Key Insights

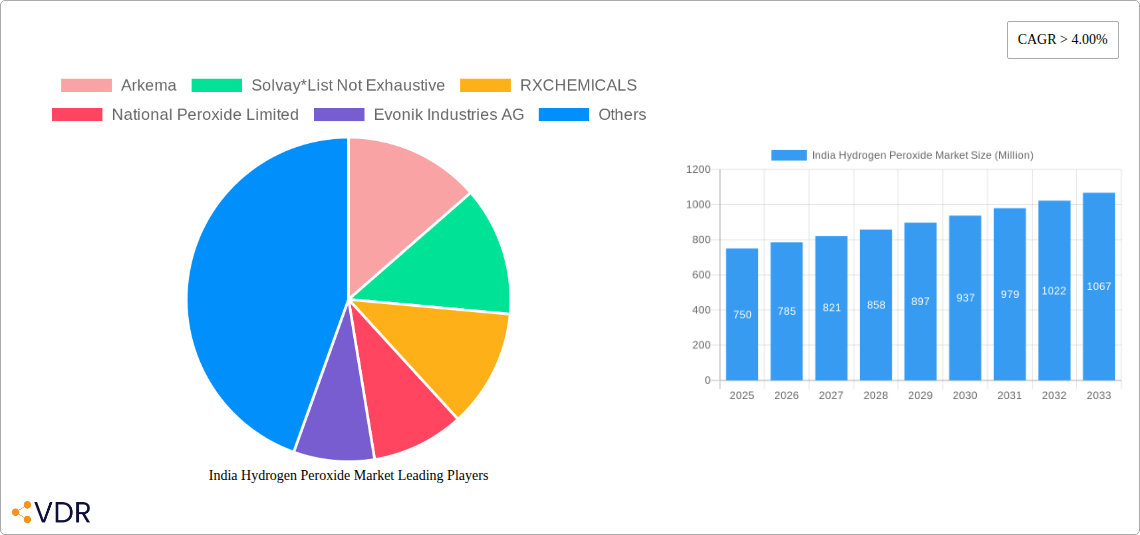

The Indian Hydrogen Peroxide market is projected for substantial growth, with an estimated market size of 5.8 billion and a Compound Annual Growth Rate (CAGR) of 6% between 2025 and 2033. Key growth drivers include escalating demand for disinfectants, rising needs in the textile and pulp & paper industries for bleaching agents, and its vital role in chemical synthesis and wastewater treatment. Increased hygiene awareness, particularly post-pandemic, is a significant driver for the disinfectant segment. Additionally, India's expanding manufacturing sector and government initiatives for environmental protection and sustainable practices are boosting demand in wastewater treatment and mining.

India Hydrogen Peroxide Market Market Size (In Billion)

Emerging trends include the adoption of eco-friendly hydrogen peroxide production methods, influenced by stringent environmental regulations and consumer demand for sustainable products. Innovations in applications within cosmetics and healthcare are also contributing to market dynamism. Potential challenges include raw material price volatility and high initial investment for advanced production facilities. However, significant opportunities exist across end-user industries such as Pulp and Paper, Chemical Synthesis, Wastewater Treatment, Mining, Food and Beverage, Cosmetics and Healthcare, and Textiles. Leading companies like Arkema, Solvay, and Aditya Birla Chemicals are actively shaping this market through innovation and development.

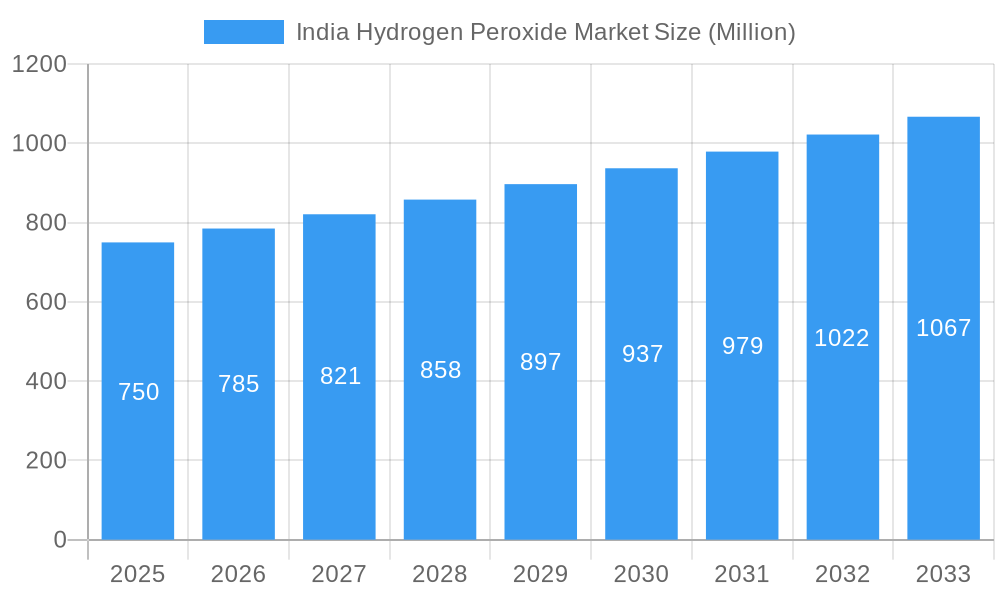

India Hydrogen Peroxide Market Company Market Share

India Hydrogen Peroxide Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides an unparalleled analysis of the India Hydrogen Peroxide Market, offering strategic insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and competitive intelligence. Leveraging extensive data from 2019-2033, with a base year of 2025, this report empowers industry stakeholders with actionable intelligence for informed decision-making. Discover the critical role of hydrogen peroxide in disinfectant applications, bleaching processes, oxidant functions, and across diverse end-user industries including pulp and paper, chemical synthesis, wastewater treatment, mining, food and beverage, cosmetics and healthcare, and textiles.

India Hydrogen Peroxide Market Market Dynamics & Structure

The Indian hydrogen peroxide market is characterized by a moderate to high level of concentration, with a few key players dominating production capacity. Technological innovation is primarily driven by the pursuit of more efficient and environmentally friendly production methods, such as the anthraquinone process, and the development of higher purity grades for specialized applications. Regulatory frameworks, particularly concerning environmental protection and the handling of hazardous chemicals, significantly influence market operations and investment decisions. Competitive product substitutes, while present in some niche applications, are generally outcompeted by hydrogen peroxide's cost-effectiveness and versatility. End-user demographics are shifting with increasing industrialization and a growing emphasis on hygiene and environmental sustainability, leading to diversified demand. Merger and acquisition (M&A) trends are observed as companies seek to consolidate market share, expand product portfolios, and achieve economies of scale. While innovation barriers exist in terms of capital investment for advanced manufacturing, the overall competitive landscape is dynamic.

- Market Concentration: Dominated by a few major manufacturers, with a significant portion of production capacity held by leading domestic and international players.

- Technological Innovation Drivers: Focus on energy efficiency in production, development of high-purity grades (e.g., 70% H2O2), and exploration of novel applications.

- Regulatory Frameworks: Stringent environmental regulations (e.g., pollution control norms) and safety standards for chemical handling are crucial influencing factors.

- Competitive Product Substitutes: Sodium hypochlorite and ozone are substitutes in certain disinfection and bleaching applications, but H2O2 offers broader efficacy.

- End-User Demographics: Growth driven by the expanding manufacturing sector, increasing disposable incomes, and rising awareness of hygiene and environmental concerns.

- M&A Trends: Strategic acquisitions and joint ventures aimed at expanding geographical reach and enhancing technological capabilities.

India Hydrogen Peroxide Market Growth Trends & Insights

The India Hydrogen Peroxide Market is poised for robust growth, driven by a confluence of factors including expanding industrial activities, increasing hygiene awareness, and a growing focus on sustainable practices. The market size is projected to witness a healthy evolution from approximately $1,200 Million in the base year 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period of 2025–2033. Adoption rates for hydrogen peroxide are steadily increasing across various end-user industries, spurred by its versatility as a powerful disinfectant, an effective bleaching agent, and a key oxidant in chemical synthesis. Technological disruptions, such as advancements in on-site generation of hydrogen peroxide and the development of more stable formulations, are further enhancing its appeal. Consumer behavior shifts, particularly the heightened demand for safe and effective sanitization solutions in the post-pandemic era and a growing preference for eco-friendly chemical alternatives in industries like textiles and pulp and paper, are significantly contributing to market penetration. The market penetration of hydrogen peroxide is expected to deepen as awareness of its benefits and its cost-effectiveness compared to alternatives becomes more pronounced.

Dominant Regions, Countries, or Segments in India Hydrogen Peroxide Market

Within the India Hydrogen Peroxide Market, the Chemical Synthesis end-user industry is a dominant force, significantly propelling market growth. This segment's dominance is attributed to the vast and expanding chemical manufacturing sector in India, which relies heavily on hydrogen peroxide as a key oxidant for producing a wide array of intermediates and finished products. India's "Make in India" initiative and the government's focus on boosting domestic manufacturing have directly translated into increased demand for essential chemicals like hydrogen peroxide. The Pulp and Paper industry also plays a crucial role, utilizing hydrogen peroxide for its environmentally friendly bleaching properties, replacing traditional chlorine-based methods. Furthermore, the growing demand for disinfectants in Cosmetics and Healthcare, driven by increased hygiene consciousness, and the critical need for effective treatment in Wastewater Treatment plants are also significant growth drivers. Economically, states with a strong industrial base, such as Gujarat, Maharashtra, and Tamil Nadu, are leading the consumption of hydrogen peroxide due to the concentration of chemical, textile, and paper manufacturing units. Infrastructure development, including improved logistics and port facilities, further facilitates the efficient distribution of this chemical across the country. The market share within the Chemical Synthesis segment is substantial, estimated to be around 25-30% of the total market value in 2025, with a projected growth potential of 7% annually.

- Chemical Synthesis Dominance: Essential oxidant for a wide range of chemical manufacturing processes, benefiting from India's industrial growth.

- Pulp and Paper Adoption: Increasing preference for eco-friendly bleaching processes drives demand for H2O2.

- Cosmetics & Healthcare Demand: Rising hygiene standards and the need for effective disinfectants contribute significantly.

- Wastewater Treatment Importance: Crucial for environmental compliance and water purification.

- Regional Hubs: Gujarat, Maharashtra, and Tamil Nadu are key consumption centers due to strong industrial presence.

- Economic Policies: Government initiatives supporting domestic manufacturing indirectly boost H2O2 demand.

- Infrastructure: Well-developed logistics networks ensure efficient supply chain management.

India Hydrogen Peroxide Market Product Landscape

The product landscape of the India Hydrogen Peroxide Market is characterized by continuous innovation and a focus on performance enhancement. Manufacturers are increasingly offering various grades of hydrogen peroxide, including food-grade and pharmaceutical-grade, to cater to the stringent requirements of these sensitive industries. Advancements in production technology have led to the availability of higher concentration solutions (e.g., 70% H2O2), which offer greater efficiency and reduced transportation costs for industrial users. Unique selling propositions often revolve around product purity, stability, and customized packaging solutions to meet specific client needs. Technological advancements are also being made in developing safer and more stable formulations for easier handling and storage, further broadening the application scope of hydrogen peroxide across its diverse end-user segments.

Key Drivers, Barriers & Challenges in India Hydrogen Peroxide Market

The India Hydrogen Peroxide Market is propelled by several key drivers, including the burgeoning demand from the pulp and paper industry for eco-friendly bleaching, the expanding chemical synthesis sector requiring effective oxidants, and the increasing adoption in wastewater treatment for environmental compliance. The growing awareness and demand for disinfectants in cosmetics and healthcare are also significant growth accelerators.

- Technological Drivers: Advancements in production efficiency, development of higher purity grades, and innovative application research.

- Economic Drivers: India's rapid industrialization, increasing disposable incomes, and supportive government policies for manufacturing.

- Policy Drivers: Stringent environmental regulations favoring greener chemicals and efficient waste management solutions.

Key challenges and restraints in the market include fluctuating raw material prices, particularly for hydrogen and oxygen, which can impact production costs and profitability. Supply chain complexities, especially in reaching remote industrial areas, and the inherent safety risks associated with handling and transporting concentrated hydrogen peroxide necessitate robust logistics and safety protocols, leading to higher operational costs. Competitive pressures from established players and the threat of alternative disinfection and oxidation technologies in certain niche applications also pose challenges.

- Supply Chain Issues: Logistical challenges in distribution and storage, especially for hazardous materials.

- Regulatory Hurdles: Compliance with evolving environmental and safety standards can be costly.

- Competitive Pressures: Intense competition among market players, leading to price sensitivity.

- Raw Material Price Volatility: Fluctuations in the cost of key feedstocks impact profitability.

Emerging Opportunities in India Hydrogen Peroxide Market

Emerging opportunities in the India Hydrogen Peroxide Market lie in the growing demand for sustainable and eco-friendly solutions. The increasing focus on environmental protection and stricter regulations are creating a significant opportunity for hydrogen peroxide in wastewater treatment and industrial effluent management. The burgeoning food and beverage sector's need for effective sanitization and preservation is another untapped area. Furthermore, the development of advanced applications in sectors like electronics manufacturing and the potential for hydrogen peroxide in the emerging hydrogen economy present substantial long-term growth prospects. The drive towards less toxic alternatives in consumer products also opens avenues for higher-purity grades.

Growth Accelerators in the India Hydrogen Peroxide Market Industry

Several catalysts are accelerating the growth of the India Hydrogen Peroxide Market. Technological breakthroughs in optimizing the anthraquinone process are leading to more cost-effective and environmentally sustainable production. Strategic partnerships and collaborations between manufacturers and end-users are fostering innovation and market penetration. Furthermore, market expansion strategies, including increasing production capacities and establishing wider distribution networks, are crucial for meeting the escalating demand. The government's continuous push for industrial development and environmental sustainability also acts as a significant growth accelerator.

Key Players Shaping the India Hydrogen Peroxide Market Market

- Arkema

- Solvay

- RXCHEMICALS

- National Peroxide Limited

- Evonik Industries AG

- Chemplast Sanmar Limited

- Indian Peroxide Limited

- PCIPL (Prakash Chemicals International Private Limited)

- Hindustan Organic Chemicals Ltd (HOCL)

- Aditya Birla Chemicals

- Gujarat Alkalies and Chemical Limited

- Meghmani Finechem Limited (MFL)

- AkzoNobel NV

Notable Milestones in India Hydrogen Peroxide Market Sector

- 2019: Increased government initiatives and investments in the chemical manufacturing sector, boosting domestic production of hydrogen peroxide.

- 2020: Heightened awareness of hygiene and disinfection due to the global pandemic, leading to a surge in demand for hydrogen peroxide-based disinfectants.

- 2021: Major expansion projects announced by key players to increase production capacity, anticipating sustained demand growth.

- 2022: Focus on developing and promoting environmentally friendly applications, particularly in the pulp and paper and textile industries, replacing chlorine-based chemicals.

- 2023: Advancements in on-site hydrogen peroxide generation technologies explored for specific industrial applications, offering greater flexibility and reduced logistics costs.

- 2024: Growing interest and investment in R&D for novel applications of hydrogen peroxide in emerging sectors like electronics and specialty chemicals.

In-Depth India Hydrogen Peroxide Market Market Outlook

The India Hydrogen Peroxide Market is set for sustained and strong growth in the coming years, fueled by its indispensable role in diverse industrial applications and increasing consumer demand for hygienic and eco-friendly products. The market's outlook is exceptionally positive, driven by ongoing industrial expansion, supportive government policies promoting manufacturing and environmental sustainability, and continuous technological advancements in production and application. The increasing adoption of green chemistry principles across industries will further solidify hydrogen peroxide's position as a preferred oxidant and disinfectant. Strategic investments in capacity expansion and R&D for new applications will be crucial for market players to capitalize on the immense future potential.

India Hydrogen Peroxide Market Segmentation

-

1. Product Function

- 1.1. Disinfectant

- 1.2. Bleaching

- 1.3. Oxidant

- 1.4. Other Pr

-

2. End-user Industry

- 2.1. Pulp and Paper

- 2.2. Chemical Synthesis

- 2.3. Wastewater Treatment

- 2.4. Mining

- 2.5. Food and Beverage

- 2.6. Cosmetics and Healthcare

- 2.7. Textiles

- 2.8. Other En

India Hydrogen Peroxide Market Segmentation By Geography

- 1. India

India Hydrogen Peroxide Market Regional Market Share

Geographic Coverage of India Hydrogen Peroxide Market

India Hydrogen Peroxide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization in the Food Processing Industry; Application in the Paper and Pulp Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Health Hazards Associated with Long-term Exposure of Hydrogen Peroxide; Other Restraints

- 3.4. Market Trends

- 3.4.1. Paper and Pulp Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Hydrogen Peroxide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Function

- 5.1.1. Disinfectant

- 5.1.2. Bleaching

- 5.1.3. Oxidant

- 5.1.4. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Pulp and Paper

- 5.2.2. Chemical Synthesis

- 5.2.3. Wastewater Treatment

- 5.2.4. Mining

- 5.2.5. Food and Beverage

- 5.2.6. Cosmetics and Healthcare

- 5.2.7. Textiles

- 5.2.8. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solvay*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RXCHEMICALS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Peroxide Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Evonik Industries AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chemplast Sanmar Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Peroxide Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PCIPL (Prakash Chemicals International Private Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hindustan Organic Chemicals Ltd (HOCL)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aditya Birla Chemicals

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gujarat Alkalies and Chemical Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Meghmani Finechem Limited (MFL)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AkzoNobel NV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: India Hydrogen Peroxide Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Hydrogen Peroxide Market Share (%) by Company 2025

List of Tables

- Table 1: India Hydrogen Peroxide Market Revenue billion Forecast, by Product Function 2020 & 2033

- Table 2: India Hydrogen Peroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: India Hydrogen Peroxide Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Hydrogen Peroxide Market Revenue billion Forecast, by Product Function 2020 & 2033

- Table 5: India Hydrogen Peroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Hydrogen Peroxide Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Hydrogen Peroxide Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the India Hydrogen Peroxide Market?

Key companies in the market include Arkema, Solvay*List Not Exhaustive, RXCHEMICALS, National Peroxide Limited, Evonik Industries AG, Chemplast Sanmar Limited, Indian Peroxide Limited, PCIPL (Prakash Chemicals International Private Limited), Hindustan Organic Chemicals Ltd (HOCL), Aditya Birla Chemicals, Gujarat Alkalies and Chemical Limited, Meghmani Finechem Limited (MFL), AkzoNobel NV.

3. What are the main segments of the India Hydrogen Peroxide Market?

The market segments include Product Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization in the Food Processing Industry; Application in the Paper and Pulp Industry; Other Drivers.

6. What are the notable trends driving market growth?

Paper and Pulp Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Health Hazards Associated with Long-term Exposure of Hydrogen Peroxide; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Hydrogen Peroxide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Hydrogen Peroxide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Hydrogen Peroxide Market?

To stay informed about further developments, trends, and reports in the India Hydrogen Peroxide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence