Key Insights

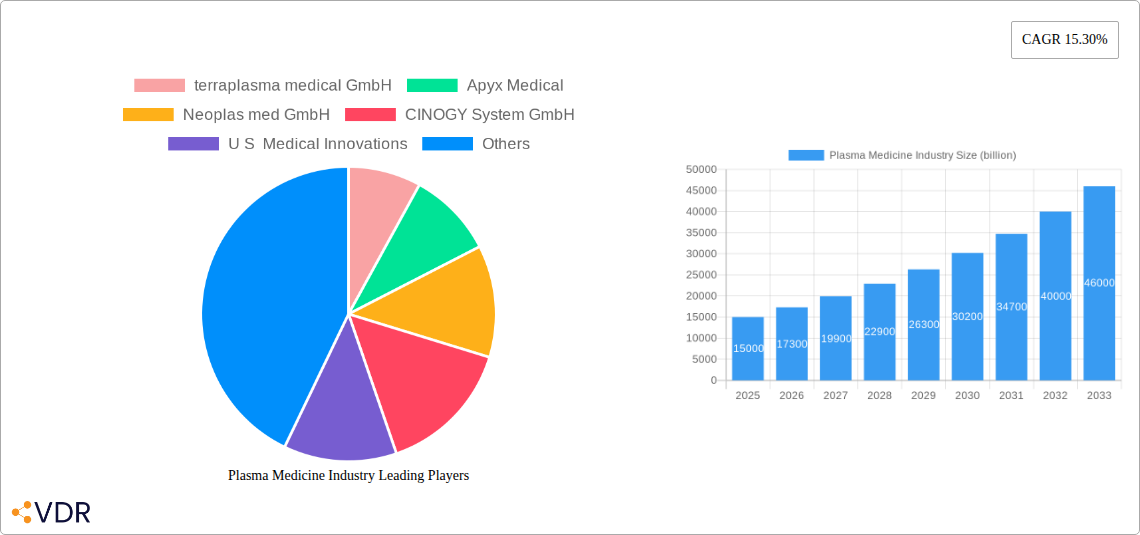

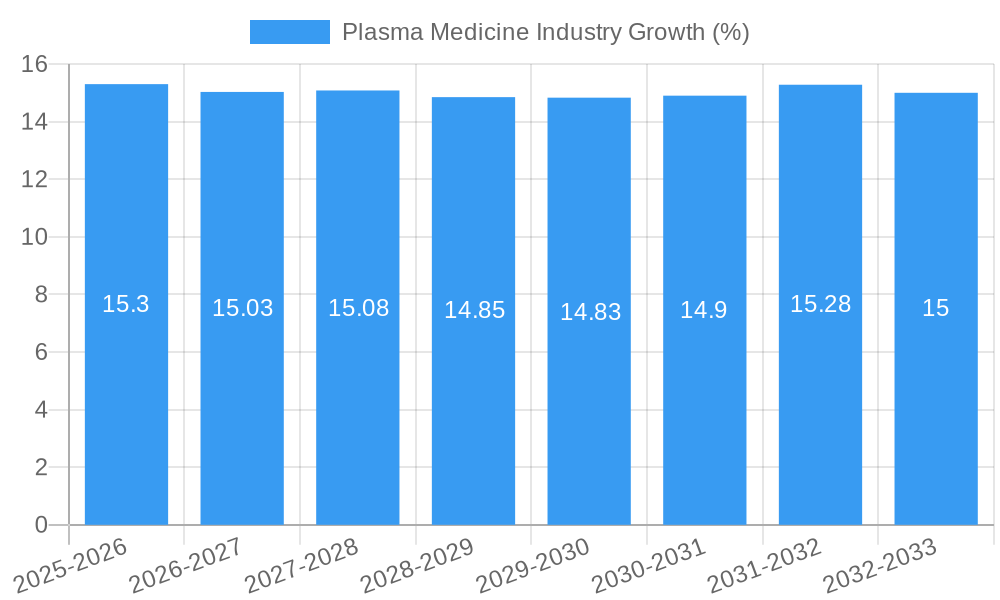

The global Plasma Medicine Industry is poised for remarkable expansion, projected to reach a substantial market size of $XX billion by 2025 and sustain a robust Compound Annual Growth Rate (CAGR) of 15.30% through 2033. This significant growth is primarily propelled by the increasing adoption of plasma-based technologies in critical healthcare applications such as advanced wound healing and minimally invasive surgical procedures. The unique properties of cold atmospheric plasma (CAP), including its antimicrobial, hemostatic, and regenerative capabilities, are revolutionizing patient care, leading to faster recovery times and improved treatment outcomes. As research and development in plasma medicine continue to uncover novel therapeutic possibilities, the demand for innovative plasma devices and treatments is expected to surge. The industry is witnessing a paradigm shift towards non-thermal, non-ionizing plasma applications, offering a safer and more effective alternative to conventional medical interventions.

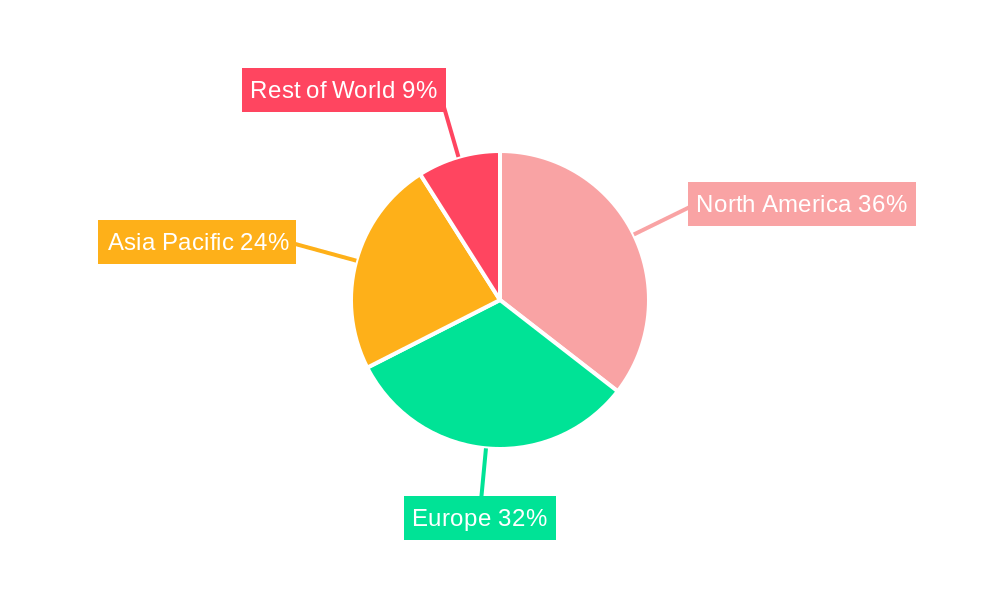

The market landscape is characterized by dynamic innovation and strategic collaborations among leading companies like terraplasma medical GmbH, Apyx Medical, and Neoplas med GmbH. These players are at the forefront of developing and commercializing cutting-edge plasma technologies for diverse medical needs. While the widespread adoption of plasma medicine holds immense promise, certain restraints, such as the initial high cost of specialized equipment and the need for further clinical validation and regulatory approvals in some regions, may present challenges. However, the compelling clinical benefits and the growing awareness among healthcare professionals are steadily overcoming these hurdles. The Asia Pacific region, driven by a rapidly expanding healthcare infrastructure and increasing R&D investments, is emerging as a key growth engine alongside the established markets of North America and Europe. The expansion into "Other Medical Applications" beyond wound healing and surgery further underscores the versatility and future potential of this transformative field.

This comprehensive report offers an in-depth analysis of the burgeoning Plasma Medicine Industry, a transformative sector at the forefront of medical innovation. Explore the market dynamics, growth trends, competitive landscape, and future outlook of cold atmospheric plasma (CAP) technology in healthcare. Discover the immense potential of CAP across diverse medical applications, from advanced wound healing to novel cancer therapies. This report provides actionable insights for stakeholders, investors, and industry professionals seeking to capitalize on this rapidly expanding market.

Plasma Medicine Industry Market Dynamics & Structure

The Plasma Medicine Industry is characterized by rapid technological advancement and increasing adoption across various medical disciplines. The market, estimated to reach $XX billion by 2025, exhibits a moderately consolidated structure with key players like terraplasma medical GmbH, Apyx Medical, and Neoplas med GmbH spearheading innovation. Technological innovation serves as a primary driver, with ongoing research into optimizing CAP parameters for enhanced efficacy and safety in diverse applications like wound healing and surgical procedures. Regulatory frameworks are evolving to accommodate these novel therapies, with agencies like the FDA gradually approving CAP devices, albeit with rigorous clinical validation requirements. Competitive product substitutes are emerging, primarily conventional treatment modalities, but CAP's unique advantages in terms of non-invasiveness and germicidal properties are increasingly recognized. End-user demographics are expanding beyond specialized medical centers to include general surgery and chronic wound care clinics, indicating broader market penetration. Mergers and acquisitions (M&A) are becoming more prevalent as larger medical device companies seek to integrate CAP technology into their portfolios, driving further market consolidation and accelerating product development cycles. For instance, XX M&A deals were observed in the historical period (2019-2024) valued at approximately $XX billion. However, innovation barriers, such as high initial research and development costs and the need for extensive clinical trials, remain significant.

- Market Concentration: Moderately consolidated with a few leading players.

- Technological Innovation Drivers: Advancements in CAP generation, control, and targeted delivery systems.

- Regulatory Frameworks: Evolving FDA and EMA guidelines for medical plasma devices.

- Competitive Product Substitutes: Conventional wound care, antimicrobial treatments, and minimally invasive surgical tools.

- End-User Demographics: Expanding to include dermatology, oncology, surgery, and chronic wound management.

- M&A Trends: Increasing consolidation driven by strategic acquisitions to gain technological advantage.

Plasma Medicine Industry Growth Trends & Insights

The Plasma Medicine Industry is poised for substantial growth, projected to expand from approximately $XX billion in 2019 to an estimated $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This robust growth trajectory is fueled by increasing demand for minimally invasive and effective medical treatments. The adoption rates for CAP devices are steadily rising across key applications. Technological disruptions, such as the development of portable and more precise CAP applicators, are further enhancing the utility and accessibility of these technologies. Consumer behavior is shifting towards seeking advanced, less painful, and faster-healing treatment options, which CAP technologies are well-positioned to deliver. For example, the plasmajet kINPen MED from Neoplas Med has demonstrated significant improvements in chronic wound closure and infection control, illustrating the tangible benefits driving market adoption. The increasing focus on combating antimicrobial resistance also presents a significant opportunity for CAP's germicidal properties. The market penetration of CAP in wound healing, a significant segment, is projected to reach XX% by 2033, indicating a substantial shift from traditional methods. This evolution is supported by a growing body of clinical evidence validating the efficacy and safety of plasma-based therapies. The market size is expected to grow from $XX billion in the base year 2025 to $XX billion by 2033.

Dominant Regions, Countries, or Segments in Plasma Medicine Industry

The Wound Healing segment is currently the dominant force driving growth within the Plasma Medicine Industry, projected to account for approximately XX% of the global market share by 2025. This dominance stems from the significant unmet need for effective treatments for chronic and non-healing wounds, a pervasive healthcare challenge globally. Cold atmospheric plasma (CAP) offers a revolutionary approach to wound care by promoting tissue regeneration, reducing bacterial load, and accelerating the healing process without the adverse effects associated with antibiotics or aggressive surgical interventions. Leading countries in this segment include the United States and Germany, owing to strong healthcare infrastructure, robust research and development ecosystems, and favorable regulatory environments that support the adoption of innovative medical technologies. The presence of key players like Neoplas Med GmbH, with their advanced plasmajet kINPen MED, has been instrumental in showcasing the therapeutic benefits of CAP in chronic wound management.

Key Drivers for Wound Healing Dominance:

- High prevalence of chronic wounds (e.g., diabetic foot ulcers, pressure sores).

- Growing demand for non-antibiotic antimicrobial solutions.

- Advancements in CAP device design for localized and precise application.

- Positive clinical trial outcomes demonstrating superior efficacy and faster healing times.

- Increasing awareness among healthcare professionals and patients.

Market Share and Growth Potential: The wound healing segment is expected to maintain its leading position, with a projected CAGR of XX% during the forecast period (2025-2033). The market value for wound healing applications is estimated to reach $XX billion by 2033. Economic policies supporting medical device innovation and reimbursement frameworks that favor advanced wound care technologies further contribute to this segment's expansion. The segment's growth potential is immense, driven by the continuous need for better wound management solutions and the increasing recognition of CAP's unique therapeutic properties.

Plasma Medicine Industry Product Landscape

The Plasma Medicine Industry is witnessing a surge in product innovations focused on enhancing efficacy, safety, and user-friendliness of CAP devices. Key advancements include the development of smaller, portable, and highly controllable plasma generators, as well as specialized applicators tailored for specific medical procedures. Products are increasingly designed for both therapeutic applications like advanced wound healing, where devices like the kINPen MED from Neoplas Med offer precise germicidal and regenerative effects, and surgical applications, where Apyx Medical's advancements contribute to hemostasis and tissue ablation. The performance metrics are continuously improving, with a focus on optimizing plasma parameters such as power, frequency, and gas composition to achieve targeted biological effects. Unique selling propositions often revolve around the non-thermal nature of CAP, its potent antimicrobial capabilities against a broad spectrum of pathogens, and its ability to stimulate cellular processes for tissue regeneration. Technological advancements are also enabling more sophisticated plasma-tissue interactions, paving the way for novel applications in dermatology, oncology, and beyond.

Key Drivers, Barriers & Challenges in Plasma Medicine Industry

Key Drivers:

- Technological Advancements: Continuous innovation in CAP generation, control, and delivery systems enhances efficacy and broadens applications.

- Growing Demand for Minimally Invasive Treatments: Patients and healthcare providers increasingly prefer less invasive and faster-healing procedures.

- Antimicrobial Resistance Crisis: CAP's potent antimicrobial properties offer a viable alternative to antibiotics.

- Clinical Evidence and Validation: Increasing positive results from clinical trials are building confidence among medical professionals and regulatory bodies.

- Expanding Application Spectrum: Research is uncovering new therapeutic uses in oncology, dermatology, and beyond.

Barriers & Challenges:

- High R&D Costs and Long Clinical Trial Durations: Developing and validating new CAP medical devices requires significant investment and time.

- Regulatory Hurdles: Navigating complex and evolving regulatory pathways for novel medical technologies can be challenging.

- Reimbursement Policies: Establishing favorable reimbursement codes for CAP treatments is crucial for widespread adoption.

- Educating Healthcare Professionals: A need exists to train and educate medical practitioners on the effective and safe use of CAP devices.

- Market Perception and Adoption Inertia: Overcoming the reluctance to adopt new technologies in established medical practices.

- Supply Chain Volatility: Ensuring a consistent and reliable supply of specialized components for CAP devices. The estimated impact of supply chain disruptions on market growth is projected to be XX% in the historical period.

Emerging Opportunities in Plasma Medicine Industry

The Plasma Medicine Industry is ripe with emerging opportunities, particularly in oncology, where preliminary studies on cold atmospheric plasma for solid tumor treatment, as highlighted by US Medical Innovations, LLC (USMI) and JCRI-ABTS's Phase I clinical trial, show immense promise. The potential for targeted cancer therapy with minimal side effects is a significant frontier. Furthermore, the application of CAP in sterilization and disinfection of medical equipment and surfaces, especially in the context of preventing healthcare-associated infections, represents another lucrative avenue. The development of home-use CAP devices for chronic wound management and skin rejuvenation is also an evolving area, catering to patient convenience and decentralized healthcare. The increasing interest in regenerative medicine further opens doors for CAP's role in stimulating cellular growth and tissue repair.

Growth Accelerators in the Plasma Medicine Industry Industry

The long-term growth of the Plasma Medicine Industry will be significantly accelerated by breakthroughs in plasma physics and engineering, leading to more efficient and versatile CAP generation systems. Strategic partnerships between academic institutions, research organizations, and medical device manufacturers are crucial for translating cutting-edge research into commercially viable products. Furthermore, global market expansion, driven by increasing healthcare expenditure in emerging economies and the growing awareness of CAP's benefits, will act as a major catalyst. The development of robust clinical evidence databases and the establishment of standardized treatment protocols will foster greater confidence and adoption among medical professionals worldwide.

Key Players Shaping the Plasma Medicine Industry Market

- terraplasma medical GmbH

- Apyx Medical

- Neoplas med GmbH

- CINOGY System GmbH

- U S Medical Innovations

- ADTEC Plasma Technology Co Ltd

Notable Milestones in Plasma Medicine Industry Sector

- March 2022: Neoplas Med GmbH announced the superiority of cold atmospheric plasma beam therapy in the treatment of chronic wounds with a gold standard trial. A comparative clinical study demonstrated significant improvement in wound closure and infection control following treatment with plasmajet kINPen MED from Neoplas Med compared to other wound care procedures.

- September 2021: US Medical Innovations, LLC (USMI) and the Jerome Canady Research Institute for Advanced and Biological Technological Sciences (JCRI-ABTS) announced the successful results of Phase I clinical trial using cold atmospheric plasma for the treatment of solid tumors at the Baird 2021 Global Healthcare Conference.

In-Depth Plasma Medicine Industry Market Outlook

The future of the Plasma Medicine Industry is exceptionally bright, fueled by its inherent ability to address critical unmet medical needs with innovative, non-invasive, and highly effective solutions. The projected market growth from $XX billion in 2025 to $XX billion by 2033 underscores the significant potential for returns on investment. Strategic opportunities lie in further refining CAP technology for precision medicine, expanding its therapeutic applications into areas like neurodegenerative diseases and autoimmune disorders, and establishing robust global distribution networks. The increasing emphasis on patient-centric care and the continuous pursuit of novel antimicrobial strategies position plasma medicine as a cornerstone of future healthcare, promising a landscape where innovative treatments are not just a possibility but a tangible reality.

Plasma Medicine Industry Segmentation

-

1. Application

- 1.1. Wound Healing

- 1.2. Surgical Application

- 1.3. Other Medical Applications

Plasma Medicine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of World

Plasma Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Environment Friendliness and Other Benefits of Cold Plasma Techniques; Increasing Use of Cold Plasma in Wound Healing

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about Cold Plasma Technology in the Healthcare Industry and Stringent regulatory Policies

- 3.4. Market Trends

- 3.4.1. Wound Healing Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Wound Healing

- 5.1.2. Surgical Application

- 5.1.3. Other Medical Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Wound Healing

- 6.1.2. Surgical Application

- 6.1.3. Other Medical Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Wound Healing

- 7.1.2. Surgical Application

- 7.1.3. Other Medical Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Wound Healing

- 8.1.2. Surgical Application

- 8.1.3. Other Medical Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of World Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Wound Healing

- 9.1.2. Surgical Application

- 9.1.3. Other Medical Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. South America Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Brazil

- 11.1.2 Mexico

- 11.1.3 Rest of South America

- 12. Europe Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Taiwan

- 13.1.6 Australia

- 13.1.7 Rest of Asia-Pacific

- 14. MEA Plasma Medicine Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Middle East

- 14.1.2 Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 terraplasma medical GmbH

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Apyx Medical

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Neoplas med GmbH

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 CINOGY System GmbH

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 U S Medical Innovations

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 ADTEC Plasma Technology Co Ltd

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 terraplasma medical GmbH

List of Figures

- Figure 1: Global Plasma Medicine Industry Revenue Breakdown (billion, %) by Region 2024 & 2032

- Figure 2: North America Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 3: North America Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 5: South America Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 7: Europe Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 9: Asia Pacific Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 11: MEA Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Plasma Medicine Industry Revenue (billion), by Application 2024 & 2032

- Figure 13: North America Plasma Medicine Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 15: North America Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Plasma Medicine Industry Revenue (billion), by Application 2024 & 2032

- Figure 17: Europe Plasma Medicine Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 19: Europe Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Plasma Medicine Industry Revenue (billion), by Application 2024 & 2032

- Figure 21: Asia Pacific Plasma Medicine Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 23: Asia Pacific Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Rest of World Plasma Medicine Industry Revenue (billion), by Application 2024 & 2032

- Figure 25: Rest of World Plasma Medicine Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Rest of World Plasma Medicine Industry Revenue (billion), by Country 2024 & 2032

- Figure 27: Rest of World Plasma Medicine Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plasma Medicine Industry Revenue billion Forecast, by Region 2019 & 2032

- Table 2: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2019 & 2032

- Table 3: Global Plasma Medicine Industry Revenue billion Forecast, by Region 2019 & 2032

- Table 4: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 5: United States Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 6: Canada Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 7: Mexico Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 8: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 9: Brazil Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 12: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 13: Germany Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 15: France Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 16: Italy Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 17: Spain Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 19: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 20: China Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 21: Japan Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 22: India Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 23: South Korea Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 24: Taiwan Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 25: Australia Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 27: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 28: Middle East Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 29: Africa Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 30: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2019 & 2032

- Table 31: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 32: United States Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 33: Canada Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 34: Mexico Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 35: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2019 & 2032

- Table 36: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 37: Germany Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 39: France Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 40: Italy Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 41: Spain Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 43: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2019 & 2032

- Table 44: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 45: China Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 46: Japan Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 47: India Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 48: Australia Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 49: South Korea Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Plasma Medicine Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 51: Global Plasma Medicine Industry Revenue billion Forecast, by Application 2019 & 2032

- Table 52: Global Plasma Medicine Industry Revenue billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plasma Medicine Industry?

The projected CAGR is approximately 15.30%.

2. Which companies are prominent players in the Plasma Medicine Industry?

Key companies in the market include terraplasma medical GmbH, Apyx Medical, Neoplas med GmbH, CINOGY System GmbH, U S Medical Innovations, ADTEC Plasma Technology Co Ltd.

3. What are the main segments of the Plasma Medicine Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX billion as of 2022.

5. What are some drivers contributing to market growth?

Environment Friendliness and Other Benefits of Cold Plasma Techniques; Increasing Use of Cold Plasma in Wound Healing.

6. What are the notable trends driving market growth?

Wound Healing Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness about Cold Plasma Technology in the Healthcare Industry and Stringent regulatory Policies.

8. Can you provide examples of recent developments in the market?

In March 2022, Neoplas Med GmbH announced the superiority of cold atmospheric plasma beam therapy in the treatment of chronic wounds with a gold standard trial. A comparative clinical study demonstrated significant improvement in wound closure and infection control following treatment with plasmajet kINPen MED from Neoplas Med compared to other wound care procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plasma Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plasma Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plasma Medicine Industry?

To stay informed about further developments, trends, and reports in the Plasma Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence