Key Insights

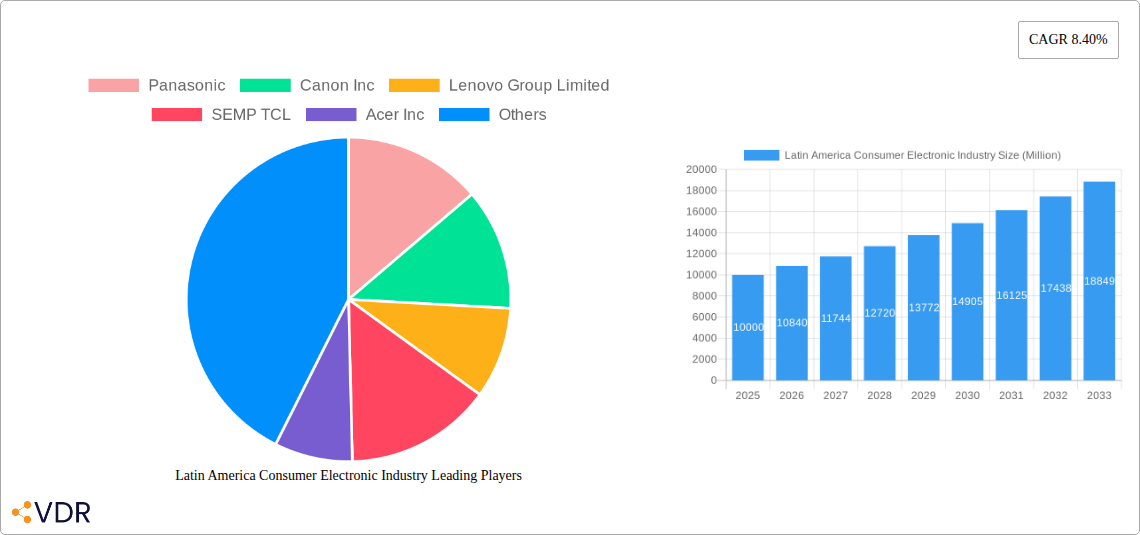

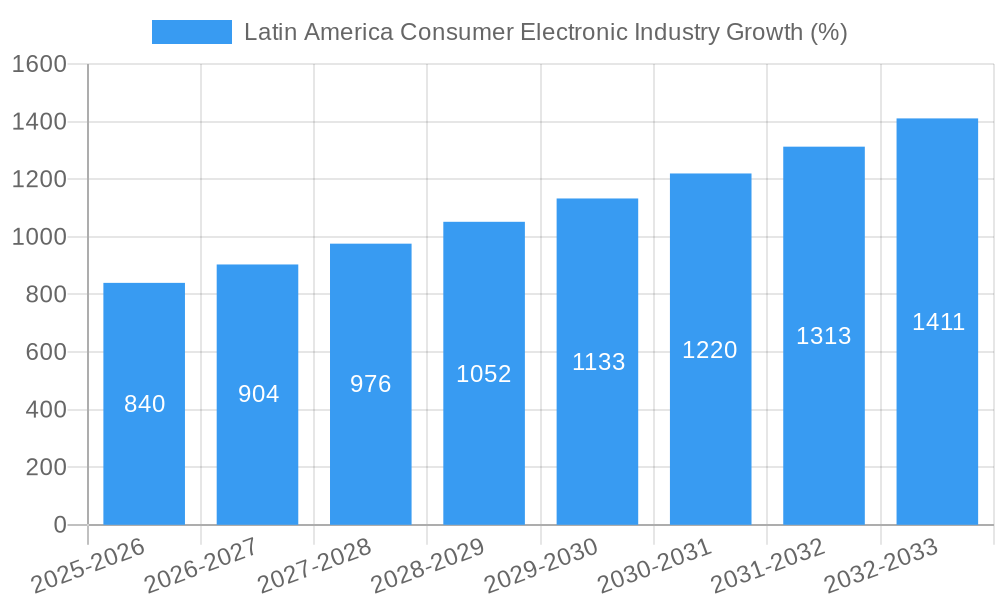

The Latin American consumer electronics market, encompassing a diverse range of products from electronic devices and household appliances to computers and smartphones, is experiencing robust growth. Driven by increasing disposable incomes, expanding internet penetration, and a burgeoning middle class across countries like Brazil, Mexico, and Argentina, the market is projected to maintain a Compound Annual Growth Rate (CAGR) of 8.40% from 2025 to 2033. This growth is fueled by rising demand for smartphones, smart TVs, and other connected devices, reflecting a shift towards a more technologically advanced and digitally connected lifestyle. The online sales channel is exhibiting particularly strong growth, driven by increased e-commerce adoption and the convenience it offers consumers. Key players such as Samsung, LG, Panasonic, and Lenovo are strategically investing in the region, focusing on localized product offerings and distribution networks to capitalize on this expanding market.

However, economic volatility within certain Latin American nations presents a significant restraint. Fluctuations in currency exchange rates and inflation can impact consumer spending, potentially dampening demand for consumer electronics, particularly for higher-priced items. Furthermore, competition within the market is fierce, with both established international brands and local manufacturers vying for market share. Successfully navigating these challenges requires a nuanced understanding of regional consumer preferences, effective supply chain management, and agile adaptation to evolving market dynamics. The segmentation of the market – by product type (electronic devices, household appliances), sales channel (online, offline), and country – presents opportunities for targeted marketing and product development strategies. Future growth will likely be shaped by the continued expansion of 5G networks, the increasing adoption of smart home technologies, and the evolving preferences of the region’s digitally-savvy consumers.

Latin America Consumer Electronics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America consumer electronics industry, offering invaluable insights for businesses, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, key players, and future opportunities across diverse segments. The report leverages robust data and expert analysis to forecast market growth, identify key trends, and highlight the potential for significant returns in this dynamic market.

Latin America Consumer Electronic Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the Latin American consumer electronics market, examining market concentration, technological innovation, regulatory frameworks, and market dynamics. We delve into the impact of competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activities, providing both qualitative and quantitative insights. The analysis covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share in specific segments (e.g., xx% market share for Samsung in smartphones). However, smaller players and regional brands continue to hold relevance in niche markets.

- Technological Innovation: The industry is characterized by rapid technological advancements, primarily driven by the increasing demand for smartphones, smart TVs, and other connected devices. However, innovation barriers include limited access to advanced technologies and high R&D costs in certain regions.

- Regulatory Frameworks: Government regulations regarding data privacy, product safety, and import/export policies significantly influence market dynamics. Variations in regulatory environments across different Latin American countries pose challenges to market standardization.

- Competitive Product Substitutes: The growing popularity of pre-owned electronics and the rise of affordable alternatives exert downward pressure on prices and market share for certain brands.

- End-User Demographics: The young and growing population in Latin America drives strong demand for consumer electronics, particularly in urban areas with higher disposable incomes.

- M&A Trends: The past five years witnessed xx M&A deals, predominantly focused on consolidating distribution networks and expanding product portfolios.

Latin America Consumer Electronic Industry Growth Trends & Insights

This section provides a detailed analysis of the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the Latin American consumer electronics industry using proprietary data and industry benchmarks. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing smartphone penetration, rising disposable incomes, and the expansion of e-commerce. Market penetration for smart TVs is expected to reach xx% by 2033. Detailed market size projections are provided for each segment and country.

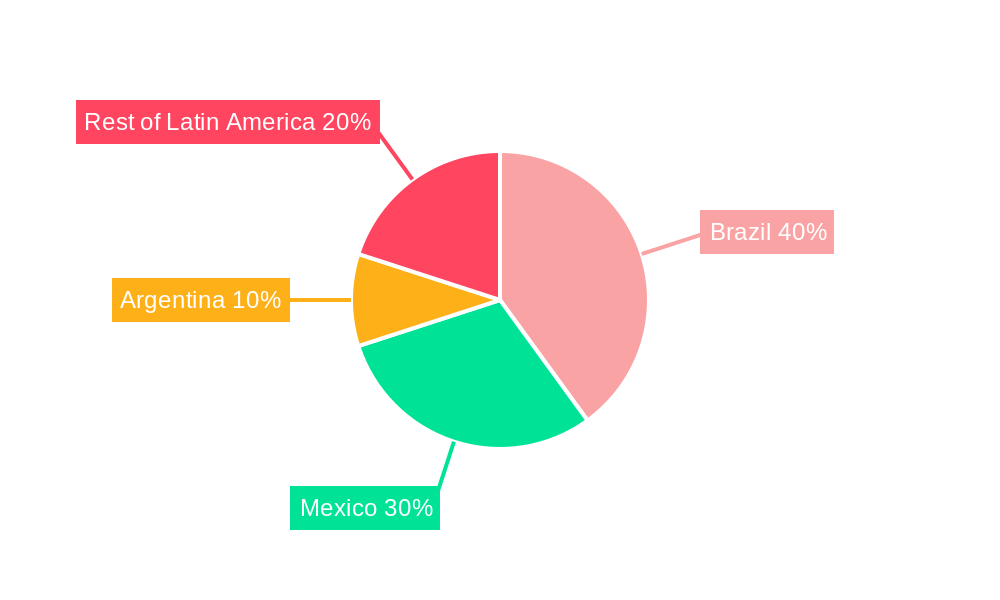

Dominant Regions, Countries, or Segments in Latin America Consumer Electronic Industry

Brazil, Mexico, and Argentina represent the largest consumer electronics markets in Latin America. Online sales channels are experiencing significant growth, while the offline retail sector remains dominant in certain product categories and geographical areas. The electronic devices segment leads in terms of both market size and growth rate, driven by strong demand for smartphones and laptops.

- Brazil: Dominates the market due to its large population and relatively higher purchasing power. Government initiatives to improve digital infrastructure further bolster growth.

- Mexico: Shows strong growth potential due to its expanding middle class and increasing adoption of technology.

- Argentina: Faces economic challenges that constrain market growth, despite significant demand.

- Online Sales: Demonstrate a rapid growth trajectory driven by increased internet penetration and smartphone usage.

- Offline Sales: Remain the predominant sales channel, particularly in smaller cities and rural areas.

- Electronic Devices: Experience strong growth due to rising demand for smartphones, laptops, tablets, and smart wearables.

- Household Appliances: Exhibit steady growth, driven by urbanization and increasing demand for modern conveniences.

Latin America Consumer Electronic Industry Product Landscape

The Latin American consumer electronics market showcases diverse product offerings catering to various price points and consumer preferences. Smartphones, smart TVs, laptops, and household appliances represent the leading product categories. Key trends include increasing integration of IoT features, enhanced connectivity, and improved energy efficiency. Manufacturers are also focusing on developing products tailored to the specific needs and preferences of Latin American consumers.

Key Drivers, Barriers & Challenges in Latin America Consumer Electronic Industry

Key Drivers:

- Rising disposable incomes and increasing urbanization are driving consumer demand.

- Expanding internet penetration and smartphone usage fuel e-commerce growth.

- Government initiatives to promote digital inclusion and infrastructure development are creating opportunities.

Key Challenges:

- Economic volatility and currency fluctuations in some countries pose significant risks.

- Supply chain disruptions and logistics challenges impact product availability and costs.

- Competition from gray market imports and counterfeit products affects brand loyalty and profitability. This impacts profitability by an estimated xx million units annually.

Emerging Opportunities in Latin America Consumer Electronic Industry

The Latin American consumer electronics market presents several emerging opportunities, including:

- Growing demand for affordable and energy-efficient products.

- Increased adoption of IoT devices and smart home solutions.

- Expansion of e-commerce and the rise of mobile commerce.

- Penetration of innovative financial services like Buy Now Pay Later (BNPL) impacting sales positively by xx million units in 2025.

Growth Accelerators in the Latin America Consumer Electronic Industry Industry

Long-term growth in the Latin American consumer electronics market will be fueled by continued technological advancements, strategic partnerships, and market expansion into less-penetrated regions. Investments in digital infrastructure, expanding e-commerce platforms, and development of innovative financial solutions will further accelerate market expansion.

Key Players Shaping the Latin America Consumer Electronic Industry Market

- Panasonic

- Canon Inc

- Lenovo Group Limited

- SEMP TCL

- Acer Inc

- Whirlpool Corp

- HP Inc

- Dell Inc

- Electrolux AB

- Esmaltec

- Apple Inc

- Samsung

- LG Electronics

Notable Milestones in Latin America Consumer Electronic Industry Sector

- 2020: Increased adoption of online shopping due to COVID-19 pandemic.

- 2021: Launch of 5G networks in major Latin American cities.

- 2022: Significant investments in e-commerce infrastructure.

- 2023: Growing popularity of smart home devices.

In-Depth Latin America Consumer Electronic Industry Market Outlook

The Latin American consumer electronics market exhibits immense growth potential driven by favorable demographics, increasing disposable incomes, and technological advancements. Strategic investments in infrastructure, expansion of e-commerce, and development of tailored product offerings will be crucial for unlocking long-term market success. The increasing adoption of smart home technologies and the growing demand for affordable and energy-efficient products represent significant future opportunities.

Latin America Consumer Electronic Industry Segmentation

-

1. Product Type

-

1.1. Electronic Devices

- 1.1.1. Smartphones

- 1.1.2. Tablets

- 1.1.3. Desktop PCs

- 1.1.4. Laptops/Notebooks

- 1.1.5. Television

- 1.1.6. Others

-

1.2. Household Appliances

- 1.2.1. Refrigerators

- 1.2.2. Air Conditioners

- 1.2.3. Washing Machines

-

1.1. Electronic Devices

-

2. Sales Channel

- 2.1. Online

- 2.2. Offline

Latin America Consumer Electronic Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Consumer Electronic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased access to the Internet; Growing inclination towards using smart appliances and devices

- 3.3. Market Restrains

- 3.3.1. Security concerns related to smart devices

- 3.4. Market Trends

- 3.4.1. Increasing smart device penetration in Latin America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Electronic Devices

- 5.1.1.1. Smartphones

- 5.1.1.2. Tablets

- 5.1.1.3. Desktop PCs

- 5.1.1.4. Laptops/Notebooks

- 5.1.1.5. Television

- 5.1.1.6. Others

- 5.1.2. Household Appliances

- 5.1.2.1. Refrigerators

- 5.1.2.2. Air Conditioners

- 5.1.2.3. Washing Machines

- 5.1.1. Electronic Devices

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Panasonic

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Canon Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Lenovo Group Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 SEMP TCL

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Acer Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Whirlpool Corp

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 HP Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dell Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Electrolux AB

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Esmaltec*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Apple Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Samsung

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 LG Electronics

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Panasonic

List of Figures

- Figure 1: Latin America Consumer Electronic Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Consumer Electronic Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Consumer Electronic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Consumer Electronic Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Latin America Consumer Electronic Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 4: Latin America Consumer Electronic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Consumer Electronic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Consumer Electronic Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Latin America Consumer Electronic Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 14: Latin America Consumer Electronic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Consumer Electronic Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Consumer Electronic Industry?

The projected CAGR is approximately 8.40%.

2. Which companies are prominent players in the Latin America Consumer Electronic Industry?

Key companies in the market include Panasonic, Canon Inc, Lenovo Group Limited, SEMP TCL, Acer Inc, Whirlpool Corp, HP Inc, Dell Inc, Electrolux AB, Esmaltec*List Not Exhaustive, Apple Inc, Samsung, LG Electronics.

3. What are the main segments of the Latin America Consumer Electronic Industry?

The market segments include Product Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased access to the Internet; Growing inclination towards using smart appliances and devices.

6. What are the notable trends driving market growth?

Increasing smart device penetration in Latin America.

7. Are there any restraints impacting market growth?

Security concerns related to smart devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Consumer Electronic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Consumer Electronic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Consumer Electronic Industry?

To stay informed about further developments, trends, and reports in the Latin America Consumer Electronic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence