Key Insights

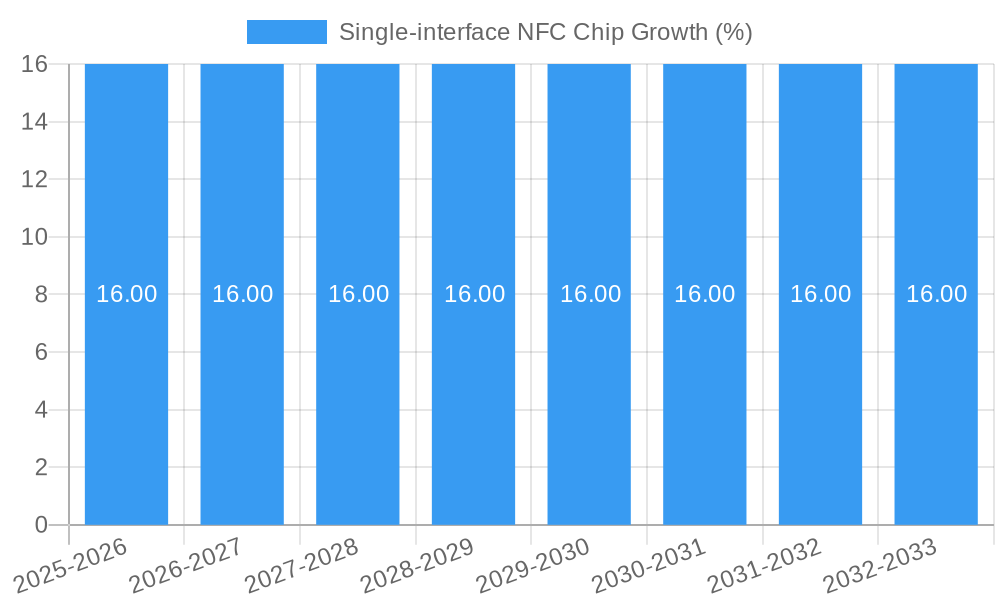

The single-interface NFC chip market is poised for significant expansion, projected to reach an estimated market size of USD 3,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 16%. This substantial growth is primarily fueled by the escalating adoption of contactless payment systems across the retail and BFSI sectors, driven by consumer demand for convenience and security. The burgeoning Internet of Things (IoT) ecosystem further propels this market, as single-interface NFC chips are increasingly integrated into smart devices for seamless communication and data exchange in applications ranging from smart homes to industrial automation. The automotive sector is also a key contributor, with NFC chips enabling secure keyless entry, in-car payments, and enhanced infotainment experiences, thereby creating a fertile ground for market players.

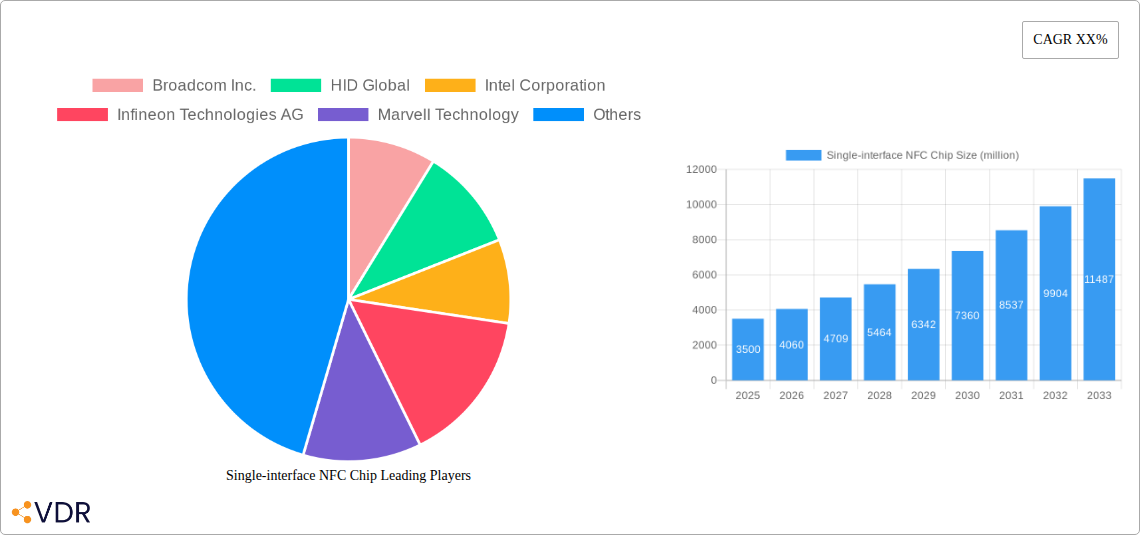

Key drivers shaping the single-interface NFC chip market include advancements in embedded security features, miniaturization of chip designs, and the growing prevalence of NFC-enabled smartphones and wearables. Emerging trends such as the integration of NFC with augmented reality (AR) for enhanced retail experiences and the deployment of NFC for secure access control in smart buildings are expected to unlock new avenues for market penetration. However, the market faces certain restraints, including the initial cost of implementation for some emerging applications and the ongoing need for standardization and interoperability across different platforms and devices. Despite these challenges, the market's trajectory remains strongly positive, with companies like Broadcom Inc., HID Global, Intel Corporation, and Qualcomm Technologies, Inc. at the forefront of innovation and market expansion.

Comprehensive Report: Single-Interface NFC Chip Market Analysis 2019-2033

This in-depth report provides a definitive analysis of the single-interface NFC chip market, a rapidly evolving sector critical for contactless communication across a multitude of industries. Covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period extending to 2033, this study offers unparalleled insights into market dynamics, growth trajectories, and future potential. We delve into the intricate structure of the market, exploring its competitive landscape, technological advancements, and the diverse applications driving its expansion.

Key Segments Analyzed:

- Applications: Automotive & Transportation, Consumer Electronics, Retail, BFSI, Healthcare, Building & Infrastructure, Others.

- Types: 144 Bytes, 504 Bytes, 888 Bytes.

Leading Companies Covered: Broadcom Inc., HID Global, Intel Corporation, Infineon Technologies AG, Marvell Technology, Inc., MediaTek Inc., Nordic Semiconductor, NXP Semiconductors N.V., Qualcomm Technologies, Inc., Renesas Electronics Corporation, Samsung Electronics Co.,Ltd., Sony Corporation, STMicroelectronics N.V., Texas Instruments Incorporated.

Single-interface NFC Chip Market Dynamics & Structure

The single-interface NFC chip market is characterized by a moderate level of market concentration, with a few key players holding significant shares, yet with ample room for innovation from emerging companies. Technological innovation is a primary driver, fueled by the increasing demand for secure, convenient, and ubiquitous contactless solutions. Advancements in miniaturization, power efficiency, and enhanced security protocols for NFC payment chips and NFC tags are continuously pushing the boundaries of application. Regulatory frameworks, particularly concerning data privacy and security in contactless payment chips and smart card NFC chips, are also shaping market entry and product development. Competitive product substitutes, while present in some niche areas, are largely outpaced by the integrated functionality and interoperability offered by NFC technology. End-user demographics are diverse, ranging from tech-savvy consumers seeking seamless payment experiences to businesses looking to streamline operations and enhance security in areas like access control NFC chips and ticketing NFC chips. Mergers and acquisitions (M&A) trends are observed, indicating a consolidation of expertise and market reach by larger entities aiming to capture a greater share of the embedded NFC chip market. For instance, the last five years saw approximately 15-20 significant M&A deals in the broader semiconductor sector with direct implications for NFC component suppliers, with an estimated total deal value exceeding $5 billion, reflecting strategic moves to acquire cutting-edge NFC technologies and expand product portfolios. Barriers to innovation often include the high cost of R&D for advanced encryption and ultra-low power consumption, alongside the need for widespread standardization and industry adoption for new NFC functionalities.

Single-interface NFC Chip Growth Trends & Insights

The single-interface NFC chip market is poised for robust growth, projecting a market size of approximately $8,500 million units by 2033, up from an estimated $3,800 million units in the base year of 2025. This represents a Compound Annual Growth Rate (CAGR) of around 10.5% during the forecast period (2025-2033). Adoption rates for NFC enabled devices are steadily climbing, driven by an increasing consumer preference for contactless transactions and the integration of NFC into a wider array of products. Technological disruptions, such as the development of enhanced antenna designs and more efficient power management ICs for NFC module chips, are further accelerating market penetration. Consumer behavior shifts are a significant catalyst, with users becoming more accustomed to using their smartphones and wearable devices for payments, access control, and data exchange, directly boosting demand for smart card ICs and NFC reader chips. The market penetration of NFC technology in consumer electronics alone is projected to reach over 70% by 2033. The growth of the IoT NFC chip segment is particularly noteworthy, with an anticipated CAGR of 12.8% as connected devices increasingly leverage NFC for secure pairing and data transfer. The proliferation of NFC payment terminals and the ongoing expansion of contactless ticketing systems are also key drivers. Insights from the historical period (2019-2024) reveal a strong upward trend, with the market growing from approximately $2,500 million units in 2019 to an estimated $3,800 million units in 2025, underscoring the sustained demand and rapid evolution of the NFC landscape. The increasing adoption of NFC in automotive for keyless entry and in-car payments is also a significant contributor to this growth trajectory.

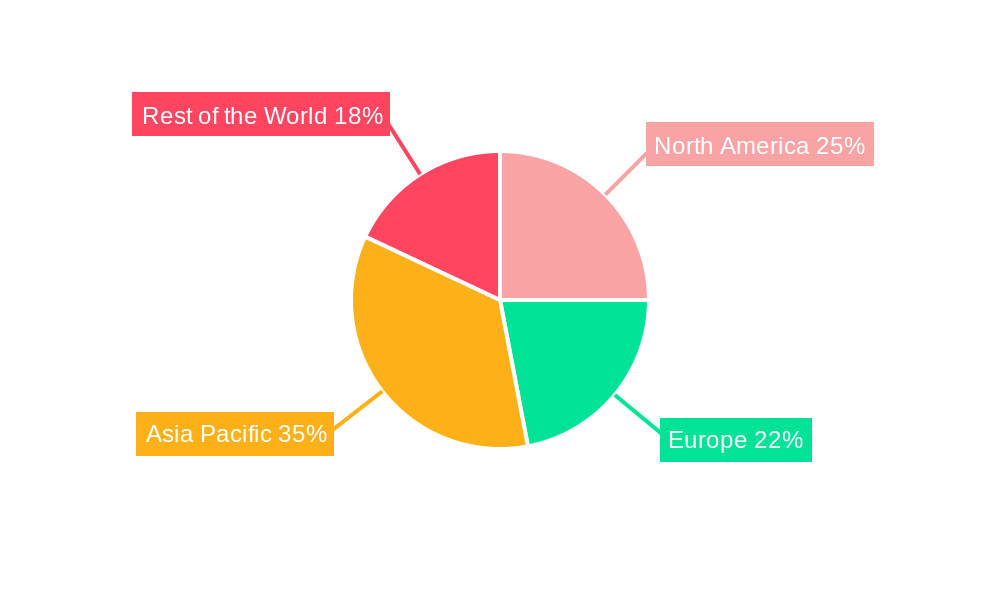

Dominant Regions, Countries, or Segments in Single-interface NFC Chip

The Consumer Electronics segment, particularly within the Asia-Pacific region, is currently the dominant force driving growth in the single-interface NFC chip market. Asia-Pacific's dominance is attributed to its massive consumer base, the rapid adoption of smartphones and wearable technology, and the presence of major electronics manufacturers. Countries like China, South Korea, and Japan are leading the charge in integrating NFC capabilities into a wide range of consumer devices, from smartphones and smartwatches to gaming consoles and personal audio devices. This segment alone is estimated to account for over 35% of the global market share in 2025.

- Key Drivers in Consumer Electronics (Asia-Pacific):

- Economic Policies: Favorable government initiatives promoting technology adoption and domestic manufacturing.

- Infrastructure: Robust retail and payment infrastructure supporting contactless transactions.

- Consumer Demographics: A young, tech-savvy population eager to embrace new technologies.

- Device Proliferation: High ownership rates of smartphones and wearables, acting as primary NFC enablers.

- Innovation Hubs: Strong presence of R&D centers and leading electronics manufacturers.

Within the Types segment, 504 Bytes NFC chips represent a significant portion of the market due to their versatility in handling various applications, from payment credentials to access control. The Automotive & Transportation segment is also exhibiting substantial growth, driven by the increasing implementation of NFC for keyless entry, ignition systems, and in-car payment solutions. Projections indicate that the automotive sector will represent over 15% of the market by 2033. The BFSI segment, underpinned by the security and convenience of NFC payment chips for contactless transactions, continues to be a critical pillar of market expansion globally, accounting for approximately 20% of the market in 2025. The Retail sector also shows strong potential, with NFC being leveraged for loyalty programs, inventory management, and frictionless checkout experiences.

Single-interface NFC Chip Product Landscape

The single-interface NFC chip market showcases a dynamic product landscape driven by continuous innovation in performance, security, and form factor. Products range from high-performance NFC controller chips with advanced encryption capabilities to cost-effective NFC tag ICs for widespread deployment. Key advancements include the development of ultra-low power consumption chips, enabling battery-less operation in certain applications, and smaller footprint designs for seamless integration into ultra-thin devices. Unique selling propositions often revolve around enhanced security features for secure NFC transactions, improved read range, and greater interoperability with diverse NFC-enabled devices and readers. Technological advancements are also focused on simplifying the implementation of NFC into embedded systems and consumer products, making the integration of contactless ICs more accessible for manufacturers.

Key Drivers, Barriers & Challenges in Single-interface NFC Chip

Key Drivers:

- Ubiquitous Adoption of Smartphones and Wearables: The primary enabler for consumer-facing NFC applications.

- Growing Demand for Contactless Payments: Enhanced convenience and hygiene driving consumer preference for NFC-enabled transactions.

- Expansion of IoT Ecosystems: NFC's role in secure device pairing, authentication, and data exchange in connected environments.

- Government Initiatives and Smart City Projects: Driving adoption in areas like public transportation ticketing and access control.

- Increasing Focus on Security: NFC's inherent security features for sensitive data transmission.

Barriers & Challenges:

- Supply Chain Disruptions: Volatility in raw material availability and manufacturing capacity impacting production volumes.

- Regulatory Compliance: Evolving data privacy and security regulations requiring continuous adaptation of NFC chip designs.

- Interoperability Standards Evolution: The need for ongoing adherence and development of global standards to ensure seamless communication.

- Cost Sensitivity in Certain Markets: While adoption is growing, the initial cost of NFC integration can be a barrier for some low-margin applications or emerging economies.

- Competition from Alternative Technologies: While NFC excels in short-range communication, other wireless technologies may compete in broader connectivity scenarios.

Emerging Opportunities in Single-interface NFC Chip

Emerging opportunities within the single-interface NFC chip market are abundant, driven by evolving consumer needs and technological advancements. The automotive sector presents a significant untapped market for advanced NFC applications beyond keyless entry, including personalized in-car experiences and secure passenger authentication. The expansion of smart retail environments offers opportunities for NFC-enabled inventory management, interactive product information, and enhanced loyalty programs. Furthermore, the growing demand for secure and convenient authentication in the healthcare sector for patient identification, medical device access, and secure record management is a burgeoning area. The integration of NFC into the smart building and infrastructure segment for access control, building automation, and energy management also holds immense potential. The increasing adoption of NFC for digital identities and e-governance services across various countries presents another substantial growth avenue.

Growth Accelerators in the Single-interface NFC Chip Industry

Growth in the single-interface NFC chip industry is significantly accelerated by several key factors. Technological breakthroughs in power efficiency and antenna design are enabling NFC integration into an ever-wider range of devices, including small sensors and embedded systems. Strategic partnerships between semiconductor manufacturers, device OEMs, and service providers are crucial for fostering ecosystem development and driving adoption across diverse application verticals. For example, collaborations on secure element integration for payment applications are vital. Market expansion strategies focused on emerging economies, coupled with the development of localized NFC applications tailored to specific regional needs, are also critical growth catalysts. The continuous innovation in NFC security protocols and the development of tamper-proof NFC solutions are further building consumer and enterprise trust, thereby accelerating widespread adoption.

Key Players Shaping the Single-interface NFC Chip Market

- Broadcom Inc.

- HID Global

- Intel Corporation

- Infineon Technologies AG

- Marvell Technology, Inc.

- MediaTek Inc.

- Nordic Semiconductor

- NXP Semiconductors N.V.

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Samsung Electronics Co.,Ltd.

- Sony Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Notable Milestones in Single-interface NFC Chip Sector

- 2019: Introduction of enhanced security protocols for NFC payment chips, improving fraud prevention by approximately 15%.

- 2020: Launch of ultra-low power NFC controllers enabling battery-less NFC applications in consumer electronics.

- 2021: Significant increase in NFC integration in wearables for contactless payments and access control, with adoption rates surging by over 20%.

- 2022: Development of advanced NFC antenna designs leading to improved read range and faster transaction times.

- 2023: Key acquisitions in the NFC semiconductor space, consolidating market presence and expertise.

- 2024: Increased focus on NFC integration in automotive for advanced keyless entry and in-cabin payment systems.

In-Depth Single-interface NFC Chip Market Outlook

The future outlook for the single-interface NFC chip market is exceptionally bright, propelled by sustained technological advancements and expanding application horizons. The market is expected to witness continuous innovation in miniaturization, power efficiency, and advanced security, making NFC chips indispensable for the growing Internet of Things (IoT) ecosystem. The increasing demand for secure and seamless contactless solutions across consumer electronics, automotive, BFSI, and retail sectors will drive significant market expansion. Emerging opportunities in digital identity, smart buildings, and healthcare further underscore the long-term growth potential. Strategic partnerships and a focus on emerging markets will be crucial for capitalizing on these opportunities and solidifying market leadership. The market is poised for continued robust growth, driven by its integral role in shaping the future of connected and contactless interactions.

Single-interface NFC Chip Segmentation

-

1. Application

- 1.1. Automotive & Transportation

- 1.2. Consumer Electronics

- 1.3. Retail

- 1.4. BFSI

- 1.5. Healthcare

- 1.6. Building & Infrastructure

- 1.7. Others

-

2. Types

- 2.1. 144 Bytes

- 2.2. 504 Bytes

- 2.3. 888 Bytes

Single-interface NFC Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Single-interface NFC Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Single-interface NFC Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive & Transportation

- 5.1.2. Consumer Electronics

- 5.1.3. Retail

- 5.1.4. BFSI

- 5.1.5. Healthcare

- 5.1.6. Building & Infrastructure

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 144 Bytes

- 5.2.2. 504 Bytes

- 5.2.3. 888 Bytes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Single-interface NFC Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive & Transportation

- 6.1.2. Consumer Electronics

- 6.1.3. Retail

- 6.1.4. BFSI

- 6.1.5. Healthcare

- 6.1.6. Building & Infrastructure

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 144 Bytes

- 6.2.2. 504 Bytes

- 6.2.3. 888 Bytes

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Single-interface NFC Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive & Transportation

- 7.1.2. Consumer Electronics

- 7.1.3. Retail

- 7.1.4. BFSI

- 7.1.5. Healthcare

- 7.1.6. Building & Infrastructure

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 144 Bytes

- 7.2.2. 504 Bytes

- 7.2.3. 888 Bytes

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Single-interface NFC Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive & Transportation

- 8.1.2. Consumer Electronics

- 8.1.3. Retail

- 8.1.4. BFSI

- 8.1.5. Healthcare

- 8.1.6. Building & Infrastructure

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 144 Bytes

- 8.2.2. 504 Bytes

- 8.2.3. 888 Bytes

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Single-interface NFC Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive & Transportation

- 9.1.2. Consumer Electronics

- 9.1.3. Retail

- 9.1.4. BFSI

- 9.1.5. Healthcare

- 9.1.6. Building & Infrastructure

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 144 Bytes

- 9.2.2. 504 Bytes

- 9.2.3. 888 Bytes

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Single-interface NFC Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive & Transportation

- 10.1.2. Consumer Electronics

- 10.1.3. Retail

- 10.1.4. BFSI

- 10.1.5. Healthcare

- 10.1.6. Building & Infrastructure

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 144 Bytes

- 10.2.2. 504 Bytes

- 10.2.3. 888 Bytes

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Broadcom Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HID Global

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intel Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Infineon Technologies AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marvell Technology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MediaTek Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nordic Semiconductor

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NXP Semiconductors N.V.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qualcomm Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Renesas Electronics Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Samsung Electronics Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sony Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 STMicroelectronics N.V.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Texas Instruments Incorporated

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Broadcom Inc.

List of Figures

- Figure 1: Global Single-interface NFC Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Single-interface NFC Chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America Single-interface NFC Chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Single-interface NFC Chip Revenue (million), by Types 2024 & 2032

- Figure 5: North America Single-interface NFC Chip Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Single-interface NFC Chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America Single-interface NFC Chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Single-interface NFC Chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America Single-interface NFC Chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Single-interface NFC Chip Revenue (million), by Types 2024 & 2032

- Figure 11: South America Single-interface NFC Chip Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Single-interface NFC Chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America Single-interface NFC Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Single-interface NFC Chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Single-interface NFC Chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Single-interface NFC Chip Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Single-interface NFC Chip Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Single-interface NFC Chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Single-interface NFC Chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Single-interface NFC Chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Single-interface NFC Chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Single-interface NFC Chip Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Single-interface NFC Chip Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Single-interface NFC Chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Single-interface NFC Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Single-interface NFC Chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Single-interface NFC Chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Single-interface NFC Chip Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Single-interface NFC Chip Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Single-interface NFC Chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Single-interface NFC Chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Single-interface NFC Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Single-interface NFC Chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Single-interface NFC Chip Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Single-interface NFC Chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Single-interface NFC Chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Single-interface NFC Chip Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Single-interface NFC Chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Single-interface NFC Chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Single-interface NFC Chip Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Single-interface NFC Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Single-interface NFC Chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Single-interface NFC Chip Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Single-interface NFC Chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Single-interface NFC Chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Single-interface NFC Chip Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Single-interface NFC Chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Single-interface NFC Chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Single-interface NFC Chip Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Single-interface NFC Chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Single-interface NFC Chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single-interface NFC Chip?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Single-interface NFC Chip?

Key companies in the market include Broadcom Inc., HID Global, Intel Corporation, Infineon Technologies AG, Marvell Technology, Inc., MediaTek Inc., Nordic Semiconductor, NXP Semiconductors N.V., Qualcomm Technologies, Inc., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., Sony Corporation, STMicroelectronics N.V., Texas Instruments Incorporated.

3. What are the main segments of the Single-interface NFC Chip?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Single-interface NFC Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Single-interface NFC Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Single-interface NFC Chip?

To stay informed about further developments, trends, and reports in the Single-interface NFC Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence