Key Insights

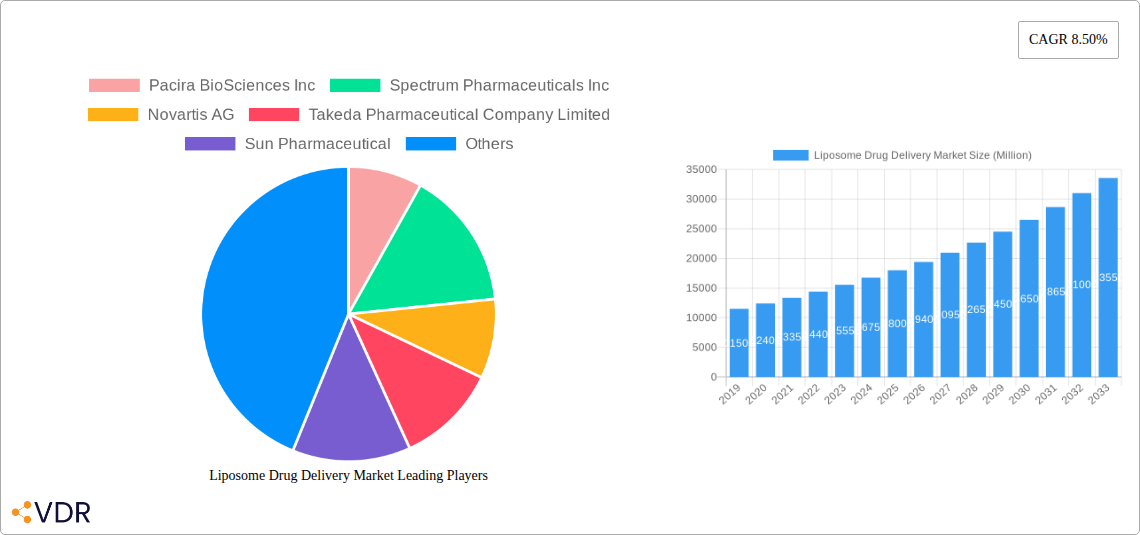

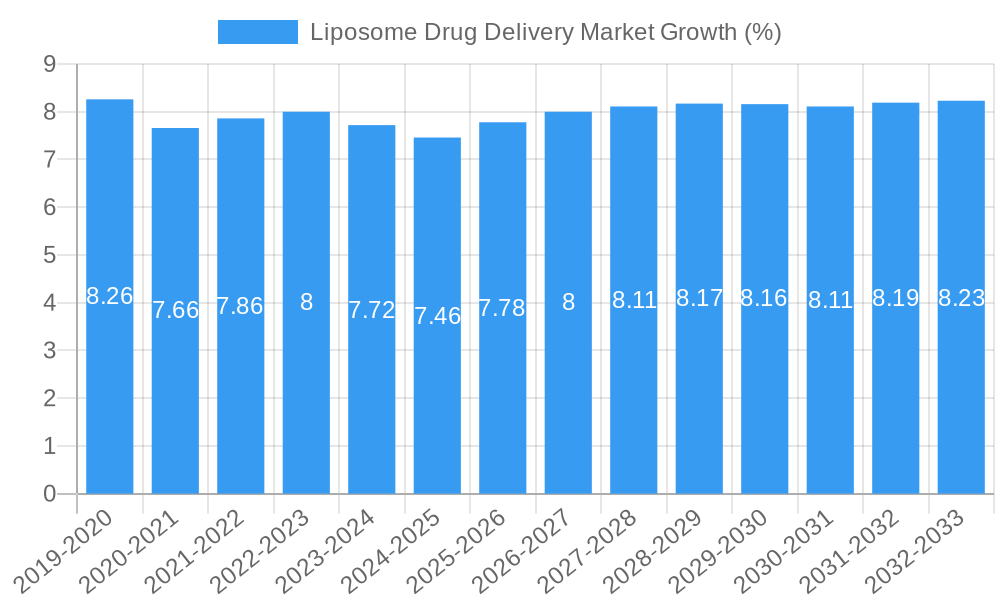

The global Liposome Drug Delivery Market is poised for significant expansion, projected to reach a substantial market size of approximately USD 18,000 million by 2025, and is expected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.50% through 2033. This dynamic growth is primarily fueled by the increasing prevalence of chronic diseases such as cancer and fungal infections, which necessitate advanced and targeted therapeutic solutions. Liposomal drug delivery systems offer enhanced efficacy, reduced toxicity, and improved patient compliance by encapsulating active pharmaceutical ingredients within lipid bilayers. The market is further propelled by continuous innovation in liposome formulation technologies, including advancements in Stealth Liposome Technology, Non-PEGylated Liposome Technology, and DepoFoam Liposome Technology, enabling more efficient drug targeting and sustained release. Key players like Novartis AG, Takeda Pharmaceutical Company Limited, and Johnson and Johnson are actively investing in research and development, driving the market forward through product approvals and strategic collaborations.

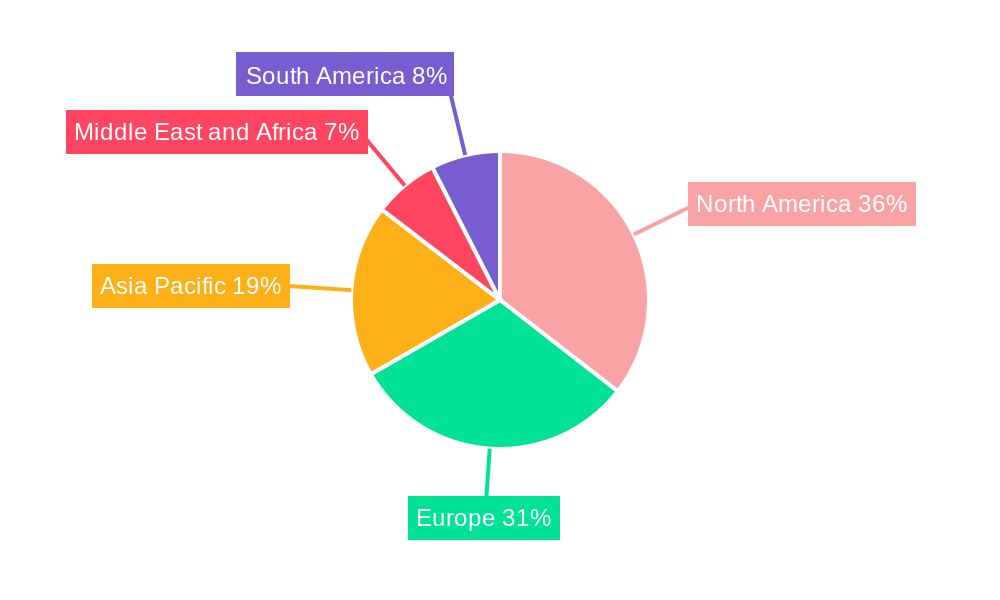

Geographically, North America and Europe currently dominate the liposome drug delivery market, owing to well-established healthcare infrastructures, high healthcare spending, and a strong presence of leading pharmaceutical companies. However, the Asia Pacific region is emerging as a rapidly growing market, driven by increasing healthcare investments, a rising patient pool, and a growing awareness of advanced drug delivery systems. The market's trajectory is also influenced by trends such as the growing use of liposomes in vaccine delivery and the expanding applications in pain management, beyond traditional cancer therapeutics. While the market exhibits strong growth potential, challenges such as high manufacturing costs and complex regulatory pathways for novel formulations may present some restraints. Nevertheless, the inherent advantages of liposomal drug delivery in improving therapeutic outcomes are expected to outweigh these challenges, ensuring a sustained growth trajectory for the foreseeable future.

Report Description: Liposome Drug Delivery Market Size, Share, Growth & Forecast (2024-2033)

Unlock the future of targeted therapeutics with our comprehensive "Liposome Drug Delivery Market" report. This in-depth analysis navigates the dynamic landscape of liposome-based drug formulations, offering critical insights into market size, growth trajectories, technological innovations, and competitive strategies. Essential for pharmaceutical companies, biotech innovators, investors, and healthcare providers, this report provides actionable intelligence to capitalize on the burgeoning demand for advanced drug delivery systems.

The liposome drug delivery market is experiencing robust expansion, driven by the inherent advantages of liposomes in improving drug solubility, bioavailability, and targeted delivery, thereby minimizing systemic toxicity. This report meticulously examines the market's evolution from 2019 to 2024, with a detailed forecast spanning from 2025 to 2033, projecting significant growth opportunities and evolving competitive dynamics. Our analysis leverages extensive market data and expert foresight to empower strategic decision-making in this high-impact sector.

Liposome Drug Delivery Market Market Dynamics & Structure

The liposome drug delivery market is characterized by a moderately concentrated structure, with leading pharmaceutical giants and innovative biotech firms vying for market dominance. Technological innovation remains a primary driver, fueled by ongoing research into novel liposome formulations and encapsulation techniques that enhance drug efficacy and reduce side effects. Stringent regulatory frameworks, while posing initial barriers, also pave the way for approved, safe, and effective liposomal therapies. The market grapples with the challenge of developing cost-effective manufacturing processes and addressing the complexities of clinical trials for novel drug combinations. Substitutes, though present in conventional drug delivery, often fall short in offering the targeted efficacy and reduced toxicity profiles of liposomes. End-user demographics are increasingly favoring treatments with improved patient outcomes and minimal adverse events, thereby boosting the adoption of liposomal drugs. Mergers and acquisitions (M&A) are prevalent, with companies seeking to expand their pipelines, acquire novel technologies, and gain market share. For instance, recent M&A activities have focused on acquiring early-stage liposomal drug candidates and specialized manufacturing capabilities.

- Market Concentration: Dominated by a mix of large pharmaceutical enterprises and emerging specialty companies.

- Technological Innovation Drivers: Development of novel liposome formulations, stimuli-responsive liposomes, and improved encapsulation efficiencies.

- Regulatory Frameworks: Strict guidelines from agencies like the FDA and EMA ensure product safety and efficacy, influencing market entry and development timelines.

- Competitive Product Substitutes: Conventional drug formulations, nanoparticles, and other advanced drug delivery systems.

- End-User Demographics: Growing preference for targeted therapies, reduced toxicity, and improved quality of life.

- M&A Trends: Strategic acquisitions and partnerships focused on pipeline expansion and technological advancements, with an estimated xx deals in the historical period.

Liposome Drug Delivery Market Growth Trends & Insights

The liposome drug delivery market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This significant expansion is underpinned by a burgeoning understanding of liposome technology's potential to revolutionize therapeutic outcomes across a spectrum of diseases. The market size, estimated at $XX Million units in the base year 2025, is expected to reach $XX Million units by 2033. Adoption rates are accelerating as more liposomal formulations gain regulatory approval and demonstrate superior clinical efficacy compared to traditional treatments. Technological disruptions, such as advancements in liposome surface modification for enhanced targeting and the development of sophisticated manufacturing techniques, are continuously broadening the application horizons of liposome drug delivery. Consumer behavior is also shifting, with patients and healthcare providers increasingly seeking treatments that offer improved therapeutic indices, reduced side effects, and better patient compliance.

The market penetration of liposomal drugs is steadily increasing, particularly in oncology and infectious diseases, where the ability to deliver potent agents directly to affected sites while sparing healthy tissues is paramount. The historical period (2019-2024) has witnessed a steady increase in research and development investments, leading to a robust pipeline of liposomal drug candidates in various stages of clinical trials. This sustained investment, coupled with the proven success of established liposomal drugs like pegylated liposomal doxorubicin, is creating a virtuous cycle of innovation and market expansion. The market is also benefiting from the growing trend towards personalized medicine, where liposomes can be engineered to deliver specific drug combinations or tailored dosages to individual patients. Furthermore, the development of liposomal vaccines is emerging as a significant growth avenue, offering enhanced immunogenicity and stability. The increasing prevalence of chronic diseases and the continuous pursuit of more effective and safer treatment modalities are expected to be key pillars supporting the sustained growth of the liposome drug delivery market.

Dominant Regions, Countries, or Segments in Liposome Drug Delivery Market

The North America region is currently the dominant force in the global Liposome Drug Delivery Market, driven by its robust healthcare infrastructure, substantial investments in pharmaceutical research and development, and a high prevalence of chronic diseases, particularly cancer. The United States, a key contributor within North America, boasts a well-established regulatory environment that supports the approval and commercialization of innovative drug delivery systems.

- Product Segment Dominance: Cancer Therapeutics stands out as the leading indication, accounting for a significant share of the market. This is primarily due to the extensive use of liposomal formulations for chemotherapy drugs, such as liposomal paclitaxel and liposomal doxorubicin, which offer improved efficacy and reduced toxicity in treating various cancers.

- Technique Dominance: Stealth Liposome Technology, characterized by the incorporation of polyethylene glycol (PEG) to prolong circulation time and enhance drug targeting, is a key driver. This technology has been instrumental in the success of several blockbuster liposomal drugs.

- Regional Dominance Factors:

- High R&D Expenditure: North America, particularly the US, leads in pharmaceutical R&D spending, fostering innovation in liposome drug delivery.

- Advanced Healthcare Infrastructure: Sophisticated healthcare systems facilitate the adoption and widespread use of advanced drug delivery technologies.

- Favorable Regulatory Environment: Streamlined approval processes for novel therapeutics encourage market entry.

- Prevalence of Target Diseases: High incidence rates of cancer and infectious diseases drive demand for effective liposomal treatments.

Other regions, including Europe and Asia Pacific, are exhibiting rapid growth. Europe benefits from a strong pharmaceutical base and increasing healthcare expenditure. The Asia Pacific region, with its large patient population and growing economies, presents significant untapped potential, with countries like China and India emerging as key growth markets. The increasing focus on developing liposomal treatments for emerging diseases and the growing demand for cost-effective healthcare solutions are contributing to the expansion in these regions.

Liposome Drug Delivery Market Product Landscape

The liposome drug delivery market product landscape is rich with innovation, featuring key formulations like Liposomal Paclitaxel, Liposomal Doxorubicin, and Liposomal Amphotericin B, alongside a growing category of "Others." Liposomal Paclitaxel, for instance, offers a distinct advantage in cancer therapy by reducing hypersensitivity reactions associated with conventional paclitaxel. Liposomal Doxorubicin has revolutionized the treatment of various cancers by extending drug circulation time and minimizing cardiotoxicity. Liposomal Amphotericin B provides a less nephrotoxic alternative for treating severe fungal infections. The "Others" category encompasses a broad range of emerging liposomal drugs targeting diverse indications, including pain management and viral vaccines, showcasing the technology's versatility. These products often boast unique selling propositions such as enhanced drug targeting, improved patient compliance, and reduced systemic side effects, driven by cutting-edge encapsulation technologies and advanced manufacturing processes.

Key Drivers, Barriers & Challenges in Liposome Drug Delivery Market

The liposome drug delivery market is propelled by several key drivers. The increasing incidence of chronic diseases, particularly cancer, fuels the demand for more effective and targeted therapies. Technological advancements in liposome formulation and manufacturing, enabling better drug encapsulation and controlled release, are crucial. The growing emphasis on targeted drug delivery and reduced systemic toxicity by healthcare providers and patients further bolsters market growth. Policy-driven initiatives promoting innovative healthcare solutions also contribute positively.

However, the market faces significant barriers and challenges. The high cost of research and development, manufacturing, and clinical trials for novel liposomal drugs can be a substantial impediment. Stringent regulatory hurdles and the lengthy approval processes for new liposomal formulations also present challenges. Complex supply chain management and potential for product instability can impact market reach. Furthermore, competition from alternative drug delivery systems and the need for specialized expertise in liposome technology pose ongoing restraints. The cost of specialized manufacturing equipment and the demand for skilled personnel can also add to operational expenses.

Emerging Opportunities in Liposome Drug Delivery Market

Emerging opportunities in the liposome drug delivery market are diverse and promising. The development of liposomal vaccines for infectious diseases and cancer represents a significant growth area, leveraging liposomes to enhance immunogenicity and vaccine efficacy. Targeted drug delivery for rare diseases and orphan drugs offers untapped potential, where the precision of liposomes can be particularly beneficial. The application of liposomes in regenerative medicine and advanced wound healing is also gaining traction. Furthermore, the exploration of novel stimuli-responsive liposomes that release drugs in response to specific biological cues, such as pH or temperature changes, opens up avenues for highly precise therapeutic interventions. The expanding global healthcare market and the increasing focus on patient-centric therapies are creating a fertile ground for these emerging opportunities.

Growth Accelerators in the Liposome Drug Delivery Market Industry

Several catalysts are accelerating the growth of the liposome drug delivery market. Breakthroughs in nanotechnology and materials science are continuously improving liposome design, enabling enhanced drug loading capacities and improved cellular uptake. Strategic partnerships and collaborations between pharmaceutical companies, academic institutions, and biotechnology firms are fostering innovation and accelerating the development pipeline. Market expansion into emerging economies with a growing demand for advanced healthcare solutions presents significant opportunities. Furthermore, the increasing understanding of disease pathophysiology at a molecular level allows for the design of more sophisticated liposomal formulations tailored to specific therapeutic targets. The continuous refinement of manufacturing processes to achieve scalability and cost-effectiveness will also be a key growth accelerator.

Key Players Shaping the Liposome Drug Delivery Market Market

- Pacira BioSciences Inc

- Spectrum Pharmaceuticals Inc

- Novartis AG

- Takeda Pharmaceutical Company Limited

- Sun Pharmaceutical

- Johnson and Johnson

- Teva Pharmaceutical Industries Ltd

- Celsion Corporation

- Luye Pharma Group

- Acrotech Biopharma Inc

- Gilead Sciences Inc

- Ipsen Pharma

Notable Milestones in Liposome Drug Delivery Market Sector

- January 2022: Sun Pharma Advanced Research Company was manufacturing a liposome-encapsulated formulation of the taxane compound paclitaxel (a tubulin inhibitor) for the treatment of breast cancer.

- June 2022: Endo International plc's subsidiary Endo Ventures Limited (EVL) entered into an agreement with Taiwan Liposome Company, Ltd. (TLC), a clinical-stage specialty pharmaceutical company, to commercialize TLC599, a TLC investigational product. TLC599 is an injectable compound in phase 3 development for the treatment of osteoarthritis knee pain.

In-Depth Liposome Drug Delivery Market Market Outlook

The outlook for the liposome drug delivery market is exceptionally strong, driven by its proven ability to overcome limitations of conventional drug delivery. Future growth will be fueled by ongoing advancements in targeted therapies, particularly in oncology and infectious diseases. The integration of artificial intelligence (AI) and machine learning in drug discovery and formulation design will expedite the development of novel liposomal products. Furthermore, increasing investments in biopharmaceuticals and the growing adoption of nanomedicine are expected to create a sustained demand for liposome-based drug delivery systems. Strategic alliances and a focus on developing cost-effective manufacturing solutions will be critical for market players to capitalize on the vast potential of this dynamic sector. The market's trajectory indicates a significant expansion, solidifying liposomes as a cornerstone of modern therapeutics.

Liposome Drug Delivery Market Segmentation

-

1. Product

- 1.1. Liposomal Paclitaxel

- 1.2. Liposomal Doxorubicin

- 1.3. Liposomal Amphotericin B

- 1.4. Others

-

2. Technique

- 2.1. Stealth Liposome Technology

- 2.2. Non-PEGylated Liposome Technology

- 2.3. DepoFoam Liposome Technology

-

3. Indication

- 3.1. Fungal Infections/Diseases

- 3.2. Cancer Therapeutics

- 3.3. Pain Management

- 3.4. Viral Vaccines

- 3.5. Others

Liposome Drug Delivery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Liposome Drug Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cronic Diseases Like Cancer; Advantages Associated With The Liposome Drug Delivery System

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies and Adverse Effects Associated with the Drug Delivery

- 3.4. Market Trends

- 3.4.1. Cancer Therapeutics are Expected to Account for the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Liposomal Paclitaxel

- 5.1.2. Liposomal Doxorubicin

- 5.1.3. Liposomal Amphotericin B

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Technique

- 5.2.1. Stealth Liposome Technology

- 5.2.2. Non-PEGylated Liposome Technology

- 5.2.3. DepoFoam Liposome Technology

- 5.3. Market Analysis, Insights and Forecast - by Indication

- 5.3.1. Fungal Infections/Diseases

- 5.3.2. Cancer Therapeutics

- 5.3.3. Pain Management

- 5.3.4. Viral Vaccines

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Liposomal Paclitaxel

- 6.1.2. Liposomal Doxorubicin

- 6.1.3. Liposomal Amphotericin B

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Technique

- 6.2.1. Stealth Liposome Technology

- 6.2.2. Non-PEGylated Liposome Technology

- 6.2.3. DepoFoam Liposome Technology

- 6.3. Market Analysis, Insights and Forecast - by Indication

- 6.3.1. Fungal Infections/Diseases

- 6.3.2. Cancer Therapeutics

- 6.3.3. Pain Management

- 6.3.4. Viral Vaccines

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Liposomal Paclitaxel

- 7.1.2. Liposomal Doxorubicin

- 7.1.3. Liposomal Amphotericin B

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Technique

- 7.2.1. Stealth Liposome Technology

- 7.2.2. Non-PEGylated Liposome Technology

- 7.2.3. DepoFoam Liposome Technology

- 7.3. Market Analysis, Insights and Forecast - by Indication

- 7.3.1. Fungal Infections/Diseases

- 7.3.2. Cancer Therapeutics

- 7.3.3. Pain Management

- 7.3.4. Viral Vaccines

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Liposomal Paclitaxel

- 8.1.2. Liposomal Doxorubicin

- 8.1.3. Liposomal Amphotericin B

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Technique

- 8.2.1. Stealth Liposome Technology

- 8.2.2. Non-PEGylated Liposome Technology

- 8.2.3. DepoFoam Liposome Technology

- 8.3. Market Analysis, Insights and Forecast - by Indication

- 8.3.1. Fungal Infections/Diseases

- 8.3.2. Cancer Therapeutics

- 8.3.3. Pain Management

- 8.3.4. Viral Vaccines

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Liposomal Paclitaxel

- 9.1.2. Liposomal Doxorubicin

- 9.1.3. Liposomal Amphotericin B

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Technique

- 9.2.1. Stealth Liposome Technology

- 9.2.2. Non-PEGylated Liposome Technology

- 9.2.3. DepoFoam Liposome Technology

- 9.3. Market Analysis, Insights and Forecast - by Indication

- 9.3.1. Fungal Infections/Diseases

- 9.3.2. Cancer Therapeutics

- 9.3.3. Pain Management

- 9.3.4. Viral Vaccines

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Liposomal Paclitaxel

- 10.1.2. Liposomal Doxorubicin

- 10.1.3. Liposomal Amphotericin B

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Technique

- 10.2.1. Stealth Liposome Technology

- 10.2.2. Non-PEGylated Liposome Technology

- 10.2.3. DepoFoam Liposome Technology

- 10.3. Market Analysis, Insights and Forecast - by Indication

- 10.3.1. Fungal Infections/Diseases

- 10.3.2. Cancer Therapeutics

- 10.3.3. Pain Management

- 10.3.4. Viral Vaccines

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Liposome Drug Delivery Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Pacira BioSciences Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Spectrum Pharmaceuticals Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Novartis AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Takeda Pharmaceutical Company Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Sun Pharmaceutical

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Johnson and Johnson

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Teva Pharmaceutical Industries Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Celsion Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Luye Pharma Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Acrotech Biopharma Inc *List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Gilead Sciences Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Ipsen Pharma

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Pacira BioSciences Inc

List of Figures

- Figure 1: Global Liposome Drug Delivery Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Liposome Drug Delivery Market Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Liposome Drug Delivery Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Liposome Drug Delivery Market Revenue (Million), by Technique 2024 & 2032

- Figure 15: North America Liposome Drug Delivery Market Revenue Share (%), by Technique 2024 & 2032

- Figure 16: North America Liposome Drug Delivery Market Revenue (Million), by Indication 2024 & 2032

- Figure 17: North America Liposome Drug Delivery Market Revenue Share (%), by Indication 2024 & 2032

- Figure 18: North America Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Liposome Drug Delivery Market Revenue (Million), by Product 2024 & 2032

- Figure 21: Europe Liposome Drug Delivery Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Liposome Drug Delivery Market Revenue (Million), by Technique 2024 & 2032

- Figure 23: Europe Liposome Drug Delivery Market Revenue Share (%), by Technique 2024 & 2032

- Figure 24: Europe Liposome Drug Delivery Market Revenue (Million), by Indication 2024 & 2032

- Figure 25: Europe Liposome Drug Delivery Market Revenue Share (%), by Indication 2024 & 2032

- Figure 26: Europe Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Liposome Drug Delivery Market Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Liposome Drug Delivery Market Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Liposome Drug Delivery Market Revenue (Million), by Technique 2024 & 2032

- Figure 31: Asia Pacific Liposome Drug Delivery Market Revenue Share (%), by Technique 2024 & 2032

- Figure 32: Asia Pacific Liposome Drug Delivery Market Revenue (Million), by Indication 2024 & 2032

- Figure 33: Asia Pacific Liposome Drug Delivery Market Revenue Share (%), by Indication 2024 & 2032

- Figure 34: Asia Pacific Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Liposome Drug Delivery Market Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East and Africa Liposome Drug Delivery Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa Liposome Drug Delivery Market Revenue (Million), by Technique 2024 & 2032

- Figure 39: Middle East and Africa Liposome Drug Delivery Market Revenue Share (%), by Technique 2024 & 2032

- Figure 40: Middle East and Africa Liposome Drug Delivery Market Revenue (Million), by Indication 2024 & 2032

- Figure 41: Middle East and Africa Liposome Drug Delivery Market Revenue Share (%), by Indication 2024 & 2032

- Figure 42: Middle East and Africa Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Liposome Drug Delivery Market Revenue (Million), by Product 2024 & 2032

- Figure 45: South America Liposome Drug Delivery Market Revenue Share (%), by Product 2024 & 2032

- Figure 46: South America Liposome Drug Delivery Market Revenue (Million), by Technique 2024 & 2032

- Figure 47: South America Liposome Drug Delivery Market Revenue Share (%), by Technique 2024 & 2032

- Figure 48: South America Liposome Drug Delivery Market Revenue (Million), by Indication 2024 & 2032

- Figure 49: South America Liposome Drug Delivery Market Revenue Share (%), by Indication 2024 & 2032

- Figure 50: South America Liposome Drug Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Liposome Drug Delivery Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Liposome Drug Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Liposome Drug Delivery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Liposome Drug Delivery Market Revenue Million Forecast, by Technique 2019 & 2032

- Table 4: Global Liposome Drug Delivery Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 5: Global Liposome Drug Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Liposome Drug Delivery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Liposome Drug Delivery Market Revenue Million Forecast, by Technique 2019 & 2032

- Table 34: Global Liposome Drug Delivery Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 35: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Liposome Drug Delivery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Liposome Drug Delivery Market Revenue Million Forecast, by Technique 2019 & 2032

- Table 41: Global Liposome Drug Delivery Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 42: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Liposome Drug Delivery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Liposome Drug Delivery Market Revenue Million Forecast, by Technique 2019 & 2032

- Table 51: Global Liposome Drug Delivery Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 52: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Liposome Drug Delivery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Liposome Drug Delivery Market Revenue Million Forecast, by Technique 2019 & 2032

- Table 61: Global Liposome Drug Delivery Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 62: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Liposome Drug Delivery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 67: Global Liposome Drug Delivery Market Revenue Million Forecast, by Technique 2019 & 2032

- Table 68: Global Liposome Drug Delivery Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 69: Global Liposome Drug Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Liposome Drug Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liposome Drug Delivery Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Liposome Drug Delivery Market?

Key companies in the market include Pacira BioSciences Inc, Spectrum Pharmaceuticals Inc, Novartis AG, Takeda Pharmaceutical Company Limited, Sun Pharmaceutical, Johnson and Johnson, Teva Pharmaceutical Industries Ltd, Celsion Corporation, Luye Pharma Group, Acrotech Biopharma Inc *List Not Exhaustive, Gilead Sciences Inc, Ipsen Pharma.

3. What are the main segments of the Liposome Drug Delivery Market?

The market segments include Product, Technique, Indication.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cronic Diseases Like Cancer; Advantages Associated With The Liposome Drug Delivery System.

6. What are the notable trends driving market growth?

Cancer Therapeutics are Expected to Account for the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies and Adverse Effects Associated with the Drug Delivery.

8. Can you provide examples of recent developments in the market?

In June 2022, Endo International plc's subsidiary Endo Ventures Limited (EVL) entered into an agreement with Taiwan Liposome Company, Ltd. (TLC), a clinical-stage specialty pharmaceutical company, to commercialize TLC599, a TLC investigational product. TLC599 is an injectable compound in phase 3 development for the treatment of osteoarthritis knee pain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Liposome Drug Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Liposome Drug Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Liposome Drug Delivery Market?

To stay informed about further developments, trends, and reports in the Liposome Drug Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence