Key Insights

The global 3D Printing Market is poised for significant expansion, with a projected market size of 16.16 billion by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 17.2%. This growth is propelled by escalating demand for rapid prototyping, mass customization, and on-demand manufacturing across key sectors such as automotive and aerospace, where intricate designs and lightweight solutions are essential. The healthcare industry is also a major growth driver, utilizing 3D printing for bespoke implants, prosthetics, and surgical instrumentation. Continuous advancements in material science and the development of enhanced printing technologies, including SLA and SLS, are expanding application areas and improving accessibility. The increasing adoption of additive manufacturing for complex components and the trend towards decentralized production models further underpin market penetration.

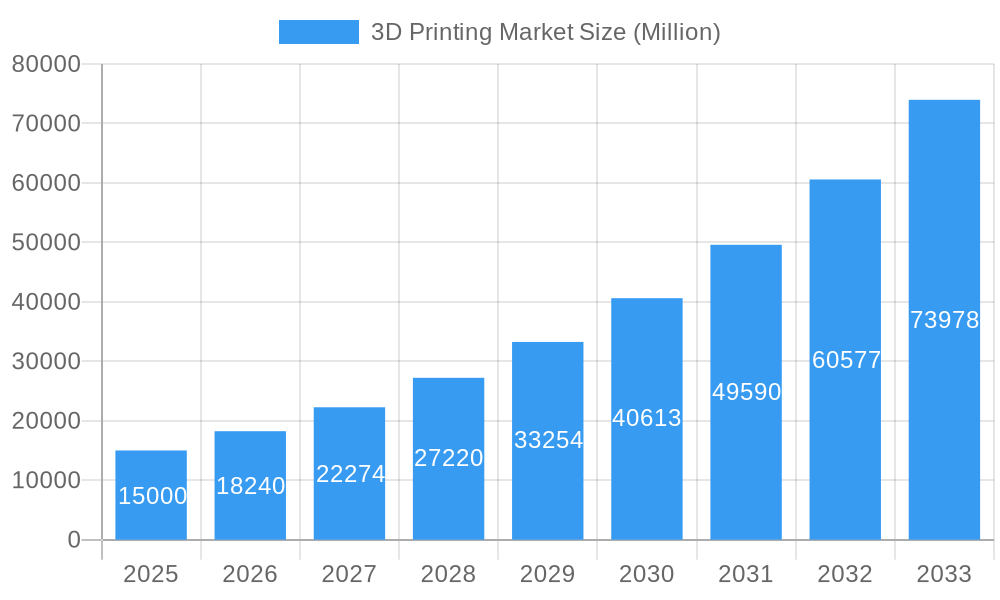

3D Printing Market Market Size (In Billion)

Market dynamics are further influenced by the integration of artificial intelligence and machine learning into 3D printing processes, optimizing design and efficiency. The utilization of advanced materials, including high-performance polymers, metals, and ceramics, is enabling the creation of more durable and functional end products. While challenges such as substantial initial investment costs for industrial equipment and the requirement for skilled operators persist, ongoing research and development, alongside a growing service provider network, are effectively addressing these limitations. Key industry players, including Hewlett Packard Inc., General Electric Company (GE Additive), and Stratasys Ltd., are actively driving innovation and portfolio expansion to secure market leadership.

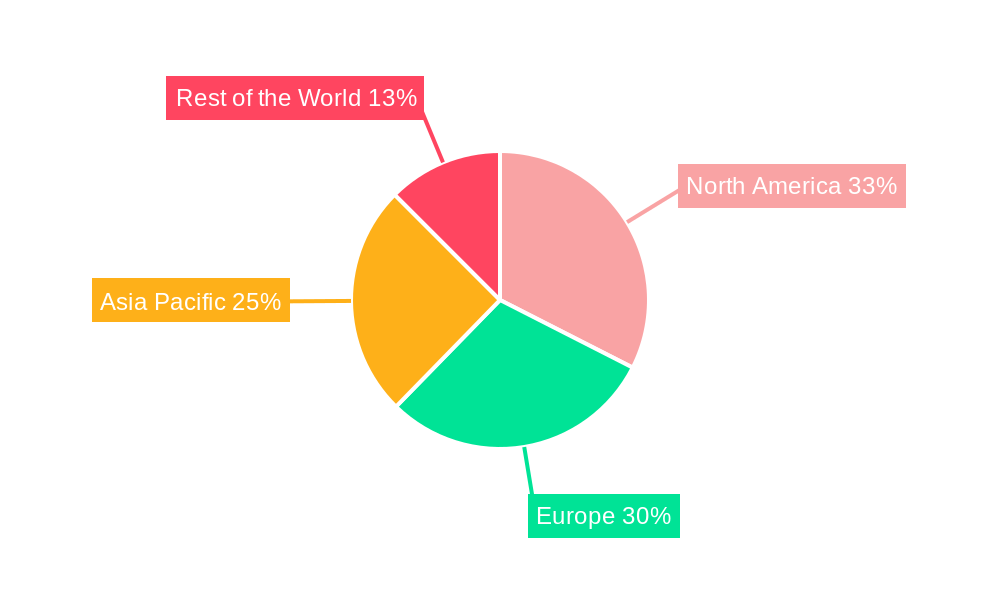

3D Printing Market Company Market Share

Global 3D Printing Market Analysis: A Comprehensive Report (2019-2033)

Uncover the transformative power of additive manufacturing with this in-depth report on the global 3D Printing Market. Explore market dynamics, growth trends, regional dominance, technological advancements, and key players shaping this rapidly evolving industry. Essential for industry professionals seeking to capitalize on the future of manufacturing.

3D Printing Market Market Dynamics & Structure

The 3D printing market is characterized by dynamic innovation, driven by the quest for advanced materials, faster printing speeds, and enhanced precision across diverse applications. Market concentration is moderate, with key players like Hewlett Packard Inc., General Electric Company (GE Additive), and Stratasys Ltd. vying for market share through continuous R&D and strategic partnerships. Regulatory frameworks are evolving to support the widespread adoption of additive manufacturing, particularly in critical sectors like healthcare and aerospace. Competitive product substitutes, while present in traditional manufacturing, are increasingly being outperformed by the customization and efficiency offered by 3D printing. End-user demographics are expanding beyond prototyping to include mass production, fueled by decreasing costs and increasing reliability. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating capabilities and expanding their product portfolios. For instance, the historical period (2019-2024) witnessed an estimated X M&A deals in the additive manufacturing space. Barriers to innovation include the high cost of industrial-grade equipment and specialized materials, as well as the need for skilled personnel.

- Market Concentration: Moderate, with significant R&D investment from major players.

- Technological Innovation Drivers: Demand for customized solutions, complex geometries, and reduced lead times.

- Regulatory Frameworks: Evolving to support industrial adoption and quality control.

- Competitive Product Substitutes: Traditional manufacturing methods are increasingly challenged by 3D printing's advantages.

- End-user Demographics: Expanding from prototyping to full-scale production across industries.

- M&A Trends: Active consolidation to enhance market presence and technological capabilities.

3D Printing Market Growth Trends & Insights

The global 3D printing market is poised for exponential growth, projected to reach xx billion USD by 2033, with a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). The base year of 2025 estimates the market size at xx billion USD, reflecting a significant increase from historical figures. Adoption rates are soaring across various end-user industries, propelled by the inherent advantages of additive manufacturing, including on-demand production, material efficiency, and the ability to create intricate designs that were previously impossible. Technological disruptions are at the forefront, with advancements in printer hardware, software, and materials continuously pushing the boundaries of what's achievable. Consumer behavior is shifting towards personalized products and localized manufacturing, areas where 3D printing excels. The market penetration of 3D printing in sectors like automotive and healthcare has seen remarkable acceleration. For example, the integration of 3D printing for producing patient-specific implants and surgical guides has revolutionized medical treatments. Furthermore, the aerospace industry continues to leverage additive manufacturing for lightweight components and complex aerospace parts, leading to improved fuel efficiency and performance. The increasing accessibility of desktop 3D printers has also democratized the technology, fostering innovation among smaller businesses and hobbyists, thereby expanding the overall market ecosystem. As material science advances, the range of printable materials expands, further broadening the application spectrum of 3D printing across diverse sectors. The overall market evolution is a testament to its disruptive potential and its capacity to redefine manufacturing paradigms.

Dominant Regions, Countries, or Segments in 3D Printing Market

North America currently dominates the global 3D printing market, driven by substantial investments in research and development, a strong presence of leading additive manufacturing companies, and high adoption rates across key end-user industries such as aerospace, automotive, and healthcare. The United States, in particular, plays a pivotal role due to government initiatives supporting advanced manufacturing and a robust ecosystem of technology providers and end-users.

- Dominant Technology: Selective Laser Sintering (SLS) and Fused Deposition Modeling (FDM) technologies are leading the market. SLS is highly favored in industrial applications for its ability to produce strong, complex parts with good surface finish, particularly for functional prototypes and end-use parts in industries like aerospace. FDM, on the other hand, offers a cost-effective entry point for prototyping and functional part creation across various sectors, experiencing widespread adoption due to its versatility and affordability.

- Dominant Material Type: Plastics remain the dominant material type due to their versatility, cost-effectiveness, and broad range of applications, from functional prototyping to end-use parts. However, the metal 3D printing segment is experiencing rapid growth, fueled by demand from high-value industries like aerospace and automotive for lightweight, high-strength components.

- Dominant End-user Industry: The Automotive sector stands out as a major driver of growth. 3D printing is extensively used for rapid prototyping of vehicle components, tool design, and even the production of customized parts, leading to significant cost savings and reduced lead times. The Aerospace and Defense sector also represents a substantial market share, leveraging additive manufacturing for producing complex, lightweight, and high-performance aircraft components.

The market's growth in North America is further bolstered by initiatives encouraging advanced manufacturing and reshoring efforts. The presence of major players like 3D Systems Corporation and Stratasys Ltd. in this region contributes significantly to market expansion and innovation. Economic policies promoting technological adoption and a skilled workforce adept at operating and designing for 3D printing also underpin the region's dominance. The high market share of these segments and regions is indicative of their current impact and future growth potential within the broader 3D printing landscape.

3D Printing Market Product Landscape

The 3D printing market is characterized by a dynamic product landscape driven by continuous innovation in printer hardware, materials, and software. Recent product introductions include high-speed industrial metal 3D printers capable of producing complex geometries with enhanced material properties for aerospace and automotive applications. Advancements in photopolymer resins have enabled the creation of biocompatible and high-resolution parts for healthcare, such as dental aligners and surgical guides. Furthermore, software solutions are evolving to streamline the design-to-print workflow, incorporating AI-driven optimization and real-time process monitoring for improved efficiency and quality control. The unique selling propositions of these products lie in their ability to offer unparalleled design freedom, rapid prototyping capabilities, and the potential for mass customization, leading to reduced manufacturing costs and lead times.

Key Drivers, Barriers & Challenges in 3D Printing Market

The 3D printing market is propelled by several key drivers, including the increasing demand for customized products, the need for rapid prototyping and on-demand manufacturing, and advancements in material science that expand application possibilities. Government initiatives promoting advanced manufacturing and investments in R&D by leading companies further accelerate market growth.

- Key Drivers:

- Demand for mass customization and personalized products.

- Reduced lead times and costs for prototyping and small-batch production.

- Development of advanced materials with superior properties.

- Government support and investment in additive manufacturing technologies.

Conversely, the market faces significant barriers and challenges. The high initial investment cost for industrial-grade 3D printers and specialized materials remains a considerable hurdle for widespread adoption. Regulatory compliance, especially in highly regulated industries like healthcare and aerospace, can be complex and time-consuming. Furthermore, a shortage of skilled labor capable of operating and maintaining advanced 3D printing systems poses a challenge. Supply chain issues for raw materials and the need for robust quality control systems for end-use parts also present ongoing concerns.

- Key Barriers & Challenges:

- High capital investment for industrial-grade equipment.

- Complex regulatory landscapes and certification processes.

- Shortage of skilled workforce in additive manufacturing.

- Supply chain reliability for specialized materials.

- Ensuring consistent quality and scalability for mass production.

Emerging Opportunities in 3D Printing Market

Emerging opportunities in the 3D printing market are abundant, driven by untapped potential in sectors like construction and architecture for on-site printing of building components, and the food industry for personalized nutrition and complex food designs. The increasing focus on sustainability presents an opportunity for additive manufacturing to reduce waste and optimize material usage. Furthermore, the development of advanced multi-material printing capabilities opens doors for creating highly functional and integrated parts with tailored properties. The growing adoption of 3D printing for spare parts inventory management and direct digital manufacturing of end-use products signifies a shift towards more decentralized and efficient supply chains, creating significant market expansion potential.

Growth Accelerators in the 3D Printing Market Industry

Several catalysts are accelerating the long-term growth of the 3D printing industry. Technological breakthroughs in printer speed, resolution, and material capabilities are continuously expanding the application scope. Strategic partnerships between material suppliers, printer manufacturers, and end-users are fostering innovation and co-creation of tailored solutions. Market expansion strategies, including entry into emerging economies and the development of user-friendly platforms, are also crucial growth accelerators. The increasing integration of AI and machine learning in the design and manufacturing processes is further enhancing efficiency and enabling more complex creations, solidifying 3D printing's role as a transformative manufacturing technology.

Key Players Shaping the 3D Printing Market Market

- ExOne Co

- Hewlett Packard Inc

- General Electric Company (GE Additive)

- Proto Labs Inc

- Nano Dimension Ltd

- 3D Systems Corporation

- SLM Solutions Group AG

- Ultimaker BV

- EOS GmbH

- Sisma SPA

- Stratasys Ltd

Notable Milestones in 3D Printing Market Sector

- October 2022: PostProcess Technologies and EOS launched a distribution relationship to provide EOS clients with a fully automated and sustainable depowering solution, enhancing process digitization.

- August 2022: India's Department of Empowerment of Persons with Disabilities (DEPWD) initiated plans to introduce 3D printing technology for customizing assistive devices, improving the quality of life for individuals with locomotor disabilities.

- February 2022: The Indian government announced a national strategy for 3D printing to foster collaboration and establish India as a global hub for additive manufacturing.

In-Depth 3D Printing Market Market Outlook

The future outlook for the 3D printing market is exceptionally promising, driven by the relentless pace of technological innovation and the expanding adoption across a multitude of industries. Growth accelerators such as breakthroughs in material science, enabling the printing of high-performance alloys and composites, will unlock novel applications in sectors like medical implants and advanced electronics. Strategic partnerships will continue to be pivotal, fostering ecosystems for application development and market penetration. The increasing focus on sustainability will further propel additive manufacturing as a preferred solution for localized production, waste reduction, and the creation of circular economy models. The ongoing digitization of manufacturing processes and the integration of AI will lead to more intelligent and efficient 3D printing workflows, solidifying its position as a cornerstone of Industry 4.0 and a key driver of future economic growth.

3D Printing Market Segmentation

-

1. Technology

- 1.1. Stereo Lithography (SLA)

- 1.2. Fused Deposition Modeling (FDM)

- 1.3. Electron Beam Melting

- 1.4. Digital Light Processing

- 1.5. Selective Laser Sintering (SLS)

- 1.6. Other Technologies

-

2. Material Type

- 2.1. Metal

- 2.2. Plastic

- 2.3. Ceramics

- 2.4. Other Material Types

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Aerospace and Defense

- 3.3. Healthcare

- 3.4. Construction and Architecture

- 3.5. Energy

- 3.6. Food

- 3.7. Other End-user Industries

3D Printing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

3D Printing Market Regional Market Share

Geographic Coverage of 3D Printing Market

3D Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Initiatives and Spending by the Government; Ease in Development of Customized Products

- 3.3. Market Restrains

- 3.3.1. Lack of Enough Space to Build Self-storage Facilities

- 3.4. Market Trends

- 3.4.1. Rapid Advancement in Printing Technologies and Materials to Drive Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereo Lithography (SLA)

- 5.1.2. Fused Deposition Modeling (FDM)

- 5.1.3. Electron Beam Melting

- 5.1.4. Digital Light Processing

- 5.1.5. Selective Laser Sintering (SLS)

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Metal

- 5.2.2. Plastic

- 5.2.3. Ceramics

- 5.2.4. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Aerospace and Defense

- 5.3.3. Healthcare

- 5.3.4. Construction and Architecture

- 5.3.5. Energy

- 5.3.6. Food

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereo Lithography (SLA)

- 6.1.2. Fused Deposition Modeling (FDM)

- 6.1.3. Electron Beam Melting

- 6.1.4. Digital Light Processing

- 6.1.5. Selective Laser Sintering (SLS)

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Metal

- 6.2.2. Plastic

- 6.2.3. Ceramics

- 6.2.4. Other Material Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Aerospace and Defense

- 6.3.3. Healthcare

- 6.3.4. Construction and Architecture

- 6.3.5. Energy

- 6.3.6. Food

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereo Lithography (SLA)

- 7.1.2. Fused Deposition Modeling (FDM)

- 7.1.3. Electron Beam Melting

- 7.1.4. Digital Light Processing

- 7.1.5. Selective Laser Sintering (SLS)

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Metal

- 7.2.2. Plastic

- 7.2.3. Ceramics

- 7.2.4. Other Material Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Aerospace and Defense

- 7.3.3. Healthcare

- 7.3.4. Construction and Architecture

- 7.3.5. Energy

- 7.3.6. Food

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereo Lithography (SLA)

- 8.1.2. Fused Deposition Modeling (FDM)

- 8.1.3. Electron Beam Melting

- 8.1.4. Digital Light Processing

- 8.1.5. Selective Laser Sintering (SLS)

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Metal

- 8.2.2. Plastic

- 8.2.3. Ceramics

- 8.2.4. Other Material Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Aerospace and Defense

- 8.3.3. Healthcare

- 8.3.4. Construction and Architecture

- 8.3.5. Energy

- 8.3.6. Food

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World 3D Printing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stereo Lithography (SLA)

- 9.1.2. Fused Deposition Modeling (FDM)

- 9.1.3. Electron Beam Melting

- 9.1.4. Digital Light Processing

- 9.1.5. Selective Laser Sintering (SLS)

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Metal

- 9.2.2. Plastic

- 9.2.3. Ceramics

- 9.2.4. Other Material Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Aerospace and Defense

- 9.3.3. Healthcare

- 9.3.4. Construction and Architecture

- 9.3.5. Energy

- 9.3.6. Food

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ExOne Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hewlett Packard Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Electric Company (GE Additive)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Proto Labs Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nano Dimernsion Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3D Systems Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SLM Solutions Group AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ultimaker BV*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 EOS GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sisma SPA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Stratasys Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 ExOne Co

List of Figures

- Figure 1: Global 3D Printing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America 3D Printing Market Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America 3D Printing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America 3D Printing Market Revenue (billion), by Material Type 2025 & 2033

- Figure 5: North America 3D Printing Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America 3D Printing Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America 3D Printing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America 3D Printing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America 3D Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe 3D Printing Market Revenue (billion), by Technology 2025 & 2033

- Figure 11: Europe 3D Printing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe 3D Printing Market Revenue (billion), by Material Type 2025 & 2033

- Figure 13: Europe 3D Printing Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe 3D Printing Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe 3D Printing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe 3D Printing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe 3D Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific 3D Printing Market Revenue (billion), by Technology 2025 & 2033

- Figure 19: Asia Pacific 3D Printing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific 3D Printing Market Revenue (billion), by Material Type 2025 & 2033

- Figure 21: Asia Pacific 3D Printing Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific 3D Printing Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific 3D Printing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific 3D Printing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific 3D Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World 3D Printing Market Revenue (billion), by Technology 2025 & 2033

- Figure 27: Rest of the World 3D Printing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Rest of the World 3D Printing Market Revenue (billion), by Material Type 2025 & 2033

- Figure 29: Rest of the World 3D Printing Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Rest of the World 3D Printing Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World 3D Printing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World 3D Printing Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World 3D Printing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D Printing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global 3D Printing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: Global 3D Printing Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global 3D Printing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global 3D Printing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global 3D Printing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 7: Global 3D Printing Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global 3D Printing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global 3D Printing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global 3D Printing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 11: Global 3D Printing Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global 3D Printing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global 3D Printing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global 3D Printing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 15: Global 3D Printing Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global 3D Printing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global 3D Printing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Global 3D Printing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 19: Global 3D Printing Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global 3D Printing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing Market?

The projected CAGR is approximately 17.2%.

2. Which companies are prominent players in the 3D Printing Market?

Key companies in the market include ExOne Co, Hewlett Packard Inc, General Electric Company (GE Additive), Proto Labs Inc, Nano Dimernsion Ltd, 3D Systems Corporation, SLM Solutions Group AG, Ultimaker BV*List Not Exhaustive, EOS GmbH, Sisma SPA, Stratasys Ltd.

3. What are the main segments of the 3D Printing Market?

The market segments include Technology, Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.16 billion as of 2022.

5. What are some drivers contributing to market growth?

Initiatives and Spending by the Government; Ease in Development of Customized Products.

6. What are the notable trends driving market growth?

Rapid Advancement in Printing Technologies and Materials to Drive Market.

7. Are there any restraints impacting market growth?

Lack of Enough Space to Build Self-storage Facilities.

8. Can you provide examples of recent developments in the market?

October 2022: PostProcess Technologies and EOS have launched a distribution relationship to provide EOS clients with a fully automated and sustainable depowering solution. According to PostProcess, the Variable Acoustic Displacement (VAD) technology solution will complement the EOS printer product line and automate gross depowering for 3D printed parts. The partnership makes it easier for consumers to obtain post-printing solutions, allowing for complete process digitization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Printing Market?

To stay informed about further developments, trends, and reports in the 3D Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence