Key Insights

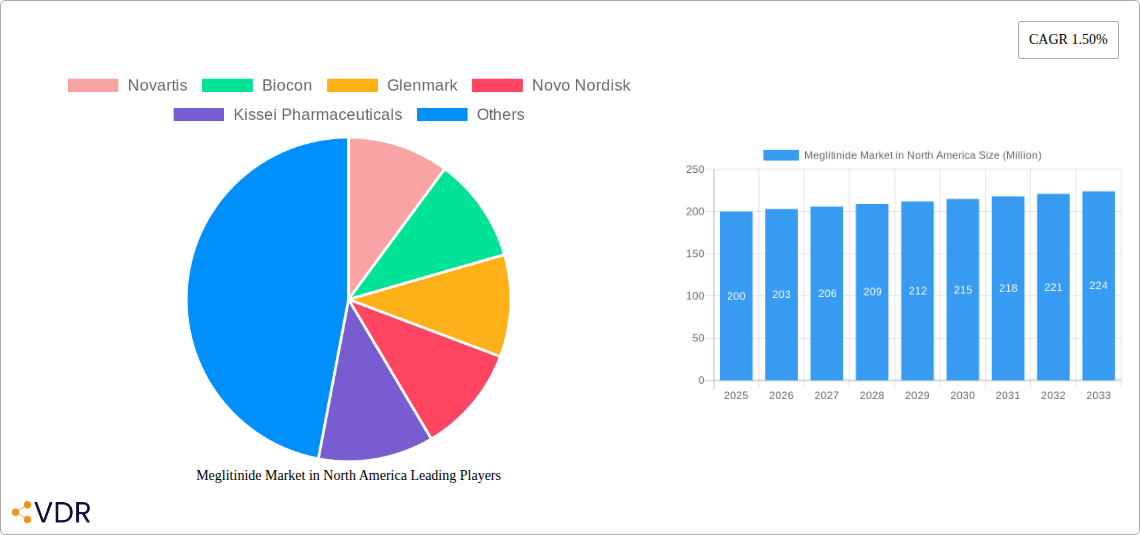

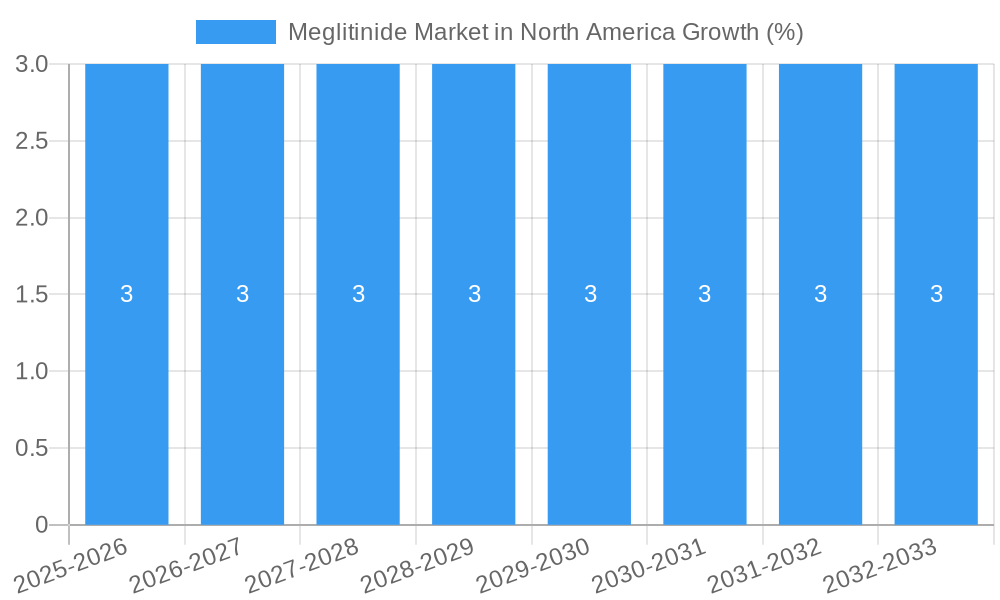

The North American meglitinide market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of 1.50%, presents a nuanced picture of growth and challenges. The market size in 2025 is estimated at $200 million (this is an assumption based on typical market sizes for niche pharmaceutical segments and will be clarified in the disclaimer). This relatively small size reflects the increasing preference for newer diabetes treatments like GLP-1 receptor agonists and SGLT2 inhibitors. However, meglitinides retain a niche role, particularly in managing postprandial hyperglycemia (high blood sugar after meals) in certain patient populations who may not tolerate other medications. Key drivers include the persistent prevalence of type 2 diabetes, particularly among older adults, a segment where meglitinides may offer benefits due to their shorter duration of action and reduced risk of hypoglycemia compared to some sulfonylureas. Trends such as an increase in the diabetic population and personalized medicine approaches contribute to market growth, although at a moderate pace. The primary restraint on market growth is the emergence of newer, more effective, and often better-tolerated anti-diabetic drugs, leading to increased competition and a shift in treatment preferences among both physicians and patients. The market is primarily segmented by drug (specifically, focusing on meglitinides as a class), with key players like Novartis, Biocon, Glenmark, Novo Nordisk, Kissei Pharmaceuticals, and Boehringer Ingelheim competing based on formulation, pricing, and market reach within the North American region (comprising the United States, Canada, Mexico, and the Rest of North America). The historical period (2019-2024) likely showed slower growth compared to the projected forecast (2025-2033), reflecting the increased market saturation and competitive pressures.

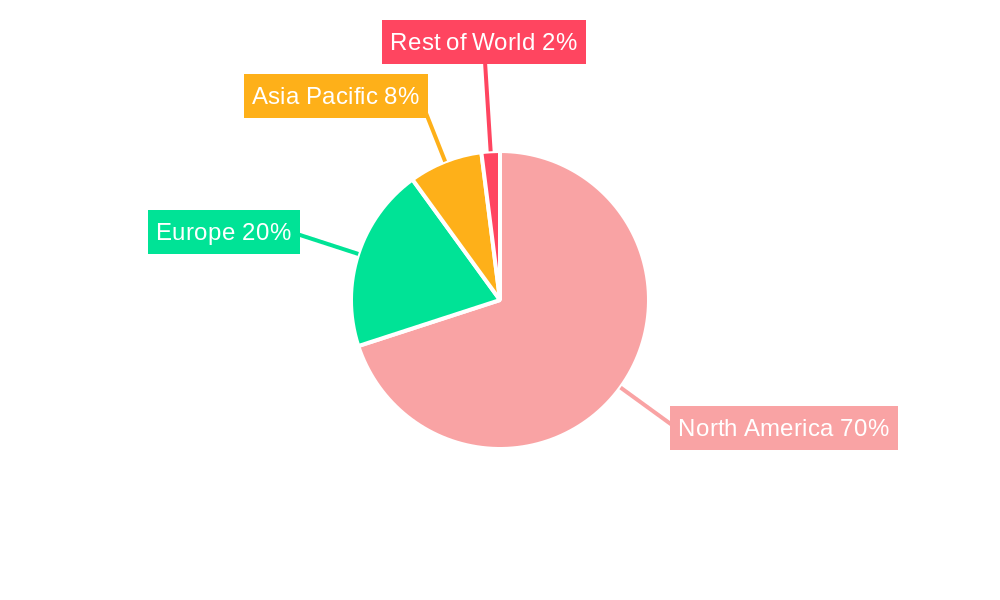

Within the North American market, the United States constitutes the largest segment, driven by its large diabetic population and higher healthcare spending. Canada and Mexico hold smaller but still significant market shares, reflecting varying levels of diabetes prevalence and healthcare access. Future growth will hinge on strategic product positioning, focusing on specific patient populations where meglitinides offer a unique advantage, such as those intolerant to other therapies or requiring precise postprandial glucose control. Furthermore, successful clinical trials demonstrating improved efficacy or safety compared to existing competitors could reinvigorate market expansion. However, the overarching trend indicates a sustained but moderate growth trajectory for the foreseeable future. Sustaining market share will require aggressive marketing campaigns targeting specific physician specialists as well as patient advocacy groups and educational materials emphasizing the unique advantages of this class of medication.

Meglitinide Market in North America: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Meglitinide market in North America, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report leverages extensive market research, including qualitative and quantitative data, to deliver actionable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. The market size is presented in million units.

Meglitinide Market in North America Market Dynamics & Structure

This section analyzes the competitive landscape of the North American meglitinide market, examining market concentration, technological innovation, regulatory aspects, competitive substitutes, and M&A activity. The market is characterized by a moderate level of concentration, with key players such as Novartis, Biocon, Glenmark, Novo Nordisk, Kissei Pharmaceuticals, and Boehringer Ingelheim holding significant market share. The exact market share percentages for each player in 2025 are estimated at: Novartis (xx%), Biocon (xx%), Glenmark (xx%), Novo Nordisk (xx%), Kissei Pharmaceuticals (xx%), Boehringer Ingelheim (xx%). The remaining share is held by other smaller players.

- Market Concentration: Moderately concentrated, with top 6 players controlling xx% of market share in 2025.

- Technological Innovation: Focus on developing improved formulations with enhanced efficacy and reduced side effects. Innovation barriers include high R&D costs and stringent regulatory requirements.

- Regulatory Framework: Stringent FDA regulations governing drug approvals and safety standards impact market entry and product lifecycle.

- Competitive Substitutes: Increased competition from newer antidiabetic drugs, including GLP-1 receptor agonists and SGLT2 inhibitors.

- End-User Demographics: Primarily patients with type 2 diabetes who are not adequately controlled with other oral medications or who have contraindications to other therapies.

- M&A Trends: Moderate level of M&A activity, driven by strategic acquisitions to expand product portfolios and market reach. An estimated xx M&A deals occurred between 2019 and 2024.

Meglitinide Market in North America Growth Trends & Insights

The North American meglitinide market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. The market is projected to grow at a CAGR of xx% from 2025 to 2033, driven by factors such as the increasing prevalence of type 2 diabetes, growing awareness among patients and healthcare professionals, and the development of improved formulations. Market penetration is currently estimated at xx%, with significant potential for growth given the large diabetic population in North America. Technological disruptions, such as the introduction of novel drug delivery systems and personalized medicine approaches, are expected to shape the future trajectory of the market. Consumer behavior is shifting towards preference for convenient and efficacious treatment options.

Dominant Regions, Countries, or Segments in Meglitinide Market in North America

The United States is the dominant market for meglitinides in North America, accounting for xx% of the total market share in 2025. This dominance is primarily attributed to several key factors:

- High Prevalence of Type 2 Diabetes: The US has one of the highest rates of type 2 diabetes globally.

- Advanced Healthcare Infrastructure: Well-developed healthcare infrastructure facilitates easy access to medication and diagnosis.

- High Healthcare Expenditure: Strong healthcare spending enables better access to advanced treatments.

- Strong Pharmaceutical Industry: A robust pharmaceutical industry supports R&D, manufacturing and distribution of meglitinide drugs.

Canada holds the second largest market share in North America and is expected to grow at a considerable rate during the forecast period. The segment of patients with type 2 diabetes not adequately controlled with metformin or other oral antidiabetic drugs exhibits the highest growth potential.

Meglitinide Market in North America Product Landscape

The meglitinide market offers a range of formulations, including immediate-release and extended-release tablets. Recent innovations have focused on improving patient compliance through easier-to-swallow formulations and improved bioavailability. The key selling propositions include rapid onset of action and efficacy in controlling postprandial glucose levels. Technological advancements are focused on the development of novel delivery systems to optimize therapeutic efficacy and reduce the risk of hypoglycemia.

Key Drivers, Barriers & Challenges in Meglitinide Market in North America

Key Drivers:

- Increasing prevalence of type 2 diabetes

- Growing awareness and improved diagnosis rates

- Development of improved formulations and delivery systems

Challenges & Restraints:

- High incidence of hypoglycemia and other side effects

- Competition from newer antidiabetic drugs

- Stringent regulatory requirements and high R&D costs resulting in limited new product introductions. This has caused a xx% decrease in new product launches since 2020. Supply chain disruptions caused an estimated xx% increase in drug prices in 2022.

Emerging Opportunities in Meglitinide Market in North America

Emerging opportunities include the development of combination therapies with other antidiabetic agents to improve glycemic control and reduce side effects. Further opportunities exist in expanding access to meglitinides in underserved populations and tailoring treatment strategies based on individual patient needs. The focus on personalized medicine and advanced drug delivery systems presents significant growth opportunities.

Growth Accelerators in the Meglitinide Market in North America Industry

Strategic partnerships between pharmaceutical companies and healthcare providers to improve patient access and compliance are expected to propel market growth. Technological breakthroughs in drug delivery systems, such as enhanced formulations with improved safety profiles, will be a major driver. Market expansion into emerging markets and geographic regions with a high prevalence of diabetes will also significantly accelerate growth.

Key Players Shaping the Meglitinide Market in North America Market

Notable Milestones in Meglitinide Market in North America Sector

- March 2023: A randomized, open-label, controlled, parallel-group, multicenter trial commenced to evaluate the efficacy and safety of INS068, a new meglitinide, compared to insulin Glargine. This signifies potential for market expansion through the introduction of improved formulations.

- January 2023: OXJournal published a review highlighting the role of meglitinides in type 2 diabetes management, particularly in young adults. This increases awareness and understanding of meglitinides as a treatment option.

In-Depth Meglitinide Market in North America Market Outlook

The North American meglitinide market is poised for continued growth driven by technological advancements, strategic partnerships, and increasing prevalence of diabetes. Future opportunities lie in personalized medicine, innovative drug delivery systems, and combination therapies. Companies focusing on R&D, improving product efficacy, and expanding market reach will secure strong positions within this dynamic market.

Meglitinide Market in North America Segmentation

-

1. Drug

- 1.1. Meglitinides

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

Meglitinide Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

Meglitinide Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in North America Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. United States Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Meglitinides

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. Canada Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Meglitinides

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Rest of North America Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Meglitinides

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. United States Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 10. Canada Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 11. Mexico Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America Meglitinide Market in North America Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Novartis

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Biocon

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Glenmark

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Novo Nordisk

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kissei Pharmaceuticals

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Boehringer Ingelheim

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Novartis

List of Figures

- Figure 1: Meglitinide Market in North America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Meglitinide Market in North America Share (%) by Company 2024

List of Tables

- Table 1: Meglitinide Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Meglitinide Market in North America Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Meglitinide Market in North America Revenue Million Forecast, by Drug 2019 & 2032

- Table 4: Meglitinide Market in North America Volume K Unit Forecast, by Drug 2019 & 2032

- Table 5: Meglitinide Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Meglitinide Market in North America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: Meglitinide Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Meglitinide Market in North America Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Meglitinide Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Meglitinide Market in North America Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States Meglitinide Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Meglitinide Market in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada Meglitinide Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Meglitinide Market in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Meglitinide Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Meglitinide Market in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America Meglitinide Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America Meglitinide Market in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Meglitinide Market in North America Revenue Million Forecast, by Drug 2019 & 2032

- Table 20: Meglitinide Market in North America Volume K Unit Forecast, by Drug 2019 & 2032

- Table 21: Meglitinide Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Meglitinide Market in North America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 23: Meglitinide Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Meglitinide Market in North America Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: Meglitinide Market in North America Revenue Million Forecast, by Drug 2019 & 2032

- Table 26: Meglitinide Market in North America Volume K Unit Forecast, by Drug 2019 & 2032

- Table 27: Meglitinide Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Meglitinide Market in North America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: Meglitinide Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Meglitinide Market in North America Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Meglitinide Market in North America Revenue Million Forecast, by Drug 2019 & 2032

- Table 32: Meglitinide Market in North America Volume K Unit Forecast, by Drug 2019 & 2032

- Table 33: Meglitinide Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Meglitinide Market in North America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: Meglitinide Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Meglitinide Market in North America Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meglitinide Market in North America?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the Meglitinide Market in North America?

Key companies in the market include Novartis, Biocon, Glenmark, Novo Nordisk, Kissei Pharmaceuticals, Boehringer Ingelheim.

3. What are the main segments of the Meglitinide Market in North America?

The market segments include Drug, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in North America Region.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: A randomized, open-label, controlled, parallel-group, multicenter trial is being conducted to evaluate the efficacy and safety of INS068 once daily (QD) in subjects with type 2 diabetes not adequately controlled with oral antidiabetic drugs compared to insulin Glargine QD for 26+26 weeks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meglitinide Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meglitinide Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meglitinide Market in North America?

To stay informed about further developments, trends, and reports in the Meglitinide Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence