Key Insights

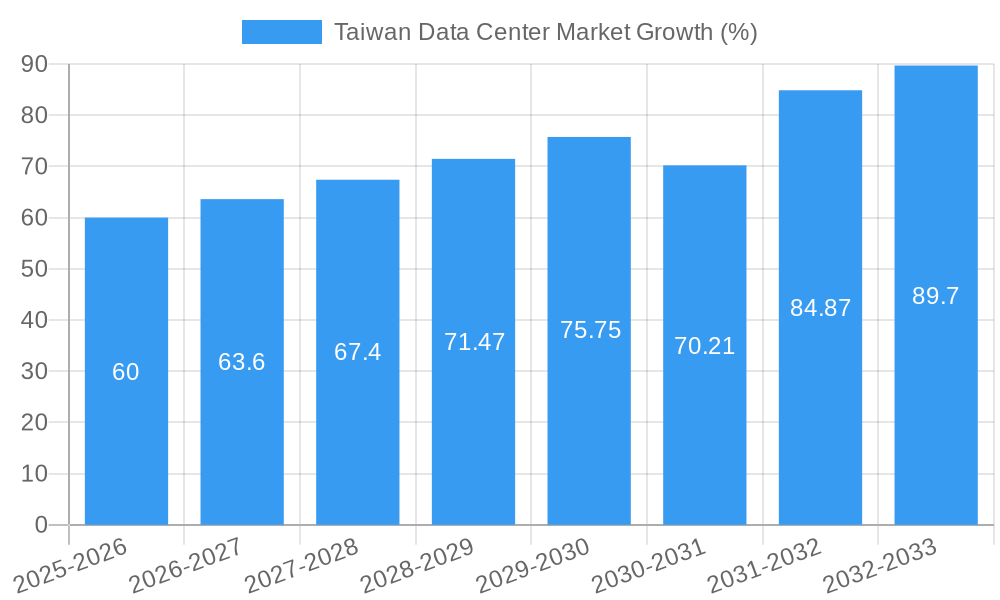

The Taiwan data center market, valued at approximately $XX million in 2025 (estimated based on provided CAGR and unspecified market size), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning digital economy in Taiwan, driven by advancements in e-commerce, cloud computing, and the increasing adoption of big data analytics, significantly fuels the demand for advanced data center infrastructure. Furthermore, government initiatives promoting digital transformation and investments in high-speed internet infrastructure contribute to the market's positive trajectory. Taipei, as a major technological hub, holds a dominant share of the market, but growth is also expected across other regions of Taiwan. The market segmentation reveals a diverse landscape, with substantial demand across various data center sizes (large, massive, medium, mega, small) and tiers (Tier 1 and others), catering to a range of end-user needs. Competition is fierce, with key players like Chief Telecom Inc, Chunghwa Telecom Co Ltd, and others vying for market share through innovative offerings and strategic partnerships.

Despite the optimistic outlook, the market faces certain restraints. Land scarcity and high real estate prices in major urban centers like Taipei could hinder expansion. Additionally, ensuring sufficient power supply and managing energy consumption effectively remain critical challenges for data center operators. The increasing importance of data security and regulatory compliance also presents complexities, requiring significant investments in robust security measures. Nevertheless, the ongoing digital transformation within Taiwan's various sectors and the rising demand for cloud-based services are expected to outweigh these challenges, securing the sustained growth of the Taiwan data center market throughout the forecast period (2025-2033). The absorption rate of data center space, though not fully specified, is likely influenced by these market dynamics.

Taiwan Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Taiwan data center market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes data from XXX and other reliable sources to deliver robust quantitative and qualitative analysis. Market values are presented in million units.

Taiwan Data Center Market Dynamics & Structure

The Taiwan data center market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is relatively high, with a few major players holding significant market share. However, the emergence of new entrants and technological advancements is gradually increasing competition. Government regulations play a crucial role, impacting infrastructure development and data sovereignty. The market experiences continuous technological innovation, driven by the demand for higher bandwidth, improved energy efficiency, and enhanced security features. The increasing adoption of cloud computing and the proliferation of data-intensive applications are primary drivers. Meanwhile, competitive product substitutes like edge computing are slowly affecting market growth. Finally, M&A activity is expected to increase as larger players seek to consolidate market share.

- Market Concentration: Top 3 players hold approximately XX% market share (2024).

- Technological Innovation: Focus on 5G, AI, and edge computing is accelerating market growth.

- Regulatory Framework: Government initiatives promoting digitalization are creating favorable conditions.

- M&A Activity: XX major M&A deals recorded between 2019-2024, resulting in market consolidation.

- End-User Demographics: Predominantly driven by telecommunications, finance, and IT sectors.

- Innovation Barriers: High capital expenditure and technical expertise required for new entrants.

Taiwan Data Center Market Growth Trends & Insights

The Taiwan data center market has exhibited consistent growth over the historical period (2019-2024), with a CAGR of XX%. This growth is fueled by several factors, including the rapid expansion of digital technologies such as cloud computing and the Internet of Things (IoT). Increased data traffic, alongside government initiatives to build robust digital infrastructure and stringent cybersecurity norms, further accelerate growth. Consumer behavior changes, including a heightened reliance on digital services and remote work, significantly contribute to the market's expansion. Market penetration in major sectors such as finance and telecommunications is above XX%, and this is anticipated to increase gradually in the forecast period. Technological disruptions, such as the rise of edge computing and the ongoing development of next-generation networks, shape the data center landscape. The forecast period (2025-2033) projects a CAGR of XX%, driven primarily by 5G deployments and the government’s Digital Nation initiative. The overall market size is projected to reach XX million by 2033.

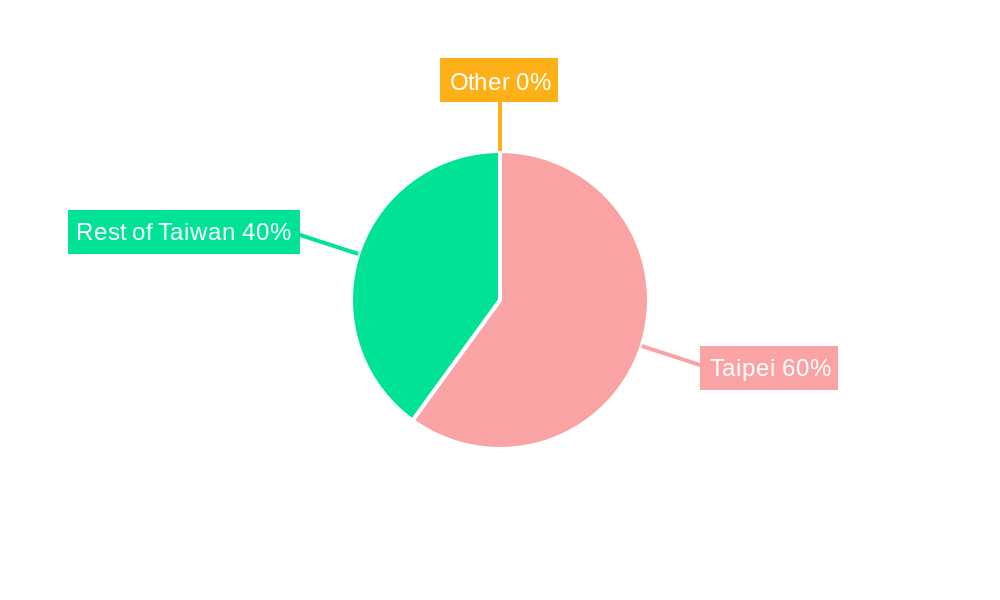

Dominant Regions, Countries, or Segments in Taiwan Data Center Market

Taipei dominates the Taiwan data center market, accounting for approximately XX% of the total market share in 2024. This dominance stems from its concentration of businesses, skilled workforce, and superior infrastructure. However, the "Rest of Taiwan" segment is showing promising growth potential, driven by ongoing infrastructure investments and increasing demand from regional businesses. Within data center sizes, the Large and Mega segments are currently leading, but the Medium and Small segments are showing strong growth driven by increasing demand for cloud computing services. Tier 1 and Tier 3 facilities command the majority of market share while the absorption rate of data center space is currently at XX% utilized and XX% non-utilized, with some space remaining under "Others" category which includes non-traditional spaces.

- Key Drivers for Taipei's Dominance:

- Concentrated business activity and high demand for colocation services.

- Superior infrastructure including robust power and connectivity.

- Skilled workforce and established digital ecosystem.

- Growth Potential in "Rest of Taiwan":

- Government investments in infrastructure development are extending data center reach.

- Growing demand from regional businesses and industries.

- Reduced reliance on single locations through distributed cloud services.

- Data Center Size: Large and Mega segments dominate, driven by enterprise needs.

- Tier Type: Tier 1 and Tier 3 facilities dominate, driven by the need for reliability.

- Absorption: Utilized capacity reflects strong demand; Non-utilized capacity suggests future growth potential.

Taiwan Data Center Market Product Landscape

The Taiwan data center market offers a diverse range of products, including colocation services, cloud computing, managed services, and specialized data center solutions. Continuous technological advancements focus on improving energy efficiency, enhancing security features, and increasing capacity. Key trends include the adoption of hyperscale infrastructure, the integration of AI and machine learning for optimized operations, and the use of sustainable energy sources. Unique selling propositions often include highly reliable infrastructure, strategic locations, and tailored solutions catering to diverse customer requirements.

Key Drivers, Barriers & Challenges in Taiwan Data Center Market

Key Drivers:

- Government Support: Policies aimed at digitalization and economic diversification are creating incentives for data center development.

- Economic Growth: Taiwan's robust economy fuels demand for data storage and processing capacity.

- Technological Advancements: 5G and edge computing are generating significant demand for data centers.

Challenges:

- Land Scarcity: Limited available land in key locations presents a constraint.

- Energy Costs: High energy costs can impact data center operations' profitability.

- Competition: Intense competition among established and new market entrants. This competition can lead to price wars and compressed profit margins.

Emerging Opportunities in Taiwan Data Center Market

- Edge Computing: Expanding adoption of edge computing offers opportunities for data centers closer to users.

- Hyperscale Data Centers: Demand for large-scale data centers from hyperscale cloud providers.

- Green Data Centers: Growing focus on sustainability and energy efficiency is opening opportunities for green data center solutions.

Growth Accelerators in the Taiwan Data Center Market Industry

The long-term growth of the Taiwan data center market will be driven by factors such as continuous technological innovation, particularly in areas like AI and 5G. Strategic partnerships between data center providers and cloud service providers will create synergetic opportunities. Furthermore, market expansion into less-developed regions of Taiwan, coupled with an increased focus on energy efficiency, will enhance the industry's sustainability and profitability. Government investment in infrastructure and supportive regulatory frameworks will also contribute significantly.

Key Players Shaping the Taiwan Data Center Market Market

- Chief Telecom Inc

- Chunghwa Telecom Co Ltd

- TAIWAN TELIN CO LTD

- Far EasTone Telecommunications Co Ltd

- Zenlayer Inc

- eASPNet Taiwan Inc

- Telstra Corporation Limited

- DYXnet

- Taiwan Mobile Co Ltd

Notable Milestones in Taiwan Data Center Market Sector

- January 2016: Chunghwa Telecom Co.,Ltd. opened TIA-942 rated 4 data center “CHT Taipei IDC” in Taiwan, providing co-location and interconnection services (ICS).

- January 2017: Zenlayer entered the Taiwan market with the launch of four data centers.

- August 2020: Pico strengthened its global data center presence with a new Taiwan colocation facility managed by a colocation facility at Chunghwa Telecom’s CHT Taipei IDC in Banqiao, New Taipei City.

In-Depth Taiwan Data Center Market Market Outlook

The future of the Taiwan data center market appears promising, driven by sustained economic growth, technological advancements, and governmental support. The market is poised for continued expansion, particularly in segments such as edge computing and hyperscale data centers. Strategic partnerships and investments in sustainable infrastructure will further drive growth. Companies that can adapt to evolving technological landscapes and cater to the diverse needs of customers will be well-positioned to capitalize on the numerous opportunities that lie ahead. The market's potential for robust growth presents attractive prospects for investment and innovation.

Taiwan Data Center Market Segmentation

-

1. Hotspot

- 1.1. Taipei

- 1.2. Rest of Taiwan

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End Users

Taiwan Data Center Market Segmentation By Geography

- 1. Taiwan

Taiwan Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Taipei

- 5.1.2. Rest of Taiwan

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End Users

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Chief Telecom Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chunghwa Telecom Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TAIWAN TELIN CO LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Far EasTone Telecommunications Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zenlayer Inc5

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 eASPNet Taiwan Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telstra Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DYXnet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Taiwan Mobile Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Chief Telecom Inc

List of Figures

- Figure 1: Taiwan Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Taiwan Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Taiwan Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Taiwan Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Taiwan Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Taiwan Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Taiwan Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Taiwan Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Taiwan Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Taiwan Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Taiwan Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Taiwan Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Taiwan Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Taiwan Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Taiwan Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Taiwan Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Taiwan Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Taiwan Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Taiwan Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Taiwan Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Taiwan Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Taiwan Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Taiwan Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Taiwan Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Taiwan Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Taiwan Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Taiwan Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Taiwan Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Taiwan Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Taiwan Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Taiwan Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Taiwan Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Taiwan Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Taiwan Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Taiwan Data Center Market?

Key companies in the market include Chief Telecom Inc, Chunghwa Telecom Co Ltd, TAIWAN TELIN CO LTD, Far EasTone Telecommunications Co Ltd, Zenlayer Inc5 , eASPNet Taiwan Inc, Telstra Corporation Limited, DYXnet, Taiwan Mobile Co Ltd.

3. What are the main segments of the Taiwan Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

August 2020: Pico Strengthens its Global Data Center Presence with New Taiwan Colocation Facility and managed by colocation facility at Chunghwa Telecom’s CHT Taipei IDC in Banqiao, New Taipei City.January 2017: Zenlayer entered the Taiwan market in 2017 with the launch of four data centers in Taiwan.January 2016: Chunghwa Telecom Co.,Ltd. opened TIA-942 rated 4 data center “CHT Taipei IDC” in Taiwan, providing co-location and interconnection services (ICS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Data Center Market?

To stay informed about further developments, trends, and reports in the Taiwan Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence