Key Insights

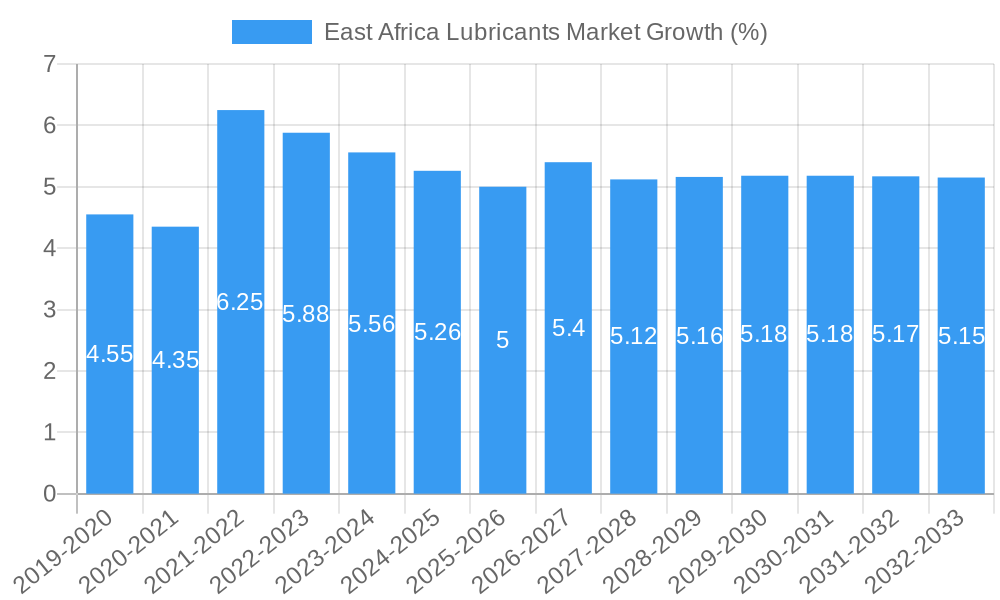

The East Africa Lubricants Market is poised for significant expansion, projected to reach a substantial market size of approximately USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 5.00% throughout the forecast period (2025-2033). This growth is propelled by several key drivers, including the increasing demand from the automotive sector, particularly for passenger vehicles and commercial transportation, as well as the burgeoning needs of heavy equipment in infrastructure development and mining operations across the region. Furthermore, the expanding industrial base, encompassing metallurgy and metalworking, power generation, and marine applications, contributes significantly to the sustained demand for a diverse range of lubricants, from engine oils and greases to hydraulic and metalworking fluids. The growing adoption of advanced machinery and the increasing focus on efficient operations further underscore the market's upward trajectory.

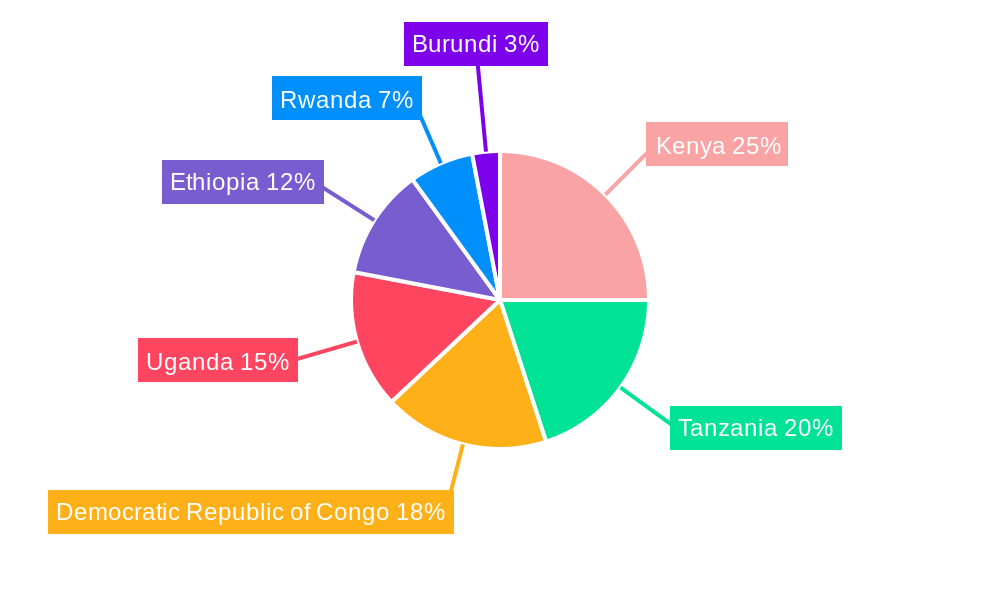

Despite the optimistic outlook, certain restraints may temper the pace of growth. These include the volatility of crude oil prices, which directly impacts the cost of lubricant production, and the prevalence of counterfeit or substandard lubricant products that can undermine market confidence and pose performance risks. Additionally, stringent environmental regulations regarding lubricant disposal and the development of bio-lubricants, while presenting future opportunities, may also necessitate significant investment and adaptation from market players. Geographically, countries like Kenya and Tanzania are expected to lead market share, driven by their relatively developed economies and substantial industrial and automotive sectors. Ethiopia and the Democratic Republic of Congo present significant growth potential due to ongoing infrastructure projects and expanding vehicle fleets. The market segmentation reveals a balanced demand across various product types, with engine oils and hydraulic fluids holding substantial shares, catering to the core needs of the region's diverse industrial and transportation landscape.

East Africa Lubricants Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the East Africa Lubricants Market, covering the historical period (2019-2024), base year (2025), and a robust forecast period (2025-2033). We delve into the intricate dynamics, growth trends, product landscape, and competitive strategies shaping this vital sector. Our research incorporates high-traffic keywords such as "East Africa lubricants," "automotive lubricants Africa," "industrial lubricants Kenya," "hydraulic fluids Tanzania," "engine oils Uganda," "greases market Ethiopia," and "marine lubricants DRC," ensuring maximum search engine visibility. We analyze parent and child market segments to provide a holistic view of market opportunities and challenges. All monetary values are presented in USD Million.

East Africa Lubricants Market Market Dynamics & Structure

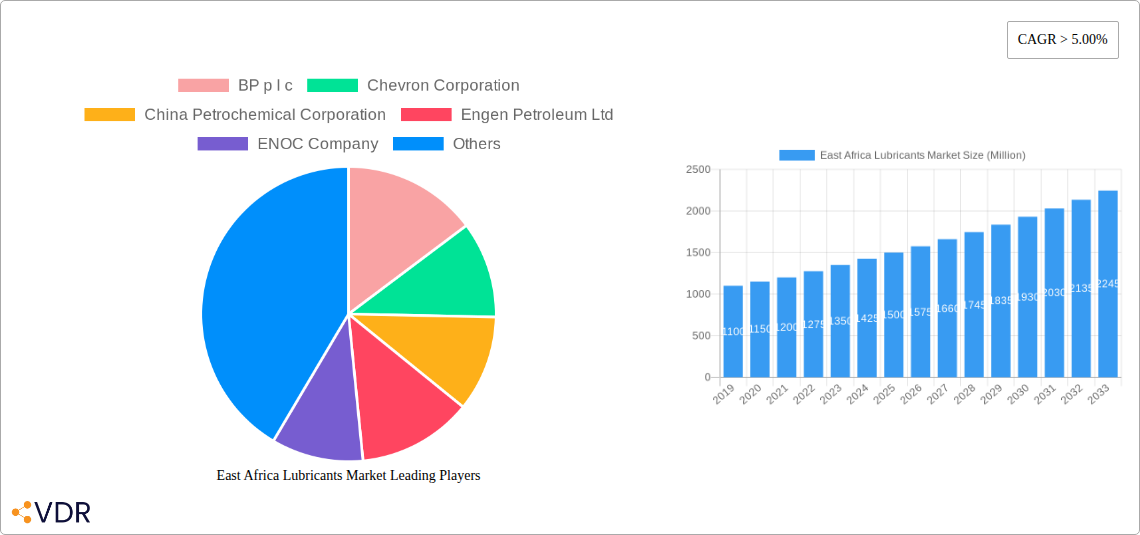

The East Africa Lubricants Market is characterized by a moderately concentrated competitive landscape, with a few major international players holding significant market share, alongside a growing number of regional and local manufacturers. Technological innovation is a key driver, particularly in the development of high-performance, fuel-efficient, and environmentally friendly lubricants. Stringent regulatory frameworks regarding product standards and environmental impact are increasingly influencing product development and market entry. Competitive product substitutes such as synthetic lubricants and advanced additive technologies are pushing conventional mineral oil-based lubricants to innovate or risk obsolescence. End-user demographics are shifting, with rapid urbanization and a growing middle class driving demand for passenger vehicles and associated lubricants, while infrastructure development fuels demand for heavy equipment and industrial lubricants. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating their presence and expanding their regional footprint. For instance, the proposed combination of Engen and Vivo Energy is set to reshape the distribution landscape. The market faces barriers to entry due to high capital investment for manufacturing facilities, established distribution networks of dominant players, and complex import regulations in some countries.

- Market Concentration: Dominated by key international players (e.g., Shell, BP, Chevron, TotalEnergies) with growing influence of regional players.

- Technological Innovation: Focus on advanced formulations, extended drain intervals, and eco-friendly lubricants.

- Regulatory Frameworks: Evolving standards for product quality, emissions, and biodegradability.

- Competitive Product Substitutes: Increasing adoption of synthetic and semi-synthetic lubricants.

- End-User Demographics: Rising disposable incomes and increased vehicle ownership boosting automotive segment.

- M&A Trends: Strategic consolidations to enhance market reach and operational efficiency.

- Innovation Barriers: High R&D costs and the need for localized testing and validation.

East Africa Lubricants Market Growth Trends & Insights

The East Africa Lubricants Market is poised for robust growth, driven by a confluence of economic development, industrial expansion, and an expanding automotive fleet. The market size is projected to experience a healthy Compound Annual Growth Rate (CAGR) of approximately 5.2% over the forecast period, reaching an estimated $3,500 Million by 2033. This growth is underpinned by increasing vehicle parc across passenger and commercial segments, coupled with significant investments in infrastructure projects, power generation, and mining operations. Adoption rates for premium and synthetic lubricants are accelerating, as end-users seek enhanced performance, longer equipment life, and improved fuel efficiency. Technological disruptions, such as the advent of electric vehicles (EVs) and advancements in engine technology, are creating new product development opportunities and challenges, necessitating a proactive approach from lubricant manufacturers. Consumer behavior is also shifting, with a greater emphasis on brand reputation, product quality, and after-sales service. The increasing awareness of environmental sustainability is further propelling the demand for environmentally acceptable lubricants (EALs) in sensitive applications. The penetration of organized retail channels and the growth of e-commerce platforms are also facilitating wider accessibility and influencing purchasing decisions.

- Market Size Evolution: Projected to grow from an estimated $2,200 Million in 2025 to $3,500 Million by 2033, exhibiting a CAGR of 5.2%.

- Adoption Rates: Steadily increasing demand for synthetic and semi-synthetic lubricants, estimated to capture 35% of the market share by 2033.

- Technological Disruptions: Adaptation to new engine technologies, potential impact of EVs, and the rise of bio-based lubricants.

- Consumer Behavior Shifts: Growing preference for high-quality, performance-driven, and eco-friendly lubrication solutions.

- Market Penetration: Expanding reach into semi-urban and rural areas through improved distribution networks.

- Industry Investment: Significant capital expenditure expected in lubricant manufacturing and blending facilities to meet growing demand.

Dominant Regions, Countries, or Segments in East Africa Lubricants Market

The East Africa Lubricants Market is experiencing dynamic growth across its various geographical and segmental landscapes. The Automotive segment, particularly Commercial Vehicles, stands out as a dominant force, driven by the region's burgeoning trade, logistics, and infrastructure development. Countries like Kenya and the Democratic Republic of Congo (DRC) are major contributors to this segment's growth due to extensive road networks and increased freight movement.

Within the geographical scope, Kenya consistently emerges as a leading market. Its diversified economy, significant transportation hub status, and relatively stable economic environment foster strong demand across all lubricant categories. The automotive sector in Kenya, with its substantial fleet of commercial trucks and buses for inter-country trade, along with a growing passenger car market, is a primary consumer of engine oils and transmission fluids. Furthermore, Kenya's developing industrial base in manufacturing and agriculture fuels the demand for hydraulic fluids and industrial lubricants.

The Democratic Republic of Congo (DRC), with its vast mineral resources and ongoing infrastructure projects, presents substantial demand for heavy-duty lubricants used in mining equipment, construction machinery, and transportation. Its massive geographical area necessitates extensive logistics, further bolstering the commercial vehicle lubricant market. While facing infrastructure challenges, the sheer scale of its resource extraction activities makes it a significant and growing market.

In terms of Product Type, Engine Oils remain the largest segment, accounting for an estimated 50% of the market share. This is directly attributable to the overwhelming presence of internal combustion engines in the automotive and heavy equipment sectors. However, Hydraulic Fluids are witnessing rapid growth, driven by the expansion of the construction, manufacturing, and mining industries across the region. The demand for specialized Greases for industrial machinery and automotive components is also on an upward trajectory.

- Dominant End User Segment: Automotive, specifically Commercial Vehicles, is the largest segment, driven by trade and logistics.

- Leading Country: Kenya, due to its diversified economy, trade hub status, and robust transportation sector.

- High Growth Potential Country: Democratic Republic of Congo, fueled by its significant mining activities and infrastructure development.

- Dominant Product Type: Engine Oils, representing over 50% of the market due to widespread use in transportation and machinery.

- Fastest Growing Product Type: Hydraulic Fluids, propelled by industrialization and infrastructure expansion.

- Key Drivers in Kenya: Growing vehicle parc, expanding manufacturing sector, and government infrastructure projects.

- Key Drivers in DRC: Extensive mining operations, demand for heavy-duty machinery lubricants, and reconstruction efforts.

East Africa Lubricants Market Product Landscape

The East Africa Lubricants Market is characterized by a diverse product landscape, with manufacturers offering a wide array of formulations designed to meet specific operational demands. Engine Oils remain the cornerstone, encompassing mineral-based, semi-synthetic, and fully synthetic variants catering to passenger cars, commercial vehicles, and motorcycles, with formulations optimized for fuel efficiency and emissions reduction. Hydraulic Fluids are crucial for the industrial and construction sectors, with products engineered for high pressure, temperature stability, and wear protection. Transmission and Gear Oils are vital for the smooth operation of drivetrains, offering extreme pressure additives and shear stability. Greases find application in a multitude of moving parts, from automotive chassis components to industrial bearings, providing long-lasting lubrication and protection against corrosion. Manufacturers are increasingly innovating with bio-based and biodegradable lubricants, particularly for marine and environmentally sensitive applications, driven by sustainability initiatives and regulatory pressures. Performance metrics such as viscosity, flash point, pour point, and additive packages are critical selling points.

Key Drivers, Barriers & Challenges in East Africa Lubricants Market

The East Africa Lubricants Market is propelled by several key drivers, including burgeoning economic growth, significant investments in infrastructure development, and a rapidly expanding automotive parc across passenger and commercial vehicles. The increasing adoption of modern machinery in mining, construction, and manufacturing sectors also fuels demand for specialized industrial lubricants. Furthermore, growing consumer awareness regarding the benefits of high-quality lubricants, such as extended equipment life and improved fuel efficiency, is a significant growth accelerator.

However, the market faces considerable challenges. Supply chain disruptions, exacerbated by logistical complexities and import dependencies, can lead to price volatility and availability issues. Regulatory hurdles and varying product standards across different East African nations add to the operational complexity for manufacturers and distributors. Counterfeit lubricants pose a persistent threat, undermining genuine products and potentially damaging equipment, leading to a loss of trust. The presence of established players with extensive distribution networks creates competitive pressures for new entrants. Furthermore, the fluctuating prices of crude oil, the primary raw material, directly impact lubricant production costs and pricing strategies.

Emerging Opportunities in East Africa Lubricants Market

Emerging opportunities within the East Africa Lubricants Market lie in the growing demand for specialized and high-performance lubricants. The increasing adoption of newer generation engines in the automotive sector, designed for higher efficiency and lower emissions, presents a demand for advanced synthetic engine oils. The expanding renewable energy sector, particularly in solar and wind power generation, is creating opportunities for specialized lubricants with enhanced thermal stability and oxidation resistance. Furthermore, the drive towards sustainability is opening avenues for environmentally acceptable lubricants (EALs), especially in the marine and agricultural sectors, aligning with global environmental directives. The untapped potential in smaller, developing markets within the region, coupled with the increasing formalization of the automotive service industry, offers significant room for market penetration and brand building.

Growth Accelerators in the East Africa Lubricants Market Industry

Several factors are acting as catalysts for long-term growth in the East Africa Lubricants Market. Technological breakthroughs in lubricant formulations, such as the development of advanced additive packages and novel base oils, are enhancing product performance and extending service intervals, creating a demand for premium offerings. Strategic partnerships between lubricant manufacturers and original equipment manufacturers (OEMs) are crucial for developing co-branded lubricants that are precisely tailored to specific vehicle and machinery requirements, thereby securing market share. Furthermore, market expansion strategies, including the establishment of local blending plants and a robust distribution network, are vital for improving accessibility and reducing logistical costs, particularly in landlocked countries. The increasing focus on digitalization and e-commerce platforms is also accelerating market reach and customer engagement.

Key Players Shaping the East Africa Lubricants Market Market

- BP p l c

- Chevron Corporation

- China Petrochemical Corporation

- Engen Petroleum Ltd

- ENOC Company

- Exxon Mobil Corporation

- General Petroleum

- Hass Petroleum

- Lake Group

- LIQUI MOLY GmbH

- Mineral Oil Corporation Limited

- Motul S A

- National Oil Corporation of Kenya

- Oryx Energies SA

- Shell PLC

- TotalEnergies

Notable Milestones in East Africa Lubricants Market Sector

- February 2023: Engen and Vivo Energy announced a combination of their respective African businesses, with PETRONAS to sell its 74% shareholding in Engen to Vivo Energy at completion, creating one of Africa’s largest energy distribution companies.

- November 2022: Chevron Corporation launched environmentally acceptable lubricants (EALs) for marine applications, including Clarity Synthetic EA Grease 0, made from biodegradable ingredients suitable for various marine components.

In-Depth East Africa Lubricants Market Market Outlook

The future outlook for the East Africa Lubricants Market is exceptionally promising, driven by sustained economic development and infrastructure expansion. The strategic growth accelerators, including technological advancements in high-performance lubricants and the expansion of regional manufacturing capabilities through local blending plants, will be pivotal. Increasing OEM partnerships and the adoption of digital channels for sales and customer engagement will further solidify market positions. The growing emphasis on sustainability and the demand for specialized, eco-friendly lubricant solutions present significant untapped potential, particularly in the marine and industrial sectors. By focusing on innovation, expanding distribution networks, and adapting to evolving regulatory landscapes, stakeholders can capitalize on the robust growth trajectory and secure long-term market leadership in this dynamic region.

East Africa Lubricants Market Segmentation

-

1. End User

-

1.1. Automotive

- 1.1.1. Passenger Vehicles

- 1.1.2. Commercial Vehicles

- 1.1.3. Motorcycles

- 1.2. Heavy Equipment

- 1.3. Metallurgy and Metalworking

- 1.4. Power Generation

- 1.5. Marine

- 1.6. Other End-user Industries (Oil and Gas, Etc.)

-

1.1. Automotive

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Metalworking Fluids

- 2.5. Transmission and Gear Oils

- 2.6. Other Pr

-

3. Geography

- 3.1. Kenya

- 3.2. Tanzania

- 3.3. Democratic Republic of Congo

- 3.4. Burundi

- 3.5. Uganda

- 3.6. Ethiopia

- 3.7. Rwanda

East Africa Lubricants Market Segmentation By Geography

- 1. Kenya

- 2. Tanzania

- 3. Democratic Republic of Congo

- 4. Burundi

- 5. Uganda

- 6. Ethiopia

- 7. Rwanda

East Africa Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand Due to Industrial and Economic Growth; Rising Penetration of Used Vehicles Increases the Lubricant Consumption; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand Due to Industrial and Economic Growth; Rising Penetration of Used Vehicles Increases the Lubricant Consumption; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Automotive Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Automotive

- 5.1.1.1. Passenger Vehicles

- 5.1.1.2. Commercial Vehicles

- 5.1.1.3. Motorcycles

- 5.1.2. Heavy Equipment

- 5.1.3. Metallurgy and Metalworking

- 5.1.4. Power Generation

- 5.1.5. Marine

- 5.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 5.1.1. Automotive

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Metalworking Fluids

- 5.2.5. Transmission and Gear Oils

- 5.2.6. Other Pr

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Kenya

- 5.3.2. Tanzania

- 5.3.3. Democratic Republic of Congo

- 5.3.4. Burundi

- 5.3.5. Uganda

- 5.3.6. Ethiopia

- 5.3.7. Rwanda

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kenya

- 5.4.2. Tanzania

- 5.4.3. Democratic Republic of Congo

- 5.4.4. Burundi

- 5.4.5. Uganda

- 5.4.6. Ethiopia

- 5.4.7. Rwanda

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Kenya East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Automotive

- 6.1.1.1. Passenger Vehicles

- 6.1.1.2. Commercial Vehicles

- 6.1.1.3. Motorcycles

- 6.1.2. Heavy Equipment

- 6.1.3. Metallurgy and Metalworking

- 6.1.4. Power Generation

- 6.1.5. Marine

- 6.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 6.1.1. Automotive

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Engine Oils

- 6.2.2. Greases

- 6.2.3. Hydraulic Fluids

- 6.2.4. Metalworking Fluids

- 6.2.5. Transmission and Gear Oils

- 6.2.6. Other Pr

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Kenya

- 6.3.2. Tanzania

- 6.3.3. Democratic Republic of Congo

- 6.3.4. Burundi

- 6.3.5. Uganda

- 6.3.6. Ethiopia

- 6.3.7. Rwanda

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Tanzania East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Automotive

- 7.1.1.1. Passenger Vehicles

- 7.1.1.2. Commercial Vehicles

- 7.1.1.3. Motorcycles

- 7.1.2. Heavy Equipment

- 7.1.3. Metallurgy and Metalworking

- 7.1.4. Power Generation

- 7.1.5. Marine

- 7.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 7.1.1. Automotive

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Engine Oils

- 7.2.2. Greases

- 7.2.3. Hydraulic Fluids

- 7.2.4. Metalworking Fluids

- 7.2.5. Transmission and Gear Oils

- 7.2.6. Other Pr

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Kenya

- 7.3.2. Tanzania

- 7.3.3. Democratic Republic of Congo

- 7.3.4. Burundi

- 7.3.5. Uganda

- 7.3.6. Ethiopia

- 7.3.7. Rwanda

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Democratic Republic of Congo East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Automotive

- 8.1.1.1. Passenger Vehicles

- 8.1.1.2. Commercial Vehicles

- 8.1.1.3. Motorcycles

- 8.1.2. Heavy Equipment

- 8.1.3. Metallurgy and Metalworking

- 8.1.4. Power Generation

- 8.1.5. Marine

- 8.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 8.1.1. Automotive

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Engine Oils

- 8.2.2. Greases

- 8.2.3. Hydraulic Fluids

- 8.2.4. Metalworking Fluids

- 8.2.5. Transmission and Gear Oils

- 8.2.6. Other Pr

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Kenya

- 8.3.2. Tanzania

- 8.3.3. Democratic Republic of Congo

- 8.3.4. Burundi

- 8.3.5. Uganda

- 8.3.6. Ethiopia

- 8.3.7. Rwanda

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Burundi East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Automotive

- 9.1.1.1. Passenger Vehicles

- 9.1.1.2. Commercial Vehicles

- 9.1.1.3. Motorcycles

- 9.1.2. Heavy Equipment

- 9.1.3. Metallurgy and Metalworking

- 9.1.4. Power Generation

- 9.1.5. Marine

- 9.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 9.1.1. Automotive

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Engine Oils

- 9.2.2. Greases

- 9.2.3. Hydraulic Fluids

- 9.2.4. Metalworking Fluids

- 9.2.5. Transmission and Gear Oils

- 9.2.6. Other Pr

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Kenya

- 9.3.2. Tanzania

- 9.3.3. Democratic Republic of Congo

- 9.3.4. Burundi

- 9.3.5. Uganda

- 9.3.6. Ethiopia

- 9.3.7. Rwanda

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Uganda East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Automotive

- 10.1.1.1. Passenger Vehicles

- 10.1.1.2. Commercial Vehicles

- 10.1.1.3. Motorcycles

- 10.1.2. Heavy Equipment

- 10.1.3. Metallurgy and Metalworking

- 10.1.4. Power Generation

- 10.1.5. Marine

- 10.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 10.1.1. Automotive

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Engine Oils

- 10.2.2. Greases

- 10.2.3. Hydraulic Fluids

- 10.2.4. Metalworking Fluids

- 10.2.5. Transmission and Gear Oils

- 10.2.6. Other Pr

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Kenya

- 10.3.2. Tanzania

- 10.3.3. Democratic Republic of Congo

- 10.3.4. Burundi

- 10.3.5. Uganda

- 10.3.6. Ethiopia

- 10.3.7. Rwanda

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Ethiopia East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by End User

- 11.1.1. Automotive

- 11.1.1.1. Passenger Vehicles

- 11.1.1.2. Commercial Vehicles

- 11.1.1.3. Motorcycles

- 11.1.2. Heavy Equipment

- 11.1.3. Metallurgy and Metalworking

- 11.1.4. Power Generation

- 11.1.5. Marine

- 11.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 11.1.1. Automotive

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. Engine Oils

- 11.2.2. Greases

- 11.2.3. Hydraulic Fluids

- 11.2.4. Metalworking Fluids

- 11.2.5. Transmission and Gear Oils

- 11.2.6. Other Pr

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Kenya

- 11.3.2. Tanzania

- 11.3.3. Democratic Republic of Congo

- 11.3.4. Burundi

- 11.3.5. Uganda

- 11.3.6. Ethiopia

- 11.3.7. Rwanda

- 11.1. Market Analysis, Insights and Forecast - by End User

- 12. Rwanda East Africa Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by End User

- 12.1.1. Automotive

- 12.1.1.1. Passenger Vehicles

- 12.1.1.2. Commercial Vehicles

- 12.1.1.3. Motorcycles

- 12.1.2. Heavy Equipment

- 12.1.3. Metallurgy and Metalworking

- 12.1.4. Power Generation

- 12.1.5. Marine

- 12.1.6. Other End-user Industries (Oil and Gas, Etc.)

- 12.1.1. Automotive

- 12.2. Market Analysis, Insights and Forecast - by Product Type

- 12.2.1. Engine Oils

- 12.2.2. Greases

- 12.2.3. Hydraulic Fluids

- 12.2.4. Metalworking Fluids

- 12.2.5. Transmission and Gear Oils

- 12.2.6. Other Pr

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Kenya

- 12.3.2. Tanzania

- 12.3.3. Democratic Republic of Congo

- 12.3.4. Burundi

- 12.3.5. Uganda

- 12.3.6. Ethiopia

- 12.3.7. Rwanda

- 12.1. Market Analysis, Insights and Forecast - by End User

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 BP p l c

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Chevron Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 China Petrochemical Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Engen Petroleum Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ENOC Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Exxon Mobil Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Petroleum

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hass Petroleum

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lake Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LIQUI MOLY GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Mineral Oil Corporation Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Motul S A

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 National Oil Corporation of Kenya

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Oryx Energies SA

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Shell PLC

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 TotalEnergies*List Not Exhaustive

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 BP p l c

List of Figures

- Figure 1: Global East Africa Lubricants Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Kenya East Africa Lubricants Market Revenue (Million), by End User 2024 & 2032

- Figure 3: Kenya East Africa Lubricants Market Revenue Share (%), by End User 2024 & 2032

- Figure 4: Kenya East Africa Lubricants Market Revenue (Million), by Product Type 2024 & 2032

- Figure 5: Kenya East Africa Lubricants Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: Kenya East Africa Lubricants Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: Kenya East Africa Lubricants Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: Kenya East Africa Lubricants Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Kenya East Africa Lubricants Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Tanzania East Africa Lubricants Market Revenue (Million), by End User 2024 & 2032

- Figure 11: Tanzania East Africa Lubricants Market Revenue Share (%), by End User 2024 & 2032

- Figure 12: Tanzania East Africa Lubricants Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: Tanzania East Africa Lubricants Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: Tanzania East Africa Lubricants Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Tanzania East Africa Lubricants Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Tanzania East Africa Lubricants Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Tanzania East Africa Lubricants Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Democratic Republic of Congo East Africa Lubricants Market Revenue (Million), by End User 2024 & 2032

- Figure 19: Democratic Republic of Congo East Africa Lubricants Market Revenue Share (%), by End User 2024 & 2032

- Figure 20: Democratic Republic of Congo East Africa Lubricants Market Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Democratic Republic of Congo East Africa Lubricants Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Democratic Republic of Congo East Africa Lubricants Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Democratic Republic of Congo East Africa Lubricants Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Democratic Republic of Congo East Africa Lubricants Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Democratic Republic of Congo East Africa Lubricants Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Burundi East Africa Lubricants Market Revenue (Million), by End User 2024 & 2032

- Figure 27: Burundi East Africa Lubricants Market Revenue Share (%), by End User 2024 & 2032

- Figure 28: Burundi East Africa Lubricants Market Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Burundi East Africa Lubricants Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Burundi East Africa Lubricants Market Revenue (Million), by Geography 2024 & 2032

- Figure 31: Burundi East Africa Lubricants Market Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Burundi East Africa Lubricants Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Burundi East Africa Lubricants Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Uganda East Africa Lubricants Market Revenue (Million), by End User 2024 & 2032

- Figure 35: Uganda East Africa Lubricants Market Revenue Share (%), by End User 2024 & 2032

- Figure 36: Uganda East Africa Lubricants Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Uganda East Africa Lubricants Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Uganda East Africa Lubricants Market Revenue (Million), by Geography 2024 & 2032

- Figure 39: Uganda East Africa Lubricants Market Revenue Share (%), by Geography 2024 & 2032

- Figure 40: Uganda East Africa Lubricants Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Uganda East Africa Lubricants Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Ethiopia East Africa Lubricants Market Revenue (Million), by End User 2024 & 2032

- Figure 43: Ethiopia East Africa Lubricants Market Revenue Share (%), by End User 2024 & 2032

- Figure 44: Ethiopia East Africa Lubricants Market Revenue (Million), by Product Type 2024 & 2032

- Figure 45: Ethiopia East Africa Lubricants Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Ethiopia East Africa Lubricants Market Revenue (Million), by Geography 2024 & 2032

- Figure 47: Ethiopia East Africa Lubricants Market Revenue Share (%), by Geography 2024 & 2032

- Figure 48: Ethiopia East Africa Lubricants Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Ethiopia East Africa Lubricants Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Rwanda East Africa Lubricants Market Revenue (Million), by End User 2024 & 2032

- Figure 51: Rwanda East Africa Lubricants Market Revenue Share (%), by End User 2024 & 2032

- Figure 52: Rwanda East Africa Lubricants Market Revenue (Million), by Product Type 2024 & 2032

- Figure 53: Rwanda East Africa Lubricants Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 54: Rwanda East Africa Lubricants Market Revenue (Million), by Geography 2024 & 2032

- Figure 55: Rwanda East Africa Lubricants Market Revenue Share (%), by Geography 2024 & 2032

- Figure 56: Rwanda East Africa Lubricants Market Revenue (Million), by Country 2024 & 2032

- Figure 57: Rwanda East Africa Lubricants Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global East Africa Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global East Africa Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 7: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global East Africa Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 11: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global East Africa Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global East Africa Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global East Africa Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global East Africa Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Global East Africa Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global East Africa Lubricants Market Revenue Million Forecast, by End User 2019 & 2032

- Table 31: Global East Africa Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global East Africa Lubricants Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Global East Africa Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the East Africa Lubricants Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the East Africa Lubricants Market?

Key companies in the market include BP p l c, Chevron Corporation, China Petrochemical Corporation, Engen Petroleum Ltd, ENOC Company, Exxon Mobil Corporation, General Petroleum, Hass Petroleum, Lake Group, LIQUI MOLY GmbH, Mineral Oil Corporation Limited, Motul S A, National Oil Corporation of Kenya, Oryx Energies SA, Shell PLC, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the East Africa Lubricants Market?

The market segments include End User, Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand Due to Industrial and Economic Growth; Rising Penetration of Used Vehicles Increases the Lubricant Consumption; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Automotive Sector.

7. Are there any restraints impacting market growth?

Increasing Demand Due to Industrial and Economic Growth; Rising Penetration of Used Vehicles Increases the Lubricant Consumption; Other Drivers.

8. Can you provide examples of recent developments in the market?

February 2023: Engen and Vivo Energy announced a combination of their respective African businesses. Moreover, PETRONAS was to sell its 74% shareholding in Engen to Vivo Energy at completion. This was to create one of Africa’s largest energy distribution companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "East Africa Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the East Africa Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the East Africa Lubricants Market?

To stay informed about further developments, trends, and reports in the East Africa Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence