Key Insights

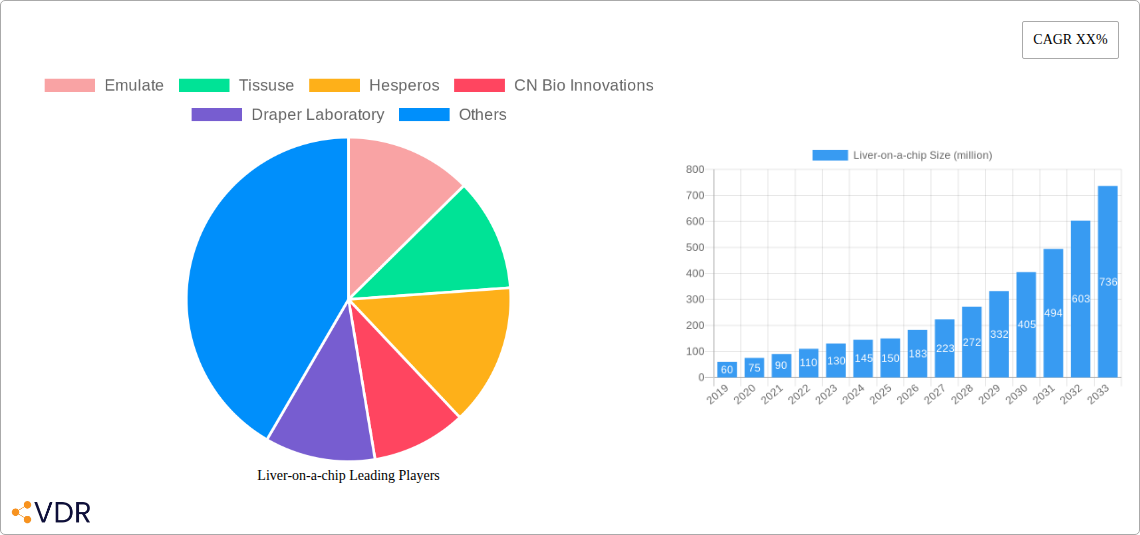

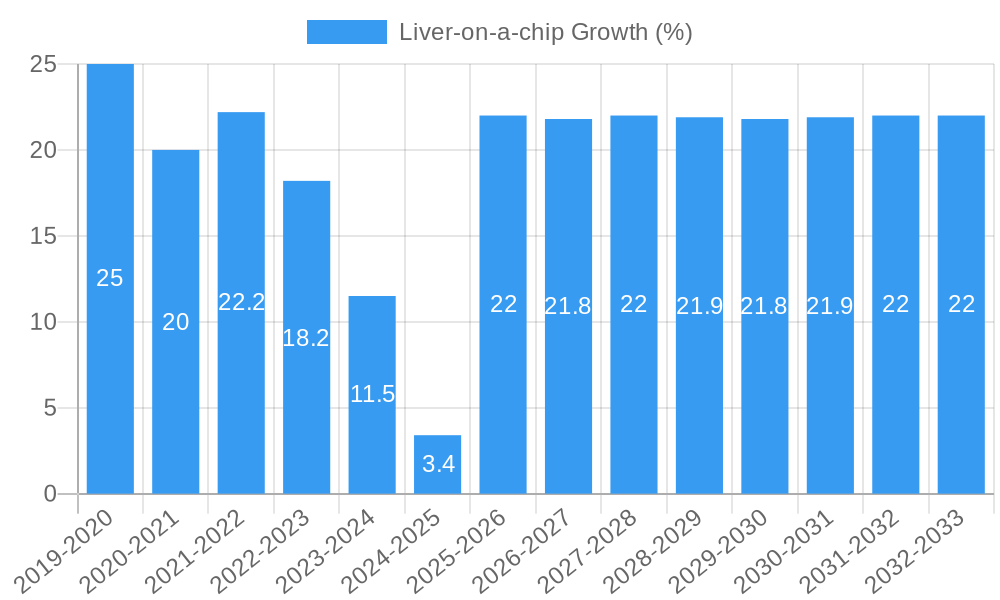

The Liver-on-a-chip market is poised for substantial expansion, driven by the increasing demand for more accurate and predictive preclinical models in drug discovery and development. With an estimated market size of USD 150 million in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 22% through 2033, reaching a significant valuation. This robust growth is fueled by the inherent limitations of traditional animal models, which often fail to replicate human physiological responses accurately, leading to high attrition rates in clinical trials. Liver-on-a-chip technology offers a compelling alternative by mimicking the complex microenvironment and cellular functions of the human liver, enabling better prediction of drug efficacy and toxicity. Key applications are predominantly within pharmaceutical and biotechnology companies, where these advanced models accelerate research timelines and reduce the cost associated with late-stage failures. Academic and research institutes also represent a significant segment, leveraging these platforms for fundamental biological research and novel therapeutic development.

The market's trajectory is further bolstered by continuous technological advancements and increasing regulatory acceptance of these novel testing methods. The development of more sophisticated microfluidic devices, improved cell culture techniques, and integration of multi-organ systems are key trends shaping the landscape. These innovations are addressing challenges related to long-term culture stability and scalability. However, the market faces certain restraints, including the high initial cost of setting up and acquiring these advanced systems, as well as the need for specialized expertise in their operation and data interpretation. Despite these hurdles, the undeniable benefits of reduced animal testing, enhanced drug safety profiling, and accelerated R&D cycles are expected to propel the Liver-on-a-chip market forward, making it a critical component of the future of pharmaceutical research. The segmentation into child and adult liver-on-a-chip models highlights the growing focus on specific patient populations and disease modeling.

Comprehensive Liver-on-a-Chip Market Report: Dynamics, Growth, and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Liver-on-a-Chip market, offering critical insights for stakeholders in pharmaceutical R&D, biotechnology innovation, and academic research. Spanning the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this report delves into market structure, growth trends, regional dominance, product innovations, and future opportunities. Leveraging cutting-edge data and expert analysis, it equips industry professionals with actionable intelligence to navigate this rapidly evolving landscape, focusing on both child and adult liver-on-a-chip applications.

Liver-on-a-chip Market Dynamics & Structure

The Liver-on-a-Chip market exhibits a moderate to highly concentrated structure, with a few key players dominating technological development and commercialization. Emulate and CN Bio Innovations are at the forefront, driving significant innovation in microfluidic technologies and physiologically relevant cell culture models. Technological innovation is primarily fueled by the increasing demand for more accurate and predictive drug toxicity testing, aiming to reduce costly late-stage failures in pharmaceutical development. Regulatory bodies are also playing an increasingly influential role, with a growing acceptance of in vitro human models as alternatives to traditional animal testing. Competitive product substitutes include established in vitro assays and animal models, but the unique advantage of Liver-on-a-Chip lies in its ability to mimic human liver microenvironments, offering superior predictive power. End-user demographics are dominated by pharmaceutical and biotechnology companies seeking to accelerate drug discovery and development pipelines, followed by academic and research institutes exploring fundamental biological processes and disease modeling. Mergers and acquisitions (M&A) activity is moderate, with smaller, innovative startups being acquired by larger players seeking to integrate advanced technologies. For instance, the acquisition of Mimetas by Organoid.AI in 2023 for an undisclosed sum highlights consolidation efforts. Barriers to entry include high R&D costs, the need for specialized expertise in microfluidics and cell biology, and the lengthy validation process required for regulatory acceptance.

- Market Concentration: Moderate to High, with key players like Emulate and CN Bio Innovations holding significant market share.

- Technological Innovation Drivers: Drug toxicity testing, personalized medicine, disease modeling, reduction of animal testing.

- Regulatory Frameworks: Growing acceptance of in vitro human models, evolving guidelines for drug development.

- Competitive Product Substitutes: Traditional in vitro assays, animal testing models.

- End-User Demographics: Pharmaceutical & Biotechnology Companies (dominant), Academic & Research Institutes.

- M&A Trends: Moderate activity, with strategic acquisitions of emerging technologies and platforms.

Liver-on-a-chip Growth Trends & Insights

The global Liver-on-a-Chip market is experiencing robust growth, driven by an escalating need for more human-relevant preclinical testing platforms. The market size, valued at approximately $750 million in 2023, is projected to reach a significant $3,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 18.5%. This impressive trajectory is underpinned by increasing adoption rates across pharmaceutical and biotechnology sectors, as these industries strive to enhance drug efficacy and safety profiles while mitigating the financial and ethical implications of traditional animal testing. Technological disruptions, such as advancements in microfluidics, 3D bioprinting, and artificial intelligence-driven data analysis, are continuously refining the capabilities of Liver-on-a-Chip systems, leading to more complex and accurate models that can better recapitulate human liver physiology and pathology. Consumer behavior shifts, particularly within the research community, are leaning towards more ethical and cost-effective research methodologies. This sentiment is further amplified by the inherent limitations of animal models in predicting human responses to drug candidates. Market penetration is steadily increasing, with a projected penetration rate of 35% in drug discovery and development workflows by 2030. The demand for both child and adult liver-on-a-chip models is on the rise, reflecting the growing understanding of age-specific drug metabolism and toxicity. Insights from recent market analyses indicate that investments in organ-on-chip technologies, including Liver-on-a-Chip, have surged, with venture capital funding reaching approximately $200 million in 2023 alone. The development of more sophisticated and scalable Liver-on-a-Chip platforms capable of testing multiple drug candidates simultaneously is a key factor contributing to market expansion. Furthermore, the integration of advanced imaging and biosensing technologies is enhancing the data output and analytical capabilities of these systems, making them indispensable tools for researchers.

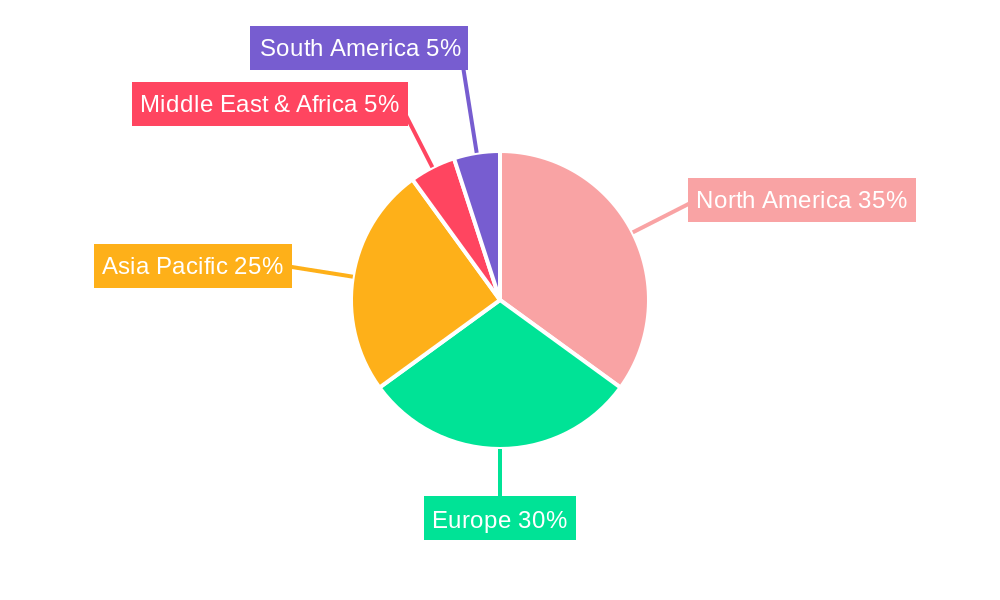

Dominant Regions, Countries, or Segments in Liver-on-a-chip

The Pharmaceutical & Biotechnology Companies segment unequivocally stands as the dominant force propelling the growth of the global Liver-on-a-Chip market. This segment is projected to account for over 65% of the total market revenue by 2028, driven by the critical need for advanced drug discovery and preclinical testing solutions. North America, particularly the United States, is the leading region, contributing approximately 40% of the global market share. This dominance is attributed to a robust pharmaceutical industry, substantial R&D investments, and a well-established regulatory framework that encourages innovation in drug development.

Key drivers for the dominance of Pharmaceutical & Biotechnology Companies include:

- High R&D Expenditure: These companies invest billions annually in developing new therapeutics, seeking to reduce attrition rates and accelerate time-to-market. Liver-on-a-Chip offers a compelling solution by providing more predictive in vitro models.

- Need for Reduced Animal Testing: Growing ethical concerns and regulatory pressures are pushing pharmaceutical companies towards alternatives to animal testing, making human-relevant in vitro models highly desirable.

- Improved Drug Efficacy and Safety Prediction: Liver-on-a-Chip platforms offer unprecedented insights into drug metabolism, toxicity, and efficacy, minimizing the risk of costly late-stage clinical trial failures.

- Focus on Personalized Medicine: The ability to use patient-derived cells in Liver-on-a-Chip models opens avenues for personalized drug testing and treatment strategies.

Within the Types segment, Adult Liver-on-a-chip currently holds a larger market share due to the higher volume of adult-targeted drug development. However, Child Liver-on-a-chip is poised for significant growth, driven by increased research into pediatric diseases and the unique physiological differences in drug metabolism in children. The market share for Adult Liver-on-a-chip is estimated at 70% in 2025, with Child Liver-on-a-chip at 30%.

Economic policies favoring scientific research and innovation, coupled with robust healthcare infrastructure, further bolster the growth in leading regions. For instance, government initiatives in the US and European Union countries that support advanced therapeutic development directly benefit the Liver-on-a-Chip market.

Liver-on-a-chip Product Landscape

The Liver-on-a-Chip product landscape is characterized by continuous innovation aimed at enhancing physiological relevance and predictive accuracy. Products range from single-cell liver models to multi-organ-on-chip systems incorporating liver co-cultures. Key innovations include the development of advanced microfluidic chips capable of precisely controlling shear stress, oxygen gradients, and nutrient delivery to mimic in vivo conditions. These systems often utilize primary human hepatocytes, co-cultured with other cell types like Kupffer cells and stellate cells, to better recapitulate the complex liver microenvironment. Performance metrics are increasingly focused on demonstrating improved prediction of drug-induced liver injury (DILI) and accurate characterization of drug metabolism compared to traditional cell cultures and animal models. Unique selling propositions include the ability to conduct long-term drug exposure studies, assess hepatic clearance mechanisms, and investigate disease pathology with high fidelity. Technological advancements are also incorporating real-time monitoring capabilities through integrated biosensors, enabling dynamic assessment of liver function.

Key Drivers, Barriers & Challenges in Liver-on-a-chip

The Liver-on-a-Chip market is propelled by several key drivers. The urgent need for more predictive preclinical models to reduce drug development costs and failure rates is paramount. Advances in microfluidics and cell culture technologies have made these complex systems more accessible and reliable. Furthermore, the growing ethical imperative and regulatory push to reduce animal testing are significant catalysts. Academic research breakthroughs in understanding liver biology and disease also fuel demand.

Conversely, several barriers and challenges impede widespread adoption. The high initial cost of sophisticated Liver-on-a-Chip systems and specialized consumables is a significant hurdle, particularly for smaller research institutions. Standardizing protocols and ensuring reproducibility across different laboratories remains an ongoing challenge, impacting regulatory acceptance. The complexity of maintaining viable and functional primary human hepatocytes in culture for extended periods also presents a technical challenge. The market also faces competition from established, albeit less predictive, testing methods. The estimated financial impact of drug development failures due to unforeseen toxicity is in the billions of dollars annually, highlighting the economic imperative to overcome these challenges.

Emerging Opportunities in Liver-on-a-chip

Emerging opportunities in the Liver-on-a-Chip sector are vast and multifaceted. The development of highly predictive models for specific liver diseases, such as non-alcoholic steatohepatitis (NASH) and viral hepatitis, presents a significant untapped market. The growing interest in personalized medicine opens avenues for creating patient-specific Liver-on-a-Chip models for predicting individual drug responses and optimizing treatment regimens. Furthermore, the integration of AI and machine learning algorithms with Liver-on-a-Chip data is creating new opportunities for in-silico modeling and predictive analytics, accelerating drug discovery. The expansion of these technologies into toxicology screening for environmental contaminants and consumer products also represents a growing niche.

Growth Accelerators in the Liver-on-a-chip Industry

Long-term growth in the Liver-on-a-Chip industry is being significantly accelerated by technological breakthroughs in bioengineering and cell biology. The refinement of microfluidic designs to better simulate in vivo microenvironments, coupled with advancements in stem cell technology for generating consistent and scalable hepatic cell populations, are critical accelerators. Strategic partnerships between technology developers, pharmaceutical companies, and contract research organizations (CROs) are crucial for driving commercialization and wider adoption. Market expansion strategies, including the development of user-friendly platforms and comprehensive training programs, are also essential for broadening the user base. The increasing focus on developing multi-organ-on-chip systems that integrate liver models with other organs will further enhance their utility and drive adoption.

Key Players Shaping the Liver-on-a-chip Market

- Emulate

- Tissuse

- Hesperos

- CN Bio Innovations

- Draper Laboratory

- Mimetas

- Nortis

- Kirkstall

- Cherry Biotech SAS

- Else Else Kooi Laboratory

- Micronit Microtechnologies B.V.

Notable Milestones in Liver-on-a-chip Sector

- 2019: Emulate launches its Liver-Intestine-Chip, enhancing capabilities for drug absorption and metabolism studies.

- 2020: CN Bio Innovations secures significant funding to expand its organ-on-chip platform, including liver models.

- 2021: Mimetas introduces a new generation of microfluidic chips for advanced liver toxicity screening.

- 2022: Hesperos showcases its multi-organ systems, including liver components, for drug development applications.

- 2023: Several academic institutions publish groundbreaking research demonstrating the predictive power of Liver-on-a-Chip for specific drug-induced liver injuries.

- 2023: Kirkstall launches its scalable perfusion bioreactor system designed for advanced liver tissue engineering.

- Early 2024: Continued advancements in automation and AI integration for Liver-on-a-Chip data analysis reported by multiple research groups.

In-Depth Liver-on-a-chip Market Outlook

The future market potential for Liver-on-a-Chip is exceptionally bright, driven by ongoing technological advancements and an increasing demand for more predictive and ethical preclinical models. The growth accelerators identified, including technological breakthroughs in microfluidics and cell biology, along with strategic industry collaborations, will continue to fuel market expansion. Strategic opportunities lie in the further development of standardized, robust, and scalable Liver-on-a-Chip platforms that can seamlessly integrate into existing drug discovery workflows. The increasing focus on precision medicine and personalized therapies will also present significant opportunities for custom-designed liver models. The market is poised for sustained growth, with a projected market size of over $5,000 million by 2033, offering substantial returns for innovators and investors in this critical field of bioengineering.

Liver-on-a-chip Segmentation

-

1. Application

- 1.1. Pharmaceutical & Biotechnology Companies

- 1.2. Academic & Research Institutes

- 1.3. Other End Users

-

2. Types

- 2.1. Child Liver-on-a-chip

- 2.2. Adult Liver-on-a-chip

Liver-on-a-chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Liver-on-a-chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liver-on-a-chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical & Biotechnology Companies

- 5.1.2. Academic & Research Institutes

- 5.1.3. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Child Liver-on-a-chip

- 5.2.2. Adult Liver-on-a-chip

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Liver-on-a-chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical & Biotechnology Companies

- 6.1.2. Academic & Research Institutes

- 6.1.3. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Child Liver-on-a-chip

- 6.2.2. Adult Liver-on-a-chip

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Liver-on-a-chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical & Biotechnology Companies

- 7.1.2. Academic & Research Institutes

- 7.1.3. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Child Liver-on-a-chip

- 7.2.2. Adult Liver-on-a-chip

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Liver-on-a-chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical & Biotechnology Companies

- 8.1.2. Academic & Research Institutes

- 8.1.3. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Child Liver-on-a-chip

- 8.2.2. Adult Liver-on-a-chip

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Liver-on-a-chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical & Biotechnology Companies

- 9.1.2. Academic & Research Institutes

- 9.1.3. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Child Liver-on-a-chip

- 9.2.2. Adult Liver-on-a-chip

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Liver-on-a-chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical & Biotechnology Companies

- 10.1.2. Academic & Research Institutes

- 10.1.3. Other End Users

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Child Liver-on-a-chip

- 10.2.2. Adult Liver-on-a-chip

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Emulate

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tissuse

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hesperos

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CN Bio Innovations

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Draper Laboratory

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mimetas

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nortis

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kirkstall

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cherry Biotech SAS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Else Else Kooi Laboratory

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Micronit Microtechnologies B.V.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Emulate

List of Figures

- Figure 1: Global Liver-on-a-chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Liver-on-a-chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America Liver-on-a-chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Liver-on-a-chip Revenue (million), by Types 2024 & 2032

- Figure 5: North America Liver-on-a-chip Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Liver-on-a-chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America Liver-on-a-chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Liver-on-a-chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America Liver-on-a-chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Liver-on-a-chip Revenue (million), by Types 2024 & 2032

- Figure 11: South America Liver-on-a-chip Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Liver-on-a-chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America Liver-on-a-chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Liver-on-a-chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Liver-on-a-chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Liver-on-a-chip Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Liver-on-a-chip Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Liver-on-a-chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Liver-on-a-chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Liver-on-a-chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Liver-on-a-chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Liver-on-a-chip Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Liver-on-a-chip Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Liver-on-a-chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Liver-on-a-chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Liver-on-a-chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Liver-on-a-chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Liver-on-a-chip Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Liver-on-a-chip Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Liver-on-a-chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Liver-on-a-chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Liver-on-a-chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Liver-on-a-chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Liver-on-a-chip Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Liver-on-a-chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Liver-on-a-chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Liver-on-a-chip Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Liver-on-a-chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Liver-on-a-chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Liver-on-a-chip Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Liver-on-a-chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Liver-on-a-chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Liver-on-a-chip Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Liver-on-a-chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Liver-on-a-chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Liver-on-a-chip Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Liver-on-a-chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Liver-on-a-chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Liver-on-a-chip Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Liver-on-a-chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Liver-on-a-chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liver-on-a-chip?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Liver-on-a-chip?

Key companies in the market include Emulate, Tissuse, Hesperos, CN Bio Innovations, Draper Laboratory, Mimetas, Nortis, Kirkstall, Cherry Biotech SAS, Else Else Kooi Laboratory, Micronit Microtechnologies B.V..

3. What are the main segments of the Liver-on-a-chip?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Liver-on-a-chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Liver-on-a-chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Liver-on-a-chip?

To stay informed about further developments, trends, and reports in the Liver-on-a-chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence