Key Insights

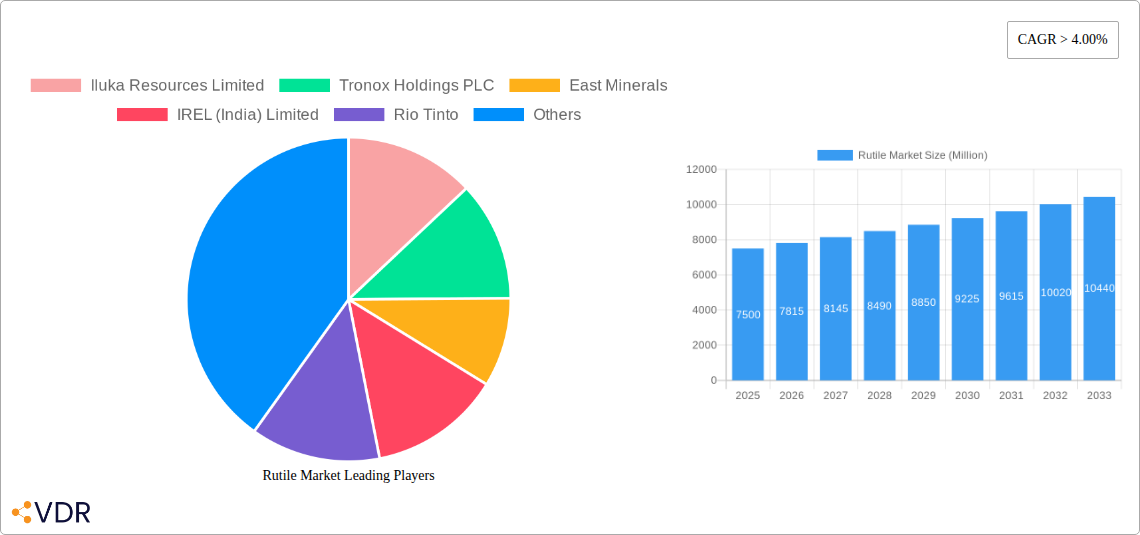

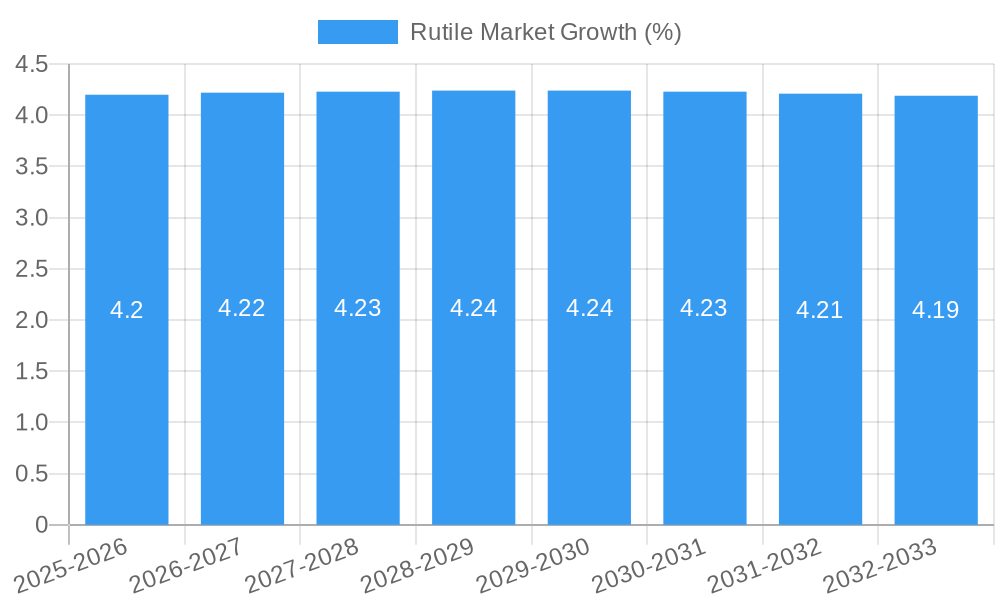

The global Rutile Market is projected to experience robust growth, with a projected market size of approximately $7,500 million in 2025 and a Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This expansion is primarily driven by the escalating demand for titanium dioxide (TiO2) pigments, a critical component in paints, coatings, plastics, and paper, fueled by burgeoning construction and automotive industries globally. The increasing adoption of advanced manufacturing processes and the continuous innovation in product applications further bolster market momentum. Furthermore, the growing emphasis on sustainable and high-performance materials in various end-user industries will continue to stimulate the demand for natural and synthetic rutile.

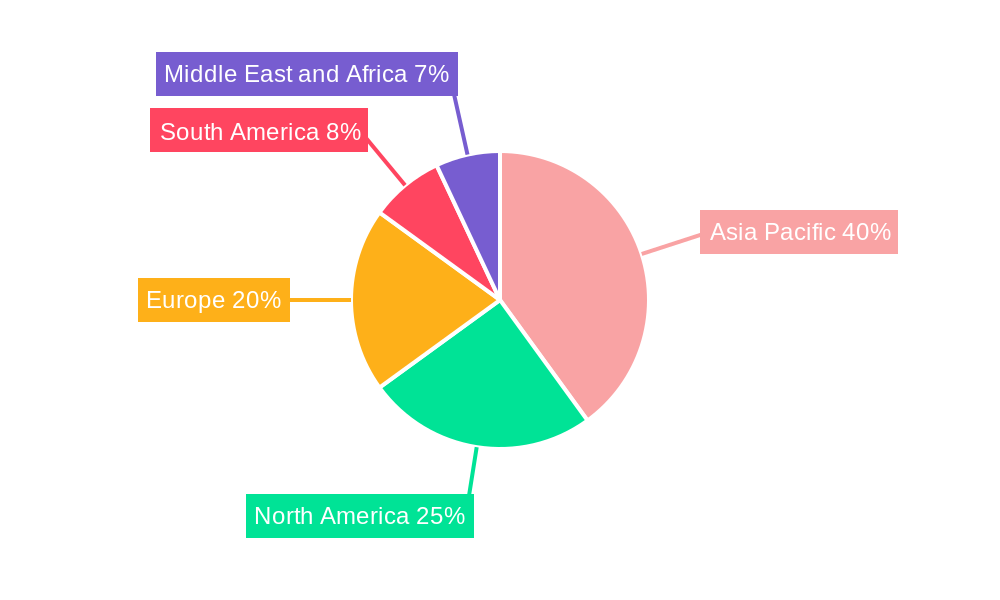

Key restraints for the market include price volatility of raw materials, stringent environmental regulations associated with mining and processing, and the availability of substitute materials in certain applications. However, these challenges are being mitigated by technological advancements aimed at improving extraction efficiency and developing eco-friendlier production methods. The market is segmented into Natural Rutile and Synthetic Rutile, with Natural Rutile holding a significant share due to its widespread use. The application segment is dominated by Pigment in Paints, followed by Titanium Metal and Refractory Ceramics. Geographically, the Asia Pacific region, particularly China and India, is expected to lead the market due to rapid industrialization and infrastructure development. North America and Europe also represent substantial markets with a growing focus on high-value applications.

This in-depth Rutile Market report provides a definitive analysis of the global rutile industry, offering critical insights into market dynamics, growth trends, regional dominance, product landscapes, and key players. Covering the historical period from 2019-2024, base year 2025, and a forecast period up to 2033, this report is an indispensable resource for industry stakeholders, investors, and strategists seeking to navigate the evolving landscape of this vital mineral. We dissect the parent and child markets of Rutile, examining the intricate relationships and growth drivers across various segments.

Rutile Market Market Dynamics & Structure

The global rutile market exhibits a moderately concentrated structure, characterized by the significant presence of a few key players, including Iluka Resources Limited, Tronox Holdings PLC, and Rio Tinto. Technological innovation is a primary driver, particularly in enhancing extraction efficiency and developing synthetic rutile production methods to meet rising demand. Regulatory frameworks, while generally supportive of industrial minerals, can impact environmental compliance and exploration rights. Competitive product substitutes, primarily titanium dioxide (TiO2) pigments derived from ilmenite, present a constant challenge, though rutile's higher TiO2 content often provides a premium advantage. End-user demographics are diverse, spanning the paint and coatings, plastics, aerospace, and chemical industries. Mergers and acquisitions (M&A) are crucial for market consolidation and capacity expansion.

- Market Concentration: Dominated by a handful of major global producers, with significant market share held by Iluka Resources Limited, Tronox Holdings PLC, and Rio Tinto.

- Technological Innovation: Focus on improving extraction yields from natural deposits, developing cost-effective synthetic rutile production, and advanced beneficiation techniques.

- Regulatory Environment: Impacted by environmental regulations governing mining operations, land use, and emissions, as well as trade policies affecting mineral exports.

- Competitive Landscape: Presence of titanium dioxide derived from ilmenite and slag as key substitutes, demanding a focus on rutile's purity and performance advantages.

- End-User Demographics: Significant demand from the pigment in paints industry, followed by titanium metal production, refractory ceramics, and optical equipment.

- M&A Trends: Strategic acquisitions and partnerships aimed at securing raw material supply, expanding production capacity, and diversifying product portfolios. Expected M&A deal volumes in the millions, with a focus on vertical integration and geographical expansion.

Rutile Market Growth Trends & Insights

The global rutile market is poised for sustained growth, driven by increasing demand across its diverse applications. The market size is projected to expand significantly from an estimated XX million units in 2025 to XX million units by 2033, exhibiting a compound annual growth rate (CAGR) of XX% during the forecast period. Adoption rates of natural and synthetic rutile are influenced by their respective cost-effectiveness and performance characteristics in specific applications. Technological disruptions are emerging in beneficiation processes, leading to higher purity rutile and improved production efficiency. Consumer behavior shifts, particularly a growing emphasis on durable goods and infrastructure development in emerging economies, are indirectly fueling demand. The report leverages market intelligence to forecast these trends, incorporating data on end-user industry growth, raw material availability, and global economic indicators.

- Market Size Evolution: Projected to grow from XX million units in 2025 to XX million units by 2033, demonstrating robust expansion.

- CAGR: An anticipated CAGR of XX% signifies a healthy and consistent growth trajectory.

- Adoption Rates: Natural rutile continues to be preferred for high-purity applications, while synthetic rutile adoption is increasing due to its cost-competitiveness and consistent quality.

- Technological Disruptions: Advancements in froth flotation, magnetic separation, and electrostatic separation techniques are enhancing rutile recovery and purity.

- Consumer Behavior Shifts: Increased demand for paints and coatings in construction and automotive sectors, coupled with growth in aerospace and medical devices, drives rutile consumption.

- Market Penetration: Expanding into new geographical markets and exploring novel applications will be crucial for deeper market penetration.

Dominant Regions, Countries, or Segments in Rutile Market

The Natural Rutile segment is identified as a dominant force driving market growth within the broader rutile industry. This is primarily attributed to its superior TiO2 content, making it the preferred choice for high-performance applications such as titanium metal production and specialized pigments. Countries like Australia, South Africa, and Sierra Leone are leading producers of natural rutile, benefiting from rich geological deposits and established mining infrastructure. Economic policies that favor resource extraction and export, coupled with significant investments in mining technologies, further bolster their dominance.

- Natural Rutile Dominance: Accounts for a substantial market share due to its high TiO2 concentration and performance advantages in critical applications like titanium metal production.

- Leading Producing Regions: Australia and South Africa are key players, supported by extensive natural rutile reserves and efficient extraction operations.

- Key Driver: Titanium Metal Industry: The burgeoning aerospace, defense, and medical device sectors are significant consumers of titanium metal, directly boosting natural rutile demand.

- Supporting Infrastructure: Well-developed mining and processing infrastructure in major producing countries facilitates efficient extraction and export.

- Market Share: Natural rutile segment projected to hold over XX% of the total rutile market by 2025.

- Growth Potential: Continued demand from high-value applications and potential for new discoveries in unexplored regions offer substantial growth prospects.

The Pigment in Paints application segment also holds significant sway, contributing a substantial portion to the overall market value. The visual appeal and protective qualities of titanium dioxide pigments, largely derived from rutile, are indispensable in the architectural, automotive, and industrial coatings sectors. Emerging economies' rapid urbanization and infrastructure development fuel consistent demand for paints and coatings, thereby underpinning the growth of this application.

- Pigment in Paints Application: A primary driver for rutile consumption, essential for opacity, brightness, and durability in coatings.

- End-Use Industries: Construction, automotive, and consumer goods sectors are major contributors to paint demand.

- Market Share: This application segment is anticipated to contribute approximately XX% of the total market revenue by 2025.

- Growth Factors: Increasing disposable incomes, urbanization, and infrastructure projects in developing nations are key accelerators.

Rutile Market Product Landscape

The rutile product landscape is characterized by its natural occurrence and synthetic production, catering to a spectrum of demanding applications. Natural rutile, valued for its high purity, is extracted from mineral sands deposits. Synthetic rutile is manufactured through the treatment of ilmenite, offering a more controlled composition. Within the variety segment, Ilmenorutile and Rutilated Quartz hold niche importance. Applications are diverse, with Pigment in Paints and Titanium Metal being major consumers. Refractory Ceramics and Optical Equipment also represent significant end-uses, leveraging rutile's thermal stability and optical properties.

- Product Varieties: Natural Rutile and Synthetic Rutile are the primary types, with niche varieties like Ilmenorutile and Rutilated Quartz also present.

- Key Applications: Titanium Metal, Pigment in Paints, Refractory Ceramic, and Optical Equipment are the leading consumption sectors.

- Performance Metrics: High TiO2 content, excellent refractive index, thermal stability, and UV resistance define rutile's value proposition.

- Technological Advancements: Innovations in synthetic rutile production aim to achieve purer grades and reduce environmental impact.

Key Drivers, Barriers & Challenges in Rutile Market

Key Drivers:

- Growing Demand for Titanium Dioxide: The insatiable demand for TiO2 pigments in paints, plastics, and paper industries remains the foremost driver.

- Expansion of Titanium Metal Production: Increasing use of titanium in aerospace, medical implants, and high-performance sporting goods fuels demand for high-purity rutile.

- Infrastructure Development: Global urbanization and infrastructure projects necessitate extensive use of paints and coatings, indirectly boosting rutile consumption.

- Technological Advancements in Mining and Processing: Improved extraction and beneficiation techniques enhance efficiency and reduce costs.

Barriers & Challenges:

- Environmental Regulations and Permitting: Stringent environmental laws and lengthy permitting processes can hinder new mine development and expansion.

- Supply Chain Disruptions: Geopolitical instability, transportation issues, and natural disasters can disrupt the global rutile supply chain, leading to price volatility.

- Price Volatility of Raw Materials: Fluctuations in the cost of energy and other inputs impact the profitability of rutile production.

- Competition from Ilmenite and Other TiO2 Sources: The availability and pricing of ilmenite and synthetic TiO2 slag pose a competitive challenge.

- Resource Depletion: The finite nature of high-grade natural rutile deposits necessitates exploration and development of synthetic alternatives.

Emerging Opportunities in Rutile Market

Emerging opportunities within the rutile market lie in the development of novel applications and the expansion into underserved geographical regions. The increasing focus on sustainable technologies presents an opportunity for rutile's use in advanced materials for solar energy and environmental remediation. Furthermore, the growing demand for high-performance coatings in the automotive and electronics sectors, particularly in electric vehicles, offers a significant growth avenue. Exploring untapped mineral deposits and optimizing synthetic rutile production for niche industrial requirements will be crucial for capitalizing on these emerging trends.

- Sustainable Applications: Rutile's potential use in photocatalysis for water purification and air pollution control.

- Advanced Materials: Incorporation into high-performance composites and advanced ceramics for specialized industries.

- Automotive Sector: Growing demand for durable and aesthetically pleasing coatings in electric vehicles.

- Untapped Geographies: Exploration and development of rutile resources in regions with nascent mining industries.

- Niche Industrial Requirements: Tailoring synthetic rutile grades for specific, high-value industrial applications.

Growth Accelerators in the Rutile Market Industry

The rutile market industry's long-term growth is propelled by several key accelerators. Technological breakthroughs in extraction and processing, such as advanced beneficiation techniques and more efficient synthetic rutile production methods, are paramount. Strategic partnerships between mining companies and end-users can foster innovation and ensure stable supply chains. Market expansion strategies, including geographical diversification and the development of new product applications, will further enhance growth trajectories. Investments in research and development aimed at uncovering novel uses for rutile will also play a pivotal role.

- Technological Breakthroughs: Innovations in mineral processing and synthetic production methods.

- Strategic Partnerships: Collaborations between producers, consumers, and technology providers.

- Market Expansion: Entering new geographical markets and developing diversified application portfolios.

- Investment in R&D: Focusing on discovering new uses and improving existing product functionalities.

Key Players Shaping the Rutile Market Market

- Iluka Resources Limited

- Tronox Holdings PLC

- East Minerals

- IREL (India) Limited

- Rio Tinto

- V V Mineral

- TOR Minerals

- Kerala Minerals & Metals Ltd

- Yucheng Jinhe Industrial Co Ltd

Notable Milestones in Rutile Market Sector

- November 2022: Rio Tinto and Yindjibarndi Aboriginal Corporation (YAC) signed an updated agreement, strengthening ties and enhancing social and economic outcomes for the Yindjibarndi people.

- October 2022: Rio Tinto announced plans to modernize its Sorel-Tracy site in Quebec with new smelter technology, aiming to bolster the supply of minerals controlled by China and reduce emissions.

In-Depth Rutile Market Market Outlook

- November 2022: Rio Tinto and Yindjibarndi Aboriginal Corporation (YAC) signed an updated agreement, strengthening ties and enhancing social and economic outcomes for the Yindjibarndi people.

- October 2022: Rio Tinto announced plans to modernize its Sorel-Tracy site in Quebec with new smelter technology, aiming to bolster the supply of minerals controlled by China and reduce emissions.

In-Depth Rutile Market Market Outlook

The outlook for the rutile market remains strongly positive, driven by ongoing demand from established sectors and promising growth in emerging applications. Key accelerators such as technological innovation in extraction and synthetic production, coupled with strategic industry partnerships, will continue to fuel expansion. The increasing global emphasis on sustainable materials and advanced technologies presents significant opportunities for rutile's integration into novel uses. Market players are expected to focus on securing raw material supply, enhancing production efficiencies, and exploring new geographical frontiers to capitalize on the projected robust growth trajectory.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Rutile Market Segmentation

-

1. Type

- 1.1. Natural Rutile

- 1.2. Synthetic Rutile

-

2. Variety

- 2.1. Ilmenorutile

- 2.2. Rutilated Quartz

- 2.3. Sagenite

- 2.4. Struverite

- 2.5. Venus Hairstone

- 2.6. Other Varieties

-

3. Application

- 3.1. Titanium Metal

- 3.2. Pigment in Paints

- 3.3. Refractory Ceramic

- 3.4. Optical Equipment

- 3.5. Other Applications

Rutile Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Rutile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific

- 3.4. Market Trends

- 3.4.1. Growing Demand for Rutile from the Production of Titanium Metal

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rutile Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Rutile

- 5.1.2. Synthetic Rutile

- 5.2. Market Analysis, Insights and Forecast - by Variety

- 5.2.1. Ilmenorutile

- 5.2.2. Rutilated Quartz

- 5.2.3. Sagenite

- 5.2.4. Struverite

- 5.2.5. Venus Hairstone

- 5.2.6. Other Varieties

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Titanium Metal

- 5.3.2. Pigment in Paints

- 5.3.3. Refractory Ceramic

- 5.3.4. Optical Equipment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Rutile Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural Rutile

- 6.1.2. Synthetic Rutile

- 6.2. Market Analysis, Insights and Forecast - by Variety

- 6.2.1. Ilmenorutile

- 6.2.2. Rutilated Quartz

- 6.2.3. Sagenite

- 6.2.4. Struverite

- 6.2.5. Venus Hairstone

- 6.2.6. Other Varieties

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Titanium Metal

- 6.3.2. Pigment in Paints

- 6.3.3. Refractory Ceramic

- 6.3.4. Optical Equipment

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Rutile Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural Rutile

- 7.1.2. Synthetic Rutile

- 7.2. Market Analysis, Insights and Forecast - by Variety

- 7.2.1. Ilmenorutile

- 7.2.2. Rutilated Quartz

- 7.2.3. Sagenite

- 7.2.4. Struverite

- 7.2.5. Venus Hairstone

- 7.2.6. Other Varieties

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Titanium Metal

- 7.3.2. Pigment in Paints

- 7.3.3. Refractory Ceramic

- 7.3.4. Optical Equipment

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Rutile Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural Rutile

- 8.1.2. Synthetic Rutile

- 8.2. Market Analysis, Insights and Forecast - by Variety

- 8.2.1. Ilmenorutile

- 8.2.2. Rutilated Quartz

- 8.2.3. Sagenite

- 8.2.4. Struverite

- 8.2.5. Venus Hairstone

- 8.2.6. Other Varieties

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Titanium Metal

- 8.3.2. Pigment in Paints

- 8.3.3. Refractory Ceramic

- 8.3.4. Optical Equipment

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Rutile Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural Rutile

- 9.1.2. Synthetic Rutile

- 9.2. Market Analysis, Insights and Forecast - by Variety

- 9.2.1. Ilmenorutile

- 9.2.2. Rutilated Quartz

- 9.2.3. Sagenite

- 9.2.4. Struverite

- 9.2.5. Venus Hairstone

- 9.2.6. Other Varieties

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Titanium Metal

- 9.3.2. Pigment in Paints

- 9.3.3. Refractory Ceramic

- 9.3.4. Optical Equipment

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Rutile Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural Rutile

- 10.1.2. Synthetic Rutile

- 10.2. Market Analysis, Insights and Forecast - by Variety

- 10.2.1. Ilmenorutile

- 10.2.2. Rutilated Quartz

- 10.2.3. Sagenite

- 10.2.4. Struverite

- 10.2.5. Venus Hairstone

- 10.2.6. Other Varieties

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Titanium Metal

- 10.3.2. Pigment in Paints

- 10.3.3. Refractory Ceramic

- 10.3.4. Optical Equipment

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Iluka Resources Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tronox Holdings PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 East Minerals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IREL (India) Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rio Tinto

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 V V Mineral

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TOR Minerals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kerala Minerals & Metals Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yucheng Jinhe Industrial Co Ltd*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Iluka Resources Limited

List of Figures

- Figure 1: Global Rutile Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Rutile Market Revenue (Million), by Type 2024 & 2032

- Figure 3: Asia Pacific Rutile Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: Asia Pacific Rutile Market Revenue (Million), by Variety 2024 & 2032

- Figure 5: Asia Pacific Rutile Market Revenue Share (%), by Variety 2024 & 2032

- Figure 6: Asia Pacific Rutile Market Revenue (Million), by Application 2024 & 2032

- Figure 7: Asia Pacific Rutile Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: Asia Pacific Rutile Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Rutile Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Rutile Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Rutile Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Rutile Market Revenue (Million), by Variety 2024 & 2032

- Figure 13: North America Rutile Market Revenue Share (%), by Variety 2024 & 2032

- Figure 14: North America Rutile Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Rutile Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Rutile Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Rutile Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Rutile Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Rutile Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Rutile Market Revenue (Million), by Variety 2024 & 2032

- Figure 21: Europe Rutile Market Revenue Share (%), by Variety 2024 & 2032

- Figure 22: Europe Rutile Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Rutile Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Rutile Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Rutile Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Rutile Market Revenue (Million), by Type 2024 & 2032

- Figure 27: South America Rutile Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: South America Rutile Market Revenue (Million), by Variety 2024 & 2032

- Figure 29: South America Rutile Market Revenue Share (%), by Variety 2024 & 2032

- Figure 30: South America Rutile Market Revenue (Million), by Application 2024 & 2032

- Figure 31: South America Rutile Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: South America Rutile Market Revenue (Million), by Country 2024 & 2032

- Figure 33: South America Rutile Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Rutile Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Middle East and Africa Rutile Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Middle East and Africa Rutile Market Revenue (Million), by Variety 2024 & 2032

- Figure 37: Middle East and Africa Rutile Market Revenue Share (%), by Variety 2024 & 2032

- Figure 38: Middle East and Africa Rutile Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Rutile Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Rutile Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Rutile Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rutile Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Rutile Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Rutile Market Revenue Million Forecast, by Variety 2019 & 2032

- Table 4: Global Rutile Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Rutile Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Rutile Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global Rutile Market Revenue Million Forecast, by Variety 2019 & 2032

- Table 8: Global Rutile Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Global Rutile Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Korea Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia Pacific Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Rutile Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Rutile Market Revenue Million Forecast, by Variety 2019 & 2032

- Table 17: Global Rutile Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Rutile Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Rutile Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Rutile Market Revenue Million Forecast, by Variety 2019 & 2032

- Table 24: Global Rutile Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Rutile Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: United Kingdom Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Rutile Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Rutile Market Revenue Million Forecast, by Variety 2019 & 2032

- Table 33: Global Rutile Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Rutile Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Brazil Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of South America Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Rutile Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Rutile Market Revenue Million Forecast, by Variety 2019 & 2032

- Table 40: Global Rutile Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Rutile Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Saudi Arabia Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East and Africa Rutile Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rutile Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Rutile Market?

Key companies in the market include Iluka Resources Limited, Tronox Holdings PLC, East Minerals, IREL (India) Limited, Rio Tinto, V V Mineral, TOR Minerals, Kerala Minerals & Metals Ltd, Yucheng Jinhe Industrial Co Ltd*List Not Exhaustive.

3. What are the main segments of the Rutile Market?

The market segments include Type, Variety, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific.

6. What are the notable trends driving market growth?

Growing Demand for Rutile from the Production of Titanium Metal.

7. Are there any restraints impacting market growth?

Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific.

8. Can you provide examples of recent developments in the market?

November 2022: Rio Tinto and Yindjibarndi Aboriginal Corporation (YAC) have signed an updated agreement to strengthen ties and deliver improved social and economic outcomes for the Yindjibarndi people for generations to come.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rutile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rutile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rutile Market?

To stay informed about further developments, trends, and reports in the Rutile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence