Key Insights

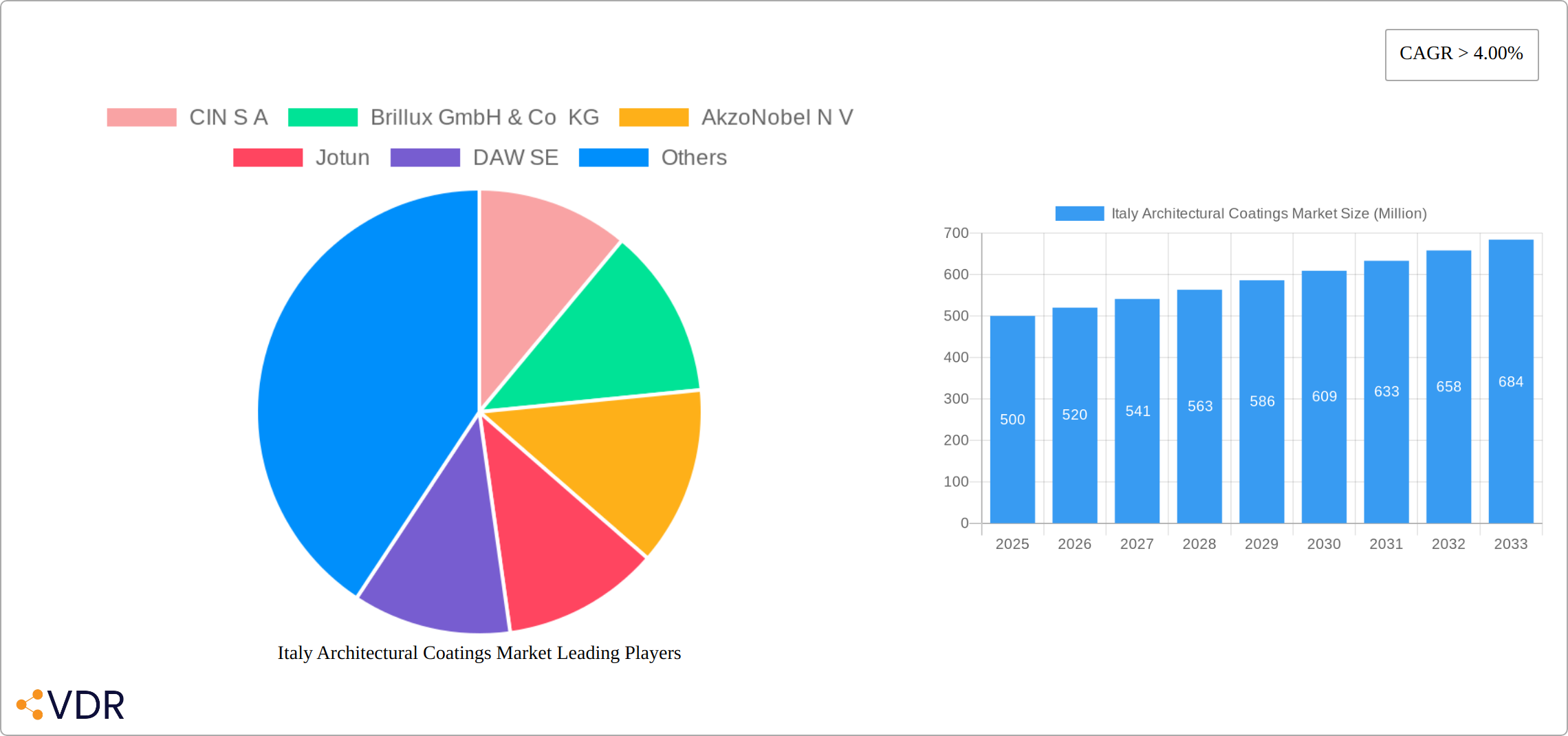

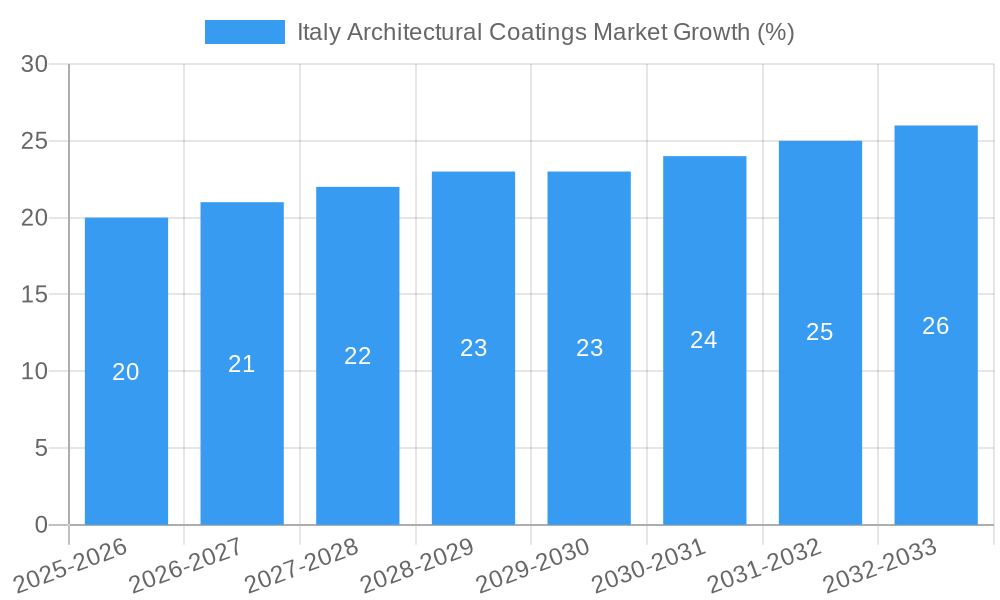

The Italian architectural coatings market, valued at approximately €[Estimate based on available market size and unit - let's assume €500 million in 2025 for example purposes, this needs to be replaced with actual data if available] in 2025, exhibits robust growth potential, driven by a CAGR exceeding 4.00%. Several factors contribute to this positive outlook. Firstly, ongoing construction and renovation projects across residential and commercial sectors fuel demand for high-quality paints and coatings. Secondly, a growing emphasis on energy efficiency and sustainable building practices is boosting the adoption of waterborne coatings, which are environmentally friendly and offer superior performance. The market is segmented by end-user (commercial and residential) and technology (solventborne and waterborne), with resin types including acrylic, alkyd, epoxy, polyester, polyurethane, and others. This diverse landscape provides ample opportunities for manufacturers. Key players like AkzoNobel, Jotun, PPG Industries, and others are strategically positioning themselves to capitalize on these market trends.

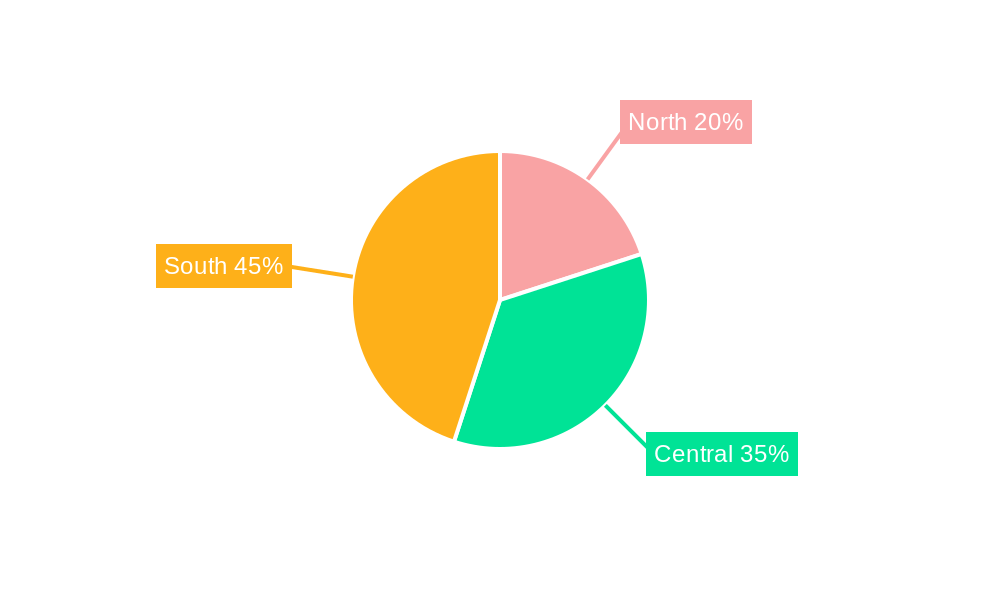

However, the market also faces challenges. Economic fluctuations impacting construction activity and stringent environmental regulations regarding volatile organic compounds (VOCs) in coatings pose potential restraints. Nevertheless, the long-term forecast for the Italian architectural coatings market remains optimistic, fueled by continuous urbanization, infrastructure development, and a sustained demand for aesthetically pleasing and durable coatings. The increased focus on innovative product development, including advanced coatings with improved durability and aesthetics, will further propel market growth. Specific regional variations within Italy will also play a role, with certain areas experiencing higher growth rates than others due to factors like construction boom or government-led initiatives. Further research into specific regional data within Italy is recommended for a more granular understanding of market dynamics.

Italy Architectural Coatings Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Italy Architectural Coatings Market, encompassing market dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033. The market is segmented by sub-end user (Commercial, Residential), technology (Solventborne, Waterborne), and resin type (Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, Other Resin Types). The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The total market size in 2025 is estimated at xx Million units.

Italy Architectural Coatings Market Market Dynamics & Structure

The Italian architectural coatings market exhibits moderate concentration, with key players like AkzoNobel N.V., PPG Industries Inc., and Jotun commanding significant market share (estimated at a combined xx% in 2025). This dynamic landscape is propelled by technological innovation, specifically the rising demand for eco-friendly and high-performance coatings. Stringent Italian environmental regulations are a key driver, pushing manufacturers to prioritize waterborne and low-VOC formulations. The market faces competitive pressure from substitute products such as wall coverings and cladding. However, robust growth is fueled by end-user demographics, particularly the expanding residential sector, boosted by both renovation projects and new constructions. Mergers and acquisitions (M&A) activity within the sector remains relatively moderate, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with the top 3 players holding xx% market share in 2025.

- Technological Innovation: Strong emphasis on waterborne, low-VOC, and high-performance coatings, reflecting evolving consumer and regulatory priorities.

- Regulatory Framework: Stringent environmental regulations are a key catalyst for the adoption of sustainable coatings, creating both challenges and opportunities for manufacturers.

- Competitive Landscape: Wall coverings and cladding present a competitive threat, necessitating product differentiation and innovation.

- End-User Demographics: The growth of the residential sector, driven by new construction and renovations, is a significant market driver.

- M&A Activity: Moderate M&A activity (xx deals between 2019 and 2024) indicates ongoing consolidation and strategic repositioning within the market.

- Innovation Barriers: High R&D costs and navigating stringent regulatory approval processes pose challenges to innovation.

Italy Architectural Coatings Market Growth Trends & Insights

The Italy architectural coatings market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Market size evolution is driven by factors including increasing construction activity, rising disposable incomes, and growing consumer preference for aesthetically pleasing and durable coatings. Adoption rates of waterborne coatings are increasing significantly due to environmental concerns and regulatory pressures. Technological disruptions, such as the introduction of self-cleaning and antimicrobial coatings, are reshaping the market landscape. Consumer behavior shifts towards sustainable and eco-friendly products are further propelling market growth. Market penetration of high-performance coatings remains relatively low, presenting significant growth opportunities.

Dominant Regions, Countries, or Segments in Italy Architectural Coatings Market

The residential segment dominates the Italian architectural coatings market, accounting for approximately xx% of the total market value in 2025. This dominance stems from the increasing number of new housing projects and widespread renovation activities across the country. The Waterborne technology segment is also experiencing robust growth, driven by stricter environmental regulations and a growing consumer preference for eco-friendly products. Acrylic resin remains the most prevalent type, valued for its versatility, cost-effectiveness, and superior performance characteristics. Northern Italy exhibits stronger market penetration compared to Southern Italy, reflecting the higher economic activity and infrastructure development in the north.

Key Drivers:

- Residential Sector Expansion: High demand from new construction and renovation projects is a primary growth engine.

- Environmental Regulations: Stringent regulations are accelerating the adoption of waterborne coatings.

- Regional Economic Disparities: Higher market penetration in economically developed regions (Northern Italy) highlights the correlation between economic activity and construction.

- Infrastructure Development: Ongoing construction of new buildings and infrastructure projects contributes to market growth.

Market Segmentation:

- Market Share Leadership: The residential segment holds the largest market share (xx% in 2025).

- High-Growth Segments: Waterborne and acrylic segments demonstrate significant growth potential.

Italy Architectural Coatings Market Product Landscape

The Italian architectural coatings market showcases a wide array of products, from traditional solventborne paints to innovative waterborne coatings with enhanced performance characteristics, such as self-cleaning, antimicrobial, and high-durability features. Recent innovations focus on environmentally friendly formulations, improved application ease, and enhanced aesthetic appeal. Product differentiation strategies include specialized coatings for various substrates (concrete, wood, metal), unique color palettes, and advanced functionalities (UV resistance, moisture barrier).

Key Drivers, Barriers & Challenges in Italy Architectural Coatings Market

Key Drivers: Increasing construction activity, rising disposable incomes, and government initiatives promoting sustainable building practices. The growing emphasis on aesthetics and improved building performance is also driving demand for high-performance coatings. Technological advancements in coating formulations are creating new opportunities for innovation.

Key Challenges: Intense competition from established players and the emergence of new entrants, fluctuating raw material prices, stringent environmental regulations, and potential supply chain disruptions due to geopolitical factors can impact the market. The market faces challenges in balancing cost-effectiveness with enhanced performance features.

Emerging Opportunities in Italy Architectural Coatings Market

Significant untapped potential exists in specialized coatings for heritage buildings, reflecting Italy's rich architectural history. The demand for eco-friendly and sustainable coatings continues to rise, alongside high-performance coatings offering improved durability and functionality. Consumer preferences for personalized colors and finishes present opportunities for customized coating solutions. Further expansion into niche segments, such as protective coatings for industrial applications and decorative coatings for interiors, offers promising avenues for growth.

Growth Accelerators in the Italy Architectural Coatings Market Industry

Strategic partnerships, technological breakthroughs in resin and pigment technology, and expansion into new application areas are key growth accelerators. Investment in research and development to enhance product performance and create sustainable formulations is crucial. Successful market expansion strategies targeting both residential and commercial sectors will be essential for continued growth.

Key Players Shaping the Italy Architectural Coatings Market Market

- CIN S A

- Brillux GmbH & Co KG

- AkzoNobel N.V.

- Jotun

- DAW SE

- PPG Industries Inc.

- ICA SpA

- Nippon Paint Holdings Co Ltd

- San Marco

- Covema Vernici (Rialto)

- VALPAINT S p A

- Oikos Spa

Notable Milestones in Italy Architectural Coatings Market Sector

- July 2022: Valpaint's launch of VALPAINT E-VOLUTION, a waterproof, crushproof coating resistant to aggressive chemicals, signifies innovation in the high-performance segment.

- May 2022: PPG's opening of a Color Automation Laboratory in Milan accelerates paint color formulation and enhances product variety, reflecting investments in technological advancement.

- April 2022: Hammerite Ultima's launch broadened market reach with its primerless water-based exterior paint for metal surfaces, showcasing a successful product launch targeting a specific application.

In-Depth Italy Architectural Coatings Market Market Outlook

The Italian architectural coatings market is poised for sustained growth, driven by the aforementioned factors. Leveraging technological innovation to create sustainable, high-performance coatings that meet evolving consumer demands is crucial for success. Strategic partnerships and expansion into niche market segments will be key to unlocking the market's full potential. The long-term outlook remains positive, with a projected market size of xx Million units by 2033.

Italy Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

Italy Architectural Coatings Market Segmentation By Geography

- 1. Italy

Italy Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Soaring Demand for Water based Coatings; Rising Building & Construction Industry in Emerging Economies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Architectural Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CIN S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brillux GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AkzoNobel N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DAW SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PPG Industries Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ICA SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nippon Paint Holdings Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 San Marco

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Covema Vernici (Rialto)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VALPAINT S p A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Oikos Spa

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 CIN S A

List of Figures

- Figure 1: Italy Architectural Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Architectural Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Architectural Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Architectural Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: Italy Architectural Coatings Market Revenue Million Forecast, by Sub End User 2019 & 2032

- Table 4: Italy Architectural Coatings Market Volume liter Forecast, by Sub End User 2019 & 2032

- Table 5: Italy Architectural Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Italy Architectural Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 7: Italy Architectural Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 8: Italy Architectural Coatings Market Volume liter Forecast, by Resin 2019 & 2032

- Table 9: Italy Architectural Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Italy Architectural Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 11: Italy Architectural Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Italy Architectural Coatings Market Volume liter Forecast, by Country 2019 & 2032

- Table 13: Italy Architectural Coatings Market Revenue Million Forecast, by Sub End User 2019 & 2032

- Table 14: Italy Architectural Coatings Market Volume liter Forecast, by Sub End User 2019 & 2032

- Table 15: Italy Architectural Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Italy Architectural Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 17: Italy Architectural Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 18: Italy Architectural Coatings Market Volume liter Forecast, by Resin 2019 & 2032

- Table 19: Italy Architectural Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Italy Architectural Coatings Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Architectural Coatings Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Italy Architectural Coatings Market?

Key companies in the market include CIN S A, Brillux GmbH & Co KG, AkzoNobel N V, Jotun, DAW SE, PPG Industries Inc, ICA SpA, Nippon Paint Holdings Co Ltd, San Marco, Covema Vernici (Rialto), VALPAINT S p A, Oikos Spa.

3. What are the main segments of the Italy Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Soaring Demand for Water based Coatings; Rising Building & Construction Industry in Emerging Economies; Other Drivers.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic; Other Restraints.

8. Can you provide examples of recent developments in the market?

July 2022: Valpaint launched VALPAINT E-VOLUTION, which is waterproof, crushproof, and resistant to aggressive chemical substances. It can be used for continuous surfaces and is particularly popular in interior design projects for easy maintenance and obtaining extremely hygienic surfaces. It can be applied on a large number of surfaces and with a wide range of decorative effects.May 2022: PPG opened an Architectural Paints and Coatings Color Automation Laboratory in Milan to increase the speed of developing paint color formulations.April 2022: Hammerite Ultima was introduced in several markets. It is a water-based exterior paint that can be applied directly to any metal surface without the need for a primer, which was designed to help the company expand its customer base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the Italy Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence