Key Insights

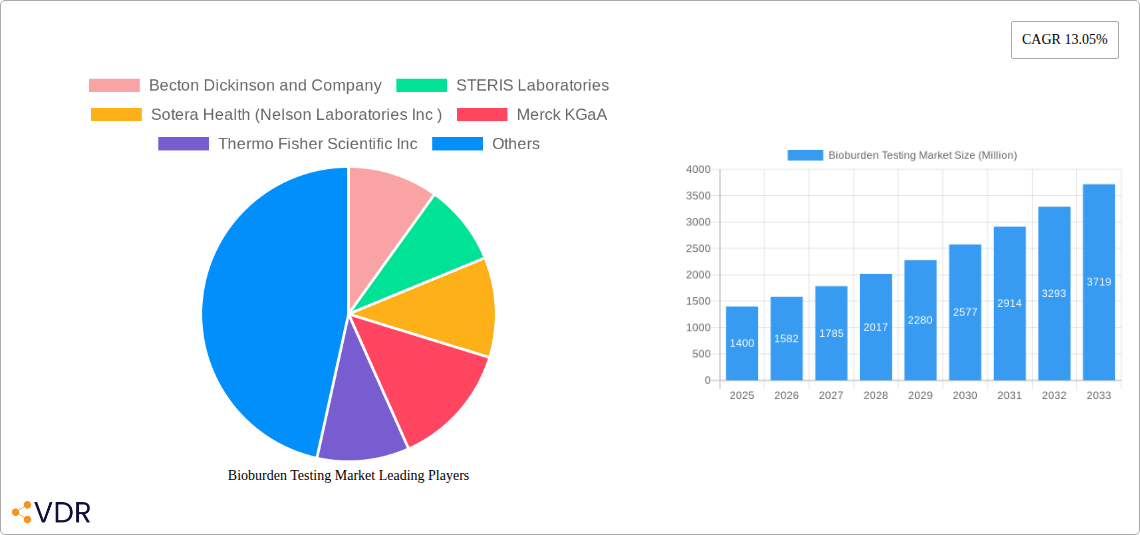

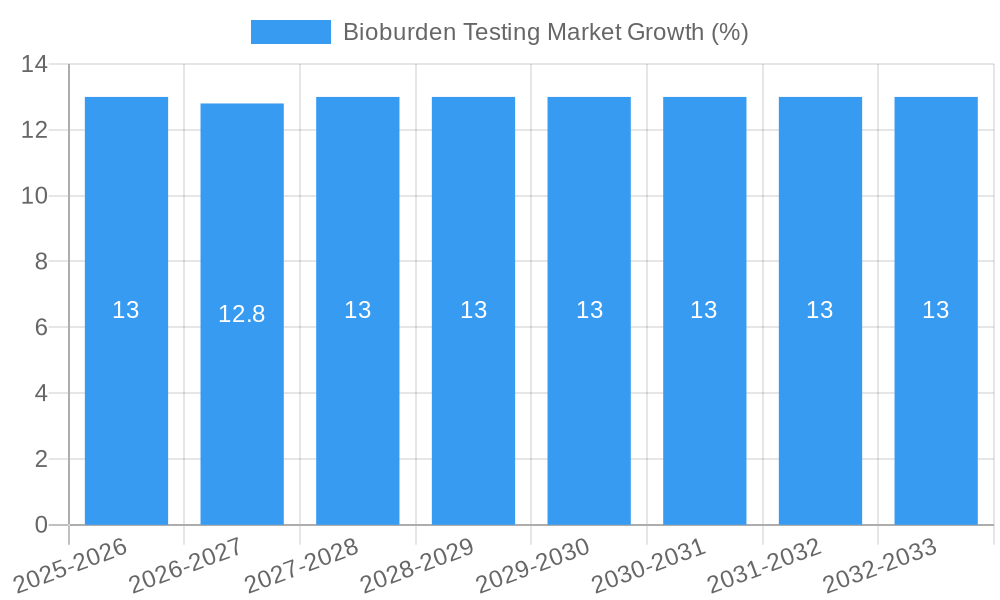

The global bioburden testing market is poised for significant expansion, projected to reach approximately USD 1.40 billion with a robust Compound Annual Growth Rate (CAGR) of 13.05%. This impressive growth trajectory is underpinned by increasing regulatory scrutiny and a heightened awareness of microbial contamination risks across various industries, particularly pharmaceuticals, medical devices, and food and beverages. The rising demand for sterile and safe products, coupled with advancements in testing technologies, fuels this market expansion. Key drivers include the stringent compliance requirements imposed by regulatory bodies worldwide, the growing complexity of pharmaceutical formulations, and the increasing outsourcing of testing services by smaller and medium-sized enterprises seeking specialized expertise. Furthermore, the escalating prevalence of healthcare-associated infections (HAIs) necessitates rigorous bioburden testing to ensure the safety of medical devices and pharmaceutical products, thereby contributing significantly to market growth.

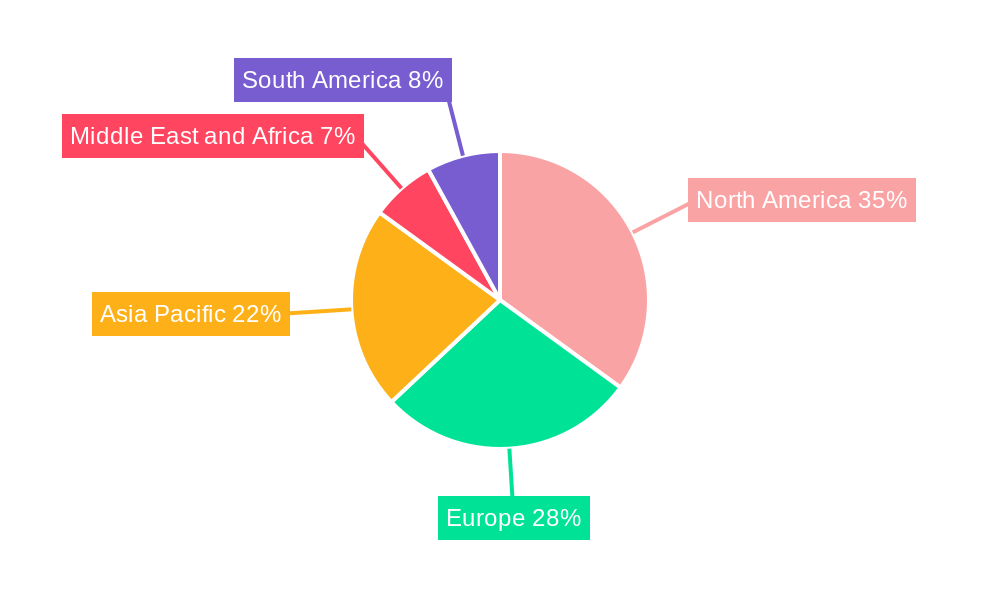

The market is segmented across several critical areas, with "Consumables," particularly culture media and reagents, and "Instruments" such as Automated Microbial Identification Systems and Polymerase Chain Reaction (PCR) Systems, being major contributors. The "Plate Count Method" and "Membrane Filtration" remain dominant enumeration techniques, while "Raw Material Testing," "Medical Devices Testing," and "In-process Testing" represent key application areas driving demand. Geographically, North America is anticipated to lead the market due to its well-established pharmaceutical and biotechnology industries, stringent regulatory frameworks, and substantial investments in R&D. However, the Asia Pacific region is expected to witness the fastest growth, driven by the expanding biopharmaceutical manufacturing base, increasing healthcare expenditure, and a growing focus on quality control in emerging economies. Major industry players like Becton Dickinson and Company, Thermo Fisher Scientific Inc., and Merck KGaA are actively investing in innovation and strategic collaborations to capture market share and address evolving customer needs.

This in-depth report offers a panoramic view of the global Bioburden Testing Market, a critical segment within pharmaceutical and medical device quality control. With a study period spanning from 2019 to 2033, and a base year of 2025, this analysis meticulously examines market dynamics, growth trajectories, regional dominance, and key player strategies. The report provides actionable insights for stakeholders seeking to navigate the evolving landscape of microbial contamination control, encompassing vital segments like consumables (culture media and reagents), instruments (automated microbial identification systems), enumeration methods (membrane filtration), and applications across raw material testing, medical devices testing, and in-process testing.

Bioburden Testing Market Market Dynamics & Structure

The Bioburden Testing Market exhibits a moderately concentrated structure, driven by continuous technological innovation and stringent regulatory frameworks across the pharmaceutical, biotechnology, and medical device industries. Key drivers include the increasing demand for advanced sterile manufacturing processes and the rising prevalence of healthcare-associated infections (HAIs), which necessitate robust microbial control strategies. Competitive product substitutes are limited due to the highly specialized nature of bioburden testing, but advancements in rapid microbial methods (RMMs) are slowly gaining traction. End-user demographics are primarily pharmaceutical manufacturers, contract research organizations (CROs), and medical device companies, all of whom are prioritizing product safety and efficacy. Mergers and acquisitions (M&A) remain a significant trend, enabling market consolidation and the expansion of service portfolios, with approximately 15-20 M&A deals reported annually in the broader life sciences testing sector. Innovation barriers include the high cost of R&D for novel testing methodologies and the lengthy validation processes required by regulatory bodies.

- Market Concentration: Moderately concentrated with a few key players holding significant market share.

- Technological Innovation Drivers: Development of rapid microbial methods, automation, and AI-powered data analysis.

- Regulatory Frameworks: Stringent guidelines from FDA, EMA, and other global health authorities are paramount.

- Competitive Product Substitutes: Emerging rapid microbial testing solutions pose a long-term challenge to traditional methods.

- End-User Demographics: Primarily pharmaceutical, biotechnology, and medical device industries.

- M&A Trends: Active consolidation and strategic partnerships to enhance service offerings and market reach.

Bioburden Testing Market Growth Trends & Insights

The Bioburden Testing Market is poised for substantial growth, driven by an escalating global demand for sterile pharmaceuticals and an increasing focus on patient safety. The market size is projected to expand from approximately $750 Million in 2025 to over $1,200 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 6.5%. Adoption rates of advanced bioburden testing solutions are steadily increasing, particularly among small and medium-sized enterprises (SMEs) that are recognizing the economic and regulatory benefits of early contamination detection. Technological disruptions, such as the integration of artificial intelligence (AI) in microbial identification and the development of more sensitive and faster testing kits, are significantly reshaping the market. Consumer behavior shifts are evident, with end-users prioritizing suppliers offering comprehensive testing solutions, robust data integrity, and efficient turnaround times. The growing complexity of drug formulations and the rise of biologics further contribute to the need for sophisticated bioburden testing to ensure product integrity and patient well-being.

Dominant Regions, Countries, or Segments in Bioburden Testing Market

North America, led by the United States, currently dominates the Bioburden Testing Market, driven by a robust pharmaceutical and biotechnology industry, stringent regulatory oversight, and significant investment in R&D. The Product: Consumables segment, particularly Culture Media and Reagents, is a substantial contributor to market revenue, estimated at over $300 Million in 2025, owing to their recurring usage in various testing methodologies. Within instruments, Automated Microbial Identification Systems are gaining significant traction, offering enhanced efficiency and accuracy, contributing an estimated $180 Million to the market in the base year. The Enumeration Method: Membrane Filtration remains a cornerstone of bioburden testing, widely adopted for its reliability in detecting and quantifying microbial contamination in liquid samples. Its market share is estimated to be around 40% of the enumeration methods segment.

In terms of applications, Medical Devices Testing is a key growth driver, accounting for an estimated 35% of the total application market share, spurred by the global demand for safe and sterile medical equipment. The rising prevalence of chronic diseases and an aging population are fueling this demand. Furthermore, Raw Material Testing is critical for ensuring the quality of ingredients used in pharmaceutical production, estimated at 25% of the application market. Emerging economies in Asia-Pacific, particularly China and India, are witnessing rapid growth due to increasing pharmaceutical manufacturing capabilities, growing healthcare expenditure, and a rising awareness of quality control standards.

- Dominant Region: North America (especially the USA).

- Key Segment Drivers:

- Product (Consumables - Culture Media and Reagents): High frequency of use and essential for microbial growth.

- Instrument (Automated Microbial Identification Systems): Efficiency, speed, and accuracy improvements.

- Enumeration Method (Membrane Filtration): Established reliability and wide applicability.

- Application (Medical Devices Testing): Growing demand for sterile healthcare products.

Bioburden Testing Market Product Landscape

The Bioburden Testing Market is characterized by continuous product innovation focused on enhancing sensitivity, speed, and ease of use. Key advancements include the development of highly selective culture media that promote the growth of specific microorganisms while inhibiting others, leading to more accurate identification. Automated microbial identification systems are revolutionizing the field by reducing manual labor, minimizing human error, and providing faster results. Polymerase Chain Reaction (PCR) systems are emerging as powerful tools for rapid detection of microbial DNA, offering significant time savings over traditional culture-based methods. Microscopes continue to play a crucial role in visual inspection and enumeration, with advancements in digital imaging and automation improving their utility. The performance metrics are primarily driven by factors like detection limits, specificity, and turnaround time, with new products consistently aiming to surpass existing benchmarks.

Key Drivers, Barriers & Challenges in Bioburden Testing Market

Key Drivers: The primary forces propelling the Bioburden Testing Market include the escalating global demand for sterile pharmaceuticals and medical devices, driven by an aging population and the increasing prevalence of chronic diseases. Stringent regulatory requirements from global health authorities like the FDA and EMA mandate rigorous bioburden testing to ensure product safety and efficacy. Technological advancements in rapid microbial detection methods and automation are enhancing efficiency and accuracy, thereby accelerating adoption. Furthermore, the growing outsourcing trend in pharmaceutical manufacturing to contract research and manufacturing organizations (CRMOs) fuels the demand for specialized testing services.

Barriers & Challenges: Significant challenges include the high cost associated with developing and validating new testing methodologies, which can be a substantial barrier for smaller companies. Regulatory hurdles and the lengthy approval processes for novel technologies can impede market entry and adoption. Supply chain disruptions, particularly for specialized reagents and consumables, can impact the availability and cost of testing. Moreover, the competitive pressure to offer cost-effective solutions while maintaining high quality standards remains a constant challenge for market players. The need for skilled personnel to operate complex equipment and interpret results also presents a hurdle.

Emerging Opportunities in Bioburden Testing Market

Emerging opportunities within the Bioburden Testing Market lie in the development and adoption of advanced rapid microbial methods (RMMs) that significantly reduce testing time compared to traditional culture-based approaches. The increasing focus on the safety of biologics and advanced therapies presents a substantial growth avenue, requiring highly specialized and sensitive testing techniques. Untapped markets in developing economies, with their expanding pharmaceutical manufacturing sectors and growing healthcare infrastructure, offer significant potential for market penetration. Furthermore, the integration of AI and machine learning for predictive microbial contamination analysis and data interpretation represents an innovative application that could revolutionize quality control processes. The growing demand for personalized medicine also creates opportunities for tailored bioburden testing solutions.

Growth Accelerators in the Bioburden Testing Market Industry

Catalysts driving long-term growth in the Bioburden Testing Market include relentless technological breakthroughs in areas like molecular diagnostics and biosensors, which promise faster, more sensitive, and more cost-effective testing solutions. Strategic partnerships between instrument manufacturers, reagent suppliers, and contract testing laboratories are crucial for expanding service portfolios and market reach. The increasing investment in biopharmaceutical research and development, particularly in novel drug modalities, necessitates sophisticated bioburden testing capabilities. Furthermore, government initiatives promoting domestic pharmaceutical manufacturing and stringent quality control standards in emerging economies are significant market expansion strategies. The continuous need to ensure patient safety and regulatory compliance remains a fundamental growth accelerator.

Key Players Shaping the Bioburden Testing Market Market

- Becton Dickinson and Company

- STERIS Laboratories

- Sotera Health (Nelson Laboratories Inc)

- Merck KGaA

- Thermo Fisher Scientific Inc

- SGS SA

- Sartorius AG

- WuXi AppTec Co Ltd

- Charles River Laboratories Inc

- Biomérieux SA

- North American Science Associates Inc

- Pacific BioLabs Inc

Notable Milestones in Bioburden Testing Market Sector

- August 2022: Lonza introduced the Nebula Multimode Reader, the first multimode reader certified for use with Lonza's turbidimetric, chromogenic, and recombinant endotoxin detection methodologies, enhancing efficiency in endotoxin testing.

- July 2022: Merck launched the first Microbiology Application and Training (MAT) Lab in Bengaluru, India, providing facilities and technical skills to enhance the Indian life science community's microbiological quality control capabilities.

In-Depth Bioburden Testing Market Market Outlook

- August 2022: Lonza introduced the Nebula Multimode Reader, the first multimode reader certified for use with Lonza's turbidimetric, chromogenic, and recombinant endotoxin detection methodologies, enhancing efficiency in endotoxin testing.

- July 2022: Merck launched the first Microbiology Application and Training (MAT) Lab in Bengaluru, India, providing facilities and technical skills to enhance the Indian life science community's microbiological quality control capabilities.

In-Depth Bioburden Testing Market Market Outlook

The Bioburden Testing Market outlook remains exceptionally positive, driven by ongoing technological advancements and an unyielding global emphasis on product safety and regulatory compliance. Growth accelerators such as the development of rapid microbial methods, the increasing complexity of pharmaceutical products, and the expanding outsourcing trend will continue to fuel market expansion. Strategic opportunities lie in targeting emerging markets, investing in R&D for novel testing solutions, and forming synergistic partnerships. The future of bioburden testing is characterized by a shift towards more automated, data-driven, and rapid detection systems, promising to enhance efficiency and reliability in safeguarding public health. The estimated market size for 2025 is $750 Million, with robust growth projected through 2033.

Bioburden Testing Market Segmentation

-

1. Product

-

1.1. Consumables

- 1.1.1. Culture Media and Reagents

- 1.1.2. Other Consumables

-

1.2. Instrument

- 1.2.1. Automated Microbial Identification Systems

- 1.2.2. Polymerase Chain Reaction (PCR) Systems

- 1.2.3. Microscopes

- 1.2.4. Other Instruments

-

1.1. Consumables

-

2. Enumeration Method

- 2.1. Membrane Filtration

- 2.2. Plate Count Method

- 2.3. Most Probable Number (MPN)

- 2.4. Other Enumeration Methods

-

3. Application

- 3.1. Raw Material Testing

- 3.2. Medical Devices Testing

- 3.3. In-process Testing

- 3.4. Equipment Cleaning Validation

- 3.5. Other Applications

Bioburden Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Bioburden Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Frequency of Product Recall Due to Microbial Contamination; Increasing R&D Investments in Life Sciences

- 3.3. Market Restrains

- 3.3.1. High Costs of Microbial Enumeration Instruments

- 3.4. Market Trends

- 3.4.1. Polymerase Chain Reaction (PCR) Systems are Expected to Hold the Large Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Consumables

- 5.1.1.1. Culture Media and Reagents

- 5.1.1.2. Other Consumables

- 5.1.2. Instrument

- 5.1.2.1. Automated Microbial Identification Systems

- 5.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 5.1.2.3. Microscopes

- 5.1.2.4. Other Instruments

- 5.1.1. Consumables

- 5.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 5.2.1. Membrane Filtration

- 5.2.2. Plate Count Method

- 5.2.3. Most Probable Number (MPN)

- 5.2.4. Other Enumeration Methods

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Raw Material Testing

- 5.3.2. Medical Devices Testing

- 5.3.3. In-process Testing

- 5.3.4. Equipment Cleaning Validation

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Consumables

- 6.1.1.1. Culture Media and Reagents

- 6.1.1.2. Other Consumables

- 6.1.2. Instrument

- 6.1.2.1. Automated Microbial Identification Systems

- 6.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 6.1.2.3. Microscopes

- 6.1.2.4. Other Instruments

- 6.1.1. Consumables

- 6.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 6.2.1. Membrane Filtration

- 6.2.2. Plate Count Method

- 6.2.3. Most Probable Number (MPN)

- 6.2.4. Other Enumeration Methods

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Raw Material Testing

- 6.3.2. Medical Devices Testing

- 6.3.3. In-process Testing

- 6.3.4. Equipment Cleaning Validation

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Consumables

- 7.1.1.1. Culture Media and Reagents

- 7.1.1.2. Other Consumables

- 7.1.2. Instrument

- 7.1.2.1. Automated Microbial Identification Systems

- 7.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 7.1.2.3. Microscopes

- 7.1.2.4. Other Instruments

- 7.1.1. Consumables

- 7.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 7.2.1. Membrane Filtration

- 7.2.2. Plate Count Method

- 7.2.3. Most Probable Number (MPN)

- 7.2.4. Other Enumeration Methods

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Raw Material Testing

- 7.3.2. Medical Devices Testing

- 7.3.3. In-process Testing

- 7.3.4. Equipment Cleaning Validation

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Consumables

- 8.1.1.1. Culture Media and Reagents

- 8.1.1.2. Other Consumables

- 8.1.2. Instrument

- 8.1.2.1. Automated Microbial Identification Systems

- 8.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 8.1.2.3. Microscopes

- 8.1.2.4. Other Instruments

- 8.1.1. Consumables

- 8.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 8.2.1. Membrane Filtration

- 8.2.2. Plate Count Method

- 8.2.3. Most Probable Number (MPN)

- 8.2.4. Other Enumeration Methods

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Raw Material Testing

- 8.3.2. Medical Devices Testing

- 8.3.3. In-process Testing

- 8.3.4. Equipment Cleaning Validation

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Consumables

- 9.1.1.1. Culture Media and Reagents

- 9.1.1.2. Other Consumables

- 9.1.2. Instrument

- 9.1.2.1. Automated Microbial Identification Systems

- 9.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 9.1.2.3. Microscopes

- 9.1.2.4. Other Instruments

- 9.1.1. Consumables

- 9.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 9.2.1. Membrane Filtration

- 9.2.2. Plate Count Method

- 9.2.3. Most Probable Number (MPN)

- 9.2.4. Other Enumeration Methods

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Raw Material Testing

- 9.3.2. Medical Devices Testing

- 9.3.3. In-process Testing

- 9.3.4. Equipment Cleaning Validation

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Consumables

- 10.1.1.1. Culture Media and Reagents

- 10.1.1.2. Other Consumables

- 10.1.2. Instrument

- 10.1.2.1. Automated Microbial Identification Systems

- 10.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 10.1.2.3. Microscopes

- 10.1.2.4. Other Instruments

- 10.1.1. Consumables

- 10.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 10.2.1. Membrane Filtration

- 10.2.2. Plate Count Method

- 10.2.3. Most Probable Number (MPN)

- 10.2.4. Other Enumeration Methods

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Raw Material Testing

- 10.3.2. Medical Devices Testing

- 10.3.3. In-process Testing

- 10.3.4. Equipment Cleaning Validation

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 STERIS Laboratories

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sotera Health (Nelson Laboratories Inc )

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Merck KGaA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Thermo Fisher Scientific Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 SGS SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Sartorius AG*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 WuXi AppTec Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Charles River Laboratories Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Biomérieux SA

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 North American Science Associates Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Pacific BioLabs Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Bioburden Testing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 15: North America Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 16: North America Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 21: Europe Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 23: Europe Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 24: Europe Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 31: Asia Pacific Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 32: Asia Pacific Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 39: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 40: Middle East and Africa Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East and Africa Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 45: South America Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 46: South America Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 47: South America Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 48: South America Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 49: South America Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: South America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bioburden Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 4: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Bioburden Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 34: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 41: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 51: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 61: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 67: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 68: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 69: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bioburden Testing Market?

The projected CAGR is approximately 13.05%.

2. Which companies are prominent players in the Bioburden Testing Market?

Key companies in the market include Becton Dickinson and Company, STERIS Laboratories, Sotera Health (Nelson Laboratories Inc ), Merck KGaA, Thermo Fisher Scientific Inc, SGS SA, Sartorius AG*List Not Exhaustive, WuXi AppTec Co Ltd, Charles River Laboratories Inc, Biomérieux SA, North American Science Associates Inc, Pacific BioLabs Inc.

3. What are the main segments of the Bioburden Testing Market?

The market segments include Product, Enumeration Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

High Frequency of Product Recall Due to Microbial Contamination; Increasing R&D Investments in Life Sciences.

6. What are the notable trends driving market growth?

Polymerase Chain Reaction (PCR) Systems are Expected to Hold the Large Share of the Market.

7. Are there any restraints impacting market growth?

High Costs of Microbial Enumeration Instruments.

8. Can you provide examples of recent developments in the market?

In August 2022, Lonza introduced the Nebula Multimode Reader, the first multimode reader certified for use with Lonza's turbidimetric, chromogenic, and recombinant endotoxin detection methodologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bioburden Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bioburden Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bioburden Testing Market?

To stay informed about further developments, trends, and reports in the Bioburden Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence