Key Insights

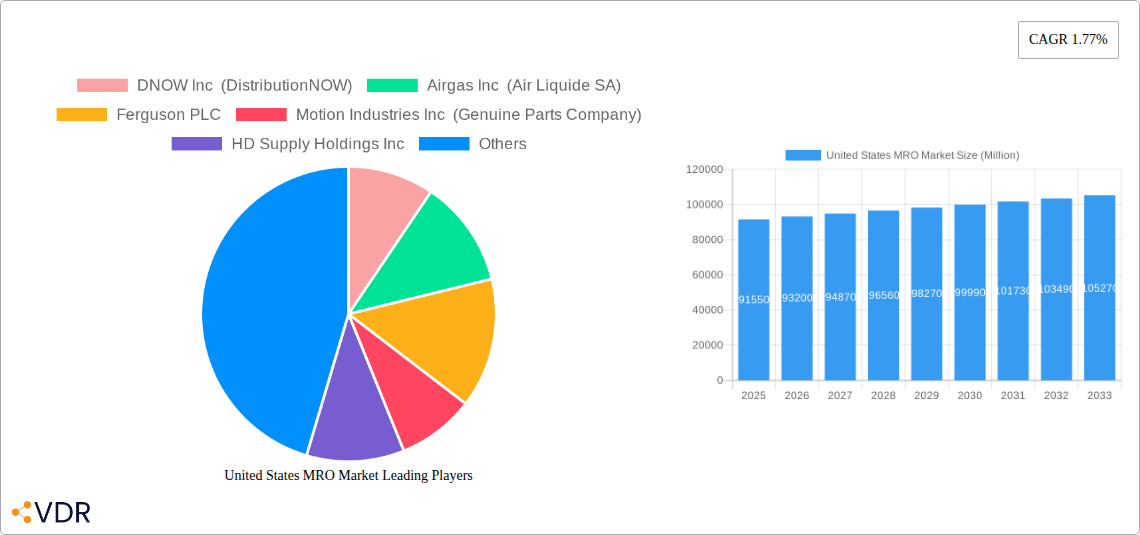

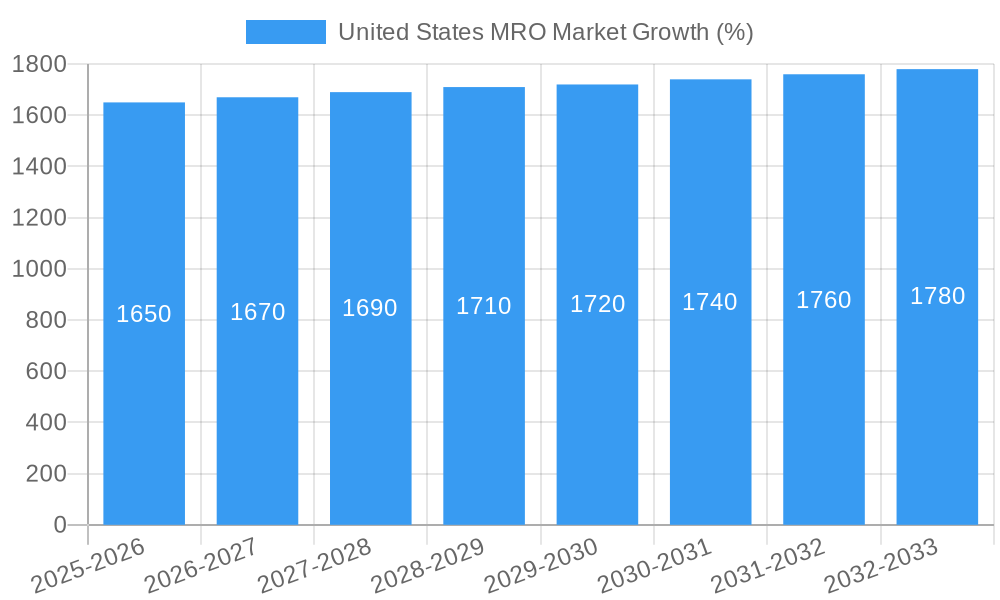

The United States MRO (Maintenance, Repair, and Operations) market, valued at $91.55 billion in 2025, is projected to experience steady growth, driven by increasing industrial activity and a focus on optimizing operational efficiency. The market's Compound Annual Growth Rate (CAGR) of 1.77% from 2025 to 2033 reflects a moderate yet consistent expansion, influenced by factors such as infrastructure development, the resurgence of manufacturing, and a growing emphasis on preventative maintenance within various sectors. Key drivers include the expanding automotive, aerospace, and energy industries, all requiring substantial MRO supplies and services. Furthermore, technological advancements like the Industrial Internet of Things (IIoT) and predictive maintenance analytics are streamlining operations and increasing demand for sophisticated MRO solutions, fostering a shift towards digitalization and improved inventory management within the sector. However, factors such as economic fluctuations and supply chain disruptions could potentially temper growth in certain periods. The market's segmentation, while not explicitly provided, can be inferred to include categories such as industrial supplies, electrical components, safety equipment, and specialized tools. Major players, including DNOW Inc, Airgas Inc, Ferguson PLC, and W.W. Grainger Inc., compete through diverse product offerings, distribution networks, and value-added services. This competitive landscape encourages innovation and drives improvements in efficiency and cost-effectiveness within the MRO sector. The long-term outlook suggests continued growth, albeit at a moderate pace, influenced by the overall health of the US economy and advancements in industrial technologies.

The competitive landscape is characterized by a mix of large multinational corporations and specialized distributors. These companies compete on several factors including product breadth, service capabilities (such as on-site support and inventory management solutions), pricing strategies, and technological integration. The increasing adoption of e-commerce platforms and digital procurement solutions is also transforming the distribution and purchasing processes within the MRO sector, enhancing transparency and efficiency. Geographic variations in market growth will likely be influenced by the concentration of industrial activity and infrastructural projects within specific regions. Continued investment in infrastructure renewal and expansion, coupled with government initiatives promoting industrial growth, will likely support the sustained growth of the US MRO market over the forecast period.

United States MRO Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States MRO (Maintenance, Repair, and Operations) market, offering valuable insights for industry professionals, investors, and strategic planners. The report covers the period from 2019 to 2033, with a focus on the current market dynamics, growth trends, and future outlook. The analysis encompasses key market segments, dominant players, and emerging opportunities within the broader industrial supplies and services market.

United States MRO Market Dynamics & Structure

The US MRO market is a complex ecosystem characterized by a fragmented landscape, significant technological advancements, and evolving regulatory environments. Market concentration is moderate, with several large players and numerous smaller, specialized distributors. Technological innovation is a key driver, with advancements in data analytics, IoT, and automation significantly impacting maintenance strategies and supply chain management. Regulatory frameworks, including environmental regulations and safety standards, influence product development and operational practices. The market witnesses a constant flux of M&A activities, shaping the competitive dynamics and enhancing capabilities.

- Market Concentration: Moderately fragmented, with top 5 players holding approximately xx% market share (2025).

- Technological Innovation: Increased adoption of digital technologies, including predictive maintenance and remote diagnostics, driving efficiency gains.

- Regulatory Framework: Stringent safety and environmental standards influencing product choices and operational procedures.

- Competitive Substitutes: Emergence of alternative solutions like outsourced maintenance services and on-demand platforms.

- End-User Demographics: Diverse end-user base across manufacturing, energy, transportation, and construction sectors.

- M&A Trends: Consolidation continues with xx major M&A deals recorded between 2019-2024 (value of xx Million).

United States MRO Market Growth Trends & Insights

The US MRO market exhibits steady growth driven by increasing industrial activity, infrastructure development, and technological advancements. The market size is projected to reach xx Million in 2025, with a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by rising demand for efficient maintenance solutions, increasing adoption of predictive maintenance technologies, and the shift towards more sustainable and environmentally friendly practices. Consumer behavior reflects an increasing preference for digitally enabled solutions, streamlined procurement processes, and value-added services.

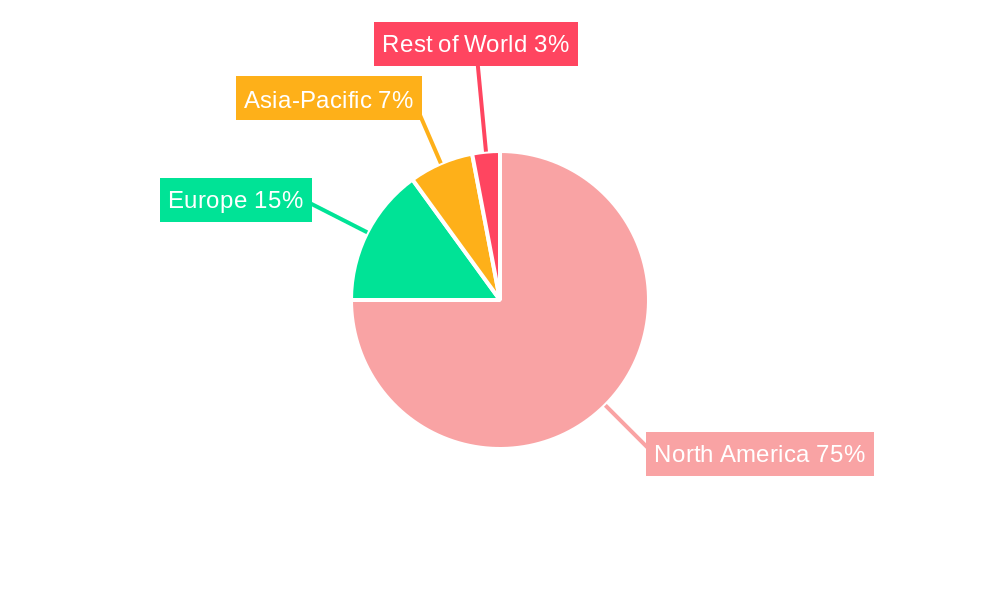

Dominant Regions, Countries, or Segments in United States MRO Market

The manufacturing sector constitutes the largest segment within the US MRO market, contributing xx% to the total market value in 2025. This dominance is fueled by high capital expenditure in the manufacturing sector and the critical role of MRO services in maintaining productivity and ensuring operational efficiency. Other key segments include energy, transportation, and construction, each characterized by unique MRO needs and growth trajectories. Geographically, the Midwest and South regions show strong growth potential due to concentrated manufacturing activities and infrastructure investments.

- Key Drivers: Robust industrial production, rising capital expenditures in key sectors, and increasing focus on operational efficiency.

- Dominance Factors: High concentration of manufacturing facilities, significant investments in infrastructure development, and the necessity for reliable MRO services.

- Growth Potential: Expanding industrial base, adoption of advanced technologies, and increased focus on sustainable practices.

United States MRO Market Product Landscape

The MRO product landscape encompasses a wide range of products, from basic maintenance supplies to sophisticated software and technology solutions. The market is characterized by continuous product innovation, with a focus on enhancing product performance, reliability, and ease of use. The unique selling propositions of these products increasingly revolve around data-driven insights, predictive maintenance capabilities, and integration with broader industrial automation systems. The market also witnesses a trend towards the adoption of sustainable and environmentally friendly products.

Key Drivers, Barriers & Challenges in United States MRO Market

Key Drivers:

- Technological advancements like AI-driven predictive maintenance and IoT-enabled remote monitoring drive efficiency and reduce downtime.

- Growing industrial production across sectors fuels demand for MRO supplies and services.

- Government investments in infrastructure projects boost MRO spending.

Key Barriers and Challenges:

- Supply chain disruptions and global economic uncertainty impact product availability and pricing.

- Regulatory compliance and environmental standards can increase costs and complexity.

- Intense competition and price pressures from both established and new market entrants. This pressure results in a reported xx% reduction in profit margins for some players in 2024.

Emerging Opportunities in United States MRO Market

The US MRO market presents several emerging opportunities, including:

- Growth in the renewable energy sector: Expanding demand for MRO services related to wind and solar energy infrastructure.

- Adoption of digital twin technology: Increased use of digital twins for predictive maintenance and operational optimization.

- Focus on sustainability: Growing preference for eco-friendly products and sustainable maintenance practices.

Growth Accelerators in the United States MRO Market Industry

Several factors will propel long-term growth within the US MRO market, including: continued technological advancements in areas such as AI, IoT, and robotics, fostering efficiency gains and improved maintenance strategies. Strategic partnerships and collaborations among market players will broaden product offerings and enhance market reach. Government initiatives to support infrastructure modernization and industrial expansion will positively influence market demand.

Key Players Shaping the United States MRO Market Market

- DNOW Inc (DistributionNOW)

- Airgas Inc (Air Liquide SA)

- Ferguson PLC

- Motion Industries Inc (Genuine Parts Company)

- HD Supply Holdings Inc

- MRC Global Inc

- Fastenal Company

- MSC Industrial Direct Co Inc

- Applied Industrial Technologies

- WESCO International Inc

- Sonepar SA

- Rexel Holdings USA (Rexel)

- Eastern Power Technologies Inc

- Consolidated Electrical Distributors Inc

- Elliot Electric Supply

- Border States Industrial Inc

- W W Grainger Inc

- Fastenal Company

- MSC Industrial Direct Co Inc

- Distribution Solutions Group Inc

- The Home Depot Inc (Interline Brands Inc)

- Builders Firstsource

- Bluelinx Holding

Notable Milestones in United States MRO Market Sector

- June 2024: Hololight and Taqtile's strategic partnership aims to revolutionize industrial maintenance through XR technology.

- May 2024: Applied Industrial Technologies' acquisition of Grupo Kopar strengthens its automation portfolio.

In-Depth United States MRO Market Market Outlook

The US MRO market is poised for sustained growth driven by technological innovation, expanding industrial activity, and increasing focus on operational efficiency. Strategic partnerships, adoption of advanced technologies, and expansion into new market segments offer significant growth opportunities. The market's future potential lies in leveraging data analytics, artificial intelligence, and automation to further optimize maintenance operations, enhance productivity, and reduce downtime across various industries.

United States MRO Market Segmentation

-

1. Industrial MRO

- 1.1. Current Market Scenario

-

1.2. By End-user Industry

- 1.2.1. Manufacturing

- 1.2.2. Construction

- 1.2.3. Chemicals and Petrochemicals

- 1.2.4. Food, Beverage and Paper Processing

- 1.2.5. Others

- 1.3. Market Outlook

-

2. Electrical MRO

- 2.1. Current Market Scenario

-

2.2. By End-user Industry

- 2.2.1. Manufacturing (Process and Non-Process)

- 2.2.2. Construction

- 2.2.3. Chemicals and Petrochemicals

- 2.2.4. Food, Beverage and Paper Processing

- 2.2.5. Other End-user Industries

- 2.3. Market Outlook

-

3. Facility MRO

- 3.1. Current Market Scenario

-

3.2. By End-user Industry

- 3.2.1. Healthcare and Social Assistance

- 3.2.2. Manufacturing

- 3.2.3. Construction

- 3.2.4. Other End-user Industries

- 3.3. Market Outlook

United States MRO Market Segmentation By Geography

- 1. United States

United States MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Emphasis on Operational Efficiency and Aging of Manufacturing Equipment in the Country; Technological Advancements

- 3.2.2 such as the Emergence of Automated Solutions (Industrial Vending Machines)

- 3.3. Market Restrains

- 3.3.1 Growing Emphasis on Operational Efficiency and Aging of Manufacturing Equipment in the Country; Technological Advancements

- 3.3.2 such as the Emergence of Automated Solutions (Industrial Vending Machines)

- 3.4. Market Trends

- 3.4.1. Manufacturing (Industrial MRO) Accounts for the Largest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States MRO Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Industrial MRO

- 5.1.1. Current Market Scenario

- 5.1.2. By End-user Industry

- 5.1.2.1. Manufacturing

- 5.1.2.2. Construction

- 5.1.2.3. Chemicals and Petrochemicals

- 5.1.2.4. Food, Beverage and Paper Processing

- 5.1.2.5. Others

- 5.1.3. Market Outlook

- 5.2. Market Analysis, Insights and Forecast - by Electrical MRO

- 5.2.1. Current Market Scenario

- 5.2.2. By End-user Industry

- 5.2.2.1. Manufacturing (Process and Non-Process)

- 5.2.2.2. Construction

- 5.2.2.3. Chemicals and Petrochemicals

- 5.2.2.4. Food, Beverage and Paper Processing

- 5.2.2.5. Other End-user Industries

- 5.2.3. Market Outlook

- 5.3. Market Analysis, Insights and Forecast - by Facility MRO

- 5.3.1. Current Market Scenario

- 5.3.2. By End-user Industry

- 5.3.2.1. Healthcare and Social Assistance

- 5.3.2.2. Manufacturing

- 5.3.2.3. Construction

- 5.3.2.4. Other End-user Industries

- 5.3.3. Market Outlook

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Industrial MRO

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DNOW Inc (DistributionNOW)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airgas Inc (Air Liquide SA)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ferguson PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Motion Industries Inc (Genuine Parts Company)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HD Supply Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MRC Global Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fastenal Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MSC Industrial Direct Co Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Applied Industrial Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WESCO International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sonepar SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rexel Holdings USA (Rexel)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Eastern Power Technologies Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Consolidated Electrical Distributors Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Elliot Electric Supply

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Border States Industrial Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Ferguson PLC

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 W W Grainger Inc

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Fastenal Company

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 MSC Industrial Direct Co Inc

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Distribution Solutions Group Inc

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 The Home Depot Inc (Interline Brands Inc )

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Builders Firstsource

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Bluelinx Holding

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.1 DNOW Inc (DistributionNOW)

List of Figures

- Figure 1: United States MRO Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States MRO Market Share (%) by Company 2024

List of Tables

- Table 1: United States MRO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States MRO Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States MRO Market Revenue Million Forecast, by Industrial MRO 2019 & 2032

- Table 4: United States MRO Market Volume Billion Forecast, by Industrial MRO 2019 & 2032

- Table 5: United States MRO Market Revenue Million Forecast, by Electrical MRO 2019 & 2032

- Table 6: United States MRO Market Volume Billion Forecast, by Electrical MRO 2019 & 2032

- Table 7: United States MRO Market Revenue Million Forecast, by Facility MRO 2019 & 2032

- Table 8: United States MRO Market Volume Billion Forecast, by Facility MRO 2019 & 2032

- Table 9: United States MRO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States MRO Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: United States MRO Market Revenue Million Forecast, by Industrial MRO 2019 & 2032

- Table 12: United States MRO Market Volume Billion Forecast, by Industrial MRO 2019 & 2032

- Table 13: United States MRO Market Revenue Million Forecast, by Electrical MRO 2019 & 2032

- Table 14: United States MRO Market Volume Billion Forecast, by Electrical MRO 2019 & 2032

- Table 15: United States MRO Market Revenue Million Forecast, by Facility MRO 2019 & 2032

- Table 16: United States MRO Market Volume Billion Forecast, by Facility MRO 2019 & 2032

- Table 17: United States MRO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States MRO Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States MRO Market?

The projected CAGR is approximately 1.77%.

2. Which companies are prominent players in the United States MRO Market?

Key companies in the market include DNOW Inc (DistributionNOW), Airgas Inc (Air Liquide SA), Ferguson PLC, Motion Industries Inc (Genuine Parts Company), HD Supply Holdings Inc, MRC Global Inc, Fastenal Company, MSC Industrial Direct Co Inc, Applied Industrial Technologies, WESCO International Inc, Sonepar SA, Rexel Holdings USA (Rexel), Eastern Power Technologies Inc, Consolidated Electrical Distributors Inc, Elliot Electric Supply, Border States Industrial Inc, Ferguson PLC, W W Grainger Inc, Fastenal Company, MSC Industrial Direct Co Inc, Distribution Solutions Group Inc, The Home Depot Inc (Interline Brands Inc ), Builders Firstsource, Bluelinx Holding.

3. What are the main segments of the United States MRO Market?

The market segments include Industrial MRO, Electrical MRO, Facility MRO.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Operational Efficiency and Aging of Manufacturing Equipment in the Country; Technological Advancements. such as the Emergence of Automated Solutions (Industrial Vending Machines).

6. What are the notable trends driving market growth?

Manufacturing (Industrial MRO) Accounts for the Largest Share.

7. Are there any restraints impacting market growth?

Growing Emphasis on Operational Efficiency and Aging of Manufacturing Equipment in the Country; Technological Advancements. such as the Emergence of Automated Solutions (Industrial Vending Machines).

8. Can you provide examples of recent developments in the market?

June 2024 - Hololight unveiled a strategic collaboration with Seattle's Taqtile. This partnership is poised to revolutionize the manufacturing sector and other vital industries. It combines Taqtile's advanced digital work instructions and remote spatial collaboration technologies with Hololight's robust XR streaming capabilities. Together, they aim to enhance various functions, from inspection and diagnosis to maintenance, operations, and remote assistance, benefiting front-line and deskless employees in diverse sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States MRO Market?

To stay informed about further developments, trends, and reports in the United States MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence