Key Insights

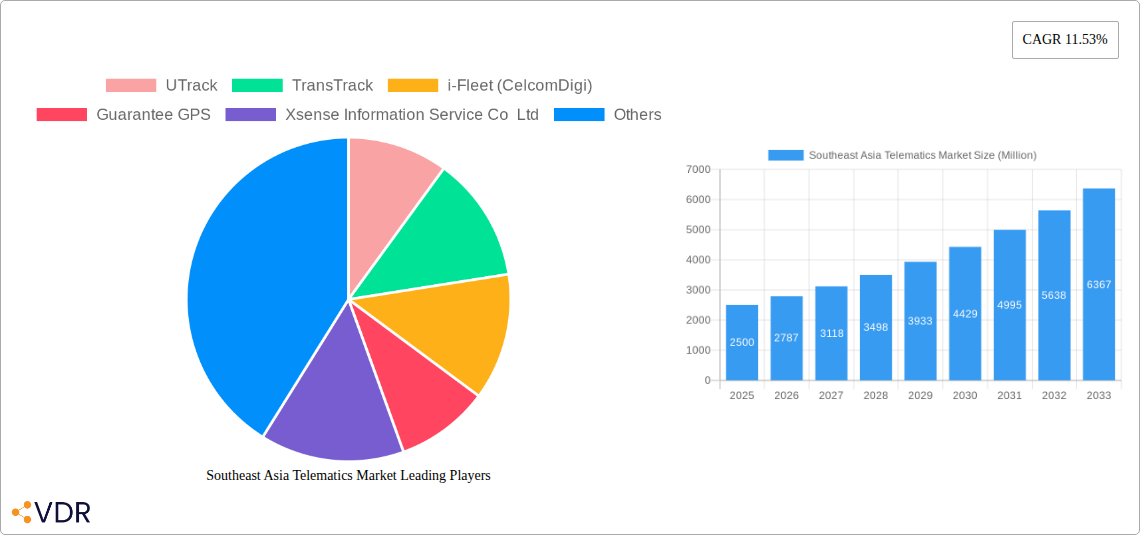

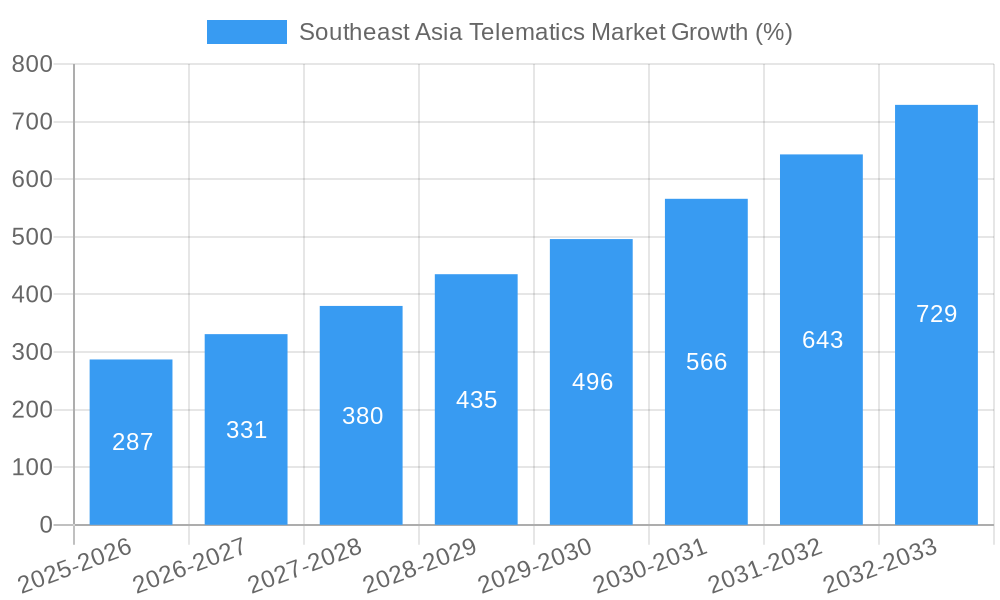

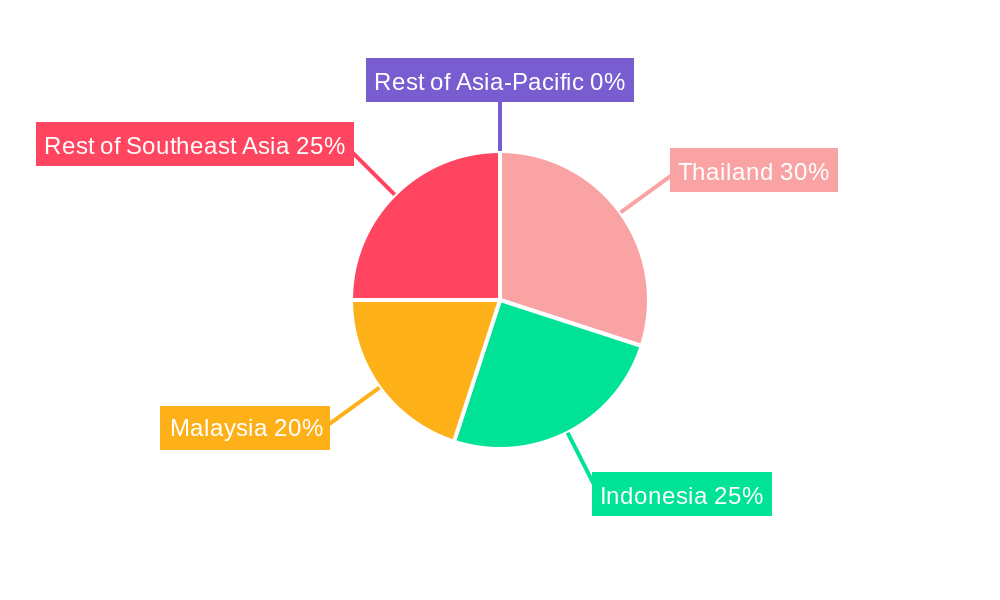

The Southeast Asia telematics market is experiencing robust growth, driven by increasing government regulations mandating vehicle tracking, a burgeoning logistics sector demanding efficient fleet management, and rising adoption of connected car technologies. The market's Compound Annual Growth Rate (CAGR) of 11.53% from 2019 to 2024 indicates a significant upward trajectory. This growth is further fueled by the expanding adoption of telematics solutions across various vehicle types, including light commercial vehicles (LCVs) and medium/heavy commercial vehicles (M/HCVs). Thailand, Indonesia, and Malaysia are key contributors to this market expansion, reflecting their significant economic activity and robust transportation infrastructure. However, high initial investment costs for implementing telematics systems and a lack of awareness among smaller businesses, particularly in less developed regions within Southeast Asia, represent significant restraints to market growth. The competitive landscape is characterized by a mix of established international players and regional providers, leading to innovation and competitive pricing. The market segmentation by vehicle type and country allows for targeted strategies, with LCVs currently holding the largest market share due to their high volume and rising demand for efficient delivery services. Future growth will likely be influenced by advancements in 5G technology, enabling enhanced data transmission and real-time analytics, and the integration of telematics with other IoT solutions for improved fleet safety and operational efficiency. The forecast period from 2025-2033 suggests continued expansion, potentially influenced by government initiatives promoting digitalization within the transportation industry.

The market's segmentation offers significant opportunities for both established and emerging players. Focusing on specific regional needs and technological advancements will be crucial for companies seeking a competitive edge. Tailoring solutions to address local regulatory requirements and providing customized services to suit diverse industry segments will be key success factors. Furthermore, strategic partnerships and mergers and acquisitions could play a significant role in shaping the market's future landscape. The increasing adoption of subscription-based telematics services and the development of user-friendly interfaces will also contribute to the overall market growth. The rise of data analytics capabilities within telematics platforms further promises to enhance operational efficiency and provide valuable insights for businesses.

Southeast Asia Telematics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Southeast Asia telematics market, encompassing market size, growth trends, competitive landscape, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033. The base year is 2025, and the study period spans from 2019 to 2024. Key segments analyzed include Light Commercial Vehicles (LCV), Medium/Heavy Commercial Vehicles (M/HCV), and individual countries – Thailand, Indonesia, Malaysia, and the Rest of Southeast Asia.

Southeast Asia Telematics Market Dynamics & Structure

The Southeast Asia telematics market exhibits a moderately fragmented structure, with several regional and international players vying for market share. Market concentration is expected to increase slightly over the forecast period due to consolidation and strategic acquisitions. Technological innovation, particularly in areas such as AI-powered analytics and IoT integration, is a key driver. However, innovation barriers, including data security concerns and varying levels of digital infrastructure across the region, pose challenges. Regulatory frameworks, such as those recently implemented in Malaysia concerning commercial vehicle safety, significantly influence market dynamics. The market is further shaped by the availability of competitive product substitutes and end-user demographics, particularly the growing adoption of telematics by fleet operators and logistics companies. M&A activity, while not at high levels, is anticipated to increase, primarily focused on regional consolidation and expansion into new markets.

- Market Concentration: Moderately fragmented (xx% market share held by top 5 players in 2024, projected to increase to xx% by 2033)

- Technological Drivers: AI-powered analytics, IoT integration, 5G connectivity

- Regulatory Landscape: Malaysia's JISA implementation, varying data privacy regulations across countries

- Competitive Substitutes: Traditional fleet management systems, manual tracking methods

- End-User Demographics: Growth driven by logistics, transportation, and government fleets.

- M&A Activity: Projected increase in consolidation and expansion-focused deals (xx deals in 2024, projected to xx by 2033)

Southeast Asia Telematics Market Growth Trends & Insights

The Southeast Asia telematics market has demonstrated robust growth in recent years, fueled by increasing demand for efficient fleet management solutions, improved road safety regulations, and rising awareness of the benefits of telematics technology. The market size is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million units by 2033 from xx million units in 2025. This growth is driven by factors such as increasing adoption rates across various vehicle types and industries, technological advancements enhancing the functionality and value proposition of telematics systems, and supportive government initiatives promoting digitization and smart mobility. Consumer behavior shifts towards improved safety, efficiency, and cost optimization are further accelerating market growth. Market penetration is expected to grow from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Southeast Asia Telematics Market

Thailand, Indonesia, and Malaysia represent the largest telematics markets within Southeast Asia, driven by robust economic growth, expanding logistics industries, and supportive government policies. The M/HCV segment is expected to witness higher growth compared to the LCV segment due to stringent regulations and the increasing need for efficient fleet management within the heavy commercial vehicle sector. Thailand's well-developed infrastructure and advanced technological adoption contribute to its leading position. Indonesia's large and growing fleet size contributes to significant market potential, while Malaysia benefits from government-led initiatives promoting road safety and efficient transport.

- Thailand: Strong economic growth, advanced infrastructure, high technology adoption.

- Indonesia: Large market size, increasing fleet modernization, growing logistics sector.

- Malaysia: Government regulations promoting road safety and fleet management efficiency.

- M/HCV Segment: Higher growth potential due to stringent safety regulations and efficiency demands.

Southeast Asia Telematics Market Product Landscape

The telematics product landscape is characterized by a wide range of solutions, from basic GPS tracking devices to advanced systems incorporating AI-powered analytics, driver behavior monitoring, and fuel efficiency optimization. Unique selling propositions (USPs) include real-time vehicle location tracking, geofencing capabilities, driver scorecards, and integrated reporting dashboards. Technological advancements are focused on improved data accuracy, enhanced connectivity, and seamless integration with existing fleet management systems. The integration of AI and machine learning is transforming telematics solutions, enabling predictive maintenance and improved operational efficiency.

Key Drivers, Barriers & Challenges in Southeast Asia Telematics Market

Key Drivers:

- Growing demand for enhanced fleet management efficiency and cost reduction.

- Stringent government regulations promoting road safety and vehicle monitoring.

- Increasing adoption of connected vehicles and IoT technologies.

- Expansion of e-commerce and logistics sectors driving demand for efficient delivery solutions.

Key Challenges:

- High initial investment costs associated with telematics system implementation.

- Concerns about data security and privacy.

- Inconsistent digital infrastructure across Southeast Asia.

- Competition from established and emerging players. The competitive intensity results in a pressure to reduce prices (estimated xx% price reduction from 2025-2033).

Emerging Opportunities in Southeast Asia Telematics Market

- Untapped markets in smaller cities and rural areas.

- Integration of telematics with other technologies (e.g., autonomous driving).

- Development of specialized solutions for specific industry sectors (e.g., agriculture, construction).

- Growing demand for value-added services (e.g., driver training, insurance integration).

Growth Accelerators in the Southeast Asia Telematics Market Industry

The long-term growth of the Southeast Asia telematics market will be fueled by several key factors, including the continuing development and adoption of 5G technology, strategic partnerships between telematics providers and fleet management companies, and the expansion of telematics solutions into new market segments. Technological advancements, particularly in AI and machine learning, are creating more sophisticated and valuable solutions. Moreover, government initiatives supporting the digitalization of transportation will continue to drive growth.

Key Players Shaping the Southeast Asia Telematics Market Market

- UTrack

- TransTrack

- i-Fleet (CelcomDigi)

- Guarantee GPS

- Xsense Information Service Co Ltd

- Onelink Technology

- Forth Tracking System

- Evo Systems SDN BHD

- PT Navindo Technologies

- Thai GPS Tracker

- Maxxfleet (PT Lavinta Buana Sakti)

- Vectras Inc

- EUPFIN Technology SDN BHD

- Get Prepared SDN BHD

- East Innovation Co Ltd (EyeFleet)

- Explosoft International SDN BHD

- Manila GPS Trackers

- i-Tracking (S) Pte Ltd

- Gigabyte Indonesia

- Thai Global Technologies Co Ltd

- DTC Enterprise

- Foxlogger (PT Sumber Sinergi Makmur)

- GPSiam

- IntelliTrac GPS Tracking

- Teltonika Asia Pte Ltd

- Omnicomm Vietnam

- SkyFy Technology Pte Ltd

- FindMyCar Philippines

- Tramigo Singapore

Notable Milestones in Southeast Asia Telematics Market Sector

- March 2023: OCTO Group enters the Singaporean market, expanding its presence in Southeast Asia.

- October 2022: Malaysia's Road Transport Department (RTD) implements stricter safety regulations for commercial vehicles, impacting telematics adoption.

In-Depth Southeast Asia Telematics Market Market Outlook

The Southeast Asia telematics market holds significant long-term growth potential, driven by technological innovation, supportive government policies, and the expansion of connected vehicle technologies. Strategic partnerships, market consolidation, and the development of value-added services will further enhance market attractiveness. The focus on enhancing road safety and improving fleet efficiency will create substantial opportunities for telematics providers in the coming years. The market is expected to experience a sustained period of growth, benefiting from the region's dynamic economic landscape and increasing adoption of advanced technologies.

Southeast Asia Telematics Market Segmentation

-

1. Type of Vehicle

- 1.1. LCV

- 1.2. M/HCV

Southeast Asia Telematics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Southeast Asia Telematics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Vehicle Safety

- 3.2.2 Emission

- 3.2.3 and Fleet Management Regulations; Advancements Such as Route Calculation

- 3.2.4 Vehicle Tracking

- 3.2.5 and Fuel Pilferage

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. LCVs Expected to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 5.1.1. LCV

- 5.1.2. M/HCV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 6. North America Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 6.1.1. LCV

- 6.1.2. M/HCV

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 7. South America Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 7.1.1. LCV

- 7.1.2. M/HCV

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 8. Europe Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 8.1.1. LCV

- 8.1.2. M/HCV

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 9. Middle East & Africa Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 9.1.1. LCV

- 9.1.2. M/HCV

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 10. Asia Pacific Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 10.1.1. LCV

- 10.1.2. M/HCV

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 11. China Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 13. India Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Southeast Asia Telematics Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 UTrack

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 TransTrack

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 i-Fleet (CelcomDigi)

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Guarantee GPS

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Xsense Information Service Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Onelink Technology

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Forth Tracking System

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Evo Systems SDN BHD

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 PT Navindo Technologies

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Thai GPS Tracker

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Maxxfleet (PT Lavinta Buana Sakti)

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Vectras Inc

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 EUPFIN Technology SDN BHD

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Get Prepared SDN BHD

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 East Innovation Co Ltd (EyeFleet)

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 Explosoft International SDN BHD

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.17 Manila GPS Trackers

- 18.2.17.1. Overview

- 18.2.17.2. Products

- 18.2.17.3. SWOT Analysis

- 18.2.17.4. Recent Developments

- 18.2.17.5. Financials (Based on Availability)

- 18.2.18 i-Tracking (S) Pte Ltd

- 18.2.18.1. Overview

- 18.2.18.2. Products

- 18.2.18.3. SWOT Analysis

- 18.2.18.4. Recent Developments

- 18.2.18.5. Financials (Based on Availability)

- 18.2.19 Gigabyte Indonesia

- 18.2.19.1. Overview

- 18.2.19.2. Products

- 18.2.19.3. SWOT Analysis

- 18.2.19.4. Recent Developments

- 18.2.19.5. Financials (Based on Availability)

- 18.2.20 Thai Global Technologies Co Ltd

- 18.2.20.1. Overview

- 18.2.20.2. Products

- 18.2.20.3. SWOT Analysis

- 18.2.20.4. Recent Developments

- 18.2.20.5. Financials (Based on Availability)

- 18.2.21 DTC Enterprise

- 18.2.21.1. Overview

- 18.2.21.2. Products

- 18.2.21.3. SWOT Analysis

- 18.2.21.4. Recent Developments

- 18.2.21.5. Financials (Based on Availability)

- 18.2.22 Foxlogger (PT Sumber Sinergi Makmur)

- 18.2.22.1. Overview

- 18.2.22.2. Products

- 18.2.22.3. SWOT Analysis

- 18.2.22.4. Recent Developments

- 18.2.22.5. Financials (Based on Availability)

- 18.2.23 GPSiam

- 18.2.23.1. Overview

- 18.2.23.2. Products

- 18.2.23.3. SWOT Analysis

- 18.2.23.4. Recent Developments

- 18.2.23.5. Financials (Based on Availability)

- 18.2.24 IntelliTrac GPS Tracking

- 18.2.24.1. Overview

- 18.2.24.2. Products

- 18.2.24.3. SWOT Analysis

- 18.2.24.4. Recent Developments

- 18.2.24.5. Financials (Based on Availability)

- 18.2.25 Teltonika Asia Pte Ltd

- 18.2.25.1. Overview

- 18.2.25.2. Products

- 18.2.25.3. SWOT Analysis

- 18.2.25.4. Recent Developments

- 18.2.25.5. Financials (Based on Availability)

- 18.2.26 Omnicomm Vietnam

- 18.2.26.1. Overview

- 18.2.26.2. Products

- 18.2.26.3. SWOT Analysis

- 18.2.26.4. Recent Developments

- 18.2.26.5. Financials (Based on Availability)

- 18.2.27 SkyFy Technology Pte Ltd

- 18.2.27.1. Overview

- 18.2.27.2. Products

- 18.2.27.3. SWOT Analysis

- 18.2.27.4. Recent Developments

- 18.2.27.5. Financials (Based on Availability)

- 18.2.28 FindMyCar Philippines

- 18.2.28.1. Overview

- 18.2.28.2. Products

- 18.2.28.3. SWOT Analysis

- 18.2.28.4. Recent Developments

- 18.2.28.5. Financials (Based on Availability)

- 18.2.29 Tramigo Singapore

- 18.2.29.1. Overview

- 18.2.29.2. Products

- 18.2.29.3. SWOT Analysis

- 18.2.29.4. Recent Developments

- 18.2.29.5. Financials (Based on Availability)

- 18.2.1 UTrack

List of Figures

- Figure 1: Global Southeast Asia Telematics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Southeast Asia Telematics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Southeast Asia Telematics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Southeast Asia Telematics Market Revenue (Million), by Type of Vehicle 2024 & 2032

- Figure 5: North America Southeast Asia Telematics Market Revenue Share (%), by Type of Vehicle 2024 & 2032

- Figure 6: North America Southeast Asia Telematics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Southeast Asia Telematics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Southeast Asia Telematics Market Revenue (Million), by Type of Vehicle 2024 & 2032

- Figure 9: South America Southeast Asia Telematics Market Revenue Share (%), by Type of Vehicle 2024 & 2032

- Figure 10: South America Southeast Asia Telematics Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Southeast Asia Telematics Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Southeast Asia Telematics Market Revenue (Million), by Type of Vehicle 2024 & 2032

- Figure 13: Europe Southeast Asia Telematics Market Revenue Share (%), by Type of Vehicle 2024 & 2032

- Figure 14: Europe Southeast Asia Telematics Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Southeast Asia Telematics Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Southeast Asia Telematics Market Revenue (Million), by Type of Vehicle 2024 & 2032

- Figure 17: Middle East & Africa Southeast Asia Telematics Market Revenue Share (%), by Type of Vehicle 2024 & 2032

- Figure 18: Middle East & Africa Southeast Asia Telematics Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Southeast Asia Telematics Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Southeast Asia Telematics Market Revenue (Million), by Type of Vehicle 2024 & 2032

- Figure 21: Asia Pacific Southeast Asia Telematics Market Revenue Share (%), by Type of Vehicle 2024 & 2032

- Figure 22: Asia Pacific Southeast Asia Telematics Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Southeast Asia Telematics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Southeast Asia Telematics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Southeast Asia Telematics Market Revenue Million Forecast, by Type of Vehicle 2019 & 2032

- Table 3: Global Southeast Asia Telematics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Southeast Asia Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Southeast Asia Telematics Market Revenue Million Forecast, by Type of Vehicle 2019 & 2032

- Table 13: Global Southeast Asia Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Southeast Asia Telematics Market Revenue Million Forecast, by Type of Vehicle 2019 & 2032

- Table 18: Global Southeast Asia Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Southeast Asia Telematics Market Revenue Million Forecast, by Type of Vehicle 2019 & 2032

- Table 23: Global Southeast Asia Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Southeast Asia Telematics Market Revenue Million Forecast, by Type of Vehicle 2019 & 2032

- Table 34: Global Southeast Asia Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Turkey Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Israel Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: GCC Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: North Africa Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Africa Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Middle East & Africa Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Southeast Asia Telematics Market Revenue Million Forecast, by Type of Vehicle 2019 & 2032

- Table 42: Global Southeast Asia Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: India Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: ASEAN Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Oceania Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Southeast Asia Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Telematics Market?

The projected CAGR is approximately 11.53%.

2. Which companies are prominent players in the Southeast Asia Telematics Market?

Key companies in the market include UTrack, TransTrack, i-Fleet (CelcomDigi), Guarantee GPS, Xsense Information Service Co Ltd, Onelink Technology, Forth Tracking System, Evo Systems SDN BHD, PT Navindo Technologies, Thai GPS Tracker, Maxxfleet (PT Lavinta Buana Sakti), Vectras Inc, EUPFIN Technology SDN BHD, Get Prepared SDN BHD, East Innovation Co Ltd (EyeFleet), Explosoft International SDN BHD, Manila GPS Trackers, i-Tracking (S) Pte Ltd, Gigabyte Indonesia, Thai Global Technologies Co Ltd, DTC Enterprise, Foxlogger (PT Sumber Sinergi Makmur), GPSiam, IntelliTrac GPS Tracking, Teltonika Asia Pte Ltd, Omnicomm Vietnam, SkyFy Technology Pte Ltd, FindMyCar Philippines, Tramigo Singapore.

3. What are the main segments of the Southeast Asia Telematics Market?

The market segments include Type of Vehicle.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Vehicle Safety. Emission. and Fleet Management Regulations; Advancements Such as Route Calculation. Vehicle Tracking. and Fuel Pilferage.

6. What are the notable trends driving market growth?

LCVs Expected to Register Significant Growth.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

March 2023 - OCTO Group, a telematics solutions provider to insurance, fleet management, and smart mobility, announced its entry in Singapore. Other notable names, such as Radius Telematics, GeoTab, etc., have also expanded their footprint in the Southeast Asian region in recent years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Telematics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Telematics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Telematics Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Telematics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence