Key Insights

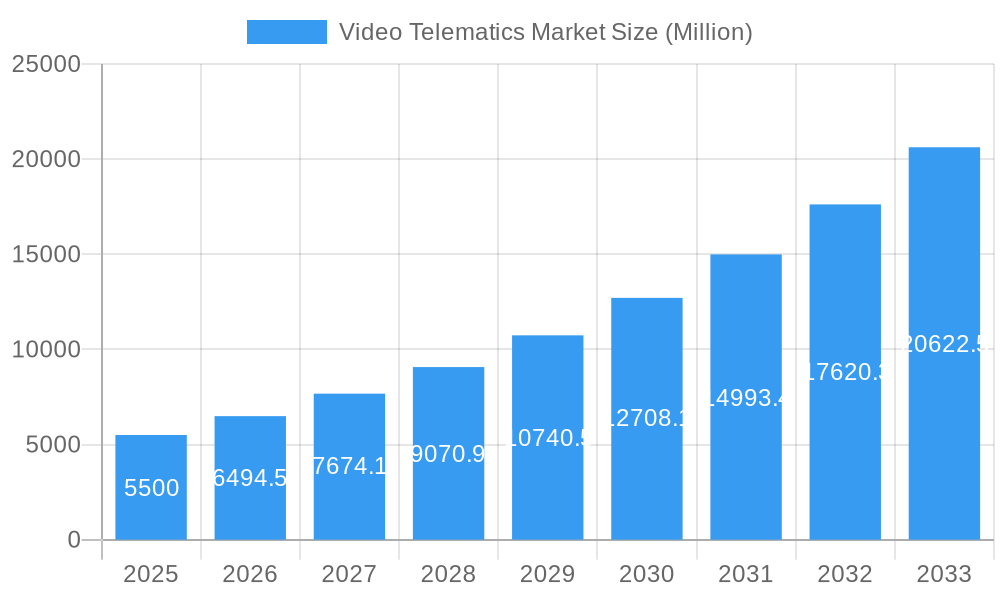

The global Video Telematics Market is projected for significant expansion, expected to reach $1.8 billion by 2025. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of 17.8% from a base year of 2025. Key growth factors include the increasing demand for fleet safety and security, the need for operational cost reduction through efficient vehicle management, and the rising adoption of advanced driver-assistance systems (ADAS). Evolving regulatory frameworks and the advancement of connected vehicle technologies are also significant catalysts, prompting businesses to integrate sophisticated video telematics solutions. The market is characterized by a growing adoption of integrated systems, which combine video recording with GPS tracking, diagnostics, and other telematics functionalities for comprehensive fleet management.

Video Telematics Market Market Size (In Billion)

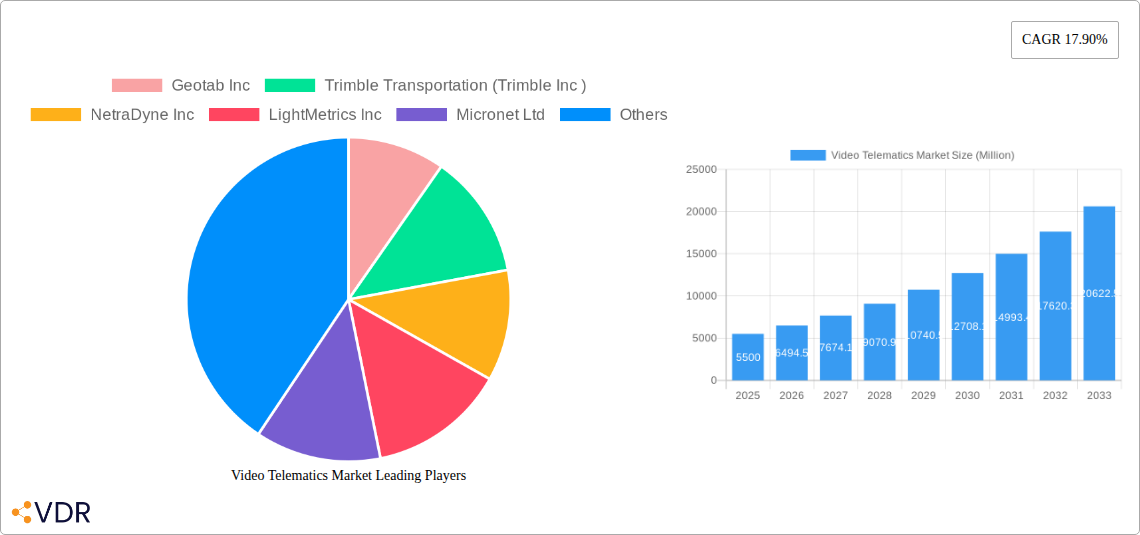

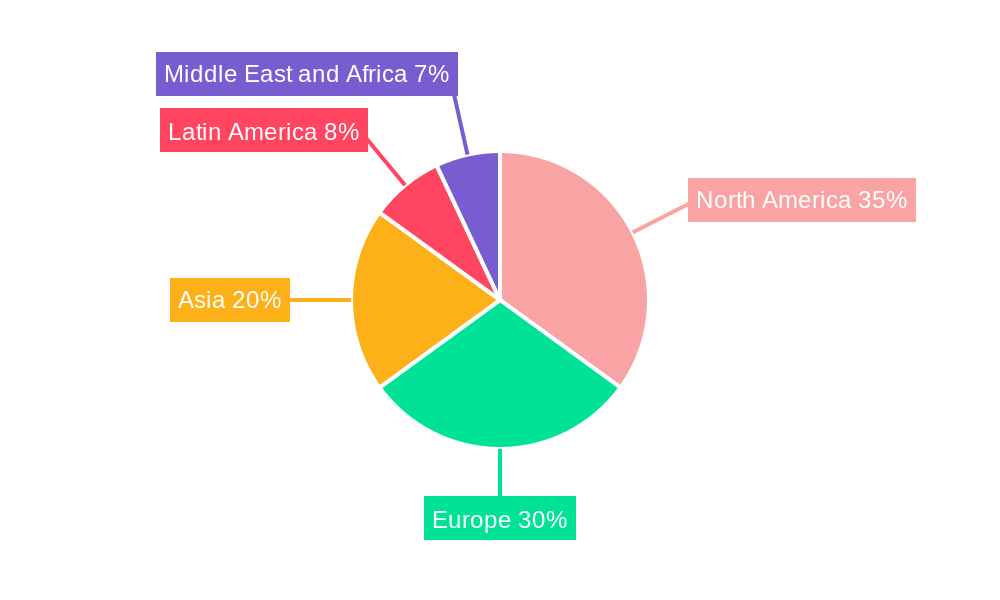

The competitive environment features established players and emerging innovators like Geotab, Trimble Transportation, NetraDyne, Lytx, and Samsara. These companies are investing in R&D for next-generation solutions offering real-time incident detection, driver behavior analysis, and predictive maintenance. Key market trends include the integration of AI and machine learning for advanced video analytics, the proliferation of cloud-based platforms for seamless data management, and the development of compact, robust hardware for diverse vehicle types. While strong growth is anticipated, potential restraints such as high initial investment costs and data privacy concerns require strategic attention for widespread adoption. The market is expected to perform strongly across all regions, with North America and Europe anticipated to lead due to stringent safety regulations and advanced infrastructure.

Video Telematics Market Company Market Share

Video Telematics Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock unparalleled insights into the global Video Telematics Market with our definitive report. This comprehensive study, spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, delves into the intricate dynamics of integrated and standalone systems for buses, heavy trucks, LCVs, and passenger cars. With a focus on high-traffic keywords such as "fleet management solutions," "driver safety," "vehicle tracking," "dash cam technology," and "fleet efficiency," this report is optimized for maximum search engine visibility and is essential for industry professionals, investors, and strategists seeking to navigate this rapidly evolving landscape.

All quantitative data is presented in Million Units.

Video Telematics Market Market Dynamics & Structure

The global Video Telematics Market is characterized by a moderately consolidated structure, with a handful of key players holding significant market share. Technological innovation remains a primary driver, fueled by the relentless pursuit of enhanced driver safety, operational efficiency, and regulatory compliance. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in video analysis is revolutionizing how data is interpreted, leading to predictive insights and proactive risk mitigation. Regulatory frameworks, particularly concerning driver hours and safety standards, are increasingly influencing adoption rates, especially within commercial transportation sectors. Competitive product substitutes, such as standalone dash cams and traditional fleet management systems, are being challenged by the comprehensive offerings of integrated video telematics solutions. End-user demographics are diverse, ranging from large fleet operators in logistics and transportation to smaller businesses and even individual vehicle owners seeking advanced security and monitoring. Mergers and acquisitions (M&A) activity is on the rise as companies aim to consolidate market presence, acquire innovative technologies, and expand their geographical reach. For instance, M&A deal volumes have seen a XX% increase in the past two years. The barriers to innovation, while present in terms of initial investment costs and data integration complexities, are being overcome by advancements in cloud computing and data analytics platforms.

Video Telematics Market Growth Trends & Insights

The Video Telematics Market is experiencing robust growth, driven by a confluence of factors that are reshaping how vehicles are monitored and managed. The market size evolution indicates a significant upward trajectory, projected to reach USD XXXX Million in 2025, with a Compound Annual Growth Rate (CAGR) of XX.X% from 2019–2033. Adoption rates are accelerating, particularly in commercial fleets where the return on investment through reduced insurance premiums, improved driver behavior, and enhanced operational efficiency is clearly demonstrable. Technological disruptions, such as the increasing sophistication of AI-powered driver behavior analysis and advanced accident reconstruction capabilities, are creating new avenues for value creation. Consumer behavior shifts are also playing a crucial role, with a growing demand for greater transparency and safety in transportation services. For example, passenger car owners are increasingly adopting integrated dash cam and telematics solutions for personal safety and insurance purposes. The market penetration of video telematics solutions in the heavy truck segment is estimated to reach XX% by 2025, showcasing its substantial impact. Furthermore, the integration of telematics data with other business intelligence tools is enabling fleets to optimize routes, manage fuel consumption more effectively, and improve overall asset utilization. The increasing focus on ESG (Environmental, Social, and Governance) factors is also driving demand for telematics solutions that can monitor and report on sustainable driving practices and vehicle emissions. The development of 5G technology is further poised to enhance the real-time data transmission capabilities, enabling more sophisticated and immediate insights.

Dominant Regions, Countries, or Segments in Video Telematics Market

The North America region is currently the dominant force in the Video Telematics Market, driven by stringent safety regulations, a high adoption rate of advanced fleet management technologies, and a mature commercial transportation infrastructure. Within North America, the United States spearheads this dominance due to its extensive logistics network and proactive adoption of telematics solutions across various vehicle types. The market share for video telematics in the U.S. commercial vehicle segment is estimated to be around XX%.

Key Drivers of Dominance in North America:

- Stringent Safety Regulations: Mandates for driver safety and Hours of Service (HOS) compliance, such as those from the FMCSA, strongly encourage telematics adoption.

- Economic Policies: Government incentives and policies promoting efficient transportation and logistics operations.

- Infrastructure: Well-developed road networks and a large existing fleet size across trucking, buses, and LCVs.

- Technological Advancement: High receptiveness to adopting new technologies, including AI-powered video analytics, for competitive advantage.

- Insurance Premiums: The significant cost of insurance for commercial vehicles incentivizes the use of telematics for risk reduction.

Among the Segments, Heavy Trucks represent the largest application area, accounting for approximately XX% of the total market revenue in 2025. This segment's dominance is attributed to the critical need for real-time monitoring, driver behavior management, route optimization, and cargo security in long-haul and freight operations. The regulatory landscape for commercial trucks also heavily favors telematics solutions.

LCVs (Light Commercial Vehicles) are emerging as a rapidly growing segment, driven by the expansion of last-mile delivery services and the increasing adoption of telematics by small and medium-sized businesses (SMBs) to enhance efficiency and customer service. The passenger car segment is also witnessing significant growth, fueled by consumer interest in safety features, accident recording, and anti-theft capabilities.

Regarding Type, Integrated Systems are progressively gaining market share over standalone systems. This trend is driven by the desire for a unified platform that combines GPS tracking, video recording, driver behavior monitoring, and fleet management functionalities, offering a more comprehensive and cost-effective solution for end-users.

Video Telematics Market Product Landscape

The Video Telematics Market is witnessing a surge in innovative product development, focusing on enhanced AI capabilities, improved video resolution, and seamless integration with existing fleet management ecosystems. Key product innovations include advanced driver-assistance systems (ADAS) integration, real-time driver coaching, and AI-powered incident detection that goes beyond simple impact detection to analyze pre- and post-incident behaviors. Performance metrics are increasingly evaluated based on the accuracy of AI algorithms in identifying distracted driving, fatigue, and other risky behaviors, as well as the clarity and retention of video footage for accident reconstruction and dispute resolution. Unique selling propositions often revolve around the robustness of the hardware, the user-friendliness of the software interface, and the comprehensive nature of the data analytics provided. For instance, dual-facing cameras offering both road and cabin views are becoming standard, providing a holistic view of driver actions and road conditions.

Key Drivers, Barriers & Challenges in Video Telematics Market

Key Drivers:

- Enhanced Driver Safety: The primary catalyst is the imperative to reduce accidents and improve driver well-being through real-time monitoring and alerts.

- Operational Efficiency: Telematics enables optimized routing, fuel management, and improved asset utilization, leading to cost savings.

- Regulatory Compliance: Adherence to HOS regulations and other safety mandates drives adoption, especially in commercial sectors.

- Insurance Cost Reduction: Lower premiums are a significant incentive for fleets investing in safety technologies.

- Technological Advancements: The integration of AI, ML, and IoT enhances data analysis and predictive capabilities.

Barriers & Challenges:

- High Initial Investment Costs: The upfront expenditure for hardware and software can be a hurdle for smaller businesses.

- Data Privacy Concerns: Managing and securing sensitive driver and vehicle data is a critical concern for both providers and users.

- Integration Complexity: Seamlessly integrating telematics data with existing enterprise systems can be challenging.

- Driver Acceptance and Training: Overcoming driver resistance to being monitored and providing adequate training is crucial.

- Connectivity Issues: In areas with poor cellular coverage, real-time data transmission can be affected, impacting the effectiveness of solutions. The global market faces an estimated XX% potential disruption due to unreliable connectivity in remote regions.

Emerging Opportunities in Video Telematics Market

Emerging opportunities in the Video Telematics Market lie in the expansion into new geographical markets, particularly in developing economies where fleet modernization is gaining momentum. The increasing demand for AI-driven predictive maintenance solutions, leveraging telematics data to anticipate vehicle failures, presents a significant growth avenue. Furthermore, the integration of video telematics with smart city initiatives, enabling better traffic management and public transport optimization, is an untapped market. The growing trend of electric vehicle (EV) fleets opens up opportunities for telematics solutions that can monitor battery health, charging patterns, and range, alongside traditional safety features. The rise of the gig economy and the need for efficient management of independent contractor fleets also create a niche for flexible and scalable video telematics solutions.

Growth Accelerators in the Video Telematics Market Industry

Several key catalysts are propelling the long-term growth of the Video Telematics Market. Technological breakthroughs, such as the miniaturization of advanced sensor technology and the development of more powerful on-board processing units, are enabling more sophisticated and cost-effective solutions. Strategic partnerships between telematics providers, automotive OEMs, and insurance companies are expanding market reach and product integration. For example, collaborations with OEMs ensure seamless integration at the vehicle manufacturing stage. Market expansion strategies, including the development of tailored solutions for specific industry verticals like construction, agriculture, and public safety, are unlocking new revenue streams. The continuous evolution of AI algorithms for driver behavior analysis and accident prediction is a significant growth accelerator, making these solutions increasingly indispensable for proactive risk management.

Key Players Shaping the Video Telematics Market Market

- Geotab Inc.

- Trimble Transportation (Trimble Inc.)

- NetraDyne Inc.

- LightMetrics Inc.

- Micronet Ltd

- MiX Telematics Ltd

- Motive Technologies Inc.

- Lytx Inc.

- Samsara Inc.

- Howen Technologies Co Ltd

- SureCam (Europe) Limited

- PFK Electronics

- Octo Group SpA

- Nauto Inc.

- Omnitracs (Solera Holdings Inc.)

- VisionTrack

- One Step GPS LLC

- Verizon Connect (Verizon Communications Inc.)

- FleetCam (Pty) Ltd

- Fleet Complete Inc.

- Streamax Technology Co Ltd

- Garmin Lt

- Blackvue (Pittasoft Co Ltd)

- SmartWitness (Sensata Technologies)

- AT&T Inc.

Notable Milestones in Video Telematics Market Sector

- October 2023: NetraDyne Inc. announced the launch of its Driver•i One solution, establishing the company as a full telematics solution and ELD provider. Netradyne’s Driver•i One fleet safety solution is a robust, professional-grade video telematics device designed to deliver critical data for diverse fleet needs.

- September 2023: Geotab Inc. announced the beta launch of Project G, a new industry standard empowering Australian customers with effortless access to on-demand insights on vehicle performance, efficiency, and sustainability. Project G is built on privacy-by-design principles, ensuring all customer telematics data remains within Geotab’s environment and is never shared with any Large Language Model (LLM).

In-Depth Video Telematics Market Market Outlook

The Video Telematics Market is poised for sustained and accelerated growth, driven by its proven ability to enhance safety, optimize operations, and ensure regulatory compliance. The increasing adoption of AI and ML technologies will further elevate the intelligence and predictive capabilities of these systems, moving beyond mere data collection to proactive risk management. Strategic partnerships and technological advancements in sensor technology and data analytics will continue to fuel innovation and expand market reach. The growing global awareness of ESG factors will also incentivize the deployment of telematics solutions for monitoring and reporting on sustainable transportation practices. Untapped markets in emerging economies, coupled with the evolving needs of industries such as last-mile delivery and EV fleets, present significant expansion opportunities. The future outlook is exceptionally positive, with the market set to become an indispensable component of modern vehicle management and safety protocols.

Video Telematics Market Segmentation

-

1. Type

- 1.1. Integrated Systems

- 1.2. Standalone Systems

-

2. Application

- 2.1. Buses

- 2.2. Heavy Trucks

- 2.3. LCVs

- 2.4. Passenger Cars

Video Telematics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Video Telematics Market Regional Market Share

Geographic Coverage of Video Telematics Market

Video Telematics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Adoption of Fleet Telematics; Increasing Emphasis on Safety and Compliance Management; Increasing IoT

- 3.2.2 AI

- 3.2.3 and Machine Learning Based Solutions for Video Intelligence

- 3.3. Market Restrains

- 3.3.1. High Cost and Competition from Flexible Plastic Technologies

- 3.4. Market Trends

- 3.4.1. LCVs to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Video Telematics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Integrated Systems

- 5.1.2. Standalone Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Buses

- 5.2.2. Heavy Trucks

- 5.2.3. LCVs

- 5.2.4. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Video Telematics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Integrated Systems

- 6.1.2. Standalone Systems

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Buses

- 6.2.2. Heavy Trucks

- 6.2.3. LCVs

- 6.2.4. Passenger Cars

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Video Telematics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Integrated Systems

- 7.1.2. Standalone Systems

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Buses

- 7.2.2. Heavy Trucks

- 7.2.3. LCVs

- 7.2.4. Passenger Cars

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Video Telematics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Integrated Systems

- 8.1.2. Standalone Systems

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Buses

- 8.2.2. Heavy Trucks

- 8.2.3. LCVs

- 8.2.4. Passenger Cars

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Video Telematics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Integrated Systems

- 9.1.2. Standalone Systems

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Buses

- 9.2.2. Heavy Trucks

- 9.2.3. LCVs

- 9.2.4. Passenger Cars

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Video Telematics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Integrated Systems

- 10.1.2. Standalone Systems

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Buses

- 10.2.2. Heavy Trucks

- 10.2.3. LCVs

- 10.2.4. Passenger Cars

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Geotab Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trimble Transportation (Trimble Inc )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NetraDyne Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LightMetrics Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Micronet Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MiX Telematics Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Motive Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lytx Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsara Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Howen Technologies Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SureCam (Europe) Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PFK Electronics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Octo Group SpA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nauto Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Omnitracs (Solera Holdings Inc )

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 VisionTrack

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 One Step GPS LLC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Verizon Connect (Verizon Communications Inc )

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 FleetCam (Pty) Ltd

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Fleet Complete Inc

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Streamax Technology Co Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Garmin Lt

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Blackvue (Pittasoft Co Ltd)

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 SmartWitness (Sensata Technologies)

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 AT&T Inc

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Geotab Inc

List of Figures

- Figure 1: Global Video Telematics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Video Telematics Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America Video Telematics Market Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Video Telematics Market Volume (Million), by Type 2025 & 2033

- Figure 5: North America Video Telematics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Video Telematics Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Video Telematics Market Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Video Telematics Market Volume (Million), by Application 2025 & 2033

- Figure 9: North America Video Telematics Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Video Telematics Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Video Telematics Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Video Telematics Market Volume (Million), by Country 2025 & 2033

- Figure 13: North America Video Telematics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Video Telematics Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Video Telematics Market Revenue (billion), by Type 2025 & 2033

- Figure 16: Europe Video Telematics Market Volume (Million), by Type 2025 & 2033

- Figure 17: Europe Video Telematics Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Video Telematics Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Video Telematics Market Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Video Telematics Market Volume (Million), by Application 2025 & 2033

- Figure 21: Europe Video Telematics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Video Telematics Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Video Telematics Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Video Telematics Market Volume (Million), by Country 2025 & 2033

- Figure 25: Europe Video Telematics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Video Telematics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Video Telematics Market Revenue (billion), by Type 2025 & 2033

- Figure 28: Asia Video Telematics Market Volume (Million), by Type 2025 & 2033

- Figure 29: Asia Video Telematics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Video Telematics Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Video Telematics Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Video Telematics Market Volume (Million), by Application 2025 & 2033

- Figure 33: Asia Video Telematics Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Video Telematics Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Video Telematics Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Video Telematics Market Volume (Million), by Country 2025 & 2033

- Figure 37: Asia Video Telematics Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Video Telematics Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Video Telematics Market Revenue (billion), by Type 2025 & 2033

- Figure 40: Latin America Video Telematics Market Volume (Million), by Type 2025 & 2033

- Figure 41: Latin America Video Telematics Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Latin America Video Telematics Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Latin America Video Telematics Market Revenue (billion), by Application 2025 & 2033

- Figure 44: Latin America Video Telematics Market Volume (Million), by Application 2025 & 2033

- Figure 45: Latin America Video Telematics Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Latin America Video Telematics Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Latin America Video Telematics Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Latin America Video Telematics Market Volume (Million), by Country 2025 & 2033

- Figure 49: Latin America Video Telematics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Video Telematics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Video Telematics Market Revenue (billion), by Type 2025 & 2033

- Figure 52: Middle East and Africa Video Telematics Market Volume (Million), by Type 2025 & 2033

- Figure 53: Middle East and Africa Video Telematics Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Video Telematics Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Video Telematics Market Revenue (billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Video Telematics Market Volume (Million), by Application 2025 & 2033

- Figure 57: Middle East and Africa Video Telematics Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Video Telematics Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Video Telematics Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Video Telematics Market Volume (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Video Telematics Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Video Telematics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Video Telematics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Video Telematics Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Global Video Telematics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Video Telematics Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Global Video Telematics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Video Telematics Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Video Telematics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Video Telematics Market Volume Million Forecast, by Type 2020 & 2033

- Table 9: Global Video Telematics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Video Telematics Market Volume Million Forecast, by Application 2020 & 2033

- Table 11: Global Video Telematics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Video Telematics Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: Global Video Telematics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Video Telematics Market Volume Million Forecast, by Type 2020 & 2033

- Table 15: Global Video Telematics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Video Telematics Market Volume Million Forecast, by Application 2020 & 2033

- Table 17: Global Video Telematics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Video Telematics Market Volume Million Forecast, by Country 2020 & 2033

- Table 19: Global Video Telematics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Video Telematics Market Volume Million Forecast, by Type 2020 & 2033

- Table 21: Global Video Telematics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Video Telematics Market Volume Million Forecast, by Application 2020 & 2033

- Table 23: Global Video Telematics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Video Telematics Market Volume Million Forecast, by Country 2020 & 2033

- Table 25: Global Video Telematics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Video Telematics Market Volume Million Forecast, by Type 2020 & 2033

- Table 27: Global Video Telematics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Video Telematics Market Volume Million Forecast, by Application 2020 & 2033

- Table 29: Global Video Telematics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Video Telematics Market Volume Million Forecast, by Country 2020 & 2033

- Table 31: Global Video Telematics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Video Telematics Market Volume Million Forecast, by Type 2020 & 2033

- Table 33: Global Video Telematics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Video Telematics Market Volume Million Forecast, by Application 2020 & 2033

- Table 35: Global Video Telematics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Video Telematics Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Video Telematics Market?

The projected CAGR is approximately 17.8%.

2. Which companies are prominent players in the Video Telematics Market?

Key companies in the market include Geotab Inc, Trimble Transportation (Trimble Inc ), NetraDyne Inc, LightMetrics Inc, Micronet Ltd, MiX Telematics Ltd, Motive Technologies Inc, Lytx Inc, Samsara Inc, Howen Technologies Co Ltd, SureCam (Europe) Limited, PFK Electronics, Octo Group SpA, Nauto Inc, Omnitracs (Solera Holdings Inc ), VisionTrack, One Step GPS LLC, Verizon Connect (Verizon Communications Inc ), FleetCam (Pty) Ltd, Fleet Complete Inc, Streamax Technology Co Ltd, Garmin Lt, Blackvue (Pittasoft Co Ltd), SmartWitness (Sensata Technologies), AT&T Inc.

3. What are the main segments of the Video Telematics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Fleet Telematics; Increasing Emphasis on Safety and Compliance Management; Increasing IoT. AI. and Machine Learning Based Solutions for Video Intelligence.

6. What are the notable trends driving market growth?

LCVs to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost and Competition from Flexible Plastic Technologies.

8. Can you provide examples of recent developments in the market?

October 2023 - NetraDyne Inc. announced the launch of its Driver•i One solution, making the company a full telematics solution and ELD provider. Netradyne’s Driver•i One fleet safety solution is a robust, professional-grade video telematics device that can deliver data to power many of the solutions that fleets need.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Video Telematics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Video Telematics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Video Telematics Market?

To stay informed about further developments, trends, and reports in the Video Telematics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence