Key Insights

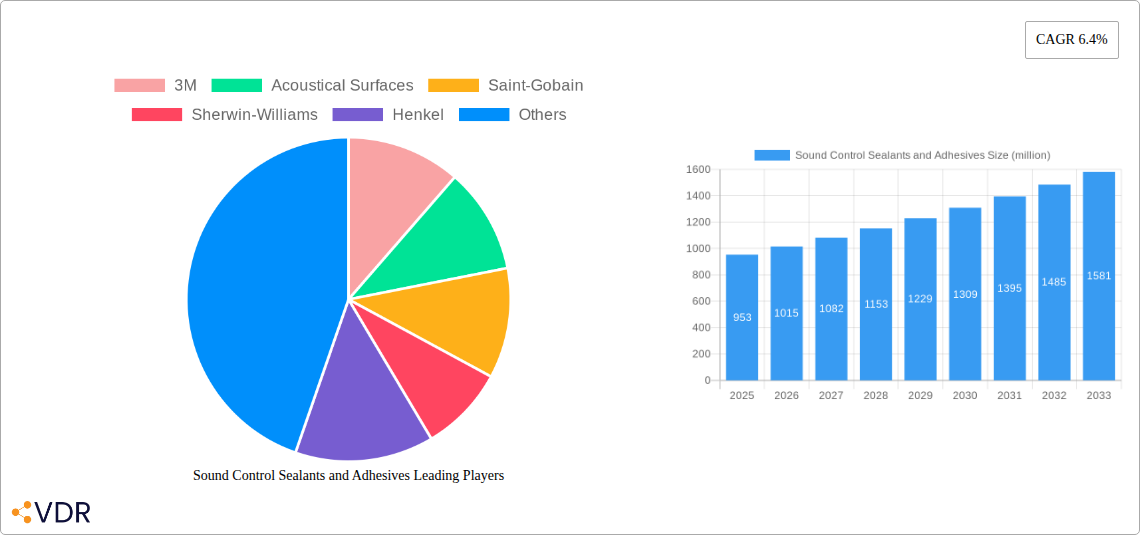

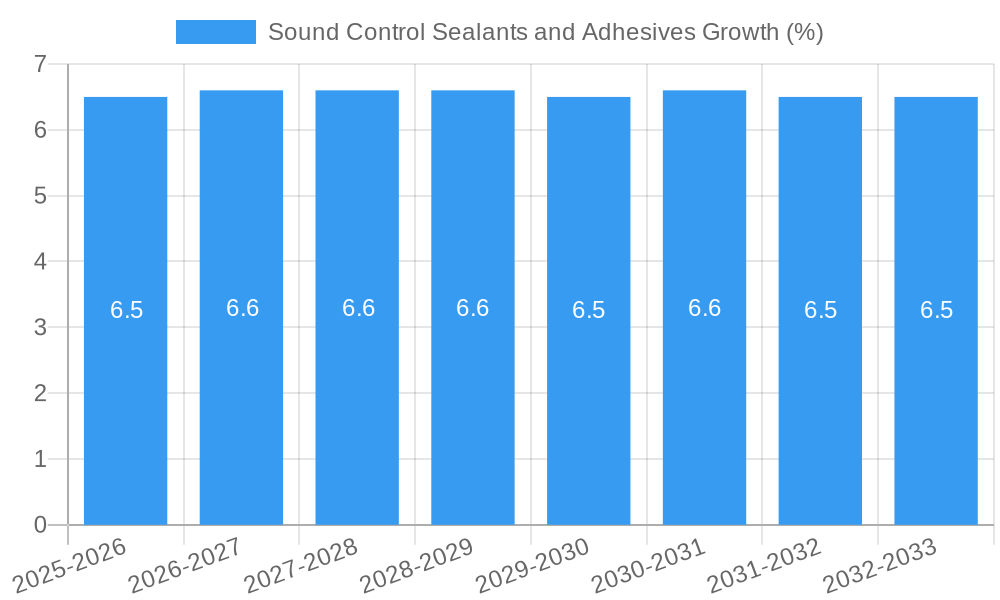

The global sound control sealants and adhesives market is poised for robust expansion, projected to reach an estimated USD 953 million in 2025 and grow at a healthy Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This significant growth is primarily fueled by escalating demand across diverse end-use industries seeking enhanced acoustic performance and noise reduction solutions. The construction sector stands out as a major driver, with increasing urbanization and a greater emphasis on creating quieter living and working environments driving the adoption of advanced sound dampening materials. Stringent building codes and a growing awareness of the health and productivity benefits associated with reduced noise pollution further bolster this trend.

Beyond construction, the automotive industry is a substantial contributor, as manufacturers continuously strive to deliver more refined and comfortable driving experiences. This includes reducing engine noise, road noise, and vibrations, for which specialized sealants and adhesives are crucial. The aerospace sector also presents considerable opportunities, with a persistent need for lightweight yet highly effective acoustic solutions to enhance passenger comfort and operational efficiency. Emerging applications within the industrial sector, particularly in manufacturing facilities requiring noise mitigation for worker safety and productivity, also contribute to market dynamism. Innovations in material science, leading to the development of more sustainable, high-performance, and easier-to-apply sound control products, are expected to further accelerate market penetration and adoption.

Sound Control Sealants and Adhesives Market Dynamics & Structure

The global sound control sealants and adhesives market exhibits a moderately consolidated structure, with key players like 3M, Henkel, and Sika dominating significant market shares. Technological innovation remains a primary driver, with continuous advancements in material science leading to enhanced acoustic performance, durability, and ease of application. Regulatory frameworks, particularly concerning environmental impact and building codes that mandate noise reduction, are increasingly influencing product development and market access. Competitive product substitutes, such as traditional insulation materials and passive acoustic treatments, are present but are increasingly being supplemented by specialized sealants and adhesives that offer integrated sound dampening properties. End-user demographics are shifting towards a greater demand for comfort and well-being, especially in urban environments and specialized applications like automotive and aerospace, driving the adoption of advanced sound control solutions. Mergers and acquisitions (M&A) activity is moderate, with larger companies strategically acquiring smaller innovators to expand their product portfolios and market reach. For instance, over the historical period (2019-2024), an estimated 15 M&A deals in the specialty chemical sector focused on acoustic solutions have occurred. Innovation barriers include the high cost of R&D for novel formulations and the need for extensive testing and certification to meet stringent performance standards.

- Market Concentration: Moderately consolidated with 3M, Henkel, Sika, Saint-Gobain, and Sherwin-Williams holding a combined market share of approximately 65% in 2025.

- Technological Innovation: Focus on advanced polymer chemistries for improved sound absorption and damping, as well as smart materials with self-healing capabilities.

- Regulatory Frameworks: Stringent building codes in North America and Europe mandating noise pollution reduction; REACH and other environmental regulations influencing material sourcing and formulation.

- Competitive Product Substitutes: Traditional insulation, vibration damping materials, acoustic panels.

- End-User Demographics: Growing demand from residential construction for quieter living spaces, increasing preference for silent cabins in automotive and aerospace industries.

- M&A Trends: Strategic acquisitions of niche players by established chemical giants to bolster acoustic product lines. Estimated 15 M&A deals within the historical period (2019-2024).

Sound Control Sealants and Adhesives Growth Trends & Insights

The global sound control sealants and adhesives market is poised for robust growth, driven by escalating awareness of noise pollution's detrimental effects on health and productivity, coupled with increasingly stringent environmental regulations across developed and emerging economies. The market size, valued at an estimated $7,500 million units in the base year 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period (2025-2033). This expansion is significantly influenced by the escalating demand for enhanced acoustic comfort in residential and commercial buildings, where soundproofing solutions are becoming a standard requirement rather than a luxury. In the automotive sector, the pursuit of quieter cabin experiences, a key differentiator for premium vehicles, fuels the adoption of advanced sound control adhesives and sealants for vibration dampening and noise insulation. The aerospace industry also presents a substantial growth avenue, as manufacturers strive to reduce cabin noise for passenger comfort and crew well-being, particularly in long-haul flights. Industrial applications, ranging from machinery enclosures to HVAC systems, are also experiencing increased demand for effective noise mitigation solutions to comply with workplace safety regulations and improve operational efficiency.

Technological disruptions are playing a pivotal role in shaping market evolution. Innovations in nanotechnology have led to the development of sealants and adhesives with superior sound-absorbing properties at reduced material thicknesses. Furthermore, the integration of smart functionalities, such as self-healing capabilities and advanced curing technologies, is enhancing product performance and durability, thereby increasing their attractiveness to end-users. Consumer behavior is shifting towards a greater appreciation for acoustically comfortable environments, influencing purchasing decisions in both the consumer electronics and building sectors. The increasing trend of urbanization further amplifies the need for effective sound control solutions in densely populated areas. Market penetration is deepening as awareness about the benefits of these products grows, with manufacturers actively educating consumers and specifiers about their efficacy. The historical period (2019-2024) saw a steady market expansion, laying the groundwork for the accelerated growth anticipated in the forecast period. Key performance indicators such as market size in million units and CAGR are critical for understanding the trajectory. For instance, the market size in 2019 was approximately $5,800 million units, indicating a strong foundation for future growth.

- Market Size Evolution: Projected to grow from an estimated $7,500 million units in 2025 to over $12,000 million units by 2033.

- CAGR: Expected to be approximately 7.2% during the forecast period (2025-2033).

- Adoption Rates: Increasing significantly in residential construction due to rising noise pollution concerns and premiumization trends.

- Technological Disruptions: Nanotechnology, smart materials, advanced curing technologies are enhancing product performance.

- Consumer Behavior Shifts: Growing preference for quiet and comfortable living and working spaces, influencing purchasing decisions.

- Market Penetration: Deepening as awareness of acoustic benefits expands across various end-use industries.

- Historical Market Size (2019): Approximately $5,800 million units.

Dominant Regions, Countries, or Segments in Sound Control Sealants and Adhesives

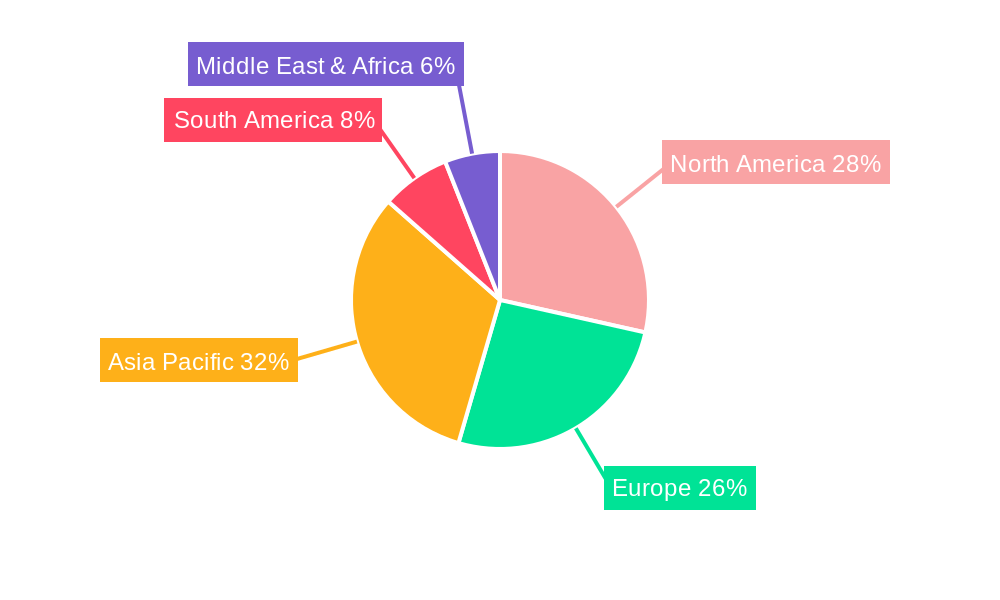

The Construction application segment is unequivocally the dominant force driving the global sound control sealants and adhesives market. This dominance stems from the escalating demand for noise reduction in residential, commercial, and institutional buildings, particularly in urbanized and densely populated areas. Stringent building codes and regulations in regions like North America and Europe, aimed at mitigating noise pollution and enhancing occupant well-being, mandate the use of effective soundproofing materials, including specialized sealants and adhesives. The market share within this segment is significant, accounting for an estimated 55% of the total market in 2025. Key drivers include the growing trend of smart home technologies that integrate acoustic comfort, the development of sustainable and eco-friendly building materials, and the increasing awareness among architects, builders, and homeowners about the health benefits associated with quieter environments.

Within the Types segmentation, Sealants hold a slightly larger market share, estimated at 52% in 2025, compared to adhesives. This is primarily due to their critical role in sealing gaps and cracks that are primary pathways for sound transmission in buildings and vehicles. Their ability to provide both acoustic insulation and weatherproofing makes them indispensable in construction and automotive applications.

North America, particularly the United States, stands out as a dominant country within this market, driven by a combination of factors including high disposable incomes, a strong focus on premium construction and automotive standards, and robust regulatory enforcement. The market share for North America is estimated at 30% in 2025. Canada also contributes significantly due to similar environmental concerns and building standards.

The Automotive application segment is the second-largest contributor, with an estimated market share of 25% in 2025. The relentless pursuit of quieter cabin experiences in vehicles, a key differentiator for automotive manufacturers, fuels the demand for advanced sound control sealants and adhesives for vibration dampening, sealing engine noise, and reducing road noise. The growth in electric vehicles (EVs) also presents a unique opportunity, as the absence of engine noise makes other ambient sounds more noticeable, thereby increasing the demand for superior acoustic solutions.

- Dominant Application Segment: Construction (estimated 55% market share in 2025).

- Key Drivers: Urbanization, stringent building codes, demand for enhanced occupant comfort, growth of green building initiatives.

- Market Share in Construction: Estimated at 55% of the total market in 2025.

- Growth Potential: Continued strong growth due to ongoing urbanization and increasing emphasis on well-being.

- Dominant Type: Sealants (estimated 52% market share in 2025).

- Key Drivers: Versatility in sealing air gaps, vibration dampening properties, integration with other functional requirements like weatherproofing.

- Dominant Region/Country: North America (estimated 30% market share in 2025), specifically the United States.

- Key Drivers: High consumer spending, advanced automotive and construction industries, strong regulatory framework for noise control.

- Second Largest Application Segment: Automotive (estimated 25% market share in 2025).

- Key Drivers: Demand for quieter vehicle cabins, growth of EV market, increasing focus on passenger comfort.

Sound Control Sealants and Adhesives Product Landscape

The product landscape of sound control sealants and adhesives is characterized by continuous innovation focused on enhancing acoustic performance, improving ease of application, and meeting sustainability demands. Manufacturers are developing advanced formulations that offer superior sound absorption and damping across a wider range of frequencies. This includes novel polymer chemistries, the incorporation of micro-encapsulated damping agents, and the integration of lightweight, high-performance materials. Products are tailored for specific applications, such as low-VOC (Volatile Organic Compound) sealants for residential construction and high-temperature resistant adhesives for automotive under-hood applications. Unique selling propositions often revolve around the balance of acoustic performance, durability, and cost-effectiveness. Technological advancements are also seen in application methods, with the introduction of sprayable and extrudable solutions that simplify installation and reduce labor costs.

Key Drivers, Barriers & Challenges in Sound Control Sealants and Adhesives

Key Drivers:

- Increasing Urbanization and Noise Pollution: Growing global population density amplifies the need for effective noise mitigation solutions in residential and commercial spaces.

- Stringent Environmental Regulations: Building codes and noise pollution directives in various regions mandate improved acoustic performance, driving demand.

- Technological Advancements: Development of higher-performance, lightweight, and easier-to-apply sound control materials.

- Growing Demand for Comfort and Well-being: Consumers and industries are increasingly prioritizing quiet environments for better productivity and quality of life.

- Growth in Automotive and Aerospace Industries: The continuous pursuit of quieter cabins in vehicles and aircraft fuels demand for specialized acoustic solutions.

Barriers & Challenges:

- High Cost of R&D and Raw Materials: Developing and sourcing advanced materials for superior acoustic performance can be expensive, impacting product pricing.

- Lack of Awareness and Education: In some developing markets, awareness of the benefits and applications of specialized sound control sealants and adhesives may be limited.

- Performance Variability and Testing: Ensuring consistent performance across diverse environmental conditions and application methods requires rigorous testing and quality control.

- Competition from Traditional Insulation: Established insulation materials can pose a competitive challenge, especially in price-sensitive markets.

- Supply Chain Disruptions: The global nature of the chemical industry can expose the market to disruptions in raw material availability and logistics, impacting production and delivery. Estimated impact on market growth could be around 1-2% annually in case of severe disruptions.

Emerging Opportunities in Sound Control Sealants and Adhesives

Emerging opportunities lie in the development of bio-based and recyclable sound control sealants and adhesives, aligning with the growing global emphasis on sustainability and circular economy principles. The expanding electric vehicle (EV) market presents a significant untapped area, as the absence of engine noise highlights the need for enhanced cabin acoustics. Furthermore, the integration of smart technologies, such as self-healing sealants that can automatically repair minor damage, offers a compelling value proposition for long-term performance. Growth in emerging economies, particularly in Asia-Pacific, with increasing disposable incomes and infrastructure development, represents a vast untapped market for residential and industrial acoustic solutions. The rise of modular construction and prefabricated buildings also creates opportunities for specialized, easy-to-apply acoustic sealants and adhesives.

Growth Accelerators in the Sound Control Sealants and Adhesives Industry

Several key factors are accelerating growth in the sound control sealants and adhesives industry. Technological breakthroughs, such as the development of advanced nanocomposite materials that significantly enhance sound dampening capabilities, are a major catalyst. Strategic partnerships between chemical manufacturers and end-use industry leaders (e.g., automotive OEMs, construction firms) are fostering co-development and rapid adoption of innovative solutions. Market expansion strategies targeting emerging economies with tailored product offerings and localized distribution networks are opening new revenue streams. The increasing focus on occupant comfort and health in building design and vehicle manufacturing, driven by both consumer demand and regulatory pressures, acts as a powerful growth accelerator. Furthermore, the trend towards multi-functional materials that offer both acoustic performance and other benefits like fire resistance or thermal insulation further boosts market attractiveness.

Key Players Shaping the Sound Control Sealants and Adhesives Market

- 3M

- Acoustical Surfaces

- Saint-Gobain

- Sherwin-Williams

- Henkel

- Sika

- Grabber Construction Products

- DAP Global

- deVan Sealants

- Nitto Denko

- Scapa

- HB Fuller

- Pyrotek

- Hanno Werk

- Avery Dennison

- Bostik

Notable Milestones in Sound Control Sealants and Adhesives Sector

- 2019: Introduction of bio-based acoustic sealants by several key players, responding to sustainability demands.

- 2020: Significant increase in R&D investment towards advanced damping materials for automotive applications due to rising EV adoption.

- 2021: Launch of a new generation of lightweight, high-performance acoustic adhesives for aerospace, improving fuel efficiency and cabin comfort.

- 2022: Major regulatory bodies in Europe and North America begin reviewing and updating building codes to include stricter noise insulation standards.

- 2023: Acquisition of a niche acoustic materials company by a leading chemical conglomerate to expand its product portfolio.

- 2024: Advancements in nanotechnology lead to the development of sealants with unprecedented sound absorption coefficients.

In-Depth Sound Control Sealants and Adhesives Market Outlook

The future outlook for the sound control sealants and adhesives market is exceptionally promising, driven by persistent global megatrends such as urbanization, environmental consciousness, and the pursuit of enhanced quality of life. Growth accelerators, including groundbreaking material science innovations, strategic collaborations, and aggressive market expansion into burgeoning economies, will continue to fuel this upward trajectory. The integration of smart functionalities and sustainable formulations will redefine product offerings, catering to increasingly sophisticated end-user demands. The market is set to witness continued innovation in product performance, application ease, and environmental responsibility, solidifying its position as a critical component in modern construction, automotive, and industrial sectors. Strategic opportunities abound for companies that can adeptly navigate technological advancements and evolving regulatory landscapes.

Sound Control Sealants and Adhesives Segmentation

-

1. Application

- 1.1. Construction

- 1.2. Automotive

- 1.3. Aerospace

- 1.4. Industrial

- 1.5. Other

-

2. Types

- 2.1. Sealants

- 2.2. Adhesives

Sound Control Sealants and Adhesives Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sound Control Sealants and Adhesives REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sound Control Sealants and Adhesives Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction

- 5.1.2. Automotive

- 5.1.3. Aerospace

- 5.1.4. Industrial

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Sealants

- 5.2.2. Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sound Control Sealants and Adhesives Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Construction

- 6.1.2. Automotive

- 6.1.3. Aerospace

- 6.1.4. Industrial

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Sealants

- 6.2.2. Adhesives

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sound Control Sealants and Adhesives Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Construction

- 7.1.2. Automotive

- 7.1.3. Aerospace

- 7.1.4. Industrial

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Sealants

- 7.2.2. Adhesives

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sound Control Sealants and Adhesives Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Construction

- 8.1.2. Automotive

- 8.1.3. Aerospace

- 8.1.4. Industrial

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Sealants

- 8.2.2. Adhesives

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sound Control Sealants and Adhesives Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Construction

- 9.1.2. Automotive

- 9.1.3. Aerospace

- 9.1.4. Industrial

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Sealants

- 9.2.2. Adhesives

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sound Control Sealants and Adhesives Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Construction

- 10.1.2. Automotive

- 10.1.3. Aerospace

- 10.1.4. Industrial

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Sealants

- 10.2.2. Adhesives

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Acoustical Surfaces

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saint-Gobain

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sherwin-Williams

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Henkel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sika

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grabber Construction Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DAP Global

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 deVan Sealants

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nitto Denko

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Scapa

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HB Fuller

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pyrotek

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hanno Werk

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Avery Dennison

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bostik

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Sound Control Sealants and Adhesives Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Sound Control Sealants and Adhesives Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Sound Control Sealants and Adhesives Revenue (million), by Application 2024 & 2032

- Figure 4: North America Sound Control Sealants and Adhesives Volume (K), by Application 2024 & 2032

- Figure 5: North America Sound Control Sealants and Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Sound Control Sealants and Adhesives Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Sound Control Sealants and Adhesives Revenue (million), by Types 2024 & 2032

- Figure 8: North America Sound Control Sealants and Adhesives Volume (K), by Types 2024 & 2032

- Figure 9: North America Sound Control Sealants and Adhesives Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Sound Control Sealants and Adhesives Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Sound Control Sealants and Adhesives Revenue (million), by Country 2024 & 2032

- Figure 12: North America Sound Control Sealants and Adhesives Volume (K), by Country 2024 & 2032

- Figure 13: North America Sound Control Sealants and Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Sound Control Sealants and Adhesives Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Sound Control Sealants and Adhesives Revenue (million), by Application 2024 & 2032

- Figure 16: South America Sound Control Sealants and Adhesives Volume (K), by Application 2024 & 2032

- Figure 17: South America Sound Control Sealants and Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Sound Control Sealants and Adhesives Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Sound Control Sealants and Adhesives Revenue (million), by Types 2024 & 2032

- Figure 20: South America Sound Control Sealants and Adhesives Volume (K), by Types 2024 & 2032

- Figure 21: South America Sound Control Sealants and Adhesives Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Sound Control Sealants and Adhesives Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Sound Control Sealants and Adhesives Revenue (million), by Country 2024 & 2032

- Figure 24: South America Sound Control Sealants and Adhesives Volume (K), by Country 2024 & 2032

- Figure 25: South America Sound Control Sealants and Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Sound Control Sealants and Adhesives Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Sound Control Sealants and Adhesives Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Sound Control Sealants and Adhesives Volume (K), by Application 2024 & 2032

- Figure 29: Europe Sound Control Sealants and Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Sound Control Sealants and Adhesives Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Sound Control Sealants and Adhesives Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Sound Control Sealants and Adhesives Volume (K), by Types 2024 & 2032

- Figure 33: Europe Sound Control Sealants and Adhesives Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Sound Control Sealants and Adhesives Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Sound Control Sealants and Adhesives Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Sound Control Sealants and Adhesives Volume (K), by Country 2024 & 2032

- Figure 37: Europe Sound Control Sealants and Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Sound Control Sealants and Adhesives Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Sound Control Sealants and Adhesives Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Sound Control Sealants and Adhesives Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Sound Control Sealants and Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Sound Control Sealants and Adhesives Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Sound Control Sealants and Adhesives Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Sound Control Sealants and Adhesives Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Sound Control Sealants and Adhesives Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Sound Control Sealants and Adhesives Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Sound Control Sealants and Adhesives Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Sound Control Sealants and Adhesives Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Sound Control Sealants and Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Sound Control Sealants and Adhesives Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Sound Control Sealants and Adhesives Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Sound Control Sealants and Adhesives Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Sound Control Sealants and Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Sound Control Sealants and Adhesives Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Sound Control Sealants and Adhesives Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Sound Control Sealants and Adhesives Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Sound Control Sealants and Adhesives Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Sound Control Sealants and Adhesives Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Sound Control Sealants and Adhesives Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Sound Control Sealants and Adhesives Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Sound Control Sealants and Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Sound Control Sealants and Adhesives Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sound Control Sealants and Adhesives Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Sound Control Sealants and Adhesives Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Sound Control Sealants and Adhesives Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Sound Control Sealants and Adhesives Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Sound Control Sealants and Adhesives Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Sound Control Sealants and Adhesives Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Sound Control Sealants and Adhesives Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Sound Control Sealants and Adhesives Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Sound Control Sealants and Adhesives Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Sound Control Sealants and Adhesives Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Sound Control Sealants and Adhesives Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Sound Control Sealants and Adhesives Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Sound Control Sealants and Adhesives Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Sound Control Sealants and Adhesives Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Sound Control Sealants and Adhesives Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Sound Control Sealants and Adhesives Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Sound Control Sealants and Adhesives Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Sound Control Sealants and Adhesives Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Sound Control Sealants and Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Sound Control Sealants and Adhesives Volume K Forecast, by Country 2019 & 2032

- Table 81: China Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Sound Control Sealants and Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Sound Control Sealants and Adhesives Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sound Control Sealants and Adhesives?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Sound Control Sealants and Adhesives?

Key companies in the market include 3M, Acoustical Surfaces, Saint-Gobain, Sherwin-Williams, Henkel, Sika, Grabber Construction Products, DAP Global, deVan Sealants, Nitto Denko, Scapa, HB Fuller, Pyrotek, Hanno Werk, Avery Dennison, Bostik.

3. What are the main segments of the Sound Control Sealants and Adhesives?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 953 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sound Control Sealants and Adhesives," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sound Control Sealants and Adhesives report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sound Control Sealants and Adhesives?

To stay informed about further developments, trends, and reports in the Sound Control Sealants and Adhesives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence