Key Insights

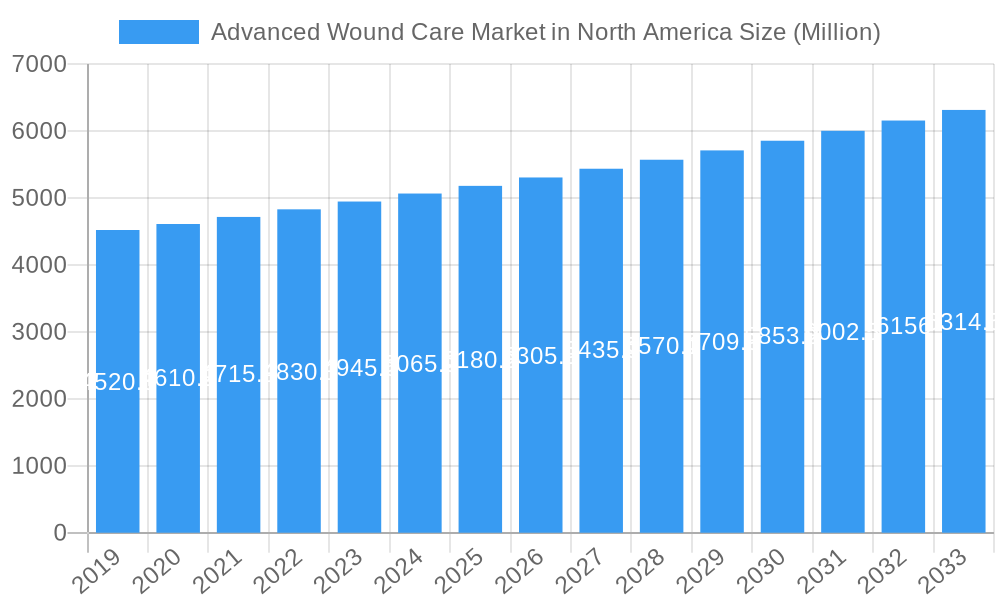

The North American Advanced Wound Care Market is projected to experience robust growth, reaching an estimated USD 5.34 million in 2025. This expansion is driven by a confluence of factors including an aging population, increasing prevalence of chronic diseases like diabetes and cardiovascular conditions that contribute to difficult-to-heal wounds, and a rising demand for innovative wound management solutions. The market is set to witness a Compound Annual Growth Rate (CAGR) of 3.50% through 2033, indicating sustained momentum. Key growth drivers include the escalating incidence of diabetic foot ulcers and pressure ulcers, alongside advancements in wound care technologies such as bioengineered skin substitutes and advanced dressing materials that promote faster healing and reduce infection risks. The emphasis on improving patient outcomes and reducing healthcare costs associated with prolonged wound management further bolsters market expansion.

Advanced Wound Care Market in North America Market Size (In Billion)

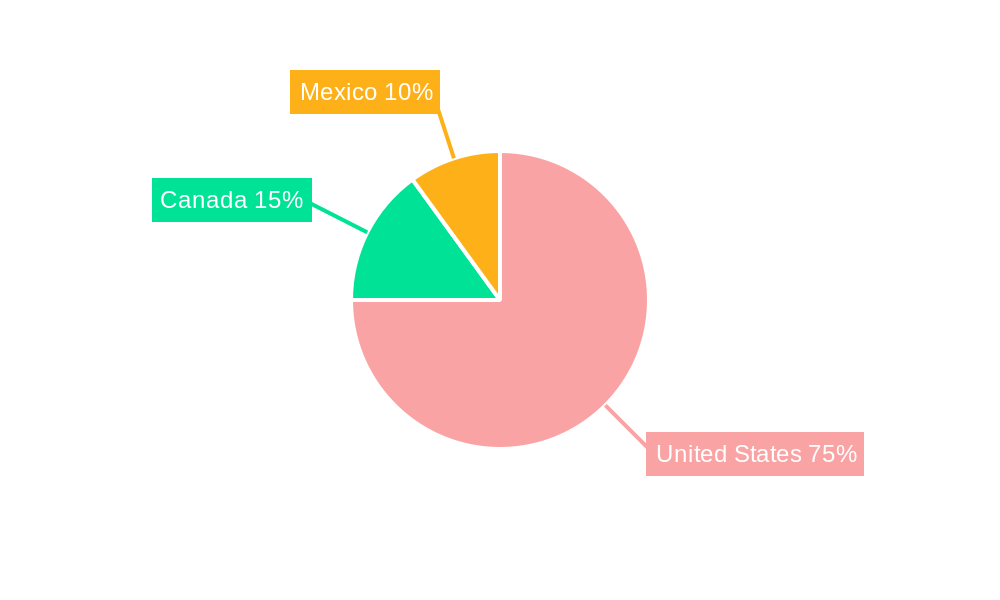

The market is segmented into various product categories, with dressings, bandages, topical agents, and wound care devices forming the core of wound care products, while sutures, surgical staplers, tissue adhesives, sealants, and glues cater to wound closure needs. Within wound types, chronic wounds, particularly diabetic foot ulcers, pressure ulcers, and arterial/venous ulcers, represent a significant segment due to their complexity and long treatment durations. Acute wounds, including surgical wounds and burns, also contribute to market demand. Geographically, the United States dominates the North American market, followed by Canada and Mexico. Leading companies such as Becton Dickinson and Company, Molnlycke Health Care, Cardinal Health, 3M, Baxter, ConvaTec Group PLC, Johnson & Johnson (Ethicon), Smith + Nephew, Medtronic Plc, Integra LifeSciences, Hollister Incorporated, and Coloplast are actively engaged in research and development and strategic partnerships to capitalize on emerging opportunities and address unmet clinical needs within this dynamic sector.

Advanced Wound Care Market in North America Company Market Share

This in-depth report offers a detailed examination of the North American Advanced Wound Care Market, providing critical insights into its dynamics, growth trends, competitive landscape, and future outlook. Covering the United States, Canada, and Mexico, the report delves into both the primary advanced wound care market and its sub-segments, including wound care products (dressings, bandages, topical agents, wound care devices) and wound closure solutions (sutures, surgical staplers, tissue adhesives, sealants, and glues). We meticulously analyze the market's evolution across different wound types, such as chronic wounds (diabetic foot ulcers, pressure ulcers, arterial and venous ulcers, and others) and acute wounds (surgical wounds, burns). With a robust study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report equips industry stakeholders with the data and analysis needed to navigate this complex and evolving sector. All values are presented in Million units for clarity and comparison.

Advanced Wound Care Market in North America Market Dynamics & Structure

The North American advanced wound care market is characterized by a moderately concentrated structure, with key players like Becton Dickinson and Company, Molnlycke Health Care, and Cardinal Health holding significant shares. Technological innovation remains a primary driver, fueled by advancements in biomaterials, drug-delivery systems, and digital wound management solutions. The regulatory landscape, overseen by bodies such as the FDA in the United States, influences product development and market entry. Competitive product substitutes, ranging from traditional wound care to emerging regenerative medicine, present a continuous challenge. End-user demographics, marked by an aging population and a rising prevalence of chronic diseases like diabetes, are reshaping demand patterns. Mergers and acquisitions (M&A) activity is moderately active, reflecting strategic efforts to consolidate market presence, acquire innovative technologies, and expand product portfolios. For instance, the past few years have seen several strategic acquisitions of smaller biotechnology firms by larger established players aiming to bolster their wound care innovations and wound healing solutions. Barriers to innovation often stem from stringent regulatory approval processes and the high cost of clinical trials.

Advanced Wound Care Market in North America Growth Trends & Insights

The North American advanced wound care market is projected to experience robust growth, driven by increasing healthcare expenditure, a growing aging population, and the escalating incidence of chronic diseases such as diabetes and venous insufficiency, which are significant contributors to diabetic foot ulcers and venous ulcers. The market size is estimated to witness a compound annual growth rate (CAGR) of approximately 5.8% during the forecast period (2025–2033). Adoption rates for advanced wound dressings, including hydrogels, foams, and alginates, are steadily increasing due to their superior moisture management and healing properties. Technological disruptions are revolutionizing wound care, with the advent of smart bandages, bio-engineered skin substitutes, and telemedicine platforms enhancing patient outcomes and reducing healthcare costs. Consumer behavior shifts are also playing a crucial role, with greater patient awareness of advanced treatment options and a preference for home-based care solutions. The market penetration of specialized wound care devices and advanced wound closure techniques is expected to expand as healthcare providers increasingly adopt evidence-based practices and seek to minimize hospital readmissions. The rising demand for effective wound management solutions across various wound types is a testament to the market’s dynamic nature.

Dominant Regions, Countries, or Segments in Advanced Wound Care Market in North America

The United States is the dominant region within the North American advanced wound care market, accounting for an estimated xx% of the total market share in 2025. This dominance is attributed to several key drivers.

- High Prevalence of Chronic Diseases: The U.S. has a disproportionately high prevalence of chronic conditions like diabetes, obesity, and cardiovascular diseases, which are primary contributors to chronic wounds, specifically diabetic foot ulcers and arterial and venous ulcers. This significantly increases the demand for advanced wound care products and wound management solutions.

- Advanced Healthcare Infrastructure: The country boasts a sophisticated healthcare infrastructure, with a high number of specialized wound care centers, hospitals, and clinics equipped with advanced technologies and staffed by trained professionals. This facilitates the widespread adoption of cutting-edge wound healing technologies.

- Strong Research and Development Focus: Significant investment in R&D by both domestic and international companies, coupled with favorable government funding for medical research, fuels continuous innovation in wound care products and wound closure techniques. This leads to the development of novel wound dressing materials and topical agents.

- Favorable Reimbursement Policies: While evolving, reimbursement policies in the U.S. generally support the use of advanced wound care modalities, encouraging their uptake by healthcare providers to improve patient outcomes and reduce long-term treatment costs.

- Technological Adoption: The U.S. is often at the forefront of adopting new medical technologies, including advanced wound care devices and sophisticated wound closure methods like tissue adhesives and sealants.

Within the product segments, Wound Care (encompassing dressings, bandages, topical agents, and wound care devices) holds the largest market share, driven by the broad applicability and high consumption of these products across all wound types. Specifically, advanced dressings such as hydrocolloids, foams, and alginates are experiencing significant growth. Among wound types, Chronic Wounds represent the largest segment, with Diabetic Foot Ulcers and Pressure Ulcers being particularly prevalent. The increasing incidence of diabetes and an aging population susceptible to pressure-related injuries are key factors propelling this segment.

Advanced Wound Care Market in North America Product Landscape

The advanced wound care market in North America is rich with product innovations, focusing on enhancing wound healing efficiency and patient comfort. This includes next-generation wound dressings incorporating antimicrobial agents, growth factors, and advanced moisture-balancing technologies. Novel topical agents, such as enzyme-based debriding agents and stem cell therapies, are demonstrating remarkable efficacy in accelerating tissue regeneration. Furthermore, wound care devices, including negative pressure wound therapy (NPWT) systems and electrical stimulation devices, are becoming more sophisticated and user-friendly, offering targeted therapeutic interventions. The wound closure segment is witnessing advancements in sutures with enhanced knot security, biodegradable surgical staplers, and advanced tissue adhesives and sealants offering faster and less invasive closure options for various surgical and traumatic wounds. These advancements are driven by a need for improved patient outcomes, reduced healing times, and minimized scar formation.

Key Drivers, Barriers & Challenges in Advanced Wound Care Market in North America

Key Drivers:

- Rising prevalence of chronic diseases: The escalating incidence of diabetes, obesity, and vascular diseases directly contributes to a higher demand for advanced wound care solutions to manage complex wounds.

- Technological advancements: Continuous innovation in wound dressings, wound care devices, and wound closure technologies is improving treatment efficacy and patient outcomes.

- Aging population: The growing elderly demographic is more prone to chronic conditions and mobility issues, leading to an increased incidence of pressure ulcers and other chronic wounds.

- Increased healthcare expenditure: Growing investments in healthcare infrastructure and R&D activities across North America are supporting the adoption and development of advanced wound care treatments.

Barriers & Challenges:

- High cost of advanced wound care products: The premium pricing of many advanced wound care solutions can be a deterrent for widespread adoption, especially in resource-limited settings.

- Reimbursement challenges: Navigating complex and often inconsistent reimbursement policies across different payers and regions can hinder market penetration.

- Lack of trained professionals: A shortage of skilled healthcare professionals with specialized knowledge in advanced wound management can limit the effective utilization of these technologies.

- Regulatory hurdles: Stringent and time-consuming regulatory approval processes for new wound care products and devices can delay market entry. Supply chain disruptions, as witnessed in recent global events, also pose a significant challenge, impacting the availability and cost of raw materials and finished products.

Emerging Opportunities in Advanced Wound Care Market in North America

Emerging opportunities in the North American advanced wound care market lie in the development and adoption of personalized wound management strategies, leveraging AI and data analytics to predict wound progression and optimize treatment plans. The increasing demand for home healthcare solutions presents a significant avenue for growth, particularly for advanced wound care products and devices designed for patient self-management. Furthermore, the burgeoning field of regenerative medicine, including the use of stem cells and tissue engineering for wound repair, holds immense potential for transformative treatments. The untapped market of underserved rural areas and specific patient populations with unique wound needs offers fertile ground for market expansion. Innovations in bio-printed skin and advanced biomaterials for wound healing are also poised to create new product categories and treatment paradigms.

Growth Accelerators in the Advanced Wound Care Market in North America Industry

Several catalysts are accelerating long-term growth in the North American advanced wound care industry. Technological breakthroughs, such as the development of smart bandages with integrated biosensors for real-time wound monitoring, are set to revolutionize patient care and provide invaluable data for clinicians. Strategic partnerships between medical device manufacturers, pharmaceutical companies, and academic research institutions are fostering collaborative innovation and speeding up the translation of research into commercially viable products. Market expansion strategies focusing on emerging markets within North America and niche therapeutic areas are also contributing to sustained growth. The increasing focus on value-based healthcare and preventative care models is further driving the adoption of advanced wound care solutions that demonstrably improve patient outcomes and reduce overall healthcare costs.

Key Players Shaping the Advanced Wound Care Market in North America Market

- Becton Dickinson and Company

- Molnlycke Health Care

- Cardinal Health

- 3M

- Baxter

- ConvaTec Group PLC

- Johnson & Johnson (Ethicon)

- Smith + Nephew

- Medtronic Plc

- Integra LifeSciences

- Hollister Incorporated

- Coloplast

Notable Milestones in Advanced Wound Care Market in North America Sector

- October 2022: Wounds Canada and the Registered Nurses Association of Ontario (RNAO) announced plans to launch the Wound Care Champion Program (WCCP), designed to deliver evidence-informed, interdisciplinary, proficient-level wound education for front-line clinicians. The program will train regulated health professionals in Ontario, with 200 spots funded by the provincial Ministry of Health. This initiative is poised to enhance clinical expertise in advanced wound care, driving better patient outcomes.

- September 2022: Arch Therapeutics, Inc., a developer of novel self-assembling wound care and bio-surgical products, launched a multi-site clinical study to accelerate payor adoption and differentiate the benefits of the AC5 Advanced Wound System in treating challenging wounds. This study launch is a significant step in validating the efficacy and economic benefits of their innovative wound healing product, potentially influencing wound management practices and reimbursement.

In-Depth Advanced Wound Care Market in North America Market Outlook

The future outlook for the North American advanced wound care market is exceptionally promising, fueled by a confluence of demographic trends, technological advancements, and evolving healthcare priorities. The continued rise in chronic conditions and an aging populace will sustain the demand for effective wound healing solutions. Growth accelerators such as the integration of digital health technologies, the expanding use of regenerative medicine, and the increasing preference for minimally invasive wound closure techniques will further shape the market. Strategic collaborations and market expansion into underserved segments will unlock new revenue streams. Industry players are expected to focus on developing integrated care pathways and value-based solutions that demonstrate clear economic and clinical benefits. The North American market is poised to remain a global leader in innovation and adoption of advanced wound care, offering significant opportunities for stakeholders invested in improving patient lives and driving healthcare efficiency.

Advanced Wound Care Market in North America Segmentation

-

1. Product

-

1.1. Wound Care

- 1.1.1. Dressing

- 1.1.2. Bandages

- 1.1.3. Topical Agents

- 1.1.4. Wound Care Devices

-

1.2. Wound Closure

- 1.2.1. Suture

- 1.2.2. Surgical Staplers

- 1.2.3. Tissue Adhesive, Sealants and Glue

-

1.1. Wound Care

-

2. Wound Type

-

2.1. Chronic Wound

- 2.1.1. Diabetic Foot Ulcer

- 2.1.2. Pressure Ulcer

- 2.1.3. Arterial and Venous Ulcer

- 2.1.4. Others

-

2.2. Acute Wound

- 2.2.1. Surgical Wounds

- 2.2.2. Burns

-

2.1. Chronic Wound

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

Advanced Wound Care Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

Advanced Wound Care Market in North America Regional Market Share

Geographic Coverage of Advanced Wound Care Market in North America

Advanced Wound Care Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Geriatric Population; Rising Incidences of Chronic Wound

- 3.3. Market Restrains

- 3.3.1. High-cost and Risk associated with Advanced Products

- 3.4. Market Trends

- 3.4.1. Suture Sub-segment by Wound Closure Segment is Expected to Grow Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Advanced Wound Care Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wound Care

- 5.1.1.1. Dressing

- 5.1.1.2. Bandages

- 5.1.1.3. Topical Agents

- 5.1.1.4. Wound Care Devices

- 5.1.2. Wound Closure

- 5.1.2.1. Suture

- 5.1.2.2. Surgical Staplers

- 5.1.2.3. Tissue Adhesive, Sealants and Glue

- 5.1.1. Wound Care

- 5.2. Market Analysis, Insights and Forecast - by Wound Type

- 5.2.1. Chronic Wound

- 5.2.1.1. Diabetic Foot Ulcer

- 5.2.1.2. Pressure Ulcer

- 5.2.1.3. Arterial and Venous Ulcer

- 5.2.1.4. Others

- 5.2.2. Acute Wound

- 5.2.2.1. Surgical Wounds

- 5.2.2.2. Burns

- 5.2.1. Chronic Wound

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States Advanced Wound Care Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Wound Care

- 6.1.1.1. Dressing

- 6.1.1.2. Bandages

- 6.1.1.3. Topical Agents

- 6.1.1.4. Wound Care Devices

- 6.1.2. Wound Closure

- 6.1.2.1. Suture

- 6.1.2.2. Surgical Staplers

- 6.1.2.3. Tissue Adhesive, Sealants and Glue

- 6.1.1. Wound Care

- 6.2. Market Analysis, Insights and Forecast - by Wound Type

- 6.2.1. Chronic Wound

- 6.2.1.1. Diabetic Foot Ulcer

- 6.2.1.2. Pressure Ulcer

- 6.2.1.3. Arterial and Venous Ulcer

- 6.2.1.4. Others

- 6.2.2. Acute Wound

- 6.2.2.1. Surgical Wounds

- 6.2.2.2. Burns

- 6.2.1. Chronic Wound

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada Advanced Wound Care Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Wound Care

- 7.1.1.1. Dressing

- 7.1.1.2. Bandages

- 7.1.1.3. Topical Agents

- 7.1.1.4. Wound Care Devices

- 7.1.2. Wound Closure

- 7.1.2.1. Suture

- 7.1.2.2. Surgical Staplers

- 7.1.2.3. Tissue Adhesive, Sealants and Glue

- 7.1.1. Wound Care

- 7.2. Market Analysis, Insights and Forecast - by Wound Type

- 7.2.1. Chronic Wound

- 7.2.1.1. Diabetic Foot Ulcer

- 7.2.1.2. Pressure Ulcer

- 7.2.1.3. Arterial and Venous Ulcer

- 7.2.1.4. Others

- 7.2.2. Acute Wound

- 7.2.2.1. Surgical Wounds

- 7.2.2.2. Burns

- 7.2.1. Chronic Wound

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico Advanced Wound Care Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Wound Care

- 8.1.1.1. Dressing

- 8.1.1.2. Bandages

- 8.1.1.3. Topical Agents

- 8.1.1.4. Wound Care Devices

- 8.1.2. Wound Closure

- 8.1.2.1. Suture

- 8.1.2.2. Surgical Staplers

- 8.1.2.3. Tissue Adhesive, Sealants and Glue

- 8.1.1. Wound Care

- 8.2. Market Analysis, Insights and Forecast - by Wound Type

- 8.2.1. Chronic Wound

- 8.2.1.1. Diabetic Foot Ulcer

- 8.2.1.2. Pressure Ulcer

- 8.2.1.3. Arterial and Venous Ulcer

- 8.2.1.4. Others

- 8.2.2. Acute Wound

- 8.2.2.1. Surgical Wounds

- 8.2.2.2. Burns

- 8.2.1. Chronic Wound

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Becton Dickinson and Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Molnlycke Health Care

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Cardinal Health*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 3M

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Baxter

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 ConvaTec Group PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Johnson & Johnson (Ethicon)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Smith + Nephew

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Medtronic Plc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Integra LifeSciences

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Hollister Incorporated

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Coloplast

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Advanced Wound Care Market in North America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Advanced Wound Care Market in North America Share (%) by Company 2025

List of Tables

- Table 1: Advanced Wound Care Market in North America Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Advanced Wound Care Market in North America Revenue Million Forecast, by Wound Type 2020 & 2033

- Table 3: Advanced Wound Care Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Advanced Wound Care Market in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Advanced Wound Care Market in North America Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Advanced Wound Care Market in North America Revenue Million Forecast, by Wound Type 2020 & 2033

- Table 7: Advanced Wound Care Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Advanced Wound Care Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Advanced Wound Care Market in North America Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Advanced Wound Care Market in North America Revenue Million Forecast, by Wound Type 2020 & 2033

- Table 11: Advanced Wound Care Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Advanced Wound Care Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Advanced Wound Care Market in North America Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Advanced Wound Care Market in North America Revenue Million Forecast, by Wound Type 2020 & 2033

- Table 15: Advanced Wound Care Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Advanced Wound Care Market in North America Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Advanced Wound Care Market in North America?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Advanced Wound Care Market in North America?

Key companies in the market include Becton Dickinson and Company, Molnlycke Health Care, Cardinal Health*List Not Exhaustive, 3M, Baxter, ConvaTec Group PLC, Johnson & Johnson (Ethicon), Smith + Nephew, Medtronic Plc, Integra LifeSciences, Hollister Incorporated, Coloplast.

3. What are the main segments of the Advanced Wound Care Market in North America?

The market segments include Product, Wound Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Geriatric Population; Rising Incidences of Chronic Wound.

6. What are the notable trends driving market growth?

Suture Sub-segment by Wound Closure Segment is Expected to Grow Over the Forecast Period.

7. Are there any restraints impacting market growth?

High-cost and Risk associated with Advanced Products.

8. Can you provide examples of recent developments in the market?

In October 2022, Wounds Canada and the Registered Nurses Association of Ontario (RNAO) planned to launch the Wound Care Champion Program (WCCP), designed to deliver evidence-informed, interdisciplinary, proficient-level wound education for front-line clinicians. The program will train regulated health professionals in Ontario, with 200 spots to be funded by the provincial Ministry of Health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Advanced Wound Care Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Advanced Wound Care Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Advanced Wound Care Market in North America?

To stay informed about further developments, trends, and reports in the Advanced Wound Care Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence