Key Insights

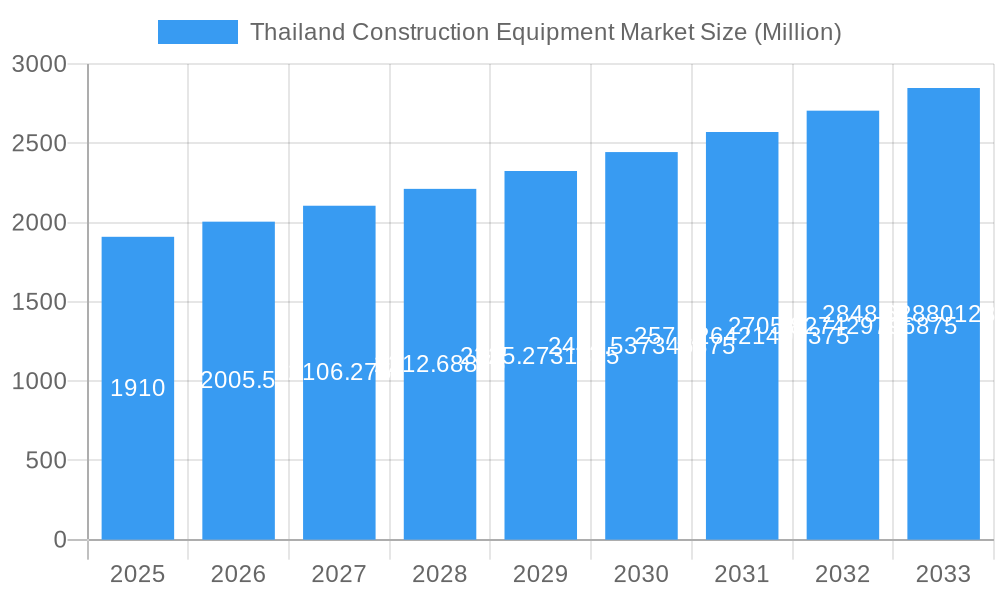

The Thailand construction equipment market, valued at $1.91 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This positive trajectory is fueled by sustained infrastructure development initiatives within Thailand, including ongoing investments in transportation networks (roads, railways, and airports), urban development projects, and industrial expansion. Government policies supporting infrastructure modernization and a growing construction sector are key drivers. The market is segmented by machinery type (cranes, telescopic handlers, excavators, loaders and backhoes, motor graders, and other machinery), and propulsion (internal combustion engine, electric, and hybrid). The dominance of internal combustion engine-powered equipment is expected to gradually diminish as the adoption of electric and hybrid models increases, driven by environmental concerns and government regulations promoting sustainable construction practices. Competitive pressures from established international players like Caterpillar, Komatsu, and JCB, alongside local manufacturers such as SANY Group and XCMG Group, contribute to a dynamic market landscape characterized by technological advancements and price competitiveness.

Thailand Construction Equipment Market Market Size (In Billion)

While the market presents significant opportunities, challenges exist. Fluctuations in raw material prices and potential economic slowdowns could impact equipment demand. Moreover, the increasing adoption of stricter emission norms could influence the market dynamics and require manufacturers to adapt. However, the long-term outlook remains optimistic due to the government's commitment to sustained infrastructure investment, which will continue to fuel demand for construction equipment in the coming years. The expanding middle class and urbanization further contribute to the market's upward trajectory. The market's diverse segmentations offer opportunities for specialized equipment providers to cater to specific construction needs and thereby capture substantial market shares.

Thailand Construction Equipment Market Company Market Share

Thailand Construction Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand construction equipment market, encompassing market dynamics, growth trends, key players, and future prospects. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The analysis delves into various segments, including machinery types (cranes, excavators, loaders, etc.) and propulsion systems (internal combustion engines, electric, and hybrid). The report is essential for industry professionals, investors, and stakeholders seeking a granular understanding of this dynamic market. Market values are presented in million units.

Thailand Construction Equipment Market Dynamics & Structure

The Thailand construction equipment market is characterized by a moderately concentrated landscape with a few dominant players and several regional and specialized competitors. Technological innovation, driven by the need for increased efficiency and sustainability, is a major driver. Stringent government regulations concerning safety and emissions are shaping market trends, while the availability of substitute technologies (e.g., automation) also plays a role. The end-user demographics are diverse, including large construction firms, smaller contractors, and government entities. M&A activity in recent years has been moderate, with a focus on consolidating market share and expanding geographic reach.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Focus on automation, electrification, and digitalization is driving product development.

- Regulatory Framework: Emphasis on safety, emissions, and environmental standards impacts equipment choices.

- M&A Activity: xx deals were recorded between 2019 and 2024, primarily focusing on consolidation.

- Innovation Barriers: High initial investment costs and limited skilled labor can hinder technological adoption.

Thailand Construction Equipment Market Growth Trends & Insights

The Thailand construction equipment market exhibited a CAGR of xx% during the historical period (2019-2024), driven by robust infrastructure development and government investment in large-scale projects. Adoption rates for advanced technologies like electric and hybrid machinery are gradually increasing, albeit from a low base. Consumer behavior is shifting towards more efficient, sustainable, and technologically advanced equipment. The market size is expected to reach xx million units in 2025 and continue growing at a CAGR of xx% during the forecast period (2025-2033). Increased urbanization and ongoing investments in transportation infrastructure are expected to further fuel market expansion. Technological disruptions, such as the increased adoption of autonomous systems and the development of electric and hybrid technologies, will continue to influence market growth dynamics.

Dominant Regions, Countries, or Segments in Thailand Construction Equipment Market

The Bangkok Metropolitan Region dominates the Thai construction equipment market, followed by other major urban centers and rapidly developing regions across the country. The Excavators segment holds the largest market share within the “By Machinery Type” category, fueled by ongoing infrastructure projects and urbanization. Within “By Propulsion”, the Internal Combustion Engine segment presently holds the majority of the market, however, growth in the Electric and Hybrid segment is expected to accelerate in the coming years driven by environmental concerns and government initiatives. This growth is fueled by factors such as government initiatives promoting infrastructure development, a booming construction sector fueled by both public and private investments, and the increasing demand for larger construction projects requiring heavy machinery.

- Key Drivers (Bangkok): High concentration of construction activity, robust infrastructure projects.

- Key Drivers (Other Regions): Government initiatives focused on regional development, expanding industrialization.

- Market Share: Excavators hold xx% of the By Machinery Type market, Internal Combustion Engines hold xx% of the By Propulsion market in 2025.

- Growth Potential: The Electric and Hybrid segment shows the highest growth potential.

Thailand Construction Equipment Market Product Landscape

The market offers a wide range of construction equipment, from traditional internal combustion engine-powered machines to advanced electric and hybrid models. Innovation is focused on enhancing efficiency, safety, and sustainability. Products incorporate advanced technologies such as telematics for remote monitoring, improved operator interfaces, and automated features. Unique selling propositions often center on fuel efficiency, reduced emissions, and enhanced productivity. The competitive landscape compels manufacturers to continuously introduce new features and models to stay ahead of the curve.

Key Drivers, Barriers & Challenges in Thailand Construction Equipment Market

Key Drivers:

- Government investment in infrastructure projects.

- Rising urbanization and industrialization.

- Technological advancements in efficiency and sustainability.

Challenges:

- Supply chain disruptions impacting equipment availability and costs.

- Stringent regulatory requirements increase compliance costs.

- Intense competition amongst numerous domestic and international players.

Emerging Opportunities in Thailand Construction Equipment Market

- Growing Demand for Sustainable and Eco-Friendly Equipment: The increasing focus on environmental sustainability is driving demand for electric, hybrid, and other low-emission construction equipment. Government initiatives promoting green construction practices further fuel this trend. This includes incentives for adopting energy-efficient technologies and stricter regulations on emissions.

- Expanding Adoption of Automation and Robotics: To enhance efficiency and safety, the construction sector in Thailand is progressively adopting automation technologies. This includes robotic-assisted construction, autonomous vehicles, and Building Information Modeling (BIM) integration, leading to increased demand for equipment compatible with these technologies.

- Untapped Potential in Smaller Regional Markets: Beyond the major urban centers like Bangkok, significant opportunities exist in developing Thailand's infrastructure across smaller cities and provinces. This presents a considerable market for smaller, more versatile construction equipment.

- Development of Specialized Equipment for Niche Construction Applications: The diversification of construction projects in Thailand, including specialized infrastructure and high-rise buildings, necessitates the development and adoption of specialized construction equipment to meet unique demands. This includes equipment for specific materials, terrains, and construction techniques.

- Infrastructure Development Projects: Large-scale infrastructure projects funded by both public and private sectors present significant growth potential for construction equipment sales. These include road expansions, rail projects, and urban development initiatives.

Growth Accelerators in the Thailand Construction Equipment Market Industry

Sustained growth in the Thailand construction equipment market will be propelled by continuous infrastructure development, urbanization, and ongoing investments in both private and public sector projects. Further expansion will be fueled by technological advancements in automation and the rising popularity of sustainable solutions. Strategic partnerships between equipment manufacturers and construction firms can play a significant role in accelerating market expansion and facilitating wider adoption of new technologies.

Key Players Shaping the Thailand Construction Equipment Market Market

- Kobelco Construction Machinery

- CNH Industrial N V

- Hitachi Construction Equipment Co Ltd

- Liebherr Group

- JC Bamford Excavators Ltd (JCB)

- Caterpillar Inc

- Komatsu Ltd

- Zoomlion Heavy Industry Science And Technology Co Ltd

- SANY Group

- Hyundai Construction Equipment Co Ltd

- XCMG Group

Notable Milestones in Thailand Construction Equipment Market Sector

- June 2023: Volo Construction Equipment launches the region's first fully electric construction machines, signifying a commitment to sustainable practices and aiming for 35% electric machine sales by 2030. This launch highlights the growing importance of environmentally friendly equipment in the Thai market.

- January 2023: Tadano Ltd. introduces the TM-ZX1205HRS loader crane, a high-capacity crane (12 tons) meeting the demands of the Thai construction sector. This launch indicates the need for heavy-duty equipment to support large-scale infrastructure projects.

- [Add more recent milestones here with dates and brief descriptions. Include details on new product launches, significant investments, mergers and acquisitions, or changes in government regulations affecting the sector.]

In-Depth Thailand Construction Equipment Market Outlook

The Thailand construction equipment market is poised for continued robust growth, driven by the nation's ongoing development strategy and the increasing complexity of large-scale construction projects. The adoption of innovative technologies, combined with strategic partnerships and investment in infrastructure, will be key to unlocking further growth potential in the coming years. Companies focusing on sustainability and offering technologically advanced, efficient equipment are best positioned to capitalize on emerging market opportunities.

Thailand Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders and Backhoe

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Propulsion

- 2.1. Internal Combustion Engine

- 2.2. Electric and Hybrid

Thailand Construction Equipment Market Segmentation By Geography

- 1. Thailand

Thailand Construction Equipment Market Regional Market Share

Geographic Coverage of Thailand Construction Equipment Market

Thailand Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure Activities Across the Country

- 3.3. Market Restrains

- 3.3.1. Rapid Expansion of Construction Equipment Industry

- 3.4. Market Trends

- 3.4.1. Growing Infrastructure Activities To Drive Demand In The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoe

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric and Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNH Industrial N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Construction Equipment Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Liebherr Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JC Bamford Excavators Ltd (JCB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Komatsu Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zoomlion Heavy Industry Science And Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SANY Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hyundai Construction Equipment Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 XCMG Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Thailand Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Thailand Construction Equipment Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 3: Thailand Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Thailand Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 5: Thailand Construction Equipment Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 6: Thailand Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Construction Equipment Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Thailand Construction Equipment Market?

Key companies in the market include Kobelco Construction Machinery, CNH Industrial N V, Hitachi Construction Equipment Co Ltd, Liebherr Group, JC Bamford Excavators Ltd (JCB, Caterpillar Inc, Komatsu Ltd, Zoomlion Heavy Industry Science And Technology Co Ltd, SANY Group, Hyundai Construction Equipment Co Ltd, XCMG Group.

3. What are the main segments of the Thailand Construction Equipment Market?

The market segments include Machinery Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure Activities Across the Country.

6. What are the notable trends driving market growth?

Growing Infrastructure Activities To Drive Demand In The Market.

7. Are there any restraints impacting market growth?

Rapid Expansion of Construction Equipment Industry.

8. Can you provide examples of recent developments in the market?

June 2023: Volo Construction Equipment made a groundbreaking entry into the Southeast Asian market by unveiling the region's inaugural fully electric construction machines. This significant development underscores the company's commitment to advancing sustainable practices in the construction industry. Volo Construction Equipment has set an ambitious goal to have 35% of the machines it sells powered by electricity by the year 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Thailand Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence