Key Insights

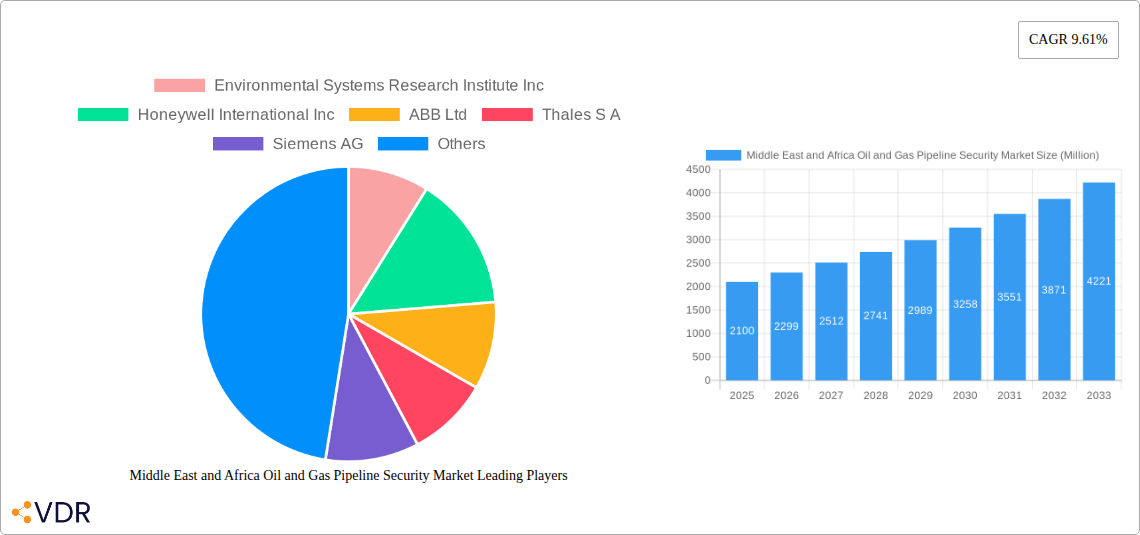

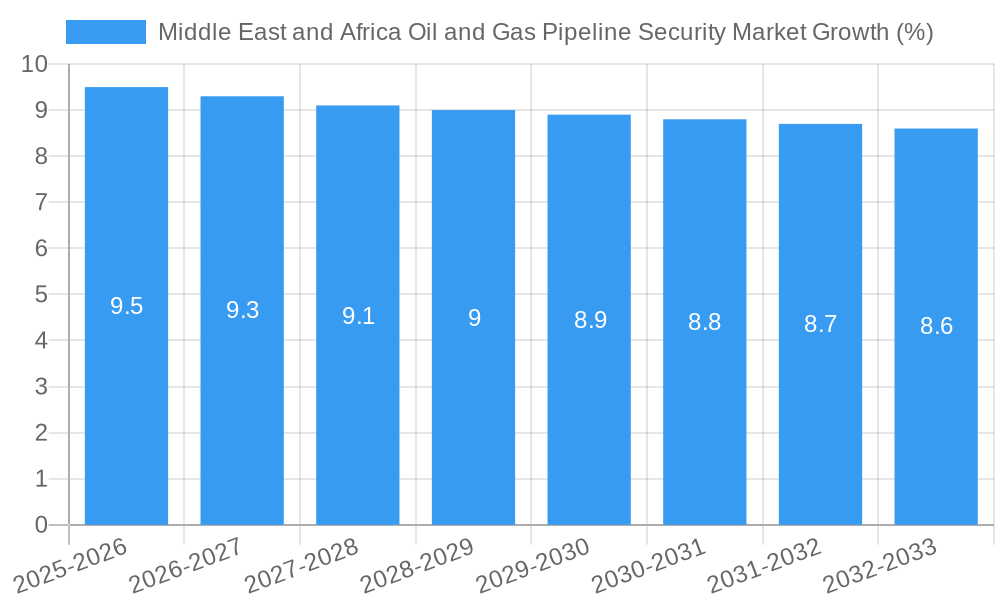

The Middle East and Africa (MEA) Oil and Gas Pipeline Security Market is poised for significant expansion, projected to reach $2.10 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 9.61%. This growth is primarily propelled by an increasing reliance on oil and gas as primary energy sources across the region, necessitating enhanced security measures to safeguard critical infrastructure. The escalating geopolitical tensions and the threat of sabotage, terrorism, and theft are key drivers compelling energy companies and governments to invest heavily in advanced security solutions. Furthermore, the growing emphasis on operational efficiency and the need to minimize revenue loss due to pipeline breaches are fueling the adoption of sophisticated technologies. The market's trajectory suggests a strong demand for a comprehensive range of solutions, from advanced surveillance and detection systems to robust control and monitoring platforms, ensuring the uninterrupted flow of vital energy resources.

The market is segmented into diverse product categories, with Crude Oil and Natural Gas pipelines commanding a substantial share due to their widespread presence and critical economic importance. Hazardous liquid pipelines and chemical transport also represent a growing segment as industrialization intensifies across MEA. Technologically, Unmanned Aerial Systems (UAS) are emerging as a transformative force, offering cost-effective and efficient surveillance capabilities. Perimeter security solutions, Electric-Optic Systems, and Ground Sensors are also integral to fortifying pipeline networks. The increasing adoption of PIG Location Monitoring and Sub-Aqua Systems underscores the industry's commitment to proactive leak detection and intervention. Leading companies such as Honeywell International Inc., Siemens AG, and Thales S.A. are at the forefront, offering innovative solutions that cater to the unique security challenges of the MEA region. The Middle Eastern sub-segment, particularly Saudi Arabia and the United Arab Emirates, is expected to lead the market due to substantial investments in energy infrastructure and heightened security concerns.

This report provides an in-depth analysis of the Middle East and Africa (MEA) Oil and Gas Pipeline Security Market, a critical sector for ensuring the safe and reliable transportation of vital energy resources. The MEA region, a global powerhouse in oil and gas production, faces unique security challenges due to its vast pipeline networks, geopolitical complexities, and evolving technological landscape. This study meticulously examines market dynamics, growth trends, dominant segments, product innovations, key drivers, emerging opportunities, and the competitive landscape, offering strategic insights for stakeholders. The market is segmented by Products including Natural Gas, Crude Oil, Hazardous Liquid Pipelines/Chemicals, Water, and Other Products. Furthermore, the Technology and Solutions segment is analyzed, encompassing Unmanned Aerial Systems, Perimeter Security, Electric-Optic Systems, Ground Sensors, PIG Location Monitoring, Sub-Aqua Systems, Video Surveillance, Control Systems, and Other Technology and Solutions.

The report covers a comprehensive Study Period of 2019–2033, with Base Year 2025 and Estimated Year 2025, followed by a detailed Forecast Period of 2025–2033 and an analysis of the Historical Period from 2019–2024. The projected Middle East and Africa Oil and Gas Pipeline Security Market is expected to reach US$ XX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is driven by increasing investments in pipeline infrastructure, the rising threat of security breaches, and the adoption of advanced security technologies.

Middle East and Africa Oil and Gas Pipeline Security Market Dynamics & Structure

The MEA Oil and Gas Pipeline Security Market is characterized by a moderate level of market concentration, with a few dominant players holding significant market shares. Technological innovation is a primary driver, fueled by the constant need for more sophisticated solutions to counter evolving threats. Regulatory frameworks, though varying across countries, are increasingly emphasizing stringent security protocols for critical energy infrastructure, thereby influencing market adoption. Competitive product substitutes are emerging, particularly in the areas of advanced sensor technologies and AI-powered surveillance systems. End-user demographics are diverse, ranging from national oil companies to international energy corporations, each with specific security requirements. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Moderately concentrated with key players like Honeywell International Inc. and Siemens AG holding substantial influence.

- Technological Innovation Drivers: Need for real-time threat detection, prevention of physical and cyber attacks, and efficient pipeline integrity monitoring.

- Regulatory Frameworks: Increasing government mandates for pipeline security, anti-terrorism measures, and environmental protection compliance.

- Competitive Product Substitutes: Advancements in AI-driven analytics, IoT sensors, and drone surveillance offer alternatives to traditional security systems.

- End-User Demographics: National oil companies (NOCs), International Oil Companies (IOCs), midstream operators, and petrochemical industries.

- M&A Trends: Strategic acquisitions to bolster offerings in areas like cybersecurity, perimeter intrusion detection, and advanced monitoring solutions. For instance, a potential M&A activity in the region for US$ XX Million in 2023 highlights consolidation efforts.

Middle East and Africa Oil and Gas Pipeline Security Market Growth Trends & Insights

The MEA Oil and Gas Pipeline Security Market is experiencing significant growth, propelled by escalating security concerns and substantial investments in the region's vast energy infrastructure. The market size is projected to expand from US$ XX Million in 2025 to US$ XX Million by 2033, with a projected CAGR of XX%. Adoption rates for advanced security solutions, including integrated surveillance systems and intelligent intrusion detection, are on the rise as companies prioritize proactive threat mitigation. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into video analytics and sensor networks, are enhancing detection accuracy and response times. Consumer behavior shifts are evident, with a growing preference for comprehensive, end-to-end security solutions that offer real-time monitoring, anomaly detection, and rapid incident response capabilities. The increasing focus on cybersecurity alongside physical security further accentuates this trend. Market penetration of specialized security technologies is accelerating, driven by the critical need to safeguard critical energy assets from physical sabotage, theft, and cyber threats.

The region's strategic importance as a global energy supplier necessitates robust security measures. The ongoing expansion of oil and gas exploration and production activities, coupled with the construction of new pipeline networks, directly fuels the demand for advanced security systems. For example, the development of new natural gas pipelines, spanning thousands of kilometers, requires sophisticated monitoring and protection strategies. Furthermore, the increasing geopolitical tensions and the rise of sophisticated cyber threats compel operators to invest in multi-layered security approaches. The market is also influenced by the growing adoption of cloud-based security platforms, which offer scalability, remote access, and enhanced data analytics capabilities, thereby improving operational efficiency and security posture. The demand for specialized solutions like PIG Location Monitoring systems to ensure pipeline integrity and prevent leaks is also a significant growth driver.

Dominant Regions, Countries, or Segments in Middle East and Africa Oil and Gas Pipeline Security Market

The Natural Gas segment is emerging as a dominant force within the MEA Oil and Gas Pipeline Security Market, driven by substantial regional reserves and increasing global demand. This dominance is further amplified by the ongoing development of extensive natural gas pipeline networks aimed at both domestic consumption and international export, as exemplified by the Africa-Atlantic gas pipeline initiative. The Crude Oil segment also remains a cornerstone of the market, with established infrastructure and continuous production activities.

Within the Technology and Solutions segment, Perimeter Security and Video Surveillance are currently leading the charge. These foundational technologies are critical for establishing an initial layer of defense and providing visual confirmation of security events. However, significant growth is anticipated in Unmanned Aerial Systems (UAS) for aerial surveillance and inspection, and Electric-Optic Systems, including fiber optic sensors, for early detection of ground disturbances and leaks.

- Dominant Product Segment: Natural Gas pipelines are experiencing accelerated growth due to new infrastructure projects and increasing export capabilities.

- Key Drivers: Growing global demand for LNG, strategic regional reserves, and government initiatives promoting gas utilization.

- Market Share: Estimated to account for XX% of the total product segment by 2033.

- Dominant Technology Segment: Perimeter Security and Video Surveillance systems form the backbone of current pipeline security, offering essential detection and monitoring capabilities.

- Key Drivers: Established industry practice, proven effectiveness in detecting unauthorized access, and integration with other security systems.

- Market Share: These segments collectively hold an estimated XX% of the technology and solutions market in 2025.

- Emerging Technology Segment: Unmanned Aerial Systems (UAS) and Electric-Optic Systems are projected for rapid growth.

- Key Drivers: UAS offer cost-effective aerial surveillance and inspection, while electric-optic systems provide highly sensitive and non-intrusive detection of anomalies along pipelines.

- Growth Potential: Expected CAGR of XX% for UAS and XX% for Electric-Optic Systems between 2025 and 2033.

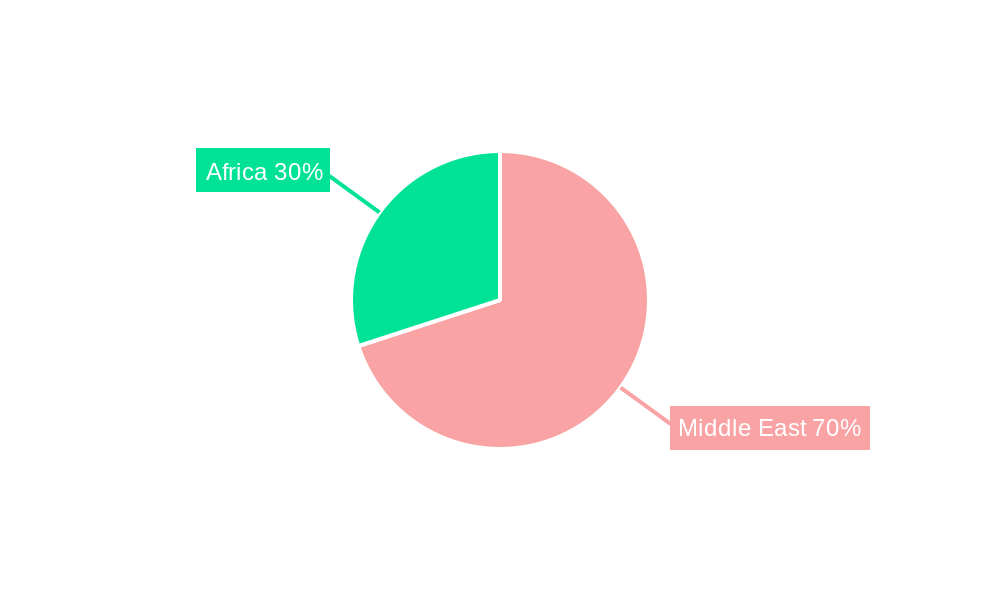

- Geographical Dominance: The Middle East region, particularly countries like Saudi Arabia, UAE, and Qatar, currently dominates due to their extensive oil and gas infrastructure and significant investments in security. However, countries in North Africa are expected to see substantial growth due to planned pipeline projects.

Middle East and Africa Oil and Gas Pipeline Security Market Product Landscape

The MEA Oil and Gas Pipeline Security Market product landscape is characterized by continuous innovation aimed at enhancing detection capabilities, reducing false alarms, and enabling faster response times. Products range from robust Perimeter Security systems, employing technologies like fence-mounted sensors and microwave barriers, to advanced Video Surveillance solutions integrated with AI-powered analytics for anomaly detection. Electric-Optic Systems, particularly fiber optic sensing, offer unparalleled sensitivity for detecting ground vibrations, pressure changes, and temperature anomalies along pipeline routes. The growing adoption of Unmanned Aerial Systems (UAS) provides aerial reconnaissance and monitoring, complementing ground-based security. Solutions for PIG Location Monitoring are crucial for maintaining pipeline integrity and preventing operational disruptions.

Key Drivers, Barriers & Challenges in Middle East and Africa Oil and Gas Pipeline Security Market

Key Drivers: The primary forces propelling the MEA Oil and Gas Pipeline Security Market include the escalating threats of sabotage, theft, and terrorism targeting critical energy infrastructure. Significant government investments in expanding and modernizing pipeline networks across the region are a major catalyst. The increasing adoption of advanced technologies like AI, IoT, and drone surveillance to enhance threat detection and response capabilities also plays a crucial role. Furthermore, stricter regulatory compliance mandates for pipeline security and environmental protection are driving demand for sophisticated solutions.

Barriers & Challenges: Despite robust growth, the market faces several challenges. High initial implementation costs for advanced security systems can be a significant barrier, especially for smaller operators. The complex geopolitical landscape and varying regulatory frameworks across different countries can create operational hurdles and compliance complexities. Supply chain disruptions and the availability of skilled personnel to operate and maintain sophisticated security technologies also pose challenges. Intense competition among security solution providers can lead to pricing pressures, impacting profit margins. The threat of cyberattacks on operational technology (OT) within pipeline control systems presents a growing and complex challenge.

Emerging Opportunities in Middle East and Africa Oil and Gas Pipeline Security Market

Emerging opportunities within the MEA Oil and Gas Pipeline Security Market lie in the increasing demand for integrated security solutions that combine physical and cybersecurity. The development of smart pipeline technologies, leveraging IoT and AI for predictive maintenance and anomaly detection, presents a significant growth avenue. The growing focus on environmental protection is also creating opportunities for security solutions that can detect and prevent leaks and spills. Untapped markets in certain African nations with developing oil and gas sectors offer substantial potential for market entry and expansion. The rise of digital twins for pipeline simulation and security planning also represents an innovative application area.

Growth Accelerators in the Middle East and Africa Oil and Gas Pipeline Security Market Industry

Catalysts driving long-term growth in the MEA Oil and Gas Pipeline Security Market include ongoing technological breakthroughs in areas such as advanced radar systems, acoustic sensors, and biometrics for access control. Strategic partnerships between technology providers, security firms, and energy companies are crucial for developing and deploying comprehensive security solutions. Market expansion strategies focused on underserved regions within Africa, coupled with the increasing demand for secure energy transportation routes to global markets, are set to accelerate growth. The continued digitalization of the oil and gas sector, including the adoption of Industry 4.0 principles, will further necessitate and enable more sophisticated pipeline security measures.

Key Players Shaping the Middle East and Africa Oil and Gas Pipeline Security Market Market

- Environmental Systems Research Institute Inc.

- Honeywell International Inc.

- ABB Ltd

- Thales S A

- Siemens AG

- General Electric Co.

- GE Grid Solutions SPA

- SkyWave Mobile Communications Inc.

- Huawei Technologies Co Ltd

- SightLogix Inc.

- Senstar Corporation

- Future Fiber Technologies Ltd

- Optasens Ltd

- Bae Systems Inc.

Notable Milestones in Middle East and Africa Oil and Gas Pipeline Security Market Sector

- August 2023: A new agreement to invest in the construction of the Africa-Atlantic gas pipeline has been signed between Morocco and the United Arab Emirates to transport gas from Nigeria to North Africa and ultimately to Europe. This shows the commitment of UAE to support and is expected to promote economic integration and energy security in West Africa.

- February 2023: General Electric Co. stated that Amazon Web Services, Inc. (AWS) had inked a multi-year strategic collaboration agreement to assist utilities with accelerating grid modernization. GE Digital and AWS intend to provide solutions for intelligent grid orchestration through this partnership. These software products will aid in the digital transformation of utilities, the power grid's modernization, and the energy transition's acceleration.

In-Depth Middle East and Africa Oil and Gas Pipeline Security Market Market Outlook

- August 2023: A new agreement to invest in the construction of the Africa-Atlantic gas pipeline has been signed between Morocco and the United Arab Emirates to transport gas from Nigeria to North Africa and ultimately to Europe. This shows the commitment of UAE to support and is expected to promote economic integration and energy security in West Africa.

- February 2023: General Electric Co. stated that Amazon Web Services, Inc. (AWS) had inked a multi-year strategic collaboration agreement to assist utilities with accelerating grid modernization. GE Digital and AWS intend to provide solutions for intelligent grid orchestration through this partnership. These software products will aid in the digital transformation of utilities, the power grid's modernization, and the energy transition's acceleration.

In-Depth Middle East and Africa Oil and Gas Pipeline Security Market Market Outlook

The future outlook for the MEA Oil and Gas Pipeline Security Market is exceptionally strong, driven by a confluence of factors including escalating security imperatives, continuous infrastructure development, and rapid technological advancements. Growth accelerators such as the increasing demand for integrated physical and cybersecurity solutions, alongside the adoption of AI and IoT for intelligent pipeline management, will shape the market's trajectory. Strategic collaborations and partnerships are expected to play a vital role in delivering comprehensive and customized security offerings. The untapped potential in various African nations and the global demand for MEA's energy resources will further fuel market expansion. Stakeholders can anticipate a dynamic market landscape characterized by innovation and strategic investments aimed at ensuring the secure and uninterrupted flow of vital energy commodities.

Middle East and Africa Oil and Gas Pipeline Security Market Segmentation

-

1. Products

- 1.1. Natural Gas

- 1.2. Crude Oil

- 1.3. Hazardous Liquid Pipelines/Chemicals

- 1.4. Water

- 1.5. Other Products

-

2. Technology and Solutions

- 2.1. Unmanned Aerial Systems

- 2.2. Perimeter Security

- 2.3. Electric-Optic Systems

- 2.4. Ground Sensors

- 2.5. PIG Location Monitoring

- 2.6. Sub-Aqua Systems

- 2.7. Video Surveillance

- 2.8. Control Systems

- 2.9. Other Technology and Solutions

Middle East and Africa Oil and Gas Pipeline Security Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Oil and Gas Pipeline Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending by Oil and Gas Companies for Reliable Protected Networks; Increased demand for natural gas and the upgradation of refineries; Rising Political Instability in the Region; Pipelines for the Transportation of Crude Oils to Drive the Demand

- 3.3. Market Restrains

- 3.3.1. High Installation & Maintenance Cost; Distributed Site Locations

- 3.4. Market Trends

- 3.4.1. Pipelines to Transport Crude Oil to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Natural Gas

- 5.1.2. Crude Oil

- 5.1.3. Hazardous Liquid Pipelines/Chemicals

- 5.1.4. Water

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Technology and Solutions

- 5.2.1. Unmanned Aerial Systems

- 5.2.2. Perimeter Security

- 5.2.3. Electric-Optic Systems

- 5.2.4. Ground Sensors

- 5.2.5. PIG Location Monitoring

- 5.2.6. Sub-Aqua Systems

- 5.2.7. Video Surveillance

- 5.2.8. Control Systems

- 5.2.9. Other Technology and Solutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. South Africa Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Environmental Systems Research Institute Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ABB Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Thales S A

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 General Electric Co

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GE Grid Solutions SPA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SkyWave Mobile Communications Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Huawei Technologies Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SightLogix Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Senstar Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Future Fiber Technologies Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Optasens Ltd

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Bae Systems Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Environmental Systems Research Institute Inc

List of Figures

- Figure 1: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Oil and Gas Pipeline Security Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Products 2019 & 2032

- Table 3: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Technology and Solutions 2019 & 2032

- Table 4: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Products 2019 & 2032

- Table 13: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Technology and Solutions 2019 & 2032

- Table 14: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Saudi Arabia Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Israel Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Qatar Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Kuwait Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Oman Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bahrain Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Jordan Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Lebanon Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Oil and Gas Pipeline Security Market?

The projected CAGR is approximately 9.61%.

2. Which companies are prominent players in the Middle East and Africa Oil and Gas Pipeline Security Market?

Key companies in the market include Environmental Systems Research Institute Inc, Honeywell International Inc, ABB Ltd, Thales S A, Siemens AG, General Electric Co, GE Grid Solutions SPA, SkyWave Mobile Communications Inc, Huawei Technologies Co Ltd, SightLogix Inc, Senstar Corporation, Future Fiber Technologies Ltd, Optasens Ltd, Bae Systems Inc.

3. What are the main segments of the Middle East and Africa Oil and Gas Pipeline Security Market?

The market segments include Products, Technology and Solutions.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending by Oil and Gas Companies for Reliable Protected Networks; Increased demand for natural gas and the upgradation of refineries; Rising Political Instability in the Region; Pipelines for the Transportation of Crude Oils to Drive the Demand.

6. What are the notable trends driving market growth?

Pipelines to Transport Crude Oil to Drive the Demand.

7. Are there any restraints impacting market growth?

High Installation & Maintenance Cost; Distributed Site Locations.

8. Can you provide examples of recent developments in the market?

August 2023 - A new agreement to invest in the construction of the Africa-Atlantic gas pipeline has been signed between Morocco and the United Arab Emirates to transport gas from Nigeria to North Africa and ultimately to Europe. This shows the commitment of UAE to support and is expected to promote economic integration and energy security in West Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Oil and Gas Pipeline Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Oil and Gas Pipeline Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Oil and Gas Pipeline Security Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Oil and Gas Pipeline Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence