Key Insights

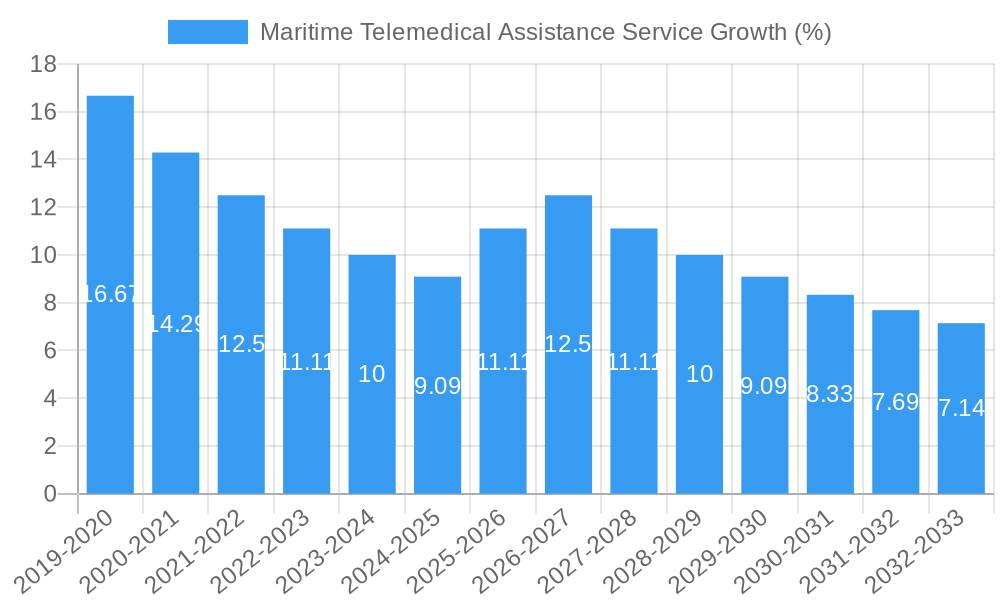

The global Maritime Telemedical Assistance Service market is experiencing robust growth, projected to reach approximately \$1,800 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 15% from 2019 to 2033. This significant expansion is primarily driven by the increasing global shipping volume and the growing awareness of the critical need for immediate and expert medical support for seafarers, regardless of their location. Stricter maritime regulations concerning crew welfare and health, coupled with advancements in communication technology like satellite internet, are further propelling the adoption of these services. The market is segmented into various applications, with Merchant Ships constituting the largest share due to their sheer volume and extended voyages, followed by Military Ships requiring specialized medical protocols. Cruise Ships are also a significant segment, emphasizing passenger safety and well-being. The types of services offered range from Offshore Medical support, which is crucial for vessels operating in remote areas with limited access to shore-based medical facilities, to Onshore Medical services that facilitate the transfer of seafarers to appropriate land-based healthcare for complex treatments.

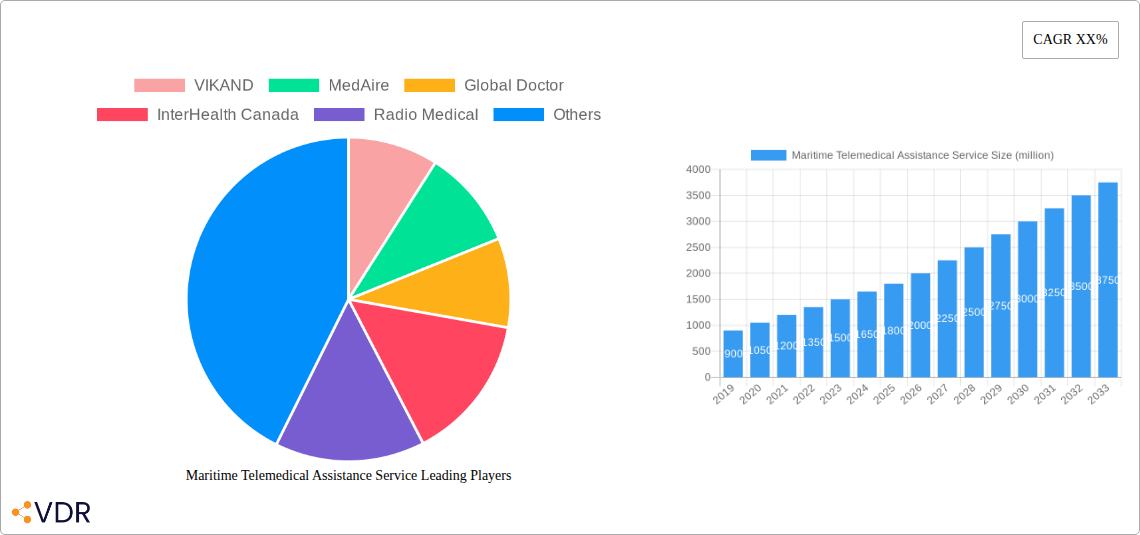

Key trends shaping the Maritime Telemedical Assistance Service market include the integration of Artificial Intelligence (AI) for preliminary diagnosis and remote monitoring, and the development of advanced telemedicine platforms offering real-time video consultations, remote diagnostic tools, and seamless data sharing between onboard medical personnel and shore-based doctors. The increasing focus on mental health support for crews, especially post-pandemic, is also emerging as a key differentiator. However, the market faces certain restraints, such as the high initial investment costs for advanced communication equipment and telemedicine platforms, potential cybersecurity concerns regarding sensitive patient data, and the varying regulatory landscapes across different maritime nations. Despite these challenges, the proactive approach of companies like VIKAND, MedAire, and Global Doctor in providing comprehensive telemedical solutions, alongside the expansion of services to cover diverse maritime needs, indicates a promising future for the industry, with significant opportunities in regions like Asia Pacific and Europe.

This in-depth report provides a definitive analysis of the global Maritime Telemedical Assistance Service market, offering critical insights for stakeholders across the maritime and healthcare industries. Covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period extending to 2033, this research delves into market dynamics, growth drivers, regional dominance, product innovations, and key player strategies. We meticulously examine market segments including Merchant Ships, Military Ships, Cruise Ships, and Others, alongside service types such as Offshore Medical and Onshore Medical. This report is an essential resource for understanding current trends, identifying future opportunities, and navigating the competitive landscape of maritime healthcare solutions.

Maritime Telemedical Assistance Service Market Dynamics & Structure

The Maritime Telemedical Assistance Service market is characterized by a dynamic and evolving structure, driven by increasing demand for remote healthcare solutions at sea. Market concentration is moderately fragmented, with a few key players holding significant market share while a larger number of niche providers cater to specific regional or segment needs. Technological innovation remains a primary driver, with advancements in telemedicine platforms, AI-driven diagnostics, and remote monitoring devices constantly enhancing service capabilities. Regulatory frameworks, though varying by jurisdiction, are increasingly focusing on ensuring the quality and accessibility of remote medical care for seafarers, fostering market growth. Competitive product substitutes include traditional onshore medical facilities, but the inherent challenges of timely access at sea significantly limit their direct substitutability for immediate care. End-user demographics span a wide range, from commercial shipping operations prioritizing cost-effectiveness and crew well-being to military vessels requiring specialized medical support in remote deployments and cruise lines focusing on passenger safety and satisfaction. Mergers and Acquisitions (M&A) trends indicate a growing consolidation, with larger companies acquiring smaller entities to expand their service portfolios and geographical reach. For instance, recent M&A activities have seen an estimated 8 M&A deals in the past two years, with deal values reaching upwards of $50 million, signaling an increasing interest in strategic expansion. Innovation barriers are primarily related to the high cost of specialized equipment, the need for reliable and secure communication infrastructure at sea, and the challenge of ensuring consistent quality of care across diverse maritime environments.

- Market Concentration: Moderately fragmented, with a blend of established global providers and regional specialists.

- Technological Innovation Drivers: AI, IoT, advanced telemedicine platforms, wearable health devices, and satellite communication advancements.

- Regulatory Frameworks: Growing emphasis on international maritime health standards and remote medical service accreditation.

- Competitive Product Substitutes: Limited for immediate at-sea scenarios, but onshore emergency services represent a fallback.

- End-User Demographics: Diverse, including commercial shipping fleets, naval operations, and passenger cruise lines.

- M&A Trends: Active consolidation observed, with strategic acquisitions aimed at portfolio expansion and market penetration.

Maritime Telemedical Assistance Service Growth Trends & Insights

The global Maritime Telemedical Assistance Service market is poised for significant expansion, driven by a confluence of factors that are reshaping how healthcare is delivered to individuals operating in remote maritime environments. The market size is projected to grow from an estimated $1,200 million in the base year 2025 to an anticipated $2,800 million by the end of the forecast period in 2033, reflecting a compound annual growth rate (CAGR) of approximately 11.5%. This robust growth trajectory is underpinned by an increasing adoption rate of telemedical services across all maritime applications, spurred by the inherent limitations and risks associated with providing immediate medical care at sea. Technological disruptions are playing a pivotal role, with the integration of artificial intelligence (AI) for preliminary diagnostics, the deployment of advanced remote monitoring systems for chronic conditions, and the enhancement of high-definition video conferencing capabilities for detailed consultations. These innovations are not only improving the efficacy of telemedical interventions but also expanding the scope of services offered, from routine medical advice to critical emergency response coordination. Consumer behavior shifts are also a key influencer; ship owners and operators are increasingly prioritizing crew welfare and passenger safety as paramount concerns, recognizing that comprehensive medical support significantly contributes to operational efficiency and reduced downtime. The rising awareness of the potential for pandemics and other health emergencies at sea further accentuates the need for reliable and accessible telemedical solutions, driving demand for sophisticated and proactive healthcare strategies. Moreover, the growing implementation of digital health records and secure data exchange protocols is enhancing the continuity of care and enabling more personalized medical interventions, even in the most challenging maritime settings. The market penetration of telemedical services, while varying across regions and vessel types, is steadily increasing as the proven benefits of reduced evacuation costs, faster access to specialist advice, and improved health outcomes become more apparent. For instance, over 70% of new merchant vessels being built are now being equipped with advanced telemedical capabilities as a standard feature. The industry is also witnessing a rise in subscription-based models and managed service offerings, providing predictable costs and comprehensive support for maritime operators.

Dominant Regions, Countries, or Segments in Maritime Telemedical Assistance Service

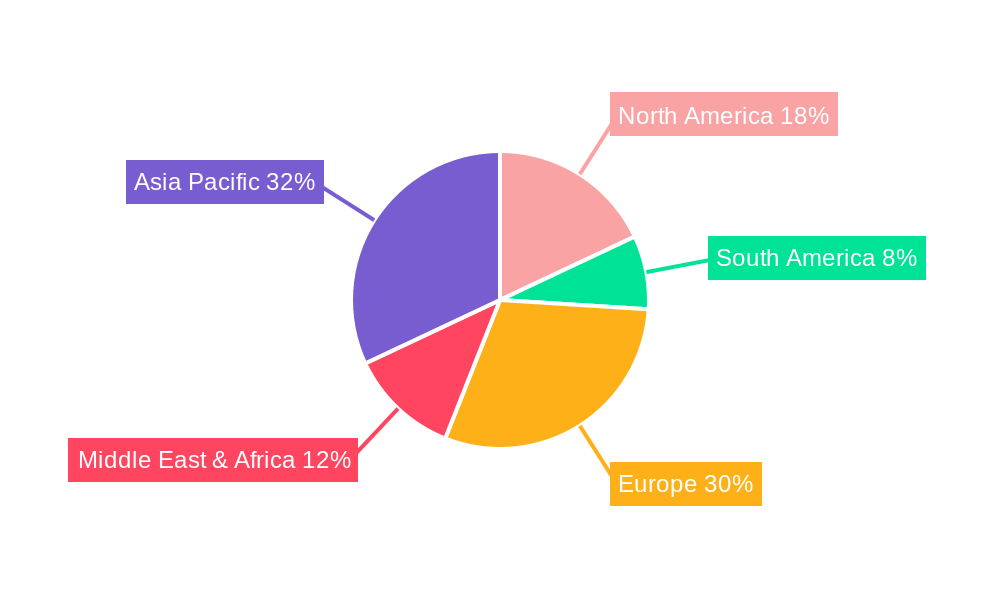

The Maritime Telemedical Assistance Service market is witnessing pronounced growth and dominance across several key regions and segments, with Europe and Asia-Pacific emerging as significant powerhouses. Within the application segment, Merchant Ships currently represent the largest market share, estimated at over 55% of the total market value, owing to the sheer volume of global trade and the critical need for maintaining the health and operational readiness of vast commercial fleets. The Offshore Medical type segment also exhibits substantial growth, driven by the expansion of offshore energy exploration and production activities, requiring constant medical support in remote and challenging environments.

Europe stands out as the dominant region, contributing an estimated 35% to the global market revenue. This dominance is attributed to a well-established maritime industry, stringent regulations concerning seafarer health and safety, and a high concentration of leading telemedical service providers. Countries like Norway, Greece, and the United Kingdom are at the forefront, investing heavily in advanced telemedicine infrastructure and services. Strong economic policies supporting maritime safety and innovation, coupled with robust port infrastructure that facilitates the integration of onshore medical expertise with onboard capabilities, further bolster Europe's leading position. The presence of major cruise ship operators in the region also contributes significantly to the demand for comprehensive passenger healthcare services delivered remotely.

Asia-Pacific is rapidly emerging as the fastest-growing region, projected to witness a CAGR of over 13% during the forecast period. Countries such as China, Singapore, and Japan are investing significantly in their maritime sectors and are increasingly adopting advanced telemedical solutions. Government initiatives promoting digital transformation in the shipping industry and a growing fleet size are key drivers. The region’s expanding role in global shipping and the increasing complexity of offshore operations in its waters necessitate advanced medical support systems. The market share for Asia-Pacific is projected to reach approximately 30% by 2033.

The Merchant Ship application segment is expected to maintain its lead, with an estimated market share of $1,540 million in 2025. This segment's growth is fueled by the continuous need to ensure the health and well-being of seafarers, who are crucial for global supply chains. Increasing regulatory pressures and the growing awareness of the economic benefits of preventative care and rapid medical response at sea are further propelling this segment.

The Offshore Medical type segment is a significant growth accelerator, driven by the expanding offshore oil and gas industry, renewable energy projects, and the increasing number of offshore support vessels. This segment, projected to reach $700 million by 2033, requires highly specialized and responsive medical services due to the remote and often hazardous working conditions.

- Dominant Region: Europe, with a market share of approximately 35% in 2025, driven by strong maritime industries and regulatory frameworks.

- Fastest-Growing Region: Asia-Pacific, with a projected CAGR exceeding 13% and an anticipated market share of 30% by 2033.

- Dominant Application Segment: Merchant Ships, accounting for over 55% of the market value in 2025, driven by the extensive global fleet.

- Key Growth Segment (Type): Offshore Medical, fueled by expanding offshore energy exploration and production activities.

- Key Drivers for Dominance: Economic policies, advanced infrastructure, stringent regulations, technological adoption, and fleet expansion.

Maritime Telemedical Assistance Service Product Landscape

The Maritime Telemedical Assistance Service product landscape is characterized by an array of sophisticated and integrated solutions designed to address the unique healthcare challenges faced at sea. Key product innovations include advanced telemedicine platforms that offer secure video consultations, remote diagnostic capabilities, and real-time patient data monitoring. These platforms are increasingly incorporating artificial intelligence (AI) for preliminary diagnosis assistance and risk assessment, enhancing the accuracy and speed of medical interventions. Wearable health devices and remote monitoring sensors are also becoming integral, providing continuous physiological data for proactive health management and early detection of potential issues. Specialized medical kits, equipped with advanced diagnostic tools and medications, are tailored for maritime environments, often accompanied by comprehensive training for onboard personnel. Unique selling propositions revolve around the ability to provide immediate, high-quality medical advice and, in many cases, a preliminary diagnosis without the need for immediate evacuation, thereby reducing costs and operational disruptions. Technological advancements are focused on improving connectivity, data security, and the seamless integration of onboard medical capabilities with onshore specialist networks. For example, solutions offering predictive health analytics for crew members are gaining traction, allowing for preventative interventions and personalized care plans. The performance metrics of these products are evaluated based on response times, diagnostic accuracy, cost-effectiveness, and the overall improvement in crew and passenger health outcomes.

Key Drivers, Barriers & Challenges in Maritime Telemedical Assistance Service

The Maritime Telemedical Assistance Service market is propelled by several key drivers. The paramount driver is the increasing emphasis on seafarer welfare and passenger safety, mandated by international regulations and corporate social responsibility. Technological advancements, including improved satellite communication, AI-powered diagnostics, and advanced telemedicine platforms, are enabling more effective remote healthcare delivery. The growing recognition of the economic benefits, such as reduced evacuation costs and minimized operational downtime, further fuels market adoption. Furthermore, the rising prevalence of chronic diseases and mental health concerns among seafarers necessitates continuous and accessible medical support.

However, the market also faces significant barriers and challenges. High initial investment costs for advanced telemedicine equipment and reliable communication infrastructure can be prohibitive for smaller operators. Regulatory fragmentation and the lack of standardized protocols across different maritime jurisdictions create complexities. Limited internet bandwidth and unreliable connectivity in remote oceanic regions can hinder real-time consultations and data transmission. Cybersecurity concerns and the need to protect sensitive patient data are also critical challenges. Moreover, the shortage of qualified onboard medical personnel to effectively utilize advanced telemedical systems presents another hurdle, alongside the need for continuous training and upskilling.

Emerging Opportunities in Maritime Telemedical Assistance Service

Emerging opportunities in the Maritime Telemedical Assistance Service sector are largely centered on enhancing the comprehensiveness and accessibility of care. The increasing integration of AI-powered diagnostic tools promises to further revolutionize remote medical assessments, potentially reducing the reliance on immediate specialist intervention. Untapped markets include the expansion of services to smaller commercial vessels and the growing segment of private yachting, where specialized medical support is often lacking. Innovative applications are emerging in preventative healthcare, with advanced remote monitoring systems and personalized wellness programs designed to address chronic conditions and improve overall crew health. Evolving consumer preferences are leaning towards integrated health solutions that offer seamless continuity of care, from routine check-ups to emergency response. Furthermore, the development of more robust and cost-effective satellite communication solutions will further democratize access to these critical services across all maritime domains. The growing focus on mental health support at sea also presents a significant opportunity for specialized teletherapy and counseling services.

Growth Accelerators in the Maritime Telemedical Assistance Service Industry

The Maritime Telemedical Assistance Service industry is experiencing significant growth acceleration driven by key factors. Technological breakthroughs, particularly in the field of AI and machine learning for diagnostic support, alongside advancements in wearable health technology and satellite communication, are continuously expanding the capabilities and reach of telemedical services. Strategic partnerships between telemedical providers, maritime operators, insurance companies, and technology firms are crucial for developing comprehensive and integrated healthcare solutions. These collaborations foster innovation, streamline service delivery, and reduce costs, making advanced healthcare more accessible. Market expansion strategies, including entering new geographical regions and catering to specialized maritime segments like offshore renewable energy installations, are also contributing to sustained growth. The increasing adoption of IoT devices for real-time monitoring of environmental and physiological data onboard vessels further accelerates the demand for integrated telemedical platforms that can process and act upon this information.

Key Players Shaping the Maritime Telemedical Assistance Service Market

- VIKAND

- MedAire

- Global Doctor

- InterHealth Canada

- Radio Medical

- GVA

- SphereMD

- Seacare

- RMI

- SeaMed24

- Future Care

- Bergen Maritime

- Marine Medical Service

- AP Companies

- Marine Medical Solutions

- Bethesda Medical

- Larkin Health

- Discovery Health MD

- Maritime Medical Services Ltd(MMS)

- The First Call

- Health Med Center

- Flinders Emergency Medical Assistance Pte Ltd

- MaritimeHealth

- Patronus Medical

- Athens Medical Group

Notable Milestones in Maritime Telemedical Assistance Service Sector

- 2020: Increased adoption of remote consultations due to the COVID-19 pandemic, highlighting the critical need for contactless healthcare solutions.

- 2021: Launch of AI-powered diagnostic tools for maritime telemedicine, improving accuracy and speed of initial assessments.

- 2022: Major maritime shipping companies begin integrating comprehensive telemedical service packages as standard for their fleets.

- 2023: Significant advancements in satellite communication technology enable more reliable and higher bandwidth for real-time video consultations at sea.

- Q1 2024: Growing trend of partnerships between telemedical providers and insurance companies to offer bundled health and safety packages for seafarers.

- 2024: Enhanced focus on mental health tele-support services for seafarers, recognizing the unique psychological pressures of maritime work.

In-Depth Maritime Telemedical Assistance Service Market Outlook

The future outlook for the Maritime Telemedical Assistance Service market is exceptionally promising, driven by a sustained increase in demand for remote healthcare solutions at sea. Growth accelerators, including continuous technological innovation in AI, IoT, and connectivity, coupled with strategic partnerships and market expansion into underserved segments, will fuel this upward trajectory. The growing awareness of the essential role of robust healthcare in ensuring operational efficiency and crew well-being will continue to drive investment in these services. The market is expected to see further consolidation as companies seek to broaden their service offerings and geographical reach. The increasing regulatory focus on seafarer health and safety will also act as a significant catalyst, encouraging wider adoption of advanced telemedical capabilities across all vessel types. Overall, the sector is poised for robust, long-term growth, offering significant opportunities for providers who can deliver innovative, reliable, and cost-effective healthcare solutions to the global maritime industry.

Maritime Telemedical Assistance Service Segmentation

-

1. Application

- 1.1. Merchant Ship

- 1.2. Military Ship

- 1.3. Cruise Ship

- 1.4. Others

-

2. Types

- 2.1. Offshore Medical

- 2.2. Onshore Medical

Maritime Telemedical Assistance Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Maritime Telemedical Assistance Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Telemedical Assistance Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Merchant Ship

- 5.1.2. Military Ship

- 5.1.3. Cruise Ship

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Offshore Medical

- 5.2.2. Onshore Medical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Maritime Telemedical Assistance Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Merchant Ship

- 6.1.2. Military Ship

- 6.1.3. Cruise Ship

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Offshore Medical

- 6.2.2. Onshore Medical

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Maritime Telemedical Assistance Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Merchant Ship

- 7.1.2. Military Ship

- 7.1.3. Cruise Ship

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Offshore Medical

- 7.2.2. Onshore Medical

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Maritime Telemedical Assistance Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Merchant Ship

- 8.1.2. Military Ship

- 8.1.3. Cruise Ship

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Offshore Medical

- 8.2.2. Onshore Medical

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Maritime Telemedical Assistance Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Merchant Ship

- 9.1.2. Military Ship

- 9.1.3. Cruise Ship

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Offshore Medical

- 9.2.2. Onshore Medical

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Maritime Telemedical Assistance Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Merchant Ship

- 10.1.2. Military Ship

- 10.1.3. Cruise Ship

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Offshore Medical

- 10.2.2. Onshore Medical

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VIKAND

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MedAire

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Global Doctor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 InterHealth Canada

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Radio Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GVA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SphereMD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seacare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RMI

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SeaMed24

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Future Care

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bergen Maritime

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Marine Medical Service

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AP Companies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Marine Medical Solutions

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bethesda Medical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Larkin Health

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Discovery Health MD

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Maritime Medical Services Ltd(MMS)

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 The First Call

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Health Med Center

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Flinders Emergency Medical Assistance Pte Ltd

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 MaritimeHealth

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Patronus Medical

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Athens Medical Group

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 VIKAND

List of Figures

- Figure 1: Global Maritime Telemedical Assistance Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Maritime Telemedical Assistance Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Maritime Telemedical Assistance Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Maritime Telemedical Assistance Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Maritime Telemedical Assistance Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Maritime Telemedical Assistance Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Maritime Telemedical Assistance Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Maritime Telemedical Assistance Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Maritime Telemedical Assistance Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Maritime Telemedical Assistance Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Maritime Telemedical Assistance Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Maritime Telemedical Assistance Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Maritime Telemedical Assistance Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Maritime Telemedical Assistance Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Maritime Telemedical Assistance Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Maritime Telemedical Assistance Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Maritime Telemedical Assistance Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Maritime Telemedical Assistance Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Maritime Telemedical Assistance Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Maritime Telemedical Assistance Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Maritime Telemedical Assistance Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Maritime Telemedical Assistance Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Maritime Telemedical Assistance Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Maritime Telemedical Assistance Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Maritime Telemedical Assistance Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Maritime Telemedical Assistance Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Maritime Telemedical Assistance Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Maritime Telemedical Assistance Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Maritime Telemedical Assistance Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Maritime Telemedical Assistance Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Maritime Telemedical Assistance Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Maritime Telemedical Assistance Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Maritime Telemedical Assistance Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Telemedical Assistance Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Maritime Telemedical Assistance Service?

Key companies in the market include VIKAND, MedAire, Global Doctor, InterHealth Canada, Radio Medical, GVA, SphereMD, Seacare, RMI, SeaMed24, Future Care, Bergen Maritime, Marine Medical Service, AP Companies, Marine Medical Solutions, Bethesda Medical, Larkin Health, Discovery Health MD, Maritime Medical Services Ltd(MMS), The First Call, Health Med Center, Flinders Emergency Medical Assistance Pte Ltd, MaritimeHealth, Patronus Medical, Athens Medical Group.

3. What are the main segments of the Maritime Telemedical Assistance Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Telemedical Assistance Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Telemedical Assistance Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Telemedical Assistance Service?

To stay informed about further developments, trends, and reports in the Maritime Telemedical Assistance Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence