Key Insights

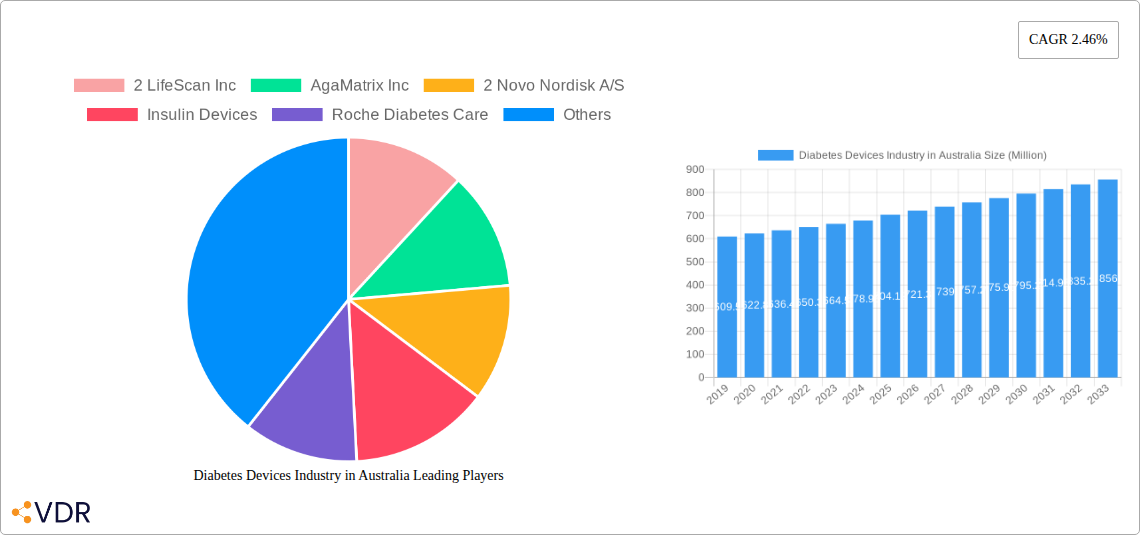

The Australian Diabetes Devices market is projected to reach a substantial valuation of AUD 704.12 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.46% through to 2033. This consistent growth is propelled by a confluence of factors, including the increasing prevalence of diabetes nationwide, a growing awareness among patients and healthcare providers regarding the benefits of advanced diabetes management technologies, and supportive government initiatives aimed at improving chronic disease care. The market is segmented into crucial categories: Management Devices, encompassing insulin pumps, syringes, pen cartridges, disposable pens, and jet injectors; and Monitoring Devices, which include self-monitoring blood glucose (SMBG) devices, continuous glucose monitoring (CGM) systems, and lancets. The rising adoption of CGM technologies, offering real-time glucose data and proactive management, is a significant trend shaping the landscape. Furthermore, the increasing demand for user-friendly and less invasive insulin delivery systems, such as advanced insulin pumps and sophisticated pen injectors, is a key driver, empowering individuals to better manage their condition.

Diabetes Devices Industry in Australia Market Size (In Million)

Despite the positive growth trajectory, the Australian market faces certain restraints. The high cost associated with some advanced diabetes devices, particularly newer CGM and sophisticated insulin pump models, can pose a barrier to widespread adoption, especially for individuals with limited financial resources or without comprehensive private health insurance. Reimbursement policies and accessibility challenges also play a critical role. However, ongoing technological advancements, including the development of more affordable and integrated solutions, alongside evolving healthcare policies, are expected to mitigate these challenges. The competitive landscape is robust, featuring key global and local players like Abbott Diabetes Care, Medtronic, Roche Diabetes Care, Novo Nordisk, and Dexcom, all actively innovating and expanding their product portfolios to cater to the evolving needs of the Australian diabetes population. The focus on improving patient outcomes and reducing the long-term burden of diabetes underscores the strategic importance of this market.

Diabetes Devices Industry in Australia Company Market Share

This comprehensive report offers an in-depth analysis of the Australian diabetes devices market, a critical sector poised for significant expansion. Explore the intricate dynamics, growth trajectories, and competitive landscape of insulin delivery devices and blood glucose monitoring solutions. Our research covers the historical period (2019–2024) and provides a detailed forecast for 2025–2033, with 2025 serving as the base year and estimated year. Discover the latest innovations and strategic initiatives from leading companies shaping the future of diabetes management in Australia. This report is your essential guide to understanding the parent market of diabetes devices and its crucial child markets like continuous glucose monitoring devices and self-monitoring blood glucose devices.

Diabetes Devices Industry in Australia Market Dynamics & Structure

The Australian diabetes devices market is characterized by a dynamic and evolving structure, driven by technological advancements and a growing prevalence of diabetes. Market concentration is moderate, with key players like Roche Diabetes Care, Abbott Diabetes Care, and LifeScan Inc. holding substantial shares in self-monitoring blood glucose devices. The continuous glucose monitoring devices segment, however, is witnessing increased competition with the entry and expansion of companies such as Dexcom Inc. and Medtronic PLC. Technological innovation is a primary driver, with advancements in sensor accuracy, connectivity, and data analytics continually pushing the boundaries of effective diabetes management. The regulatory framework, managed by the Therapeutic Goods Administration (TGA), ensures product safety and efficacy, though it can also present barriers to rapid market entry for novel technologies. Competitive product substitutes range from traditional blood glucose meters and test strips to advanced insulin pumps and integrated CGM systems. End-user demographics are diverse, encompassing individuals with Type 1, Type 2, and gestational diabetes across all age groups, with a growing focus on personalized care solutions. Mergers and acquisitions (M&A) activity, while not overtly dominant, plays a role in market consolidation and strategic expansion, with recent smaller acquisitions focused on enhancing digital health capabilities and data integration. The market is projected to see significant growth, with an estimated management devices segment valued at 120 Million units in 2025 and the monitoring devices segment at 250 Million units in the same year.

- Market Concentration: Moderate, with key players in SMBG and growing competition in CGM.

- Technological Innovation Drivers: Sensor accuracy, wireless connectivity, AI-powered insights, and user-friendly interfaces.

- Regulatory Framework: TGA oversight ensuring safety and efficacy, with evolving guidelines for digital health.

- Competitive Product Substitutes: Traditional meters vs. integrated CGM systems and advanced insulin delivery solutions.

- End-User Demographics: Diverse, requiring tailored solutions for different diabetes types and age groups.

- M&A Trends: Focus on digital health integration and niche technology acquisition.

- Estimated Management Devices Market Size (2025): 120 Million units

- Estimated Monitoring Devices Market Size (2025): 250 Million units

Diabetes Devices Industry in Australia Growth Trends & Insights

The Australian diabetes devices industry is on a robust growth trajectory, fueled by an increasing diabetes incidence and a heightened awareness of proactive diabetes management. The market size has seen a steady expansion, with the self-monitoring blood glucose devices segment, a cornerstone of traditional diabetes care, projected to reach approximately 280 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 3.5% from 2025. Simultaneously, the continuous glucose monitoring devices segment is experiencing explosive growth, with an anticipated CAGR of 18.2% over the forecast period, driven by technological advancements and favorable reimbursement policies. This surge in CGM adoption is transforming patient care, offering real-time insights and enabling more precise insulin dosing. The increasing prevalence of Type 2 diabetes, often linked to lifestyle factors, is a significant contributor to the sustained demand for monitoring devices. Furthermore, advancements in insulin delivery devices, including smart insulin pens and sophisticated insulin pumps, are enhancing treatment adherence and patient outcomes. The tempo platform by Eli Lilly signifies a move towards integrated digital solutions, empowering patients and clinicians with data-driven decision-making. Consumer behavior is shifting towards empowered self-management, with individuals actively seeking technologies that offer convenience, accuracy, and personalized feedback. The market penetration of CGM devices, which stood at an estimated 15% in 2025, is projected to reach 45% by 2033, demonstrating a profound shift in monitoring preferences. The adoption of smart insulin pens, offering improved accuracy and ease of use, is also expected to grow significantly. The overall market value is anticipated to more than double from its 2025 estimate, driven by both volume increases and the introduction of higher-value, technologically advanced devices. The increasing demand for connected health solutions and remote patient monitoring further propels this growth, aligning with global trends in healthcare digitalization. The ongoing research and development in closed-loop systems, which aim to automate insulin delivery, also represent a significant future growth catalyst.

Dominant Regions, Countries, or Segments in Diabetes Devices Industry in Australia

The Australian diabetes devices industry is largely dominated by the Monitoring Devices segment, specifically driven by the rapid uptake of Continuous Glucose Monitoring (CGM) Devices and the sustained demand for Self-monitoring Blood Glucose (SMBG) Devices. Within Australia, the Eastern Seaboard, encompassing New South Wales, Victoria, and Queensland, represents the most dominant region for diabetes device consumption and innovation. This dominance is attributed to a confluence of factors, including a higher population density, a greater concentration of specialized diabetes clinics and healthcare professionals, and more robust healthcare infrastructure. Economic policies that support the adoption of advanced medical technologies and a strong research and development ecosystem further bolster this region's lead. The recent Australian government approval in November 2023 for obtaining prescriptions for CGM devices from various healthcare professionals, including General Practitioners (GPs), diabetes educators, diabetes clinics, Registered Nurses (RNs), and specialists, has been a significant catalyst for the CGM market. This broadened access is expected to accelerate adoption rates in metropolitan and regional areas alike. The market share within the Monitoring Devices segment is seeing a significant shift, with CGM devices, already representing an estimated 35% of the monitoring market in 2025, projected to capture over 55% by 2033. SMBG devices, while still holding a substantial share of 45% in 2025, are expected to see a modest growth of around 2% annually as CGM gains traction. Key drivers for the dominance of Monitoring Devices include the increasing incidence of diabetes, the growing awareness of the long-term complications of poorly managed blood glucose levels, and the technological superiority of continuous monitoring in providing actionable insights. Furthermore, the supportive regulatory environment and the presence of major global players like Abbott Diabetes Care, Dexcom Inc., and LifeScan Inc. with established distribution networks contribute to market leadership. The Management Devices segment, including Insulin Pumps, Insulin Syringes, and disposable pens, also plays a vital role, with an estimated market size of 120 Million units in 2025. However, the growth trajectory of Monitoring Devices, particularly CGM, is outpacing that of management devices, indicating a strategic focus on predictive and proactive management through data. The increasing integration of these devices with smart insulin pens and automated insulin delivery systems further enhances their value proposition and market appeal.

- Dominant Segment: Monitoring Devices (Continuous Glucose Monitoring Devices and Self-monitoring Blood Glucose Devices).

- Leading Region: Eastern Seaboard (New South Wales, Victoria, Queensland).

- Key Drivers for Dominance: Higher population, specialized healthcare access, supportive economic policies, strong R&D, and regulatory approvals.

- CGM Market Share Growth: From 35% (2025) to over 55% (2033) within the Monitoring Devices segment.

- SMBG Market Share: 45% (2025) with modest annual growth.

- Impact of Government Approval: Accelerated CGM adoption across healthcare settings.

Diabetes Devices Industry in Australia Product Landscape

The Australian diabetes devices landscape is characterized by rapid product innovation focused on enhancing accuracy, user-friendliness, and connectivity. Continuous Glucose Monitoring (CGM) devices are at the forefront, with advancements in sensor technology leading to smaller, more discreet designs and improved accuracy, minimizing the need for fingerprick calibration. Companies like Dexcom Inc. and Abbott Diabetes Care are leading this charge with their latest-generation sensors offering real-time data transmission to smartphones and smartwatches. In the realm of Insulin Delivery Devices, smart insulin pens, such as those integrated with the Tempo Personalized Diabetes Management Platform by Eli Lilly, are gaining traction. These devices record insulin doses, time of injection, and can connect to apps to help users manage their treatment. Traditional Self-monitoring Blood Glucose (SMBG) Devices are also evolving, incorporating features like memory storage, trend analysis, and Bluetooth connectivity for seamless data transfer. The development of insulin pumps by companies like Medtronic PLC continues to push towards more sophisticated automated insulin delivery systems, often integrated with CGM technology for closed-loop functionality.

Key Drivers, Barriers & Challenges in Diabetes Devices Industry in Australia

The Australian diabetes devices industry is propelled by several key drivers. The escalating prevalence of diabetes, coupled with an aging population and rising obesity rates, creates a substantial and growing patient base. Technological advancements in miniaturization, accuracy, and connectivity of devices are transforming patient care and driving demand for newer, more effective solutions. Increased health awareness among consumers and a growing preference for proactive self-management further fuel market growth. The supportive Australian government's initiatives, including reimbursement policies for advanced diabetes technologies, are crucial accelerators.

Conversely, significant barriers and challenges exist. High upfront costs associated with advanced devices, particularly CGM and insulin pumps, can limit accessibility for some individuals, despite reimbursement schemes. Stringent regulatory approval processes, while ensuring safety, can sometimes slow down the introduction of innovative products. Supply chain disruptions and global manufacturing limitations can impact product availability. Furthermore, the need for adequate digital literacy and patient training to effectively utilize connected devices presents an ongoing challenge for widespread adoption. Competitive pressures from established players and emerging market entrants also necessitate continuous innovation and strategic pricing.

Emerging Opportunities in Diabetes Devices Industry in Australia

Emerging opportunities in the Australian diabetes devices market lie in the expansion of integrated digital health ecosystems. The growing demand for remote patient monitoring solutions presents a significant avenue, allowing healthcare providers to track patient data and intervene proactively. Personalized diabetes management platforms that leverage artificial intelligence (AI) and machine learning to provide tailored insights and treatment recommendations are gaining traction. Untapped markets exist in extending these advanced technologies to underserved rural and remote communities, requiring innovative distribution and support models. The development of more affordable and accessible CGM systems and smart insulin pens will further broaden market penetration, especially among younger demographics and those with newly diagnosed diabetes.

Growth Accelerators in the Diabetes Devices Industry in Australia Industry

Several catalysts are accelerating long-term growth within the Australian diabetes devices industry. Continued advancements in sensor technology for CGM, leading to even greater accuracy, comfort, and longevity, will be a primary growth driver. The ongoing development and wider adoption of closed-loop and automated insulin delivery systems, effectively creating artificial pancreases, represent a significant leap in diabetes management. Strategic partnerships between device manufacturers, pharmaceutical companies, and digital health providers are fostering integrated solutions that improve patient experience and outcomes. Expansion of reimbursement programs to cover a wider array of advanced diabetes technologies will also unlock significant market potential.

Key Players Shaping the Diabetes Devices Industry in Australia Market

- LifeScan Inc.

- AgaMatrix Inc.

- Novo Nordisk A/S

- Roche Diabetes Care

- Eli Lilly

- Abbott Diabetes Care

- Medtronic

- Dexcom Inc.

- Sanofi Aventis

- Medtronic PLC

- Insulet Corporation

- ARKRAY Inc.

- Ypsomed Holding AG

- Ascensia Diabetes Care

Notable Milestones in Diabetes Devices Industry in Australia Sector

- November 2023: Australian government grants approval for individuals to obtain prescriptions for continuous glucose monitoring (CGM) devices from various healthcare professionals, including General Practitioners (GPs), diabetes educators, diabetes clinics, Registered Nurses (RNs), and specialists, significantly expanding access.

- November 2022: Eli Lilly and Company announces the rollout of its first connected platform, the Tempo Personalized Diabetes Management Platform, designed to empower adults with type 1 or 2 diabetes and clinicians with data-backed decision-making for treatment management.

In-Depth Diabetes Diabetes Devices Industry in Australia Market Outlook

The Australian diabetes devices market is poised for substantial future growth, driven by a confluence of technological innovation, evolving patient needs, and supportive governmental policies. The increasing adoption of continuous glucose monitoring (CGM) devices, further boosted by the expanded prescription access, will continue to be a primary growth accelerator. Innovations in insulin delivery devices, particularly in smart pens and automated insulin delivery systems, promise to enhance patient convenience and glycemic control. The trend towards integrated digital health solutions, where devices seamlessly connect to provide holistic patient management, will define future market offerings. Strategic partnerships and a focus on developing more affordable and accessible technologies will be crucial in capturing a larger market share and addressing the diverse needs of the Australian population living with diabetes. The market outlook remains exceptionally strong, with a clear trajectory towards more personalized, data-driven, and patient-centric diabetes care.

Diabetes Devices Industry in Australia Segmentation

-

1. Management Devices

- 1.1. Insulin Pump

- 1.2. Insulin Syringes

- 1.3. cartridges in reusable pens

- 1.4. disposable pens

- 1.5. jet injectors

-

2. Monitoring Devices

- 2.1. Self-monitoring Blood Glucose

- 2.2. Continuous Glucose Monitoring

- 2.3. lancets

Diabetes Devices Industry in Australia Segmentation By Geography

- 1. Australia

Diabetes Devices Industry in Australia Regional Market Share

Geographic Coverage of Diabetes Devices Industry in Australia

Diabetes Devices Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Increasing Diabetes Prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Diabetes Devices Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Management Devices

- 5.1.1. Insulin Pump

- 5.1.2. Insulin Syringes

- 5.1.3. cartridges in reusable pens

- 5.1.4. disposable pens

- 5.1.5. jet injectors

- 5.2. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.2.1. Self-monitoring Blood Glucose

- 5.2.2. Continuous Glucose Monitoring

- 5.2.3. lancets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Management Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 2 LifeScan Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AgaMatrix Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 Novo Nordisk A/S

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Insulin Devices

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roche Diabetes Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LifeScan Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbott Diabetes Care

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Medtronic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 Dexcom Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dexcom Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Continuous Glucose Monitoring Devices

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 1 Abbott Diabetes Care

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sanofi Aventis

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 2 Medtronic PLC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Insulet Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ARKRAY Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 1 Insulet Corporation

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Self-monitoring Blood Glucose Devices

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Novo Nordisk A/S

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Ypsomed Holding AG

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Ascensia Diabetes Care

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 2 LifeScan Inc

List of Figures

- Figure 1: Diabetes Devices Industry in Australia Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Diabetes Devices Industry in Australia Share (%) by Company 2025

List of Tables

- Table 1: Diabetes Devices Industry in Australia Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 2: Diabetes Devices Industry in Australia Volume K Unit Forecast, by Management Devices 2020 & 2033

- Table 3: Diabetes Devices Industry in Australia Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 4: Diabetes Devices Industry in Australia Volume K Unit Forecast, by Monitoring Devices 2020 & 2033

- Table 5: Diabetes Devices Industry in Australia Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Diabetes Devices Industry in Australia Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Diabetes Devices Industry in Australia Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 8: Diabetes Devices Industry in Australia Volume K Unit Forecast, by Management Devices 2020 & 2033

- Table 9: Diabetes Devices Industry in Australia Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 10: Diabetes Devices Industry in Australia Volume K Unit Forecast, by Monitoring Devices 2020 & 2033

- Table 11: Diabetes Devices Industry in Australia Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Diabetes Devices Industry in Australia Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diabetes Devices Industry in Australia?

The projected CAGR is approximately 2.46%.

2. Which companies are prominent players in the Diabetes Devices Industry in Australia?

Key companies in the market include 2 LifeScan Inc, AgaMatrix Inc, 2 Novo Nordisk A/S, Insulin Devices, Roche Diabetes Care, Eli Lilly, LifeScan Inc, Abbott Diabetes Care, Medtronic, 1 Dexcom Inc, Dexcom Inc, Continuous Glucose Monitoring Devices, 1 Abbott Diabetes Care, Sanofi Aventis, 2 Medtronic PLC, Insulet Corporation, ARKRAY Inc, 1 Insulet Corporation, Self-monitoring Blood Glucose Devices, Novo Nordisk A/S, Ypsomed Holding AG, Ascensia Diabetes Care.

3. What are the main segments of the Diabetes Devices Industry in Australia?

The market segments include Management Devices, Monitoring Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 704.12 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Increasing Diabetes Prevalence.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

November 2023: The Australian government has granted approval for individuals to obtain prescriptions for continuous glucose monitoring (CGM) devices from various healthcare professionals, including General Practitioners (GPs), diabetes educators, diabetes clinics, Registered Nurses (RNs), and specialists.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diabetes Devices Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diabetes Devices Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diabetes Devices Industry in Australia?

To stay informed about further developments, trends, and reports in the Diabetes Devices Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence