Key Insights

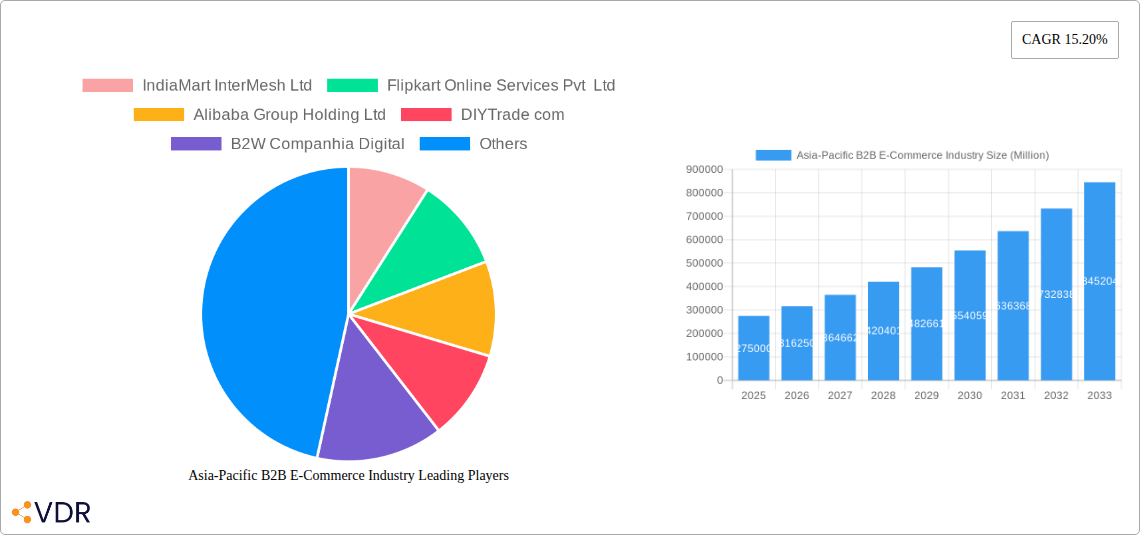

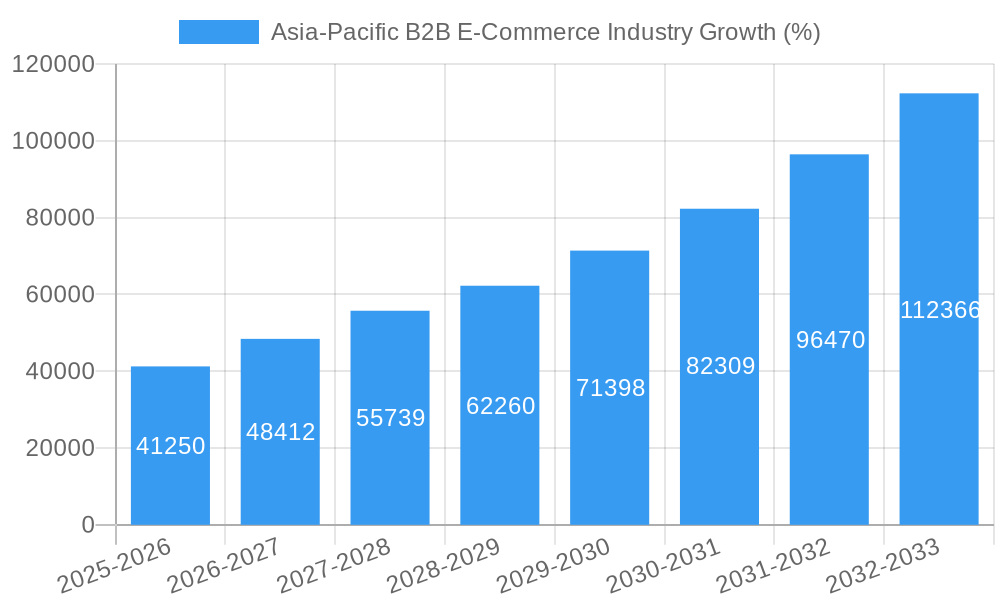

The Asia-Pacific B2B e-commerce market is experiencing robust growth, fueled by increasing internet and smartphone penetration, a burgeoning digital economy, and the rising adoption of e-commerce platforms by businesses across diverse sectors. The region's diverse economies, ranging from established markets like Japan and South Korea to rapidly developing ones like India and China, contribute to this expansive market. A compound annual growth rate (CAGR) of 15.20% from 2019 to 2024 suggests significant market expansion. While precise market size figures for 2025 are unavailable, extrapolating from the historical data and projected growth, a reasonable estimation for the 2025 market size would be in the range of $250 to $300 billion USD (in millions of USD, this would be 250,000 - 300,000). Key drivers include the enhanced efficiency and cost-effectiveness of B2B e-commerce, improved supply chain management capabilities, and a greater demand for digitalized business processes. The increasing preference for online marketplaces and direct sales channels is transforming the landscape, while challenges such as cybersecurity concerns, limited digital literacy in certain areas, and regulatory complexities present ongoing hurdles.

The dominance of major players like Alibaba, Amazon, and Flipkart underscores the competitive intensity of the market. However, the presence of numerous regional and niche players indicates opportunities for both established businesses and new entrants to carve out their niche. The segmental breakdown, while limited to Direct Sales and Marketplace Sales, hints at the growing preference for online marketplaces as a crucial distribution channel. Future growth will be influenced by technological advancements like AI and big data analytics, which will further refine operational efficiency and enhance customer experience. Expansion into underserved markets within the Asia-Pacific region and fostering greater digital literacy across businesses will also significantly impact future market performance. Government initiatives promoting digitalization and the ongoing development of robust digital infrastructure are expected to create a favorable environment for sustained market growth throughout the 2025-2033 forecast period.

Asia-Pacific B2B E-Commerce Industry: Market Dynamics, Growth, & Opportunities (2019-2033)

This comprehensive report provides a detailed analysis of the Asia-Pacific B2B e-commerce market, encompassing market size, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by channel (Direct Sales, Marketplace Sales) and analyzes key regional markets. Download now to gain valuable insights into this rapidly expanding sector.

Asia-Pacific B2B E-Commerce Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Asia-Pacific B2B e-commerce industry. The market is characterized by a mix of established giants and emerging players, leading to both intense competition and opportunities for innovation.

- Market Concentration: The Asia-Pacific B2B e-commerce market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share (estimated at xx Million units in 2025). However, a large number of smaller companies also contribute to the overall market size.

- Technological Innovation: The rapid adoption of technologies such as AI, big data analytics, and blockchain is driving innovation. These technologies are improving supply chain efficiency, enhancing customer experiences, and fostering greater transparency.

- Regulatory Frameworks: Varying regulatory landscapes across different countries in the Asia-Pacific region impact market growth. Harmonization of regulations and consistent policies will further accelerate growth.

- Competitive Product Substitutes: Traditional B2B sales channels represent a key substitute. However, the increasing convenience and efficiency of online platforms are gradually shifting the balance in favor of e-commerce.

- End-User Demographics: The Asia-Pacific region's large and growing middle class, coupled with increasing internet penetration and digital literacy, fuels the growth of the B2B e-commerce market. SMBs represent a significant portion of the user base.

- M&A Trends: The industry has witnessed several mergers and acquisitions (M&A) deals in recent years (estimated xx deals in 2024). These activities aim to enhance market share, expand product offerings, and leverage technological capabilities. Consolidation is expected to continue.

Asia-Pacific B2B E-Commerce Industry Growth Trends & Insights

The Asia-Pacific B2B e-commerce market is experiencing robust growth, driven by a confluence of factors including rising internet penetration, increasing smartphone usage, and the growing adoption of digital technologies by businesses. The market size is projected to expand significantly, reaching xx Million units by 2033, with a CAGR of xx% during the forecast period (2025-2033). Market penetration is also expected to rise substantially, reaching xx% by 2033. Technological disruptions like the adoption of AI-powered tools for customer relationship management (CRM) and predictive analytics are further accelerating this growth. Consumer behavior shifts towards online transactions and preference for digital interaction with suppliers are also contributing factors. This growth is particularly evident in rapidly developing economies like India and Indonesia, where e-commerce is transforming traditional B2B practices.

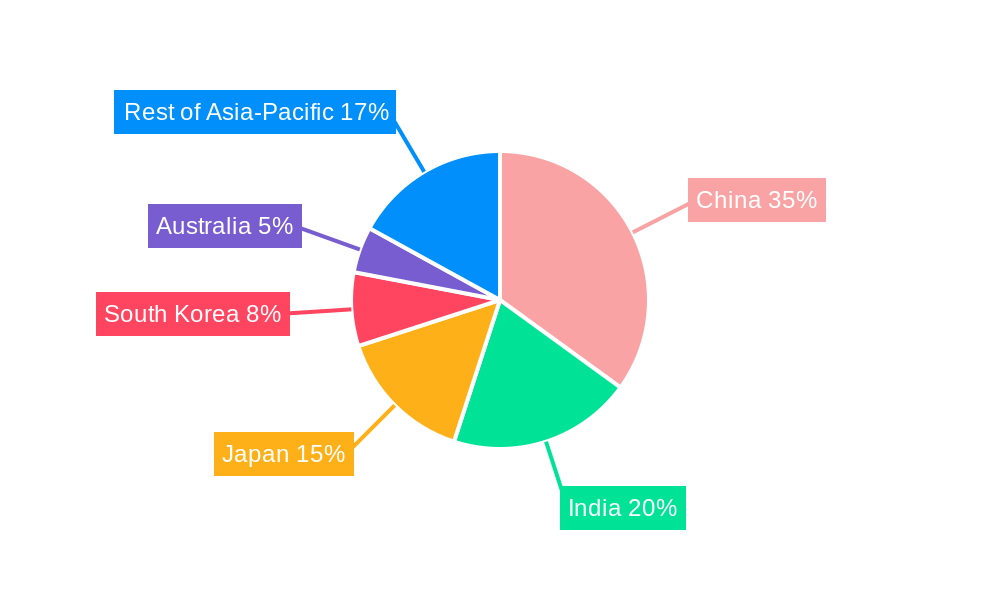

Dominant Regions, Countries, or Segments in Asia-Pacific B2B E-Commerce Industry

China and India are the leading markets in the Asia-Pacific B2B e-commerce sector, driving overall market growth. However, other countries such as Singapore, Indonesia, and Australia are also showing strong growth potential. By Channel, Marketplace Sales currently dominates the market share (estimated at xx Million units in 2025) due to its accessibility and wide reach. However, Direct Sales is expected to witness significant growth owing to increased investments in digital infrastructure and logistics networks.

Key Drivers for China and India:

- Large and growing consumer base

- High smartphone penetration

- Favorable government policies

- Robust infrastructure development

- Increased investments in logistics and delivery networks

Dominance Factors:

- High Market Share: China and India together account for xx% of the overall market share.

- Growth Potential: These countries are expected to maintain the fastest growth rates within the region.

- Technological Advancement: The presence of tech giants in these regions facilitates rapid technological adoption and innovation.

Asia-Pacific B2B E-Commerce Industry Product Landscape

The Asia-Pacific B2B e-commerce landscape is characterized by a diverse range of products and services tailored to meet specific industry needs. This includes specialized software solutions for inventory management, order processing, and supply chain optimization, as well as value-added services like payment gateways, logistics support, and customer service tools. Unique selling propositions often involve personalized experiences, streamlined procurement processes, and access to niche markets. Recent technological advancements are focused on improving data analytics capabilities, enhancing user interface design, and offering greater customization options for buyers and sellers.

Key Drivers, Barriers & Challenges in Asia-Pacific B2B E-Commerce Industry

Key Drivers: Technological advancements (AI, big data), increasing internet & smartphone penetration, supportive government policies, growing adoption of digital payments, and a shift towards online procurement practices are accelerating market growth.

Key Challenges & Restraints: Lack of digital literacy in certain regions, high logistics costs, concerns regarding data security and privacy, payment gateway limitations, and inconsistent regulatory frameworks across various nations pose significant challenges. Supply chain disruptions, leading to delays and increased costs, also impact market growth. These factors contribute to a slower adoption rate in certain segments.

Emerging Opportunities in Asia-Pacific B2B E-Commerce Industry

The untapped potential of smaller businesses (SMBs) in many Asia-Pacific countries presents a significant opportunity. Growing demand for specialized B2B marketplaces focused on specific industry verticals holds considerable promise. The rise of cross-border e-commerce allows companies to reach a wider customer base across borders. There is also an increasing demand for innovative solutions like virtual showrooms and augmented reality (AR)/virtual reality (VR) technologies to enhance customer experience.

Growth Accelerators in the Asia-Pacific B2B E-Commerce Industry Industry

Strategic partnerships between e-commerce platforms and logistics providers are critical for streamlining delivery and enhancing efficiency. Investments in advanced technologies like AI and blockchain are essential for optimizing supply chains, improving fraud detection, and enhancing user experience. Government initiatives promoting digitalization and fostering favorable regulatory environments will significantly propel market growth.

Key Players Shaping the Asia-Pacific B2B E-Commerce Industry Market

- IndiaMart InterMesh Ltd

- Flipkart Online Services Pvt Ltd

- Alibaba Group Holding Ltd

- DIYTrade com

- B2W Companhia Digital

- KOMPASS

- ChinaAseanTrade com

- Amazon com Inc

- EWORLDTRADE Inc

- eBay Inc

Notable Milestones in Asia-Pacific B2B E-Commerce Industry Sector

- June 2022: Vertiv launched its official store on Tokopedia, expanding its presence in Southeast Asia's e-commerce market.

- June 2022: Ramagya Mart introduced home appliance categories to its B2B e-commerce platform, onboarding 900 manufacturers.

In-Depth Asia-Pacific B2B E-Commerce Industry Market Outlook

The Asia-Pacific B2B e-commerce market is poised for substantial growth in the coming years, driven by continued technological advancements, expanding internet access, and supportive government policies. Strategic partnerships, investments in logistics infrastructure, and the exploration of new market segments will further fuel this expansion. The focus on enhancing user experience through innovative technologies and solutions will be crucial for capturing significant market share. The region's robust economic growth, coupled with the increasing adoption of digital technologies by businesses, promises exciting opportunities for players in this dynamic market.

Asia-Pacific B2B E-Commerce Industry Segmentation

-

1. Channel

- 1.1. Direct Sales

- 1.2. Marketplace Sales

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support

- 3.3. Market Restrains

- 3.3.1. Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution

- 3.4. Market Trends

- 3.4.1. Advancement in Technologies Plays a Significant Role in Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Direct Sales

- 5.1.2. Marketplace Sales

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. South Korea

- 5.2.5. Rest of APAC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Rest of APAC

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Direct Sales

- 6.1.2. Marketplace Sales

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. South Korea

- 6.2.5. Rest of APAC

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Direct Sales

- 7.1.2. Marketplace Sales

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. South Korea

- 7.2.5. Rest of APAC

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 8.1.1. Direct Sales

- 8.1.2. Marketplace Sales

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. South Korea

- 8.2.5. Rest of APAC

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 9. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 9.1.1. Direct Sales

- 9.1.2. Marketplace Sales

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. South Korea

- 9.2.5. Rest of APAC

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 10. Rest of APAC Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 10.1.1. Direct Sales

- 10.1.2. Marketplace Sales

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. South Korea

- 10.2.5. Rest of APAC

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 11. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 IndiaMart InterMesh Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Flipkart Online Services Pvt Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Alibaba Group Holding Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 DIYTrade com

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 B2W Companhia Digital

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 KOMPASS

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 ChinaAseanTrade com

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Amazon com Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 EWORLDTRADE Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 eBay Inc

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 IndiaMart InterMesh Ltd

List of Figures

- Figure 1: Asia-Pacific B2B E-Commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific B2B E-Commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 3: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 14: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 17: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 20: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 23: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 26: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific B2B E-Commerce Industry?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Asia-Pacific B2B E-Commerce Industry?

Key companies in the market include IndiaMart InterMesh Ltd, Flipkart Online Services Pvt Ltd, Alibaba Group Holding Ltd, DIYTrade com, B2W Companhia Digital, KOMPASS, ChinaAseanTrade com, Amazon com Inc, EWORLDTRADE Inc, eBay Inc.

3. What are the main segments of the Asia-Pacific B2B E-Commerce Industry?

The market segments include Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support.

6. What are the notable trends driving market growth?

Advancement in Technologies Plays a Significant Role in Market Growth.

7. Are there any restraints impacting market growth?

Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution.

8. Can you provide examples of recent developments in the market?

June 2022 - Vertiv, a provider of critical digital infrastructure and continuity solutions, announced opening its official store in Tokopedia, Indonesia's e-commerce platform. This is part of Vertiv's continuous expansion into the e-commerce space in Southeast Asia, reaching more customers looking to buy small to medium-sized uninterruptible power supply (UPS) solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific B2B E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific B2B E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific B2B E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific B2B E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence