Key Insights

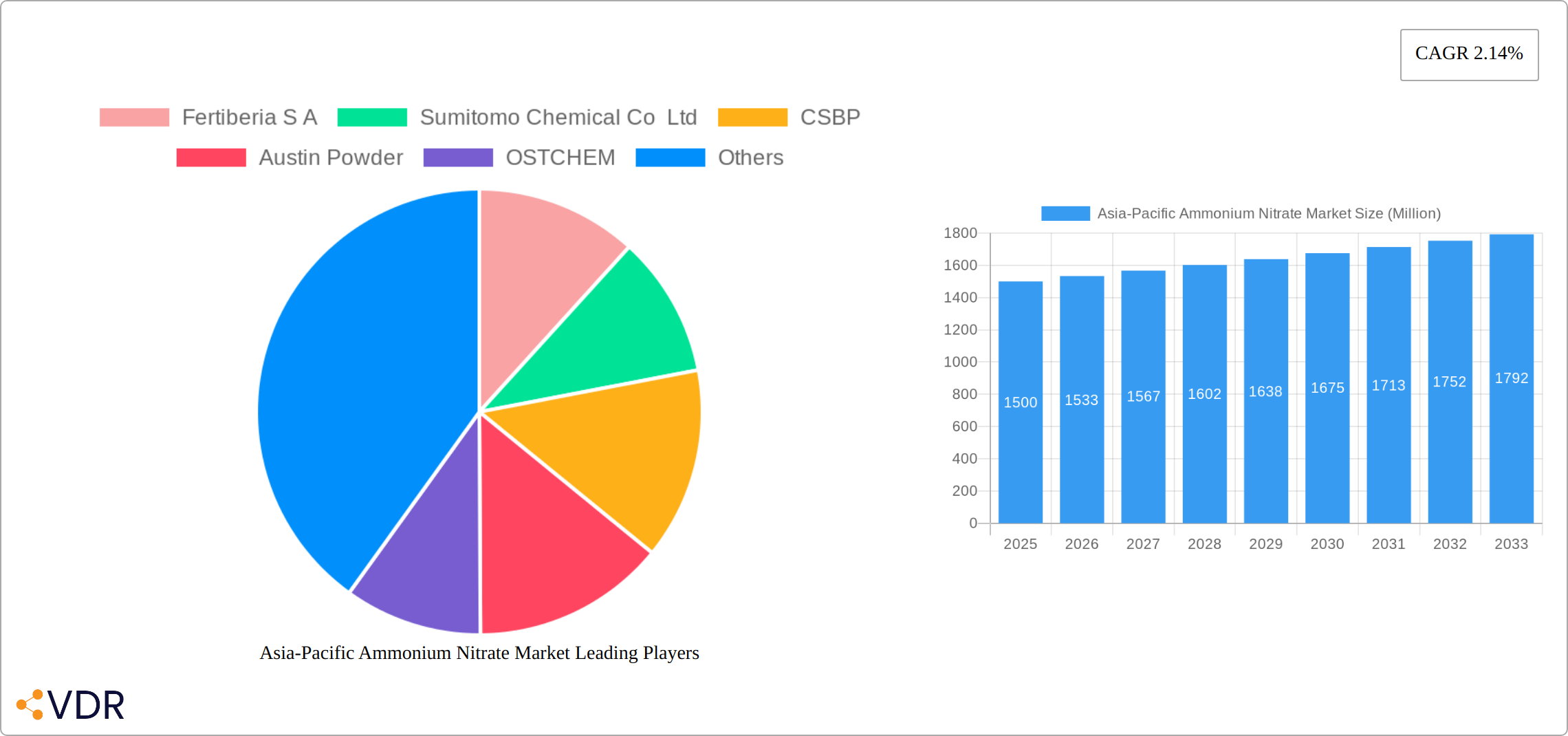

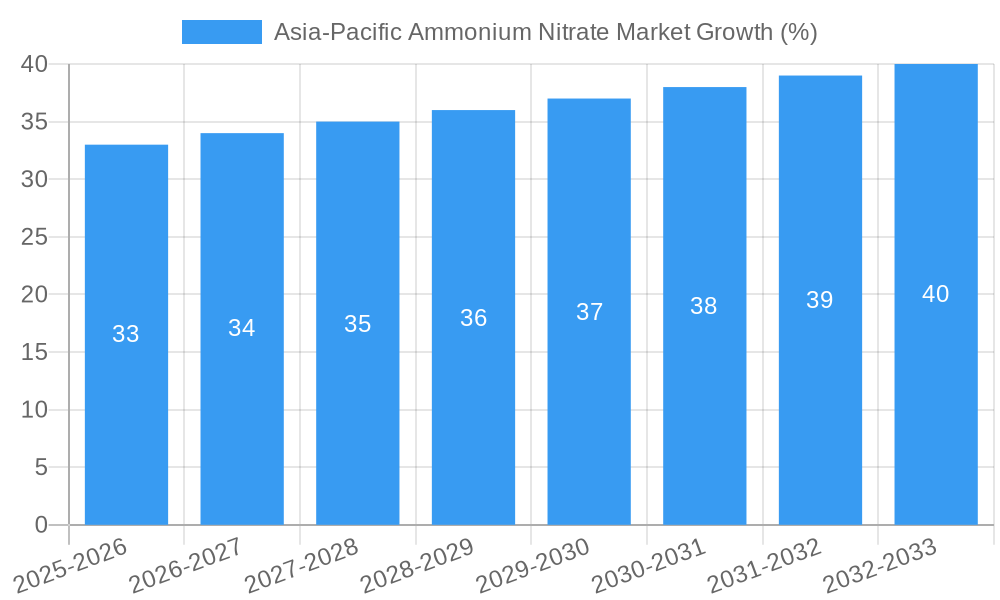

The Asia-Pacific ammonium nitrate market, currently valued at approximately $XX million (estimated based on global market size and regional market share estimations), is projected to experience steady growth with a CAGR of 2.14% from 2025 to 2033. This growth is fueled by several key drivers. The agricultural sector, particularly in rapidly developing economies like India and China, constitutes a significant portion of demand due to the increasing use of ammonium nitrate-based fertilizers to enhance crop yields and meet the food security needs of burgeoning populations. Simultaneously, the mining and construction industries, also prevalent in the region, contribute to the market's expansion through the use of ammonium nitrate in explosives for excavation and infrastructure development. However, environmental concerns surrounding nitrate runoff and potential water contamination pose a significant restraint, leading to stricter regulations and a push for sustainable alternatives in certain segments. Furthermore, price volatility in raw materials like natural gas, a key component in ammonium nitrate production, can impact profitability and market stability. Market segmentation reveals that the fertilizer application dominates, followed by explosives and other niche uses. Within end-user industries, agriculture holds the largest share, followed by mining and defense. The competitive landscape features both global players and regional manufacturers, leading to varying pricing strategies and market penetration levels. Future growth will depend on addressing environmental concerns, navigating raw material price fluctuations, and capitalizing on emerging opportunities in sustainable agricultural practices and infrastructure development within the region.

The Asia-Pacific ammonium nitrate market's growth trajectory is influenced by several trends. The increasing adoption of precision farming techniques and improved fertilizer application methods enhances efficiency and reduces environmental impact, supporting market growth. Simultaneously, technological advancements in explosives manufacturing lead to safer and more effective blasting solutions for mining and construction, bolstering demand. Government initiatives focused on infrastructure development and agricultural modernization in several Asia-Pacific nations further stimulate market growth by increasing demand for both fertilizers and explosives. Conversely, challenges remain, including stricter environmental regulations aimed at mitigating the negative effects of nitrate pollution, and the potential for substitution by alternative fertilizers and explosives with a lower environmental footprint. Companies are actively investing in research and development to develop more environmentally friendly ammonium nitrate production methods and formulations, which will significantly shape the market in the coming years. Regional variations in growth rates reflect differences in agricultural practices, industrial development levels, and regulatory environments across the Asia-Pacific region.

Asia-Pacific Ammonium Nitrate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Ammonium Nitrate market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base and estimated year. The analysis delves into the parent market (Chemical Fertilizers) and child markets (Fertilizers, Explosives, and other applications) within the Asia-Pacific region, offering valuable insights for industry professionals, investors, and strategic decision-makers. The market size is presented in million units.

Asia-Pacific Ammonium Nitrate Market Market Dynamics & Structure

This section provides a comprehensive analysis of the competitive landscape, technological advancements, the intricate regulatory environment, and prevailing market trends that are shaping the Asia-Pacific Ammonium Nitrate market. We delve into market concentration, evaluating the market share commanded by prominent industry players including Fertiberia S.A., Sumitomo Chemical Co. Ltd., CSBP, Austin Powder, OSTCHEM, ENAEX, Incitec Pivot Limited, San Corporation, Orica Limited, Yara, and Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL). Our analysis is underpinned by robust quantitative data on market share percentages and insightful qualitative assessments of the factors profoundly influencing the market's structure.

- Market Concentration: The Asia-Pacific ammonium nitrate market is characterized by a moderately concentrated structure. In 2025, the top 5 players collectively held an estimated [Insert specific percentage here, e.g., 65%] of the market share. This concentration is projected to remain relatively stable throughout the forecast period, though strategic mergers and acquisitions (M&A) could introduce shifts in this dynamic.

- Technological Innovation: Continuous innovation in production processes, with a strong emphasis on enhancing efficiency and embracing sustainability, serves as a pivotal driver. However, the substantial initial investment costs and inherent technological barriers present significant hurdles for emerging players looking to enter or expand within the market.

- Regulatory Frameworks: The market is significantly influenced by stringent environmental regulations pertaining to nitrogen emissions and paramount safety standards for transportation. Compliance with these mandates necessitates technological upgrades, drives operational cost considerations, and profoundly impacts strategic operational planning for all stakeholders.

- Competitive Product Substitutes: In the fertilizer application segment, urea and other nitrogen-based fertilizers represent significant competitive alternatives. The price competitiveness of these substitutes directly impacts the market share and demand for ammonium nitrate.

- End-User Demographics: The robust growth of the agricultural sector, particularly within rapidly developing economies, is a primary fuel for demand. Evolving agricultural practices and an escalating demand for high-yielding crop varieties have a direct and substantial influence on ammonium nitrate consumption patterns.

- M&A Trends: The forecast period (2025-2033) is anticipated to witness a moderate level of M&A activity. This trend is primarily propelled by larger corporations seeking to consolidate their market positions and expand their geographical footprints. An estimated [Insert specific number here, e.g., 8-12] M&A deals are projected to occur within this timeframe.

Asia-Pacific Ammonium Nitrate Market Growth Trends & Insights

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the Asia-Pacific Ammonium Nitrate market from 2019 to 2033. The analysis leverages proprietary data and industry reports to provide a comprehensive overview of market growth trends. The analysis will detail the factors behind the observed trends, including the impact of economic growth, government policies, and technological advancements.

The Asia-Pacific Ammonium Nitrate market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. Driven by increasing demand from the agricultural and mining sectors, the market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Market penetration in key regions will be analyzed, showcasing variations in growth rates due to diverse economic conditions and agricultural practices. Technological disruptions, such as the adoption of precision farming techniques and advanced fertilizer application methods, will also be evaluated, detailing their impact on market growth.

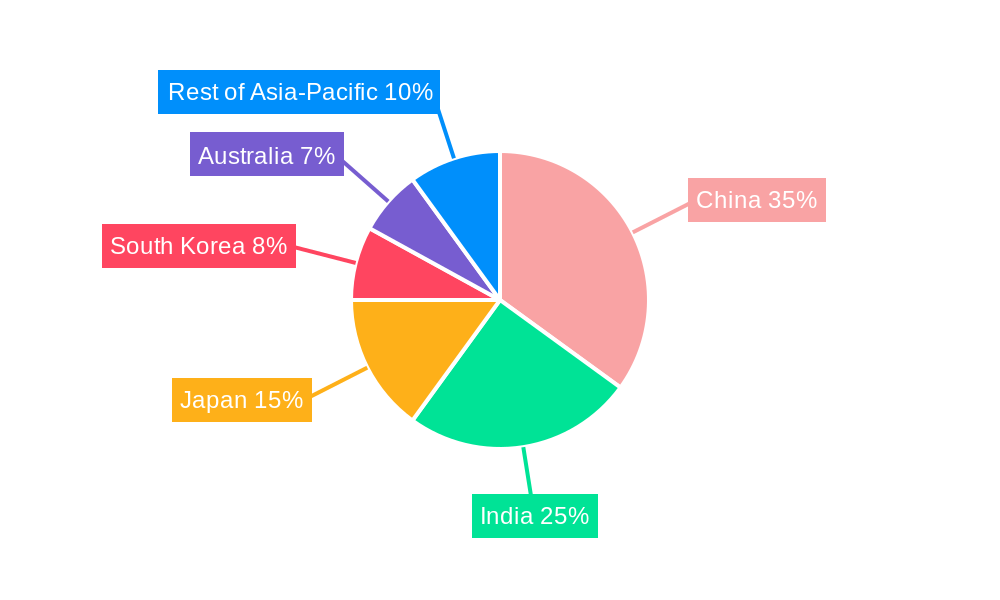

Dominant Regions, Countries, or Segments in Asia-Pacific Ammonium Nitrate Market

This section identifies the leading regions, countries, and segments within the Asia-Pacific Ammonium Nitrate market driving market growth. The analysis focuses on the contribution of different application segments (Fertilizers, Explosives, Other Applications) and end-user industries (Agriculture, Mining, Defense, Other End-User Industry) to overall market growth. Detailed analysis will reveal the dominant regions and countries, outlining the key drivers of their market leadership.

- Dominant Segment: The Fertilizer application segment is expected to dominate the market throughout the forecast period, driven by the growing demand for enhanced agricultural yields across the region. This segment accounted for approximately xx% of the total market value in 2025.

- Key Drivers:

- Rapidly Growing Agricultural Sector: The increasing demand for food in rapidly developing economies significantly boosts fertilizer consumption.

- Government Initiatives: Support for agriculture through subsidies and incentives promotes the adoption of high-yielding crop varieties that require greater fertilizer input.

- Favorable Climate Conditions: Specific regions within the Asia-Pacific experience favorable conditions for agriculture, leading to increased crop production and fertilizer demand.

- Dominant Countries: China and India, owing to their vast agricultural land and expanding agricultural sectors, are the major contributors to the market. Other countries like Australia, Indonesia, and Vietnam also show significant growth potential.

Asia-Pacific Ammonium Nitrate Market Product Landscape

Ammonium nitrate products are meticulously categorized based on their purity levels and physical forms, including prills and granules. Recent advancements are keenly focused on optimizing nitrogen uptake efficiency by plants, minimizing environmental impact through the development of controlled-release formulations, and enhancing safety protocols during handling and transportation. Technological breakthroughs encompass the development of coated ammonium nitrate fertilizers, specifically designed to mitigate nutrient losses and elevate overall application efficiency. These innovations directly address growing concerns regarding environmental sustainability and aim to maximize the value proposition delivered to end-users.

Key Drivers, Barriers & Challenges in Asia-Pacific Ammonium Nitrate Market

Key Drivers:

- Escalating demand from the global agriculture sector, driven by continuous population growth and mounting food security concerns.

- Expansion in mining and construction activities, which directly fuels demand for ammonium nitrate in the explosives segment.

- Proactive government support for agricultural development, manifested through subsidies, infrastructure investments, and policy initiatives.

- Ongoing technological advancements in both production processes and application methods, leading to substantial increases in efficiency and yield.

Key Challenges & Restraints:

- Significant price volatility in raw materials, particularly natural gas and ammonia, which directly impacts production costs.

- The imposition of stringent safety regulations and considerable transportation concerns arising from the inherent explosive nature of ammonium nitrate.

- Growing environmental concerns related to nitrogen runoff and its detrimental impact on water bodies. This has, in certain environmentally sensitive regions, led to an approximate [Insert specific percentage here, e.g., 15-20%] reduction in the usage of ammonium nitrate.

- Intense competition from substitute fertilizers, which exerts significant price pressure on the ammonium nitrate market.

Emerging Opportunities in Asia-Pacific Ammonium Nitrate Market

Emerging opportunities lie in the development of specialized ammonium nitrate formulations tailored to specific crop needs and soil conditions. This includes exploring controlled-release technologies to minimize environmental impact and maximize fertilizer efficiency. Expanding into untapped markets within the region presents further opportunities, alongside the development of innovative application methods (e.g., precision farming techniques). The adoption of sustainable agricultural practices also creates a strong demand for environmentally friendly ammonium nitrate products.

Growth Accelerators in the Asia-Pacific Ammonium Nitrate Market Industry

Long-term growth is significantly influenced by technological innovations focused on improving the efficiency and sustainability of ammonium nitrate production and application. Strategic partnerships between fertilizer manufacturers and agricultural technology providers are also key growth drivers, along with the implementation of government policies promoting sustainable agriculture and responsible fertilizer use. Expansion into new markets and diversification of product offerings to cater to specific end-user needs are crucial for sustained growth.

Key Players Shaping the Asia-Pacific Ammonium Nitrate Market Market

- Fertiberia S.A.

- Sumitomo Chemical Co., Ltd.

- CSBP

- Austin Powder

- OSTCHEM

- ENAEX

- Incitec Pivot Limited

- San Corporation

- Orica Limited

- Yara

- Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL)

Notable Milestones in Asia-Pacific Ammonium Nitrate Market Sector

- 2022 (Q3): Incitec Pivot Limited announced a substantial expansion of its ammonium nitrate production facility located in Australia, signaling strategic growth.

- 2021 (Q4): Yara International made a significant investment in cutting-edge technology aimed at effectively reducing nitrogen emissions during its ammonium nitrate production processes.

- 2020 (Q1): A new, comprehensive regulation was implemented in China concerning the safe transportation and meticulous handling of ammonium nitrate, enhancing safety protocols.

- (This section will be further expanded with additional significant milestones in the complete market report)

In-Depth Asia-Pacific Ammonium Nitrate Market Market Outlook

The Asia-Pacific Ammonium Nitrate market is poised for robust growth in the coming years, driven by several factors, including increasing agricultural production, urbanization, and infrastructure development. The market will witness continued technological advancements aimed at improving efficiency and reducing environmental impact. Strategic partnerships and investments in sustainable production processes will further fuel growth. Companies focusing on innovation, sustainability, and efficient supply chain management will be well-positioned to capture significant market share.

Asia-Pacific Ammonium Nitrate Market Segmentation

-

1. Application

- 1.1. Fertilizers

- 1.2. Explosives

- 1.3. Other Applications

-

2. End-User Industry

- 2.1. Agriculture

- 2.2. Mining

- 2.3. Defense

- 2.4. Other End User Industry

Asia-Pacific Ammonium Nitrate Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Southeast Asia

- 6. Australia

- 7. Rest of Asia Pacific

Asia-Pacific Ammonium Nitrate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.14% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Fertilizer Industry; Increasing Demand for Ammonium Nitrate-Fuel Oil (ANFO); Other Drivers

- 3.3. Market Restrains

- 3.3.1 Stringent Regulations related to Production

- 3.3.2 Storage and Handling of Ammonium Nitrate; Other Restraints

- 3.4. Market Trends

- 3.4.1. Agricultural Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fertilizers

- 5.1.2. Explosives

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Agriculture

- 5.2.2. Mining

- 5.2.3. Defense

- 5.2.4. Other End User Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Southeast Asia

- 5.3.6. Australia

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Fertilizers

- 6.1.2. Explosives

- 6.1.3. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Agriculture

- 6.2.2. Mining

- 6.2.3. Defense

- 6.2.4. Other End User Industry

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Fertilizers

- 7.1.2. Explosives

- 7.1.3. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Agriculture

- 7.2.2. Mining

- 7.2.3. Defense

- 7.2.4. Other End User Industry

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Fertilizers

- 8.1.2. Explosives

- 8.1.3. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Agriculture

- 8.2.2. Mining

- 8.2.3. Defense

- 8.2.4. Other End User Industry

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Korea Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Fertilizers

- 9.1.2. Explosives

- 9.1.3. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Agriculture

- 9.2.2. Mining

- 9.2.3. Defense

- 9.2.4. Other End User Industry

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Southeast Asia Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Fertilizers

- 10.1.2. Explosives

- 10.1.3. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Agriculture

- 10.2.2. Mining

- 10.2.3. Defense

- 10.2.4. Other End User Industry

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Australia Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Fertilizers

- 11.1.2. Explosives

- 11.1.3. Other Applications

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Agriculture

- 11.2.2. Mining

- 11.2.3. Defense

- 11.2.4. Other End User Industry

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Rest of Asia Pacific Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Fertilizers

- 12.1.2. Explosives

- 12.1.3. Other Applications

- 12.2. Market Analysis, Insights and Forecast - by End-User Industry

- 12.2.1. Agriculture

- 12.2.2. Mining

- 12.2.3. Defense

- 12.2.4. Other End User Industry

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. China Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 14. Japan Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 15. India Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 16. South Korea Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 17. Taiwan Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 18. Australia Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Asia-Pacific Asia-Pacific Ammonium Nitrate Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Fertiberia S A

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Sumitomo Chemical Co Ltd

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 CSBP

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Austin Powder

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 OSTCHEM

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 ENAEX

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Incitec Pivot limited

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 San Corporation

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Orica Limited

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Yara

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.11 Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL)

- 20.2.11.1. Overview

- 20.2.11.2. Products

- 20.2.11.3. SWOT Analysis

- 20.2.11.4. Recent Developments

- 20.2.11.5. Financials (Based on Availability)

- 20.2.1 Fertiberia S A

List of Figures

- Figure 1: Asia-Pacific Ammonium Nitrate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Ammonium Nitrate Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 7: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Ammonium Nitrate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Ammonium Nitrate Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Ammonium Nitrate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Ammonium Nitrate Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Ammonium Nitrate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Ammonium Nitrate Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Ammonium Nitrate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Ammonium Nitrate Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia-Pacific Ammonium Nitrate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia-Pacific Ammonium Nitrate Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Ammonium Nitrate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Ammonium Nitrate Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Ammonium Nitrate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Ammonium Nitrate Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 27: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 28: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 29: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 34: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 35: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 39: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 40: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 41: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 43: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 45: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 46: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 47: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 49: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 51: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 52: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 53: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 55: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 57: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 58: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 59: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 61: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 63: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 64: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 65: Asia-Pacific Ammonium Nitrate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Asia-Pacific Ammonium Nitrate Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Ammonium Nitrate Market?

The projected CAGR is approximately 2.14%.

2. Which companies are prominent players in the Asia-Pacific Ammonium Nitrate Market?

Key companies in the market include Fertiberia S A, Sumitomo Chemical Co Ltd, CSBP, Austin Powder, OSTCHEM, ENAEX, Incitec Pivot limited, San Corporation, Orica Limited, Yara, Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL).

3. What are the main segments of the Asia-Pacific Ammonium Nitrate Market?

The market segments include Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Fertilizer Industry; Increasing Demand for Ammonium Nitrate-Fuel Oil (ANFO); Other Drivers.

6. What are the notable trends driving market growth?

Agricultural Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Regulations related to Production. Storage and Handling of Ammonium Nitrate; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Ammonium Nitrate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Ammonium Nitrate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Ammonium Nitrate Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Ammonium Nitrate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence