Key Insights

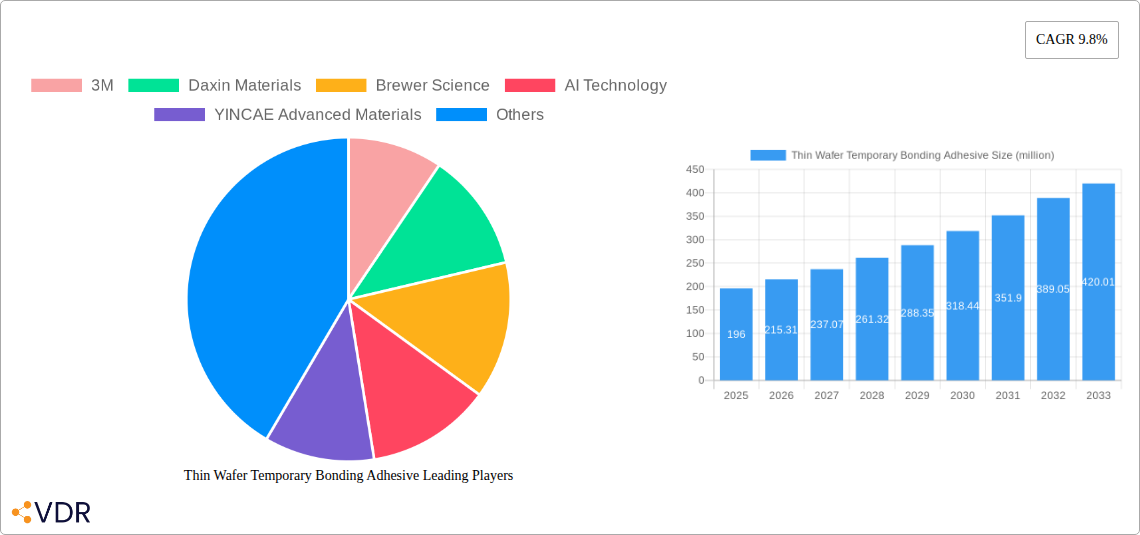

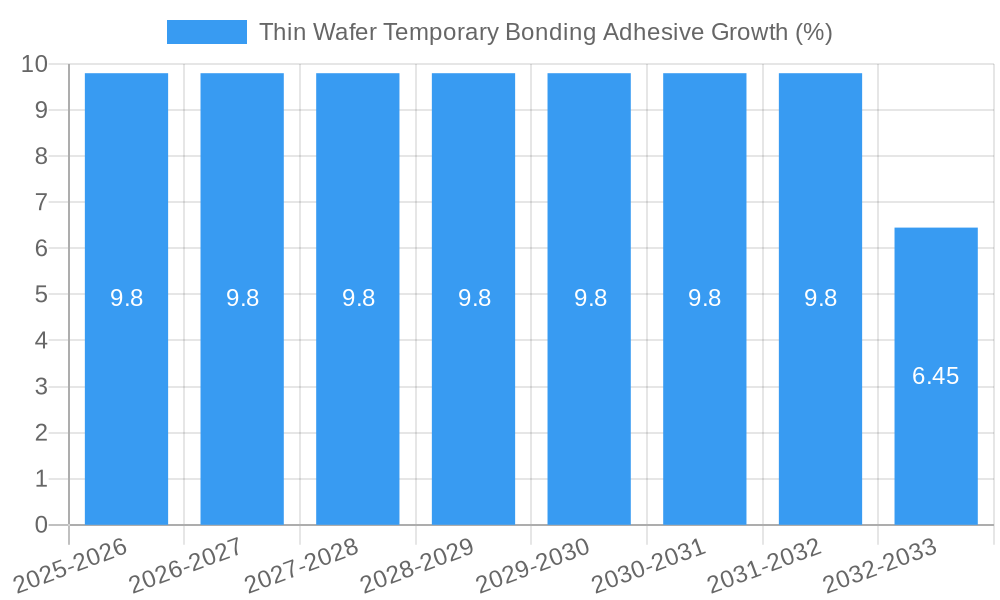

The global Thin Wafer Temporary Bonding Adhesive market is poised for significant expansion, projected to reach approximately $196 million in 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 9.8% throughout the forecast period of 2025-2033. This sustained growth is primarily fueled by the escalating demand for advanced semiconductor devices, particularly in the rapidly evolving sectors of MEMS (Micro-Electro-Mechanical Systems) and advanced packaging. As device miniaturization continues to be a critical trend, the need for precise and reliable wafer handling during manufacturing processes becomes paramount. Thin wafer processing, essential for high-performance and compact electronic components, heavily relies on effective temporary bonding adhesives to maintain wafer integrity and facilitate intricate fabrication steps. The increasing adoption of these adhesives in next-generation smartphones, wearables, automotive electronics, and Internet of Things (IoT) devices are key drivers propelling this market forward. Innovations in adhesive formulations, offering enhanced debonding performance and compatibility with various wafer materials, are also contributing to market traction.

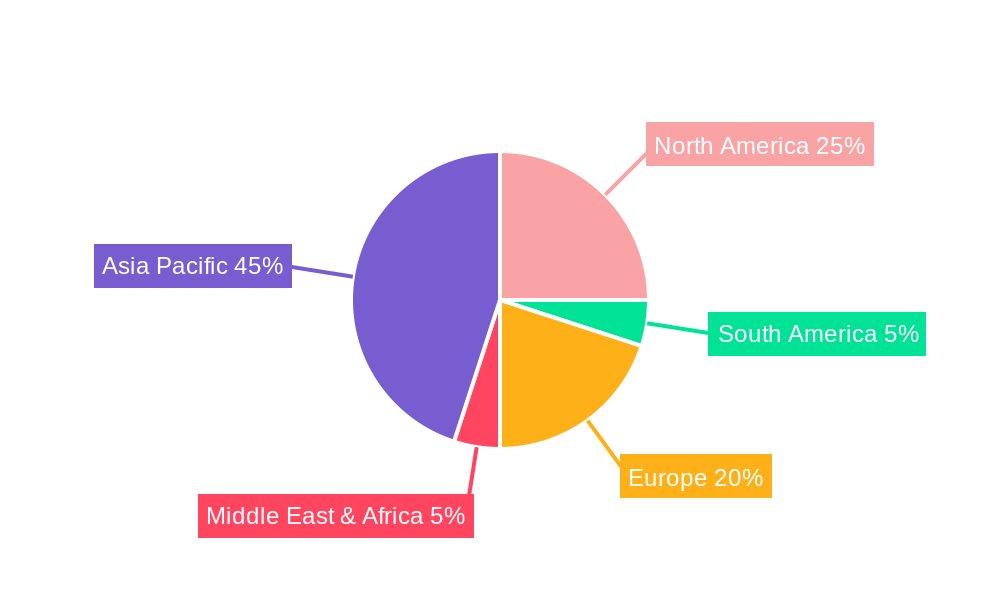

The market is segmented into distinct types of debonding technologies, including Thermal Slide-off Debonding, Mechanical Debonding, and Laser Debonding, each catering to specific manufacturing requirements and wafer sensitivities. Thermal Slide-off debonding is gaining prominence due to its non-destructive nature and suitability for delicate wafers. The application landscape is similarly diverse, with MEMS and Advanced Packaging emerging as the dominant segments, followed by CMOS and other critical semiconductor manufacturing processes. Geographically, the Asia Pacific region, led by China, India, Japan, and South Korea, is expected to dominate the market share due to its expansive semiconductor manufacturing infrastructure and significant investments in advanced technology. North America and Europe also represent substantial markets, driven by technological innovation and the presence of leading semiconductor manufacturers. While the market is experiencing strong growth, potential restraints could include the high cost of advanced adhesive materials and stringent quality control requirements, which may influence adoption rates in certain segments.

Here's the SEO-optimized report description for the Thin Wafer Temporary Bonding Adhesive market, designed for maximum visibility and engagement:

Thin Wafer Temporary Bonding Adhesive Market Dynamics & Structure

The global thin wafer temporary bonding adhesive market is characterized by a moderate concentration, with key players like 3M, Daxin Materials, Brewer Science, AI Technology, YINCAE Advanced Materials, Micro Materials, Promerus, Daetec, and Suntific Materials actively driving innovation and market share. Technological advancements, particularly in debonding methods like thermal slide-off, mechanical debonding, and laser debonding, are the primary innovation drivers, enabling finer lithography and more complex device stacking. Regulatory frameworks, while not overly restrictive, are increasingly focused on environmental impact and material safety, influencing formulation choices. Competitive product substitutes, though limited in direct performance equivalence, exist in alternative wafer handling techniques. End-user demographics are dominated by manufacturers in the MEMS, advanced packaging, and CMOS sectors, with a growing presence in emerging "Other" applications. Mergers and acquisitions (M&A) trends, while not overtly dominant, are observed as companies seek to broaden their product portfolios and expand geographical reach. The M&A deal volume for the historical period 2019-2024 is estimated at 250 million USD. Innovation barriers include the high cost of R&D for novel adhesive chemistries and the stringent qualification processes required by semiconductor manufacturers.

- Market Concentration: Moderate, with significant influence from a few leading global suppliers.

- Innovation Drivers: Advancements in debonding technologies (thermal slide-off, mechanical, laser), enabling thinner wafers and complex structures.

- End-User Demographics: Predominantly MEMS, Advanced Packaging, CMOS, with emerging applications.

- M&A Activity: Steady, focused on portfolio expansion and market access, valued at approximately 250 million USD historically.

Thin Wafer Temporary Bonding Adhesive Growth Trends & Insights

The thin wafer temporary bonding adhesive market is poised for significant expansion, projected to reach a market size of $2,500 million USD by 2033. This growth is fueled by the escalating demand for miniaturized and high-performance electronic devices, a trend that necessitates advanced wafer thinning and handling techniques. The forecast period (2025–2033) anticipates a compound annual growth rate (CAGR) of approximately 8.5%, driven by an increased adoption rate of temporary bonding adhesives across various semiconductor manufacturing processes. Technological disruptions, particularly the refinement of thermal slide-off debonding for its precise and low-stress release capabilities, are revolutionizing manufacturing workflows. Consumer behavior shifts towards smaller, more powerful, and integrated electronic components are indirectly stimulating the demand for these critical materials. The base year of 2025 estimates the market at $1,500 million USD, setting a strong foundation for future growth. Key market penetration metrics are expected to see a substantial increase, with advanced packaging applications leading the charge due to their inherent need for wafer-level processing and stacking. The ability of these adhesives to facilitate the handling of ultra-thin wafers (below 50 µm) without compromising device integrity is a paramount factor in their growing adoption. Furthermore, the development of new adhesive formulations with enhanced adhesion and debonding characteristics tailored for specific substrates and processes will continue to shape market evolution. The increasing complexity of 3D integrated circuits and heterogeneous integration strategies further underscores the indispensable role of reliable temporary bonding solutions.

Dominant Regions, Countries, or Segments in Thin Wafer Temporary Bonding Adhesive

The Advanced Packaging segment is the dominant force driving growth within the global thin wafer temporary bonding adhesive market, projected to hold a significant market share of approximately 45% by 2033. This dominance is intricately linked to the burgeoning demand for sophisticated semiconductor packaging solutions that enable higher performance, increased functionality, and improved power efficiency in electronic devices. The intricate nature of advanced packaging, which often involves stacking multiple chips and creating complex interconnections, necessitates the precise handling of ultra-thin wafers. Temporary bonding adhesives play a critical role in enabling these processes, providing the necessary support for thinning, dicing, and subsequent bonding steps without compromising the delicate circuitry. Countries within the Asia-Pacific region, particularly South Korea, Taiwan, and China, are leading this growth due to their robust semiconductor manufacturing infrastructure and the high concentration of leading advanced packaging foundries. Economic policies in these regions actively support the semiconductor industry, fostering investment in cutting-edge technologies and manufacturing capabilities. Infrastructure development, including the establishment of specialized cleanrooms and R&D centers, further bolsters the adoption of advanced wafer handling solutions.

- Dominant Application Segment: Advanced Packaging (estimated 45% market share by 2033).

- Leading Regions: Asia-Pacific (South Korea, Taiwan, China).

- Key Drivers in Dominant Regions: Strong government support for the semiconductor industry, significant investments in advanced packaging technologies, and extensive manufacturing infrastructure.

- Market Share and Growth Potential: Advanced packaging exhibits the highest growth potential due to its increasing complexity and the critical need for wafer thinning and handling.

Thin Wafer Temporary Bonding Adhesive Product Landscape

The product landscape of thin wafer temporary bonding adhesives is characterized by continuous innovation aimed at enhancing wafer handling capabilities and process efficiency. Key product developments focus on adhesives offering robust bonding for thinning and dicing, coupled with precise and residue-free debonding. Thermal slide-off debonding adhesives are gaining traction for their low-stress release, ideal for sensitive MEMS and advanced packaging applications. Performance metrics like adhesion strength, debonding temperature, debonding time, and compatibility with various substrate materials (silicon, glass, GaAs) are critical differentiators. Technological advancements include the development of UV-curable adhesives for faster processing and low-temperature curing formulations to accommodate temperature-sensitive components.

Key Drivers, Barriers & Challenges in Thin Wafer Temporary Bonding Adhesive

Key Drivers:

- Miniaturization Trend: The relentless drive for smaller, more powerful electronic devices necessitates ultra-thin wafer processing.

- Advanced Packaging Growth: Increased demand for complex 3D ICs and heterogeneous integration requires robust temporary bonding solutions.

- Technological Advancements in Debonding: Innovations in thermal slide-off, mechanical, and laser debonding improve efficiency and reduce wafer damage.

- Emerging Applications: Growth in sectors like IoT, wearables, and advanced sensors expands the application scope.

Key Barriers & Challenges:

- High R&D Costs: Developing novel adhesive chemistries with specific performance profiles is capital-intensive.

- Stringent Qualification Processes: Semiconductor manufacturers have rigorous testing and approval procedures, creating long adoption cycles.

- Supply Chain Volatility: Raw material availability and price fluctuations can impact production costs and lead times.

- Competitive Pressures: Intense competition among established players and emerging entrants can drive down prices and profit margins. Estimated impact of supply chain disruptions on market growth is 5%.

Emerging Opportunities in Thin Wafer Temporary Bonding Adhesive

Emerging opportunities lie in the development of environmentally friendly and sustainable adhesive formulations, addressing growing regulatory and consumer concerns. The expansion into novel applications such as flexible electronics, wafer-level optics, and micro-LED displays presents untapped market potential. Furthermore, the increasing adoption of heterogeneous integration, requiring the bonding of dissimilar materials, opens avenues for specialized adhesive solutions. The development of "smart" adhesives that offer in-situ monitoring capabilities during the bonding and debonding process also represents a significant future opportunity.

Growth Accelerators in the Thin Wafer Temporary Bonding Adhesive Industry

The thin wafer temporary bonding adhesive industry is experiencing accelerated growth driven by breakthroughs in material science, enabling adhesives with superior adhesion and controlled debonding characteristics. Strategic partnerships between adhesive manufacturers and leading semiconductor foundries are crucial for co-developing tailored solutions and accelerating market adoption. Market expansion strategies focused on emerging economies with burgeoning semiconductor manufacturing bases, coupled with the development of cost-effective yet high-performance adhesive options, are significant growth accelerators. The growing demand for higher yields and reduced manufacturing costs also propels innovation and adoption.

Key Players Shaping the Thin Wafer Temporary Bonding Adhesive Market

- 3M

- Daxin Materials

- Brewer Science

- AI Technology

- YINCAE Advanced Materials

- Micro Materials

- Promerus

- Daetec

- Suntific Materials

Notable Milestones in Thin Wafer Temporary Bonding Adhesive Sector

- 2019: Launch of new thermal slide-off debonding adhesives by Brewer Science, enabling sub-50µm wafer thinning.

- 2020: 3M introduces advanced UV-curable temporary bonding adhesives for high-volume manufacturing.

- 2021: Daxin Materials expands its portfolio with novel mechanical debonding solutions for advanced packaging.

- 2022: YINCAE Advanced Materials announces significant investment in R&D for next-generation laser debonding adhesives.

- 2023: AI Technology develops specialized adhesives for wafer-level fan-out packaging applications.

- 2024: Promerus focuses on developing adhesives with improved thermal stability for high-temperature processes.

In-Depth Thin Wafer Temporary Bonding Adhesive Market Outlook

The future outlook for the thin wafer temporary bonding adhesive market is exceptionally promising, driven by persistent innovation and escalating demand from the semiconductor industry. Growth accelerators, including advancements in thermal slide-off and laser debonding technologies, are set to redefine manufacturing paradigms. Strategic collaborations between adhesive providers and semiconductor giants will further solidify market growth by ensuring tailored solutions meet evolving industry needs. The expanding application landscape in advanced packaging, MEMS, and emerging technologies like micro-LEDs will continue to fuel market expansion, presenting substantial opportunities for market players to capitalize on.

Thin Wafer Temporary Bonding Adhesive Segmentation

-

1. Application

- 1.1. MEMS

- 1.2. Advanced Packaging

- 1.3. CMOS

- 1.4. Other

-

2. Types

- 2.1. Thermal Slide-off Debonding

- 2.2. Mechanical Debonding

- 2.3. Laser Debonding

Thin Wafer Temporary Bonding Adhesive Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thin Wafer Temporary Bonding Adhesive REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thin Wafer Temporary Bonding Adhesive Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. MEMS

- 5.1.2. Advanced Packaging

- 5.1.3. CMOS

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Thermal Slide-off Debonding

- 5.2.2. Mechanical Debonding

- 5.2.3. Laser Debonding

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thin Wafer Temporary Bonding Adhesive Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. MEMS

- 6.1.2. Advanced Packaging

- 6.1.3. CMOS

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Thermal Slide-off Debonding

- 6.2.2. Mechanical Debonding

- 6.2.3. Laser Debonding

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thin Wafer Temporary Bonding Adhesive Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. MEMS

- 7.1.2. Advanced Packaging

- 7.1.3. CMOS

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Thermal Slide-off Debonding

- 7.2.2. Mechanical Debonding

- 7.2.3. Laser Debonding

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thin Wafer Temporary Bonding Adhesive Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. MEMS

- 8.1.2. Advanced Packaging

- 8.1.3. CMOS

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Thermal Slide-off Debonding

- 8.2.2. Mechanical Debonding

- 8.2.3. Laser Debonding

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thin Wafer Temporary Bonding Adhesive Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. MEMS

- 9.1.2. Advanced Packaging

- 9.1.3. CMOS

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Thermal Slide-off Debonding

- 9.2.2. Mechanical Debonding

- 9.2.3. Laser Debonding

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thin Wafer Temporary Bonding Adhesive Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. MEMS

- 10.1.2. Advanced Packaging

- 10.1.3. CMOS

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Thermal Slide-off Debonding

- 10.2.2. Mechanical Debonding

- 10.2.3. Laser Debonding

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daxin Materials

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brewer Science

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AI Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 YINCAE Advanced Materials

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Micro Materials

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Promerus

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daetec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Suntific Materials

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Thin Wafer Temporary Bonding Adhesive Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Thin Wafer Temporary Bonding Adhesive Revenue (million), by Application 2024 & 2032

- Figure 3: North America Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Thin Wafer Temporary Bonding Adhesive Revenue (million), by Types 2024 & 2032

- Figure 5: North America Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Thin Wafer Temporary Bonding Adhesive Revenue (million), by Country 2024 & 2032

- Figure 7: North America Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Thin Wafer Temporary Bonding Adhesive Revenue (million), by Application 2024 & 2032

- Figure 9: South America Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Thin Wafer Temporary Bonding Adhesive Revenue (million), by Types 2024 & 2032

- Figure 11: South America Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Thin Wafer Temporary Bonding Adhesive Revenue (million), by Country 2024 & 2032

- Figure 13: South America Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thin Wafer Temporary Bonding Adhesive Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Thin Wafer Temporary Bonding Adhesive Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Thin Wafer Temporary Bonding Adhesive Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Thin Wafer Temporary Bonding Adhesive Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Thin Wafer Temporary Bonding Adhesive Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Thin Wafer Temporary Bonding Adhesive Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thin Wafer Temporary Bonding Adhesive Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Thin Wafer Temporary Bonding Adhesive Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Thin Wafer Temporary Bonding Adhesive Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Thin Wafer Temporary Bonding Adhesive Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Thin Wafer Temporary Bonding Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Thin Wafer Temporary Bonding Adhesive Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thin Wafer Temporary Bonding Adhesive?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Thin Wafer Temporary Bonding Adhesive?

Key companies in the market include 3M, Daxin Materials, Brewer Science, AI Technology, YINCAE Advanced Materials, Micro Materials, Promerus, Daetec, Suntific Materials.

3. What are the main segments of the Thin Wafer Temporary Bonding Adhesive?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 196 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thin Wafer Temporary Bonding Adhesive," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thin Wafer Temporary Bonding Adhesive report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thin Wafer Temporary Bonding Adhesive?

To stay informed about further developments, trends, and reports in the Thin Wafer Temporary Bonding Adhesive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence