Key Insights

The Asia-Pacific industrial flooring market is poised for robust growth, driven by increasing industrialization, infrastructure development, and a burgeoning manufacturing sector across the region. With an estimated market size of USD XX million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This upward trajectory is fueled by significant investments in sectors like food and beverage, chemical processing, and transportation and aviation, where durable, safe, and hygienic flooring solutions are paramount. The rising demand for advanced flooring materials that offer enhanced chemical resistance, abrasion resistance, and ease of maintenance further bolsters market expansion. Key applications, particularly on concrete substrates, are witnessing substantial adoption of epoxy, polyaspartic, and polyurethane resins due to their superior performance characteristics. Emerging economies within the Asia-Pacific, notably China and India, are expected to be major growth engines, contributing significantly to the overall market value.

Asia-Pacific Industrial Flooring Market Market Size (In Billion)

The market's dynamism is further shaped by evolving industry trends and a strategic focus on sustainability and technological advancements. The increasing emphasis on stringent regulatory standards for workplace safety and hygiene in industries like healthcare and food and beverage necessitates the adoption of high-performance industrial flooring. Moreover, the development of innovative resin technologies, including fast-curing and low-VOC (Volatile Organic Compound) options, caters to the need for reduced downtime and environmental consciousness. While opportunities abound, potential restraints such as the fluctuating raw material prices and the availability of skilled labor for installation could pose challenges. However, the strong underlying demand from diverse end-user industries and the continuous technological innovation in flooring solutions are expected to outweigh these constraints, ensuring a sustained growth phase for the Asia-Pacific industrial flooring market. The competitive landscape features established global players and regional manufacturers vying for market share through product innovation and strategic collaborations.

Asia-Pacific Industrial Flooring Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Asia-Pacific Industrial Flooring Market, providing critical insights into market dynamics, growth drivers, regional dominance, and future trajectories. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers a robust understanding of historical trends, current market conditions, and future projections. We delve into parent and child market segments to offer a granular view of this dynamic industry, integrating high-traffic keywords to maximize search engine visibility and engage industry professionals seeking actionable intelligence. Values are presented in Million units for clarity and comparative analysis.

Asia-Pacific Industrial Flooring Market Market Dynamics & Structure

The Asia-Pacific Industrial Flooring Market exhibits a moderately concentrated structure, with key players investing heavily in technological innovation to gain a competitive edge. The primary drivers of innovation include the demand for durable, chemical-resistant, and aesthetically pleasing flooring solutions across various end-user industries. Regulatory frameworks, particularly concerning safety, environmental impact, and hygiene standards in sectors like food and beverage and healthcare, are increasingly shaping product development and adoption. Competitive product substitutes, such as traditional concrete or tile, are being challenged by the superior performance characteristics and rapid installation times offered by modern industrial flooring systems, particularly resin-based solutions. End-user demographics are shifting, with a growing emphasis on sustainable and low-VOC (Volatile Organic Compound) flooring options. Mergers and acquisitions (M&A) activity, while moderate, has been strategic, focusing on acquiring specialized technologies or expanding geographical reach. For instance, the market saw approximately 5-7 M&A deals in the historical period (2019-2024) focused on niche product portfolios. Innovation barriers include high initial R&D costs and the need for specialized installation expertise.

- Market Concentration: Moderately concentrated, with leading companies holding significant market share.

- Technological Innovation Drivers: Demand for durability, chemical resistance, aesthetics, and sustainability.

- Regulatory Frameworks: Focus on safety, environmental standards (e.g., VOC emissions), and hygiene.

- Competitive Product Substitutes: Traditional materials like concrete and tiles are challenged by resin-based solutions.

- End-user Demographics: Growing preference for sustainable, low-VOC, and high-performance flooring.

- M&A Trends: Strategic acquisitions for technology and market expansion, with an estimated 5-7 deals in the historical period.

Asia-Pacific Industrial Flooring Market Growth Trends & Insights

The Asia-Pacific Industrial Flooring Market is poised for substantial growth, driven by rapid industrialization, infrastructure development, and increasing investments in manufacturing and logistics across the region. Leveraging advanced market research methodologies, we forecast a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. The adoption rates for advanced industrial flooring solutions, particularly epoxy and polyurethane systems, are accelerating due to their superior performance attributes, including chemical resistance, abrasion resistance, and ease of maintenance. Technological disruptions are playing a pivotal role, with the emergence of polyaspartic coatings offering faster curing times and enhanced durability, addressing the need for minimized downtime in industrial operations. Consumer behavior shifts are evident, with end-users prioritizing lifecycle cost, safety, and environmental impact when selecting flooring solutions. The market penetration of specialized industrial flooring in developing economies within the Asia-Pacific region is expected to witness a significant increase. For example, the adoption of seamless, hygienic flooring in the food and beverage sector is expected to grow by over 10% annually. Furthermore, the demand for customized flooring solutions tailored to specific industry requirements, such as static-dissipative flooring in electronics manufacturing, is on the rise. The market size, estimated at $3,200 million in the base year 2025, is projected to reach $5,600 million by the end of the forecast period.

Dominant Regions, Countries, or Segments in Asia-Pacific Industrial Flooring Market

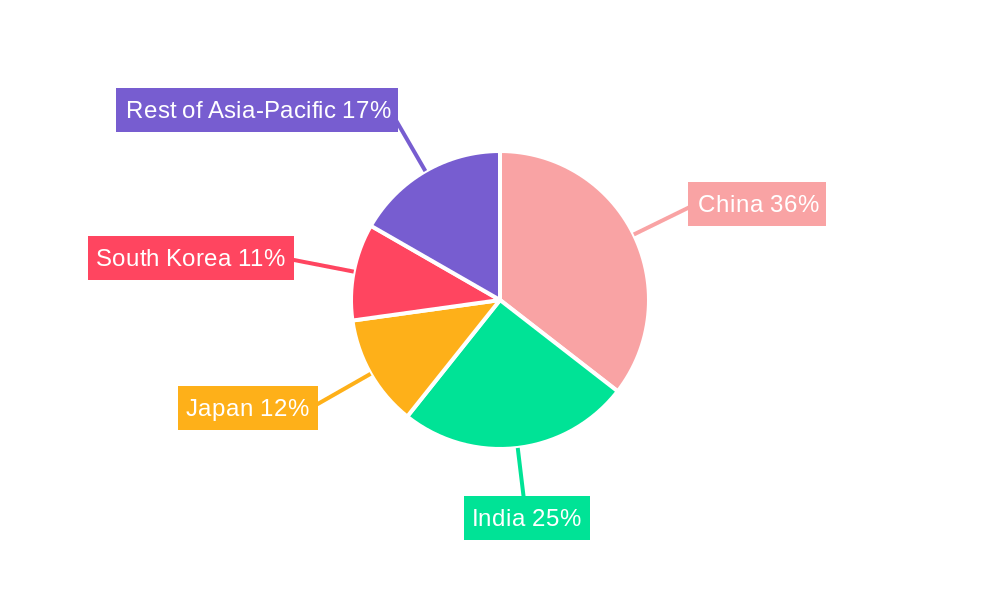

China stands out as the dominant region and country driving growth in the Asia-Pacific Industrial Flooring Market. Its robust manufacturing sector, extensive infrastructure development projects, and significant investments in industrial expansion are creating a massive demand for high-performance flooring solutions. The "Made in China 2025" initiative, alongside ongoing urbanization, fuels the need for modern, efficient, and safe industrial environments. Within the Resin Type segment, Epoxy flooring remains the largest and most dominant due to its versatility, cost-effectiveness, and proven track record in diverse applications, holding an estimated market share of 45% in 2025. However, Polyaspartic and Polyurethane segments are exhibiting higher growth rates, driven by their advanced performance characteristics. In terms of Application, Concrete flooring is the bedrock, given the prevalence of concrete structures in industrial settings, accounting for over 70% of the market. The End-user Industry segment witnessing the most significant demand is the Food and Beverage sector, driven by stringent hygiene regulations and the need for durable, easy-to-clean surfaces. The Chemical industry also presents substantial demand due to its requirement for highly chemical-resistant flooring. India and Japan represent the next significant markets, with India showing rapid growth due to its expanding manufacturing base and government support for industrial development, while Japan continues to lead in technological adoption and high-value applications.

- Dominant Region/Country: China

- Drivers: Robust manufacturing, infrastructure development, industrial expansion policies.

- Dominant Resin Type: Epoxy (estimated 45% market share in 2025)

- Growth Segments: Polyaspartic and Polyurethane experiencing higher CAGRs.

- Dominant Application: Concrete (over 70% market share in 2025)

- Dominant End-user Industry: Food and Beverage

- Key Drivers: Hygiene regulations, durability, ease of cleaning.

- Significant Demand: Chemical industry for chemical resistance.

- Other Key Markets: India (rapid growth), Japan (technological adoption).

Asia-Pacific Industrial Flooring Market Product Landscape

The product landscape of the Asia-Pacific Industrial Flooring Market is characterized by continuous innovation focused on enhancing performance, durability, and sustainability. Epoxy resins continue to be a staple, offering a balance of cost and performance for general industrial applications. Polyurethane systems are gaining traction for their superior flexibility, impact resistance, and thermal shock resistance, making them ideal for demanding environments. Polyaspartic coatings represent a significant technological advancement, offering rapid cure times and excellent UV stability, crucial for applications requiring minimal downtime. Acrylic-based flooring solutions are emerging for niche applications requiring quick installation and good chemical resistance. Innovations are also centered on developing low-VOC and solvent-free formulations to meet increasing environmental regulations and improve workplace safety. Performance metrics such as compressive strength, abrasion resistance, and chemical resistance are key differentiators for products in this market.

Key Drivers, Barriers & Challenges in Asia-Pacific Industrial Flooring Market

Key Drivers:

- Industrialization and Infrastructure Development: Growing manufacturing hubs and infrastructure projects across Asia-Pacific fuel demand for robust flooring.

- Technological Advancements: Development of high-performance resins like polyaspartics offering faster curing and enhanced durability.

- Stringent Regulations: Increasing emphasis on safety, hygiene, and environmental compliance in sectors like food & beverage and healthcare.

- Economic Growth: Rising disposable incomes and increased investment in commercial and industrial spaces.

Barriers & Challenges:

- High Initial Costs: Some advanced flooring systems can have a higher upfront investment, impacting adoption in price-sensitive segments.

- Skilled Labor Shortage: The need for trained installers for specialized flooring systems can be a constraint in certain regions.

- Awareness and Education: Lack of widespread awareness about the benefits of modern industrial flooring solutions in some emerging markets.

- Supply Chain Disruptions: Global supply chain volatility can impact raw material availability and pricing.

- Competitive Pressure: Intense competition among manufacturers can lead to price wars, affecting profit margins. The market faces challenges in maintaining consistent quality across different regions due to varying manufacturing standards, estimated to affect approximately 15-20% of projects.

Emerging Opportunities in Asia-Pacific Industrial Flooring Market

Emerging opportunities in the Asia-Pacific Industrial Flooring Market lie in the growing demand for sustainable and eco-friendly flooring solutions, including bio-based resins and recycled materials. The expansion of e-commerce logistics and warehousing is creating a surge in demand for specialized flooring that can withstand heavy traffic and provide optimal material handling. The healthcare sector's increasing focus on infection control and hygiene presents a significant opportunity for antimicrobial and seamless flooring systems. Furthermore, smart flooring solutions incorporating sensor technology for monitoring, safety, and energy efficiency are an emerging niche. The "Rest of Asia-Pacific" segment, encompassing countries like Vietnam, Thailand, and Indonesia, offers untapped potential for market penetration due to their rapidly developing industrial sectors.

Growth Accelerators in the Asia-Pacific Industrial Flooring Market Industry

Long-term growth in the Asia-Pacific Industrial Flooring Market will be significantly accelerated by continued technological breakthroughs in material science, leading to flooring that offers even greater durability, chemical resistance, and specialized functionalities. Strategic partnerships between flooring manufacturers, raw material suppliers, and end-users will foster innovation and tailor-made solutions. Market expansion strategies, particularly focusing on untapped regions within Southeast Asia and South Asia, will be crucial. Government initiatives promoting advanced manufacturing and sustainable development will also act as significant catalysts. The increasing adoption of Industry 4.0 principles in manufacturing will drive the demand for flooring that supports automation and robotics, such as anti-static and highly smooth surfaces.

Key Players Shaping the Asia-Pacific Industrial Flooring Market Market

- Tremco Incorporated

- RPM International Inc

- MBCC Group

- Sherwin-Williams Company

- Lubrizol Corporation

- 3M

- Nippon Paint Holdings Co Ltd

- Akzo Nobel N V

- CoGri Group Ltd

- Sika AG

Notable Milestones in Asia-Pacific Industrial Flooring Market Sector

- 2019: Launch of new low-VOC epoxy formulations by major manufacturers in response to environmental regulations.

- 2020: Increased focus on antimicrobial flooring solutions for the healthcare and food & beverage sectors amidst global health concerns.

- 2021: Significant M&A activity focused on acquiring niche technologies for specialized industrial flooring applications.

- 2022: Introduction of faster-curing polyaspartic coatings gaining traction in logistics and warehousing sectors for reduced downtime.

- 2023: Growing demand for sustainable and bio-based flooring options, with key players investing in R&D for greener alternatives.

- 2024: Expansion of product portfolios to include enhanced chemical resistance and thermal shock resistance for the chemical and food processing industries.

In-Depth Asia-Pacific Industrial Flooring Market Market Outlook

The future outlook for the Asia-Pacific Industrial Flooring Market is exceptionally bright, driven by ongoing industrial expansion, a strong push towards sustainable practices, and continuous technological innovation. Growth accelerators such as advancements in high-performance resin technologies, strategic collaborations, and market penetration into emerging economies will solidify its trajectory. The market is well-positioned to capitalize on the evolving needs of diverse end-user industries, from the stringent demands of the food and beverage sector to the high-tech requirements of electronics manufacturing. Strategic opportunities lie in developing smart flooring solutions, expanding into underserved regions, and offering comprehensive lifecycle services. The market's ability to adapt to regulatory changes and consumer preferences for durability, safety, and sustainability will be key to its sustained success.

Asia-Pacific Industrial Flooring Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Polyaspartic

- 1.3. Polyurethane

- 1.4. Acrylic

- 1.5. Other Resin Types

-

2. Application

- 2.1. Concrete

- 2.2. Wood

- 2.3. Other Applications

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Chemical

- 3.3. Transporation and Aviation

- 3.4. Healthcare

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

Asia-Pacific Industrial Flooring Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Industrial Flooring Market Regional Market Share

Geographic Coverage of Asia-Pacific Industrial Flooring Market

Asia-Pacific Industrial Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food & Beverages Industry

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations on VOCs Released from Industrial Floorings

- 3.4. Market Trends

- 3.4.1. Rising Demand from the F&B Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartic

- 5.1.3. Polyurethane

- 5.1.4. Acrylic

- 5.1.5. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete

- 5.2.2. Wood

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Chemical

- 5.3.3. Transporation and Aviation

- 5.3.4. Healthcare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. China Asia-Pacific Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Polyaspartic

- 6.1.3. Polyurethane

- 6.1.4. Acrylic

- 6.1.5. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Concrete

- 6.2.2. Wood

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Chemical

- 6.3.3. Transporation and Aviation

- 6.3.4. Healthcare

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. India Asia-Pacific Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Polyaspartic

- 7.1.3. Polyurethane

- 7.1.4. Acrylic

- 7.1.5. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Concrete

- 7.2.2. Wood

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Chemical

- 7.3.3. Transporation and Aviation

- 7.3.4. Healthcare

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Japan Asia-Pacific Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Polyaspartic

- 8.1.3. Polyurethane

- 8.1.4. Acrylic

- 8.1.5. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Concrete

- 8.2.2. Wood

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Chemical

- 8.3.3. Transporation and Aviation

- 8.3.4. Healthcare

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. South Korea Asia-Pacific Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Epoxy

- 9.1.2. Polyaspartic

- 9.1.3. Polyurethane

- 9.1.4. Acrylic

- 9.1.5. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Concrete

- 9.2.2. Wood

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Chemical

- 9.3.3. Transporation and Aviation

- 9.3.4. Healthcare

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Rest of Asia Pacific Asia-Pacific Industrial Flooring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Epoxy

- 10.1.2. Polyaspartic

- 10.1.3. Polyurethane

- 10.1.4. Acrylic

- 10.1.5. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Concrete

- 10.2.2. Wood

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food and Beverage

- 10.3.2. Chemical

- 10.3.3. Transporation and Aviation

- 10.3.4. Healthcare

- 10.3.5. Other End-user Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tremco Incorporated*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RPM International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MBCC Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sherwin-Williams Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lubrizol Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nippon Paint Holdings Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Akzo Nobel N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CoGri Group Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sika AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tremco Incorporated*List Not Exhaustive

List of Figures

- Figure 1: Asia-Pacific Industrial Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Industrial Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 7: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 12: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 17: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 22: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 27: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Industrial Flooring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Flooring Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Asia-Pacific Industrial Flooring Market?

Key companies in the market include Tremco Incorporated*List Not Exhaustive, RPM International Inc, MBCC Group, Sherwin-Williams Company, Lubrizol Corporation, 3M, Nippon Paint Holdings Co Ltd, Akzo Nobel N V, CoGri Group Ltd, Sika AG.

3. What are the main segments of the Asia-Pacific Industrial Flooring Market?

The market segments include Resin Type, Application, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food & Beverages Industry.

6. What are the notable trends driving market growth?

Rising Demand from the F&B Industry.

7. Are there any restraints impacting market growth?

Stringent Regulations on VOCs Released from Industrial Floorings.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Flooring Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence