Key Insights

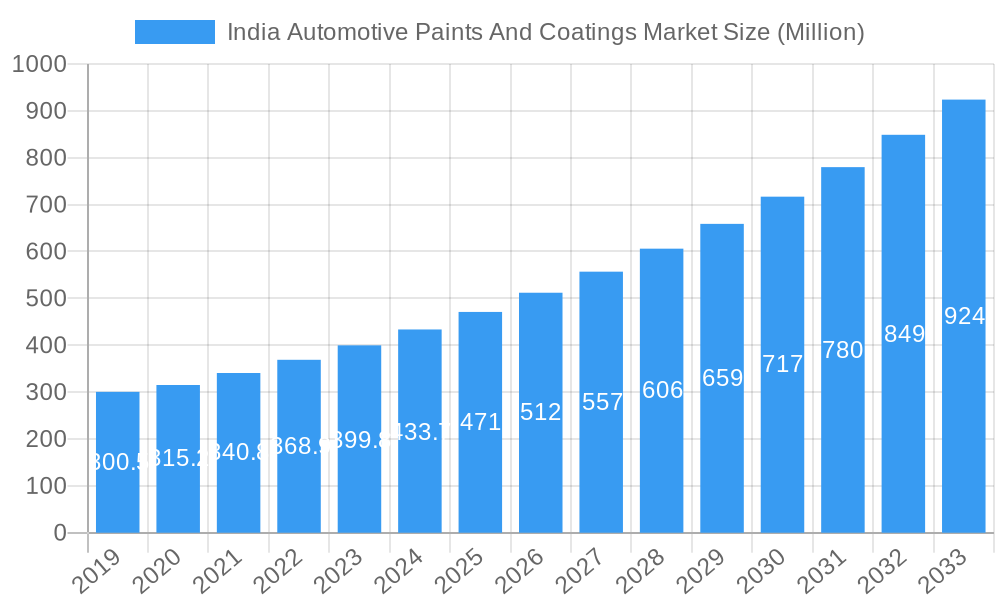

The Indian automotive paints and coatings market is projected for significant expansion, forecasting a market size of 1616.8 million by 2033. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of 5.09% from the base year 2024. Key growth drivers include the robust expansion of the automotive sector, increased vehicle production volumes, and a rising consumer demand for enhanced vehicle aesthetics and superior durability. Factors such as increasing disposable incomes, a growing middle-class population, and supportive government policies promoting manufacturing and infrastructure development are directly stimulating automotive sales and, consequently, the demand for paints and coatings. Furthermore, technological innovations in paint formulations, specifically the adoption of eco-friendly water-borne and powder coatings, are gaining momentum due to stricter environmental regulations and a growing consumer preference for sustainable automotive solutions. The market is also experiencing a surge in demand for premium and customized finishes, prompting manufacturers to focus on innovation and offer a diverse range of colors, textures, and protective coating properties.

India Automotive Paints And Coatings Market Market Size (In Billion)

The market is segmented by resin type, with Polyurethane, Epoxy, and Acrylic being prominent categories, each designed to meet specific performance and application demands. Polyurethane coatings are anticipated to lead due to their exceptional durability and resistance to chemicals and UV radiation. Water-borne coatings are emerging as a key trend, propelled by stringent environmental mandates to reduce volatile organic compound (VOC) emissions. The application landscape is bifurcated into Automotive Original Equipment Manufacturer (OEM) and Automotive Refinish. The OEM segment is expected to experience substantial growth, driven by new vehicle production, while the refinish segment, supported by the aftermarket for vehicle repair and customization, will also contribute considerably to market expansion. Leading industry players such as Akzo Nobel NV, BASF SE, and PPG Asian Paints are strategically investing in research and development to introduce innovative solutions and broaden their market reach within India.

India Automotive Paints And Coatings Market Company Market Share

India Automotive Paints and Coatings Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the India automotive paints and coatings market, offering critical insights for stakeholders navigating this dynamic sector. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the crucial role of leading players. With a focus on both parent and child market segments, and presented in million units for all values, this report is your definitive guide to the evolving Indian automotive coatings industry.

India Automotive Paints And Coatings Market Market Dynamics & Structure

The India automotive paints and coatings market exhibits a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by the increasing demand for aesthetic appeal, enhanced durability, and environmental compliance. Regulatory frameworks, particularly those promoting lower VOC emissions and eco-friendly formulations, are shaping product development and adoption rates. Competitive product substitutes are emerging, with advancements in water-borne and powder coatings challenging traditional solvent-borne systems. End-user demographics are evolving, driven by a growing middle class, increased disposable incomes, and a preference for premium and personalized vehicle finishes. Merger and acquisition (M&A) trends, though not as prevalent as in more mature markets, are expected to gain traction as larger players seek to consolidate their market position and expand their product portfolios.

- Market Concentration: Dominated by a mix of global giants and strong domestic players, with a clear trend towards consolidation.

- Technological Innovation: Driven by sustainability demands, performance enhancements (scratch resistance, UV protection), and digitalization in application processes.

- Regulatory Frameworks: Stringent environmental regulations push for lower VOC content and adoption of eco-friendly technologies like water-borne coatings.

- Competitive Product Substitutes: Water-borne and powder coatings are gaining ground, offering greener alternatives to solvent-borne systems.

- End-User Demographics: Rising consumer aspirations, demand for customization, and the growth of the electric vehicle (EV) segment are influencing coating choices.

- M&A Trends: Expected to increase as companies aim for market expansion and synergistic benefits.

India Automotive Paints And Coatings Market Growth Trends & Insights

The India automotive paints and coatings market is poised for significant expansion, driven by robust growth in vehicle production and a rising demand for high-quality, aesthetically appealing, and durable finishes. The market size is projected to witness a substantial increase from an estimated XXX million units in 2025, with a Compound Annual Growth Rate (CAGR) of approximately X.XX% expected throughout the forecast period (2025-2033). Adoption rates of advanced coating technologies are steadily increasing, spurred by OEM requirements and the growing awareness among aftermarket customers regarding the benefits of specialized coatings. Technological disruptions are a constant feature, with a noticeable shift towards sustainable and eco-friendly solutions. Water-borne coatings, for instance, are gaining significant traction due to their reduced environmental impact and compliance with stricter emission norms. This transition is impacting traditional solvent-borne technologies, which are gradually seeing their market share diminish.

Consumer behavior shifts are also playing a crucial role. There is a discernible preference for customized color options, special effect finishes, and coatings that offer enhanced protection against environmental factors like UV radiation and corrosion. The increasing demand for premium vehicles and a growing consciousness about vehicle maintenance and resale value further contribute to the adoption of higher-performance coatings. The burgeoning electric vehicle (EV) segment presents a unique opportunity, with specific coating requirements related to thermal management, lightweighting, and unique aesthetic designs. The penetration of advanced coating solutions in both the automotive OEM and automotive refinish segments is expected to deepen, reflecting the evolving priorities of manufacturers and consumers alike. This growth trajectory is further amplified by government initiatives promoting manufacturing and domestic production, which are expected to boost the overall automotive industry and, consequently, the demand for paints and coatings. The market penetration of specialized coatings, such as clear coats with advanced scratch resistance and primers with improved adhesion properties, is also expected to rise, reflecting a maturing automotive ecosystem.

Dominant Regions, Countries, or Segments in India Automotive Paints And Coatings Market

The dominance in the India automotive paints and coatings market is multifaceted, with specific segments, resin types, and technologies taking the lead. Automotive OEM application currently holds the lion's share, driven by the sheer volume of new vehicle production across the country. This segment benefits from direct partnerships with major automotive manufacturers, ensuring consistent demand for coatings. Within the Resin Type segment, Acrylic and Polyurethane resins are dominant. Acrylics offer excellent weatherability and gloss retention, making them ideal for topcoats, while Polyurethanes provide superior durability, chemical resistance, and flexibility, often used in primers and clear coats.

In terms of Technology, Solvent-borne coatings have historically been dominant due to their cost-effectiveness and ease of application. However, there is a rapid and significant shift towards Water-borne technologies. This transition is propelled by stringent environmental regulations aimed at reducing volatile organic compound (VOC) emissions. While water-borne coatings require more sophisticated application and drying equipment, their environmental advantages are increasingly making them the preferred choice for new OEM facilities and for refinish applications aiming for compliance. Powder coatings are also gaining traction, particularly for specific components and in niche applications, offering excellent durability and a VOC-free application process.

Considering the Layer within the automotive paint system, the Primer and Base Coat segments are crucial. Primers are essential for substrate adhesion, corrosion protection, and surface preparation, while the base coat provides the color and visual aesthetics. The demand for high-quality primers with enhanced anti-corrosive properties and base coats offering a wide spectrum of colors and special effects is consistently high. The Automotive Refinish segment, though smaller than OEM, is a significant growth area. This segment caters to the repair and maintenance needs of vehicles, with a growing demand for easy-to-use, fast-drying, and color-accurate coatings. The increasing number of vehicles on the road, coupled with a rising disposable income, fuels the growth of the refinish market.

Key drivers for this dominance include favorable economic policies promoting automotive manufacturing, significant infrastructure development supporting logistics and distribution, and the sheer size of India's rapidly growing vehicle parc. The increasing adoption of advanced technologies by Indian automotive manufacturers to meet global standards also contributes to the demand for premium coatings.

India Automotive Paints And Coatings Market Product Landscape

The product landscape in the India automotive paints and coatings market is characterized by a relentless pursuit of innovation, focusing on enhancing aesthetics, durability, and sustainability. Manufacturers are increasingly developing advanced formulations that offer superior scratch resistance, UV protection, and chemical inertness, thereby extending the lifespan and visual appeal of vehicles. The trend towards customizable color palettes, metallic finishes, and unique chromatic effects is a significant product development area, catering to evolving consumer preferences for personalization. Technological advancements are evident in the introduction of high-solids and water-borne coatings that minimize environmental impact while delivering exceptional performance. Unique selling propositions often revolve around eco-friendly credentials, faster drying times for improved workshop efficiency in the refinish segment, and specialized coatings for electric vehicle applications, such as those with enhanced thermal management properties or unique lightweighting capabilities.

Key Drivers, Barriers & Challenges in India Automotive Paints And Coatings Market

The India automotive paints and coatings market is propelled by several key drivers. The robust growth in the Indian automotive industry, driven by increasing disposable incomes and a young demographic, is a primary catalyst. Advancements in coating technologies, particularly the development of eco-friendly and high-performance formulations, are creating new market opportunities. Government initiatives aimed at boosting domestic manufacturing and "Make in India" campaigns further stimulate demand. The growing consumer demand for aesthetic appeal and vehicle customization also plays a significant role.

However, the market faces several barriers and challenges. Fluctuations in raw material prices, particularly petrochemical derivatives, can impact profitability and pricing strategies. Stringent environmental regulations, while driving innovation, also necessitate significant investment in R&D and new production facilities. Intense competition from both domestic and international players can lead to price pressures. Supply chain disruptions, especially in the procurement of specialized raw materials, can affect production timelines. The lack of skilled labor for the application of advanced coating systems in some regions can also pose a challenge.

Emerging Opportunities in India Automotive Paints And Coatings Market

Emerging opportunities in the India automotive paints and coatings market are abundant, driven by evolving consumer preferences and technological advancements. The rapid growth of the electric vehicle (EV) segment presents a significant untapped market for specialized coatings, including those for battery thermal management, electromagnetic shielding, and lightweight structural components. The increasing demand for customized and personalized vehicle finishes, including matte finishes, pearlescent effects, and color-changing paints, offers avenues for niche product development. Furthermore, the growing focus on sustainability is creating opportunities for bio-based and recycled content coatings. The expansion of the automotive refinish market, driven by an aging vehicle parc and a rising demand for quality repairs, also presents lucrative prospects for innovative and user-friendly coating solutions.

Growth Accelerators in the India Automotive Paints And Coatings Market Industry

Several catalysts are accelerating the growth of the India automotive paints and coatings market. Technological breakthroughs in developing coatings with superior scratch resistance, self-healing properties, and enhanced UV protection are driving demand for premium products. Strategic partnerships between paint manufacturers and automotive OEMs are crucial for co-developing customized solutions and ensuring seamless integration of new coating technologies. Market expansion strategies, including increasing production capacities, developing robust distribution networks, and focusing on Tier-2 and Tier-3 cities, are vital for reaching a wider customer base. The ongoing shift towards sustainable coating solutions, such as water-borne and powder coatings, is a significant growth accelerator, aligning with global environmental trends and regulatory mandates.

Key Players Shaping the India Automotive Paints And Coatings Market Market

- Jotun

- Cresta Paints India Pvt Ltd

- Berger Paints India Limited

- Sheenlac Paints Ltd

- Akzo Nobel NV

- Fabula Coatings India Pvt Ltd

- BASF SE

- Snowcem Paints*List Not Exhaustive

- Kansai Nerolac Paints Limited

- Nippon Paint (India) Company Limited

- Kwality Paints and Coatings Pvt Ltd

- PPG Asian Paints

Notable Milestones in India Automotive Paints And Coatings Market Sector

- May 2022: BASF expanded its Automotive Coatings Application Center at the Coatings Technology Center in Mangalore, India, to enhance customer service capabilities.

- February 2022: The long-standing cooperation between McLaren Racing and AkzoNobel was extended and enhanced through a new multi-year agreement, building on a successful 13-year partnership and exploring new sustainability, technical innovation, and product development potential.

In-Depth India Automotive Paints And Coatings Market Market Outlook

The future outlook for the India automotive paints and coatings market is exceptionally promising, driven by a confluence of growth accelerators. The sustained expansion of the Indian automotive sector, coupled with a growing consumer appetite for premium and personalized vehicles, will continue to fuel demand. The relentless pursuit of technological innovation, particularly in the realm of sustainable and high-performance coatings, will open new avenues for market penetration. Strategic alliances and partnerships between key industry players are expected to foster innovation and accelerate market development. Furthermore, the increasing adoption of advanced manufacturing techniques and a growing focus on environmental responsibility will shape the market's trajectory, solidifying its position as a critical component of India's burgeoning manufacturing economy.

India Automotive Paints And Coatings Market Segmentation

-

1. Resin Type

- 1.1. Polyurethane

- 1.2. Epoxy

- 1.3. Acrylic

- 1.4. Other Resin Types

-

2. Technology

- 2.1. Solvent-borne

- 2.2. Water-borne

- 2.3. Powder

- 2.4. Other Technologies

-

3. Layer

- 3.1. E-coat

- 3.2. Primer

- 3.3. Base Coat

- 3.4. Clear Coat

-

4. Application

- 4.1. Automotive OEM

- 4.2. Automotive Refinish

India Automotive Paints And Coatings Market Segmentation By Geography

- 1. India

India Automotive Paints And Coatings Market Regional Market Share

Geographic Coverage of India Automotive Paints And Coatings Market

India Automotive Paints And Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Automotive Refinish; Increasing Demand for Functional Coatings; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Ongoing Shortage of Semiconductors; Other Restraints

- 3.4. Market Trends

- 3.4.1. Polyurethane Resin Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyurethane

- 5.1.2. Epoxy

- 5.1.3. Acrylic

- 5.1.4. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solvent-borne

- 5.2.2. Water-borne

- 5.2.3. Powder

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Layer

- 5.3.1. E-coat

- 5.3.2. Primer

- 5.3.3. Base Coat

- 5.3.4. Clear Coat

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Automotive OEM

- 5.4.2. Automotive Refinish

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jotun

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cresta Paints India Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berger Paints India Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sheenlac Paints Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Akzo Nobel NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fabula Coatings India Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Snowcem Paints*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kansai Nerolac Paints Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nippon Paint (India) Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kwality Paints and Coatings Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PPG Asian Paints

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Jotun

List of Figures

- Figure 1: India Automotive Paints And Coatings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Automotive Paints And Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: India Automotive Paints And Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 2: India Automotive Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 3: India Automotive Paints And Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 4: India Automotive Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: India Automotive Paints And Coatings Market Revenue million Forecast, by Layer 2020 & 2033

- Table 6: India Automotive Paints And Coatings Market Volume liter Forecast, by Layer 2020 & 2033

- Table 7: India Automotive Paints And Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: India Automotive Paints And Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 9: India Automotive Paints And Coatings Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: India Automotive Paints And Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 11: India Automotive Paints And Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 12: India Automotive Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 13: India Automotive Paints And Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 14: India Automotive Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 15: India Automotive Paints And Coatings Market Revenue million Forecast, by Layer 2020 & 2033

- Table 16: India Automotive Paints And Coatings Market Volume liter Forecast, by Layer 2020 & 2033

- Table 17: India Automotive Paints And Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: India Automotive Paints And Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 19: India Automotive Paints And Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: India Automotive Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Paints And Coatings Market?

The projected CAGR is approximately 5.09%.

2. Which companies are prominent players in the India Automotive Paints And Coatings Market?

Key companies in the market include Jotun, Cresta Paints India Pvt Ltd, Berger Paints India Limited, Sheenlac Paints Ltd, Akzo Nobel NV, Fabula Coatings India Pvt Ltd, BASF SE, Snowcem Paints*List Not Exhaustive, Kansai Nerolac Paints Limited, Nippon Paint (India) Company Limited, Kwality Paints and Coatings Pvt Ltd, PPG Asian Paints.

3. What are the main segments of the India Automotive Paints And Coatings Market?

The market segments include Resin Type, Technology, Layer, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1616.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Automotive Refinish; Increasing Demand for Functional Coatings; Other Drivers.

6. What are the notable trends driving market growth?

Polyurethane Resin Type to Dominate the Market.

7. Are there any restraints impacting market growth?

Ongoing Shortage of Semiconductors; Other Restraints.

8. Can you provide examples of recent developments in the market?

May 2022: BASF expanded its Automotive Coatings Application Center at the Coatings Technology Center in Mangalore, India in order to boost its customer service capability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Paints And Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Paints And Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Paints And Coatings Market?

To stay informed about further developments, trends, and reports in the India Automotive Paints And Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence