Key Insights

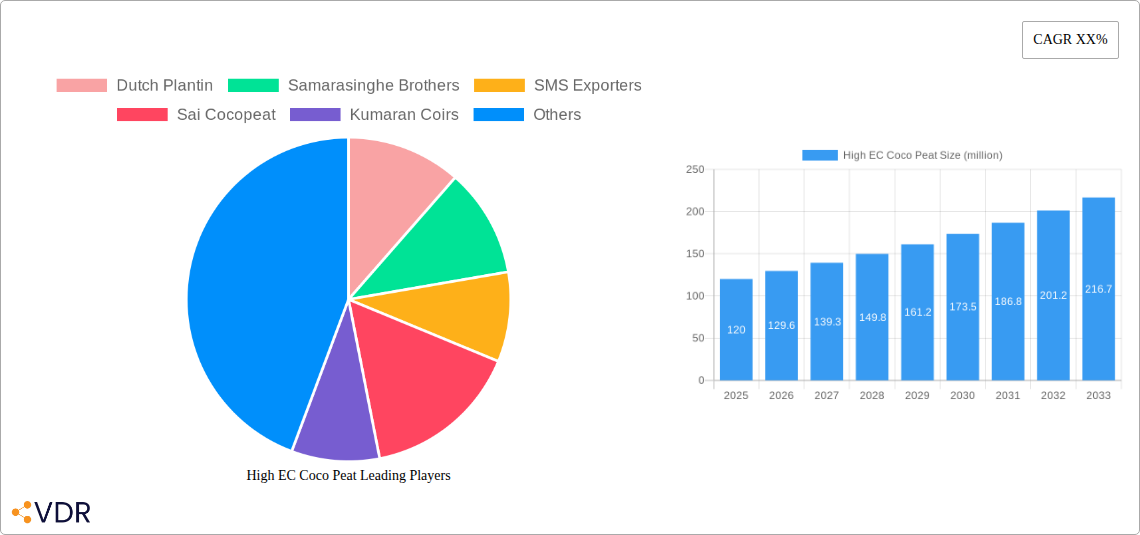

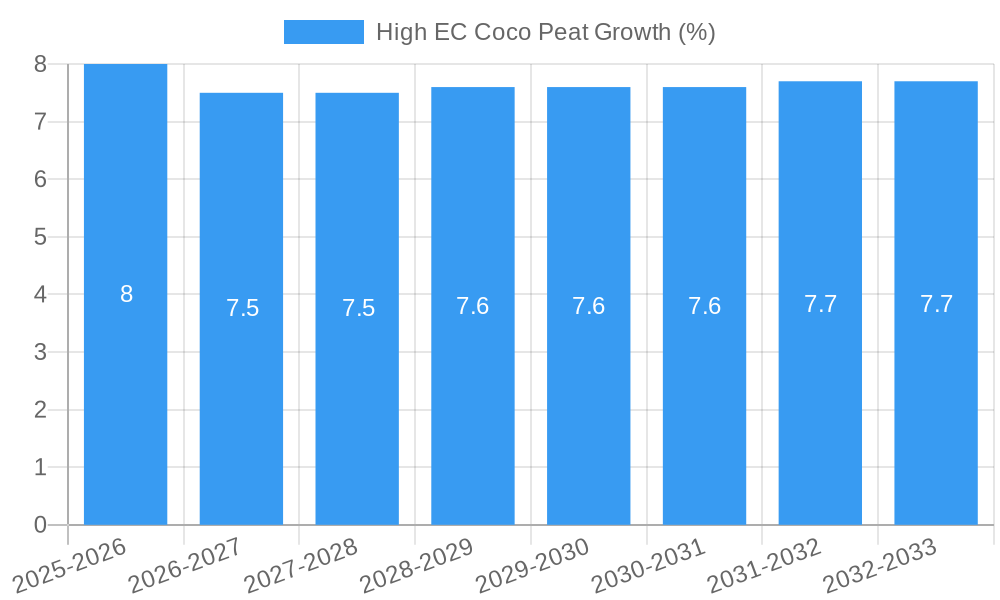

The global High EC Coco Peat market is projected for robust growth, estimated at USD 120 million in 2025 and anticipated to expand at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is primarily fueled by the escalating demand for sustainable and eco-friendly agricultural inputs, particularly in horticulture and floriculture. The inherent benefits of coco peat, such as excellent water retention, aeration, and soil conditioning properties, make it an indispensable component in modern farming practices aimed at enhancing crop yield and quality. The increasing adoption of hydroponic and soilless farming techniques globally further bolsters market prospects, as coco peat offers a sterile, renewable, and pH-neutral growing medium. Furthermore, the packaging sector is increasingly turning to coco peat as a sustainable alternative to conventional materials for cushioning and protective purposes, driven by a growing consumer preference for environmentally conscious products.

Despite the promising outlook, certain factors could temper the market's trajectory. The "restrains" component, while not explicitly quantified, likely pertains to logistical challenges in transporting bulky coco peat, potential fluctuations in raw material availability due to climate-related issues impacting coconut production, and the development of competing sustainable growing media. However, the overarching trend towards environmental sustainability and the inherent advantages of High EC Coco Peat are expected to outweigh these constraints. Key market players are actively investing in research and development to improve processing techniques, optimize product quality, and expand their global reach. The "Trends" section suggests a focus on innovation in product applications and a push towards greater market penetration in emerging economies, further solidifying coco peat's position as a vital component in various industries.

This comprehensive report offers an in-depth analysis of the global High EC Coco Peat market, forecasting its trajectory from 2019 to 2033 with a base year of 2025. It delves into market dynamics, growth drivers, regional dominance, product innovations, and competitive strategies, providing invaluable insights for stakeholders in the horticulture, agriculture, and packaging industries. With a focus on agricultural coco peat, horticultural coco peat, and sustainable coco peat, this report is essential for understanding the evolving landscape of this vital sector.

High EC Coco Peat Market Dynamics & Structure

The global High EC Coco Peat market is characterized by a moderately concentrated structure, with key players like Dutch Plantin, Samarasinghe Brothers, and SMS Exporters holding significant market shares. Technological innovation, particularly in improving coco peat processing for enhanced nutrient retention and reduced salinity, is a primary driver. Regulatory frameworks, especially concerning environmental sustainability and standards for organic farming inputs, are increasingly influential. Competitive product substitutes, such as peat moss and synthetic growing media, pose a continuous challenge, though the eco-friendly nature of coco peat offers a distinct advantage. End-user demographics are shifting towards younger, environmentally conscious farmers and horticulturalists seeking efficient and sustainable solutions. Merger and acquisition (M&A) trends are observed as established players seek to expand their product portfolios and geographical reach. In the historical period (2019-2024), an estimated 2,000 million units of coco peat were acquired by key market participants, indicating active consolidation. Barriers to innovation include the capital-intensive nature of advanced processing technologies and the need for extensive research and development to meet diverse agricultural needs.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation: Focused on processing for enhanced functionality and sustainability.

- Regulatory Frameworks: Growing emphasis on environmental standards and organic certifications.

- Competitive Substitutes: Peat moss, synthetic growing media.

- End-User Demographics: Increasing adoption by environmentally aware agricultural and horticultural professionals.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

- M&A Deal Volume (Historical 2019-2024): Approximately 2,000 million units.

High EC Coco Peat Growth Trends & Insights

The High EC Coco Peat market is poised for robust expansion, driven by the escalating demand for sustainable and eco-friendly growing media in agriculture and horticulture. Global market size is projected to witness a Compound Annual Growth Rate (CAGR) of xx% over the forecast period (2025–2033). The adoption rates for coco peat are steadily increasing as growers recognize its superior water retention, aeration, and pH buffering capabilities compared to traditional media. Technological disruptions in processing, leading to the development of low EC and treated coco peat variants, are further fueling market penetration. Consumer behavior is shifting significantly, with a growing preference for organic produce and a conscious effort to reduce reliance on peat moss due to its environmental impact. This has led to a surge in demand for premium coco peat and organic coco peat substrates. The market penetration of coco peat in the agricultural and horticultural segment is estimated to reach xx% by 2033. The others segment, encompassing applications like bedding and flooring and specialized industrial uses, is also showing promising growth, albeit from a smaller base. Insights indicate a rising awareness of coco peat's role in controlled environment agriculture (CEA) and vertical farming, contributing to its market evolution.

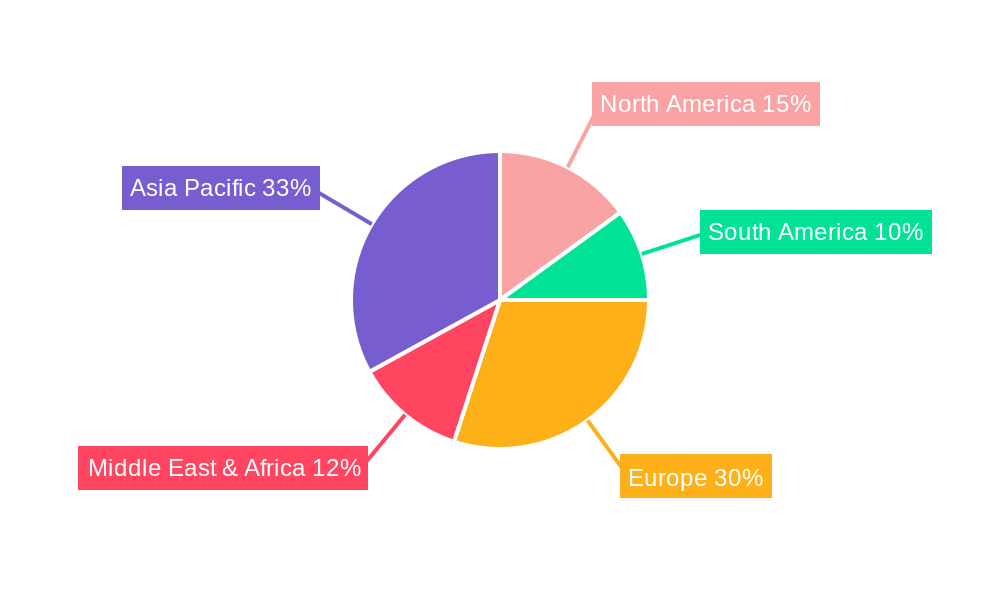

Dominant Regions, Countries, or Segments in High EC Coco Peat

The Agricultural and Horticultural segment undeniably dominates the High EC Coco Peat market, driven by the global shift towards sustainable farming practices and increasing food production demands. This segment is projected to account for over xx% of the total market revenue by 2033. Within this segment, the white fibre type of coco peat is gaining prominence due to its finer texture and superior water-holding capacity, ideal for hydroponic systems and seed starting. The brown fibre type, while still significant, is increasingly being used in landscape applications and as a soil amendment.

Key Drivers for Dominance:

- Global Food Security Initiatives: Increased focus on efficient and sustainable food production.

- Rise of Organic Farming: Growing consumer demand for organic produce and stricter regulations on synthetic inputs.

- Hydroponics and Soilless Cultivation: Expanding adoption of these advanced agricultural techniques.

- Environmental Concerns: Growing awareness of peat bog depletion and the sustainable sourcing of coco peat.

- Economic Policies: Government support for sustainable agriculture and agricultural exports.

Country-level Dominance:

- India: A major producer and exporter of coco peat, leveraging its extensive coconut plantations and established coir industry.

- Sri Lanka: Another significant player in global coco peat production and supply.

- Netherlands: A leading consumer market for high-quality coco peat, driven by its advanced horticultural sector.

- United States: A rapidly growing market, fueled by the expansion of indoor farming and the landscaping industry.

The Agricultural and Horticultural segment's dominance is further reinforced by the inherent properties of coco peat, such as excellent aeration, water retention, and its pH-neutral nature, making it an ideal growing medium for a wide array of crops. The others segment, encompassing bedding and flooring and specialized industrial applications, also presents a considerable growth avenue, though currently secondary to agriculture.

High EC Coco Peat Product Landscape

The High EC Coco Peat product landscape is evolving with innovations aimed at enhancing its performance and sustainability. Key product developments include the introduction of low EC (Electrical Conductivity) coco peat variants, crucial for sensitive plant species, and treated coco peat that offers improved microbial activity and nutrient availability. Advanced processing techniques are yielding coco peat with optimized particle sizes, catering to specific applications from seed starting to commercial horticulture. Unique selling propositions revolve around its biodegradable nature, exceptional water-holding capacity (up to 8 times its weight), and its contribution to soil health. Technological advancements are also focused on efficient dust suppression and the development of compressed coco peat blocks for ease of transport and handling.

Key Drivers, Barriers & Challenges in High EC Coco Peat

Key Drivers:

- Growing Demand for Sustainable Agriculture: The increasing global focus on eco-friendly farming practices is a primary driver.

- Advancements in Horticulture: Expansion of hydroponics, soilless cultivation, and vertical farming necessitates high-quality growing media.

- Environmental Consciousness: Growing awareness of the ecological impact of peat extraction.

- Superior Properties of Coco Peat: Excellent water retention, aeration, and pH neutrality make it a preferred choice.

- Government Initiatives: Support for organic farming and sustainable land management.

Key Barriers & Challenges:

- High EC in Raw Coco Peat: Requires extensive washing and processing, increasing production costs.

- Supply Chain Volatility: Reliance on coconut harvest and fluctuating global shipping costs.

- Competition from Established Media: Peat moss remains a well-established and cost-effective alternative in some markets.

- Technological Investment: High initial capital expenditure for advanced processing and quality control.

- Regulatory Hurdles: Stringent quality and safety standards in certain export markets.

- Price Sensitivity: While sustainability is valued, cost remains a significant factor for many end-users. The estimated impact of supply chain disruptions on market growth is an annual reduction of xx% in the historical period.

Emerging Opportunities in High EC Coco Peat

Emerging opportunities in the High EC Coco Peat market lie in the development of specialized coco peat blends for niche applications, such as mushroom cultivation and carnivorous plant media. Untapped markets in developing regions with growing agricultural sectors present significant potential for expansion. The increasing consumer preference for home gardening and urban farming also creates opportunities for smaller-scale, retail-ready coco peat products. Furthermore, the integration of coco peat with bio-fertilizers and beneficial microbes offers innovative applications that enhance soil health and plant growth.

Growth Accelerators in the High EC Coco Peat Industry

Growth accelerators in the High EC Coco Peat industry are primarily driven by breakthroughs in processing technology that enable the production of ultra-low EC coco peat and improved nutrient-release formulations. Strategic partnerships between coir producers and horticultural technology companies are vital for developing integrated solutions. Market expansion strategies, particularly targeting regions with burgeoning agricultural sectors and a strong focus on sustainability, will further fuel growth. The increasing adoption of coco peat in the packaging segment as a sustainable alternative for protective materials also presents a significant growth avenue.

Key Players Shaping the High EC Coco Peat Market

- Dutch Plantin

- Samarasinghe Brothers

- SMS Exporters

- Sai Cocopeat

- Kumaran Coirs

- Allwin Coir

- Benlion Coir Industry

- CoirGreen

- Dynamic International

- JIT Holdings

- Rajesh Agencies

- HortGrow

- Xiamen Green Field

Notable Milestones in High EC Coco Peat Sector

- 2019: Increased global focus on sustainable sourcing and certifications for coco peat.

- 2020: Significant surge in demand driven by the growth of home gardening and increased awareness of organic produce.

- 2021: Development of advanced washing techniques to significantly reduce EC levels in raw coco peat.

- 2022: Expansion of coco peat applications in the packaging industry as a biodegradable alternative.

- 2023: Rise in strategic partnerships for developing enriched coco peat substrates with enhanced nutrient profiles.

- 2024: Introduction of novel processing methods leading to improved dust suppression and compressed block technology.

In-Depth High EC Coco Peat Market Outlook

- 2019: Increased global focus on sustainable sourcing and certifications for coco peat.

- 2020: Significant surge in demand driven by the growth of home gardening and increased awareness of organic produce.

- 2021: Development of advanced washing techniques to significantly reduce EC levels in raw coco peat.

- 2022: Expansion of coco peat applications in the packaging industry as a biodegradable alternative.

- 2023: Rise in strategic partnerships for developing enriched coco peat substrates with enhanced nutrient profiles.

- 2024: Introduction of novel processing methods leading to improved dust suppression and compressed block technology.

In-Depth High EC Coco Peat Market Outlook

The future of the High EC Coco Peat market is exceptionally promising, driven by its inherent sustainability and versatile applications. Growth accelerators, including technological advancements in processing, strategic collaborations, and expanding market reach, will continue to propel the industry forward. The increasing global demand for eco-friendly solutions in agriculture and horticulture will remain the primary growth engine. Furthermore, the potential for innovation in developing specialized coco peat products for emerging sectors like packaging and urban agriculture presents significant strategic opportunities for market players seeking long-term growth and competitive advantage.

High EC Coco Peat Segmentation

-

1. Application

- 1.1. Agricultural and Horticultural

- 1.2. Packaging

- 1.3. Bedding and Flooring

- 1.4. Others

-

2. Types

- 2.1. Brown Fibre

- 2.2. White Fibre

- 2.3. Others

High EC Coco Peat Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High EC Coco Peat REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High EC Coco Peat Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Agricultural and Horticultural

- 5.1.2. Packaging

- 5.1.3. Bedding and Flooring

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Brown Fibre

- 5.2.2. White Fibre

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High EC Coco Peat Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Agricultural and Horticultural

- 6.1.2. Packaging

- 6.1.3. Bedding and Flooring

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Brown Fibre

- 6.2.2. White Fibre

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High EC Coco Peat Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Agricultural and Horticultural

- 7.1.2. Packaging

- 7.1.3. Bedding and Flooring

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Brown Fibre

- 7.2.2. White Fibre

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High EC Coco Peat Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Agricultural and Horticultural

- 8.1.2. Packaging

- 8.1.3. Bedding and Flooring

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Brown Fibre

- 8.2.2. White Fibre

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High EC Coco Peat Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Agricultural and Horticultural

- 9.1.2. Packaging

- 9.1.3. Bedding and Flooring

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Brown Fibre

- 9.2.2. White Fibre

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High EC Coco Peat Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Agricultural and Horticultural

- 10.1.2. Packaging

- 10.1.3. Bedding and Flooring

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Brown Fibre

- 10.2.2. White Fibre

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dutch Plantin

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samarasinghe Brothers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SMS Exporters

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sai Cocopeat

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kumaran Coirs

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allwin Coir

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Benlion Coir Industry

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CoirGreen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dynamic International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JIT Holdings

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rajesh Agencies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HortGrow

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Xiamen Green Field

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Dutch Plantin

List of Figures

- Figure 1: Global High EC Coco Peat Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High EC Coco Peat Revenue (million), by Application 2024 & 2032

- Figure 3: North America High EC Coco Peat Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High EC Coco Peat Revenue (million), by Types 2024 & 2032

- Figure 5: North America High EC Coco Peat Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High EC Coco Peat Revenue (million), by Country 2024 & 2032

- Figure 7: North America High EC Coco Peat Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High EC Coco Peat Revenue (million), by Application 2024 & 2032

- Figure 9: South America High EC Coco Peat Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High EC Coco Peat Revenue (million), by Types 2024 & 2032

- Figure 11: South America High EC Coco Peat Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High EC Coco Peat Revenue (million), by Country 2024 & 2032

- Figure 13: South America High EC Coco Peat Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High EC Coco Peat Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High EC Coco Peat Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High EC Coco Peat Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High EC Coco Peat Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High EC Coco Peat Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High EC Coco Peat Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High EC Coco Peat Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High EC Coco Peat Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High EC Coco Peat Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High EC Coco Peat Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High EC Coco Peat Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High EC Coco Peat Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High EC Coco Peat Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High EC Coco Peat Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High EC Coco Peat Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High EC Coco Peat Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High EC Coco Peat Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High EC Coco Peat Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High EC Coco Peat Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High EC Coco Peat Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High EC Coco Peat Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High EC Coco Peat Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High EC Coco Peat Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High EC Coco Peat Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High EC Coco Peat Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High EC Coco Peat Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High EC Coco Peat Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High EC Coco Peat Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High EC Coco Peat Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High EC Coco Peat Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High EC Coco Peat Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High EC Coco Peat Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High EC Coco Peat Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High EC Coco Peat Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High EC Coco Peat Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High EC Coco Peat Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High EC Coco Peat Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High EC Coco Peat Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High EC Coco Peat?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the High EC Coco Peat?

Key companies in the market include Dutch Plantin, Samarasinghe Brothers, SMS Exporters, Sai Cocopeat, Kumaran Coirs, Allwin Coir, Benlion Coir Industry, CoirGreen, Dynamic International, JIT Holdings, Rajesh Agencies, HortGrow, Xiamen Green Field.

3. What are the main segments of the High EC Coco Peat?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High EC Coco Peat," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High EC Coco Peat report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High EC Coco Peat?

To stay informed about further developments, trends, and reports in the High EC Coco Peat, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence