Key Insights

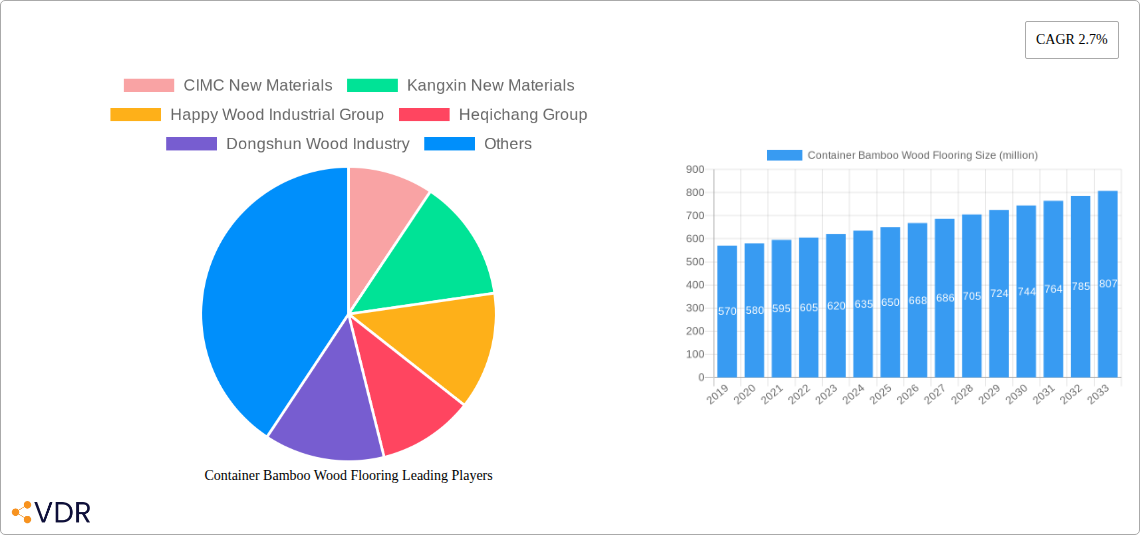

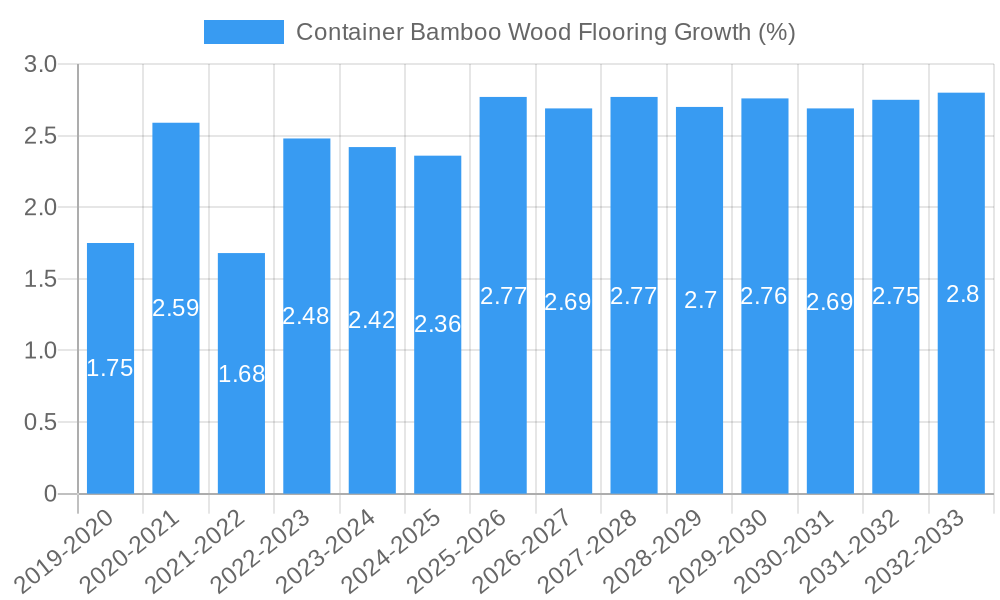

The global Container Bamboo Wood Flooring market is projected to reach approximately $650 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.7% from 2019 to 2033. This growth is propelled by several key drivers, most notably the increasing demand for sustainable and eco-friendly building materials within the logistics and shipping industries. The inherent strength, durability, and rapid renewability of bamboo and wood composites make them an attractive alternative to traditional flooring solutions. Furthermore, advancements in material science and manufacturing processes are leading to the development of more specialized and high-performance bamboo-wood flooring options, catering to diverse application needs. The market segmentation clearly highlights the dominance of the Dry Container application, reflecting the widespread use of containers for general cargo transport. However, the growing niche for Specialty Containers, which require tailored flooring solutions for specific goods like refrigerated or hazardous materials, presents a significant growth opportunity.

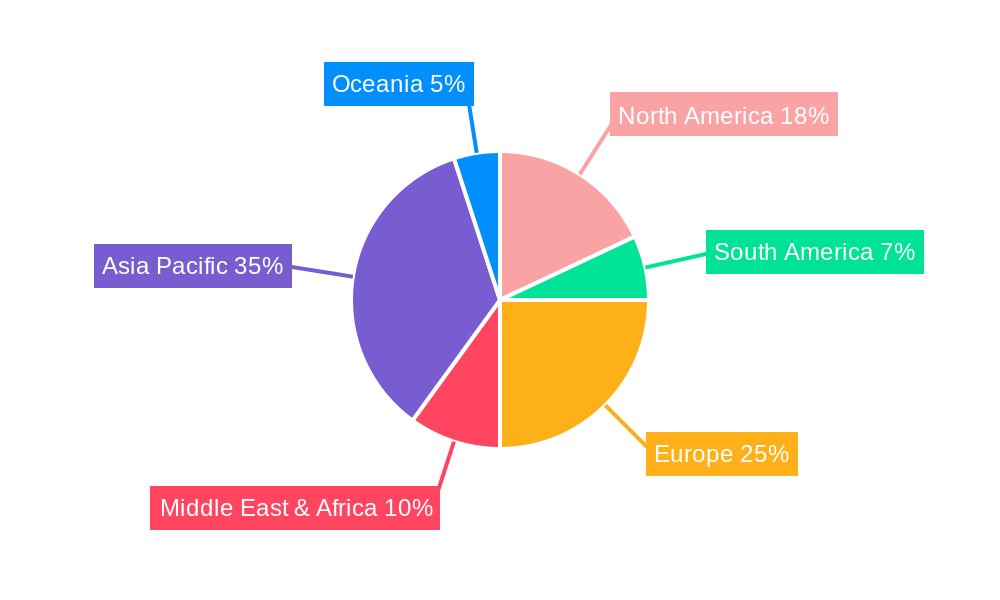

Within the product types, High-Density Bamboo-Wood Flooring is expected to lead the market due to its superior strength and resistance to wear and tear, crucial for the demanding environment of container shipping. Lightweight Bamboo-Wood Flooring, on the other hand, is gaining traction as logistics companies increasingly focus on optimizing payload capacity and reducing overall shipping costs. Key industry players like CIMC New Materials and Kangxin New Materials are actively investing in research and development to enhance product offerings and expand their market reach. Geographically, Asia Pacific, particularly China and India, is anticipated to be a major growth engine, owing to its robust manufacturing base and extensive export activities. Europe and North America also represent substantial markets, driven by stringent environmental regulations and a growing preference for green construction materials in the shipping sector. Challenges such as fluctuating raw material prices and the initial investment cost for specialized manufacturing facilities are potential restraints, but the long-term benefits of sustainability and performance are expected to outweigh these concerns.

Container Bamboo Wood Flooring Market Dynamics & Structure

The container bamboo wood flooring market exhibits a moderate concentration, with key players like CIMC New Materials, Kangxin New Materials, Happy Wood Industrial Group, Heqichang Group, Dongshun Wood Industry, and OHC driving innovation and supply. Technological innovation is primarily fueled by advancements in high-density bamboo-wood composite manufacturing, leading to enhanced durability and reduced weight. Regulatory frameworks are evolving, with a growing emphasis on sustainability and eco-friendly materials within the shipping and logistics industries. Competitive product substitutes include traditional plywood, steel flooring, and other composite materials, each offering distinct advantages and disadvantages in terms of cost, durability, and environmental impact. End-user demographics are diverse, encompassing shipping companies, logistics providers, container manufacturers, and governmental agencies involved in trade infrastructure. Mergers and acquisitions (M&A) trends, while not yet extensive, are anticipated to increase as companies seek to consolidate market share, expand product portfolios, and gain access to new technologies and distribution channels. For instance, an anticipated M&A deal volume of 1-2 significant transactions within the forecast period could reshape the competitive landscape. Innovation barriers primarily revolve around achieving consistent quality at scale, optimizing production costs for wider adoption, and navigating complex international shipping regulations for new material certifications.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation Drivers: High-density composite development, weight reduction technologies.

- Regulatory Frameworks: Increasing focus on sustainability and material certifications.

- Competitive Product Substitutes: Plywood, steel flooring, other composite materials.

- End-User Demographics: Shipping companies, logistics providers, container manufacturers.

- M&A Trends: Anticipated increase in consolidation to gain market share and technology access.

Container Bamboo Wood Flooring Growth Trends & Insights

The global container bamboo wood flooring market is poised for significant expansion, driven by a confluence of economic, environmental, and technological factors. The market size is projected to reach approximately $550 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 8.5% from 2025 to 2033. This growth trajectory is underpinned by an increasing adoption rate within the shipping industry, spurred by the demand for lighter, more durable, and environmentally sustainable container flooring solutions. Technological disruptions, such as advancements in adhesive technologies and pressing techniques for bamboo-wood composites, are enhancing the performance and cost-effectiveness of these materials, making them increasingly competitive against traditional options.

Consumer behavior shifts are also playing a crucial role. There is a discernible preference among major shipping lines and logistics companies for materials that contribute to fuel efficiency through weight reduction and align with corporate sustainability goals. This trend is particularly evident in the dry container segment, which represents the largest application, expected to account for over 75% of the market share by 2033. The push for greener supply chains and reduced carbon footprints is directly translating into greater demand for bamboo-wood flooring.

Market penetration is expected to climb steadily, moving from an estimated 12% in 2025 to over 25% by 2033. This upward trend is fueled by the clear advantages offered by bamboo-wood flooring, including its superior tensile strength, resistance to moisture and rot, and its status as a rapidly renewable resource. The lightweight bamboo-wood flooring segment, though currently smaller, is anticipated to witness a higher CAGR of approximately 9.2% due to its specific applications in specialized containers where weight optimization is paramount. The industry is witnessing a continuous refinement of manufacturing processes, leading to improved material consistency and performance metrics, further accelerating adoption. The economic landscape, characterized by global trade volumes and evolving logistics demands, will continue to shape the market's evolution, making container bamboo wood flooring a critical component in modern shipping infrastructure.

Dominant Regions, Countries, or Segments in Container Bamboo Wood Flooring

The global container bamboo wood flooring market's dominance is clearly bifurcated across key regions and product segments, reflecting varying levels of adoption, manufacturing capabilities, and regulatory pressures. Asia Pacific, particularly China, is emerging as the leading region, driven by its extensive manufacturing infrastructure for both containers and bamboo products, coupled with robust government support for sustainable materials. The region's dominant position is further solidified by the presence of major manufacturers like CIMC New Materials and Kangxin New Materials, which are actively investing in research and development for advanced bamboo-wood composite flooring. The market share for Asia Pacific is estimated to be around 45% in 2025, with a projected growth to over 50% by 2033. Key drivers in this region include favorable economic policies promoting green manufacturing, substantial investments in port and logistics infrastructure, and a strong domestic demand from container manufacturers.

Within applications, the Dry Container segment overwhelmingly dominates the market. This segment is expected to hold a substantial market share, estimated at 78% in 2025, growing to approximately 82% by 2033. This dominance is attributed to the sheer volume of dry containers used globally for general cargo transportation, making it the largest addressable market. The need for durable, cost-effective, and increasingly sustainable flooring solutions in these workhorse containers makes bamboo-wood flooring an attractive proposition. The growth potential within this segment is immense, driven by ongoing fleet expansions and the continuous need for flooring replacement and upgrades.

Considering the types of bamboo-wood flooring, High-Density Bamboo-Wood Flooring commands the largest market share. In 2025, it is projected to account for around 65% of the market, expanding to approximately 70% by 2033. This is due to its superior strength, durability, and resistance to wear and tear, making it ideal for the rigorous demands of container transport. While Lightweight Bamboo-Wood Flooring holds a smaller share (estimated at 35% in 2025), it is anticipated to experience a higher growth rate (CAGR of 9.2%) due to its specialized applications where weight reduction is a critical factor for fuel efficiency and operational cost savings. The strategic advantage of this segment lies in its potential to cater to evolving needs for lighter and more efficient shipping solutions.

- Dominant Region: Asia Pacific (especially China)

- Key Drivers: Extensive manufacturing base, government support for sustainability, robust logistics infrastructure.

- Market Share: ~45% in 2025, projected to exceed 50% by 2033.

- Dominant Application: Dry Container

- Key Drivers: High volume of usage, demand for durable and cost-effective solutions.

- Market Share: ~78% in 2025, projected to reach ~82% by 2033.

- Dominant Type: High-Density Bamboo-Wood Flooring

- Key Drivers: Superior strength, durability, and wear resistance.

- Market Share: ~65% in 2025, projected to reach ~70% by 2033.

- Growth Potential: Significant due to its all-around performance.

- Growing Segment: Lightweight Bamboo-Wood Flooring

- Key Drivers: Fuel efficiency, operational cost savings, specialized applications.

- Growth Rate: Anticipated higher CAGR (~9.2%).

Container Bamboo Wood Flooring Product Landscape

The container bamboo wood flooring market is characterized by a continuous stream of product innovations aimed at enhancing performance, sustainability, and cost-effectiveness. Key advancements include the development of high-density bamboo-wood composites engineered for extreme durability, offering superior resistance to impact, abrasion, and moisture compared to traditional materials. These products often utilize advanced bonding agents and pressing technologies to create a homogenous and robust structure. Furthermore, the industry is seeing a rise in lightweight bamboo-wood flooring solutions, designed to minimize container weight without compromising structural integrity, thereby contributing to fuel efficiency and reduced operational costs. Unique selling propositions revolve around the sustainable sourcing of bamboo, a rapidly renewable resource, and the reduced carbon footprint associated with its production. Technological advancements focus on improving water resistance, fire retardancy, and slip resistance to meet stringent industry standards and diverse application requirements. The development of modular flooring systems for faster installation and replacement is also a notable trend.

Key Drivers, Barriers & Challenges in Container Bamboo Wood Flooring

The container bamboo wood flooring market is propelled by several key drivers. The increasing global emphasis on sustainability and environmental regulations is a significant catalyst, promoting the adoption of eco-friendly materials like bamboo. Demand for lightweight yet durable flooring solutions to enhance fuel efficiency in the shipping industry is another major driver. Technological advancements in composite manufacturing processes are improving the performance and cost-competitiveness of bamboo-wood flooring. Furthermore, the growing awareness among end-users about the long-term cost savings associated with higher durability and reduced maintenance is accelerating market penetration.

- Key Drivers: Sustainability initiatives, demand for lightweight materials, technological advancements in composites, long-term cost savings.

Conversely, the market faces several barriers and challenges. High initial investment costs for advanced manufacturing facilities can deter smaller players. Perceived performance limitations compared to established materials like steel, particularly in extreme conditions, can be a hurdle. Complex international certifications and standards for new materials in the shipping industry require significant time and resources to navigate. Supply chain volatility and raw material price fluctuations for bamboo and resins can impact production costs and availability. Limited awareness and a lack of established distribution networks in certain regions also pose challenges.

- Key Barriers & Challenges: High initial investment, perceived performance limitations, complex certifications, supply chain volatility, limited awareness.

Emerging Opportunities in Container Bamboo Wood Flooring

Emerging opportunities in the container bamboo wood flooring sector lie in several promising areas. The growing demand for specialized containers, such as those used for refrigerated goods or specific industrial applications, presents a niche market for tailored bamboo-wood flooring solutions with enhanced properties like insulation or chemical resistance. Untapped markets in developing economies with expanding trade volumes and increasing environmental consciousness offer significant growth potential. Furthermore, the development of smart flooring solutions integrated with sensors for cargo monitoring or condition tracking could open up new avenues. Evolving consumer preferences for circular economy principles and products with a lower environmental impact will continue to favor sustainable materials like bamboo.

Growth Accelerators in the Container Bamboo Wood Flooring Industry

Several factors are acting as growth accelerators for the container bamboo wood flooring industry. Technological breakthroughs in bio-based adhesives and advanced composite manufacturing are leading to superior product performance and reduced production costs, making bamboo-wood flooring more competitive. Strategic partnerships between bamboo suppliers, composite manufacturers, and major container leasing companies are crucial for scaling production and securing long-term contracts. Market expansion strategies, including penetration into new geographic regions and diversification into related applications such as trailers or industrial flooring, are further fueling growth. The continuous innovation in product design, focusing on enhanced durability and reduced weight, also acts as a significant accelerator.

Key Players Shaping the Container Bamboo Wood Flooring Market

- CIMC New Materials

- Kangxin New Materials

- Happy Wood Industrial Group

- Heqichang Group

- Dongshun Wood Industry

- OHC

Notable Milestones in Container Bamboo Wood Flooring Sector

- 2019: Increased research and development into high-density bamboo composites for enhanced durability in container applications.

- 2020: Emergence of lightweight bamboo-wood flooring prototypes for trial in specialty containers.

- 2021: Growing adoption by several independent container manufacturers seeking sustainable alternatives.

- 2022: Enhanced focus on obtaining international certifications for maritime material standards.

- 2023: Significant investment in production capacity expansion by leading players to meet growing demand.

- 2024: Introduction of improved water-resistant bamboo-wood flooring formulations.

In-Depth Container Bamboo Wood Flooring Market Outlook

The future outlook for the container bamboo wood flooring market is exceptionally positive, driven by a strong alignment with global sustainability trends and the increasing demand for efficient logistics solutions. Growth accelerators such as technological advancements in bio-composites and strategic market expansions will continue to shape the industry. The increasing adoption rate in the dominant dry container segment, coupled with the nascent but rapidly growing lightweight segment, indicates a robust expansion trajectory. Strategic partnerships and the development of specialized applications are expected to unlock further market potential, ensuring sustained growth and a significant contribution to a more sustainable global trade infrastructure.

Container Bamboo Wood Flooring Segmentation

-

1. Application

- 1.1. Dry Container

- 1.2. Specialty Container

-

2. Types

- 2.1. High-Density Bamboo-Wood Flooring

- 2.2. Lightweight Bamboo-Wood Flooring

Container Bamboo Wood Flooring Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Container Bamboo Wood Flooring REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Container Bamboo Wood Flooring Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dry Container

- 5.1.2. Specialty Container

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. High-Density Bamboo-Wood Flooring

- 5.2.2. Lightweight Bamboo-Wood Flooring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Container Bamboo Wood Flooring Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dry Container

- 6.1.2. Specialty Container

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. High-Density Bamboo-Wood Flooring

- 6.2.2. Lightweight Bamboo-Wood Flooring

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Container Bamboo Wood Flooring Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dry Container

- 7.1.2. Specialty Container

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. High-Density Bamboo-Wood Flooring

- 7.2.2. Lightweight Bamboo-Wood Flooring

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Container Bamboo Wood Flooring Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dry Container

- 8.1.2. Specialty Container

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. High-Density Bamboo-Wood Flooring

- 8.2.2. Lightweight Bamboo-Wood Flooring

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Container Bamboo Wood Flooring Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dry Container

- 9.1.2. Specialty Container

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. High-Density Bamboo-Wood Flooring

- 9.2.2. Lightweight Bamboo-Wood Flooring

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Container Bamboo Wood Flooring Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dry Container

- 10.1.2. Specialty Container

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. High-Density Bamboo-Wood Flooring

- 10.2.2. Lightweight Bamboo-Wood Flooring

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CIMC New Materials

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kangxin New Materials

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Happy Wood Industrial Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Heqichang Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dongshun Wood Industry

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OHC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 CIMC New Materials

List of Figures

- Figure 1: Global Container Bamboo Wood Flooring Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Container Bamboo Wood Flooring Revenue (million), by Application 2024 & 2032

- Figure 3: North America Container Bamboo Wood Flooring Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Container Bamboo Wood Flooring Revenue (million), by Types 2024 & 2032

- Figure 5: North America Container Bamboo Wood Flooring Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Container Bamboo Wood Flooring Revenue (million), by Country 2024 & 2032

- Figure 7: North America Container Bamboo Wood Flooring Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Container Bamboo Wood Flooring Revenue (million), by Application 2024 & 2032

- Figure 9: South America Container Bamboo Wood Flooring Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Container Bamboo Wood Flooring Revenue (million), by Types 2024 & 2032

- Figure 11: South America Container Bamboo Wood Flooring Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Container Bamboo Wood Flooring Revenue (million), by Country 2024 & 2032

- Figure 13: South America Container Bamboo Wood Flooring Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Container Bamboo Wood Flooring Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Container Bamboo Wood Flooring Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Container Bamboo Wood Flooring Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Container Bamboo Wood Flooring Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Container Bamboo Wood Flooring Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Container Bamboo Wood Flooring Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Container Bamboo Wood Flooring Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Container Bamboo Wood Flooring Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Container Bamboo Wood Flooring Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Container Bamboo Wood Flooring Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Container Bamboo Wood Flooring Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Container Bamboo Wood Flooring Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Container Bamboo Wood Flooring Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Container Bamboo Wood Flooring Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Container Bamboo Wood Flooring Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Container Bamboo Wood Flooring Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Container Bamboo Wood Flooring Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Container Bamboo Wood Flooring Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Container Bamboo Wood Flooring Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Container Bamboo Wood Flooring Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Container Bamboo Wood Flooring Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Container Bamboo Wood Flooring Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Container Bamboo Wood Flooring Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Container Bamboo Wood Flooring Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Container Bamboo Wood Flooring Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Container Bamboo Wood Flooring Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Container Bamboo Wood Flooring Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Container Bamboo Wood Flooring Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Container Bamboo Wood Flooring Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Container Bamboo Wood Flooring Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Container Bamboo Wood Flooring Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Container Bamboo Wood Flooring Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Container Bamboo Wood Flooring Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Container Bamboo Wood Flooring Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Container Bamboo Wood Flooring Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Container Bamboo Wood Flooring Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Container Bamboo Wood Flooring Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Container Bamboo Wood Flooring Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Bamboo Wood Flooring?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Container Bamboo Wood Flooring?

Key companies in the market include CIMC New Materials, Kangxin New Materials, Happy Wood Industrial Group, Heqichang Group, Dongshun Wood Industry, OHC.

3. What are the main segments of the Container Bamboo Wood Flooring?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 650 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Container Bamboo Wood Flooring," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Container Bamboo Wood Flooring report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Container Bamboo Wood Flooring?

To stay informed about further developments, trends, and reports in the Container Bamboo Wood Flooring, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence