Key Insights

The global Vaccine Adjuvants Market is poised for remarkable expansion, projected to reach a substantial USD 2.11 billion in 2025 and surge at a robust Compound Annual Growth Rate (CAGR) of 12.97% throughout the forecast period of 2025-2033. This dynamic growth is primarily fueled by increasing global healthcare expenditure, a heightened awareness of infectious diseases and their prevention through vaccination, and the continuous innovation in vaccine development. The market's upward trajectory is significantly driven by the growing demand for enhanced vaccine efficacy and immunogenicity, particularly for novel vaccine candidates and those targeting challenging pathogens. The escalating prevalence of chronic diseases like cancer, which are increasingly being addressed with therapeutic vaccines, further amplifies the need for potent adjuvants.

Vaccine Adjuvants Market Market Size (In Billion)

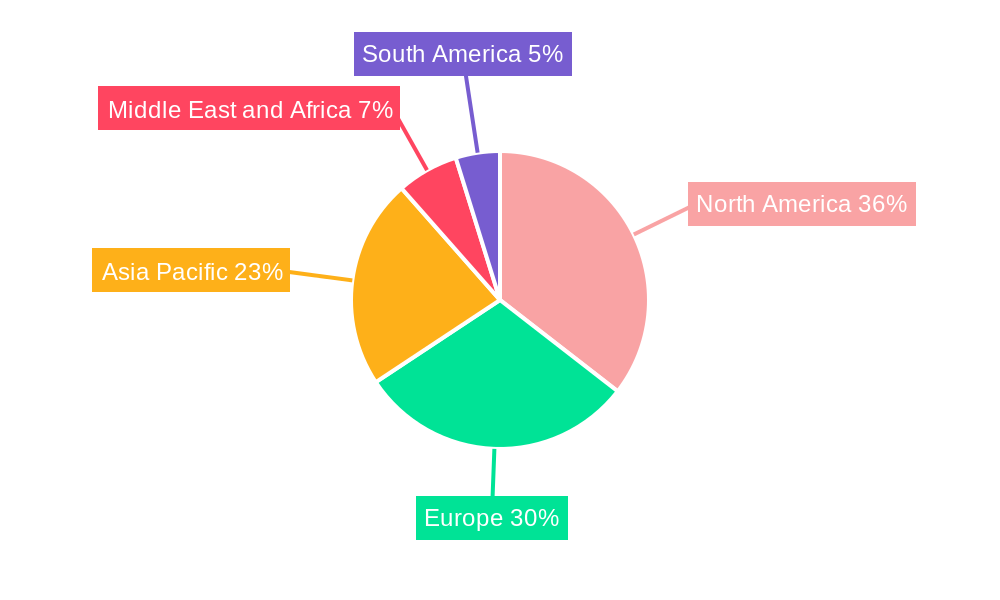

Key trends shaping the market include the rise of novel adjuvant technologies such as liposome-based and carbohydrate-based adjuvants, offering improved safety profiles and targeted immune responses. The development of combination vaccines and the integration of adjuvants into personalized medicine approaches are also gaining momentum. Geographically, North America and Europe currently lead the market due to advanced healthcare infrastructure and substantial R&D investments. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by expanding economies, increasing vaccination rates, and a growing focus on domestic vaccine manufacturing. While the market exhibits strong growth potential, challenges such as stringent regulatory approvals for new adjuvant formulations and potential side effects associated with certain adjuvant types require careful consideration and ongoing research to ensure continued market progress and widespread adoption.

Vaccine Adjuvants Market Company Market Share

This in-depth report provides a strategic roadmap to the global Vaccine Adjuvants Market, a critical component of modern immunization strategies. With a projected market size of $X,XXX Million units in 2025, this market is poised for significant expansion driven by increasing demand for potent and safer vaccines against infectious diseases and cancer. Our analysis covers the historical period (2019–2024), base year (2025), and forecast period (2025–2033), offering granular insights into market dynamics, growth trends, regional dominance, product innovation, and key industry players. Leveraging high-traffic keywords such as "vaccine adjuvants market size," "adjuvant technology," "immunotherapy adjuvants," "cancer vaccines," and "infectious disease vaccines," this report is optimized for maximum visibility and engagement with industry professionals, researchers, and investors.

Vaccine Adjuvants Market Dynamics & Structure

The Vaccine Adjuvants Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and strategic consolidations. Market concentration varies across product types, with mineral salt-based adjuvants holding a significant, yet maturing, share. However, the advent of novel adjuvant platforms, such as Virus-like Particles (VLP) and advanced liposome formulations, is increasingly driving innovation and capturing market attention. Technological advancements in adjuvant delivery systems, aimed at enhancing immunogenicity and reducing side effects, remain a paramount driver. The regulatory framework, while stringent, is also adapting to accommodate next-generation adjuvants, particularly for applications in cancer immunotherapy. Competitive product substitutes, though limited in their direct replacement capabilities for established adjuvants, are emerging in niche applications. End-user demographics are expanding beyond traditional infectious disease applications to include a growing demand for cancer vaccines and personalized immunotherapies. Merger and acquisition (M&A) trends are on the rise, as companies seek to acquire innovative adjuvant technologies and expand their therapeutic portfolios. For instance, the reported M&A activities and strategic partnerships underscore a strong consolidation drive within the sector, aiming to accelerate R&D and commercialization.

- Market Concentration: Moderate to High, with key players dominating specific product segments.

- Technological Innovation Drivers: Development of novel adjuvant platforms, improved delivery systems, and synergistic immune responses.

- Regulatory Frameworks: Evolving to support new adjuvant technologies, particularly for advanced therapeutic applications.

- Competitive Product Substitutes: Emerging in niche areas, but established adjuvants maintain broad applicability.

- End-User Demographics: Expanding from infectious diseases to oncology, auto-immune disorders, and personalized medicine.

- M&A Trends: Increasing as companies seek to consolidate technological expertise and market access.

Vaccine Adjuvants Market Growth Trends & Insights

The Vaccine Adjuvants Market is experiencing robust growth, projected to reach $X,XXX Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X.XX% between 2025 and 2033. This upward trajectory is fueled by the increasing prevalence of infectious diseases, the burgeoning demand for effective cancer vaccines, and the continuous push for enhanced vaccine efficacy and safety. The adoption rates of advanced adjuvant technologies are accelerating, particularly for novel vaccines targeting emerging infectious threats and complex diseases like cancer. Technological disruptions, such as the development of self-adjuvanting vaccines and sophisticated delivery systems, are reshaping the market landscape. Consumer behavior shifts are also playing a crucial role, with greater awareness and demand for vaccines that offer superior protection and reduced side effects. The market penetration of mineral salt-based adjuvants, while significant, is expected to be complemented by the rapid growth of newer adjuvant types that offer tailored immune responses. The infectious disease segment remains a cornerstone of market demand, driven by global vaccination campaigns and the need to combat existing and emerging pathogens. Simultaneously, the cancer adjuvant segment is witnessing exponential growth, propelled by breakthroughs in cancer immunotherapy and the development of therapeutic cancer vaccines.

The increasing investment in R&D for novel vaccine formulations, coupled with favorable government initiatives and a growing number of clinical trials, are key contributors to this sustained growth. The development of combination vaccines, which often require adjuvants to elicit a robust immune response against multiple antigens, further amplifies market demand. The research applications segment, while smaller in volume, provides critical data and insights that fuel commercial development and innovation. The ongoing refinement of adjuvant manufacturing processes, aimed at improving scalability and cost-effectiveness, is also contributing to market expansion.

Dominant Regions, Countries, or Segments in Vaccine Adjuvants Market

The North America region stands as a dominant force in the global Vaccine Adjuvants Market, driven by its robust pharmaceutical R&D infrastructure, significant government funding for vaccine development, and a high prevalence of infectious diseases and cancer. The United States, in particular, leads in terms of market share and innovation, owing to the presence of leading vaccine manufacturers and research institutions.

Dominant Region: North America

- Key Drivers:

- Extensive research and development initiatives in novel adjuvant technologies.

- Strong presence of leading pharmaceutical and biotechnology companies.

- High demand for advanced vaccines for infectious diseases and cancer.

- Favorable regulatory environment and government support for vaccine innovation.

- Significant healthcare expenditure and established vaccination programs.

- Key Drivers:

Dominant Segments:

- Product Type: Mineral Salt-based Adjuvant continues to hold a substantial market share due to its established efficacy and cost-effectiveness in traditional vaccines. However, Liposome Adjuvants and Virus-like Particles (VLP) are exhibiting rapid growth, driven by their potential for targeted delivery and enhanced immunogenicity in advanced applications.

- Usage Type: Active Immunostimulants are critical for boosting immune responses, while Vehicle Adjuvants play a vital role in antigen delivery and stability, both contributing significantly to market growth.

- Disease Type: Infectious Disease remains the largest segment, fueled by ongoing vaccination programs and the need for vaccines against a wide array of pathogens. Cancer is the fastest-growing segment, propelled by advancements in therapeutic cancer vaccines and immunotherapies.

- Application: Commercial Applications constitute the largest share, driven by the widespread use of adjuvants in approved vaccines. Research Applications, though smaller, are crucial for the discovery and development of next-generation adjuvants.

The dominance of North America is further amplified by strategic collaborations between academic institutions and industry players, fostering a dynamic ecosystem for innovation. The robust clinical trial landscape in the region allows for accelerated validation of new adjuvant technologies. Economic policies that support biopharmaceutical research and development, along with advanced healthcare infrastructure, contribute to the region's leading position. The increasing focus on personalized medicine and the development of tailored vaccines for specific patient populations also contribute to the growth of the adjuvant market in North America.

Vaccine Adjuvants Market Product Landscape

The Vaccine Adjuvants Market showcases a diverse and evolving product landscape driven by continuous innovation. Mineral Salt-based Adjuvants, such as aluminum salts, remain foundational due to their proven safety and efficacy in numerous licensed vaccines. However, the market is increasingly witnessing the rise of more sophisticated adjuvants. Tensoactive Adjuvants, like saponins, offer potent immune-boosting properties. Adjuvant Emulsions, particularly oil-in-water emulsions, are gaining traction for their ability to elicit strong cellular and humoral immune responses. Liposome Adjuvants are emerging as promising platforms for targeted antigen delivery and controlled release, enhancing immunogenicity and reducing systemic toxicity. Carbohydrate Adjuvants, derived from natural sources, are being explored for their immunomodulatory effects. Bacteria-derived Adjuvants and Virus-like Particles (VLP) represent advanced immunotherapeutic approaches, leveraging the inherent immune-stimulating properties of microbial components or viral structures. These novel products are crucial for the development of next-generation vaccines against challenging diseases.

Key Drivers, Barriers & Challenges in Vaccine Adjuvants Market

Key Drivers:

- Technological Advancements: Development of novel adjuvant platforms like VLPs and liposomes that offer enhanced immunogenicity and safety profiles.

- Growing Demand for Vaccines: Increasing prevalence of infectious diseases and the rising incidence of cancer are fueling the need for effective vaccines.

- Government Initiatives & Funding: Supportive policies and increased funding for vaccine research and development by governments worldwide.

- Expansion of Therapeutic Cancer Vaccines: Significant R&D in cancer immunotherapies is creating a substantial market for cancer vaccine adjuvants.

- Improved Vaccine Efficacy Requirements: The need for adjuvants to enhance the immune response, particularly for antigens that are poorly immunogenic or for vulnerable populations.

Barriers & Challenges:

- Stringent Regulatory Hurdles: The extensive and rigorous approval processes for new adjuvant technologies can be time-consuming and costly.

- Manufacturing Complexities: Scaling up the production of novel and complex adjuvants can present significant manufacturing challenges.

- High R&D Costs: The research and development of new adjuvants require substantial financial investment.

- Supply Chain Vulnerabilities: Ensuring a consistent and reliable supply of raw materials and finished adjuvant products globally.

- Adverse Event Concerns: Public perception and historical concerns regarding vaccine side effects can impact adoption rates, necessitating careful safety profiling of adjuvants.

Emerging Opportunities in Vaccine Adjuvants Market

Emerging opportunities in the Vaccine Adjuvants Market are largely centered around personalized medicine and advanced therapeutic applications. The growing understanding of the immune system is paving the way for the development of highly specific adjuvants tailored to individual patient needs, particularly in cancer immunotherapy. The integration of adjuvants with mRNA vaccine technology presents a significant avenue for growth, offering enhanced efficacy and faster development cycles. Furthermore, the exploration of adjuvants for non-vaccine applications, such as allergy immunotherapy and autoimmune disease treatment, represents untapped market potential. The development of "smart" adjuvants that can precisely control immune responses and minimize off-target effects will also be a key growth driver.

Growth Accelerators in the Vaccine Adjuvants Market Industry

Catalysts driving long-term growth in the Vaccine Adjuvants Market include breakthroughs in immunology, leading to a deeper understanding of immune mechanisms and the design of more sophisticated adjuvants. Strategic partnerships between academic institutions and commercial entities are accelerating the translation of cutting-edge research into viable products. The expansion of vaccine applications into new disease areas, such as chronic infectious diseases and neurodegenerative disorders, will further stimulate demand. Moreover, the ongoing focus on enhancing vaccine stability and delivery systems will necessitate the development of novel adjuvant formulations. The increasing global investment in public health infrastructure and pandemic preparedness also acts as a significant growth accelerator.

Key Players Shaping the Vaccine Adjuvants Market Market

- Dynavax Technologies Corporation

- Thermo Fisher Scientific Inc

- Air Liquide (seppic)

- Associated British Foods Plc (spi Pharma Inc)

- Agenus Inc

- Adjuvatis

- Pacific GeneTech Limited

- Croda International PLC

- CSL Limited

- Novavax Inc

- Aphios Corporation

- OZ Biosciences

- Merck KGA

- InvivoGen

- GlaxoSmithKline PLC

- Vertellus

Notable Milestones in Vaccine Adjuvants Market Sector

- January 2023: Elicio Therapeutics engineers lymph node-targeted adjuvants and vaccines for an array of aggressive cancers and infectious diseases and entered into a definitive merger agreement with Angion Biomedica Corp to focus on advancing Elicio's proprietary lymph node-targeting Amphiphile (AMP) technology to develop immunotherapies, with a focus on ELI-002, a therapeutic cancer vaccine targeting mKRAS-driven tumors.

- November 2022: Hubro Therapeutics AS acquired GM-CSF vaccine adjuvant from Targovax ASA in an asset purchase agreement for a cash payment of NOK10 million. Hubro continues the development of GM-CSF as an adjuvant for use with its pipeline of novel cancer vaccines.

In-Depth Vaccine Adjuvants Market Market Outlook

The future outlook for the Vaccine Adjuvants Market is exceptionally promising, driven by an escalating need for improved immunization strategies against a spectrum of diseases. Growth accelerators will continue to be propelled by advancements in adjuvant design, enabling more targeted and potent immune responses. Strategic collaborations and significant investments in R&D will foster the development of novel applications, particularly in the burgeoning fields of cancer immunotherapy and personalized vaccines. The market is poised for substantial expansion, with opportunities arising from emerging infectious diseases, the demand for next-generation vaccines, and the integration of adjuvants into advanced drug delivery platforms. Key opportunities lie in developing sustainable manufacturing processes and navigating evolving regulatory pathways to ensure timely market access for innovative adjuvant solutions.

Vaccine Adjuvants Market Segmentation

-

1. Product Type

- 1.1. Mineral Salt-based Adjuvant

- 1.2. Tensoactive Adjuvants

- 1.3. Adjuvant Emulsions

- 1.4. Liposome Adjuvants

- 1.5. Carbohydrate Adjuvants

- 1.6. Bacteria-derived Adjuvants

- 1.7. Virus-like Particles (VLP)

- 1.8. Other Product Types

-

2. Usage Type

- 2.1. Active Immunostimulants

- 2.2. Carriers

- 2.3. Vehicle Adjuvants

-

3. Disease Type

- 3.1. Infectious Disease

- 3.2. Cancer

-

4. Application

- 4.1. Research Applications

- 4.2. Commercial Applications

Vaccine Adjuvants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Vaccine Adjuvants Market Regional Market Share

Geographic Coverage of Vaccine Adjuvants Market

Vaccine Adjuvants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Government Recommendations for Immunizations; Unmet Vaccine Market Needs for Certain Diseases; Increasing Use of Recombinant Subunit and Synthetic Vaccines

- 3.3. Market Restrains

- 3.3.1. Side Effects and High Toxicity of Adjuvants; High R&D Cost of Developing a New Adjuvant

- 3.4. Market Trends

- 3.4.1. Carbohydrate Adjuvants Segment Expected to Witness a Significant CAGR Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vaccine Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Mineral Salt-based Adjuvant

- 5.1.2. Tensoactive Adjuvants

- 5.1.3. Adjuvant Emulsions

- 5.1.4. Liposome Adjuvants

- 5.1.5. Carbohydrate Adjuvants

- 5.1.6. Bacteria-derived Adjuvants

- 5.1.7. Virus-like Particles (VLP)

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Usage Type

- 5.2.1. Active Immunostimulants

- 5.2.2. Carriers

- 5.2.3. Vehicle Adjuvants

- 5.3. Market Analysis, Insights and Forecast - by Disease Type

- 5.3.1. Infectious Disease

- 5.3.2. Cancer

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Research Applications

- 5.4.2. Commercial Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Vaccine Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Mineral Salt-based Adjuvant

- 6.1.2. Tensoactive Adjuvants

- 6.1.3. Adjuvant Emulsions

- 6.1.4. Liposome Adjuvants

- 6.1.5. Carbohydrate Adjuvants

- 6.1.6. Bacteria-derived Adjuvants

- 6.1.7. Virus-like Particles (VLP)

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Usage Type

- 6.2.1. Active Immunostimulants

- 6.2.2. Carriers

- 6.2.3. Vehicle Adjuvants

- 6.3. Market Analysis, Insights and Forecast - by Disease Type

- 6.3.1. Infectious Disease

- 6.3.2. Cancer

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Research Applications

- 6.4.2. Commercial Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Vaccine Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Mineral Salt-based Adjuvant

- 7.1.2. Tensoactive Adjuvants

- 7.1.3. Adjuvant Emulsions

- 7.1.4. Liposome Adjuvants

- 7.1.5. Carbohydrate Adjuvants

- 7.1.6. Bacteria-derived Adjuvants

- 7.1.7. Virus-like Particles (VLP)

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Usage Type

- 7.2.1. Active Immunostimulants

- 7.2.2. Carriers

- 7.2.3. Vehicle Adjuvants

- 7.3. Market Analysis, Insights and Forecast - by Disease Type

- 7.3.1. Infectious Disease

- 7.3.2. Cancer

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Research Applications

- 7.4.2. Commercial Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Vaccine Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Mineral Salt-based Adjuvant

- 8.1.2. Tensoactive Adjuvants

- 8.1.3. Adjuvant Emulsions

- 8.1.4. Liposome Adjuvants

- 8.1.5. Carbohydrate Adjuvants

- 8.1.6. Bacteria-derived Adjuvants

- 8.1.7. Virus-like Particles (VLP)

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Usage Type

- 8.2.1. Active Immunostimulants

- 8.2.2. Carriers

- 8.2.3. Vehicle Adjuvants

- 8.3. Market Analysis, Insights and Forecast - by Disease Type

- 8.3.1. Infectious Disease

- 8.3.2. Cancer

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Research Applications

- 8.4.2. Commercial Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Vaccine Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Mineral Salt-based Adjuvant

- 9.1.2. Tensoactive Adjuvants

- 9.1.3. Adjuvant Emulsions

- 9.1.4. Liposome Adjuvants

- 9.1.5. Carbohydrate Adjuvants

- 9.1.6. Bacteria-derived Adjuvants

- 9.1.7. Virus-like Particles (VLP)

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Usage Type

- 9.2.1. Active Immunostimulants

- 9.2.2. Carriers

- 9.2.3. Vehicle Adjuvants

- 9.3. Market Analysis, Insights and Forecast - by Disease Type

- 9.3.1. Infectious Disease

- 9.3.2. Cancer

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Research Applications

- 9.4.2. Commercial Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Vaccine Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Mineral Salt-based Adjuvant

- 10.1.2. Tensoactive Adjuvants

- 10.1.3. Adjuvant Emulsions

- 10.1.4. Liposome Adjuvants

- 10.1.5. Carbohydrate Adjuvants

- 10.1.6. Bacteria-derived Adjuvants

- 10.1.7. Virus-like Particles (VLP)

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Usage Type

- 10.2.1. Active Immunostimulants

- 10.2.2. Carriers

- 10.2.3. Vehicle Adjuvants

- 10.3. Market Analysis, Insights and Forecast - by Disease Type

- 10.3.1. Infectious Disease

- 10.3.2. Cancer

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Research Applications

- 10.4.2. Commercial Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dynavax Technologies Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher Scientific Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Air Liquide (seppic)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Associated British Foods Plc (spi Pharma Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agenus Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adjuvatis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pacific GeneTech Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Croda International PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CSL Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Novavax Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aphios Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 OZ Biosciences

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Merck KGA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 InvivoGen

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 GlaxoSmithKline PLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Vertellus

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Dynavax Technologies Corporation

List of Figures

- Figure 1: Global Vaccine Adjuvants Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Vaccine Adjuvants Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Vaccine Adjuvants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Vaccine Adjuvants Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Vaccine Adjuvants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Vaccine Adjuvants Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Vaccine Adjuvants Market Revenue (Million), by Usage Type 2025 & 2033

- Figure 8: North America Vaccine Adjuvants Market Volume (K Unit), by Usage Type 2025 & 2033

- Figure 9: North America Vaccine Adjuvants Market Revenue Share (%), by Usage Type 2025 & 2033

- Figure 10: North America Vaccine Adjuvants Market Volume Share (%), by Usage Type 2025 & 2033

- Figure 11: North America Vaccine Adjuvants Market Revenue (Million), by Disease Type 2025 & 2033

- Figure 12: North America Vaccine Adjuvants Market Volume (K Unit), by Disease Type 2025 & 2033

- Figure 13: North America Vaccine Adjuvants Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 14: North America Vaccine Adjuvants Market Volume Share (%), by Disease Type 2025 & 2033

- Figure 15: North America Vaccine Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 16: North America Vaccine Adjuvants Market Volume (K Unit), by Application 2025 & 2033

- Figure 17: North America Vaccine Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Vaccine Adjuvants Market Volume Share (%), by Application 2025 & 2033

- Figure 19: North America Vaccine Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Vaccine Adjuvants Market Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Vaccine Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Vaccine Adjuvants Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Vaccine Adjuvants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 24: Europe Vaccine Adjuvants Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 25: Europe Vaccine Adjuvants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Vaccine Adjuvants Market Volume Share (%), by Product Type 2025 & 2033

- Figure 27: Europe Vaccine Adjuvants Market Revenue (Million), by Usage Type 2025 & 2033

- Figure 28: Europe Vaccine Adjuvants Market Volume (K Unit), by Usage Type 2025 & 2033

- Figure 29: Europe Vaccine Adjuvants Market Revenue Share (%), by Usage Type 2025 & 2033

- Figure 30: Europe Vaccine Adjuvants Market Volume Share (%), by Usage Type 2025 & 2033

- Figure 31: Europe Vaccine Adjuvants Market Revenue (Million), by Disease Type 2025 & 2033

- Figure 32: Europe Vaccine Adjuvants Market Volume (K Unit), by Disease Type 2025 & 2033

- Figure 33: Europe Vaccine Adjuvants Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 34: Europe Vaccine Adjuvants Market Volume Share (%), by Disease Type 2025 & 2033

- Figure 35: Europe Vaccine Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 36: Europe Vaccine Adjuvants Market Volume (K Unit), by Application 2025 & 2033

- Figure 37: Europe Vaccine Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Europe Vaccine Adjuvants Market Volume Share (%), by Application 2025 & 2033

- Figure 39: Europe Vaccine Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Vaccine Adjuvants Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Vaccine Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Vaccine Adjuvants Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Vaccine Adjuvants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 44: Asia Pacific Vaccine Adjuvants Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 45: Asia Pacific Vaccine Adjuvants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Asia Pacific Vaccine Adjuvants Market Volume Share (%), by Product Type 2025 & 2033

- Figure 47: Asia Pacific Vaccine Adjuvants Market Revenue (Million), by Usage Type 2025 & 2033

- Figure 48: Asia Pacific Vaccine Adjuvants Market Volume (K Unit), by Usage Type 2025 & 2033

- Figure 49: Asia Pacific Vaccine Adjuvants Market Revenue Share (%), by Usage Type 2025 & 2033

- Figure 50: Asia Pacific Vaccine Adjuvants Market Volume Share (%), by Usage Type 2025 & 2033

- Figure 51: Asia Pacific Vaccine Adjuvants Market Revenue (Million), by Disease Type 2025 & 2033

- Figure 52: Asia Pacific Vaccine Adjuvants Market Volume (K Unit), by Disease Type 2025 & 2033

- Figure 53: Asia Pacific Vaccine Adjuvants Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 54: Asia Pacific Vaccine Adjuvants Market Volume Share (%), by Disease Type 2025 & 2033

- Figure 55: Asia Pacific Vaccine Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Asia Pacific Vaccine Adjuvants Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Asia Pacific Vaccine Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Asia Pacific Vaccine Adjuvants Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Asia Pacific Vaccine Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Vaccine Adjuvants Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Vaccine Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Vaccine Adjuvants Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Vaccine Adjuvants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 64: Middle East and Africa Vaccine Adjuvants Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 65: Middle East and Africa Vaccine Adjuvants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 66: Middle East and Africa Vaccine Adjuvants Market Volume Share (%), by Product Type 2025 & 2033

- Figure 67: Middle East and Africa Vaccine Adjuvants Market Revenue (Million), by Usage Type 2025 & 2033

- Figure 68: Middle East and Africa Vaccine Adjuvants Market Volume (K Unit), by Usage Type 2025 & 2033

- Figure 69: Middle East and Africa Vaccine Adjuvants Market Revenue Share (%), by Usage Type 2025 & 2033

- Figure 70: Middle East and Africa Vaccine Adjuvants Market Volume Share (%), by Usage Type 2025 & 2033

- Figure 71: Middle East and Africa Vaccine Adjuvants Market Revenue (Million), by Disease Type 2025 & 2033

- Figure 72: Middle East and Africa Vaccine Adjuvants Market Volume (K Unit), by Disease Type 2025 & 2033

- Figure 73: Middle East and Africa Vaccine Adjuvants Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 74: Middle East and Africa Vaccine Adjuvants Market Volume Share (%), by Disease Type 2025 & 2033

- Figure 75: Middle East and Africa Vaccine Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 76: Middle East and Africa Vaccine Adjuvants Market Volume (K Unit), by Application 2025 & 2033

- Figure 77: Middle East and Africa Vaccine Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 78: Middle East and Africa Vaccine Adjuvants Market Volume Share (%), by Application 2025 & 2033

- Figure 79: Middle East and Africa Vaccine Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Vaccine Adjuvants Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Vaccine Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Vaccine Adjuvants Market Volume Share (%), by Country 2025 & 2033

- Figure 83: South America Vaccine Adjuvants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 84: South America Vaccine Adjuvants Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 85: South America Vaccine Adjuvants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 86: South America Vaccine Adjuvants Market Volume Share (%), by Product Type 2025 & 2033

- Figure 87: South America Vaccine Adjuvants Market Revenue (Million), by Usage Type 2025 & 2033

- Figure 88: South America Vaccine Adjuvants Market Volume (K Unit), by Usage Type 2025 & 2033

- Figure 89: South America Vaccine Adjuvants Market Revenue Share (%), by Usage Type 2025 & 2033

- Figure 90: South America Vaccine Adjuvants Market Volume Share (%), by Usage Type 2025 & 2033

- Figure 91: South America Vaccine Adjuvants Market Revenue (Million), by Disease Type 2025 & 2033

- Figure 92: South America Vaccine Adjuvants Market Volume (K Unit), by Disease Type 2025 & 2033

- Figure 93: South America Vaccine Adjuvants Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 94: South America Vaccine Adjuvants Market Volume Share (%), by Disease Type 2025 & 2033

- Figure 95: South America Vaccine Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 96: South America Vaccine Adjuvants Market Volume (K Unit), by Application 2025 & 2033

- Figure 97: South America Vaccine Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 98: South America Vaccine Adjuvants Market Volume Share (%), by Application 2025 & 2033

- Figure 99: South America Vaccine Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 100: South America Vaccine Adjuvants Market Volume (K Unit), by Country 2025 & 2033

- Figure 101: South America Vaccine Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: South America Vaccine Adjuvants Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vaccine Adjuvants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Vaccine Adjuvants Market Revenue Million Forecast, by Usage Type 2020 & 2033

- Table 4: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Usage Type 2020 & 2033

- Table 5: Global Vaccine Adjuvants Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 6: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 7: Global Vaccine Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Global Vaccine Adjuvants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Vaccine Adjuvants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 13: Global Vaccine Adjuvants Market Revenue Million Forecast, by Usage Type 2020 & 2033

- Table 14: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Usage Type 2020 & 2033

- Table 15: Global Vaccine Adjuvants Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 16: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 17: Global Vaccine Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 19: Global Vaccine Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United States Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Canada Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Mexico Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Global Vaccine Adjuvants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 29: Global Vaccine Adjuvants Market Revenue Million Forecast, by Usage Type 2020 & 2033

- Table 30: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Usage Type 2020 & 2033

- Table 31: Global Vaccine Adjuvants Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 32: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 33: Global Vaccine Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global Vaccine Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Germany Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Germany Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: United Kingdom Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Global Vaccine Adjuvants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 51: Global Vaccine Adjuvants Market Revenue Million Forecast, by Usage Type 2020 & 2033

- Table 52: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Usage Type 2020 & 2033

- Table 53: Global Vaccine Adjuvants Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 54: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 55: Global Vaccine Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 56: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 57: Global Vaccine Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 59: China Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: China Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Japan Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Japan Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: India Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: India Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Australia Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Australia Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: South Korea Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: South Korea Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Rest of Asia Pacific Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Global Vaccine Adjuvants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 72: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 73: Global Vaccine Adjuvants Market Revenue Million Forecast, by Usage Type 2020 & 2033

- Table 74: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Usage Type 2020 & 2033

- Table 75: Global Vaccine Adjuvants Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 76: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 77: Global Vaccine Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 78: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 79: Global Vaccine Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 81: GCC Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: GCC Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: South Africa Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: South Africa Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Global Vaccine Adjuvants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 88: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 89: Global Vaccine Adjuvants Market Revenue Million Forecast, by Usage Type 2020 & 2033

- Table 90: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Usage Type 2020 & 2033

- Table 91: Global Vaccine Adjuvants Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 92: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 93: Global Vaccine Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 94: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 95: Global Vaccine Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 96: Global Vaccine Adjuvants Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 97: Brazil Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: Brazil Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: Argentina Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Argentina Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Rest of South America Vaccine Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Rest of South America Vaccine Adjuvants Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vaccine Adjuvants Market?

The projected CAGR is approximately 12.97%.

2. Which companies are prominent players in the Vaccine Adjuvants Market?

Key companies in the market include Dynavax Technologies Corporation, Thermo Fisher Scientific Inc , Air Liquide (seppic), Associated British Foods Plc (spi Pharma Inc ), Agenus Inc, Adjuvatis, Pacific GeneTech Limited, Croda International PLC, CSL Limited, Novavax Inc, Aphios Corporation, OZ Biosciences, Merck KGA, InvivoGen, GlaxoSmithKline PLC, Vertellus.

3. What are the main segments of the Vaccine Adjuvants Market?

The market segments include Product Type, Usage Type, Disease Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Government Recommendations for Immunizations; Unmet Vaccine Market Needs for Certain Diseases; Increasing Use of Recombinant Subunit and Synthetic Vaccines.

6. What are the notable trends driving market growth?

Carbohydrate Adjuvants Segment Expected to Witness a Significant CAGR Over The Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects and High Toxicity of Adjuvants; High R&D Cost of Developing a New Adjuvant.

8. Can you provide examples of recent developments in the market?

January 2023: Elicio Therapeutics engineers lymph node-targeted adjuvants and vaccines for an array of aggressive cancers and infectious diseases and entered into a definitive merger agreement with Angion Biomedica Corp to focus on advancing Elicio's proprietary lymph node-targeting Amphiphile (AMP) technology to develop immunotherapies, with a focus on ELI-002, a therapeutic cancer vaccine targeting mKRAS-driven tumors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vaccine Adjuvants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vaccine Adjuvants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vaccine Adjuvants Market?

To stay informed about further developments, trends, and reports in the Vaccine Adjuvants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence