Key Insights

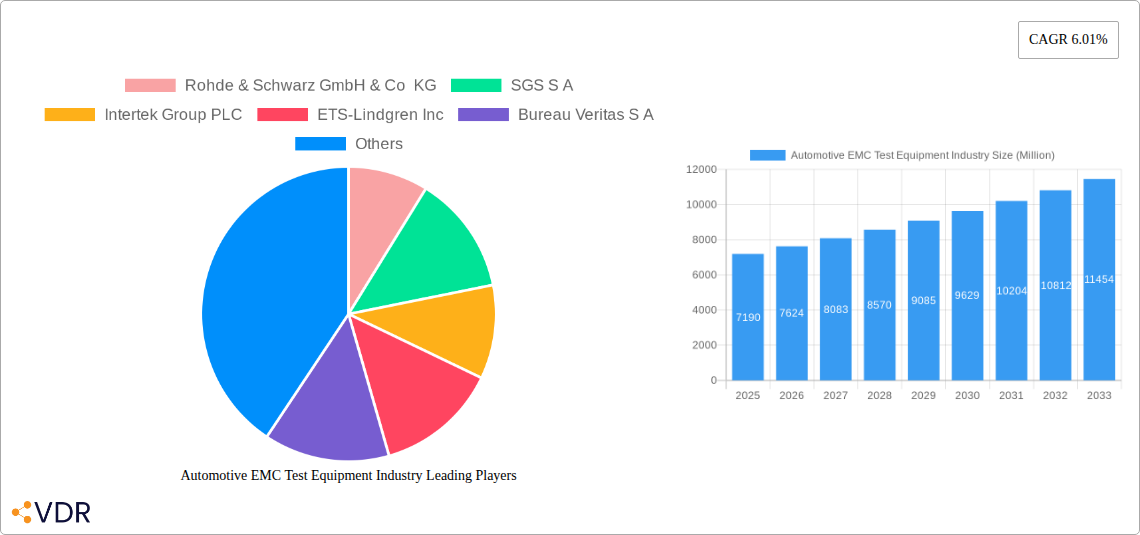

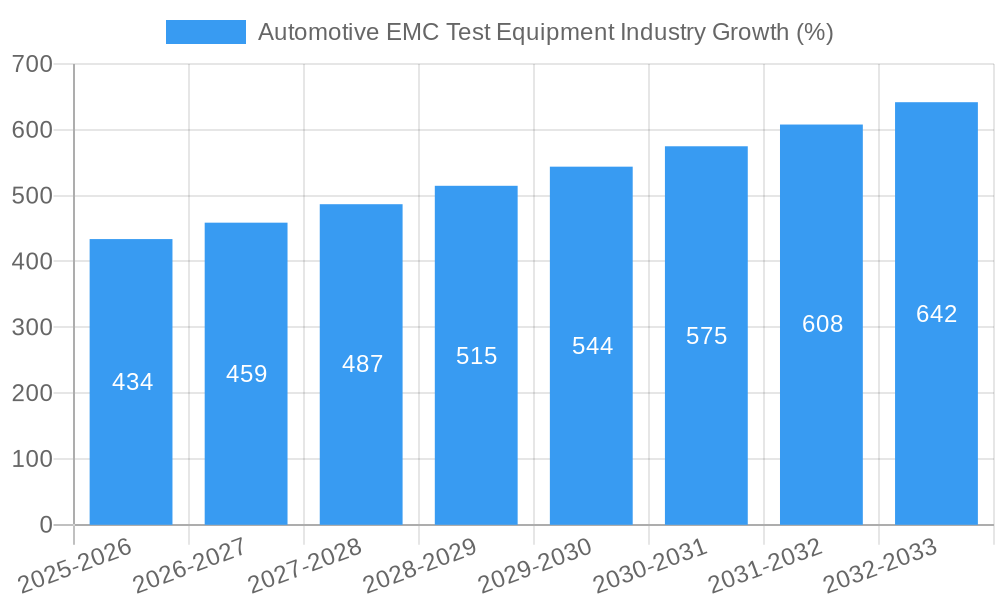

The Automotive EMC Test Equipment market, valued at $7.19 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and connected car technologies. These technological advancements necessitate rigorous electromagnetic compatibility (EMC) testing to ensure vehicle safety and reliable performance. Stringent regulatory standards worldwide, particularly concerning emission limits and interference susceptibility, further fuel market expansion. The automotive industry's focus on reducing vehicle weight and improving fuel efficiency also contributes to demand, as lighter materials and advanced electronic systems require comprehensive EMC testing. Key growth segments include test equipment for high-frequency applications and specialized testing for EVs and hybrids. Significant market share is held by established players like Rohde & Schwarz and Keysight Technologies, but smaller, specialized companies focusing on niche applications are also gaining traction. Geographic expansion is expected across all regions, with Asia-Pacific projected to show particularly strong growth due to rapid automotive manufacturing expansion in countries like China and India.

The market's growth trajectory is anticipated to continue through 2033, driven by factors such as the ongoing development of autonomous driving technology and the increasing complexity of vehicle electronics. However, challenges remain, including the high cost of advanced test equipment, the need for skilled technicians to operate and maintain this equipment, and potential supply chain disruptions. To mitigate these challenges, manufacturers are increasingly focusing on developing cost-effective, user-friendly solutions and fostering collaborations with research institutions to advance testing methodologies. Despite these restraints, the long-term outlook remains positive, fueled by the continued evolution of the automotive industry towards greater electrification, connectivity, and automation. This trend is expected to lead to sustained demand for sophisticated EMC test equipment over the forecast period.

Automotive EMC Test Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Automotive EMC Test Equipment industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is designed for industry professionals, investors, and strategic decision-makers seeking a deep understanding of this rapidly evolving sector. The global market size was valued at xx Million units in 2024 and is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Automotive EMC Test Equipment Industry Market Dynamics & Structure

The Automotive EMC Test Equipment market is characterized by a moderately concentrated landscape with several major players holding significant market share. Key dynamics include rapid technological advancements in automotive electronics, stringent regulatory compliance requirements (e.g., UN ECE R10), and the increasing complexity of electronic systems in vehicles. The market is witnessing a rise in mergers and acquisitions (M&A) activity as larger companies seek to expand their market reach and service offerings. Innovation in test equipment is driven by the need for higher accuracy, faster testing speeds, and broader test coverage to meet the demands of advanced driver-assistance systems (ADAS) and autonomous vehicles. Substitute products, such as software-based simulations, are emerging but currently lack the comprehensive capabilities of physical testing equipment.

- Market Concentration: Highly concentrated, with top 5 players holding approximately xx% of market share in 2024.

- Technological Innovation: Driven by miniaturization, automation, and increased testing speed. Barriers to entry include high R&D costs and specialized expertise.

- Regulatory Landscape: Stringent global and regional standards, such as ISO 11452, are key drivers for market growth.

- M&A Activity: xx M&A deals observed in the historical period (2019-2024).

Automotive EMC Test Equipment Industry Growth Trends & Insights

The Automotive EMC Test Equipment market has experienced significant growth over the past five years, primarily driven by the escalating demand for electric vehicles (EVs), ADAS, and connected car technologies. The increasing number of electronic components in modern vehicles necessitates robust EMC testing to ensure reliability and safety. Adoption rates have steadily increased, particularly in regions with stricter emission standards. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in testing processes, are improving efficiency and accuracy. Consumer preference for advanced vehicle features further propels market demand. The market is segmented by type (Test Equipment, Services), end-user industry (Automotive, Consumer Electronics, IT and Telecom, Aerospace and Defense, Healthcare, Other End-user Industries), and geography. The automotive segment is the largest driver, representing approximately xx% of the market in 2024.

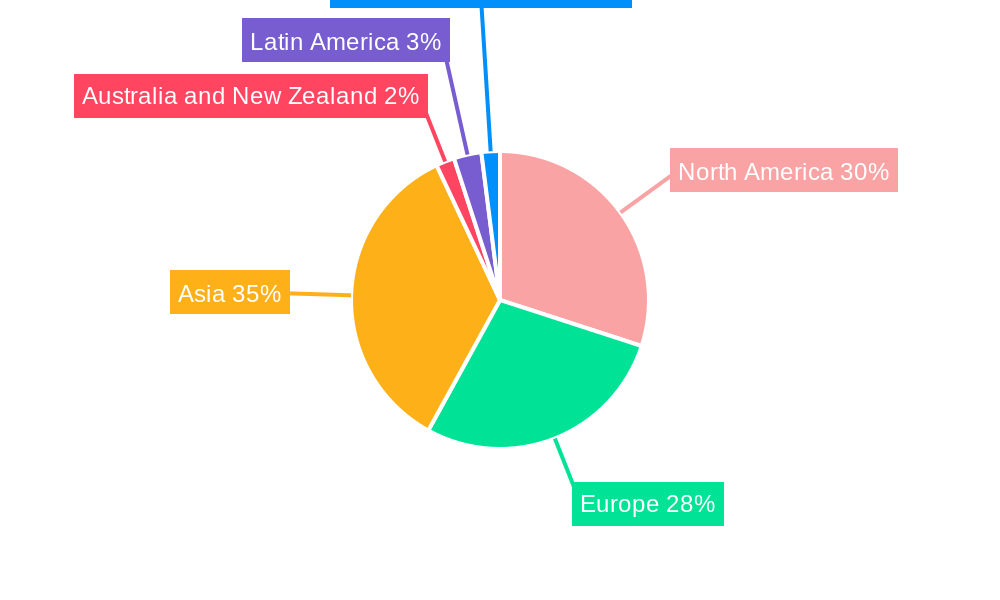

Dominant Regions, Countries, or Segments in Automotive EMC Test Equipment Industry

The automotive EMC test equipment market is geographically diverse, with North America and Europe currently holding the largest market share due to established automotive industries and stringent regulatory frameworks. However, Asia-Pacific is exhibiting the fastest growth, driven by the rapid expansion of the automotive sector in countries like China and India. Within segments, the automotive end-user industry is the dominant driver, followed by consumer electronics and IT & Telecom. Services are a growing segment, complementing the sale of testing equipment.

- Key Drivers: Stringent emission standards, rapid automotive industry growth (especially in Asia-Pacific), and increasing complexity of electronic systems in vehicles.

- Dominance Factors: Strong regulatory frameworks, established automotive manufacturing base, and high investment in R&D.

Automotive EMC Test Equipment Industry Product Landscape

The Automotive EMC Test Equipment market encompasses a wide array of products, including emission test receivers, immunity test generators, conducted and radiated immunity test systems, and specialized software for test data analysis. Product innovation focuses on improving accuracy, reducing testing time, and expanding testing capabilities to address the evolving needs of the automotive industry. Key features include automated test sequences, intuitive user interfaces, and advanced signal processing techniques. Unique selling propositions often center on ease of use, advanced features, and compliance with industry standards.

Key Drivers, Barriers & Challenges in Automotive EMC Test Equipment Industry

Key Drivers: The primary drivers are the stringent regulatory compliance requirements for EMC in vehicles, the increasing complexity of electronic systems in modern vehicles, and the growing demand for electric and autonomous vehicles. Technological advancements, such as the development of more sophisticated testing equipment, further accelerate market growth.

Challenges: Key challenges include the high cost of advanced testing equipment, the complexity of EMC testing, and the need for specialized expertise. Supply chain disruptions due to geopolitical events can also impact availability and pricing. Competition among established players and the emergence of new market entrants create pricing pressures.

Emerging Opportunities in Automotive EMC Test Equipment Industry

Significant opportunities exist in emerging markets, particularly in developing economies with rapidly growing automotive industries. The increasing adoption of electric vehicles and autonomous driving technologies creates demand for more sophisticated testing solutions. The integration of AI and machine learning into EMC testing processes offers opportunities for enhanced efficiency and accuracy. Specialized testing solutions for specific automotive applications (e.g., high-voltage battery testing) represent further growth avenues.

Growth Accelerators in the Automotive EMC Test Equipment Industry

Long-term growth will be driven by continuous technological innovation, strategic partnerships between test equipment manufacturers and automotive companies, and the expansion into new geographical markets. The development of more compact and efficient test systems will lower barriers to entry for smaller companies. Collaboration within the industry to establish universal standards will facilitate interoperability and promote wider adoption.

Key Players Shaping the Automotive EMC Test Equipment Market

- Rohde & Schwarz GmbH & Co KG

- SGS S A

- Intertek Group PLC

- ETS-Lindgren Inc

- Bureau Veritas S A

- Dekra Certification GmbH

- HV Technologies Inc

- Keysight Technologies Inc

- TUV SUD

- ALS Limited

Notable Milestones in Automotive EMC Test Equipment Industry Sector

- May 2024: SGS opens a new, larger EMC testing facility in Puchheim, Germany, expanding its automotive testing capacity.

- February 2024: SGS becomes the first third-party independent facility in India authorized by JLR to conduct EMC tests according to JLR specifications.

In-Depth Automotive EMC Test Equipment Industry Market Outlook

The Automotive EMC Test Equipment market is poised for sustained growth over the next decade, driven by technological advancements, increasing regulatory pressure, and the ongoing expansion of the global automotive industry. Strategic partnerships, investments in R&D, and the development of innovative testing solutions will shape the market landscape. Opportunities abound for companies that can adapt to evolving industry needs and provide comprehensive, efficient, and accurate EMC testing solutions.

Automotive EMC Test Equipment Industry Segmentation

-

1. Type

-

1.1. Test Equipment

- 1.1.1. EMI Test Receiver

- 1.1.2. Signal Generator

- 1.1.3. Amplifiers

- 1.1.4. Spectrum Analyzer

- 1.1.5. Other Test Equipments

- 1.2. Services

-

1.1. Test Equipment

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. IT and Telecom

- 2.4. Aerospace and Defense

- 2.5. Healthcare

- 2.6. Other End-user Industries

Automotive EMC Test Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Automotive EMC Test Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Wireless Broadband Infrastructure and Development of 5g Mobile Network; Stringent Government Regulations Against Electromagnetic Interference(EMI) Across the Industries

- 3.3. Market Restrains

- 3.3.1. High Cost Affiliated With the Electromagnetic Compatibility (EMC) Test Equipment

- 3.4. Market Trends

- 3.4.1. The Consumer Electronics Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Test Equipment

- 5.1.1.1. EMI Test Receiver

- 5.1.1.2. Signal Generator

- 5.1.1.3. Amplifiers

- 5.1.1.4. Spectrum Analyzer

- 5.1.1.5. Other Test Equipments

- 5.1.2. Services

- 5.1.1. Test Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. IT and Telecom

- 5.2.4. Aerospace and Defense

- 5.2.5. Healthcare

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Test Equipment

- 6.1.1.1. EMI Test Receiver

- 6.1.1.2. Signal Generator

- 6.1.1.3. Amplifiers

- 6.1.1.4. Spectrum Analyzer

- 6.1.1.5. Other Test Equipments

- 6.1.2. Services

- 6.1.1. Test Equipment

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics

- 6.2.3. IT and Telecom

- 6.2.4. Aerospace and Defense

- 6.2.5. Healthcare

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Test Equipment

- 7.1.1.1. EMI Test Receiver

- 7.1.1.2. Signal Generator

- 7.1.1.3. Amplifiers

- 7.1.1.4. Spectrum Analyzer

- 7.1.1.5. Other Test Equipments

- 7.1.2. Services

- 7.1.1. Test Equipment

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics

- 7.2.3. IT and Telecom

- 7.2.4. Aerospace and Defense

- 7.2.5. Healthcare

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Test Equipment

- 8.1.1.1. EMI Test Receiver

- 8.1.1.2. Signal Generator

- 8.1.1.3. Amplifiers

- 8.1.1.4. Spectrum Analyzer

- 8.1.1.5. Other Test Equipments

- 8.1.2. Services

- 8.1.1. Test Equipment

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics

- 8.2.3. IT and Telecom

- 8.2.4. Aerospace and Defense

- 8.2.5. Healthcare

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Test Equipment

- 9.1.1.1. EMI Test Receiver

- 9.1.1.2. Signal Generator

- 9.1.1.3. Amplifiers

- 9.1.1.4. Spectrum Analyzer

- 9.1.1.5. Other Test Equipments

- 9.1.2. Services

- 9.1.1. Test Equipment

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics

- 9.2.3. IT and Telecom

- 9.2.4. Aerospace and Defense

- 9.2.5. Healthcare

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Test Equipment

- 10.1.1.1. EMI Test Receiver

- 10.1.1.2. Signal Generator

- 10.1.1.3. Amplifiers

- 10.1.1.4. Spectrum Analyzer

- 10.1.1.5. Other Test Equipments

- 10.1.2. Services

- 10.1.1. Test Equipment

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Consumer Electronics

- 10.2.3. IT and Telecom

- 10.2.4. Aerospace and Defense

- 10.2.5. Healthcare

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Test Equipment

- 11.1.1.1. EMI Test Receiver

- 11.1.1.2. Signal Generator

- 11.1.1.3. Amplifiers

- 11.1.1.4. Spectrum Analyzer

- 11.1.1.5. Other Test Equipments

- 11.1.2. Services

- 11.1.1. Test Equipment

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Automotive

- 11.2.2. Consumer Electronics

- 11.2.3. IT and Telecom

- 11.2.4. Aerospace and Defense

- 11.2.5. Healthcare

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Automotive EMC Test Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Rohde & Schwarz GmbH & Co KG

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 SGS S A

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Intertek Group PLC

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 ETS-Lindgren Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Bureau Veritas S A

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Dekra Certification GmbH

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 HV Technologies Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Keysight Technologies Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 TUV SUD*List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 ALS Limited

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Rohde & Schwarz GmbH & Co KG

List of Figures

- Figure 1: Global Automotive EMC Test Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Automotive EMC Test Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Automotive EMC Test Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Automotive EMC Test Equipment Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Automotive EMC Test Equipment Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Automotive EMC Test Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Automotive EMC Test Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Automotive EMC Test Equipment Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe Automotive EMC Test Equipment Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Automotive EMC Test Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Automotive EMC Test Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Automotive EMC Test Equipment Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Asia Automotive EMC Test Equipment Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Asia Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Automotive EMC Test Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Automotive EMC Test Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Automotive EMC Test Equipment Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America Automotive EMC Test Equipment Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Automotive EMC Test Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: Middle East and Africa Automotive EMC Test Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East and Africa Automotive EMC Test Equipment Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 47: Middle East and Africa Automotive EMC Test Equipment Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 48: Middle East and Africa Automotive EMC Test Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Automotive EMC Test Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Automotive EMC Test Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Automotive EMC Test Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Automotive EMC Test Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Automotive EMC Test Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Automotive EMC Test Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Automotive EMC Test Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 25: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 28: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 34: Global Automotive EMC Test Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive EMC Test Equipment Industry?

The projected CAGR is approximately 6.01%.

2. Which companies are prominent players in the Automotive EMC Test Equipment Industry?

Key companies in the market include Rohde & Schwarz GmbH & Co KG, SGS S A, Intertek Group PLC, ETS-Lindgren Inc, Bureau Veritas S A, Dekra Certification GmbH, HV Technologies Inc, Keysight Technologies Inc, TUV SUD*List Not Exhaustive, ALS Limited.

3. What are the main segments of the Automotive EMC Test Equipment Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Wireless Broadband Infrastructure and Development of 5g Mobile Network; Stringent Government Regulations Against Electromagnetic Interference(EMI) Across the Industries.

6. What are the notable trends driving market growth?

The Consumer Electronics Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High Cost Affiliated With the Electromagnetic Compatibility (EMC) Test Equipment.

8. Can you provide examples of recent developments in the market?

May 2024 - SGS has relocated from Hofmannstrasse 50 in Munich, Germany, to a more spacious, custom-designed 6,300 m2 facility in Puchheim, a suburb of Munich. This new facility, accredited with ISO/IEC 17025, serves as an electromagnetic compatibility (EMC) laboratory, bolstering the testing and certification offerings for the automotive, industrial, and consumer electronics sectors. With this move, SGS can now test and certify a wide range of products, from small components to intricate, large-scale systems, all on one site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive EMC Test Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive EMC Test Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive EMC Test Equipment Industry?

To stay informed about further developments, trends, and reports in the Automotive EMC Test Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence