Key Insights

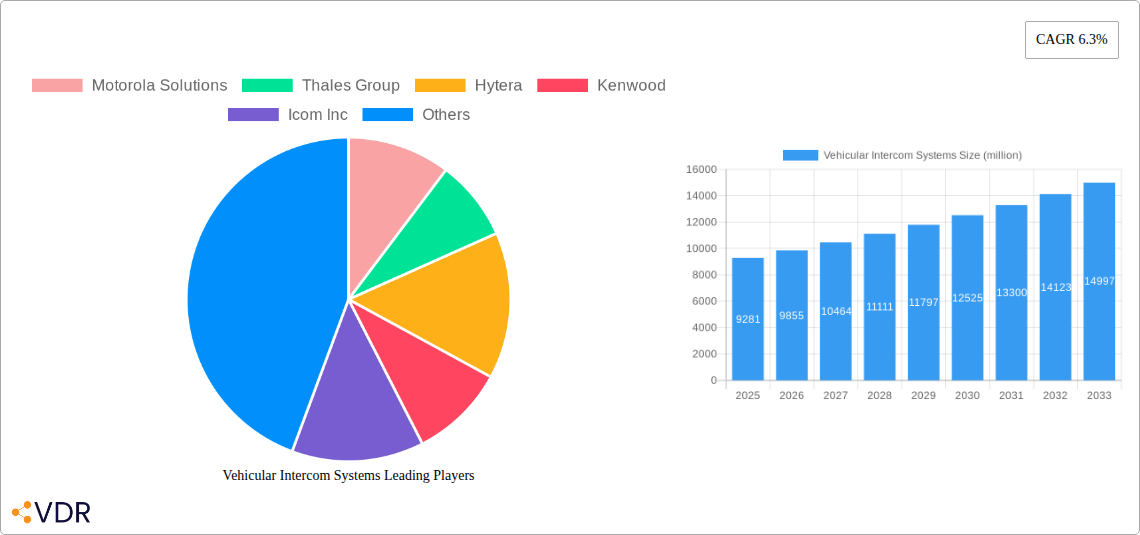

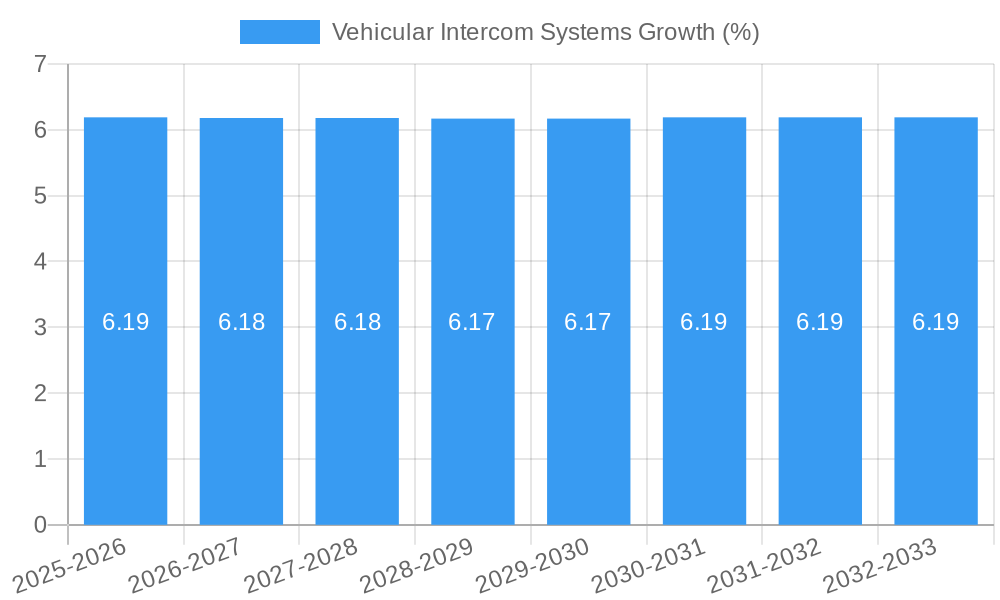

The global Vehicular Intercom Systems market is poised for robust expansion, projected to reach an estimated $9,281 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 6.3% expected throughout the forecast period. This substantial growth is primarily fueled by the increasing demand for enhanced communication and situational awareness in critical operational environments. Key drivers include the escalating adoption of advanced communication technologies in commercial fleets, the critical need for reliable and secure communication in emergency response vehicles, and the persistent requirement for ruggedized and integrated systems in military applications. The market is witnessing a notable shift towards wireless intercom systems, offering greater flexibility and ease of installation compared to traditional wired solutions. However, the initial cost of advanced wireless systems and the complexities associated with integration into existing vehicle architectures can present considerable restraints. Despite these challenges, the overarching trend towards connected vehicles and the continuous pursuit of improved operational efficiency and safety are expected to propel market growth.

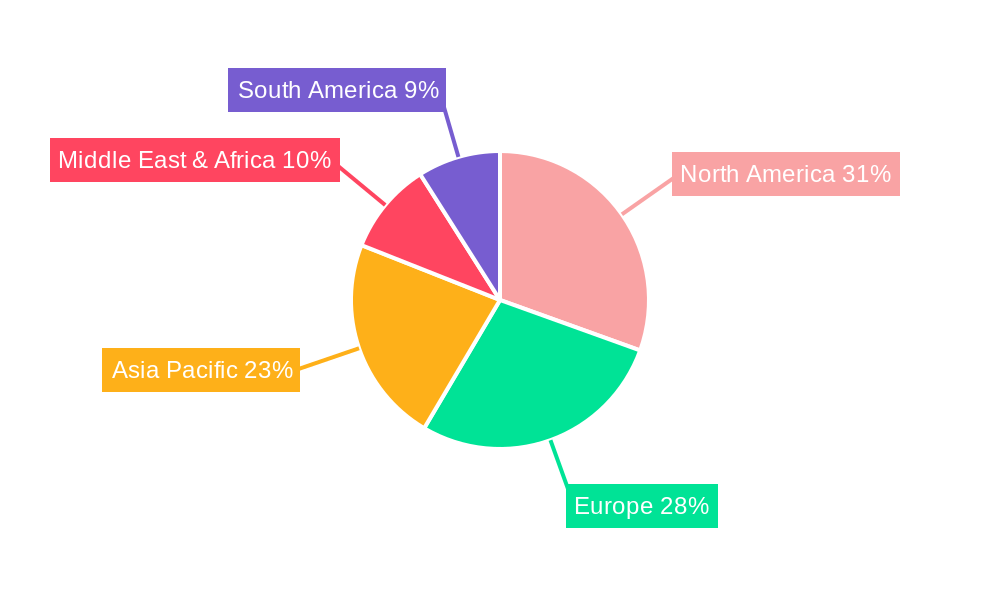

The market segmentation reveals a balanced demand across various applications, with commercial vehicles forming a significant portion due to fleet management requirements. Emergency vehicles, including ambulances and fire trucks, represent a crucial segment where clear and immediate communication can be life-saving. Military vehicles, a segment demanding the highest levels of reliability and security, also contribute substantially to market dynamics. Regionally, North America and Europe are expected to maintain dominant market shares, driven by sophisticated technological infrastructure and strong governmental investments in defense and public safety. Asia Pacific, with its rapidly expanding automotive industry and increasing focus on smart city initiatives and defense modernization, is anticipated to exhibit the highest growth rate. Companies like Motorola Solutions, Thales Group, and Hytera are at the forefront, innovating and expanding their product portfolios to cater to the evolving needs of this dynamic market.

Vehicular Intercom Systems Market Dynamics & Structure

The global vehicular intercom systems market is characterized by a moderate to high concentration, with established players investing significantly in research and development to enhance audio clarity, noise cancellation, and connectivity. Technological innovation is a primary driver, fueled by the increasing demand for seamless communication in diverse vehicular environments, from commercial fleets to demanding military operations. Robust regulatory frameworks, particularly concerning safety and communication standards in emergency and military vehicles, also shape market dynamics. While competitive product substitutes like standalone communication devices exist, integrated vehicular intercom systems offer superior functionality and convenience. End-user demographics are broad, encompassing logistics companies, public safety agencies, defense forces, and even specialized commercial transport operators. Mergers and acquisition trends are observed as larger entities seek to consolidate market share and expand their technological portfolios. For instance, the last five years have seen approximately 15-20 notable M&A deals in the broader defense and transportation technology sectors that include intercom system capabilities, reflecting a strategic consolidation. Barriers to innovation include the high cost of developing advanced audio processing and ruggedized hardware suitable for harsh vehicular environments.

- Market Concentration: Moderate to High.

- Technological Innovation Drivers: Enhanced noise cancellation, Bluetooth/IP connectivity, voice activation, advanced audio processing.

- Regulatory Frameworks: Safety standards (e.g., MIL-STD), communication protocols, spectrum allocation.

- Competitive Product Substitutes: Ruggedized mobile phones, two-way radios, personal headsets.

- End-User Demographics: Commercial (logistics, public transport), Emergency Services (police, fire, ambulance), Military (ground vehicles, naval vessels).

- M&A Trends: Strategic acquisitions to expand product offerings and technological expertise.

Vehicular Intercom Systems Growth Trends & Insights

The global vehicular intercom systems market is poised for robust expansion, driven by escalating demand for improved operational efficiency, enhanced crew safety, and mission-critical communication capabilities across various vehicular applications. The market size is projected to witness a significant CAGR of approximately 6.5% to 7.5% during the forecast period of 2025-2033. In the base year of 2025, the global market size is estimated to be around $1.2 billion. Adoption rates are steadily increasing, particularly within the commercial and emergency vehicle segments, where real-time communication between drivers, operators, and external personnel is paramount for coordination and incident response. Technological disruptions, such as the integration of AI-powered noise cancellation and advanced speech recognition, are enhancing system performance and user experience, further stimulating growth. Consumer behavior shifts are evident, with a growing preference for integrated, hands-free communication solutions that minimize driver distraction and improve overall situational awareness. The penetration of wireless intercom systems is expected to rise due to their ease of installation and flexibility, complementing the continued demand for robust wired solutions in specialized environments. Future market growth will also be influenced by the increasing adoption of connected vehicle technologies, which can seamlessly integrate intercom systems with other in-vehicle communication and data platforms. The evolution of these systems towards unified communication platforms capable of handling voice, data, and video is a key trend that will drive market penetration and adoption across a wider array of vehicular platforms. The increasing complexity of modern vehicles, coupled with the growing need for effective team coordination in challenging operational scenarios, will continue to propel the demand for advanced vehicular intercom solutions. The market is also benefiting from ongoing investments in defense modernization programs worldwide, which often include the integration of sophisticated communication systems into new and upgraded military vehicles.

Dominant Regions, Countries, or Segments in Vehicular Intercom Systems

The Military Vehicles segment, within the Application category, is a dominant force driving growth in the global vehicular intercom systems market. This dominance is underpinned by substantial government defense budgets, ongoing geopolitical tensions, and the continuous need for advanced communication systems in modern warfare and peacekeeping operations. The North America region, particularly the United States, emerges as a leading country due to its significant defense spending and the presence of major defense contractors and technology innovators. The demand for ruggedized, secure, and reliable communication solutions for tanks, armored personnel carriers, aircraft, and naval vessels is consistently high.

Dominant Segment: Military Vehicles.

- Key Drivers:

- High Defense Spending: Major economies continue to allocate significant portions of their budgets to military modernization.

- Operational Requirements: The need for clear, secure, and interoperable communication in diverse combat scenarios is critical.

- Technological Advancements: Integration of advanced features like active noise cancellation, secure encryption, and network-centric warfare capabilities.

- Fleet Upgrades and Replacements: Ongoing programs to upgrade existing military fleets and introduce new platforms drive demand for integrated intercom systems.

- Market Share: Military vehicles account for an estimated 40-45% of the total vehicular intercom systems market.

- Growth Potential: Strong growth anticipated due to continued defense investments and evolving threat landscapes.

- Key Drivers:

Dominant Region/Country: North America (specifically the United States).

- Key Drivers:

- Government Procurement: Robust procurement processes for defense and homeland security applications.

- Technological Hub: Presence of leading defense manufacturers and R&D centers.

- Infrastructure: Well-established defense industrial base and logistical networks.

- Regulatory Support: Favorable policies and funding for defense technology development and acquisition.

- Market Penetration: High adoption rate of advanced vehicular intercom systems across military and specialized commercial fleets.

- Key Drivers:

The Wireless Vehicle Intercom System type is also experiencing significant growth, driven by ease of installation, flexibility, and the increasing demand for adaptable communication solutions in both commercial and emergency vehicles. This segment is projected to grow at a CAGR of approximately 8-9% during the forecast period.

Vehicular Intercom Systems Product Landscape

The vehicular intercom systems product landscape is increasingly sophisticated, focusing on delivering crystal-clear audio in noisy environments and seamless integration with other vehicle systems. Innovations include advanced digital signal processing for superior noise cancellation, voice activation for hands-free operation, and robust wireless connectivity options leveraging Bluetooth and proprietary radio frequencies. Many systems now offer multi-channel communication, allowing for selective conversations between crew members or with external units. Performance metrics emphasize high signal-to-noise ratios, extended communication range, and extreme durability to withstand harsh operational conditions encountered in military, emergency, and heavy-duty commercial vehicles. Unique selling propositions often lie in specialized features such as secure encryption for military applications, integrated hearing protection, and modular designs for easy maintenance and upgrades.

Key Drivers, Barriers & Challenges in Vehicular Intercom Systems

Key Drivers: The vehicular intercom systems market is propelled by the escalating need for enhanced safety and operational efficiency in all types of vehicles. Technological advancements, such as sophisticated noise cancellation and voice command capabilities, are creating more user-friendly and effective communication tools. The continuous evolution of defense technologies and the demand for secure, real-time communication in military operations are significant growth catalysts. Furthermore, the increasing adoption of wireless solutions, driven by ease of installation and flexibility, is broadening market reach.

Key Barriers & Challenges: High research and development costs associated with advanced audio processing and ruggedized hardware can be a barrier for smaller players. Supply chain disruptions for critical electronic components can impact production timelines and costs. Stringent regulatory compliance for defense and emergency vehicle applications, while driving innovation, also presents a challenge in terms of validation and certification processes. Intense competition from established players and the potential for commoditization in less demanding segments exert constant price pressure. The long lifespan of existing vehicle fleets also means that replacement cycles can be extended, impacting the pace of new system adoption.

Emerging Opportunities in Vehicular Intercom Systems

Emerging opportunities in the vehicular intercom systems sector lie in the integration with the burgeoning Internet of Things (IoT) ecosystem and the development of AI-powered communication solutions. The increasing demand for unified communication platforms that can seamlessly integrate voice, data, and video across diverse vehicular networks presents a significant avenue for growth. Furthermore, the expansion of the autonomous vehicle market will create new use cases for intercom systems, potentially facilitating communication between passengers, the vehicle's AI, and external entities. The niche markets of specialized industrial vehicles, such as mining equipment and agricultural machinery, also offer untapped potential for customized intercom solutions that enhance worker safety and operational coordination in remote and hazardous environments.

Growth Accelerators in the Vehicular Intercom Systems Industry

Growth accelerators in the vehicular intercom systems industry are primarily driven by ongoing technological breakthroughs, particularly in areas of artificial intelligence for advanced noise suppression and speech enhancement, and the expansion of digital and IP-based communication protocols. Strategic partnerships between intercom system manufacturers and vehicle OEMs are crucial for seamless integration and wider market penetration from the design phase. Furthermore, market expansion strategies targeting emerging economies with increasing investments in infrastructure, defense, and commercial transportation will fuel long-term growth. The development of modular and scalable intercom systems that can cater to a wide range of vehicle types and budgets also acts as a significant growth catalyst.

Key Players Shaping the Vehicular Intercom Systems Market

- Motorola Solutions

- Thales Group

- Hytera

- Kenwood

- Icom Inc

- SCI Technology

- Harris Corporation

- David Clark Company

- Telephonics

- Cobham

- Aselsan

- Elbit Systems

- Elno

- Vitavox (Secomak)

- EID (Cohort plc)

- Setcom

- SyTech Corporation

Notable Milestones in Vehicular Intercom Systems Sector

- 2019: Launch of advanced digital intercom systems with enhanced noise cancellation and Bluetooth connectivity, improving user experience in commercial vehicles.

- 2020: Increased adoption of wireless intercom solutions for emergency vehicles due to ease of installation and flexibility during rapid deployments.

- 2021: Significant investments in ruggedized and secure intercom systems for military applications driven by geopolitical shifts and modernization programs.

- 2022: Introduction of AI-powered voice recognition and command features, enabling more intuitive and hands-free operation in all vehicle types.

- 2023: Emergence of integrated intercom solutions as part of broader vehicular communication and command systems for defense and public safety.

- 2024: Development of interoperable communication platforms allowing seamless voice exchange between diverse vehicular intercom systems and external communication networks.

In-Depth Vehicular Intercom Systems Market Outlook

The future outlook for the vehicular intercom systems market is exceptionally positive, driven by sustained innovation and expanding application areas. Growth accelerators such as the integration of AI for superior audio processing, the transition to IP-based communication for enhanced interoperability, and the increasing demand for secure communication in defense and public safety sectors will continue to propel market expansion. Strategic collaborations between intercom manufacturers and automotive OEMs are expected to lead to more integrated and advanced in-vehicle communication solutions. The burgeoning autonomous vehicle sector will also open new avenues for communication systems. Furthermore, a continued focus on ruggedized, reliable, and user-friendly systems across commercial, emergency, and military applications will solidify the market's upward trajectory, projecting strong growth and significant opportunities for key players.

Vehicular Intercom Systems Segmentation

-

1. Application

- 1.1. Commercial Vehicles

- 1.2. Emergency Vehicles

- 1.3. Military Vehicles

-

2. Type

- 2.1. Wired Vehicle Intercom System

- 2.2. Wireless Vehicle Intercom System

Vehicular Intercom Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vehicular Intercom Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicular Intercom Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicles

- 5.1.2. Emergency Vehicles

- 5.1.3. Military Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Wired Vehicle Intercom System

- 5.2.2. Wireless Vehicle Intercom System

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vehicular Intercom Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicles

- 6.1.2. Emergency Vehicles

- 6.1.3. Military Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Wired Vehicle Intercom System

- 6.2.2. Wireless Vehicle Intercom System

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Vehicular Intercom Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicles

- 7.1.2. Emergency Vehicles

- 7.1.3. Military Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Wired Vehicle Intercom System

- 7.2.2. Wireless Vehicle Intercom System

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Vehicular Intercom Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicles

- 8.1.2. Emergency Vehicles

- 8.1.3. Military Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Wired Vehicle Intercom System

- 8.2.2. Wireless Vehicle Intercom System

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Vehicular Intercom Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicles

- 9.1.2. Emergency Vehicles

- 9.1.3. Military Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Wired Vehicle Intercom System

- 9.2.2. Wireless Vehicle Intercom System

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Vehicular Intercom Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicles

- 10.1.2. Emergency Vehicles

- 10.1.3. Military Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Wired Vehicle Intercom System

- 10.2.2. Wireless Vehicle Intercom System

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Motorola Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thales Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hytera

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kenwood

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Icom Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SCI Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Harris Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 David Clark Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Telephonics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cobham

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aselsan

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Elbit Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Elno

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Vitavox (Secomak)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 EID ( Cohort plc)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Setcom

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 SyTech Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Motorola Solutions

List of Figures

- Figure 1: Global Vehicular Intercom Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Vehicular Intercom Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America Vehicular Intercom Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Vehicular Intercom Systems Revenue (million), by Type 2024 & 2032

- Figure 5: North America Vehicular Intercom Systems Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Vehicular Intercom Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Vehicular Intercom Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Vehicular Intercom Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America Vehicular Intercom Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Vehicular Intercom Systems Revenue (million), by Type 2024 & 2032

- Figure 11: South America Vehicular Intercom Systems Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Vehicular Intercom Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Vehicular Intercom Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Vehicular Intercom Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Vehicular Intercom Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Vehicular Intercom Systems Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Vehicular Intercom Systems Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Vehicular Intercom Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Vehicular Intercom Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Vehicular Intercom Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Vehicular Intercom Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Vehicular Intercom Systems Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Vehicular Intercom Systems Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Vehicular Intercom Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Vehicular Intercom Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Vehicular Intercom Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Vehicular Intercom Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Vehicular Intercom Systems Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Vehicular Intercom Systems Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Vehicular Intercom Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Vehicular Intercom Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vehicular Intercom Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Vehicular Intercom Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Vehicular Intercom Systems Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Vehicular Intercom Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Vehicular Intercom Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Vehicular Intercom Systems Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Vehicular Intercom Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Vehicular Intercom Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Vehicular Intercom Systems Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Vehicular Intercom Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Vehicular Intercom Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Vehicular Intercom Systems Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Vehicular Intercom Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Vehicular Intercom Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Vehicular Intercom Systems Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Vehicular Intercom Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Vehicular Intercom Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Vehicular Intercom Systems Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Vehicular Intercom Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Vehicular Intercom Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicular Intercom Systems?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Vehicular Intercom Systems?

Key companies in the market include Motorola Solutions, Thales Group, Hytera, Kenwood, Icom Inc, SCI Technology, Harris Corporation, David Clark Company, Telephonics, Cobham, Aselsan, Elbit Systems, Elno, Vitavox (Secomak), EID ( Cohort plc), Setcom, SyTech Corporation.

3. What are the main segments of the Vehicular Intercom Systems?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9281 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicular Intercom Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicular Intercom Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicular Intercom Systems?

To stay informed about further developments, trends, and reports in the Vehicular Intercom Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence