Key Insights

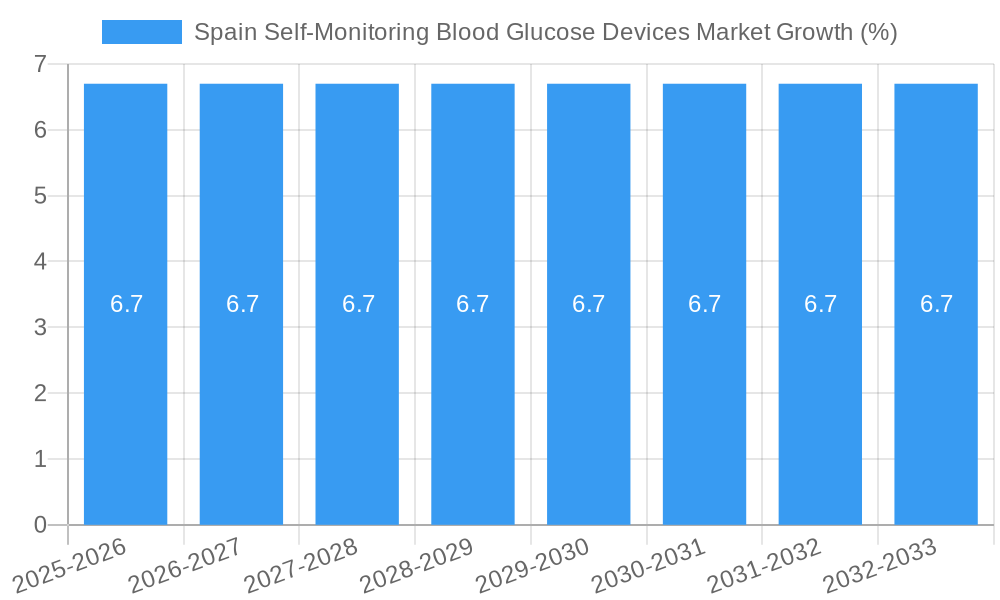

The Spain Self-Monitoring Blood Glucose Devices Market is poised for significant expansion, driven by an increasing prevalence of diabetes and a growing awareness of proactive diabetes management. With a current market size estimated at €290 million, the market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033. This growth is fueled by several key factors, including advancements in glucometer technology leading to more accurate, user-friendly, and connected devices, coupled with the sustained demand for test strips and lancets. The aging population in Spain, a demographic more susceptible to chronic diseases like diabetes, further bolsters the market. Additionally, government initiatives and healthcare provider recommendations emphasizing regular blood glucose monitoring for better patient outcomes are playing a crucial role in driving market penetration and adoption of these essential devices.

The market is segmented into key components: Glucometer Devices, Test Strips, and Lancets, with each segment contributing to the overall market value. Leading companies such as Roche Diabetes Care, Abbott Diabetes Care, and LifeScan are actively shaping the competitive landscape through product innovation and strategic partnerships. The trend towards smart glucometers with Bluetooth connectivity and mobile app integration is gaining traction, enabling seamless data tracking and sharing with healthcare professionals, thereby enhancing personalized diabetes care. While the market presents substantial growth opportunities, potential restraints might include the initial cost of advanced devices for some segments of the population and evolving reimbursement policies. However, the persistent need for effective diabetes management, coupled with technological advancements, is expected to outweigh these challenges, ensuring a steady upward trajectory for the Spain Self-Monitoring Blood Glucose Devices Market.

Gain unparalleled insights into the Spain self-monitoring blood glucose (SMBG) devices market. This comprehensive report provides an in-depth analysis of market dynamics, growth trends, competitive landscape, and future outlook from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. Delve into parent and child market segments, understand key drivers, identify emerging opportunities, and assess the impact of industry developments on this crucial healthcare sector. Discover market size evolution, adoption rates, technological disruptions, and consumer behavior shifts driving demand for blood glucose meters, test strips, and lancets in Spain. This report is an essential resource for manufacturers, distributors, healthcare providers, and investors seeking to navigate the complexities of the Spanish diabetes monitoring market.

Spain Self-Monitoring Blood Glucose Devices Market Market Dynamics & Structure

The Spain self-monitoring blood glucose devices market is characterized by a moderately consolidated structure, with key players like Roche Diabetes Care, Abbott Diabetes Care, and LifeScan holding significant market shares. Technological innovation is a primary driver, with continuous advancements in connected blood glucose meters, smart glucose monitoring systems, and user-friendly interfaces enhancing patient engagement and data management. The regulatory framework in Spain, aligned with EU directives, ensures product safety and efficacy, indirectly influencing market growth by fostering trust in approved devices. Competitive product substitutes, such as Continuous Glucose Monitoring (CGM) systems, present a growing challenge, particularly for individuals seeking more comprehensive diabetes management solutions. End-user demographics are shifting, with an aging population and increasing prevalence of diabetes driving demand for accessible and reliable SMBG devices. Merger and acquisition (M&A) trends, while not as prevalent as in other healthcare sectors, can be strategic for consolidating market presence and expanding product portfolios.

- Market Concentration: Moderately consolidated with leading global players.

- Technological Innovation Drivers: Advancements in connectivity, usability, and data analytics.

- Regulatory Frameworks: EU-aligned regulations ensuring safety and efficacy.

- Competitive Product Substitutes: Growing adoption of Continuous Glucose Monitoring (CGM) systems.

- End-User Demographics: Aging population and rising diabetes prevalence as key demand drivers.

- M&A Trends: Strategic acquisitions for market expansion and portfolio enhancement.

Spain Self-Monitoring Blood Glucose Devices Market Growth Trends & Insights

The Spain self-monitoring blood glucose devices market is projected to witness robust growth, driven by escalating diabetes prevalence and increased awareness regarding proactive diabetes management. Leveraging advanced analytics and market research methodologies, this section provides a detailed analysis of market size evolution, adoption rates, and technological disruptions shaping the Spanish SMBG market. The increasing integration of Bluetooth-enabled glucometers and mobile diabetes applications is revolutionizing patient care, enabling seamless data sharing with healthcare professionals and facilitating personalized treatment adjustments. This trend is a significant catalyst for market penetration, as individuals with diabetes are increasingly seeking convenient and integrated solutions for managing their condition. Consumer behavior is shifting towards empowerment, with patients actively participating in their health management and demanding devices that offer accurate readings, ease of use, and valuable insights into their glycemic trends. The market is also experiencing growth due to the expansion of digital health platforms and telehealth services, which often integrate SMBG data for remote patient monitoring. The forecast period is expected to see sustained growth, fueled by ongoing innovation in sensor technology, improved data interpretation algorithms, and a growing emphasis on preventative healthcare strategies within Spain.

Dominant Regions, Countries, or Segments in Spain Self-Monitoring Blood Glucose Devices Market

The Glucometer Devices segment is anticipated to be the dominant force within the Spain self-monitoring blood glucose devices market. This dominance is driven by several interconnected factors that underscore the fundamental need for a reliable and accessible primary device for blood glucose measurement. The fundamental utility of glucometers as the entry point for most individuals into self-monitoring makes them indispensable. Furthermore, ongoing technological advancements are continually enhancing their performance, offering greater accuracy, speed, and ease of use. The widespread availability and affordability of basic glucometer models cater to a broad spectrum of the Spanish population, including those with limited digital literacy or financial constraints.

- Glucometer Devices: The leading segment due to their foundational role in SMBG and continuous innovation.

- Key Drivers: Technological advancements (accuracy, speed, connectivity), affordability, and widespread availability.

- Market Share: Expected to command the largest share within the SMBG market.

- Growth Potential: Sustained by new product launches and increasing adoption among newly diagnosed diabetic patients.

- Test Strips: While a crucial consumable, their growth is intrinsically linked to glucometer sales.

- Market Dynamics: Driven by the frequency of testing and the number of active glucometer users.

- Growth Drivers: Increased testing frequency for better glycemic control and a growing installed base of glucometers.

- Lancets: Essential accessories for SMBG, their market growth mirrors that of glucometers and test strips.

- Market Factors: Driven by convenience and pain-reduction innovations in lancet technology.

- Market Potential: Steady growth expected due to their recurring purchase nature.

Spain Self-Monitoring Blood Glucose Devices Market Product Landscape

The product landscape of the Spain self-monitoring blood glucose devices market is defined by a commitment to enhanced accuracy, user-friendliness, and connectivity. Innovations are focused on smaller, faster, and more intuitive blood glucose meters that offer pain-free lancing options and clear digital displays. Smart glucometers that seamlessly transmit data to mobile applications and cloud platforms are gaining traction, enabling patients and healthcare providers to track glycemic trends, identify patterns, and receive personalized insights. The development of test strips with improved enzyme technology ensures higher accuracy and longer shelf-life, while lancets are evolving with finer gauges and innovative designs for a more comfortable testing experience. The emphasis is on creating an integrated ecosystem that simplifies diabetes management and empowers individuals to take greater control of their health.

Key Drivers, Barriers & Challenges in Spain Self-Monitoring Blood Glucose Devices Market

The Spain self-monitoring blood glucose devices market is propelled by several key drivers, including the escalating prevalence of diabetes in Spain, increased patient awareness regarding the importance of glycemic control, and continuous technological advancements in SMBG devices that enhance accuracy and user convenience. Supportive government initiatives promoting diabetes care and a growing elderly population susceptible to chronic diseases further bolster market growth.

However, the market faces notable barriers and challenges. The increasing adoption of Continuous Glucose Monitoring (CGM) systems presents a direct competitive threat, offering more comprehensive data and real-time insights. High out-of-pocket expenses for some advanced SMBG devices and consumables can limit accessibility for certain patient segments. Furthermore, ensuring consistent product quality and addressing potential supply chain disruptions, especially for specialized components, remain ongoing concerns for manufacturers. Navigating complex regulatory pathways for novel devices also poses a challenge.

Emerging Opportunities in Spain Self-Monitoring Blood Glucose Devices Market

Emerging opportunities in the Spain self-monitoring blood glucose devices market lie in the development of more affordable, connected SMBG solutions tailored for diverse socioeconomic groups. The integration of artificial intelligence (AI) and machine learning within diabetes management apps, powered by SMBG data, presents a significant avenue for personalized insights and predictive analytics. There is also potential in expanding the reach of SMBG devices through partnerships with pharmacies, primary healthcare centers, and employers offering wellness programs. Furthermore, the growing demand for remote patient monitoring solutions creates a niche for smart SMBG devices that can seamlessly transmit data to telehealth platforms.

Growth Accelerators in the Spain Self-Monitoring Blood Glucose Devices Market Industry

The Spain self-monitoring blood glucose devices market is poised for accelerated growth driven by several key catalysts. Technological breakthroughs, such as the development of non-invasive or minimally invasive glucose monitoring techniques, have the potential to revolutionize the market. Strategic partnerships between device manufacturers, pharmaceutical companies, and digital health providers are crucial for creating integrated diabetes management ecosystems. Furthermore, market expansion strategies, including targeted marketing campaigns, educational outreach programs for patients and healthcare professionals, and the development of user-friendly, multilingual interfaces, will play a vital role in capturing a larger market share.

Key Players Shaping the Spain Self-Monitoring Blood Glucose Devices Market Market

- Roche Diabetes Care

- Rossmax International Ltd

- Abbott Diabetes Care

- Arkray Inc

- Bionime Corporation

- VivaChek

- LifeScan

- Menarini

- Ascensia Diabetes Care

Notable Milestones in Spain Self-Monitoring Blood Glucose Devices Market Sector

- January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published "Improved Glycemic Control Using a Bluetooth-Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence from Over 144,000 People with Diabetes," detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes-one of the largest combined blood glucose meter and mobile diabetes app datasets ever published. This highlights the growing importance of connected devices in real-world diabetes management.

- January 2022: Roche announced the launch of the Cobas Pulse system in selected countries accepting the CE Mark. The Cobas Pulse system marks Roche Diagnostics' newest generation of connected point-of-care solutions for professional blood glucose management. The Cobas Pulse system combines the form factor of a high-performance blood glucose meter with simple usability and expanded digital capabilities like those of a smartphone. This signifies a move towards more advanced, integrated solutions within professional healthcare settings.

In-Depth Spain Self-Monitoring Blood Glucose Devices Market Market Outlook

- January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published "Improved Glycemic Control Using a Bluetooth-Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence from Over 144,000 People with Diabetes," detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes-one of the largest combined blood glucose meter and mobile diabetes app datasets ever published. This highlights the growing importance of connected devices in real-world diabetes management.

- January 2022: Roche announced the launch of the Cobas Pulse system in selected countries accepting the CE Mark. The Cobas Pulse system marks Roche Diagnostics' newest generation of connected point-of-care solutions for professional blood glucose management. The Cobas Pulse system combines the form factor of a high-performance blood glucose meter with simple usability and expanded digital capabilities like those of a smartphone. This signifies a move towards more advanced, integrated solutions within professional healthcare settings.

In-Depth Spain Self-Monitoring Blood Glucose Devices Market Market Outlook

The future outlook for the Spain self-monitoring blood glucose devices market is exceptionally promising, fueled by sustained advancements in technology and a growing emphasis on proactive health management. The trend towards connected devices and integrated digital health platforms will continue to shape the market, offering patients more comprehensive tools for monitoring and managing their diabetes. Strategic collaborations and market expansion initiatives are expected to further penetrate the market, making advanced SMBG solutions more accessible. The increasing focus on personalized medicine and preventative care will drive demand for innovative devices that provide deeper insights into glycemic patterns, ultimately contributing to improved patient outcomes and a healthier future for individuals with diabetes in Spain.

Spain Self-Monitoring Blood Glucose Devices Market Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Spain Self-Monitoring Blood Glucose Devices Market Segmentation By Geography

- 1. Spain

Spain Self-Monitoring Blood Glucose Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Roche Diabetes Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rossmax International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Diabetes Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arkray Inc *List Not Exhaustive 7 2 COMPANY SHARE ANALYSI

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bionime Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VivaChek

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LifeScan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Menarini

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ascensia Diabetes Care

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Roche Diabetes Care

List of Figures

- Figure 1: Spain Self-Monitoring Blood Glucose Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Self-Monitoring Blood Glucose Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Spain Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Spain Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 5: Spain Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Self-Monitoring Blood Glucose Devices Market?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Spain Self-Monitoring Blood Glucose Devices Market?

Key companies in the market include Roche Diabetes Care, Rossmax International Ltd, Abbott Diabetes Care, Arkray Inc *List Not Exhaustive 7 2 COMPANY SHARE ANALYSI, Bionime Corporation, VivaChek, LifeScan, Menarini, 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES, Ascensia Diabetes Care.

3. What are the main segments of the Spain Self-Monitoring Blood Glucose Devices Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 290 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Spain.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth-Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence from Over 144,000 People with Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes-one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Self-Monitoring Blood Glucose Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Self-Monitoring Blood Glucose Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Self-Monitoring Blood Glucose Devices Market?

To stay informed about further developments, trends, and reports in the Spain Self-Monitoring Blood Glucose Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence