Key Insights

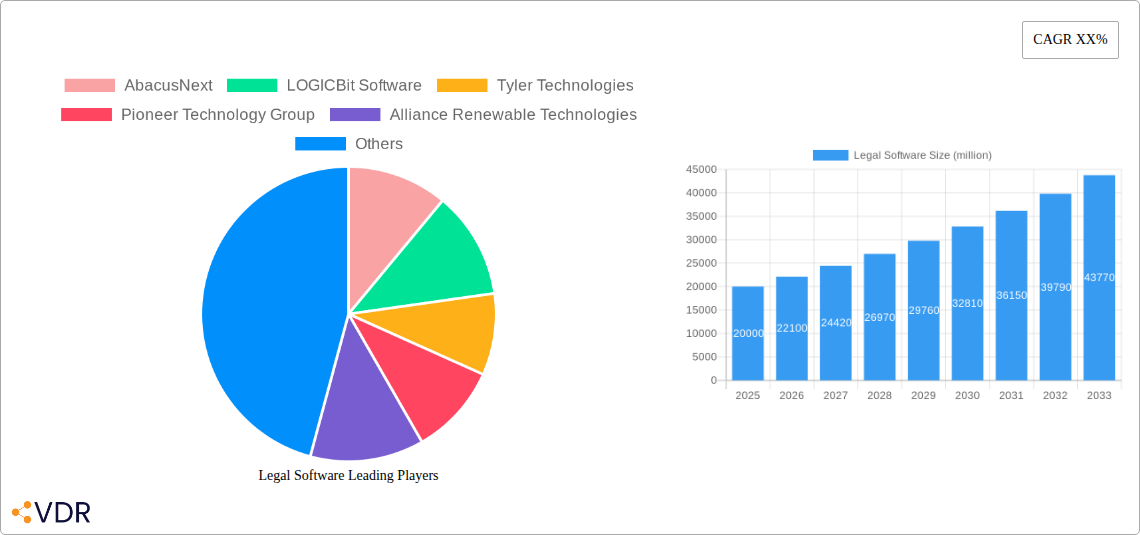

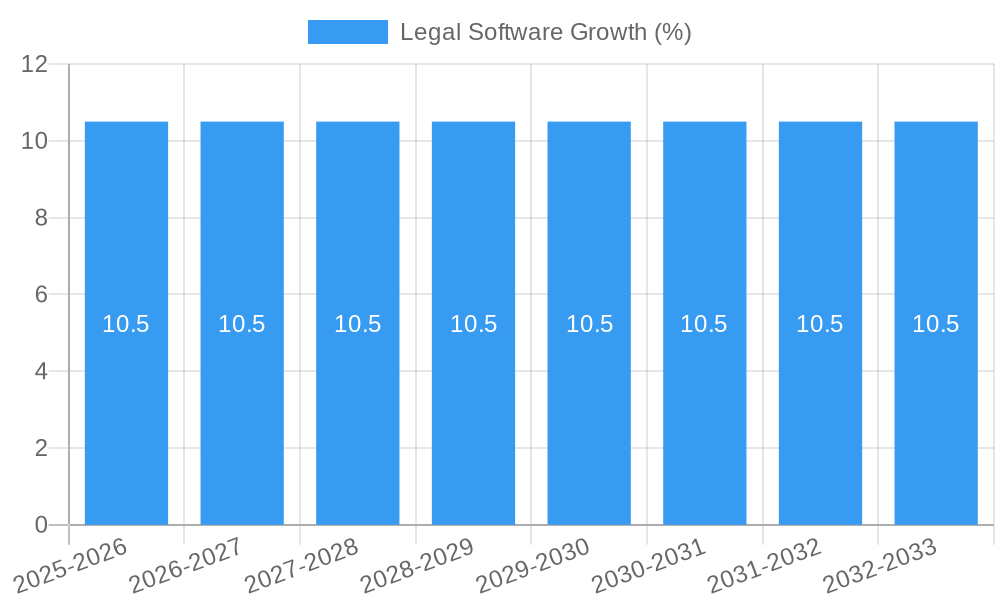

The global Legal Software market is poised for significant expansion, projected to reach approximately $38,000 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 10.5% from its estimated 2025 valuation. This substantial growth is fueled by an increasing demand for enhanced efficiency, improved case management, and streamlined legal processes across both government and commercial sectors. The digital transformation within the legal industry, coupled with the ever-growing volume of legal data and the need for sophisticated eDiscovery solutions, are primary catalysts. Furthermore, the adoption of cloud-based legal software is accelerating, offering greater accessibility, scalability, and cost-effectiveness, thereby democratizing advanced legal technology for firms of all sizes. Emerging economies are also contributing to market expansion as they invest in modernizing their legal infrastructure and legal professionals embrace technological advancements to gain a competitive edge.

The market landscape is characterized by a diverse range of solutions, including advanced Conflict Check Software, comprehensive Court Management Software, efficient Document Drafting Solutions, and powerful eDiscovery Software, catering to varied legal needs. Key market drivers such as the imperative for data security, regulatory compliance, and the pursuit of operational excellence within law firms and corporate legal departments are shaping product development and market strategies. However, the market faces certain restraints, including initial implementation costs and the need for specialized training to effectively utilize complex legal software. Despite these challenges, the overarching trend towards digital-first legal practices, the increasing complexity of legal matters, and the continuous innovation in AI-powered legal tech are expected to propel the Legal Software market to new heights, offering lucrative opportunities for both established players and emerging innovators.

Here is a comprehensive, SEO-optimized report description for Legal Software, designed for immediate use and maximum impact:

Legal Software Market Dynamics & Structure

The legal software market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and intense competition. Market concentration is moderate, with several large players like Tyler Technologies, LexisNexis, and Relativity holding significant shares, alongside a vibrant ecosystem of specialized solution providers. Technological innovation is primarily driven by advancements in AI, machine learning, and cloud computing, which are enhancing efficiency in areas such as eDiscovery, document review, and practice management. Regulatory frameworks, particularly those concerning data privacy and security, are increasingly shaping software development and adoption, requiring robust compliance features. Competitive product substitutes are emerging from adjacent software markets, including general-purpose productivity tools and business process automation solutions, necessitating continuous differentiation by legal software vendors. End-user demographics are shifting, with younger legal professionals more receptive to cloud-based and integrated solutions. Mergers and acquisitions (M&A) remain a key trend, with companies like AbacusNext and Pioneer Technology Group actively consolidating their market positions through strategic acquisitions to expand their service portfolios and customer bases. For instance, M&A deal volumes in the legal tech space have seen a steady increase, with an estimated xx million in deal value recorded in the historical period of 2019-2024. Innovation barriers include the high cost of developing sophisticated AI capabilities and the need for extensive integration with existing legal workflows.

- Market Concentration: Moderate, with a mix of large incumbents and agile niche players.

- Innovation Drivers: AI, machine learning, cloud computing, automation.

- Regulatory Influence: Data privacy (e.g., GDPR, CCPA), cybersecurity mandates.

- Competitive Landscape: Traditional legal tech, SaaS solutions, adjacent market software.

- End-User Shift: Increasing adoption of integrated, cloud-native solutions.

- M&A Activity: Consolidation for portfolio expansion and market share growth.

Legal Software Growth Trends & Insights

The global legal software market is projected to experience robust growth, expanding from an estimated $xx billion in the base year of 2025 to a projected $xx billion by the end of the forecast period in 2033. This represents a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025–2033. The historical period of 2019–2024 saw a steady expansion, with the market size growing from $xx billion to an estimated $xx billion, indicative of a xx% CAGR during that time. The adoption rates of legal software are escalating across all segments, driven by the increasing demand for efficiency, accuracy, and cost reduction within legal operations. Technological disruptions are fundamentally reshaping how legal services are delivered and managed. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into platforms like eDiscovery tools (Relativity, Everlaw, Logikcull) and document automation solutions (WealthCounsel) is transforming workflows, enabling faster analysis of vast datasets and more sophisticated document generation. Cloud-based solutions, offered by companies such as MyCase and Smokeball, are witnessing accelerated adoption due to their scalability, accessibility, and reduced IT overhead for law firms of all sizes. Consumer behavior shifts are evident in the growing preference for user-friendly interfaces, integrated suites, and subscription-based pricing models, pushing vendors to develop more intuitive and cost-effective solutions. The increasing volume of digital information and the growing complexity of legal cases are also major catalysts for the adoption of advanced legal software. The penetration of legal software in emerging markets is still in its nascent stages, presenting significant untapped potential for growth. Legal departments within corporations and government agencies are also increasingly investing in legal technology to streamline internal processes and improve compliance. The push towards digital transformation within the legal industry is a paramount trend, making the adoption of legal software not just a competitive advantage but a necessity. The market penetration in 2025 is estimated to be xx%, with projections reaching xx% by 2033.

Dominant Regions, Countries, or Segments in Legal Software

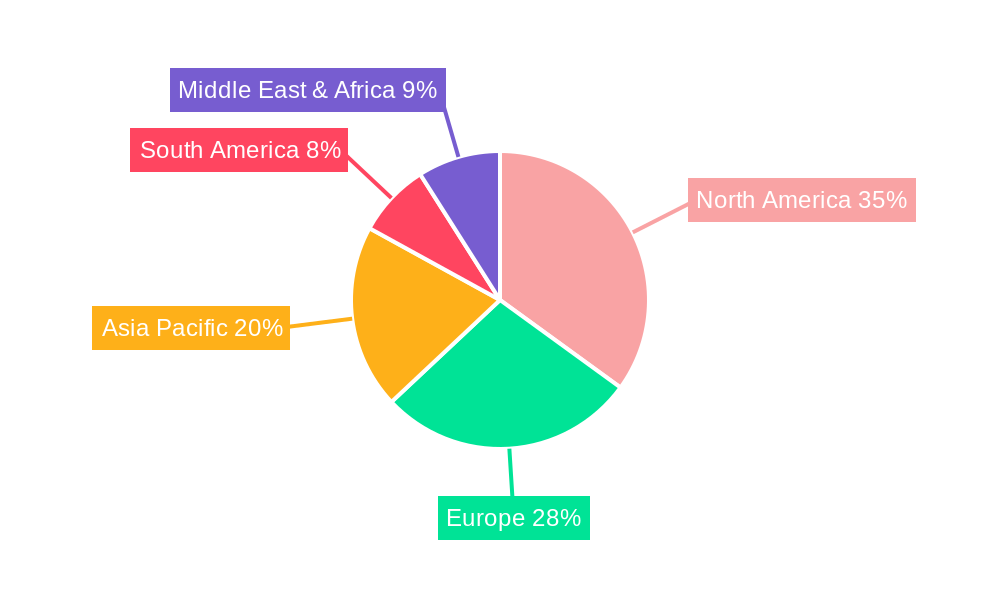

North America currently stands as the dominant region in the legal software market, driven by its robust legal infrastructure, high adoption rates of advanced technologies, and significant investment in legal tech innovation. The United States, in particular, is a powerhouse, characterized by a large number of law firms, a high volume of complex litigation, and a proactive approach to adopting solutions like eDiscovery software and court management systems. The application segment of Commercial Use is a primary growth driver within North America, as businesses increasingly leverage legal software to manage contractual obligations, ensure compliance, and mitigate risks. The presence of major legal tech companies like Tyler Technologies and LexisNexis headquartered in this region further solidifies its dominance.

In terms of specific types of legal software, eDiscovery Software is experiencing phenomenal growth, with a market share estimated at xx% of the overall legal software market in 2025. This surge is fueled by the increasing volume of digital data in litigation, stringent discovery obligations, and the need for efficient data processing and analysis. Leading players such as Relativity, Everlaw, and Exterro are at the forefront of this segment, offering sophisticated platforms that handle complex data sets from various sources. The Government application segment is also a significant contributor, with a market size estimated at xx million in 2025, driven by the need for case management, document management, and compliance solutions within public sector agencies. Court management software, offered by companies like Tyler Technologies, plays a crucial role in streamlining judicial processes across various government levels.

Europe is emerging as a strong second, with its own set of growth drivers, including evolving data privacy regulations (like GDPR) that necessitate robust compliance software. Countries like the UK and Germany are showing substantial interest in legal technology. The Asia-Pacific region, particularly countries like India and China, represents the fastest-growing market due to rapid economic expansion, increasing legal complexity, and a growing awareness of the benefits of legal automation. The Document Drafting Solutions Software segment, with players like WealthCounsel, is seeing steady growth across all regions as legal professionals seek to improve efficiency and accuracy in contract creation and other legal documentation. The "Other" application and types segments, which may include legal practice management software and specialized tools for specific legal niches, also contribute significantly to the overall market, showing adaptability and catering to diverse legal needs.

- Dominant Region: North America, particularly the United States.

- Key Application Segment: Commercial Use, followed by Government.

- Leading Software Type: eDiscovery Software, driven by data volume and complexity.

- Growth Factors (North America): Advanced legal infrastructure, tech adoption, major players.

- Growth Factors (Government): Case management, compliance, judicial efficiency.

- Emerging Markets: Asia-Pacific exhibiting the fastest growth potential.

Legal Software Product Landscape

The legal software product landscape is characterized by continuous innovation focused on enhancing efficiency, accuracy, and user experience. Companies like AbacusNext are offering integrated practice management solutions, while Smokeball provides cloud-based platforms designed for solo and small firms, emphasizing client communication and case management. eDiscovery solutions from Relativity, Everlaw, and Logikcull are pushing boundaries with advanced AI capabilities for faster data review and analysis, handling petabytes of data with unparalleled speed and accuracy. Document Drafting Solutions Software from WealthCounsel leverages intelligent templates and automation to significantly reduce the time and effort required for creating complex legal documents, ensuring consistency and compliance. Performance metrics are increasingly measured by processing speed, accuracy rates in AI-driven analysis, integration capabilities with other legal tools, and overall user adoption and satisfaction scores. Unique selling propositions often revolve around specialized features like advanced analytics, seamless cloud integration, intuitive user interfaces, and robust security protocols to meet stringent data protection requirements. Technological advancements are enabling predictive analytics for case outcomes and more proactive risk management for legal entities.

Key Drivers, Barriers & Challenges in Legal Software

The legal software market is propelled by several key drivers. The escalating volume of digital data in legal proceedings, coupled with increasingly complex regulatory environments, mandates sophisticated eDiscovery and compliance solutions. Technological advancements, particularly in AI and machine learning, are enabling greater automation, accuracy, and efficiency in legal workflows, from document review to practice management. The drive for cost optimization within legal departments and firms, alongside the growing demand for remote work capabilities, is accelerating the adoption of cloud-based and integrated legal software. Policy-driven initiatives aimed at increasing access to justice and improving judicial efficiency also contribute to market growth. For instance, government investment in digitizing court systems fuels demand for Court Management Software.

However, the market faces significant barriers and challenges. The initial cost of implementing advanced legal software, especially for smaller firms, can be prohibitive. Resistance to change among legal professionals, who may be accustomed to traditional methods, presents an adoption hurdle. Integrating new software with legacy systems and ensuring data security and privacy in compliance with regulations like GDPR and CCPA are complex technical and operational challenges. Intense competition from both established players and new entrants can lead to price wars and necessitate continuous innovation. Supply chain issues, while less prevalent in software than hardware, can impact the availability of specialized integrations or third-party services. Regulatory hurdles, though often drivers of adoption, also require continuous adaptation of software to meet evolving compliance standards, adding development costs and complexity. The market is projected to face a xx% increase in R&D investment for compliance features in the coming years.

Emerging Opportunities in Legal Software

Emerging opportunities in the legal software sector are ripe for exploration, driven by evolving client expectations and technological frontiers. The increasing demand for transparent and predictable legal pricing is creating a fertile ground for AI-powered analytics that can provide more accurate cost estimations and budget forecasting. The rise of specialized legal services, such as data privacy law and cybersecurity law, presents opportunities for niche software solutions tailored to these growing fields. Furthermore, the "Other" application segment, encompassing areas like legal operations management and legal process outsourcing (LPO) enablement, is expanding rapidly. Untapped markets in developing economies, where legal systems are modernizing, offer significant potential for scalable and affordable legal tech solutions. The integration of LegalTech with other enterprise software, like CRM and ERP systems, is also a burgeoning area, promising more holistic business process management for legal entities.

Growth Accelerators in the Legal Software Industry

Several key factors are accelerating the growth of the legal software industry. Technological breakthroughs, particularly in generative AI, are revolutionizing document drafting, legal research, and contract analysis, offering unprecedented levels of automation and insight. Strategic partnerships between legal software providers and other technology companies, such as cloud service providers or cybersecurity firms, are expanding service offerings and market reach. For instance, collaborations for enhanced data security are becoming commonplace. Market expansion strategies, including targeting underserved segments like solo practitioners and small law firms with specialized, cost-effective solutions, are driving broader adoption. The increasing focus on legal operations management as a distinct function within law firms and corporate legal departments is also fueling demand for integrated platforms that streamline administrative and business processes.

Key Players Shaping the Legal Software Market

- AbacusNext

- LOGICBit Software

- Tyler Technologies

- Pioneer Technology Group

- Alliance Renewable Technologies

- Smokeball

- MyCase

- WealthCounsel

- Logikcull

- Relativity

- Everlaw

- LexisNexis

- Exterro

- Nextpoint

- Zapproved

- Matteroom

Notable Milestones in Legal Software Sector

- 2019: Increased investment in AI-powered eDiscovery tools, leading to enhanced data analytics capabilities.

- 2020: Significant rise in cloud-based legal practice management adoption due to remote work necessities.

- 2021: Major legal tech companies focused on expanding cybersecurity features in their platforms.

- 2022: Emergence of sophisticated document automation solutions driven by advances in natural language processing.

- 2023: Increased M&A activity as larger players acquire specialized technology firms to broaden their offerings.

- 2024: Growing integration of generative AI capabilities into legal research and drafting tools.

- 2025 (Estimated): Further consolidation expected with a focus on comprehensive legal operations suites.

In-Depth Legal Software Market Outlook

The future outlook for the legal software market is exceptionally positive, fueled by persistent growth accelerators. The ongoing digital transformation within the legal industry, coupled with the ever-increasing volume of data and regulatory complexity, ensures sustained demand for advanced technological solutions. Innovations in AI and automation are poised to unlock new efficiencies and analytical capabilities, fundamentally reshaping legal practice. Strategic partnerships and the expansion of accessible, cloud-based solutions will democratize access to powerful legal tools, particularly for smaller firms and emerging markets. The market's trajectory indicates a move towards more integrated, intelligent, and user-centric platforms, creating significant opportunities for vendors who can deliver comprehensive solutions that enhance productivity, accuracy, and compliance.

Legal Software Segmentation

-

1. Application

- 1.1. Government

- 1.2. Commercial Use

- 1.3. Other

-

2. Types

- 2.1. Conflict Check Software

- 2.2. Court Management Software

- 2.3. Document Drafting Solutions Software

- 2.4. eDiscovery Software

- 2.5. Others

Legal Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Legal Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Legal Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Government

- 5.1.2. Commercial Use

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Conflict Check Software

- 5.2.2. Court Management Software

- 5.2.3. Document Drafting Solutions Software

- 5.2.4. eDiscovery Software

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Legal Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Government

- 6.1.2. Commercial Use

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Conflict Check Software

- 6.2.2. Court Management Software

- 6.2.3. Document Drafting Solutions Software

- 6.2.4. eDiscovery Software

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Legal Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Government

- 7.1.2. Commercial Use

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Conflict Check Software

- 7.2.2. Court Management Software

- 7.2.3. Document Drafting Solutions Software

- 7.2.4. eDiscovery Software

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Legal Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Government

- 8.1.2. Commercial Use

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Conflict Check Software

- 8.2.2. Court Management Software

- 8.2.3. Document Drafting Solutions Software

- 8.2.4. eDiscovery Software

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Legal Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Government

- 9.1.2. Commercial Use

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Conflict Check Software

- 9.2.2. Court Management Software

- 9.2.3. Document Drafting Solutions Software

- 9.2.4. eDiscovery Software

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Legal Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Government

- 10.1.2. Commercial Use

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Conflict Check Software

- 10.2.2. Court Management Software

- 10.2.3. Document Drafting Solutions Software

- 10.2.4. eDiscovery Software

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AbacusNext

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LOGICBit Software

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tyler Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pioneer Technology Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alliance Renewable Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Smokeball

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MyCase

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WealthCounsel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Logikcull

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Relativity

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Everlaw

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LexisNexis

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Exterro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nextpoint

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zapproved

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Matteroom

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 AbacusNext

List of Figures

- Figure 1: Global Legal Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Legal Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Legal Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Legal Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Legal Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Legal Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Legal Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Legal Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Legal Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Legal Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Legal Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Legal Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Legal Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Legal Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Legal Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Legal Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Legal Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Legal Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Legal Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Legal Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Legal Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Legal Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Legal Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Legal Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Legal Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Legal Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Legal Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Legal Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Legal Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Legal Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Legal Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Legal Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Legal Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Legal Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Legal Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Legal Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Legal Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Legal Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Legal Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Legal Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Legal Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Legal Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Legal Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Legal Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Legal Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Legal Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Legal Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Legal Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Legal Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Legal Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Legal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Legal Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Legal Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Legal Software?

Key companies in the market include AbacusNext, LOGICBit Software, Tyler Technologies, Pioneer Technology Group, Alliance Renewable Technologies, Smokeball, MyCase, WealthCounsel, Logikcull, Relativity, Everlaw, LexisNexis, Exterro, Nextpoint, Zapproved, Matteroom.

3. What are the main segments of the Legal Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Legal Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Legal Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Legal Software?

To stay informed about further developments, trends, and reports in the Legal Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence