Key Insights

The global market for Coating Agents for Synthetic Leather is projected for significant expansion, driven by robust demand in automotive interiors, furniture, footwear, and textiles. Key growth factors include synthetic leather's inherent durability, cost-effectiveness, design versatility, and increasing consumer preference for sustainable, animal-free alternatives. Advancements in coating technologies are yielding high-performance agents with enhanced texture, feel, and functionality like scratch and water resistance, meeting evolving end-user and manufacturer needs.

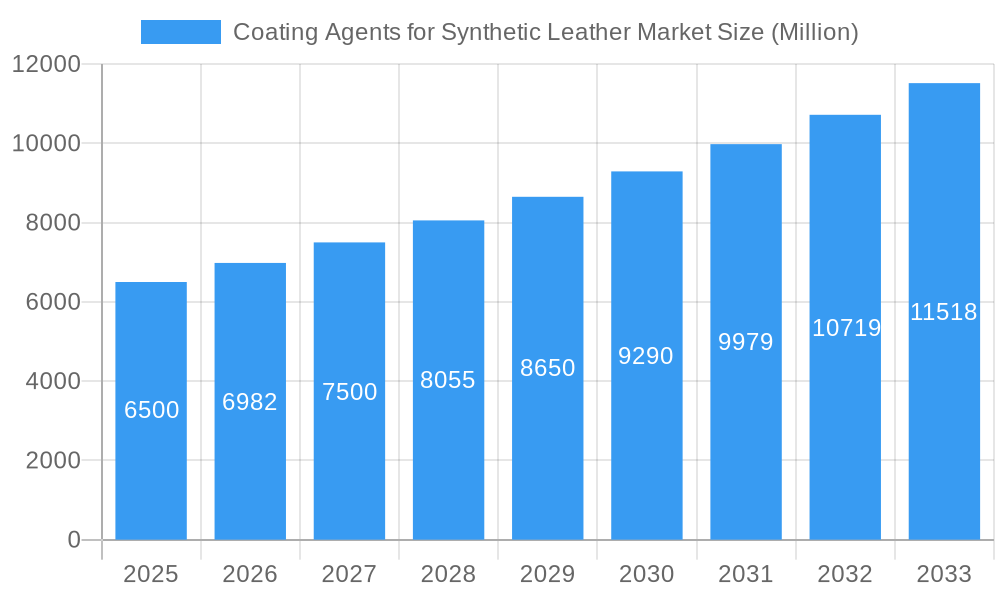

Coating Agents for Synthetic Leather Market Market Size (In Million)

The market's upward trajectory is supported by a Compound Annual Growth Rate (CAGR) of 6.5%. Polyurethane (PU) resins are expected to lead, due to their flexibility and abrasion resistance. PVC and silicone-based agents will also see adoption for applications requiring enhanced water resistance and UV stability. Asia Pacific, particularly China and India, is anticipated to dominate, fueled by a strong manufacturing base, growing automotive and footwear sectors, and rising disposable incomes. Leading players are investing in R&D to introduce innovative solutions and expand their market presence.

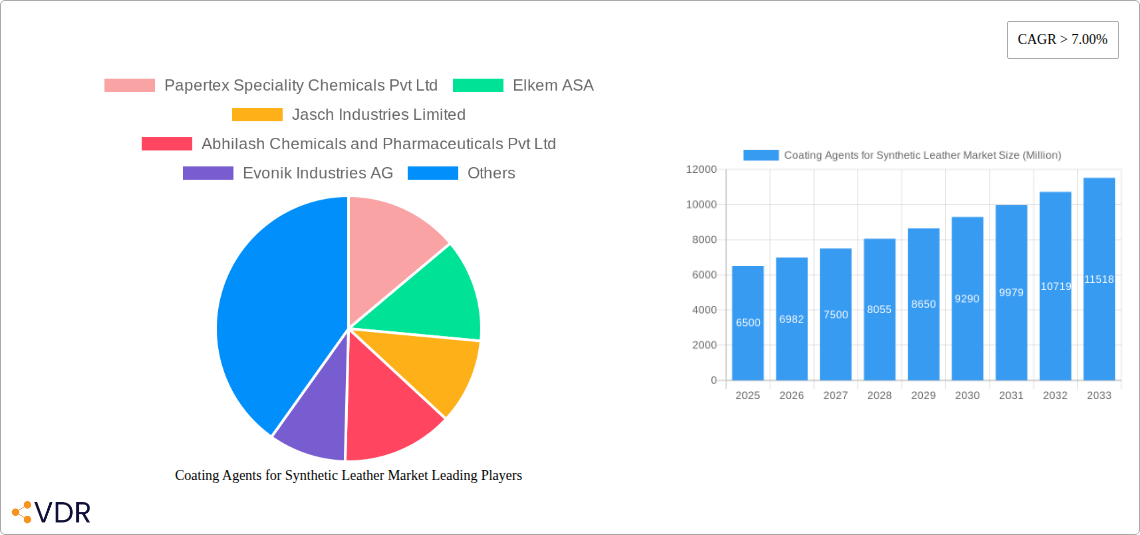

Coating Agents for Synthetic Leather Market Company Market Share

This report offers a comprehensive analysis of the global Coating Agents for Synthetic Leather Market, providing critical insights into market dynamics, growth trends, regional dominance, and key player strategies. It is designed for industry professionals, manufacturers, raw material suppliers, and investors, offering data and forecasts for the market's evolving landscape. The study covers the period 2019–2033, with a base year of 2025 and a market size of 276.32 million units. Key segments analyzed include Resin Type (PU, PVC, Silicone, Other Resin Types) and Application (Automotive, Furniture and Domestic Upholstery, Footwear, Textile and Fashion, Transportation, Other Applications), with all values presented in million units.

Coating Agents for Synthetic Leather Market Market Dynamics & Structure

The Coating Agents for Synthetic Leather Market exhibits a moderately concentrated structure, with leading players focusing on technological advancements and strategic acquisitions to expand their market share. Key drivers of innovation stem from the demand for sustainable, high-performance, and aesthetically pleasing synthetic leather alternatives across various industries. Regulatory frameworks, particularly those concerning environmental impact and chemical usage, are increasingly shaping product development and material choices. The presence of competitive product substitutes, such as genuine leather and other novel materials, necessitates continuous product differentiation and cost-effectiveness from coating agent manufacturers. End-user demographics are shifting towards younger, environmentally conscious consumers who prioritize durability, versatility, and ethical sourcing. Mergers and acquisitions (M&A) trends are evident as larger entities seek to consolidate their market position and acquire specialized technologies. For instance, recent M&A activity in the broader chemical sector suggests a trend towards integration of value chains to enhance efficiency and product portfolios. The market concentration is further influenced by the high capital investment required for research and development, creating barriers to entry for new players.

Coating Agents for Synthetic Leather Market Growth Trends & Insights

The Coating Agents for Synthetic Leather Market is poised for significant expansion, driven by escalating demand from the automotive, furniture, and textile sectors. Leveraging [Insert Placeholder for Market Research Methodology or Data Source, e.g., proprietary algorithms, extensive primary and secondary research], this analysis reveals a robust growth trajectory. The market size is projected to evolve from approximately XX Million Units in 2025 to an estimated XX Million Units by 2033, signifying a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates for advanced coating agents are accelerating, fueled by the superior properties they impart, such as enhanced scratch resistance, water repellency, and a more natural feel, rivaling that of genuine leather. Technological disruptions, including the development of bio-based and recyclable coating agents, are gaining traction as sustainability becomes a paramount concern for consumers and manufacturers alike. Consumer behavior shifts towards embracing sustainable fashion and ethically produced materials are directly impacting the demand for synthetic leather, consequently boosting the market for its essential coating agents. Innovations in application techniques and formulation advancements are further contributing to the market's dynamism, enabling the creation of synthetic leathers tailored for highly specific end-use requirements. The increasing disposable income in emerging economies also plays a crucial role, driving demand for products where synthetic leather finds widespread application.

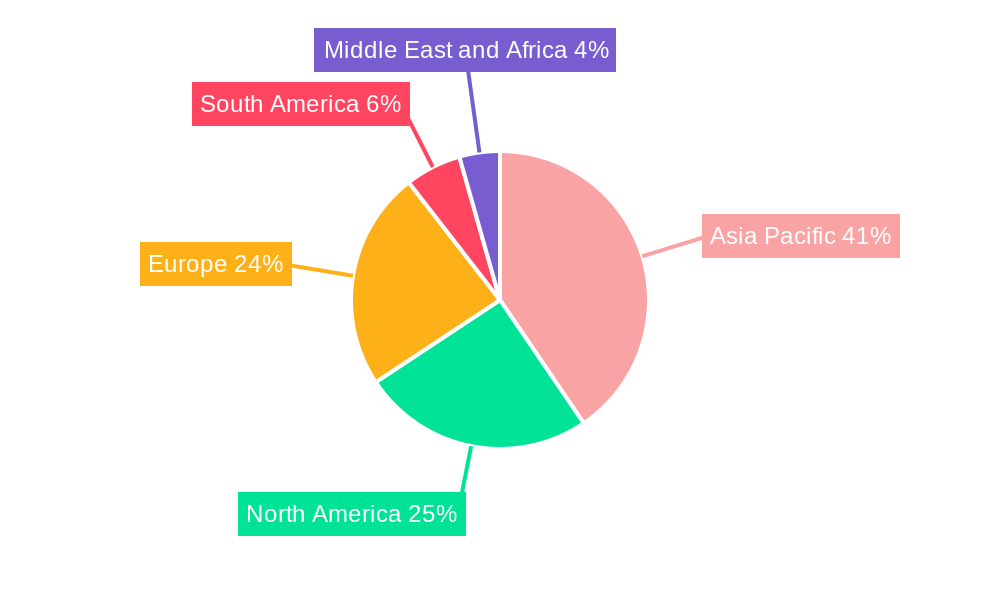

Dominant Regions, Countries, or Segments in Coating Agents for Synthetic Leather Market

The Coating Agents for Synthetic Leather Market is experiencing robust growth, with the Automotive application segment and the Asia Pacific region emerging as dominant forces. Within the Resin Type segment, PU (Polyurethane) coatings continue to hold a substantial market share due to their excellent flexibility, durability, and abrasion resistance, making them ideal for a wide array of synthetic leather applications. However, PVC (Polyvinyl Chloride) coatings remain a cost-effective alternative, particularly in price-sensitive markets and for specific industrial applications. Silicone coatings are gaining traction for their superior weather resistance and tactile properties, finding use in high-end applications.

Asia Pacific leads the market, driven by its strong manufacturing base in textiles, footwear, and automotive industries, particularly in countries like China, India, and Vietnam. Favorable economic policies, increasing industrialization, and a large consumer base contribute to this dominance. The region's burgeoning automotive sector, coupled with the extensive production of footwear and fashion accessories, creates substantial demand for synthetic leather and its associated coating agents.

The Automotive application segment is a key growth driver globally. Modern vehicles increasingly utilize synthetic leather for interiors, offering a balance of aesthetics, durability, and cost-effectiveness. The demand for lightweight materials in the automotive industry also fuels innovation in coating technologies. The Furniture and Domestic Upholstery segment is another significant contributor, with consumers opting for synthetic leather for its ease of maintenance and affordability. The Footwear industry also represents a consistent and substantial market for coating agents, especially for athletic shoes and fashion footwear. The Textile and Fashion segment, encompassing apparel and accessories, is also a notable consumer, driven by fast fashion trends and the demand for versatile materials. The Transportation sector, beyond automotive, including marine and public transport, further adds to the demand.

Coating Agents for Synthetic Leather Market Product Landscape

The product landscape of the Coating Agents for Synthetic Leather Market is characterized by a continuous stream of innovations aimed at enhancing performance, sustainability, and aesthetic appeal. Manufacturers are developing advanced formulations that offer superior abrasion resistance, improved UV stability, and enhanced tactile properties, closely mimicking the feel of genuine leather. Novel bio-based and waterborne coating agents are gaining significant traction, addressing the growing environmental concerns and regulatory pressures for sustainable manufacturing practices. These products not only reduce the environmental footprint but also often provide excellent breathability and reduced VOC emissions. Furthermore, specialized coating agents are being engineered for specific applications, such as flame-retardant coatings for transportation interiors or antimicrobial coatings for healthcare furnishings.

Key Drivers, Barriers & Challenges in Coating Agents for Synthetic Leather Market

Key Drivers:

- Growing Demand for Sustainable Materials: Increasing consumer and regulatory pressure for eco-friendly alternatives is a major driver for bio-based and recyclable coating agents.

- Expansion of Automotive and Furniture Industries: The robust growth in vehicle production and the demand for aesthetically pleasing and durable furniture are directly boosting synthetic leather consumption.

- Technological Advancements: Innovations in coating formulations offering enhanced properties like scratch resistance, water repellency, and a natural feel are propelling market growth.

- Cost-Effectiveness: Synthetic leather, enabled by efficient coating agents, offers a more affordable alternative to genuine leather, appealing to a broader consumer base.

Barriers & Challenges:

- Environmental Concerns and Regulations: Stringent regulations regarding VOC emissions and the disposal of synthetic materials can pose challenges for manufacturers.

- Competition from Genuine Leather: While synthetic leather offers advantages, genuine leather remains a premium choice for many consumers, posing a competitive threat.

- Raw Material Price Volatility: Fluctuations in the prices of petrochemical-based raw materials can impact the cost of production for coating agents.

- Supply Chain Disruptions: Geopolitical events and logistical challenges can lead to disruptions in the availability and pricing of essential raw materials.

- Perception of Synthetic Leather: In some high-end markets, synthetic leather may still be perceived as inferior to genuine leather, requiring continuous efforts to improve its quality and appeal.

Emerging Opportunities in Coating Agents for Synthetic Leather Market

Emerging opportunities in the Coating Agents for Synthetic Leather Market lie in the development of advanced, high-performance, and sustainable solutions. The increasing focus on circular economy principles presents a significant opportunity for the development of biodegradable or easily recyclable coating agents. Innovations in smart textiles and functional coatings, such as self-healing or temperature-regulating synthetic leathers, are creating new application frontiers. Furthermore, the growing demand for personalized and customized products opens avenues for specialized coating formulations tailored to unique aesthetic and performance requirements. Untapped markets in emerging economies with rapidly expanding consumer bases also offer substantial growth potential.

Growth Accelerators in the Coating Agents for Synthetic Leather Market Industry

The long-term growth of the Coating Agents for Synthetic Leather Market is being accelerated by several key factors. Technological breakthroughs in polymer science are leading to the development of novel coating agents with superior performance characteristics, such as enhanced durability, flexibility, and aesthetic appeal, directly competing with genuine leather. Strategic partnerships and collaborations between coating agent manufacturers, synthetic leather producers, and end-users are fostering innovation and ensuring that products meet evolving market demands. Furthermore, market expansion strategies targeting high-growth regions and application segments, coupled with a focus on sustainable and eco-friendly solutions, are critical growth accelerators. The continuous innovation in application technologies, leading to more efficient and cost-effective production of synthetic leather, also plays a pivotal role.

Key Players Shaping the Coating Agents for Synthetic Leather Market Market

- Papertex Speciality Chemicals Pvt Ltd

- Elkem ASA

- Jasch Industries Limited

- Abhilash Chemicals and Pharmaceuticals Pvt Ltd

- Evonik Industries AG

- CHT Group

- LANXESS

- Dow

- Stahl Holdings BV

- ROWA GROUP Holding GmbH

- Covestro AG

- W R Grace & Co -Conn

- Wacker Chemie AG

Notable Milestones in Coating Agents for Synthetic Leather Market Sector

- March 2021: Stahl Holdings BV introduced Stahlite systems based on specialty polymers to produce lightweight automotive leathers. The use of Stahlite reduces the weight of synthetic leather up to 30% compared to traditional leather material.

In-Depth Coating Agents for Synthetic Leather Market Market Outlook

The future outlook for the Coating Agents for Synthetic Leather Market is exceptionally promising, underpinned by a confluence of robust growth accelerators. The persistent demand for sustainable and high-performance materials will continue to drive innovation in eco-friendly and advanced coating technologies, including bio-based and recyclable formulations. Strategic collaborations and market expansion initiatives into emerging economies are expected to unlock significant growth potential. The increasing integration of digital technologies in manufacturing processes will also lead to greater efficiency and product customization. The market is well-positioned for sustained expansion as it continues to offer compelling alternatives to traditional materials across a diverse range of applications.

Coating Agents for Synthetic Leather Market Segmentation

-

1. Resin Type

- 1.1. PU

- 1.2. PVC

- 1.3. Silicone

- 1.4. Other Resin Types

-

2. Application

- 2.1. Automotive

- 2.2. Furniture and Domestic Upholstery

- 2.3. Footwear

- 2.4. Textile and Fashion

- 2.5. Transportation

- 2.6. Other Applications

Coating Agents for Synthetic Leather Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Coating Agents for Synthetic Leather Market Regional Market Share

Geographic Coverage of Coating Agents for Synthetic Leather Market

Coating Agents for Synthetic Leather Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. PETA Regulations limits Usage of Natural Leather; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Impact of COVID-19

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coating Agents for Synthetic Leather Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. PU

- 5.1.2. PVC

- 5.1.3. Silicone

- 5.1.4. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Furniture and Domestic Upholstery

- 5.2.3. Footwear

- 5.2.4. Textile and Fashion

- 5.2.5. Transportation

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Asia Pacific Coating Agents for Synthetic Leather Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. PU

- 6.1.2. PVC

- 6.1.3. Silicone

- 6.1.4. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Furniture and Domestic Upholstery

- 6.2.3. Footwear

- 6.2.4. Textile and Fashion

- 6.2.5. Transportation

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. North America Coating Agents for Synthetic Leather Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. PU

- 7.1.2. PVC

- 7.1.3. Silicone

- 7.1.4. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Furniture and Domestic Upholstery

- 7.2.3. Footwear

- 7.2.4. Textile and Fashion

- 7.2.5. Transportation

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Coating Agents for Synthetic Leather Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. PU

- 8.1.2. PVC

- 8.1.3. Silicone

- 8.1.4. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Furniture and Domestic Upholstery

- 8.2.3. Footwear

- 8.2.4. Textile and Fashion

- 8.2.5. Transportation

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. South America Coating Agents for Synthetic Leather Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. PU

- 9.1.2. PVC

- 9.1.3. Silicone

- 9.1.4. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Furniture and Domestic Upholstery

- 9.2.3. Footwear

- 9.2.4. Textile and Fashion

- 9.2.5. Transportation

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Middle East and Africa Coating Agents for Synthetic Leather Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. PU

- 10.1.2. PVC

- 10.1.3. Silicone

- 10.1.4. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive

- 10.2.2. Furniture and Domestic Upholstery

- 10.2.3. Footwear

- 10.2.4. Textile and Fashion

- 10.2.5. Transportation

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Papertex Speciality Chemicals Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elkem ASA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jasch Industries Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abhilash Chemicals and Pharmaceuticals Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evonik Industries AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CHT Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LANXESS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Stahl Holdings BV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ROWA GROUP Holding GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Covestro AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 W R Grace & Co -Conn

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wacker Chemie AG*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Papertex Speciality Chemicals Pvt Ltd

List of Figures

- Figure 1: Global Coating Agents for Synthetic Leather Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Coating Agents for Synthetic Leather Market Revenue (million), by Resin Type 2025 & 2033

- Figure 3: Asia Pacific Coating Agents for Synthetic Leather Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: Asia Pacific Coating Agents for Synthetic Leather Market Revenue (million), by Application 2025 & 2033

- Figure 5: Asia Pacific Coating Agents for Synthetic Leather Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Coating Agents for Synthetic Leather Market Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Coating Agents for Synthetic Leather Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Coating Agents for Synthetic Leather Market Revenue (million), by Resin Type 2025 & 2033

- Figure 9: North America Coating Agents for Synthetic Leather Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 10: North America Coating Agents for Synthetic Leather Market Revenue (million), by Application 2025 & 2033

- Figure 11: North America Coating Agents for Synthetic Leather Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Coating Agents for Synthetic Leather Market Revenue (million), by Country 2025 & 2033

- Figure 13: North America Coating Agents for Synthetic Leather Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Coating Agents for Synthetic Leather Market Revenue (million), by Resin Type 2025 & 2033

- Figure 15: Europe Coating Agents for Synthetic Leather Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 16: Europe Coating Agents for Synthetic Leather Market Revenue (million), by Application 2025 & 2033

- Figure 17: Europe Coating Agents for Synthetic Leather Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Coating Agents for Synthetic Leather Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Coating Agents for Synthetic Leather Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Coating Agents for Synthetic Leather Market Revenue (million), by Resin Type 2025 & 2033

- Figure 21: South America Coating Agents for Synthetic Leather Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 22: South America Coating Agents for Synthetic Leather Market Revenue (million), by Application 2025 & 2033

- Figure 23: South America Coating Agents for Synthetic Leather Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Coating Agents for Synthetic Leather Market Revenue (million), by Country 2025 & 2033

- Figure 25: South America Coating Agents for Synthetic Leather Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Coating Agents for Synthetic Leather Market Revenue (million), by Resin Type 2025 & 2033

- Figure 27: Middle East and Africa Coating Agents for Synthetic Leather Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Middle East and Africa Coating Agents for Synthetic Leather Market Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Coating Agents for Synthetic Leather Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Coating Agents for Synthetic Leather Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Coating Agents for Synthetic Leather Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 2: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 5: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 13: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United States Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 19: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Germany Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: France Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 27: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Brazil Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 33: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Application 2020 & 2033

- Table 34: Global Coating Agents for Synthetic Leather Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Coating Agents for Synthetic Leather Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coating Agents for Synthetic Leather Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Coating Agents for Synthetic Leather Market?

Key companies in the market include Papertex Speciality Chemicals Pvt Ltd, Elkem ASA, Jasch Industries Limited, Abhilash Chemicals and Pharmaceuticals Pvt Ltd, Evonik Industries AG, CHT Group, LANXESS, Dow, Stahl Holdings BV, ROWA GROUP Holding GmbH, Covestro AG, W R Grace & Co -Conn, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the Coating Agents for Synthetic Leather Market?

The market segments include Resin Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 276.32 million as of 2022.

5. What are some drivers contributing to market growth?

PETA Regulations limits Usage of Natural Leather; Other Drivers.

6. What are the notable trends driving market growth?

Automotive Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Impact of COVID-19.

8. Can you provide examples of recent developments in the market?

In March 2021, Stahl Holdings BV introduced Stahlite systems based on specialty polymers to produce lightweight automotive leathers. The use of Stahlite reduces the weight of synthetic leather up to 30% compared to traditional leather material.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coating Agents for Synthetic Leather Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coating Agents for Synthetic Leather Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coating Agents for Synthetic Leather Market?

To stay informed about further developments, trends, and reports in the Coating Agents for Synthetic Leather Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence