Key Insights

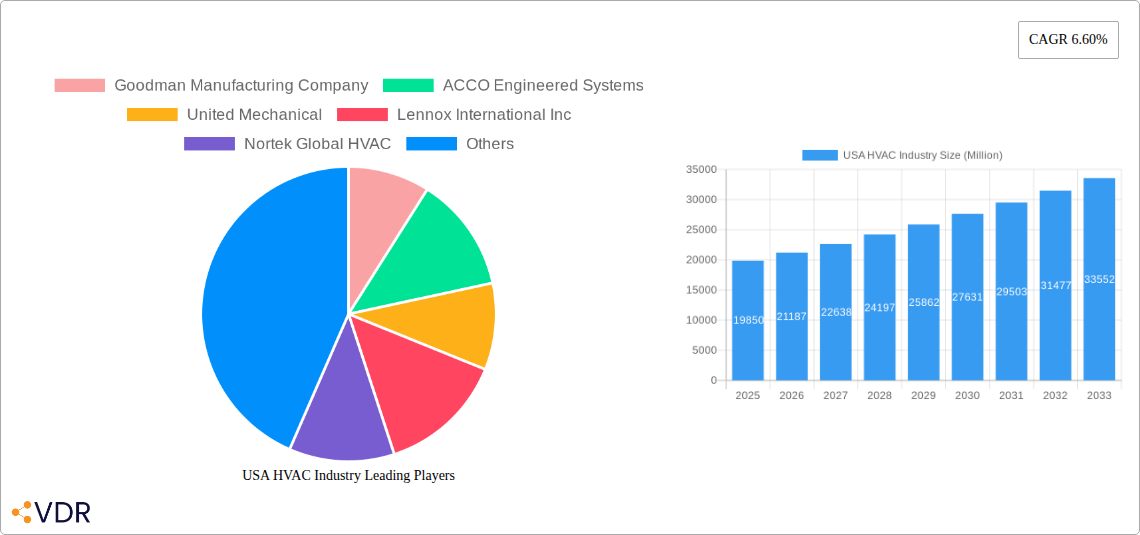

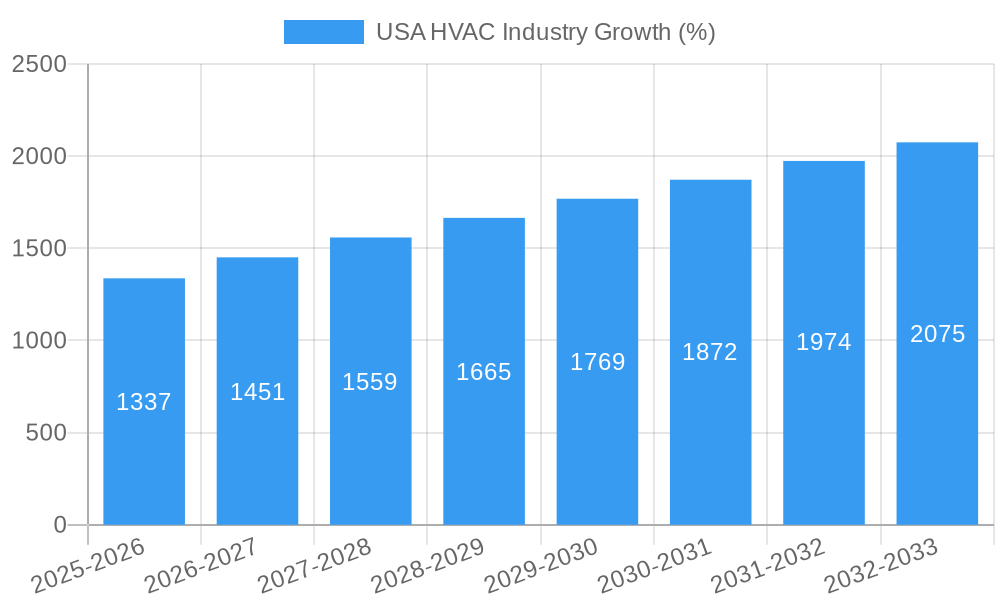

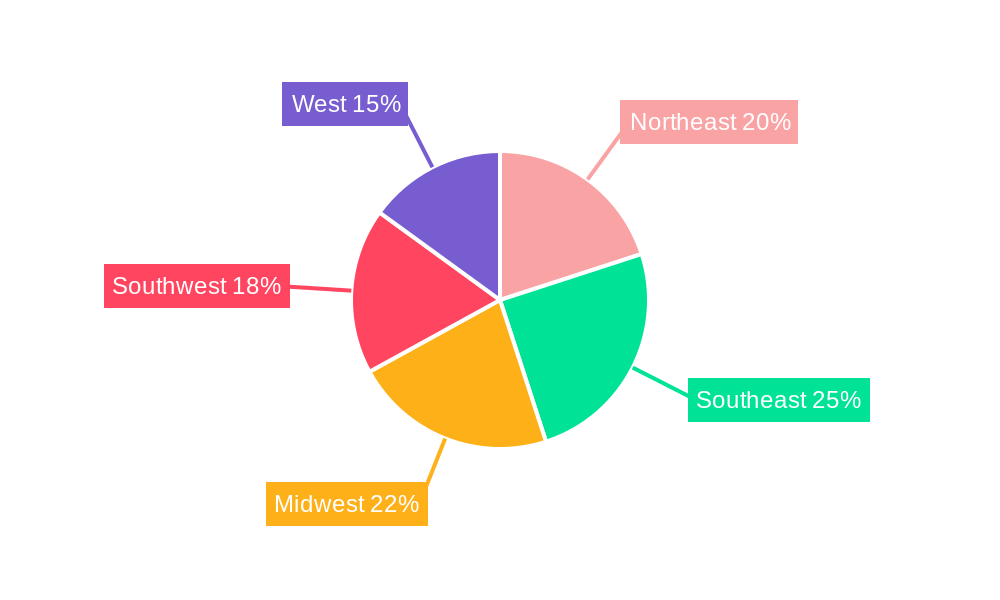

The US HVAC (Heating, Ventilation, and Air Conditioning) market, valued at $19.85 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing urbanization and construction activity, particularly in the residential and commercial sectors, fuel the demand for new HVAC installations. Furthermore, rising concerns about energy efficiency and indoor air quality are pushing adoption of advanced, energy-saving technologies like smart thermostats and heat pumps. Government initiatives promoting energy conservation and stricter building codes further contribute to market expansion. The retrofit segment is also witnessing significant growth as older systems are replaced with more efficient and sustainable alternatives. This trend is particularly pronounced in existing commercial buildings looking to reduce operational costs and meet environmental regulations. While rising material costs and supply chain disruptions pose some challenges, the overall market outlook remains positive, with a compound annual growth rate (CAGR) of 6.60% projected through 2033. Competition is intense, with major players like Goodman Manufacturing, Lennox International, and Carrier Corporation vying for market share through technological innovation, strategic partnerships, and expansion into new geographic areas. The market is segmented by end-user (residential, industrial, and commercial) and by type (new installations and retrofits), offering opportunities for specialized service providers and equipment manufacturers alike. Regional variations exist, with the Southeast and Southwest potentially experiencing faster growth due to climate conditions and construction booms.

The projected growth trajectory indicates significant opportunities for investment and expansion within the US HVAC sector. The continued focus on energy efficiency and sustainability will propel the demand for advanced technologies and services. Companies are likely to invest in research and development to create innovative, eco-friendly solutions catering to the specific needs of different market segments. Furthermore, the increasing adoption of smart home technologies presents a compelling avenue for growth, with integration of HVAC systems into broader smart building management platforms becoming increasingly common. Strategic acquisitions and mergers among existing players are also expected, leading to consolidation and further innovation within the industry. The growing focus on preventive maintenance and service contracts will create opportunities for service providers to build recurring revenue streams. The long-term outlook for the US HVAC market remains bullish, supported by consistent economic growth and a continued emphasis on comfort, energy efficiency, and sustainable practices.

USA HVAC Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the USA HVAC industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic planners. The report analyzes the market across key segments including residential, commercial, and industrial end-users and new installations versus retrofits. The market size is expressed in million units.

USA HVAC Industry Market Dynamics & Structure

The USA HVAC industry is characterized by a moderately concentrated market structure, with a few large players dominating alongside numerous smaller regional and local businesses. Technological innovation, driven by energy efficiency regulations and consumer demand for smart home solutions, is a key driver. Stringent environmental regulations, including those related to refrigerants, significantly influence market dynamics. Competitive product substitutes, such as geothermal systems and improved insulation, pose a challenge to traditional HVAC technologies. The end-user demographic is shifting towards increased adoption of smart and energy-efficient systems, particularly in the residential sector. Mergers and acquisitions (M&A) activity is prevalent, with larger players acquiring smaller companies to expand their market reach and product portfolios.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- M&A Activity: xx deals closed in the period 2019-2024, with an average deal value of $xx million.

- Technological Innovation: Focus on energy efficiency (heat pumps, smart thermostats) and connected devices.

- Regulatory Landscape: Stringent environmental regulations drive innovation in refrigerants and energy efficiency.

- Competitive Substitutes: Growing competition from geothermal energy and improved building insulation.

USA HVAC Industry Growth Trends & Insights

The US HVAC market has experienced consistent growth over the historical period (2019-2024). Driven by factors such as new construction, replacement of aging systems, and increasing awareness of energy efficiency, the market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. The adoption rate of smart HVAC systems is steadily increasing, fueled by consumer demand for enhanced comfort and energy savings. Technological disruptions, such as the development of more efficient and sustainable HVAC systems, are reshaping the market landscape. Consumer behavior is shifting towards preference for sustainable and energy-efficient solutions, impacting product demand and market segmentation. The increasing adoption of smart home technology, coupled with rising disposable incomes, further boosts market growth.

Dominant Regions, Countries, or Segments in USA HVAC Industry

The Residential segment dominates the USA HVAC market, accounting for xx% of the total market size in 2024. This is driven by a large housing stock requiring regular maintenance and replacements and a growing focus on home comfort and energy efficiency. The Southern and Southwestern states show the highest growth potential due to high temperatures and energy consumption patterns. The commercial sector is significant due to the need for climate control in offices, retail spaces, and other commercial buildings. New installations constitute a larger share compared to retrofits, driven by new construction projects and infrastructural development, although retrofits show promising growth.

- Residential Segment Drivers: High replacement rates, rising incomes, increasing homeownership, government incentives for energy efficiency upgrades.

- Commercial Segment Drivers: New building construction, growing commercial real estate sector, demand for improved indoor environmental quality.

- New Installations Drivers: Construction boom, government infrastructure projects, building renovations.

- Retrofits Drivers: Aging infrastructure, increased energy efficiency regulations, rising energy costs.

USA HVAC Industry Product Landscape

The HVAC product landscape is characterized by a wide array of products, including heat pumps, air conditioners, furnaces, and ventilation systems. Technological advancements are focused on improving energy efficiency, smart functionalities (such as smart thermostats and app connectivity), and reducing environmental impact through the use of eco-friendly refrigerants. Unique selling propositions (USPs) are emphasized through enhanced energy efficiency ratings, improved comfort features, and integration with smart home systems.

Key Drivers, Barriers & Challenges in USA HVAC Industry

Key Drivers: Rising energy costs, stringent environmental regulations promoting energy efficiency, increasing demand for improved indoor air quality, and government incentives for energy-efficient HVAC systems. Technological advancements in heat pump technology and smart home integration are pushing adoption rates.

Key Challenges: Supply chain disruptions impacting material availability and pricing, skilled labor shortages, intense competition from both established and new market entrants, fluctuating energy prices, and complex regulatory landscapes. These factors collectively lead to increased costs and uncertainty within the industry.

Emerging Opportunities in USA HVAC Industry

Significant opportunities lie in the integration of renewable energy sources (solar, wind) with HVAC systems, the expansion of smart HVAC technology and its integration with building automation systems, and providing HVAC services to underserved communities. Growth in the eco-friendly and sustainable HVAC solutions market presents a significant opportunity, addressing consumer demand for environmental responsibility.

Growth Accelerators in the USA HVAC Industry

Long-term growth in the USA HVAC industry will be significantly influenced by technological innovations, particularly in the field of heat pumps and energy-efficient HVAC systems. Strategic partnerships between HVAC manufacturers and smart home technology providers can boost market adoption rates. Expanding into underserved markets and focusing on sustainable, environmentally responsible solutions will open new avenues for growth.

Key Players Shaping the USA HVAC Industry Market

- Goodman Manufacturing Company

- ACCO Engineered Systems

- United Mechanical

- Lennox International Inc

- Nortek Global HVAC

- EMCOR Services

- Carrier Corporation

- Southland Industrial Energy

- National HVAC Services

- J&J Air Conditioning Services

Notable Milestones in USA HVAC Industry Sector

- May 2022: NearU Services partners with Bullman Heating and Air, expanding its service reach in North Carolina.

- January 2022: Marcone acquires Munch, strengthening its position as a leading HVAC parts distributor.

In-Depth USA HVAC Industry Market Outlook

The future of the USA HVAC industry looks promising, driven by ongoing technological innovation, increasing focus on sustainability, and strong demand for energy-efficient solutions. Strategic partnerships, market expansion into underserved areas, and the integration of smart technologies will further fuel market growth. The industry is well-positioned for continued expansion, driven by both residential and commercial demands and the push for sustainability.

USA HVAC Industry Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Industrial and Commercial

-

2. Type

- 2.1. New Installations

- 2.2. Retrofits

USA HVAC Industry Segmentation By Geography

- 1. United States

USA HVAC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Construction Activity; Higher Awareness on Energy Awareness Systems; Large Installed Base of HVAC Equipment in the Country

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations in the Middle East Have Been a Challenge for Vendors; Traditional Forms of Advertising Continue to Dominate in a Few Countries

- 3.4. Market Trends

- 3.4.1. Industrial and Commercial Segment to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. USA HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Industrial and Commercial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. New Installations

- 5.2.2. Retrofits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Northeast USA HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 7. Southeast USA HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 8. Midwest USA HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southwest USA HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 10. West USA HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Goodman Manufacturing Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ACCO Engineered Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 United Mechanical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lennox International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nortek Global HVAC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EMCOR Services

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carrier Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Southland Industrial Energy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 National HVAC Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 J&J Air Conditioning Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Goodman Manufacturing Company

List of Figures

- Figure 1: USA HVAC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: USA HVAC Industry Share (%) by Company 2024

List of Tables

- Table 1: USA HVAC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: USA HVAC Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 3: USA HVAC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: USA HVAC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: USA HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast USA HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast USA HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest USA HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest USA HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West USA HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: USA HVAC Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 12: USA HVAC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: USA HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA HVAC Industry?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the USA HVAC Industry?

Key companies in the market include Goodman Manufacturing Company, ACCO Engineered Systems, United Mechanical, Lennox International Inc, Nortek Global HVAC, EMCOR Services, Carrier Corporation, Southland Industrial Energy, National HVAC Services, J&J Air Conditioning Services.

3. What are the main segments of the USA HVAC Industry?

The market segments include End User, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Construction Activity; Higher Awareness on Energy Awareness Systems; Large Installed Base of HVAC Equipment in the Country.

6. What are the notable trends driving market growth?

Industrial and Commercial Segment to Grow Significantly.

7. Are there any restraints impacting market growth?

Stringent Regulations in the Middle East Have Been a Challenge for Vendors; Traditional Forms of Advertising Continue to Dominate in a Few Countries.

8. Can you provide examples of recent developments in the market?

May 2022: NearU Services announced its partnership with Bullman Heating and Air, an HVAC service provider in North Carolina. The collaboration with Bullman and NearU's May partnership with Mountain Air Mechanical Contractors will boost NearU's service capabilities in the rapidly-growing Asheville area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA HVAC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA HVAC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA HVAC Industry?

To stay informed about further developments, trends, and reports in the USA HVAC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence