Key Insights

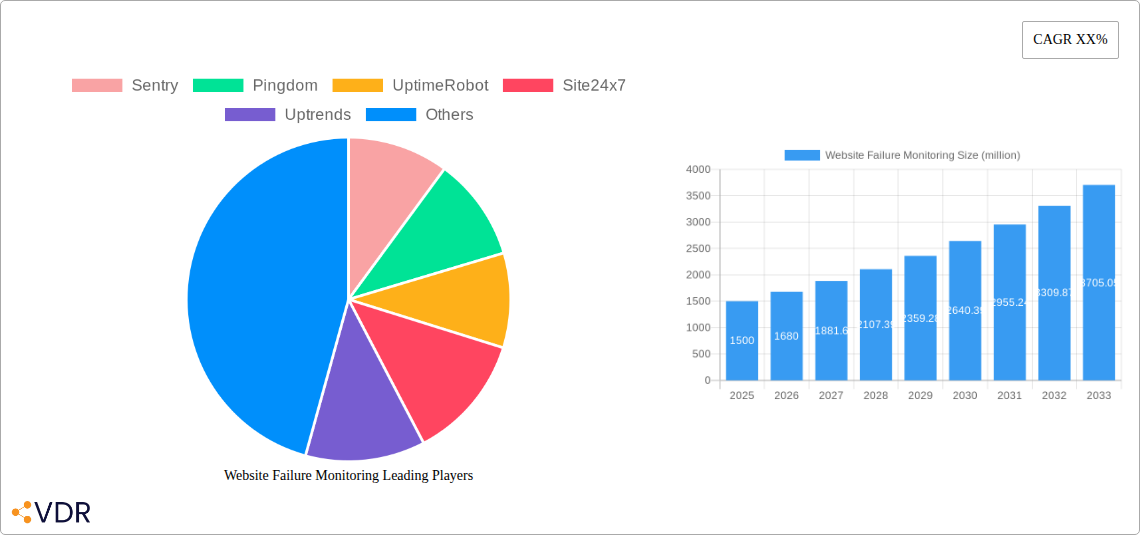

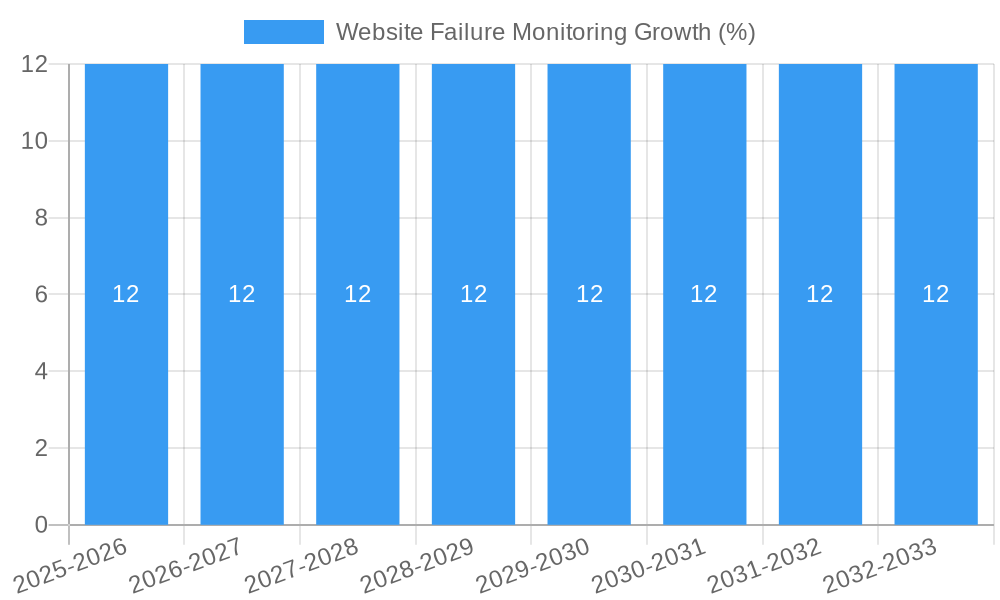

The global Website Failure Monitoring market is poised for significant expansion, projected to reach an estimated $1.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% through 2033. This impressive growth trajectory is underpinned by the escalating reliance of businesses and public entities on their online presence and the critical need to ensure uninterrupted service delivery. The increasing sophistication of cyber threats, coupled with the potential for substantial financial and reputational damage arising from website downtime, are primary catalysts driving demand for advanced monitoring solutions. Businesses are proactively investing in tools that offer real-time alerts, detailed performance analytics, and root cause analysis to mitigate risks associated with website failures. Furthermore, the proliferation of e-commerce, digital services, and remote work models further amplifies the importance of reliable website performance, making failure monitoring an indispensable component of modern IT infrastructure.

Key market drivers include the growing adoption of cloud-based infrastructure, which necessitates continuous monitoring of application performance and availability, and the rise of the Internet of Things (IoT), which expands the digital surface requiring constant oversight. The market is segmented by application, with Commercial use cases leading the demand, followed by Municipal applications and Others, reflecting the widespread need across diverse sectors. In terms of types, Website Access Monitoring and Website Response Monitoring are dominant segments, offering essential functionalities for ensuring both accessibility and responsiveness. Emerging trends like the integration of AI and machine learning for predictive failure analysis and the increasing demand for comprehensive Application Performance Monitoring (APM) solutions are shaping the competitive landscape. However, challenges such as the high initial investment for advanced solutions and the complexity of integrating multiple monitoring tools can act as restraints, though the long-term benefits of enhanced uptime and customer satisfaction are increasingly outweighing these concerns, particularly for forward-thinking organizations.

This comprehensive report offers an in-depth analysis of the global Website Failure Monitoring market, projecting a robust growth trajectory driven by the increasing reliance on digital infrastructure and the critical need for uninterrupted online services. Covering the historical period of 2019-2024, the base and estimated year of 2025, and a detailed forecast period of 2025-2033, this study provides actionable insights for stakeholders seeking to navigate this dynamic sector.

Website Failure Monitoring Market Dynamics & Structure

The Website Failure Monitoring market exhibits a moderately concentrated structure, with key players like Sentry, Pingdom, and UptimeRobot holding significant influence. Technological innovation is a primary driver, fueled by advancements in AI-powered anomaly detection and predictive analytics, enabling proactive identification and resolution of website downtime. Regulatory frameworks, while evolving, are increasingly focused on data privacy and service availability, indirectly shaping the demand for robust monitoring solutions. Competitive product substitutes, such as basic server health checks and manual testing, are largely being outpaced by sophisticated, automated website failure monitoring tools that offer comprehensive performance insights. End-user demographics span a wide spectrum, from large enterprises in the commercial segment to municipal entities ensuring public service continuity. Mergers and acquisitions (M&A) are a notable trend, with strategic consolidations aimed at expanding service portfolios and market reach. For instance, recent M&A activity has seen consolidation in the application performance monitoring (APM) space, with companies like Site24x7 and Uptrends expanding their offerings. The market's growth is also influenced by barriers to innovation, including the complexity of integrating diverse IT environments and the cost associated with implementing advanced monitoring solutions, although the ROI in preventing revenue loss from downtime is a strong counter-argument.

Website Failure Monitoring Growth Trends & Insights

The global Website Failure Monitoring market is poised for substantial expansion, with an estimated market size projected to reach $3,500 million in 2025, and a projected Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033. This growth is underpinned by escalating digital transformation initiatives across all sectors, leading to an increased number of critical web applications and a heightened awareness of the financial and reputational damage caused by website outages. Adoption rates for advanced monitoring solutions are rapidly accelerating, driven by the increasing sophistication of cyber threats and the need for real-time performance insights. Technological disruptions, including the proliferation of cloud-native architectures and the rise of the Internet of Things (IoT), present both opportunities and challenges, necessitating more dynamic and scalable monitoring capabilities. Consumer behavior shifts towards instant gratification and seamless online experiences further underscore the importance of website uptime, compelling businesses to invest in proactive failure detection and rapid remediation. Market penetration is expected to deepen, particularly in emerging economies, as digital infrastructure matures and the economic imperative for online reliability becomes more pronounced. The market is also seeing increased demand for synthetic monitoring, real user monitoring (RUM), and advanced alerting mechanisms, indicating a move towards more holistic and intelligent website health management. This evolution is crucial for businesses aiming to maintain customer loyalty and operational efficiency in an increasingly competitive digital landscape.

Dominant Regions, Countries, or Segments in Website Failure Monitoring

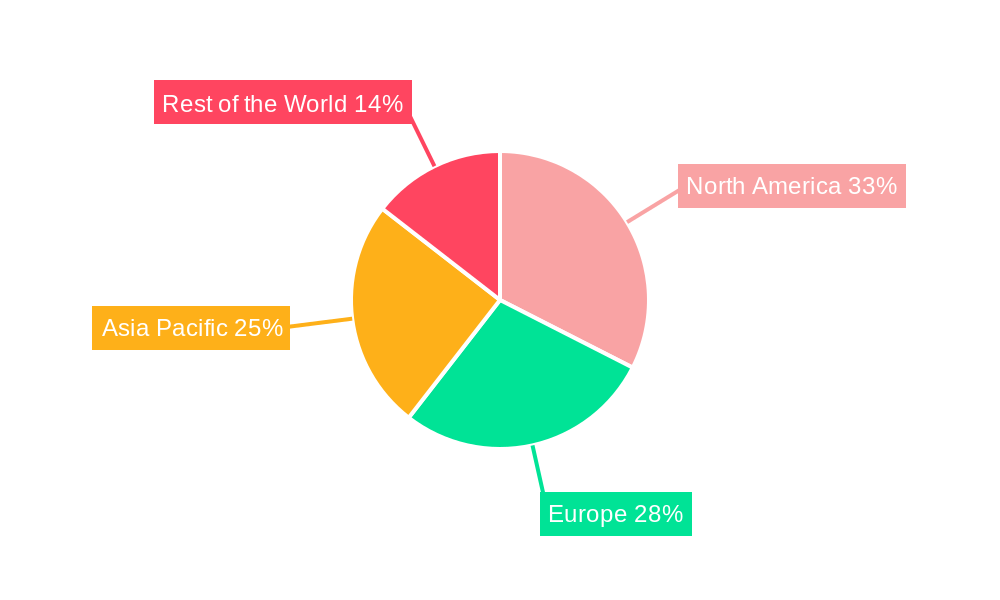

The Commercial segment, particularly within the North America region, is currently the dominant force in the Website Failure Monitoring market, driven by its advanced digital economy and the high concentration of e-commerce, SaaS, and enterprise-level businesses. North America's market share is estimated at 35% in 2025, with projected growth driven by substantial investments in cloud infrastructure and a mature understanding of the economic impact of website downtime. Key drivers in this region include robust economic policies that foster technological adoption, advanced IT infrastructure providing a fertile ground for monitoring tools, and a highly competitive business environment where online performance is a critical differentiator.

In terms of application types, Website Access Monitoring holds a significant market share within the Commercial segment. This is due to the fundamental need for businesses to ensure their websites are accessible to customers at all times. Countries like the United States and Canada are at the forefront of adopting sophisticated access monitoring solutions, utilizing tools from leading providers such as Pingdom and UptimeRobot to maintain high availability.

The Asia-Pacific region, however, is emerging as a high-growth area, with countries like China, India, and South Korea demonstrating rapid adoption rates. This surge is attributed to the explosive growth of their digital economies, a burgeoning startup ecosystem, and increasing government initiatives to promote digital infrastructure. The adoption of Website Response Monitoring is particularly notable here, as businesses grapple with increasing traffic and the need to optimize user experience.

The Municipal segment, while smaller in overall market size compared to Commercial, plays a crucial role in ensuring the availability of public services, including government portals, emergency response websites, and citizen information platforms. Countries with forward-thinking e-governance policies are driving demand for reliable monitoring solutions to prevent disruptions in critical public services.

The "Others" segment, encompassing various niche industries and non-profit organizations, is also showing steady growth as the importance of digital presence extends beyond traditional commercial and public sectors. The increasing reliance on online platforms for communication and service delivery by these entities fuels the demand for accessible and effective website failure monitoring tools.

Website Failure Monitoring Product Landscape

The Website Failure Monitoring product landscape is characterized by a continuous stream of innovations aimed at enhancing accuracy, speed, and comprehensiveness. Companies are developing advanced solutions that go beyond simple uptime checks to include deep packet inspection, synthetic transaction monitoring, and real-user experience tracking. For instance, Sentry and Rollbar offer sophisticated error tracking and performance monitoring for applications, ensuring even subtle failures are identified. Dotcom-Tools provides a suite of performance testing tools, while Visualping offers intelligent change detection. The integration of AI and machine learning is a key trend, enabling predictive analytics for potential failures and automated root cause analysis. Performance metrics like uptime percentage, response time, and error rates are becoming more granular, allowing businesses to fine-tune their online operations and deliver superior user experiences.

Key Drivers, Barriers & Challenges in Website Failure Monitoring

Key Drivers:

- Increasing Digital Dependency: The pervasive reliance on websites for commerce, communication, and services makes uptime a critical business imperative.

- Evolving Cyber Threats: Sophisticated attacks necessitate robust monitoring to detect and respond to disruptions promptly.

- Growth of E-commerce & Online Services: The expansion of online businesses directly correlates with the need for continuous website availability.

- Advancements in Monitoring Technology: AI, machine learning, and cloud-native solutions are making monitoring more intelligent and efficient.

- Stringent Service Level Agreements (SLAs): Businesses are compelled to meet high uptime guarantees, driving investment in monitoring solutions.

Barriers & Challenges:

- Implementation Complexity: Integrating advanced monitoring tools with diverse IT infrastructures can be challenging.

- Cost of Advanced Solutions: High-end monitoring systems can represent a significant investment for smaller businesses.

- Alert Fatigue: Overwhelming numbers of false positives can reduce the effectiveness of monitoring systems.

- Shortage of Skilled Professionals: A lack of expertise in managing and interpreting complex monitoring data.

- Data Privacy Concerns: Handling sensitive performance data requires adherence to strict privacy regulations.

Emerging Opportunities in Website Failure Monitoring

Emerging opportunities lie in the development of more integrated and intelligent monitoring platforms. The rise of edge computing and the expanding IoT ecosystem present a need for distributed monitoring solutions capable of managing a vast network of devices and applications. There's a growing demand for proactive maintenance and predictive failure analysis, leveraging AI to anticipate issues before they impact users. Furthermore, the increasing focus on user experience (UX) is driving the need for monitoring solutions that can accurately simulate and measure real-user journeys across various devices and network conditions. Untapped markets in developing economies and specialized industries are also ripe for growth, particularly for cost-effective and user-friendly monitoring tools.

Growth Accelerators in the Website Failure Monitoring Industry

Several catalysts are accelerating growth in the Website Failure Monitoring industry. Technological breakthroughs in AI and machine learning are enabling more sophisticated anomaly detection and predictive analytics, moving beyond reactive to proactive monitoring. Strategic partnerships between monitoring providers and cloud service providers (e.g., WP Engine's integrations) are expanding reach and enhancing service offerings. Market expansion strategies targeting underserved regions and industry verticals are also crucial. The growing trend of "as-a-service" models is making advanced monitoring solutions more accessible and scalable. Furthermore, the increasing emphasis on site reliability engineering (SRE) principles within organizations is directly driving the adoption of comprehensive failure monitoring tools.

Key Players Shaping the Website Failure Monitoring Market

- Sentry

- Pingdom

- UptimeRobot

- Site24x7

- Uptrends

- RapidSpike

- Uptimia

- Better Stack

- Rollbar

- Dotcom-Tools

- Visualping

- Super Monitoring

- SiteLock

- Uptime

- WP Engine

Notable Milestones in Website Failure Monitoring Sector

- 2019: Increased adoption of AI in anomaly detection by leading monitoring platforms.

- 2020: Growth in synthetic monitoring solutions to simulate user experiences across global locations.

- 2021: Rise of integrated Application Performance Monitoring (APM) and website monitoring suites.

- 2022: Expansion of monitoring capabilities to include containerized applications and microservices.

- 2023: Increased focus on real user monitoring (RUM) to capture authentic user behavior and performance.

- 2024: Significant M&A activity leading to consolidation and expanded service portfolios.

In-Depth Website Failure Monitoring Market Outlook

The future of the Website Failure Monitoring market is exceptionally promising, fueled by ongoing digital transformation and the unwavering demand for digital service reliability. Growth accelerators, including predictive analytics powered by AI, strategic alliances, and the expansion into emerging economies, will continue to shape the market. The increasing sophistication of user expectations and the persistent threat landscape will ensure that investment in robust, intelligent monitoring solutions remains a top priority for businesses across all sectors. The market is set to evolve towards more proactive, automated, and user-centric monitoring paradigms, offering significant strategic opportunities for innovation and market leadership.

Website Failure Monitoring Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Municipal

- 1.3. Others

-

2. Types

- 2.1. Website Access Monitoring

- 2.2. Website Response Monitoring

- 2.3. Others

Website Failure Monitoring Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Website Failure Monitoring REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Website Failure Monitoring Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Municipal

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Website Access Monitoring

- 5.2.2. Website Response Monitoring

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Website Failure Monitoring Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Municipal

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Website Access Monitoring

- 6.2.2. Website Response Monitoring

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Website Failure Monitoring Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Municipal

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Website Access Monitoring

- 7.2.2. Website Response Monitoring

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Website Failure Monitoring Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Municipal

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Website Access Monitoring

- 8.2.2. Website Response Monitoring

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Website Failure Monitoring Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Municipal

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Website Access Monitoring

- 9.2.2. Website Response Monitoring

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Website Failure Monitoring Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Municipal

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Website Access Monitoring

- 10.2.2. Website Response Monitoring

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sentry

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pingdom

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UptimeRobot

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Site24x7

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Uptrends

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RapidSpike

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Uptimia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Better Stack

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rollbar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dotcom-Tools

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Visualping

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Super Monitoring

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SiteLock

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Uptime

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 WP Engine

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Sentry

List of Figures

- Figure 1: Global Website Failure Monitoring Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Website Failure Monitoring Revenue (million), by Application 2024 & 2032

- Figure 3: North America Website Failure Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Website Failure Monitoring Revenue (million), by Types 2024 & 2032

- Figure 5: North America Website Failure Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Website Failure Monitoring Revenue (million), by Country 2024 & 2032

- Figure 7: North America Website Failure Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Website Failure Monitoring Revenue (million), by Application 2024 & 2032

- Figure 9: South America Website Failure Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Website Failure Monitoring Revenue (million), by Types 2024 & 2032

- Figure 11: South America Website Failure Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Website Failure Monitoring Revenue (million), by Country 2024 & 2032

- Figure 13: South America Website Failure Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Website Failure Monitoring Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Website Failure Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Website Failure Monitoring Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Website Failure Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Website Failure Monitoring Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Website Failure Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Website Failure Monitoring Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Website Failure Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Website Failure Monitoring Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Website Failure Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Website Failure Monitoring Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Website Failure Monitoring Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Website Failure Monitoring Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Website Failure Monitoring Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Website Failure Monitoring Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Website Failure Monitoring Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Website Failure Monitoring Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Website Failure Monitoring Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Website Failure Monitoring Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Website Failure Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Website Failure Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Website Failure Monitoring Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Website Failure Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Website Failure Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Website Failure Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Website Failure Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Website Failure Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Website Failure Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Website Failure Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Website Failure Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Website Failure Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Website Failure Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Website Failure Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Website Failure Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Website Failure Monitoring Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Website Failure Monitoring Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Website Failure Monitoring Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Website Failure Monitoring Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Website Failure Monitoring?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Website Failure Monitoring?

Key companies in the market include Sentry, Pingdom, UptimeRobot, Site24x7, Uptrends, RapidSpike, Uptimia, Better Stack, Rollbar, Dotcom-Tools, Visualping, Super Monitoring, SiteLock, Uptime, WP Engine.

3. What are the main segments of the Website Failure Monitoring?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Website Failure Monitoring," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Website Failure Monitoring report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Website Failure Monitoring?

To stay informed about further developments, trends, and reports in the Website Failure Monitoring, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence