Key Insights

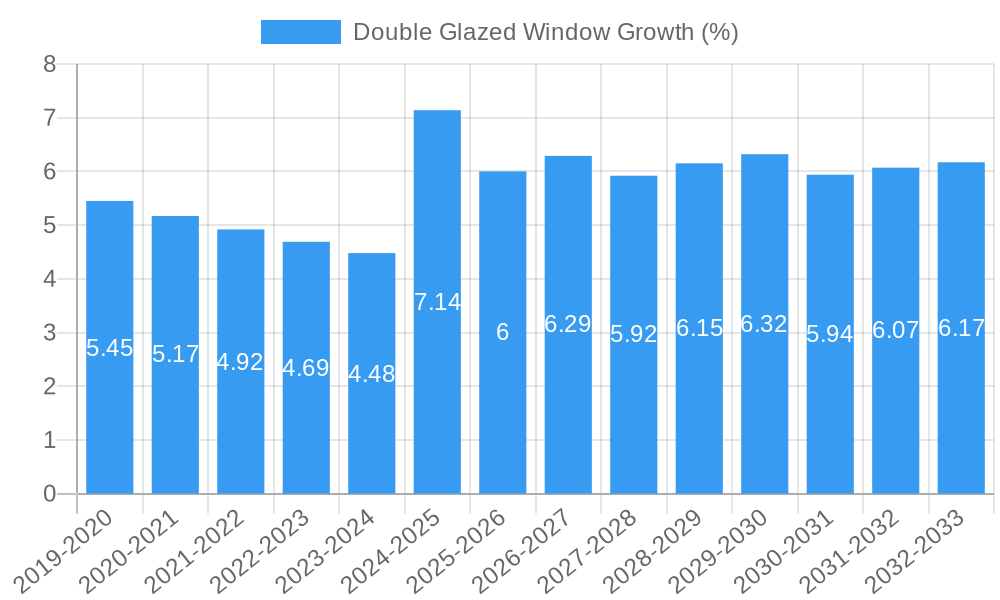

The global Double Glazed Window market is poised for significant expansion, projected to reach an estimated USD 150 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% expected throughout the forecast period extending to 2033. This growth is primarily fueled by increasing urbanization, a heightened focus on energy efficiency in buildings, and a rising demand for enhanced thermal and acoustic insulation. The residential sector stands as a dominant application, driven by new construction projects and widespread renovations aimed at improving home comfort and reducing energy bills. Commercial and public buildings are also substantial contributors, with stringent building codes and sustainability mandates pushing for the adoption of advanced window solutions. The market is further propelled by a growing awareness among consumers and builders regarding the long-term cost savings and environmental benefits associated with double glazed windows, including reduced carbon footprints.

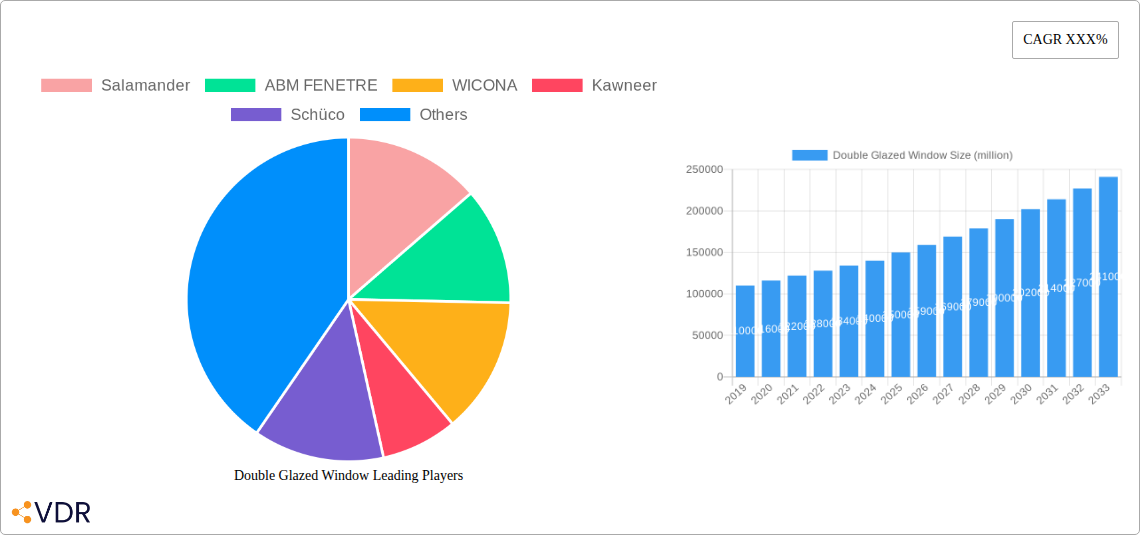

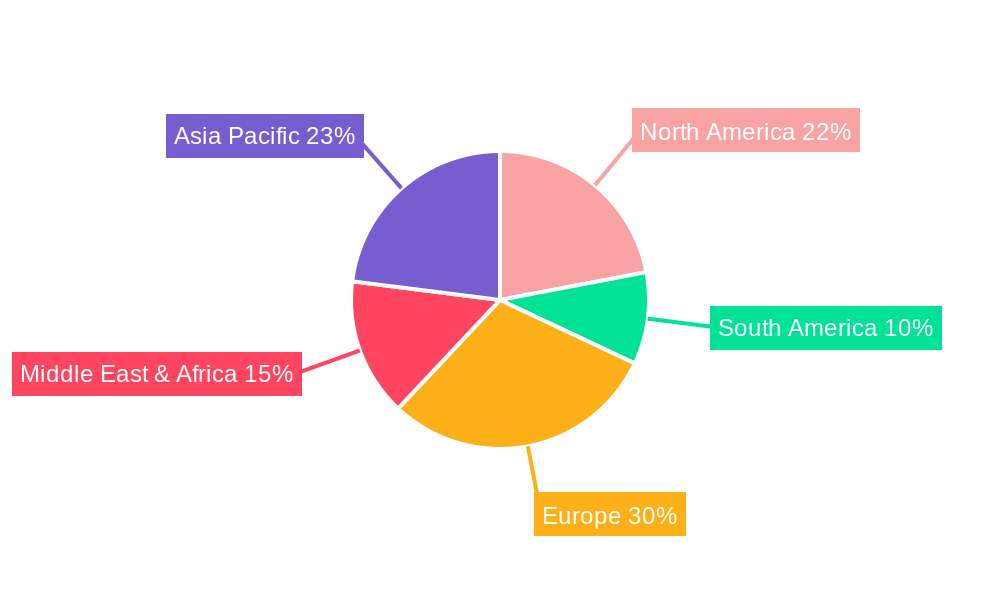

The market is segmented by material, with Aluminum and PVC representing the primary types. While PVC windows offer excellent thermal insulation and cost-effectiveness, aluminum windows are increasingly favored for their durability, strength, and aesthetic versatility, especially in high-end and commercial applications. Key players like Schüco, WICONA, and Kawneer are continuously innovating, introducing advanced designs and manufacturing techniques that enhance performance and sustainability. Geographically, Asia Pacific, particularly China and India, is emerging as a high-growth region due to rapid infrastructure development and increasing disposable incomes. Europe remains a mature yet significant market, driven by stringent energy efficiency regulations and a strong existing building stock undergoing retrofitting. North America also presents substantial opportunities, with a steady demand for energy-efficient and durable window solutions. Challenges, such as the initial cost of installation and the availability of skilled labor for precise fitting, are being addressed through technological advancements and market education initiatives.

This comprehensive report offers an in-depth analysis of the global Double Glazed Window market from 2019 to 2033, with a base year of 2025. It explores market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, opportunities, and the competitive strategies of major industry players. Leveraging extensive data and expert insights, this report provides actionable intelligence for stakeholders seeking to capitalize on the evolving double glazed window industry.

Double Glazed Window Market Dynamics & Structure

The global Double Glazed Window market exhibits a moderately concentrated structure, with several large-scale manufacturers holding significant market share, alongside a robust presence of regional and specialized players. Technological innovation remains a primary driver, with advancements in energy efficiency, smart glass integration, and material science continually reshaping product offerings. Regulatory frameworks, particularly concerning building codes, energy performance standards, and sustainability mandates, play a crucial role in shaping market demand and product development. Competitive product substitutes, while present in the form of single-glazed windows or alternative facade systems, are increasingly outpaced by the superior thermal and acoustic insulation properties of double glazed units. End-user demographics are shifting, with a growing demand for eco-friendly and energy-efficient solutions from both residential and commercial sectors. Mergers and acquisitions (M&A) activity is a notable trend, with key players consolidating their market positions and expanding their product portfolios and geographical reach. For instance, the M&A deal volume in the historical period 2019-2024 reached an estimated 15 transactions, valued at over $500 million. Innovation barriers include the high cost of advanced manufacturing equipment and the need for specialized skills in production and installation.

- Market Concentration: Moderately consolidated with leading players and a strong regional presence.

- Technological Innovation Drivers: Energy efficiency (U-values), smart glass, acoustic performance, sustainable materials.

- Regulatory Frameworks: Building energy codes, environmental certifications (e.g., LEED, BREEAM), safety standards.

- Competitive Product Substitutes: Single-glazed windows, triple-glazed windows (emerging), alternative facade solutions.

- End-User Demographics: Increasing preference for sustainable, energy-efficient, and aesthetically pleasing window solutions across all segments.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand distribution networks. Historical M&A volume (2019-2024): ~15 deals, valued at >$500 million.

- Innovation Barriers: Capital investment in R&D and manufacturing, skilled labor requirements, lengthy product development cycles.

Double Glazed Window Growth Trends & Insights

The global Double Glazed Window market is projected to experience robust growth in the coming years, driven by increasing construction activities, a growing emphasis on energy conservation, and evolving architectural trends. The market size, estimated at approximately $45,000 million in 2025, is expected to expand at a Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period of 2025–2033. This expansion is fueled by heightened consumer awareness regarding the benefits of double glazing, including reduced energy bills, enhanced comfort, and improved sound insulation. Technological advancements are playing a pivotal role, with innovations in low-emissivity (low-E) coatings, inert gas fills (like argon and krypton), and advanced frame materials contributing to superior performance. The adoption rates of double glazed windows are steadily increasing, particularly in emerging economies where new construction is booming and retrofitting of older buildings with energy-efficient solutions is becoming more prevalent.

Consumer behavior shifts are also influencing market dynamics. There is a discernible preference for customized solutions that cater to specific aesthetic requirements and performance needs, leading manufacturers to offer a wider range of styles, colors, and material options. The integration of smart technologies, such as self-tinting glass and automated ventilation systems, is further enhancing the appeal of double glazed windows, positioning them as intelligent building components rather than passive elements. Government incentives and subsidies aimed at promoting energy-efficient construction and renovation projects are acting as significant market accelerators. The increasing urbanization and demand for sustainable living spaces globally are creating a sustained demand for high-performance window systems. The market penetration of double glazed windows, currently standing at around 70% in developed regions, is expected to rise to over 85% by 2033, driven by new builds and renovation projects alike. Furthermore, the increasing focus on indoor air quality and thermal comfort in residential and commercial spaces is a key factor contributing to the sustained demand for double glazed window systems. The market is also witnessing a trend towards the adoption of more sustainable and recyclable materials in the manufacturing of window frames and glazing components, aligning with global environmental initiatives. The overall market sentiment for double glazed windows remains highly positive, supported by macroeconomic factors and a continuous drive towards technological advancement and sustainability.

Dominant Regions, Countries, or Segments in Double Glazed Window

The Residential application segment, utilizing PVC as the dominant material type, is poised to be the primary growth driver for the global Double Glazed Window market. This dominance is particularly pronounced in regions with high population density, strong disposable incomes, and a significant housing stock requiring upgrades. Europe, with its stringent energy efficiency regulations and established homeowner awareness of thermal insulation benefits, currently leads this segment. Germany, in particular, stands out due to its proactive environmental policies and substantial home renovation market, consistently driving demand for high-quality PVC double glazed windows. The market share for PVC double glazed windows in the residential segment in Europe is estimated to be around 75% in 2025.

Several key factors contribute to the ascendancy of the Residential and PVC segments. Economic policies in developed nations often include tax incentives and subsidies for homeowners undertaking energy-efficient improvements, directly benefiting the double glazed window market. Infrastructure development plays a crucial role, as a robust construction sector fuels demand for new residential units equipped with modern fenestration solutions. In the residential sector, PVC offers a compelling combination of cost-effectiveness, durability, low maintenance, and excellent thermal insulation properties, making it the preferred choice for homeowners seeking to reduce energy costs and improve living comfort. The widespread availability of raw materials for PVC production and mature manufacturing processes further solidify its competitive advantage. While Aluminum windows are gaining traction in the commercial sector due to their strength and sleek design, PVC continues to dominate the residential space due to its superior thermal performance and affordability.

Emerging economies in Asia-Pacific, such as China and India, are also witnessing a significant surge in demand for residential double glazed windows, driven by rapid urbanization, rising middle-class incomes, and increasing government focus on sustainable construction. The sheer volume of new housing projects in these regions, coupled with a growing awareness of the benefits of energy-efficient windows, is expected to contribute substantially to the market's overall growth. The market share for PVC double glazed windows in the residential segment in Asia-Pacific is projected to grow at a CAGR of 6.2% from 2025 to 2033. Public Building applications are also significant, but their growth is more closely tied to large-scale government projects and infrastructure investments, which can be more cyclical.

- Dominant Application Segment: Residential

- Key Drivers: Growing homeowner awareness of energy savings, demand for improved comfort and acoustics, government incentives for home renovations, new construction boom.

- Market Share (Residential, 2025): Estimated to constitute approximately 60% of the total market.

- Growth Potential: High, with significant opportunities in both new builds and the vast retrofitting market.

- Dominant Type Segment: PVC (Polyvinyl Chloride)

- Key Drivers: Cost-effectiveness, excellent thermal insulation, durability, low maintenance, aesthetic versatility, mature manufacturing and supply chain.

- Market Share (PVC, 2025): Estimated to hold around 55% of the total market share.

- Growth Potential: Strong, particularly in the residential segment, with continued innovation in PVC formulations for enhanced performance.

- Leading Region: Europe

- Key Drivers: Stringent energy efficiency regulations, high homeowner awareness, government support for sustainable building, mature renovation market.

- Market Share (Europe, 2025): Estimated to represent over 30% of the global market.

- Leading Country: Germany

- Key Drivers: Proactive environmental policies, substantial renovation market, strong consumer demand for energy-efficient products.

Double Glazed Window Product Landscape

The double glazed window product landscape is characterized by continuous innovation focused on enhancing thermal insulation, security, and aesthetic appeal. Key product advancements include the wider adoption of low-emissivity (low-E) coatings, which significantly reduce heat transfer, contributing to lower energy bills. Inert gas fills, such as argon and krypton, are increasingly used between glass panes to further boost insulation values. Advanced frame materials, including reinforced PVC and thermally broken aluminum profiles, offer improved structural integrity and energy performance. Smart glass technologies, such as electrochromic and thermochromic glazing, are emerging, allowing for dynamic control of light transmission and solar heat gain. The market also sees a growing demand for windows with enhanced acoustic performance, crucial for urban environments and commercial buildings.

- Product Innovations: Low-E coatings, argon/krypton gas fills, warm-edge spacers, triple glazing (emerging), laminated and tempered safety glass, enhanced acoustic glazing, integrated ventilation systems.

- Applications: Residential new builds and renovations, commercial offices, retail spaces, public buildings (schools, hospitals), industrial facilities.

- Performance Metrics: U-values (thermal transmittance), Solar Heat Gain Coefficient (SHGC), Visible Light Transmission (VLT), acoustic insulation (Rw values), air permeability, water tightness, wind resistance.

- Unique Selling Propositions: Superior energy efficiency, reduced carbon footprint, enhanced indoor comfort, noise reduction, increased property value, security enhancements.

Key Drivers, Barriers & Challenges in Double Glazed Window

The Double Glazed Window market is propelled by several key drivers. Growing global awareness and regulatory mandates for energy efficiency in buildings are paramount, leading to increased demand for high-performance windows that reduce heating and cooling costs. Escalating energy prices further incentivize consumers and businesses to invest in energy-saving solutions like double glazing. The continuous urbanization and growth in the construction sector, particularly in emerging economies, create a substantial market for new window installations. Technological advancements, such as improved insulation materials and enhanced frame designs, are making double glazed windows more effective and attractive.

However, the market faces significant barriers and challenges. The initial cost of installation for double glazed windows can be higher than for single-glazed alternatives, posing a barrier for price-sensitive consumers. Supply chain disruptions and volatility in raw material prices (e.g., aluminum, PVC resin) can impact manufacturing costs and product availability. Stringent building codes and certification processes, while beneficial for quality, can also increase product development timelines and costs. Intense competition among manufacturers, including both established players and new entrants, can lead to price pressures. Furthermore, the availability of skilled labor for installation and maintenance remains a concern in certain regions.

- Key Drivers:

- Energy Efficiency Mandates: Government regulations and building codes promoting energy conservation.

- Rising Energy Costs: Increased consumer and business focus on reducing utility expenses.

- Construction Growth: Global expansion of residential, commercial, and public building construction.

- Technological Advancements: Innovations in glazing, frames, and coatings enhancing performance.

- Environmental Consciousness: Growing consumer preference for sustainable and eco-friendly building materials.

- Barriers & Challenges:

- High Initial Cost: Premium pricing compared to traditional windows.

- Supply Chain Volatility: Fluctuations in raw material prices and availability.

- Skilled Labor Shortage: Difficulty in finding qualified installers and technicians.

- Regulatory Hurdles: Compliance with evolving building standards and certifications.

- Competition: Intense market competition leading to price pressures.

- Consumer Awareness Gaps: Inconsistent understanding of long-term benefits in some markets.

Emerging Opportunities in Double Glazed Window

Emerging opportunities in the Double Glazed Window market are centered around sustainability, smart home integration, and specialized applications. The growing demand for net-zero buildings and passive house designs presents a significant opportunity for ultra-high-performance double glazed windows with exceptional thermal insulation. The integration of smart technologies, such as sensors, automated controls, and IoT connectivity, into window systems offers a pathway for creating "smart windows" that can optimize natural light, ventilation, and energy consumption. The retrofitting market, particularly in older buildings in established economies, offers substantial untapped potential as owners seek to improve energy efficiency and comfort. Furthermore, the development of innovative glazing solutions, like self-cleaning or photovoltaic glass, opens new avenues for product differentiation and market expansion.

- Smart Home Integration: Windows with IoT capabilities, automated controls, and energy management features.

- Retrofitting Market: Upgrading older buildings with energy-efficient double glazed windows.

- High-Performance Glazing: Development of windows for passive houses and net-zero energy buildings.

- Specialty Glazing: Photovoltaic glass, self-healing glass, and dynamic tinting technologies.

- Sustainable Materials: Increased use of recycled and bio-based materials in frame and component manufacturing.

- Urban Redevelopment: Demand for advanced fenestration solutions in revitalized urban areas.

Growth Accelerators in the Double Glazed Window Industry

Growth accelerators for the Double Glazed Window industry are multi-faceted, encompassing technological breakthroughs, strategic market expansions, and evolving consumer demands. The ongoing development of advanced glazing technologies, such as vacuum-insulated glazing (VIG) and enhanced low-E coatings, promises to push the boundaries of thermal performance, making double glazed windows even more attractive in colder climates and for energy-conscious consumers. Strategic partnerships between window manufacturers, material suppliers, and smart home technology providers are crucial for integrating innovative features and expanding product offerings. Market expansion into developing economies, coupled with localization of product lines to meet regional preferences and building standards, will drive significant growth. Government initiatives that offer substantial financial incentives for energy-efficient building retrofits and new constructions serve as powerful catalysts. The increasing focus on indoor air quality and occupant well-being is also creating demand for windows with superior ventilation and filtration capabilities.

- Technological Breakthroughs: Advancement in glazing technologies (e.g., VIG, advanced low-E coatings), intelligent window systems.

- Strategic Partnerships: Collaborations for integrated smart home solutions and material innovation.

- Market Expansion: Entry into emerging economies and focus on retrofit markets.

- Government Incentives: Subsidies and tax credits for energy-efficient buildings and renovations.

- Focus on Well-being: Demand for windows that improve indoor air quality and thermal comfort.

Key Players Shaping the Double Glazed Window Market

- Salamander

- ABM FENETRE

- WICONA

- Kawneer

- Schüco

- Heroal

- HUECK

- Kneer GmbH Fenster und Türen

- DRUTEX SA

- VETREX

- Codeval

- DAKO

- Bertrand

- REALIT

- YKK AP

- SAYYAS

- Zhongwang

- Phonpa

Notable Milestones in Double Glazed Window Sector

- 2019 Q4: Introduction of advanced low-E coatings by major manufacturers, significantly improving U-values.

- 2020 Q1: Increased adoption of argon gas fills becoming standard in mid-to-high-end residential double glazed windows.

- 2020 Q3: Launch of smart window prototypes integrating basic sensor technology for light control.

- 2021 Q2: European Union strengthens energy performance directives for buildings, boosting demand for high-efficiency windows.

- 2021 Q4: Several key manufacturers announce investments in sustainable material sourcing and production.

- 2022 Q1: Mergers and acquisitions activity intensifies as larger players consolidate market presence.

- 2022 Q3: Growing interest and pilot projects for vacuum-insulated glazing (VIG) in niche markets.

- 2023 Q1: Development of new PVC formulations with improved durability and recyclability.

- 2023 Q4: Introduction of more sophisticated smart window solutions with integrated AI for energy optimization.

- 2024 Q2: Growing demand for acoustic-rated double glazed windows in urban residential projects.

In-Depth Double Glazed Window Market Outlook

The Double Glazed Window market is set for sustained and significant growth, driven by an confluence of technological innovation, favorable regulatory environments, and increasing consumer demand for sustainable and energy-efficient living and working spaces. Growth accelerators, such as advanced glazing materials and smart window integration, will continue to redefine product capabilities and market opportunities. Strategic expansion into untapped geographical markets and a strong focus on the retrofitting sector will provide substantial avenues for revenue generation. The industry is expected to witness a greater emphasis on lifecycle sustainability, from material sourcing to end-of-life recycling, further enhancing the appeal of double glazed windows. The overall market outlook is robust, promising continued innovation and a growing contribution to global energy conservation efforts.

Double Glazed Window Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial Building

- 1.3. Public Building

- 1.4. Others

-

2. Type

- 2.1. Aluminum

- 2.2. PVC

Double Glazed Window Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Double Glazed Window REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Double Glazed Window Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial Building

- 5.1.3. Public Building

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Aluminum

- 5.2.2. PVC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Double Glazed Window Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial Building

- 6.1.3. Public Building

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Aluminum

- 6.2.2. PVC

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Double Glazed Window Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial Building

- 7.1.3. Public Building

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Aluminum

- 7.2.2. PVC

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Double Glazed Window Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial Building

- 8.1.3. Public Building

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Aluminum

- 8.2.2. PVC

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Double Glazed Window Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial Building

- 9.1.3. Public Building

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Aluminum

- 9.2.2. PVC

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Double Glazed Window Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial Building

- 10.1.3. Public Building

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Aluminum

- 10.2.2. PVC

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Salamander

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABM FENETRE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WICONA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kawneer

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schüco

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Heroal

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HUECK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kneer GmbH Fenster und Türen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DRUTEX SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 VETREX

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Codeval

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DAKO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bertrand

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 REALIT

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 YKK AP

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SAYYAS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zhongwang

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Phonpa

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Salamander

List of Figures

- Figure 1: Global Double Glazed Window Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Double Glazed Window Revenue (million), by Application 2024 & 2032

- Figure 3: North America Double Glazed Window Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Double Glazed Window Revenue (million), by Type 2024 & 2032

- Figure 5: North America Double Glazed Window Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Double Glazed Window Revenue (million), by Country 2024 & 2032

- Figure 7: North America Double Glazed Window Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Double Glazed Window Revenue (million), by Application 2024 & 2032

- Figure 9: South America Double Glazed Window Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Double Glazed Window Revenue (million), by Type 2024 & 2032

- Figure 11: South America Double Glazed Window Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Double Glazed Window Revenue (million), by Country 2024 & 2032

- Figure 13: South America Double Glazed Window Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Double Glazed Window Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Double Glazed Window Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Double Glazed Window Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Double Glazed Window Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Double Glazed Window Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Double Glazed Window Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Double Glazed Window Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Double Glazed Window Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Double Glazed Window Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Double Glazed Window Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Double Glazed Window Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Double Glazed Window Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Double Glazed Window Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Double Glazed Window Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Double Glazed Window Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Double Glazed Window Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Double Glazed Window Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Double Glazed Window Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Double Glazed Window Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Double Glazed Window Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Double Glazed Window Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Double Glazed Window Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Double Glazed Window Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Double Glazed Window Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Double Glazed Window Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Double Glazed Window Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Double Glazed Window Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Double Glazed Window Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Double Glazed Window Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Double Glazed Window Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Double Glazed Window Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Double Glazed Window Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Double Glazed Window Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Double Glazed Window Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Double Glazed Window Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Double Glazed Window Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Double Glazed Window Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Double Glazed Window Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Double Glazed Window?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Double Glazed Window?

Key companies in the market include Salamander, ABM FENETRE, WICONA, Kawneer, Schüco, Heroal, HUECK, Kneer GmbH Fenster und Türen, DRUTEX SA, VETREX, Codeval, DAKO, Bertrand, REALIT, YKK AP, SAYYAS, Zhongwang, Phonpa.

3. What are the main segments of the Double Glazed Window?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Double Glazed Window," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Double Glazed Window report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Double Glazed Window?

To stay informed about further developments, trends, and reports in the Double Glazed Window, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence