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXIS Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wester Digital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dahua Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rasilient Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vivotek

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CP PLUS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Thomas Krenn*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: Europe Video Surveillance Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Video Surveillance Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Video Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Video Surveillance Storage Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Europe Video Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Europe Video Surveillance Storage Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 5: Europe Video Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 6: Europe Video Surveillance Storage Market Volume Billion Forecast, by Storage Media 2020 & 2033

- Table 7: Europe Video Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Europe Video Surveillance Storage Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 9: Europe Video Surveillance Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Europe Video Surveillance Storage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Europe Video Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Europe Video Surveillance Storage Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: Europe Video Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Europe Video Surveillance Storage Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 15: Europe Video Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 16: Europe Video Surveillance Storage Market Volume Billion Forecast, by Storage Media 2020 & 2033

- Table 17: Europe Video Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Europe Video Surveillance Storage Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 19: Europe Video Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Europe Video Surveillance Storage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Germany Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: France Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Netherlands Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Netherlands Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Belgium Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Belgium Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Sweden Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Sweden Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Norway Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Norway Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Poland Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Poland Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Denmark Europe Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Denmark Europe Video Surveillance Storage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Video Surveillance Storage Market?

The projected CAGR is approximately 6.03%.

2. Which companies are prominent players in the Europe Video Surveillance Storage Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Dell Technologies Inc, Huawei Technologies Co Ltd, Seagate Technology LLC, D-Link, AXIS Communications, Wester Digital, Dahua Technology Co Ltd, Rasilient Systems Inc, Vivotek, CP PLUS, Thomas Krenn*List Not Exhaustive.

3. What are the main segments of the Europe Video Surveillance Storage Market?

The market segments include Product Type, Deployment, Storage Media, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.37 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing. Data Analytics. and Cloud.

6. What are the notable trends driving market growth?

Solid State Drives (SSDs) Segment is Expected to Grow at a Fast Rate.

7. Are there any restraints impacting market growth?

The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing. Data Analytics. and Cloud.

8. Can you provide examples of recent developments in the market?

March 2024: ADATA Technology Co. Ltd revealed its plans to present its latest BiCS5 3D(e)TLC storage solutions, high DWPD SSDs, and high-performance/low-power industrial-grade ECC memory modules such as U-DIMM, SO-DIMM, and R-DIMM. These products come with a wide operating temperature range, anti-sulfuration properties, enhanced durability, improved data security measures, moisture-proofing capabilities, and anti-fouling technology.December 2023: Seagate Technology Holdings PLC introduced the latest addition to its product line, the Seagate SkyHawk AI 24 TB hard disk drive (HDD) designed specifically for video and imaging applications (VIA). This new release came after the successful launch of the Seagate Exos X24 24 TB conventional magnetic recording (CMR) hard drive, further catering to the growing demand for mass data storage in the edge security sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Video Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Video Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Video Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the Europe Video Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence