Key Insights

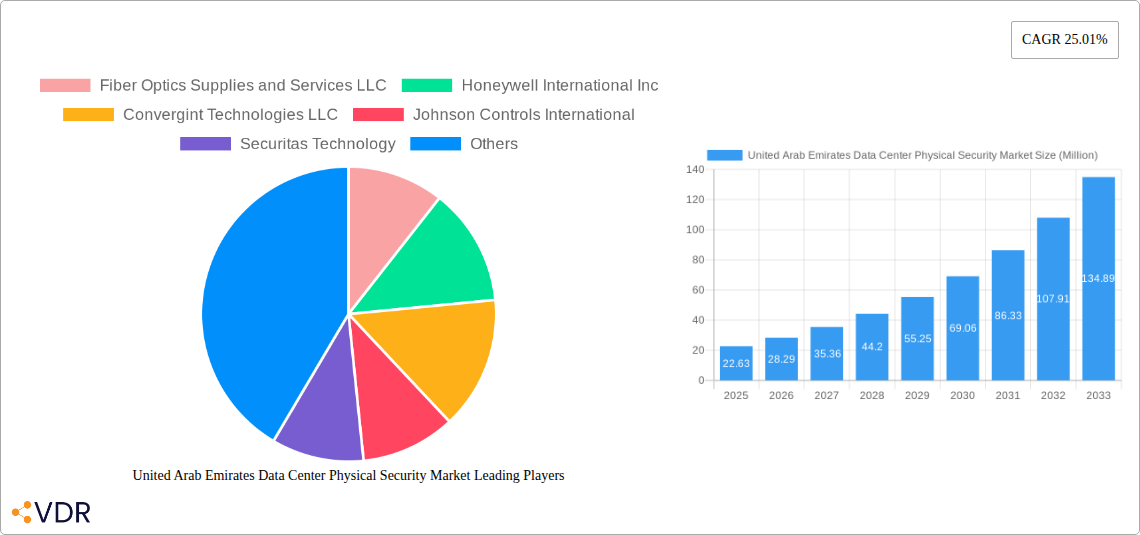

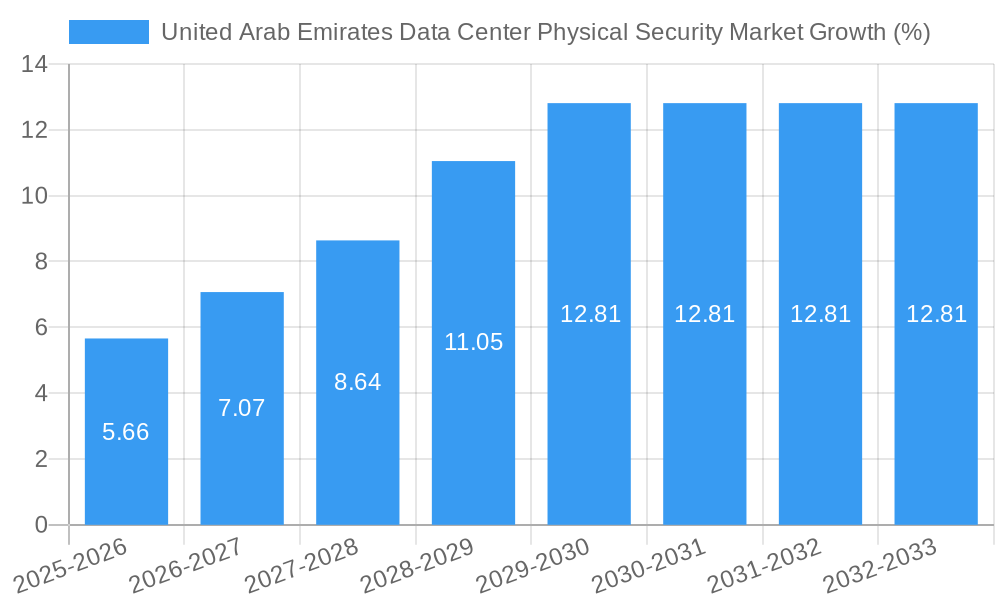

The United Arab Emirates (UAE) data center physical security market is experiencing robust growth, driven by the nation's rapid digital transformation and the increasing adoption of cloud computing and data-centric services. The market, valued at approximately $22.63 million in 2025, is projected to expand significantly over the forecast period (2025-2033), exhibiting a Compound Annual Growth Rate (CAGR) of 25.01%. This growth is fueled by several key factors. Firstly, heightened concerns regarding data breaches and cyberattacks are prompting organizations across various sectors—including IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), Government, and Healthcare—to invest heavily in robust physical security solutions. Secondly, the UAE's strategic focus on becoming a global technology hub is fostering a supportive regulatory environment and attracting substantial foreign investment in data center infrastructure. This, in turn, stimulates demand for advanced security technologies like video surveillance, access control systems, and integrated monitoring solutions. Finally, the increasing prevalence of sophisticated, interconnected security systems, facilitated by the expansion of 5G networks, is contributing to market expansion.

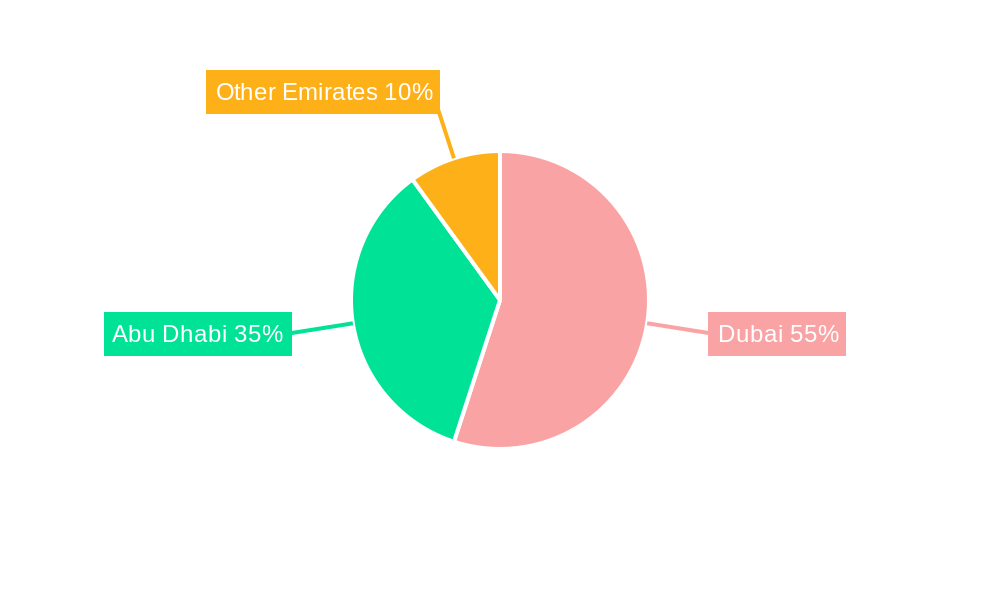

The market segmentation reveals a diverse landscape. Video surveillance and access control solutions constitute the largest segments by solution type, reflecting the critical role of these technologies in preventing unauthorized access and monitoring activities within data centers. Consulting and professional services are significant segments in the service type category, indicating a strong need for expert guidance and support in designing, implementing, and managing complex security systems. While specific regional breakdowns within the UAE are not provided, it can be reasonably inferred that the market is concentrated in major urban centers like Dubai and Abu Dhabi, which house the majority of the nation's data center infrastructure. Key players, such as Honeywell International Inc., Johnson Controls International, and Siemens AG, are actively competing in this market, offering a wide range of solutions and services to meet the evolving needs of data center operators. The continued expansion of the UAE's digital economy ensures a positive outlook for this market throughout the forecast period.

United Arab Emirates Data Center Physical Security Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Arab Emirates (UAE) data center physical security market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market of UAE Physical Security and the child market of UAE Data Center Physical Security, offering granular insights into segments like video surveillance, access control, and professional services. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The market size is predicted to reach xx Million by 2033.

United Arab Emirates Data Center Physical Security Market Dynamics & Structure

The UAE data center physical security market is characterized by a moderately concentrated landscape with several multinational and regional players competing fiercely. Technological innovation, driven by the increasing adoption of AI, IoT, and cloud-based solutions, is a key market driver. Stringent government regulations regarding data protection and cybersecurity are shaping security protocols. The market witnesses continuous innovation in access control systems, video surveillance, and perimeter security. Competitive substitutes include traditional security measures, but their adoption is decreasing as technologically advanced options offer higher efficacy. The end-user demographics are predominantly driven by the IT & Telecommunications, BFSI, and Government sectors. M&A activities are moderate, primarily focused on expanding service portfolios and geographic reach. The historical period (2019-2024) saw xx Million in M&A deals, with a predicted increase to xx Million during the forecast period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Strong emphasis on AI, IoT, and cloud-based security solutions.

- Regulatory Framework: Stringent data protection and cybersecurity regulations driving market growth.

- Competitive Substitutes: Traditional security methods facing declining adoption.

- End-User Demographics: IT & Telecommunications, BFSI, and Government sectors as major drivers.

- M&A Trends: Moderate activity focused on portfolio and geographic expansion.

United Arab Emirates Data Center Physical Security Market Growth Trends & Insights

The UAE data center physical security market exhibits robust growth, driven by increasing data center construction, rising cybersecurity concerns, and government initiatives promoting digital transformation. The market size witnessed a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, and is projected to grow at a CAGR of xx% from 2025 to 2033, reaching a market value of xx Million by 2033. This growth is largely fueled by the rising adoption of advanced security solutions such as video analytics, biometric access control, and intrusion detection systems. The market penetration of these advanced solutions is expected to increase from xx% in 2025 to xx% by 2033. Consumer behavior shifts towards proactive security measures and heightened awareness of data breaches further contribute to this growth.

Dominant Regions, Countries, or Segments in United Arab Emirates Data Center Physical Security Market

The UAE data center physical security market shows significant growth across various segments. The IT & Telecommunication sector is the dominant end-user, driving a significant portion of market demand due to the extensive infrastructure and sensitive data they handle. Video surveillance is the leading solution type, followed by access control solutions, owing to their proven efficacy in preventing unauthorized access. Consulting services dominate the service type segment due to increasing needs for specialized expertise in designing and implementing complex security systems. Dubai and Abu Dhabi are the leading regions, benefitting from concentrated IT infrastructure and government investments in digital infrastructure.

- Key Drivers: Government initiatives to promote digital transformation, robust IT infrastructure development, stringent data privacy regulations.

- Dominant Segment (Solution Type): Video Surveillance (xx% Market Share) due to its effectiveness and technological advancements.

- Dominant Segment (Service Type): Consulting Services (xx% Market Share) given the complexity of modern security systems.

- Dominant End-User: IT & Telecommunication (xx% Market Share) due to high data sensitivity and regulatory compliance.

United Arab Emirates Data Center Physical Security Market Product Landscape

The market showcases continuous product innovation, with a focus on integrating advanced technologies like AI and machine learning into video surveillance and access control systems. New products emphasize enhanced analytics capabilities, improved user interfaces, and seamless integration with existing infrastructure. These solutions offer improved threat detection, real-time monitoring, and efficient incident response. Key selling propositions include reduced false alarms, higher accuracy, and cost-effectiveness.

Key Drivers, Barriers & Challenges in United Arab Emirates Data Center Physical Security Market

Key Drivers: Increased investments in data center infrastructure, stringent government regulations, growing awareness of cybersecurity threats, and the increasing adoption of cloud-based solutions.

Challenges: High initial investment costs for advanced security systems, potential skill gaps in managing and maintaining complex technologies, and the ever-evolving nature of cyber threats requiring constant adaptation. Supply chain disruptions can also impact the availability and cost of components, potentially impacting growth by xx% in the short-term.

Emerging Opportunities in United Arab Emirates Data Center Physical Security Market

Emerging opportunities lie in the adoption of AI-powered security analytics, the integration of IoT devices for enhanced monitoring, and the development of cybersecurity solutions tailored for specific data center environments. Untapped markets include smaller data centers and edge computing facilities. The growing adoption of biometric authentication and advanced perimeter security systems presents significant growth potential.

Growth Accelerators in the United Arab Emirates Data Center Physical Security Market Industry

Technological breakthroughs in AI, IoT, and cloud computing are key growth accelerators. Strategic partnerships between technology providers and data center operators, along with government initiatives promoting digital transformation, further drive market expansion. Market expansion strategies focusing on specialized solutions and service offerings tailored to specific industry needs will also accelerate growth.

Key Players Shaping the United Arab Emirates Data Center Physical Security Market Market

- Fiber Optics Supplies and Services LLC

- Honeywell International Inc

- Convergint Technologies LLC

- Johnson Controls International

- Securitas Technology

- BIOS Middle East Group

- Siemens AG

- Schneider Electric SE

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- Pacific Control Systems

Notable Milestones in United Arab Emirates Data Center Physical Security Market Sector

- September 2023: Johnson Controls launched OpenBlue Service, enhancing security device performance and improving building safety.

- August 2023: Metrasens partnered with Convergint, expanding access to advanced detection systems.

In-Depth United Arab Emirates Data Center Physical Security Market Market Outlook

The UAE data center physical security market presents substantial growth potential driven by technological advancements, increasing cybersecurity concerns, and government support. Strategic opportunities exist for companies that offer innovative, cost-effective, and integrated security solutions tailored to the specific needs of the UAE data center market. The market is poised for continued expansion, particularly in areas like AI-driven analytics and cloud-based security management.

United Arab Emirates Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

United Arab Emirates Data Center Physical Security Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.3. Market Restrains

- 3.3.1. Operational and Return On Investment Concerns

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. North America United Arab Emirates Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United Arab Emirates Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United Arab Emirates Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of the World United Arab Emirates Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Fiber Optics Supplies and Services LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Convergint Technologies LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Johnson Controls International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Securitas Technology

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BIOS Middle East Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bosch Sicherheitssysteme GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Axis Communications AB

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Pacific Control Systems

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Fiber Optics Supplies and Services LLC

List of Figures

- Figure 1: United Arab Emirates Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Arab Emirates Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Arab Emirates Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United Arab Emirates Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 15: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 16: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: United Arab Emirates Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Data Center Physical Security Market?

The projected CAGR is approximately 25.01%.

2. Which companies are prominent players in the United Arab Emirates Data Center Physical Security Market?

Key companies in the market include Fiber Optics Supplies and Services LLC, Honeywell International Inc, Convergint Technologies LLC, Johnson Controls International, Securitas Technology, BIOS Middle East Group, Siemens AG, Schneider Electric SE, Bosch Sicherheitssysteme GmbH, Axis Communications AB, Pacific Control Systems.

3. What are the main segments of the United Arab Emirates Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Operational and Return On Investment Concerns.

8. Can you provide examples of recent developments in the market?

September 2023: Johnson Controls announced its new OpenBlue Service, ensuring security device performance. It is designed to help customers improve building safety, manage risk, and maximize the value of investments made in security technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence