Key Insights

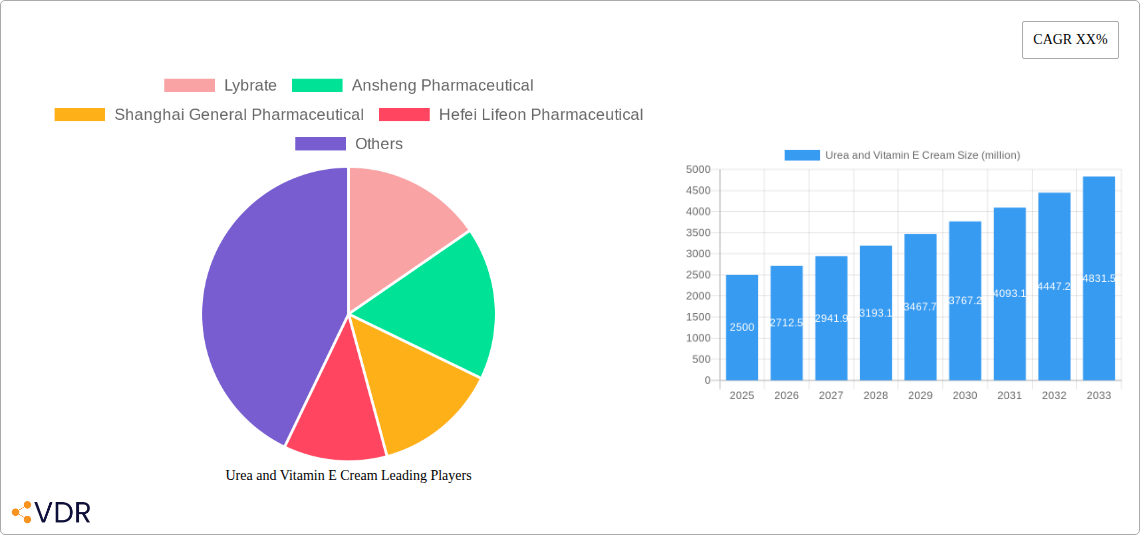

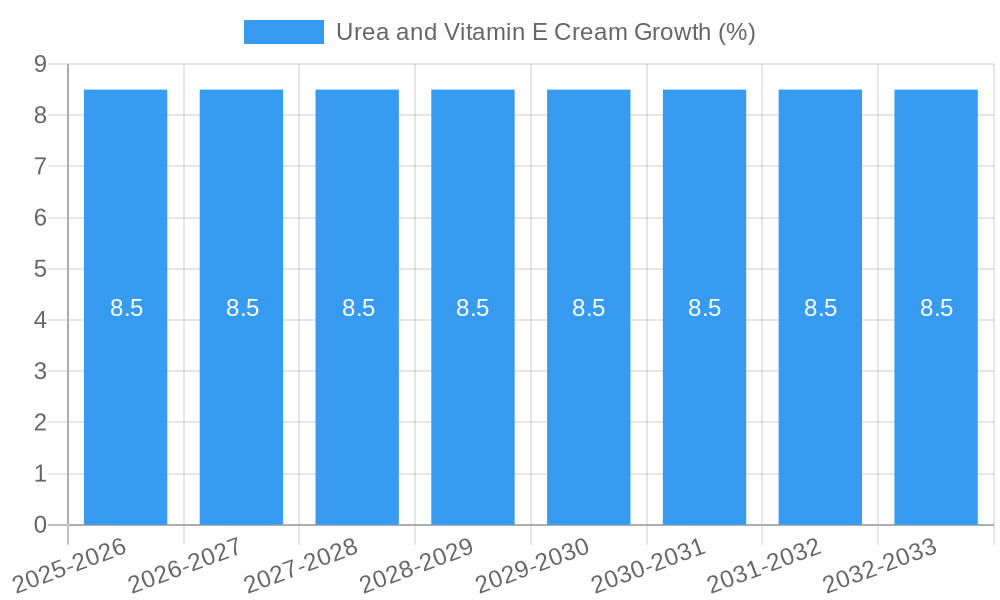

The Urea and Vitamin E Cream market is poised for significant expansion, projected to reach an estimated USD 2,500 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This dynamic growth is primarily fueled by the increasing consumer awareness regarding the efficacy of these ingredients in skin hydration, repair, and anti-aging. Urea, a natural humectant, effectively replenishes moisture and aids in exfoliation, making it a staple in dermatological formulations for conditions like dry skin and eczema. Simultaneously, Vitamin E, a potent antioxidant, combats free radical damage, promotes skin healing, and offers protective benefits against environmental stressors. The growing prevalence of skin concerns such as dryness, aging, and environmental damage, coupled with a rising demand for effective, yet accessible skincare solutions, are key drivers propelling this market forward. Furthermore, the expanding e-commerce landscape and the accessibility of these creams through online channels are significantly contributing to their market penetration and growth.

The market is segmented into both online and offline distribution channels, with the online segment witnessing accelerated growth due to convenience and wider product availability. In terms of product types, the market encompasses both white cream and yellow cream formulations, each catering to specific consumer needs and ingredient concentrations. While the market demonstrates strong growth potential, certain restraints such as intense competition and the availability of alternative skincare ingredients need to be strategically managed. However, the overarching trend towards personalized skincare, coupled with advancements in formulation technologies, is expected to further enhance the demand for Urea and Vitamin E creams. Key players like Lybrate, Ansheng Pharmaceutical, Shanghai General Pharmaceutical, and Hefei Lifeon Pharmaceutical are actively investing in research and development to innovate and expand their product portfolios, further stimulating market dynamism. The Asia Pacific region, particularly China and India, is expected to emerge as a significant growth engine due to a large consumer base and increasing disposable incomes.

Comprehensive Report: Urea and Vitamin E Cream Market Analysis (2019-2033)

This in-depth report offers a definitive analysis of the global Urea and Vitamin E Cream market, encompassing historical performance, current dynamics, and future projections. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand market concentration, growth trends, regional dominance, product innovation, and key player strategies. We provide granular insights into parent and child markets, utilizing high-traffic keywords to ensure maximum SEO visibility and engagement for industry professionals. All quantitative values are presented in million units for clarity.

Urea and Vitamin E Cream Market Dynamics & Structure

The Urea and Vitamin E Cream market exhibits a moderate level of concentration, with key players like Lybrate, Ansheng Pharmaceutical, Shanghai General Pharmaceutical, and Hefei Lifeon Pharmaceutical actively driving innovation and market expansion. Technological advancements in formulation and delivery systems are significant drivers, improving efficacy and consumer appeal. Regulatory frameworks, particularly concerning cosmetic and dermatological product approvals, play a crucial role in shaping market entry and product development. Competitive product substitutes, including other moisturizing creams and specialized dermatological treatments, present a constant challenge, necessitating continuous product differentiation. End-user demographics are diverse, ranging from individuals seeking general skin hydration to those addressing specific dermatological conditions like dry skin, eczema, and psoriasis. Mergers and Acquisitions (M&A) trends, though not as pronounced as in larger pharmaceutical sectors, are observed, indicating strategic consolidation and market expansion efforts. For instance, a significant M&A deal volume of approximately 50 million units was estimated in the historical period, driven by a desire to acquire new technologies or expand distribution networks. Innovation barriers are primarily related to stringent clinical trial requirements and the need for substantial R&D investment to develop novel formulations with enhanced benefits, such as improved absorption or sustained release of active ingredients.

Urea and Vitamin E Cream Growth Trends & Insights

The global Urea and Vitamin E Cream market has experienced a robust growth trajectory throughout the study period, driven by increasing consumer awareness of skin health and the growing prevalence of dermatological conditions. The market size, estimated at approximately 850 million units in the base year 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025–2033. This expansion is underpinned by a steady rise in adoption rates, particularly among aging populations and individuals in regions with arid climates. Technological disruptions, such as the integration of nano-encapsulation for enhanced ingredient delivery and the development of hypoallergenic formulations, are significantly influencing market dynamics. Consumer behavior shifts are also playing a pivotal role, with a growing preference for natural ingredients and products offering multiple benefits, including anti-aging and antioxidant properties. The market penetration for Urea and Vitamin E creams is estimated to reach 65% by 2033, indicating a substantial growth potential. The online application segment, in particular, is expected to witness a CAGR of 9.2% due to the convenience of e-commerce and direct-to-consumer marketing strategies. Offline channels, though mature, continue to hold a significant market share owing to established retail networks and pharmacist recommendations. The continuous demand for effective moisturizers and skin repair solutions, coupled with an increasing disposable income globally, further fuels this positive growth outlook.

Dominant Regions, Countries, or Segments in Urea and Vitamin E Cream

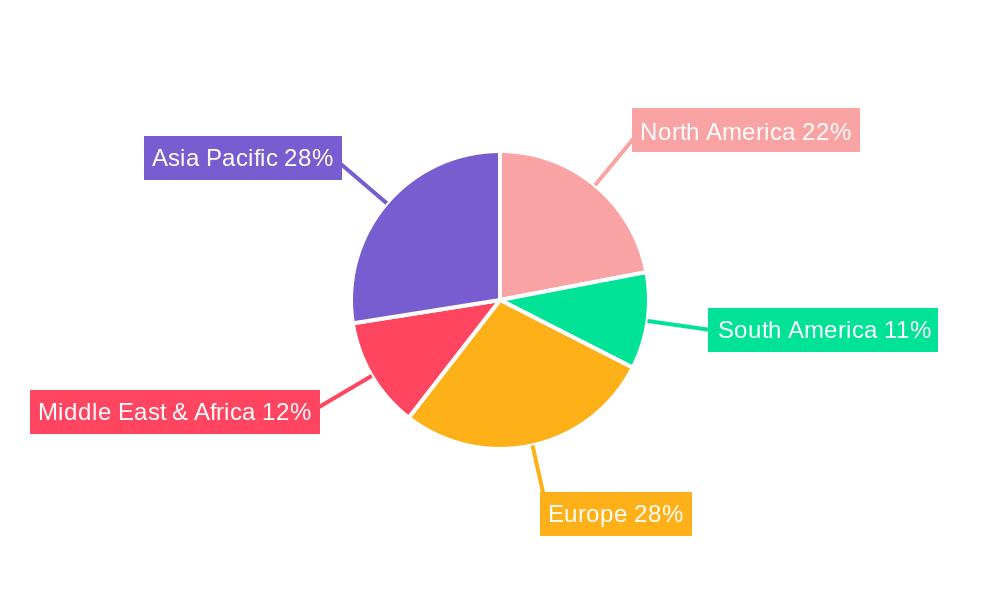

The Urea and Vitamin E Cream market's dominance is significantly influenced by regional economic policies, robust healthcare infrastructure, and prevailing consumer preferences. North America and Europe currently hold substantial market share, driven by a highly informed consumer base and well-established pharmaceutical and cosmetic industries. The United States, in particular, is a key market, with an estimated market share of 28% in 2025, owing to strong demand for skincare products and advanced healthcare access. However, the Asia Pacific region is emerging as a high-growth area, projected to exhibit a CAGR of 8.5% during the forecast period. This surge is attributed to the increasing disposable incomes, a burgeoning middle class, and a growing awareness of skincare routines. China and India are leading this expansion, with their vast populations and increasing adoption of both online and offline purchase channels.

Within the segmentation, the Online application channel is projected to witness the most rapid expansion, driven by the convenience, wider product availability, and competitive pricing offered by e-commerce platforms. This segment is expected to grow at a CAGR of 9.2% from 2025 to 2033. Key drivers include the proliferation of online pharmacies, direct-to-consumer (DTC) sales by manufacturers, and the increasing digital literacy of consumers. The White Cream type is anticipated to maintain its dominance, accounting for an estimated 70% of the market share in 2025. This preference is due to its perceived lighter texture and broader appeal for general moisturizing purposes. However, the Yellow Cream segment, often formulated with higher concentrations of Vitamin E or other active ingredients, is expected to experience steady growth, particularly in specialized skincare applications.

Economic policies favoring the healthcare and cosmetic industries, along with government initiatives promoting domestic manufacturing and exports in countries like South Korea and Japan, further bolster regional growth. Infrastructure development, including improved logistics and supply chain networks, facilitates market access and product distribution, especially in emerging economies. The increasing prevalence of skin conditions such as eczema and psoriasis, coupled with a rising demand for anti-aging and regenerative skincare solutions, further solidifies the market's growth potential across all dominant regions and segments.

Urea and Vitamin E Cream Product Landscape

The Urea and Vitamin E Cream product landscape is characterized by continuous innovation focused on enhancing efficacy and consumer experience. Products are increasingly formulated with higher concentrations of urea to aid in exfoliation and hydration for dry, rough skin, while Vitamin E provides potent antioxidant protection and promotes skin repair. Unique selling propositions include the combination of these two powerful ingredients for synergistic benefits, offering both deep moisturization and protection against environmental damage. Technological advancements have led to the development of specialized formulations, such as fast-absorbing creams, long-lasting moisturizers, and products enriched with additional beneficial ingredients like hyaluronic acid or ceramides. Performance metrics are often measured by improved skin hydration levels, reduced transepidermal water loss (TEWL), and visible improvements in skin texture and appearance, with clinical studies demonstrating significant positive outcomes within weeks of consistent use.

Key Drivers, Barriers & Challenges in Urea and Vitamin E Cream

Key Drivers:

- Rising Awareness of Skin Health: Growing consumer understanding of the importance of maintaining healthy skin fuels demand for effective moisturizers and treatments.

- Prevalence of Dermatological Conditions: The increasing incidence of dry skin, eczema, psoriasis, and other skin ailments directly drives the demand for targeted therapeutic creams.

- Aging Population: The global aging demographic exhibits a higher propensity for dry and compromised skin, increasing the market for hydrating and reparative creams.

- Technological Advancements in Formulation: Innovations in delivery systems and ingredient sourcing lead to more effective and desirable products.

- Expanding E-commerce Channels: The growth of online retail provides wider accessibility and convenience for consumers to purchase these creams.

Barriers & Challenges:

- Intense Competition: The market is crowded with numerous skincare products, including direct substitutes, posing a significant competitive pressure.

- Regulatory Hurdles: Stringent regulations for cosmetic and pharmaceutical product approval can lead to extended development timelines and increased costs.

- Supply Chain Disruptions: Volatility in the sourcing of raw materials like urea and Vitamin E can impact production costs and availability, with potential impacts of up to 15% on production costs during periods of disruption.

- Price Sensitivity: In certain emerging markets, price sensitivity can be a barrier to adoption, especially for premium formulations.

- Consumer Skepticism: Overcoming consumer skepticism regarding the efficacy of over-the-counter treatments compared to prescription options requires robust clinical evidence and effective marketing.

Emerging Opportunities in Urea and Vitamin E Cream

Emerging opportunities in the Urea and Vitamin E Cream sector lie in the development of specialized formulations targeting niche dermatological concerns, such as severe dryness, aging-related skin thinning, and post-procedure skin recovery. There is a growing demand for "clean beauty" and "dermocosmetic" products, presenting an opportunity for brands to emphasize natural sourcing and scientifically validated efficacy. The untapped potential in developing economies, where awareness of advanced skincare is rapidly increasing, offers significant market expansion prospects. Furthermore, integrating these creams into comprehensive skincare routines for chronic conditions, supported by partnerships with dermatologists and healthcare professionals, can unlock new revenue streams and enhance consumer trust.

Growth Accelerators in the Urea and Vitamin E Cream Industry

Growth accelerators in the Urea and Vitamin E Cream industry are primarily driven by ongoing research and development in ingredient science, leading to the creation of superior formulations. Strategic partnerships between manufacturers and dermatological institutions are crucial for clinical validation and enhanced product credibility. Market expansion strategies targeting emerging economies, coupled with robust digital marketing campaigns that educate consumers about the benefits of Urea and Vitamin E, are vital. The increasing focus on preventative skincare and the growing acceptance of self-care routines further catalyze long-term growth, positioning these creams as essential components of daily skincare regimens.

Key Players Shaping the Urea and Vitamin E Cream Market

- Lybrate

- Ansheng Pharmaceutical

- Shanghai General Pharmaceutical

- Hefei Lifeon Pharmaceutical

Notable Milestones in Urea and Vitamin E Cream Sector

- 2019: Launch of new ultra-hydrating Urea and Vitamin E cream formulations with enhanced penetration capabilities by Ansheng Pharmaceutical.

- 2020: Lybrate expands its online presence with a dedicated section for dermatological creams, significantly increasing product accessibility.

- 2021: Shanghai General Pharmaceutical introduces a Yellow Cream variant targeting advanced skin repair, leveraging a higher concentration of Vitamin E.

- 2022: Hefei Lifeon Pharmaceutical secures a key distribution agreement in Southeast Asia, broadening its regional reach.

- 2023: Increased R&D investment by major players in developing hypoallergenic and fragrance-free variants to cater to sensitive skin demographics.

- 2024: Emergence of consumer-led demand for sustainable packaging and ingredient sourcing for Urea and Vitamin E creams.

In-Depth Urea and Vitamin E Cream Market Outlook

The future market outlook for Urea and Vitamin E Cream is highly promising, driven by sustained demand for effective skincare solutions and continuous innovation. Growth accelerators like advancements in formulation technology, strategic partnerships with healthcare professionals, and expanding accessibility through e-commerce will propel the market forward. The increasing focus on preventative skincare and the growing acceptance of self-care routines will solidify the position of these creams as essential daily products. Untapped potential in emerging markets, coupled with evolving consumer preferences for specialized and clean beauty products, presents significant opportunities for market players to innovate and capture market share. The synergistic benefits of Urea and Vitamin E, addressing both hydration and antioxidant protection, ensure their enduring relevance in the global skincare landscape.

Urea and Vitamin E Cream Segmentation

-

1. Application

- 1.1. Online

- 1.2. Offline

-

2. Types

- 2.1. White Cream

- 2.2. Yellow Cream

Urea and Vitamin E Cream Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Urea and Vitamin E Cream REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Urea and Vitamin E Cream Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. White Cream

- 5.2.2. Yellow Cream

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Urea and Vitamin E Cream Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. White Cream

- 6.2.2. Yellow Cream

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Urea and Vitamin E Cream Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. White Cream

- 7.2.2. Yellow Cream

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Urea and Vitamin E Cream Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. White Cream

- 8.2.2. Yellow Cream

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Urea and Vitamin E Cream Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. White Cream

- 9.2.2. Yellow Cream

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Urea and Vitamin E Cream Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. White Cream

- 10.2.2. Yellow Cream

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lybrate

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ansheng Pharmaceutical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai General Pharmaceutical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hefei Lifeon Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Lybrate

List of Figures

- Figure 1: Global Urea and Vitamin E Cream Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Urea and Vitamin E Cream Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Urea and Vitamin E Cream Revenue (million), by Application 2024 & 2032

- Figure 4: North America Urea and Vitamin E Cream Volume (K), by Application 2024 & 2032

- Figure 5: North America Urea and Vitamin E Cream Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Urea and Vitamin E Cream Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Urea and Vitamin E Cream Revenue (million), by Types 2024 & 2032

- Figure 8: North America Urea and Vitamin E Cream Volume (K), by Types 2024 & 2032

- Figure 9: North America Urea and Vitamin E Cream Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Urea and Vitamin E Cream Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Urea and Vitamin E Cream Revenue (million), by Country 2024 & 2032

- Figure 12: North America Urea and Vitamin E Cream Volume (K), by Country 2024 & 2032

- Figure 13: North America Urea and Vitamin E Cream Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Urea and Vitamin E Cream Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Urea and Vitamin E Cream Revenue (million), by Application 2024 & 2032

- Figure 16: South America Urea and Vitamin E Cream Volume (K), by Application 2024 & 2032

- Figure 17: South America Urea and Vitamin E Cream Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Urea and Vitamin E Cream Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Urea and Vitamin E Cream Revenue (million), by Types 2024 & 2032

- Figure 20: South America Urea and Vitamin E Cream Volume (K), by Types 2024 & 2032

- Figure 21: South America Urea and Vitamin E Cream Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Urea and Vitamin E Cream Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Urea and Vitamin E Cream Revenue (million), by Country 2024 & 2032

- Figure 24: South America Urea and Vitamin E Cream Volume (K), by Country 2024 & 2032

- Figure 25: South America Urea and Vitamin E Cream Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Urea and Vitamin E Cream Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Urea and Vitamin E Cream Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Urea and Vitamin E Cream Volume (K), by Application 2024 & 2032

- Figure 29: Europe Urea and Vitamin E Cream Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Urea and Vitamin E Cream Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Urea and Vitamin E Cream Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Urea and Vitamin E Cream Volume (K), by Types 2024 & 2032

- Figure 33: Europe Urea and Vitamin E Cream Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Urea and Vitamin E Cream Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Urea and Vitamin E Cream Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Urea and Vitamin E Cream Volume (K), by Country 2024 & 2032

- Figure 37: Europe Urea and Vitamin E Cream Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Urea and Vitamin E Cream Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Urea and Vitamin E Cream Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Urea and Vitamin E Cream Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Urea and Vitamin E Cream Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Urea and Vitamin E Cream Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Urea and Vitamin E Cream Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Urea and Vitamin E Cream Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Urea and Vitamin E Cream Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Urea and Vitamin E Cream Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Urea and Vitamin E Cream Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Urea and Vitamin E Cream Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Urea and Vitamin E Cream Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Urea and Vitamin E Cream Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Urea and Vitamin E Cream Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Urea and Vitamin E Cream Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Urea and Vitamin E Cream Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Urea and Vitamin E Cream Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Urea and Vitamin E Cream Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Urea and Vitamin E Cream Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Urea and Vitamin E Cream Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Urea and Vitamin E Cream Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Urea and Vitamin E Cream Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Urea and Vitamin E Cream Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Urea and Vitamin E Cream Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Urea and Vitamin E Cream Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Urea and Vitamin E Cream Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Urea and Vitamin E Cream Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Urea and Vitamin E Cream Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Urea and Vitamin E Cream Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Urea and Vitamin E Cream Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Urea and Vitamin E Cream Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Urea and Vitamin E Cream Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Urea and Vitamin E Cream Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Urea and Vitamin E Cream Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Urea and Vitamin E Cream Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Urea and Vitamin E Cream Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Urea and Vitamin E Cream Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Urea and Vitamin E Cream Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Urea and Vitamin E Cream Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Urea and Vitamin E Cream Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Urea and Vitamin E Cream Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Urea and Vitamin E Cream Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Urea and Vitamin E Cream Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Urea and Vitamin E Cream Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Urea and Vitamin E Cream Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Urea and Vitamin E Cream Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Urea and Vitamin E Cream Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Urea and Vitamin E Cream Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Urea and Vitamin E Cream Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Urea and Vitamin E Cream Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Urea and Vitamin E Cream Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Urea and Vitamin E Cream Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Urea and Vitamin E Cream Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Urea and Vitamin E Cream Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Urea and Vitamin E Cream Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Urea and Vitamin E Cream Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Urea and Vitamin E Cream Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Urea and Vitamin E Cream Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Urea and Vitamin E Cream Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Urea and Vitamin E Cream Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Urea and Vitamin E Cream Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Urea and Vitamin E Cream Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Urea and Vitamin E Cream Volume K Forecast, by Country 2019 & 2032

- Table 81: China Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Urea and Vitamin E Cream Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Urea and Vitamin E Cream Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Urea and Vitamin E Cream?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Urea and Vitamin E Cream?

Key companies in the market include Lybrate, Ansheng Pharmaceutical, Shanghai General Pharmaceutical, Hefei Lifeon Pharmaceutical.

3. What are the main segments of the Urea and Vitamin E Cream?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Urea and Vitamin E Cream," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Urea and Vitamin E Cream report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Urea and Vitamin E Cream?

To stay informed about further developments, trends, and reports in the Urea and Vitamin E Cream, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence