Key Insights

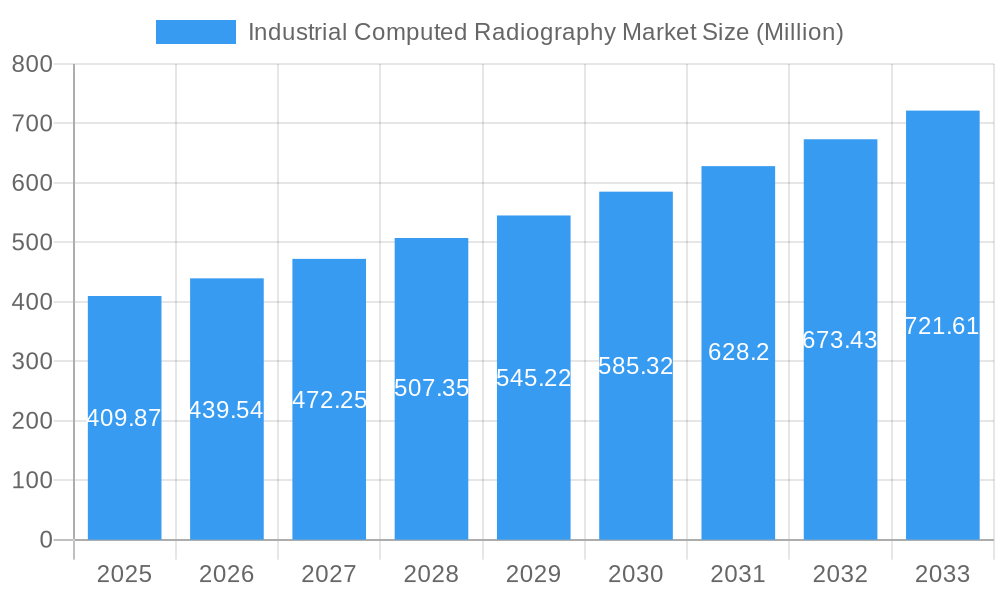

The Industrial Computed Radiography (ICR) market is poised for significant growth, projected to reach \$409.87 million in 2025 and experience a Compound Annual Growth Rate (CAGR) of 6.93% from 2025 to 2033. This expansion is driven by increasing demand for non-destructive testing (NDT) in crucial industries like oil and gas, petrochemicals, and aerospace. Stringent quality control standards and regulations across these sectors are compelling the adoption of ICR technology, due to its precision, efficiency, and ability to detect even minute flaws. Furthermore, advancements in digital imaging technology are improving image resolution and analysis capabilities, thus enhancing the overall efficacy of ICR inspections. The rising adoption of automation in manufacturing processes is another key factor bolstering market growth, as ICR systems are easily integrated into automated workflows for continuous monitoring and defect detection. While the initial investment in ICR equipment can be substantial, the long-term benefits in terms of reduced downtime, enhanced product quality, and improved safety outweigh the initial costs. The market is segmented by application, with Oil and Gas, Petrochemical and Chemical, and Foundries representing substantial segments. Key players like Baker Hughes, Fujifilm Corporation, and Applus+ are driving innovation and market competition through technological advancements and strategic partnerships.

Industrial Computed Radiography Market Market Size (In Million)

The geographical distribution of the ICR market shows robust growth across North America, Europe, and Asia Pacific, reflecting the high concentration of industries reliant on NDT in these regions. The Rest of the World segment is also expected to exhibit significant growth, driven by increasing industrialization and infrastructure development in emerging economies. While challenges such as high system costs and the need for skilled technicians exist, the overall market trajectory points toward consistent expansion, driven by the aforementioned factors. The continuous development of sophisticated software for image analysis and interpretation will further improve the efficiency and accuracy of ICR, making it an indispensable tool in diverse industrial settings. This, coupled with the escalating demand for enhanced safety measures and reliable quality control in manufacturing, will fuel the continued growth of the Industrial Computed Radiography market.

Industrial Computed Radiography Market Company Market Share

Industrial Computed Radiography Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Computed Radiography (ICR) market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The study examines the parent market of Industrial Radiography and the child market of Computed Radiography, offering a granular understanding of this vital sector. The market size is projected to reach xx Million by 2033.

Industrial Computed Radiography Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory factors impacting the ICR market. We delve into market concentration, examining the market share held by key players and assessing the potential for future consolidation through mergers and acquisitions (M&A).

- Market Concentration: The ICR market exhibits a moderately concentrated structure, with top players holding approximately xx% of the market share in 2024. Further consolidation is anticipated through strategic partnerships and acquisitions.

- Technological Innovation: Ongoing advancements in detector technology, image processing algorithms, and software integration are driving market growth. However, high initial investment costs and the need for specialized expertise present challenges to innovation.

- Regulatory Frameworks: Stringent safety regulations and quality standards related to radiation exposure influence market dynamics. Compliance costs and varying regulatory landscapes across different regions impact market expansion.

- Competitive Product Substitutes: Other Non-Destructive Testing (NDT) methods, such as ultrasonic testing and magnetic particle inspection, pose competitive challenges. The choice of technique depends on factors like material type, defect size, and accessibility.

- End-User Demographics: Key end-user industries include oil and gas, petrochemical and chemical, foundries, aerospace and defense, and other sectors requiring precise material inspection. The growth of these industries directly influences ICR market demand.

- M&A Trends: The number of M&A deals in the ICR sector increased to xx in 2024, driven by consolidation efforts and expansion strategies among key players. This trend is expected to continue, shaping the market landscape.

Industrial Computed Radiography Market Growth Trends & Insights

This section examines the historical and projected growth of the ICR market, analyzing factors influencing adoption rates and consumer behavior. Utilizing extensive market research, we project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

The market size in 2024 is estimated at xx Million. The increasing demand for enhanced inspection techniques across various industries, coupled with technological improvements, contributes to market expansion. Technological disruptions, such as the integration of AI and machine learning for image analysis, are further accelerating adoption. A shift towards more efficient and cost-effective solutions is driving market penetration, particularly in developing economies.

Dominant Regions, Countries, or Segments in Industrial Computed Radiography Market

The Oil and Gas segment is currently the dominant application of ICR, accounting for approximately xx% of the market share in 2024. This sector's reliance on rigorous quality control and safety measures necessitates extensive ICR usage. The region showing the most significant growth is North America, driven by robust infrastructure investment and stringent industry standards.

- Key Drivers in Oil & Gas:

- Stringent regulatory compliance requirements for pipeline integrity.

- Growing demand for efficient and reliable NDT methods in exploration and production activities.

- Increased focus on safety and risk mitigation in offshore operations.

- Key Drivers in North America:

- Significant investments in infrastructure development and maintenance.

- Stringent safety regulations and industry standards.

- Growing demand for advanced NDT technologies.

- Other Applications: While Oil and Gas is leading, growth is also observed in Petrochemical, Chemical, Foundries, Aerospace and Defence, and Other sectors. The rising awareness of material integrity and quality control across various industries fuels the expansion in these areas.

Industrial Computed Radiography Market Product Landscape

The Industrial Computed Radiography (ICR) market is characterized by a dynamic product landscape where advanced digital detectors are at the forefront of innovation. These systems leverage sophisticated digital sensor technology to capture radiographic images, delivering significantly superior image quality, enhanced processing capabilities, and greater sensitivity compared to traditional film-based methods. Key product advancements are being driven by breakthroughs in detector technology, including higher resolution, increased sensitivity, and faster acquisition rates. Manufacturers are actively focusing on developing intuitive and user-friendly software interfaces, integrating artificial intelligence (AI) based image analysis tools to automate defect detection, improve efficiency, and boost inspection accuracy. This relentless pursuit of technological refinement translates into reduced inspection times, a higher probability of detecting minute flaws, and ultimately, more robust quality assurance for critical industrial components.

Key Drivers, Barriers & Challenges in Industrial Computed Radiography Market

Key Drivers:

The escalating demand for stringent quality control and comprehensive material inspection across a diverse array of industries, from aerospace and automotive to energy and manufacturing, is a paramount growth driver. This is significantly amplified by continuous technological advancements, such as the development of higher resolution detectors, more sophisticated image processing algorithms, and the integration of efficient, user-friendly software solutions. Furthermore, the increasing implementation of rigorous safety regulations and a heightened emphasis on risk mitigation in the inspection of critical infrastructure are compelling businesses to adopt advanced NDT technologies like ICR. The inherent advantages of digital data storage, retrieval, and analysis also contribute to its appeal.

Key Challenges & Restraints:

Despite its advantages, the ICR market faces notable hurdles. The substantial initial investment required for acquiring advanced ICR systems can be a deterrent, particularly for small and medium-sized enterprises. The operation and interpretation of ICR data necessitate specialized expertise and rigorous training, which can be a barrier to widespread adoption. The inherent risks associated with radiation exposure also require strict adherence to safety protocols and specialized handling procedures. Supply chain vulnerabilities, especially concerning the availability of specialized electronic components and detectors, can impact production timelines and market availability. Moreover, intense competition from other Non-Destructive Testing (NDT) methods, each with its own set of advantages and cost-effectiveness, presents a continuous challenge. The ongoing costs associated with training, certification, and maintaining skilled personnel can also limit broader market penetration.

Emerging Opportunities in Industrial Computed Radiography Market

Emerging opportunities lie in the integration of AI and machine learning for automated defect detection, the development of portable and wireless ICR systems for improved accessibility, and expansion into new and untapped markets, such as renewable energy infrastructure and advanced materials manufacturing. The increasing demand for real-time data analysis and cloud-based solutions creates further opportunities.

Growth Accelerators in the Industrial Computed Radiography Market Industry

The trajectory of growth for the Industrial Computed Radiography market is poised to be significantly accelerated by several key factors. Continued and rapid technological advancements, particularly in detector sensitivity, image resolution, and processing speed, will broaden the application scope and enhance performance. Strategic collaborations and partnerships between leading ICR equipment manufacturers, software developers, and end-users are crucial for tailoring solutions to specific industry needs and fostering innovation. The expansion of ICR technology into new and emerging applications, such as additive manufacturing inspection, advanced composite materials, and complex electronic components, will unlock new market segments. The ongoing development of more cost-effective, portable, and user-friendly ICR systems is vital for democratizing access and driving market penetration, especially in sectors previously limited by budget constraints. Furthermore, government initiatives and investments aimed at promoting advanced manufacturing practices, enhancing infrastructure integrity, and ensuring product safety worldwide will serve as significant catalysts for market expansion.

Key Players Shaping the Industrial Computed Radiography Market Market

- Baker Hughes

- Virtual Media Integration

- Fujifilm Corporation

- Shawcor Ltd

- Acuren

- Applus Services Sa

- Bluestar Limited

- Durr Ndt Gmbh & Co Kg

- Rigaku Corporation

Notable Milestones in Industrial Computed Radiography Market Sector

- February 2022: Carestream Health India launched the DRX Compass, a state-of-the-art digital radiology solution designed to significantly enhance the efficiency and workflow of radiologists. While this launch directly addresses medical imaging, it signifies a broader industry trend towards advancing digital radiography technology and improving detector performance, which has direct implications and potential spillover benefits for the development and adoption of analogous technologies within the industrial computed radiography sector.

- March 2022: In a related industrial innovation, Blue Star's introduction of new, advanced air conditioning models demonstrates a commitment to technological progress and product diversification within the broader industrial equipment landscape. This highlights the prevailing atmosphere of innovation across various industrial sectors and underscores the importance of continuous research and development, market responsiveness, and the introduction of cutting-edge solutions that can influence and inspire advancements in specialized fields like ICR.

In-Depth Industrial Computed Radiography Market Market Outlook

The outlook for the Industrial Computed Radiography (ICR) market is exceptionally robust, projecting significant and sustained growth in the coming years. This optimistic forecast is underpinned by the confluence of rapidly advancing technologies, an ever-increasing demand from critical end-user industries seeking to guarantee the highest standards of quality and safety, and increasingly supportive government policies that advocate for advanced manufacturing and infrastructure integrity. Strategic partnerships and substantial investments in research and development are anticipated to be pivotal in driving market expansion, fostering innovation, and developing next-generation ICR solutions. A key trend shaping the market's future is the intense focus on developing sustainable, energy-efficient, and cost-effective ICR systems, which will not only broaden market reach into previously untapped segments but also drive long-term, consistent growth. Emerging markets, with their expanding industrial bases and growing emphasis on quality control, represent particularly significant opportunities for market players to establish a strong presence and capitalize on burgeoning demand.

Industrial Computed Radiography Market Segmentation

-

1. Applications

- 1.1. Oil and Gas

- 1.2. Petrochemical and Chemical

- 1.3. Foundries

- 1.4. Aerospace and Defense

- 1.5. Other Applications

Industrial Computed Radiography Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Computed Radiography Market Regional Market Share

Geographic Coverage of Industrial Computed Radiography Market

Industrial Computed Radiography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Decreasing the Exposure to Radiation; Growing Need for Nondestructive Testing

- 3.3. Market Restrains

- 3.3.1. High Installation Costs

- 3.4. Market Trends

- 3.4.1. Nondestructive Testing Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 5.1.1. Oil and Gas

- 5.1.2. Petrochemical and Chemical

- 5.1.3. Foundries

- 5.1.4. Aerospace and Defense

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 6. North America Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 6.1.1. Oil and Gas

- 6.1.2. Petrochemical and Chemical

- 6.1.3. Foundries

- 6.1.4. Aerospace and Defense

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 7. Europe Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 7.1.1. Oil and Gas

- 7.1.2. Petrochemical and Chemical

- 7.1.3. Foundries

- 7.1.4. Aerospace and Defense

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 8. Asia Pacific Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 8.1.1. Oil and Gas

- 8.1.2. Petrochemical and Chemical

- 8.1.3. Foundries

- 8.1.4. Aerospace and Defense

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 9. Rest of the World Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 9.1.1. Oil and Gas

- 9.1.2. Petrochemical and Chemical

- 9.1.3. Foundries

- 9.1.4. Aerospace and Defense

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Baker Hughes

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Virtual Media Integration

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fujifilm Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shawcor Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Acuren

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Applus Services Sa

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bluestar Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Durr Ndt Gmbh & Co Kg

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rigaku Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Baker Hughes

List of Figures

- Figure 1: Global Industrial Computed Radiography Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 3: North America Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 4: North America Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 7: Europe Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 8: Europe Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 11: Asia Pacific Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 12: Asia Pacific Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 15: Rest of the World Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 16: Rest of the World Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 2: Global Industrial Computed Radiography Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 4: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 6: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 8: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 10: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Computed Radiography Market?

The projected CAGR is approximately 6.93%.

2. Which companies are prominent players in the Industrial Computed Radiography Market?

Key companies in the market include Baker Hughes, Virtual Media Integration, Fujifilm Corporation, Shawcor Ltd, Acuren, Applus Services Sa, Bluestar Limited, Durr Ndt Gmbh & Co Kg, Rigaku Corporation.

3. What are the main segments of the Industrial Computed Radiography Market?

The market segments include Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 409.87 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Decreasing the Exposure to Radiation; Growing Need for Nondestructive Testing.

6. What are the notable trends driving market growth?

Nondestructive Testing Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Installation Costs.

8. Can you provide examples of recent developments in the market?

March 2022 - Blue Star, India's premier air conditioning brand, released cheap yet best-in-class distinctive' split ACs. The company has released over 50 models in the inverter, fixed speed, and window AC categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Computed Radiography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Computed Radiography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Computed Radiography Market?

To stay informed about further developments, trends, and reports in the Industrial Computed Radiography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence